Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SEAL123 INC | d388114d8k.htm |

| EX-99.1 - PRESS RELEASE - SEAL123 INC | d388114dex991.htm |

| EX-99.4 - CLINTON GROUP CORRESPONDENCE, JULY 23, 2012 - SEAL123 INC | d388114dex994.htm |

| EX-99.2 - CLINTON GROUP CORRESPONDENCE, JUNE 15, 2012 - SEAL123 INC | d388114dex992.htm |

| EX-99.5 - CLINTON GROUP CORRESPONDENCE, JULY 30, 2012 - SEAL123 INC | d388114dex995.htm |

Exhibit 99.3

IN FRASTRUCTURE | A G I L I T Y | E X P E R T I S E Globally Diversified Investment Institution Specializing In Alternative Investment Strategies

This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. However, we have not verified such information and we do not make any representations as to its accuracy or completeness. Any statements non-factual in nature constitute only current opinions, which are subject to change. No part of this report may be reproduced in any manner without the prior permission of Clinton Group, Inc. All return figures are net of fees. Total return and value will fluctuate and past performance is no guarantee of future results. The information set forth here should not be construed as an investment recommendation. This presentation should be read in conjunction with important disclosures included with this booklet. CCO Approved 6/1/11

© Clinton Group, Inc. All rights reserved 2012

The Wet Seal, Inc.

Our Initial Conclusions

June 2012

Executive Summary

We believe Wet Seal needs to optimize its capital structure and fix its operations. Shareholders have been patient long enough.

§As noted in our letter to the Board, the operating performance of the business has been dismal and the stock has underperformed

–Both long- and short-term performance has been worse than peers, despite many efforts to remake the business

–The stock now trades near a multi-year low and a low EBITDA multiple; yet, 13 million shares are sold short

§In our calls with management and the Board, it is unclear whether operating performance is turning around

–Management expresses confidence, but the Board appears unconvinced

–No objective or financial measures of improved performance, yet

§Everyone does agree that the capital structure is inefficient, with significant excess cash

–Continuing to operate with an acknowledged, dramatically suboptimal capital structure is inexcusable

–The un-needed cash dampens already low returns on invested capital from poor operating performance

–The Board can create value for shareholders with a stroke of its pen by authorizing a self tender with excess cash

§Shareholders have, understandably, grown impatient; this Board needs to act or it will be held accountable

–We believe there will be overwhelming shareholder support for replacing the Board in the event things do not improve

–We are strongly considering all of our options

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY Page 1

Optimizing the Capital Structure

A well-executed stock tender offer will increase the Company’s share price.

§Wet Seal has $75 - $100 million of excess cash

–Cash is driving ROIC down to historically low levels

–Cash as a percentage of market cap is higher than peers; ROIC is lower

–Entire growth strategy can be executed with much less cash

ØOur analysis only suggests using existing cash - we have not even considered adding leverage to the balance sheet

§With an appropriately sized / structured self-tender, the stock would trade to $4.00 or higher

–Buy 20+% of outstanding shares at a premium

–With constant P/E multiple, the stock trades to ~$4.00

–If store expansion strategy is executed well, the NPV of the stock rises to ~$6.00

–We believe the stock will trade in the $4.00-$5.00 range

§Benefits

–Take advantage of historically low stock price and high cash balance

–Signal to the market that the Board has confidence that a turnaround is coming

–Show commitment to the creation of shareholder value

–Insistence on capital structure discipline is critical component of good corporate governance

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY Page 2

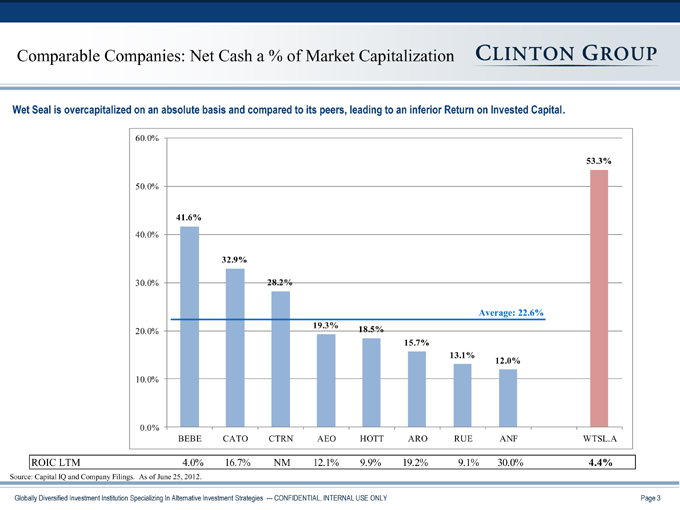

Comparable Companies: Net Cash a % of Market Capitalization

Wet Seal is overcapitalized on an absolute basis and compared to its peers, leading to an inferior Return on Invested Capital. Average: 22.6%

ROIC LTM4.0%16.7%NM12.1%9.9%19.2%9.1%30.0%4.4%41.6%32.9%28.2%19.3%18.5%15.7%13.1%12.0%

53.3%0.0%10.0%20.0%30.0%40.0%50.0%60.0%BEBECATOCTRNAEOHOTTARORUEANFWTSL.A

Source: Capital IQ and Company Filings. As of June 25, 2012.

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY Page 3

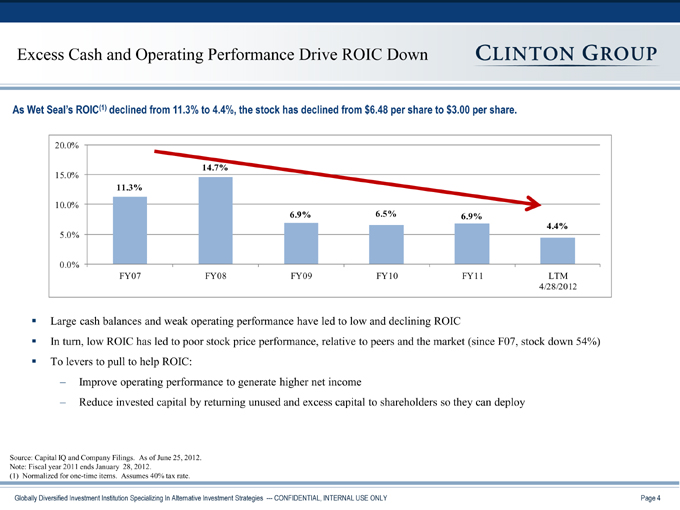

Excess Cash and Operating Performance Drive ROIC Down As Wet Seal’s ROIC(1) declined from 11.3% to 4.4%, the stock has declined from $6.48 per share to $3.00 per share.

11.3%14.7%6.9%6.5%6.9%4.4%0.0%5.0%10.0%15.0%20.0%FY07FY08FY09FY10FY11LTM4/28/2012

Source: Capital IQ and Company Filings. As of June 25, 2012.

Note: Fiscal year 2011 ends January 28, 2012.

(1) Normalized for one-time items. Assumes 40% tax rate.

§Large cash balances and weak operating performance have led to low and declining ROIC

§In turn, low ROIC has led to poor stock price performance, relative to peers and the market (since F07, stock down 54%)

§To levers to pull to help ROIC:

–Improve operating performance to generate higher net income

–Reduce invested capital by returning unused and excess capital to shareholders so they can deploy

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY Page 4

Page 5

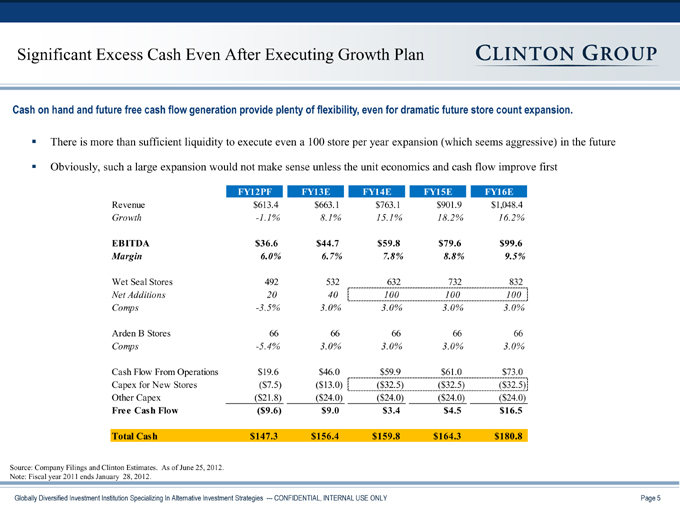

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY Significant Excess Cash Even After Executing Growth Plan

Cash on hand and future free cash flow generation provide plenty of flexibility, even for dramatic future store count expansion.

Source: Company Filings and Clinton Estimates. As of June 25, 2012.

Note: Fiscal year 2011 ends January 28, 2012.

§There is more than sufficient liquidity to execute even a 100 store per year expansion (which seems aggressive) in the future

§Obviously, such a large expansion would not make sense unless the unit economics and cash flow improve first

FY12PFFY13EFY14EFY15EFY16ERevenue $613.4$663.1$763.1$901.9$1,048.4Growth-1.1%8.1%15.1%18.2%16.2%EBITDA$36.6$44.7$59.8$79.6$99.6Margin 6.0%6.7%7.8%8.8%9.5%Wet Seal Stores492532632732832Net Additions2040100100100Comps-3.5%3.0%3.0%3.0%3.0%Arden B Stores6666666666Comps-5.4%3.0%3.0%3.0%3.0%Cash Flow From Operations$19.6$46.0$59.9$61.0$73.0Capex for New Stores($7.5)($13.0)($32.5)($32.5)($32.5)Other Capex($21.8)($24.0)($24.0)($24.0)($24.0)Free Cash Flow($9.6)$9.0$3.4$4.5$16.5Total Cash$147.3$156.4$159.8$164.3$180.8

Page 6

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY

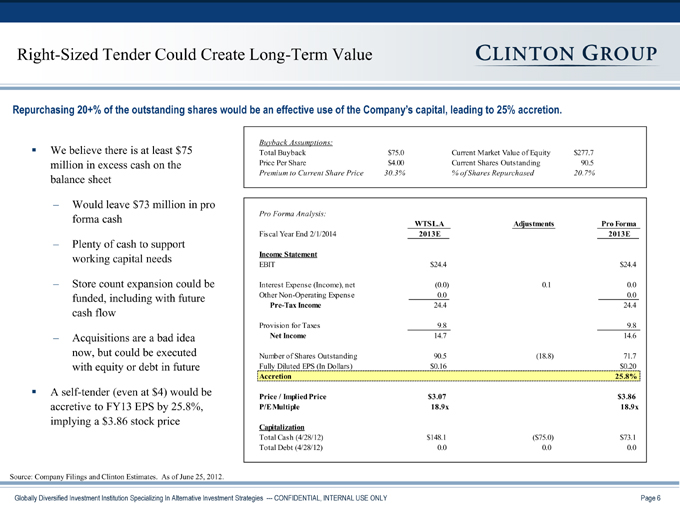

Right-Sized Tender Could Create Long-Term Value Repurchasing 20+% of the outstanding shares would be an effective use of the Company’s capital, leading to 25% accretion.

§We believe there is at least $75 million in excess cash on the balance sheet

–Would leave $73 million in pro forma cash

–Plenty of cash to support working capital needs

–Store count expansion could be funded, including with future cash flow

–Acquisitions are a bad idea now, but could be executed with equity or debt in future

§A self-tender (even at $4) would be accretive to FY13 EPS by 25.8%, implying a $3.86 stock price

Source: Company Filings and Clinton Estimates. As of June 25, 2012. Buyback Assumptions:Total Buyback$75.0Current Market Value of Equity$277.7Price Per Share$4.00Current Shares Outstanding90.5Premium to Current Share Price30.3%% of Shares Repurchased20.7%Pro Forma Analysis:WTSL.AAdjustmentsPro FormaFiscal Year End 2/1/20142013E2013EIncome StatementEBIT$24.4$24.4Interest Expense (Income), net(0.0)0.10.0Other Non-Operating Expense0.00.0 Pre-Tax Income24.424.4Provision for Taxes9.89.8 Net Income14.714.6Number of Shares Outstanding90.5(18.8)71.7Fully Diluted EPS (In Dollars)$0.16$0.20Accretion25.8%Price / Implied Price$3.07$3.86P/E Multiple18.9x18.9xCapitalizationTotal Cash (4/28/12)$148.1($75.0)$73.1Total Debt (4/28/12)0.00.00.0

Page 7

Globally Diversified Investment Institution Specializing In Alternative Investment Strategies --- CONFIDENTIAL, INTERNAL USE ONLY

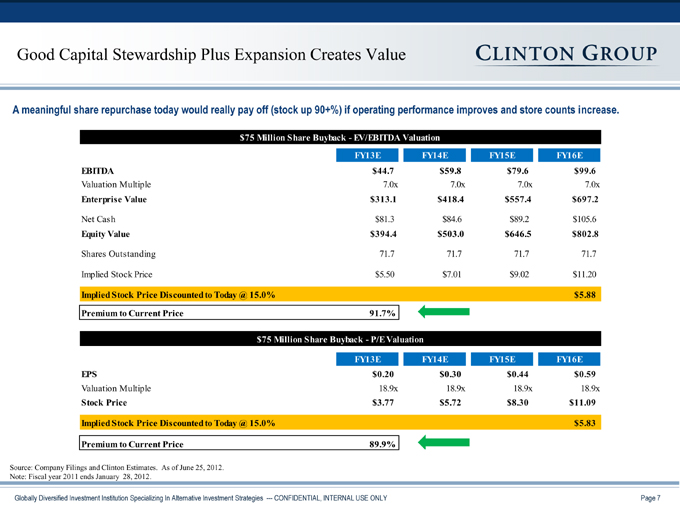

Good Capital Stewardship Plus Expansion Creates Value A meaningful share repurchase today would really pay off (stock up 90+%) if operating performance improves and store counts increase.

Source: Company Filings and Clinton Estimates. As of June 25, 2012.

Note: Fiscal year 2011 ends January 28, 2012. $75 Million Share Buyback - EV/EBITDA ValuationFY13EFY14EFY15EFY16EEBITDA$44.7$59.8$79.6$99.6Valuation Multiple7.0x7.0x7.0x7.0xEnterprise Value$313.1$418.4$557.4$697.2Net Cash$81.3$84.6$89.2$105.6Equity Value $394.4$503.0$646.5$802.8Shares Outstanding71.771.771.771.7Implied Stock Price$5.50$7.01$9.02$11.20Implied Stock Price Discounted to Today @ 15.0%$5.88Premium to Current Price91.7%$75 Million Share Buyback - P/E ValuationFY13EFY14EFY15EFY16EEPS$0.20$0.30$0.44$0.59Valuation Multiple18.9x18.9x18.9x18.9xStock Price$3.77$5.72$8.30$11.09Implied Stock Price Discounted to Today @ 15.0%$5.83Premium to Current Price89.9%