Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - EL PASO ELECTRIC CO /TX/ | form8-ker06x30x2012.htm |

| EX-99.01 - EARNINGS PRESS RELEASE - EL PASO ELECTRIC CO /TX/ | exh990106-30x2012.htm |

August 1, 2012 1 Second Quarter 2012 Earnings Conference Call August 1, 2012 El Paso Electric Company Exhibit 99.02

Statements in this presentation, other than statements of historical information, are forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 (the “act”). Such statements are intended to be made as of the date of this presentation, and the company does not undertake to update any such forward-looking statement. Forward-looking statements involve known and unknown risks and other factors that may cause actual results to differ materially from those expressed in this presentation. In connection with the safe-harbor provisions of the act, the company has set forth below a number of important risks and factors that could cause actual results to differ materially from forward-looking information. Factors that could cause or contribute to such differences include, but are not limited to: Increased prices for fuel and purchased power and the possibility that regulators may not permit EE to pass through all such increased costs to customers or to recover previously incurred fuel costs in rates The ability to increase rates to recover capital investments and operating costs in Texas and New Mexico Uncertainties and instability in the general economy and the resulting impact on EE’s sales and profitability Unanticipated increased costs associated with scheduled and unscheduled outages The size of our construction program and our ability to complete construction on budget and on time Costs at Palo Verde Deregulation and competition in the electric utility industry Possible increased costs of compliance with environmental or other laws, regulations and policies Possible income tax and interest payments as a result of audit adjustments proposed by the IRS Uncertainties and instability in the financial markets and the resulting impact on EE’s ability to access the capital and credit markets Other factors detailed by EE in its public filings with the Securities and Exchange Commission. EE’s filings are available from the Securities and Exchange Commission or may be obtained through EE’s website, http://www.epelectric.com Any such forward-looking statement is qualified by reference to these risks and factors. EE cautions that these risks and factors are not exclusive. EE does not undertake to update any forward-looking statement that may be made from time to time by or on behalf of EE except as required by law. August 1, 2012 2 El Paso Electric R Safe Harbor Statement

Tom Shockley was appointed CEO On May 18, 2012, the PUCT approved the settlement of our 2012 Texas rate case Annual non-fuel base rate reduction of $15.0mm ($11.7mm in 2012); effective May 1, 2012 Reduction of annual depreciation expense of $4.1mm ($2.7mm in 2012) Filed a certificate of convenience and necessity “CCN” for Montana Power Station Seeking authorization for two 88 MW natural gas-fired units August 1, 2012 3 El Paso Electric R Highlights for the 2nd Quarter 2012

Board of Directors approved a 13.6 percent increase in the quarterly cash dividend to $0.25 per share of common stock on May 31, 2012 Dividend paid on June 29, 2012 to shareholders of record on June 15, 2012 Dividend increase intended to achieve targeted 45 percent payout ratio On July 25, 2012, the Board declared a quarterly cash dividend of $0.25 per share payable on September 28, 2012 August 1, 2012 4 El Paso Electric R Dividend Update

2nd Quarter 2012 EPS (Basic) - $0.77, compared to 2nd quarter 2011 EPS (Basic) of $0.78 YTD 2012 (Basic) EPS - $0.85, compared to YTD 2011 (Basic) EPS of $0.94 August 1, 2012 5 El Paso Electric R 2012 Financial Results

Positive earnings driver: Lower Palo Verde (PV) O&M due primarily to timing of outages - $0.04/share Effect of prior year share repurchases - $0.03/share Negative earnings drivers: Decreased PV Unit 3 revenues due to lower proxy market prices resulting from lower natural gas prices and reduced generation – ($0.03/share) Losses on decommissioning trust equity investments – ($0.03/share) Increased pension and benefits expense resulting from lower discount rates – ($0.02/share) August 1, 2012 6 El Paso Electric R 2nd Quarter Key Earnings Drivers

Positive earnings drivers: Increased base revenues from increased kWh sales resulting from an increase in the average number of customers - $0.03/share Lower PV O&M - $0.02/share Effect of prior year share repurchases - $0.04/share Negative earnings drivers: Decreased PV Unit 3 revenues due to lower proxy market prices resulting from lower natural gas prices and reduced generation – ($0.05/share) Increased fossil-fuel plant O&M due to timing of planned maintenance of gas-fired generating units - ($0.05/share) Losses on decommissioning trust equity investments – ($0.04/share) Increased employee pension and benefits expense due to lower discount rates - ($0.04/share) August 1, 2012 7 El Paso Electric R Year-to-Date Key Earnings Drivers

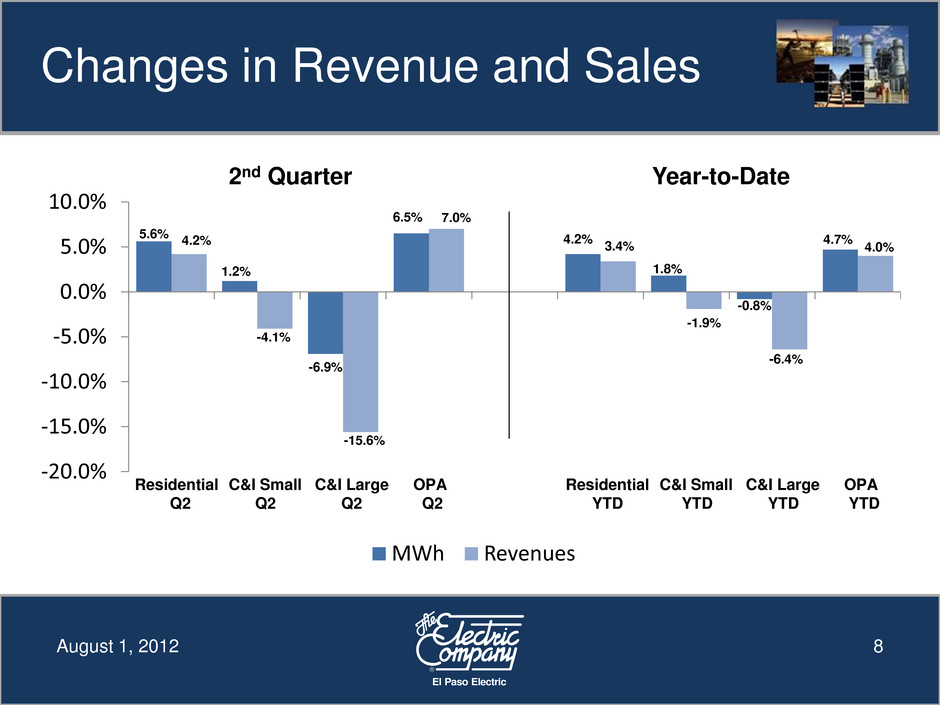

5.6% 1.2% -6.9% 6.5% 4.2% 1.8% -0.8% 4.7% 4.2% -4.1% -15.6% 7.0% 3.4% -1.9% -6.4% 4.0% -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% MWh Revenues C&I Small Q2 Residential Q2 C&I Large Q2 OPA Q2 Residential YTD C&I Small YTD C&I Large YTD OPA YTD August 1, 2012 8 El Paso Electric R Changes in Revenue and Sales 2nd Quarter Year-to-Date

Revising 2012 Earnings Guidance range to $2.10 to $2.45 per basic share from previous range of $2.05 to $2.40 per basic share Primary driver for increased earnings is due to revised AFUDC capitalization assumptions and lower depreciation expense due to lower plant balances Decommissioning fund losses realized in Q2 partially offset the increase in earnings August 1, 2012 9 El Paso Electric R 2012 Earnings Guidance

EE has expended $99.9mm for additions to utility plant for the six months ended June 30, 2012 Capital expenditures for utility plant in 2012 are anticipated to be approximately $232mm (previously $227mm) EE made $18.8mm in dividend payments for the six months ended June 30, 2012 ($10.0mm during the second quarter) EE had a cash balance of $10.1mm at June 30, 2012 At June 30, 2012, EE had liquidity of $198.8mm including cash and the revolving credit facility August 1, 2012 10 El Paso Electric R Capital Requirements and Liquidity

Q & A August 1, 2012 11 El Paso Electric R