Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIDELITY SOUTHERN CORP | d391084d8k.htm |

Exhibit 99.1

| KBW 13th Annual Community Bank Investor Conference |

| Forward-Looking Statements This presentation contains forward-looking statements that reflect our current expectations relating to present or future trends or factors generally affecting the banking industry and specifically affecting our operations, markets and services. These forward-looking statements are based upon assumptions we believe are reasonable and may relate to, among other things, the difficult economic conditions and the economy's impact on operating results, credit quality, liquidity, capital, the adequacy of the allowance for loan losses, changes in interest rates, and litigation results. These forward-looking statements are subject to risks and uncertainties. The Corporation does not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date on which the forward-looking statement is made. Use of Non-GAAP Financial Measures This presentation contains financial information determined by methods other than in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management uses these "non-GAAP" measures in their analysis of the Corporation's performance. Management believes that these non-GAAP financial measures allows better comparability with prior periods, as well as with peers in the industry who also provide a similar presentation provide a greater understanding of ongoing operations and enhance comparability of results with prior periods as well as demonstrating the effects of significant gains and charges in the current period. These disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other. |

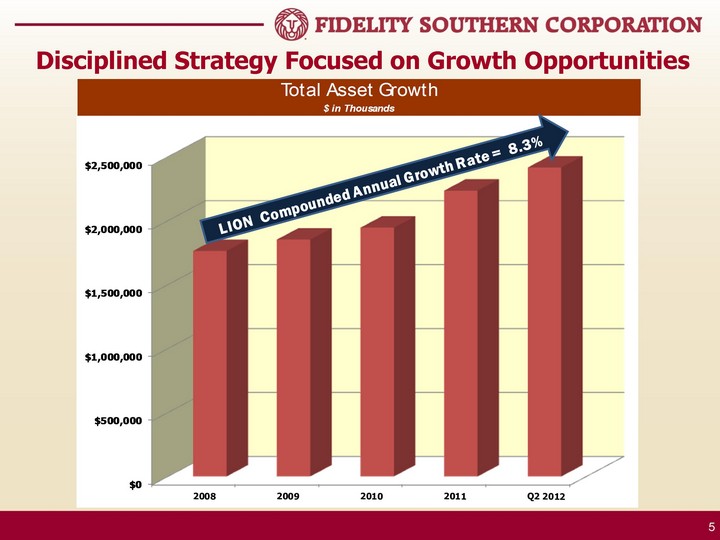

| Lion Profile Founded in 1974 Second largest bank headquartered in Atlanta $2.4 billion in total assets 32 branches Market cap~$129.4 million Insider ownership~41%; Institutional~33% Book value $9.25 Seasoned Management |

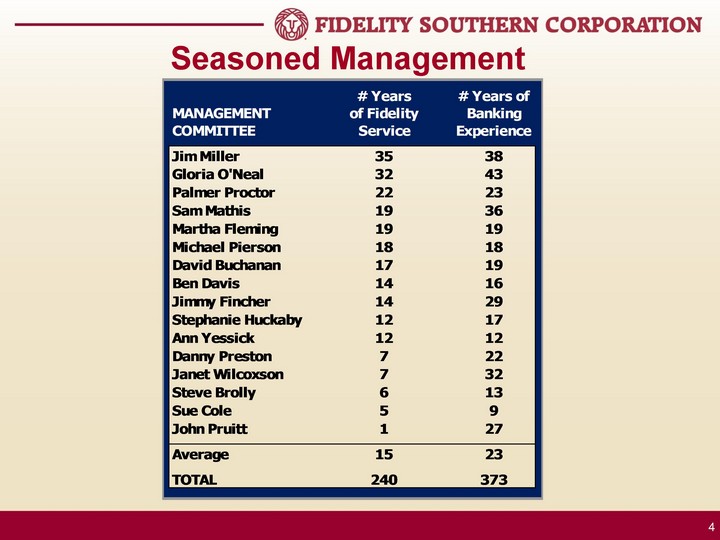

| Seasoned Management |

| Disciplined Strategy Focused on Growth Opportunities |

| Seizing Opportunities Challenging Environment Opportunities High Unemployment This year alone hired 36 lenders and 113 other professionals 83 Banks Failed in Georgia Bought 2 FDIC loss share banks Opened accounts via organic growth Banks are Closing Branches Acquired 6 branches this year Growing market share Anemic Housing Market Opened 15 mortgage offices Banks Not Lending Not true. Last year $2.3 billion in production. This year $1.5 billion to date. |

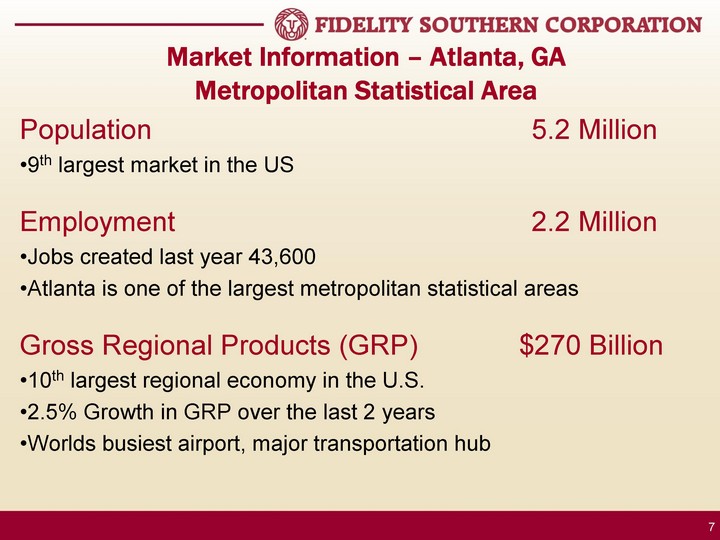

| Market Information - Atlanta, GA Metropolitan Statistical Area Population 5.2 Million 9th largest market in the US Employment 2.2 Million Jobs created last year 43,600 Atlanta is one of the largest metropolitan statistical areas Gross Regional Products (GRP) $270 Billion 10th largest regional economy in the U.S. 2.5% Growth in GRP over the last 2 years Worlds busiest airport, major transportation hub |

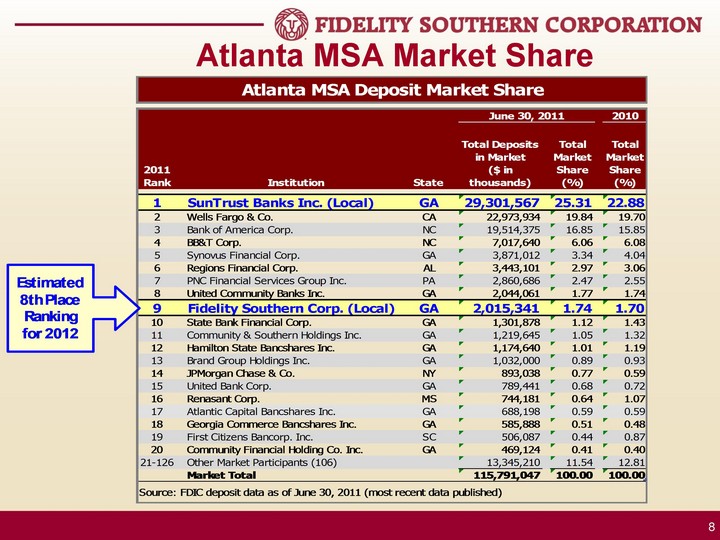

| Atlanta MSA Market Share |

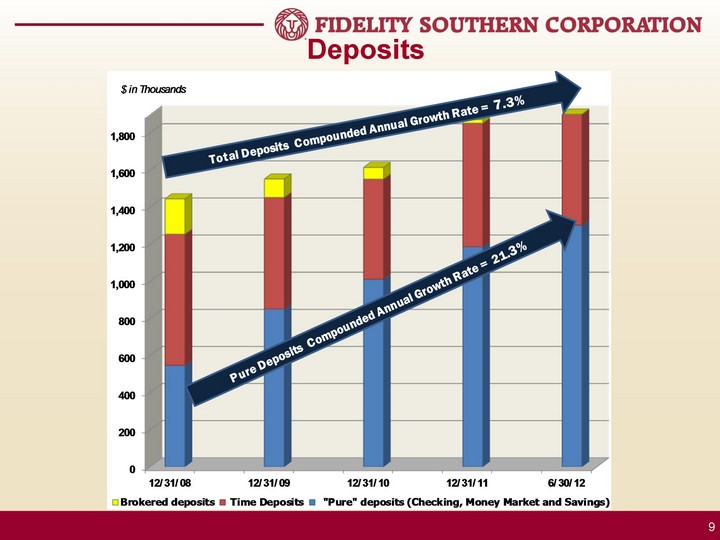

| Deposits |

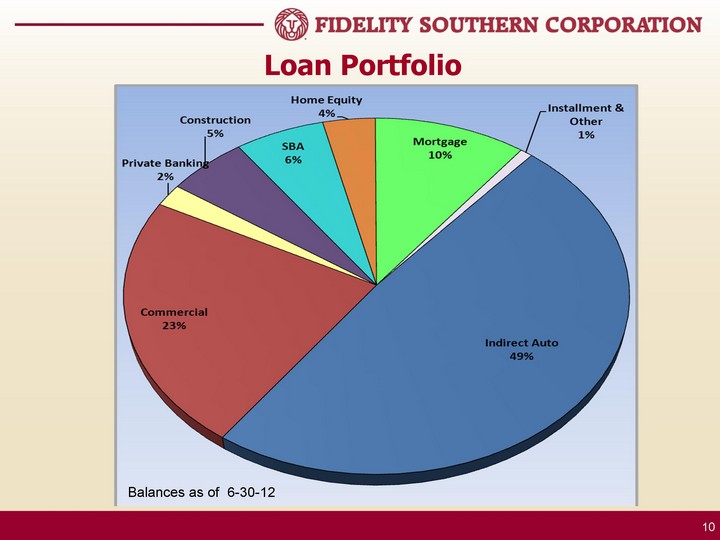

| Loan Portfolio Balances as of 6-30-12 |

| Loan Production |

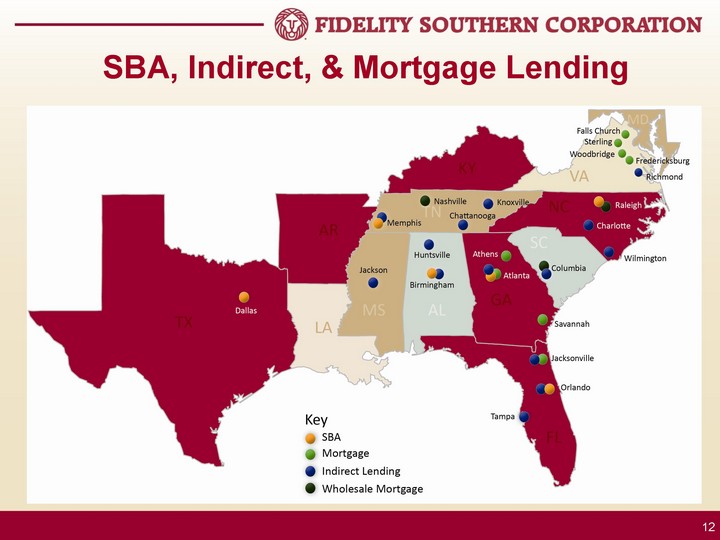

| SBA, Indirect, & Mortgage Lending |

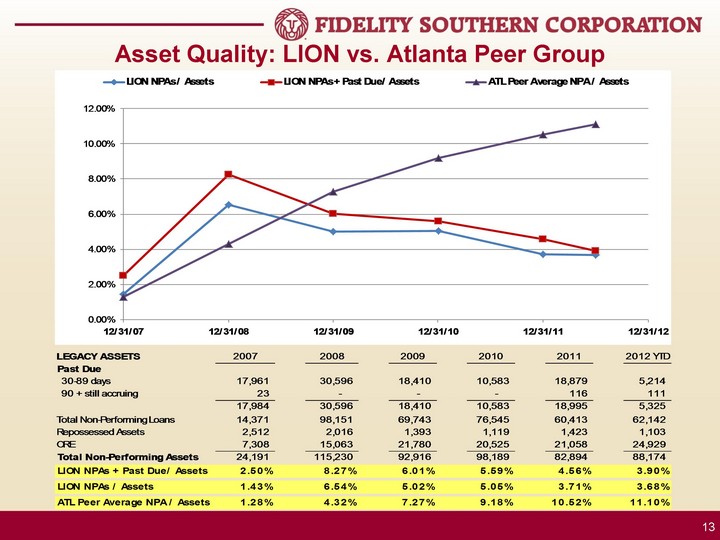

| Asset Quality: LION vs. Atlanta Peer Group |

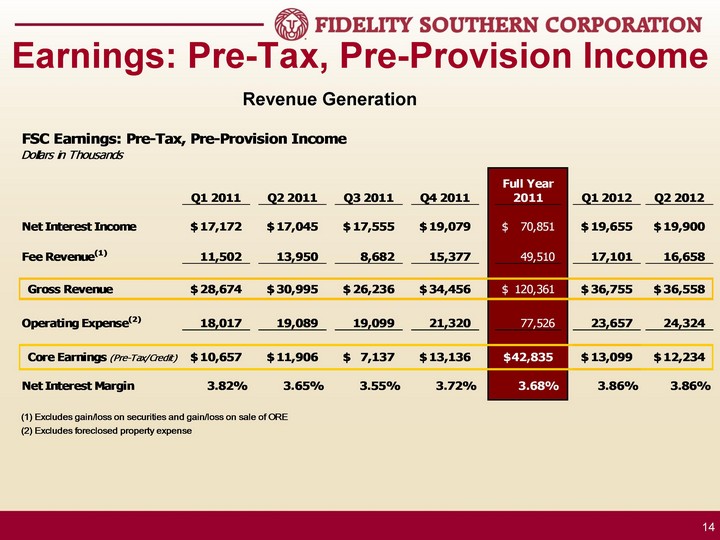

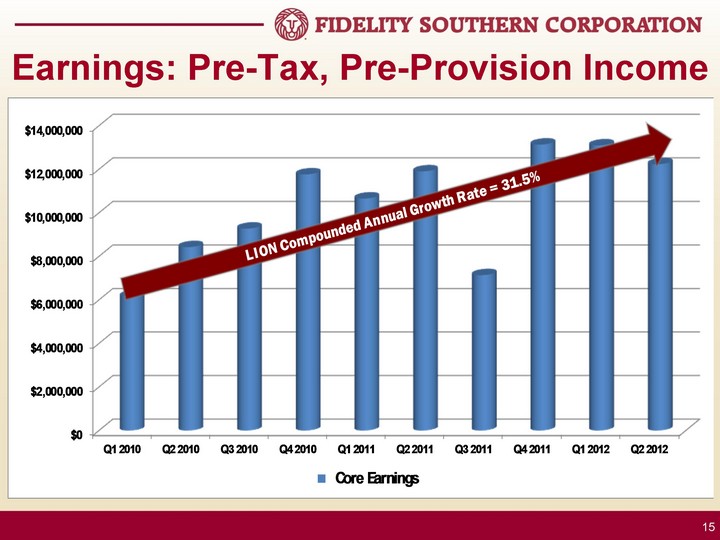

| Earnings: Pre-Tax, Pre-Provision Income Revenue Generation |

| Earnings: Pre-Tax, Pre-Provision Income |

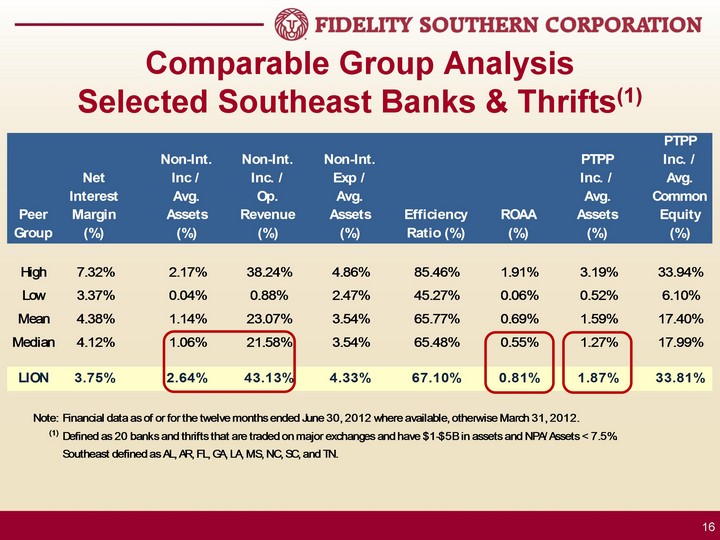

| Comparable Group Analysis Selected Southeast Banks & Thrifts(1) |

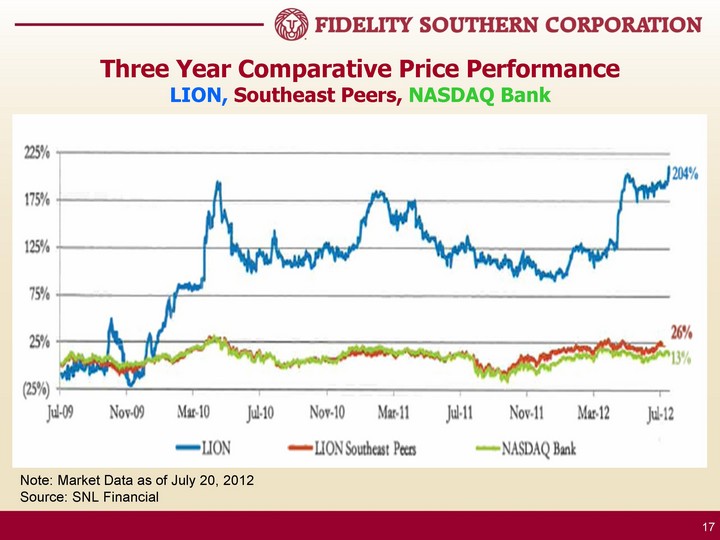

| Three Year Comparative Price Performance LION, Southeast Peers, NASDAQ Bank Note: Market Data as of July 20, 2012 Source: SNL Financial |

| Summary Proven Track Record of Strong Growth Outperforms Southeast Peers Favorable Deposit Mix Well Diversified Lending Base Thrives During Tough Economic Times Well Positioned for Strong Future Performance |