Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Ameris Bancorp | d387602d8k.htm |

Second Quarter

2012 Investor Presentation

Exhibit 99.1 |

Cautionary Statements

Cautionary Statements

2

This presentation contains certain performance measures determined by methods other than in

accordance with accounting principles generally accepted in the United States of

America (“GAAP”). Management of Ameris Bancorp (the “Company”) uses these non-GAAP

measures in its analysis of the Company’s performance. These measures are useful when

evaluating the underlying performance and efficiency of the Company’s operations

and balance sheet. The Company’s management believes that these non-GAAP measures provide a

greater understanding of ongoing operations, enhance comparability of results with prior

periods and demonstrate the effects of significant gains and charges in the current

period. The Company’s management believes that investors may use these non-GAAP financial measures to

evaluate the Company’s financial performance without the impact of unusual items that

may obscure trends in the Company’s underlying performance. These disclosures

should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are

they necessarily comparable to non-GAAP performance measures that may be presented by

other companies. Tangible common equity and Tier 1 capital ratios are non-GAAP

measures. The Company calculates the Tier 1 capital using current call report instructions. The Company’s

management uses these measures to assess the quality of capital and believes that investors

may find them useful in their evaluation of the Company. These capital measures may,

or may not be necessarily comparable to similar capital measures that may be presented by other

companies.

This presentation may contain statements that constitute “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “believe”, “estimate”, “expect”,

“intend”, “anticipate” and similar expressions and variations thereof

identify certain of such forward-looking statements, which speak only as of the

dates which they were made. The Company undertakes no obligation to publicly update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. Readers are cautioned

that any such forward-looking statements are not guarantees of future performance

and involve risks and uncertainties and that actual results may differ materially from those indicated in the

forward-looking statements as a result of various factors. Readers are cautioned not to

place undue reliance on these forward-looking statements and are referred to the

Company’s periodic filings with the Securities and Exchange Commission for a summary of certain factors

that may impact the Company’s results of operations and financial condition. |

Corporate

Profile Corporate Profile

•

Headquartered in Moultrie, Georgia

•

Founded in 1971 as American Banking Company

•

Historically grown through acquisitions of smaller

banks in areas close to existing operations

•

Recent growth through de novo expansion

strategy and 10 FDIC-assisted transactions

•

Four state footprint with 67 offices

•

Approximately 830 FTEs managing 200,000 core

customer accounts

•

Assets –

$2.9 billion

Loans –

$2.0 billion

Deposits –

$2.6 billion

3 |

Experienced

Management Team Experienced Management Team

4

NAME / POSITION

EXPERIENCE

(Banking / Ameris)

PREVIOUS

EXPERIENCE

Edwin W. Hortman Jr.

Chief Executive Officer

32/14

Colony Bankcorp, Inc.

Andrew B. Cheney

EVP & Chief Operating Officer

36/3

Barnett Bank, Mercantile Bank

Dennis J. Zember Jr.

EVP & Chief Financial Officer

19/7

Flag Financial Corporation

Jon S. Edwards

EVP & Chief Credit Officer

28/13

NationsBank, Federal Reserve

Stephen A. Melton

EVP, Chief Risk Officer

32/2

Columbus Bank & Trust (lead bank SNV)

Cindi H. Lewis

EVP, Chief Administrative Officer

36/36

Officer at Ameris Bank since 1987

T. Stan Limerick

EVP, Chief Information Officer

7/1

Whitney National Bank

Management and Board Ownership of Approximately 7% |

Current

Focus Current Focus

Position Ameris Bank as a Consolidator in our 4 Southeastern States

•

FDIC

Assisted

acquisitions

–

Slowing

pipeline

of

opportunities

but

our

markets

still

have

majority

of

potential

deals.

Interest

in

both

Strategic

(builds

market

share)

and

Financial

(builds excess TCE and T1 capital).

•

Traditional

M&A

–

Early

stages

of

a

growing

pipeline

of

opportunities

in

our

footprint

on

larger, thinly capitalized institutions

Realize the positive impacts of our Earnings Strategies

•

Build momentum on growing earning assets and additional revenue opportunities

•

Build unique non-interest lines of businesses to drive non-interest income to top

quartile of our peer group

•

Gain operating leverage from continued consolidation. Significantly reduce

non-provision credit

related

costs

such

that

strong

PTPP

earnings

drive

higher

EPS.

Continue Improving Credit Quality

•

Continue to manage strategies that restore historic quality to our Balance Sheet

•

Reduce credit-related operating expenses incrementally throughout 2012

5 |

Second Quarter

Update Second Quarter Update

6

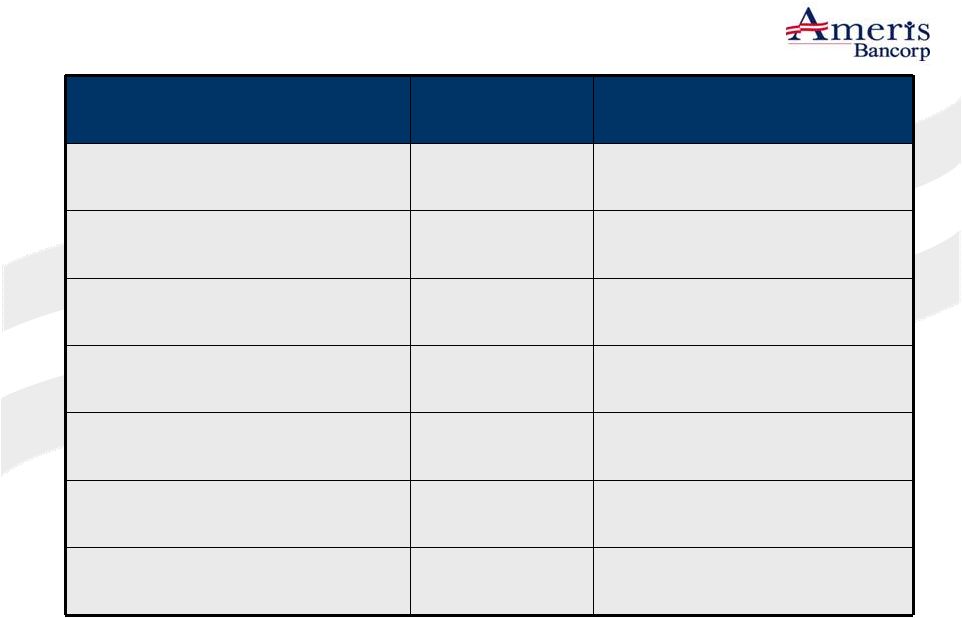

(1)

Excludes covered assets, where applicable

dollars in millions, except per share data

Q2 '11

Q3 '11

Q4 '11

Q1 '12

Q2 '12

Change

BALANCE SHEET

Assets

$2,857

$3,010

$2,994

$3,043

$2,920

2.21%

Loans, net

1,812

1,929

1,868

1,949

1,941

7.12

Tang Common Equity / Assets

7.78

%

7.96%

7.96%

7.95%

8.41%

8.10

Tangible Book Value

$9.34

$10.08

$10.06

$10.15

$10.29

10.17

PERFORMANCE

Pre-tax, pre-credit earnings

$13,491

$15,433

$15,030

$13,634

$14,700

8.96%

as a percentage of average

assets

1.89%

2.05%

2.01%

1.79%

2.01%

Revenue (ex acquisition gains)

$34,727

$34,880

$35,259

$34,954

$37,756

8.72

as a percentage of average

assets

4.86%

4.64%

4.71%

4.59%

5.17%

OPEX (ex credit costs)

$18,720

$20,501

$20,926

$21,507

$23,200

23.93

as a percentage of average

assets

2.62%

2.72%

2.80%

2.83%

3.18%

Diluted earnings per share

0.06

0.66

0.01

0.19

0.07

16.67

Net interest margin (TE)

4.21 %

4.44 %

5.21 %

4.48 %

4.66 %

10.69

Efficiency ratio (ex credit costs)

53.91%

58.78%

59.35%

61.53%

61.45%

13.99

CREDIT QUALITY

(1)

NPAs / Assets

4.27

%

3.77%

4.05%

3.03%

2.89%

(32.32)%

Classified Assets / Capital

49.27

41.78

43.93

35.07

32.05

(34.95)

Reserves / Loans

2.54

2.57

2.64

2.17

1.92

(24.41)

Reserves / NPLs

57.02

59.66

49.64

54.90

58.98

3.44 |

Earnings Growth –

Expansion/Remix of Earning Assets

Short-term plan to convert low yielding assets into traditional earning asset mix

Pickup in net interest income from the strategy is approximately

$26.1 million

7

Balance

Type

84,440

Legacy NPAs

83,467

Covered OREO

203,801

FDIC receivable

151,225

Covered NPLs

111,251

S/T assets

634,184

Total Low Yielding Assets

Balance

Type

475,638

Loans

(75% weighting, 5.00% yields)

126,836

Investments

(20% weight, 2.00% yields)

31,710

S/T assets

(5% weighting, 0.25% yields)

634,184

Traditional E/A mix

•

Majority of the conversion of low yielding assets

expected inside of 2 years

•

Cash flows here do not factor in “growth”.

Management believes growth is possible and costs of

new deposits in 2Q 2012 was approximately 0.40%.

•

Reshuffling asset mix is 100% incremental to ROA

•

After tax pickup of $0.71 per share and 57bps improvement

in ROA

•

Loan generation engine in place, focused on lending niches,

larger relationships in growth markets, existing customers

•

Some loan growth may come from additional FDIC

transactions where assets have higher yields than calculated

here |

Earnings Growth –

Non-interest Income

Significant

growth

in

mortgage

revenue

–

currently

all

from

retail

activities

•

Still hiring highly experienced, high volume teams

•

Current retail production is $20mm per month, potential

and platform to double in 12-18 months

Started wholesale activities in 2Q 2012

•

Hiring experienced relationship managers from large

wholesale players

•

Larger volume opportunity in wholesale relative to retail

activities

8

Serious about building strength and diversification in non-

interest income sources

•

Moving away from deposit charges

•

Researching unique lines of business

•

Momentum in our numbers coming from mortgage

revenue. We believe we can duplicate that strategy with

other LOBs by hiring expertise.

Peer group comparison are banks greater than $3 billion.

•

BOLI transaction in the 3Q will increase annual revenue by

$2.6 million and NII/Assets by 0.07% |

Earnings Growth –

Continued growth in Revenue

Revenue growth through this cycle with

opportunistic strategies:

•

27.4% -

CGR for mortgage related revenue

•

23.6% -

CGR for debit interchange fees

•

7.8% -

CGR for analysis and overdraft fees

•

2011 revenue gains boosted by improved net interest margins from

deployment of short-term assets

•

2012-2015 strategy demands:

•

Diversification of revenue with more emphasis on highly profitable

non-interest income LOB’s that enhance ROA and reduce burden on

capital leverage

•

Protect our advantage from strong net interest margins with emphasis on

creating a highly favorable funding mix

9

•

15.0% compounded annual growth rate in total

revenue over the last three years

•

Revenue has grown twice as fast as earning assets

•

Significant amount of assets that will be deployed

over the next 3 years that will significantly boost

revenue and earnings |

Earnings Growth –

Operating Expense Leverage

10

5 Facts that Point To Significant Leverage in Operating Expense

SAD department fully staffed

•

$5.2 million in annualized cost will trend down over the next couple years as covered and

classified assets decrease Corporate functions can accommodate growth with very little

incremental cost •

Incorporated 10 acquisitions and $1.7 billion in assets in less than 30 months with only 16

additions in staff (excluding SAD functions)

•

Headed by business experts with significant experience. Understand the efficiency

element of M&A. FDIC Insurance is going to decrease substantially

•

$4.1 million reduction in FDIC insurance starting in January 2013 when the prepaid assessment

is fully amortized M&A opportunities exist where primary catalyst for the deal is

operating leverage •

Our M&A strategy is building in existing markets where we can leverage current management

and facilities •

Our core processor contract allows for 50% reduction in processing costs

•

Believe we can integrate targets with less than 2.00% incremental opex/assets

Non-provision credit costs are moderating quickly

•

$3.4 million in 2Q 2012 vs. $12.7 million in 1Q 2012 and $24.7 million in FY 2011.

Expect moderation in these costs in 2H 2012 and into 2013 as credit quality has

improved to peer level |

Local Deposit

Customers Local Deposit Customers

Drive Profitability & Long Term Franchise Value

Drive Profitability & Long Term Franchise Value

11

•

34.9%

-

Growth rate in Non-interest Bearing Demand during last 12 months

•

64.5%

-

Percentage of deposits in retail oriented transaction style accounts

•

98.0%

-

Percentage

of

Bank’s

total

funding

through

deposits

that

“walks

through

our

front

doors”

(2Q

‘12)

Deposit Composition –

6/30/12

“Zero”

cost deposits –

6/30/12

“Zero”

cost deposits include non-interest bearing checking, NOW accounts and Savings accounts that

cost less than 0.25% and are deemed to have very little sensitivity to changing interest

rates.. |

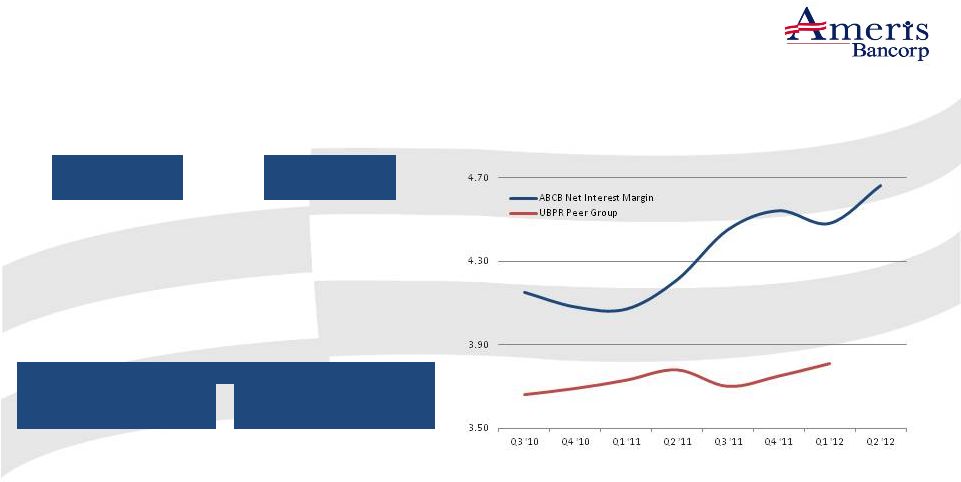

Net Interest

Margin Net Interest Margin

12

(1)

Maturity and Repricing Opportunity are amounts and yields maturing in the designated

quarter (2)

Ameris Bank net interest margin on a fully taxable-equivalent basis, excludes H/C level

TRUPs .

Net Interest Margin

Net Interest Margin

(2)

(2)

(%)

(%)

“Acquisition Yields”

Loans

CDs

Quarter

Yield

Quarter

Yield

Q3 '11

5.62%

Q3 '11

0.96%

Q4 '11

5.38%

Q4 '11

0.67%

Q1 '12

5.48%

Q1 '12

0.65%

Q2 '12

5.45%

Q2 '12

0.54%

Maturity

&

Repricing

Opportunity

(1)

(1)

)

Upcoming Maturities and Expected Renewals:

Quarter

Loans -

Balance

Maturing

Yield

Quarter

CDs -

Balance

Maturing

Cost

Q3 '12

$ 144,165

5.82%

Q3 '12

$ 232,812

1.05%

Q4 '12

$ 123,207

5.98%

Q4 '12

$ 186,914

0.89%

•

Maturing

Balances

and

yields

relative

to

“Acquisition

Yields”

are

still

in

Ameris

Bank’s

favor

•

53.5% -

Increase in new loan volume in Q2 2012 vs. Q3 2011

4.15

4.07

4.45

4.66 |

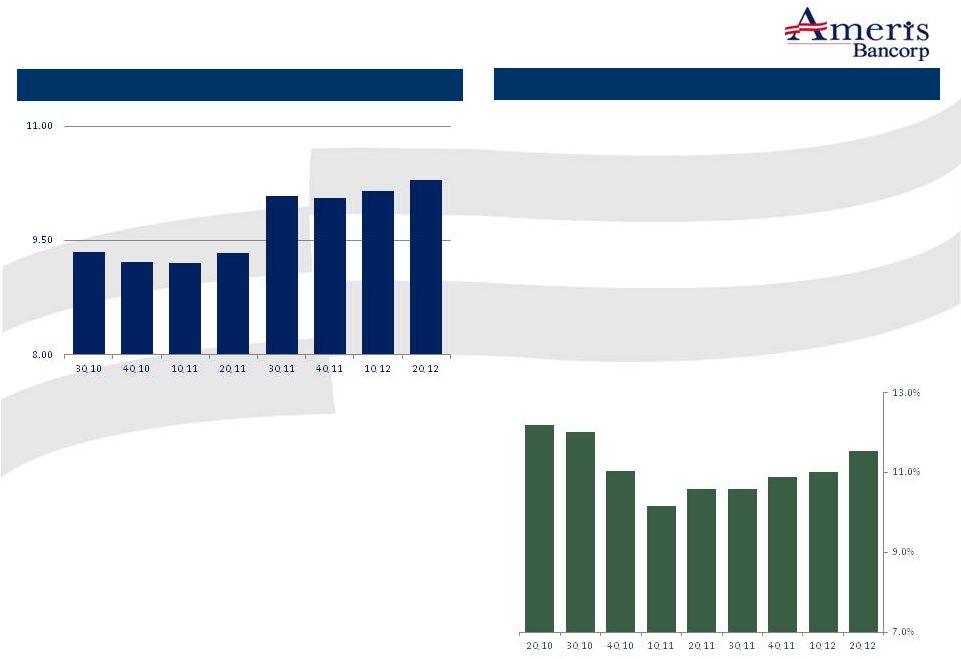

Significant

Capital Strength Significant Capital Strength

Adequate for TARP repayment and further growth

Adequate for TARP repayment and further growth

(1)

Tangible book value per share adjusted for stock dividends

13

Growing Tangible Book Value

Significant Capital left to Leverage

•

9.95% -

Proforma Tier 1 capital assuming

TARP repayment

•

8.40% Proforma TCE / TA assuming TARP

repayment

•

Additional growth of $1.36 billion possible

(leverages T1 Leverage to 8.00%) with no

additional earnings or capital raise

•

10.2% increase in TBV over the past year

•

Successfully earned our way through the

economic cycle with strong core earnings

from our “core/relationship”

oriented

balance sheet

$9.35

$9.22

$9.20

$9.34

$10.08

$10.06

$10.15

$10.29

12.2%

12.0%

11.1%

10.2%

10.6%

10.6%

10.9%

11.0%

11.5%

Tier 1 Leverage Ratio |

FDIC-Assisted Acquisitions –

FDIC-Assisted Acquisitions –

leading the nation in number of deals

leading the nation in number of deals

14

•

Line of business -

experienced teams managing workout of assets, fair value

experienced teams managing workout of assets, fair value

accounting and data conversions

accounting and data conversions

•

Self-capitalizing -

acquisition gain plus subsequent earnings have capitalized

acquisition gain plus subsequent earnings have capitalized

approximately 5.50% of acquired assets

approximately 5.50% of acquired assets

•

Serious about Cost Savings

–

–

10 of the 25 offices acquired have been closed or are

10 of the 25 offices acquired have been closed or are

scheduled to close before EOY 2012

scheduled to close before EOY 2012

Bank

Acquisition Date

Assets, FV

Deposits, FV

Discount Bid

Deposit Premium

Gain/

(Goodwill)

American United Bank

Oct-09

120,994

100,470

(19,645)

262

12,445

United Security Bank

Nov-09

169,172

141,094

(32,615)

228

26,121

Satilla Community Bank

May-10

84,342

75,530

(14,395)

92

8,208

First Bank of Jacksonville

Oct-10

77,705

71,869

(4,810)

-

2,382

Tifton Banking Company

Nov-10

132,036

132,939

(3,973)

-

(955)

Darby Bank & Trust

Nov-10

598,204

444,100

(45,002)

-

4,211

One Georgia Bank

Jul-11

184,344

160,711

(22,500)

-

6,000

High Trust Bank

Jul-11

183,880

170,967

(33,500)

-

14,308

Central Bank of Georgia

Feb-12

261,289

261,036

(33,900)

-

20,037

Montgomery Bank and Trust

Jul-12

18,117

156,647

-

-

-

1,830,083

1,715,363

(210,340)

582

92,757 |

Potential

Consolidation Opportunities Potential Consolidation Opportunities

(data for banks in our four state footprint)

(data for banks in our four state footprint)

“Loss-Share”

M&A Opportunities

(2)

(1)

Banks in Ga, Fl, Al and SC with Texas Ratio over 50% but below 100%. Total assets under

$2 billion. Excludes banks with covered assets (2)

Banks in Ga, Fl, Al and SC with Texas Ratio over 100%. Total assets under $2

billion. Excludes banks with covered assets 15

Traditional M&A Opportunities

(1)

“Traditional”

M&A

“Loss-Share”

M&A

•

Majority remaining are smaller banks where consolidation

opportunities would favor Ameris Bank

•

Average assets of approximately $250 million

•

Regulatory pressure to “make something happen”

on capital levels

and problem assets

•

Average Tier 1 leverage (incl h/c debt) of approximately 5.00%

•

20% of all banks under $2 billion in our four states have Tx

ratio between 50% and 100%

•

Some

improvement

in

number

of

“problem”

banks,

but

almost always from deleveraging vs. new capital or earnings

growth

•

Credit marks in purchase transaction are very punitive given

levels of classified assets and limit acquirers ability to

maintain TBV levels in recapitalization

•

These banks are receiving significant pressure from regulatory

agencies to strategically develop sources of capital and a

rapid path to profitability

•

Similar

in

average

assets

to

“loss

share”

M&A

opportunities

•

20%

of all banks under $2 billion in our four states have Tx

ratio over 100% |

•

Diversified loan portfolio across five regions

–

Inland Georgia –

51%

–

Coastal Georgia –

15%

–

Alabama –

9%

•

In-house lending limit of $7.5 million versus $75 million legal limit

–

4 loans greater than $5 million

•

Loan participations less than 1.00% of total loans

•

Aggressive management of concentrations of credit

•

Top 25 relationships

are only 10.3% of total loans

Loan Portfolio Detail

Loan Portfolio Detail

16

Loan Portfolio Detail –

6/30/12

–

South Carolina –

13%

–

Florida –

12%

Loan Type

Average Loan

Size

Average Rate

Commercial R/E

$ 325,927

5.49 %

C&D

108,310

5.52

Residential

67,919

5.91

C&I

54,415

5.19

Consumer

6,949

6.68

Agriculture

113,720

5.90

Total

$ 77,452

5.66 % |

Loan

Growth Opportunity •

Leveraging presence in new markets (top five markets

account for 70% of pipeline:

Atlanta, Jacksonville, Columbia, Tallahassee, Charleston

•

Upgrading production positions in key markets

production.

•

Expanding Mortgage Strategy

Jumbo mortgages, wholesale, warehouse LOC

•

Leveraging Agricultural expertise

•

Specialty lines of business that would diversify loan

portfolio

Growth in Loan Pipelines

Lending Strategies

•

Yields on current production exceed 5.40%

•

2/3

rds

of production is with existing

customers

–

higher

rates

(40bps-50bps

from

relationships)

•

Diversified

loan

types

–

not

solely

chasing

CRE or competing with low rates that do not

compensate for term or quality

17

Portfolio Diversification by Type

limited

changes

to

expense

base

but

higher

levels

of

quality

better yields than in CRE due to limited competition |

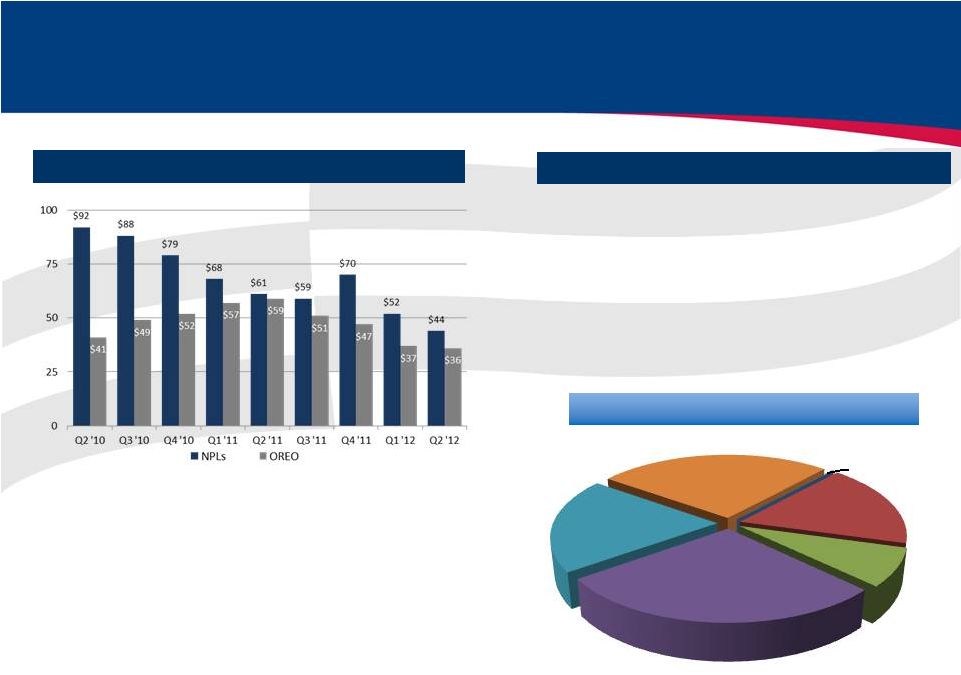

Credit Quality –

Substantial Improvement

Breakdown of OREO by Type

•

Values are appropriate for sale to end users

•

1Q

2012

Disposal

activity

–

More

aggressive

posture resulted in a $31.2 million reduction in

classified assets at 63%, net of reserves

Trends in NPA’s

OREO

•

NPLs down 52% from their peak levels over

2 years ago

18

AGRE Land,

$0.05 , 0%

Subdiv & lots,

$6.30 , 17%

SFR, $2.80 , 8%

CML Land,

$10.00 , 28%

CML Properties,

$7.10 , 20%

RRE Land, $9.60

, 27% |

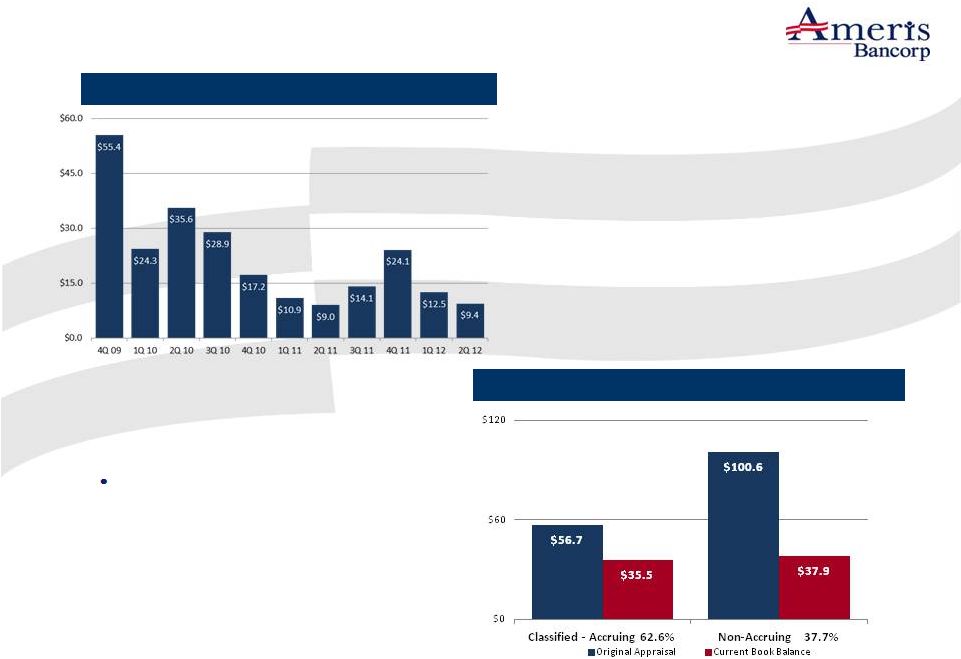

Credit

Cycle Credit Cycle

19

Average

Quarterly

“In-migration”

of

problem

loans:

2010:

$ 26.5mm

•

2011:

$ 14.5mm

•

2012 (1H)

$ 10.9mm

(1) Cumulative losses defined as provision for loan losses plus (gains)/losses on

the sale of OREO (2) Net Book balance of classified loans and

non-accruing loans is net of specific LLRs In-Migration

of

New

Problem

Loans

(1)

Conservative

Carrying

Values

of

Classified

Assets

(2)

•

45%

Decline

–

In-migration

of

new

non-

accrual loans down significantly in 2011 over

2010

•

4 quarter 2011 increase in in-migration was

concentrated in several larger relationships.

All have resolution strategies implemented

•

Management anticipates continued trends of

lower in-migration for 2H 2012 over 2011

levels, although not visually linear

th |

Second Quarter

2012 Investor Presentation |