Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HD SUPPLY, INC. | d388696d8k.htm |

Investor Presentation

Investor Presentation

July 30, 2012

Portfolio of Leading Industrial Distribution Companies

Portfolio of Leading Industrial Distribution Companies

Exhibit 99.1 |

2

Disclaimer

This presentation includes forward-looking information. Forward-looking

statements are subject to known and unknown risks and uncertainties, many of

which may be beyond our control. We caution you that the forward-looking information presented

in this presentation is not a guarantee of future performance and that our actual

results of operations, financial condition and liquidity, and the development

of the industries in which we operate may differ materially from those made in or suggested by

the forward-looking information contained in this presentation. A number

of important factors could cause actual results to

differ materially from those contained in or implied by the forward-looking

statements, including those factors discussed in our annual report on Form

10K filed March 23, 2012 and subsequent filings with the SEC. Any forward-looking information

presented herein is made only as of the date of this presentation, and we do not

undertake any obligation to update or revise any forward-looking

information to reflect changes in assumptions, the occurrence of unanticipated events, changes in future

operating results over time or otherwise. Comparisons of results

for current and any prior periods are not intended to express

any future trends or indications of future performance, unless expressed as such,

and should only be viewed as historical data.

In addition to disclosing financial results that are determined in accordance with

U.S. generally accepted accounting principles (“GAAP”), the Company

also disclosed in this presentation certain non-GAAP financial information including Adjusted

EBITDA. These financial measures are not recognized measures under GAAP, and

are not intended to be and should not be considered in isolation or as a

substitute for, or superior to, the financial information prepared and presented in accordance

with GAAP. |

3

Joe DeAngelo, HD Supply

Chief Executive Officer

Agenda

1.

Transaction Overview

3.

Financial Update

2.

Business Update

Ron Domanico, HD Supply

Chief Financial Officer

Ron Domanico, HD Supply

Chief Financial Officer |

4

Transaction Overview

HD Supply,

Inc.

(“HDS”

or

the

“Company”)

is

Seeking

to

Issue

a

$200

million

add-

on to its 8.125% Senior Secured First Lien Notes due April 2019

Proceeds

from the add-on will be Used for General Corporate Purposes and,

Pending

Such

Allocation,

will

be

Applied

to

Repay

Revolver

Borrowings

-

Pro Forma for the add-on, HDS Will Have Approximately $800 million of

Available Liquidity The Company

Continues

to

Experience

Strong

Earnings

Growth.

LTM

EBITDA

has Grown from $508 Million at end of FY’11 to $545 Million for LTM

4/29/12 ($ in millions)

Sources of Funds

Uses of Funds

Add-on to 8.125% Senior Notes due 2019

$200.0

Pay down ABL Borrowings

$200.0

Total Sources

$200.0

Total Uses

$200.0

1

1

1

Does not include

premium

or

costs

attributable

to

the

offering,

which

will

correspondingly

increase

or

reduce

the

net

proceeds,

as

applicable. |

5

New Debt Structure

Pro Forma Capitalization

($ in millions)

Note: At closing, after applying the $200 million in proceeds, approximately $430

million is expected to be outstanding under the ABL Facility. 1

Balances shown at face value

2

LTM as of 4/29/12

Capitalization

Rate

Maturity

Current

Adj.

Pro Forma

Cash And Cash Equivalents

$125.0

-

$125.0

ABL Revolver ($1,500M)

L+200 bps

4/12/17

370.0

($200.0)

170.0

Sr Sec First Lien Term Loan

L+600 bps

10/12/17

1,000.0

-

1,000.0

Sr Sec First Lien Notes

8.125%

4/15/19

950.0

$200.0

1,150.0

Total First Lien Debt

2,320.0

-

2,320.0

Sr Sec Second Lien Notes

11.000%

4/15/20

675.0

-

675.0

Total Secured Debt

2,995.0

-

2,995.0

Exchanged Senior Notes

14.875%

10/12/20

757.0

-

757.0

Senior Subordinated PIK Notes

13.500%

9/1/15

1,820.0

-

1,820.0

Total Debt

5,572.0

-

5,572.0

Shareholder's Equity

(780.0)

-

(780.0)

Total Capitalization

$4,792.0

-

$4,792.0

Operating Statistics

LTM

4/29/12

LTM

4/29/12

LTM Adj. EBITDA

2

$545.0

$545.0

Credit Statistics

Net First Lien Debt / Adj. EBITDA

4.0x

4.0x

Net Secured Debt / Adj. EBITDA

5.3x

5.3x

Total Debt / Adj. EBITDA

10.2x

10.2x

Net Debt / Adj. EBITDA

10.0x

10.0x

4/29/2012

1

1 |

6

Issuer:

HD Supply, Inc.

Security:

Add-on to 8.125% Senior Secured First Lien Notes (the “Notes”)

Amount:

$200 million

Expected Issue Ratings:

B2 / B+

Guarantors:

Each Domestic Subsidiary that is a Borrower under the ABL Facility or that

guarantees debt of the Issuer under a Credit Facility and is a

Wholly-Owned Subsidiary or under certain Capital Markets Securities

Security:

First

priority

interest

in

substantially

all

assets

and

stock

of

the

Issuer

and

Guarantors,

other

than

the

ABL

Priority Collateral, and second priority interest in the ABL Priority

Collateral Maturity:

4/15/19, provided that if more than $450 million of the 13.500% Senior

Subordinated Notes due 9/1/15 are outstanding on a date that is 90 days

prior to their maturity, the Notes will have an event of default permitting

acceleration of maturity 90 days prior to the maturity of the Senior Subordinated

Notes Optional Redemption:

Non-callable until 4/15/15, then callable at 106.094 until 4/15/16, declining

ratably to par by 4/15/18 Equity Clawback:

On or prior to 4/15/15, up to 35% of the Notes may be redeemed with the proceeds

of certain equity issuances at par plus the coupon

Change of Control:

101% of the principal amount plus accrued interest

Covenants:

Same as the existing 8.125% Senior Secured First Lien Notes

Distribution Method:

Rule 144A with Registration Rights

Add-on 1

st

Lien Bond Summary Terms |

7

Agenda

1.

Transaction Overview

3.

Financial Update

2.

Business Update

Ron Domanico, HD Supply

Chief Financial Officer

Joe DeAngelo, HD Supply

Chief Executive Officer

Ron Domanico, HD Supply

Chief Financial Officer |

8

At A Glance

Market Leading Industrial Distributor

One of the Largest

Industrial

Distributors

Serving the

Highly Fragmented U.S. and Canadian Infrastructure,

MRO

and

Construction

Sectors

Diverse

Portfolio

of Distribution Businesses that Provide

Approximately 1 Million SKUs

to

440,000 Professional

Customers,

Including

Contractors,

Government

Entities,

Maintenance Professionals, Home Builders and Industrial

Businesses

–

Operate Approximately 640 Locations Across 45 U.S.

States and 9 Canadian Provinces

Broad Diversity in Product Portfolio, Customer Base

and Vendor Relationships Reduces the Company’s

Exposure

to Any Single Segment, Product or Customer

Size, Scale

and National Presence Drive Competitive

Advantage in Large, Fragmented Markets

$7.3 Billion of Sales and

$545M

(7.5%)

of

Adj.

EBITDA

for the Last Twelve Months Ended April 29, 2012

Geographic Footprint

Geographic Footprint

1

See Appendix for Reconciliation of Adjusted EBITDA

Note: HD Supply Operates a Sourcing Office in China

1

“Expansive Footprint” |

9

End Market Overview

~$123B Market Opportunity, Solid Growth Drivers

1

Management Estimates

Infrastructure

Maintenance & Repair

Specialty Construction

“Endless, Critical Demand”

“Continual Demand”

“Niche Expertise”

2

Formerly Utilities/Electrical

2

Market

Opportunity

$42B

$42B

$64B

$64B

$17B

$17B

Demand

Drivers

Aging Overburdened

Infrastructure

Coverage for Population Growth

Cost-Effective Distribution of Water

and

Energy

Maintenance

Required for Existing

Stock

of U.S. Structures

Repair

and

Remodel

Construction

Single Family, Multi-Family,

Commercial, Municipal and Repair and

Remodel Construction

HD Supply

Businesses

Waterworks

Power

Solutions

Facilities Maintenance

Crown Bolt

Repair & Remodel

White Cap

Creative Touch Interiors

HD Supply

Competitive

Advantages

Scale, Information

Technology

and

Pricing

Rigor

Deep Customer Relationships

Industry Leading Management Talent

and Experience

Comprehensive Product Assortment,

Superior

Availability

and

Delivery

Time Differentiation

Superior

National

Distribution

Capabilities

Lean

Operating Cost

Structure

Leveraging ERP Technologies

Customer Service Differentiation

(i.e.,

Delivery Times, Sales Expertise, Value-

Added Product)

Product

Assortment

and

Knowledge

1 |

10

Addressable Opportunities

Addressable Opportunity and HD Supply’s Position

1

Management Estimates

2

Sales for the Year Ending January 29, 2012

3

Facilities Maintenance is the Largest Distributor to Multifamily Properties.

Power Solutions is the Largest Utilities Distributor $1.8B

Waterworks

$8B

$1.9B

Facilities

$63B

$1.0B

White Cap

$12B

$1.6B

Power

Solutions

$34B

Est.

Market

Size

HD

Supply

Sales

Share¹

Rank

21%

#1

#1

3%

#1

#1

8%

#1

#1

5%

#1

#1

Maintenance

Leading Position, Large Opportunities

3

3

($ in billions)

10

2

1 |

11

End Market Diversity

HD Supply Sales

HD Supply Sales

Estimated % of FYE Jan. ’12 Sales

Construction, 39%

Infrastructure

and Other

34%

MRO

27%

Residential

13%

Non-Residential

26%

39% Construction, 27% MRO, 34% Infrastructure |

12

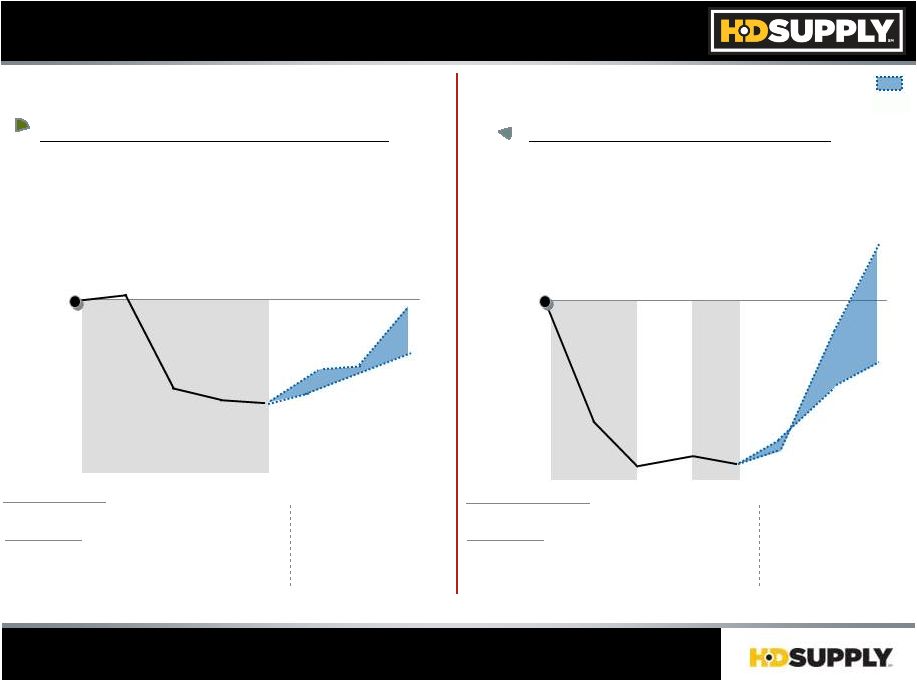

Construction End Market Outlook

Construction Market Growth Projected For ’12

Non-Residential Construction

(26%)

(Construction Spend Change, Index = ’07)

Residential

Construction

(13%)

(13%)

(SF Housing Starts Change, Index = ’07)

Third Party Forecast Range

Sources: Zelman and Associates, Economy.com, Dodge, Portland Cement

Association Spend ($ in billions)

High

$164

Low

$154

$170

$192

540

Annual

SF

Starts

(000s)

810

665

506

898

1,245

$160

$158

$165

$243

$239

Actual

$182

$226

Actual

1,035

429

471

445

616

-60%

-40%

-20%

0%

20%

40%

'07A

'08A

'09A

'10A

'11A

'13F

'14F

'07A

'08A

'09A

'10A

'11A

'12F

'13F

'14F

-60%

-40%

-20%

0%

20%

40%

'12F

High

Low

Forecast Range

Forecast Range |

13

Vacancy Rate

U.S. Apartments

U.S. Apartments

National

Forecast

–

All

Hotels

National

Forecast

–

All

Hotels

63%

55%

64%

$66

$54

$74

+1.3Pts

+1.3Pts

’11 -

’14

Source: REIS (“United States Apartment 4Q 2011 MetroTrend Futures)

Source: Hotel

Horizons

–

Econometric

Forecasts

or

U.S.

Lodging

Markets

(March

–

May

2012

Edition)

’07A

’14F

’13F

’12F

’11A

’10A

’09A

’08A

5.7%

8.0%

4.5%

5.2%

0.7 Pts

0.7 Pts

’11 -

’14

’07A

’14F

’13F

’12F

’11A

’10A

’09A

’08A

’07A

’14F

’13F

’12F

’11A

’10A

’09A

’08A

’07A

’14F

’13F

’12F

’11A

’10A

’09A

’08A

4.8%

-4.3%

3.9%

4.5%

+0.7Pts

+0.7Pts

’11 -

’14

Multifamily

Multifamily

Hospitality

Hospitality

+6% CAGR

(’11 -

’14)

Rev. Per Occupied Stock

Occupancy Rate

Rev. Per Avail. Room

U.S. Apartment and Lodging Outlook

Favorable Outlook

13 |

14

(Sales Growth Versus Market)

Outpace Market Growth…

’11A

Total HD Supply…

+9 Pts V Estimated Market Growth

Source:

3

Party

Market

Sources,

Management

Estimates

+2%

+2%

Market

WW

(3%)

(3%)

Market

PS

+11%

+11%

+14 Pts

+5%

+5%

(5%)

(5%)

Market

WC

+15%

+15%

+20 Pts

FM

+11%

+11%

+4%

+4%

+7 Pts

Market

+3 Pts

rd |

15

Investment Thesis and Key Credit Highlights

Premier Portfolio

of Assets With

Leading

Positions in

Highly Fragmented Markets

Significant Business Diversity Supports Stability:

End

Markets…

27%

MRO,

26%

Non-Residential,

13%

Residential,

34%

Infrastructure

and

Other

Customers…

10

Largest

Represent

10%

of

FY

’11

Sales;

Largest

Customer

is

4%

of

Sales

Suppliers…

10

Largest

Represent

16%

of

FY

’11

Spend

Expansive

Product

Offering…

~ 1 Million SKUs

Robust

Liquidity

and

Financial

Flexibility

Favorable

Market

Outlook...

Poised

for

Accelerated

Growth

on

Rebound

With

Significant Cost Leverage

Low Capital Intensity Results in High Cash Conversion

Experienced, Motivated

Management

Team

and Strong

Equity

Sponsorship |

16

Agenda

1.

Transaction Overview

3.

Financial Update

2.

Business Update

Ron Domanico, HD Supply

Chief Financial Officer

Ron Domanico, HD Supply

Chief Financial Officer

Joe DeAngelo, HD Supply

Chief Executive Officer |

17

Operations

Adjusted EBITDA +48% Versus ’09

FY’11 Financial Highlights

Sales

$7.0B…+$579M (YOY Growth +9.0%)

Positive Sales Growth in Unfavorable Market:

-

Residential

: -10% (Zelman)

-

Non-

Residential : -

6% (Dodge)

-

Muni:

-16% (Dodge)

GM $2.0B…+$173M

VPY Rate 28.7%

+11bps VPY

SG&A

$1.5B…+$77M VPY

Productivity Offset 100% of Inflation

Adj. EBITDA $508M…

+$97M (YOY Growth +23.6%)

EBITDA

Growth 2x Sales Growth

Initiatives +$48M VPY

Trade Net Working Capital (WC)

$1.3B…+$319M

VPY Impacted by Timing of Inventory Purchases

CapEx

$115M…+$66M VPY

Maintenance $40M…~50/50 split bet. fac. and IT

Growth $25-30M

Projects: Fleet $30M, ERP/DR $16M

Cash Flow

$94M…($564M)

VPY Impacted by Timing of Inventory Purchases

1

Includes Trade Receivables, Net Inventory & Accounts Payables

2

See Appendix for reconciliation

Plan

PY

GM

$2,014

$1,768

$1,841

% of Sales

28.7%

28.0%

28.5%

SG&A

$1,532

$1,453

$1,455

% of Sales

21.8%

23.0%

22.6%

Adj. EBITDA

$508

$343

$411

% of Sales

7.2%

5.4%

6.4%

Balance Sheet

Cash Flow

$94

$261

$658

Trade Net WC

$1,313

$1,254

$994

Liquidity

$1,247

$897

$1,323

Net Debt

$5,350

$5,236

$4,956

Adj. EBITDA

Net Sales

$7,028

$6,313

$6,449

($ in millions)

CapEx

$115

$58

$49

1

2

2

1

$508M

$411

$343M

FY ’11

FY ’09

FY ’10

+$68M

+19.8%

+$97M

+23.6% |

18

Financial Summary

1

Strong Operating Performance

Adjusted EBITDA

Adjusted EBITDA

Sales

Gross Margin %

Adj. EBITDA %

Cash Flow

See Reconciliation to GAAP in Appendix

Represents Unlevered,

Pre-Tax Cash flows including results of discontinued operations, See Reconciliation to GAAP in Appendix

Eight Consecutive Quarters of

Year-Over-Year Sales Growth;

LTM Growth

–

1Q12: 14.2%

–

4Q11: 13.6%

–

3Q11: 9.8%

–

2Q11: 9.1%

Refinancing of Nearly $4 Billion

in

Outstanding

Indebtedness.

No

Significant Debt Maturities Until

mid-2015

Completion of the Sale of the

Industrial Pipes, Valves and Fittings

Business for Approximately $464

Million After Transactions Costs

Net Sales and Adjusted EBITDA

Growth in all Four Core

Businesses:

Facilities

Maintenance, Waterworks, Power

Solutions and White Cap

LTM Q1

LTM Q1

2012

2012

$545M

$7,256M

28.6%

7.5%

$257M

$429M

$6,505M

28.6%

6.6%

$291M

+27%

$133M

$1,836M

28.5%

7.2%

$45M

$96M

$1,608M

28.6%

6.0%

($118M)

Q1 '11

Q1 '11

Q1 '12

Q1 '12

+39%

($ in millions)

LTM Q1

LTM Q1

2011

2011

Q1 2012 Comments

2

2

1 |

19

Subsequent Event

June 29, 2012, Purchased Peachtree Business Products LLC

(“Peachtree”) for Approximately $196 million, Subject to a

Customary Working Capital Adjustment

Peachtree Specializes in Customizable Business and Property Marketing

Supplies, Serving Residential and Commercial Property Managers, Medical

Facilities,

Schools

and

Universities,

Churches

and

Funeral

Homes

Will be Operated as Part of Facilities Maintenance

|

20

Accelerating Financial Performance

Financial Performance Validates the Strategy

Sales

and

Earnings

Momentum

Accelerating

Eight

Consecutive

Quarters

of

Year-Over-Year

Sales

Growth,

Gross

Profit

and

Operating

Profit…

with

Market

Headwind

Largest Percentage Sales Increase Since 2007

Gross

Profit

Rates

of

28.6%

are

Among

the

Strongest

Since

2007

Strong Operating Profit Improvement

Adjusted

EBITDA

Up

39%

Year-Over-Year

Liquidity

is

Robust

Management Team Driving Relentless Execution

1

For 1Q12

1

1 |

Q&A |

|

23

Reconciliation to GAAP Financials

($ in Millions)

Note 1: Totals may not foot due to rounding

2010

2011

2012

LTM

LTM

Fiscal

Fiscal

Fiscal

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q1-11

Q1-12

2009

2010

2011

Adjusted EBITDA

78

$

124

$

130

$

79

$

96

$

155

$

155

$

102

$

133

$

429

$

545

$

343

$

411

$

508

$

Reconciling Items:

Depreciation and Amortization

(88)

(87)

(85)

(83)

(83)

(82)

(82)

(82)

(83)

(338)

(329)

(364)

(343)

(329)

Goodwill impairment

-

-

-

-

-

-

-

-

-

-

-

(219)

-

-

Restructuring

(5)

(3)

-

-

-

-

-

-

-

(3)

-

(21)

(8)

-

Stock Compensation

(4)

(4)

(5)

(4)

(4)

(5)

(7)

(4)

(5)

(17)

(21)

(18)

(17)

(20)

Management Fee

(1)

(2)

(1)

(1)

(1)

(2)

(1)

(1)

(1)

(5)

(5)

(5)

(5)

(5)

Other

-

-

-

(1)

-

-

-

1

(1)

(1)

-

-

(1)

1

GAAP Operating Income (Loss)

(20)

28

39

(10)

8

66

65

16

43

65

190

(284)

37

155

Interest Expense, net

(156)

(155)

(153)

(159)

(158)

(159)

(160)

(162)

(166)

(625)

(647)

(602)

(623)

(639)

Loss on extinguishment of debt

-

-

-

-

-

-

-

-

(220)

-

(220)

200

-

-

Other Income (Expense)

(4)

2

1

2

1

-

-

(1)

-

6

(1)

8

1

-

GAAP Pre-Tax Income (Loss)

(180)

(125)

(113)

(167)

(149)

(93)

(95)

(147)

(343)

(554)

(678)

(678)

(585)

(484)

Tax Benefit (Expense)

(22)

12

15

(33)

(20)

(15)

(24)

(20)

33

(26)

(26)

198

(28)

(79)

GAAP Net Income (Loss) Cont Ops

(202)

$

(113)

$

(98)

$

(200)

$

(169)

$

(108)

$

(119)

$

(167)

$

(310)

$

(580)

$

(704)

$

(480)

$

(613)

$

(563)

$ |

24

Reconciliation to GAAP Financials (cont.)

($ in Millions)

Note 1: Totals may not foot due to rounding

2010

2011

2012

LTM

LTM

Fiscal

Fiscal

Fiscal

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q1 2011

Q1 2012

2009

2010

2011

Adjusted Cash Flow

249

$

55

$

116

$

238

$

(118)

$

(22)

$

173

$

61

$

45

$

291

$

257

$

261

$

658

$

94

$

Reconciling Items:

Interest Paid

(164)

(18)

(167)

(14)

(163)

(14)

(163)

(16)

(329)

(362)

(522)

(366)

(363)

(356)

Taxes (Paid) Received

218

(3)

(1)

2

1

(6)

1

(1)

-

(1)

(6)

127

216

(5)

Capital Expenditures

11

11

12

15

18

17

23

57

22

56

119

58

49

115

Proceeds from Sale of PPE

(1)

-

-

(3)

(2)

(2)

-

-

(1)

(5)

(3)

(8)

(4)

(4)

Management Fees & Expenses

(1)

(2)

(1)

(1)

(1)

(1)

(2)

(1)

(1)

(5)

(5)

(5)

(5)

(5)

Other

-

-

1

(1)

(4)

1

-

(1)

-

(4)

-

2

-

(4)

GAAP Operating Cash Flows

312

$

43

$

(40)

$

236

$

(269)

$

(27)

$

32

$

99

$

(264)

$

(30)

$

(160)

$

69

$

551

$

(165)

$ |