Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IMPAC MORTGAGE HOLDINGS INC | a12-17142_18k.htm |

Exhibit 99.1

|

|

Impac Mortgage Holdings, Inc. Annual Stockholders’ Meeting Tuesday, July 24, 2012 |

|

|

Safe Harbor Statement During this presentation we may make projections or other forward-looking statements in regards to but not limited to GAAP and taxable earnings, cash flows, interest rate and market risk exposure and general market conditions. Please refer to the “Business Risk Factors” in our most recently filed Form 10K and other reports filed under the Securities and Exchange Act of 1934. These documents contain and identify important factors that could cause the actual results to differ materially from those contained in our projections or forward-looking statements. This presentation including outlook and any guidance is effective as of the date given and we expressly disclaim any duty to update the information herein. |

|

|

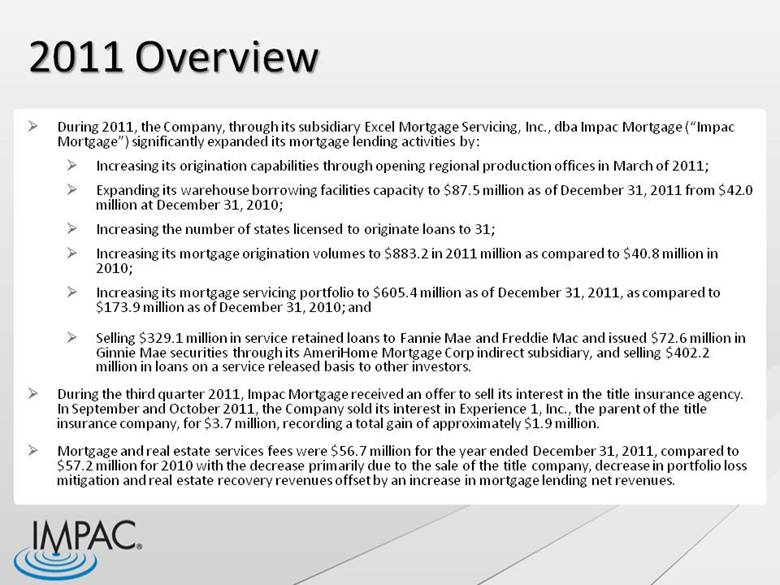

2011 Overview During 2011, the Company, through its subsidiary Excel Mortgage Servicing, Inc., dba Impac Mortgage (“Impac Mortgage”) significantly expanded its mortgage lending activities by: Increasing its origination capabilities through opening regional production offices in March of 2011; Expanding its warehouse borrowing facilities capacity to $87.5 million as of December 31, 2011 from $42.0 million at December 31, 2010; Increasing the number of states licensed to originate loans to 31; Increasing its mortgage origination volumes to $883.2 in 2011 million as compared to $40.8 million in 2010; Increasing its mortgage servicing portfolio to $605.4 million as of December 31, 2011, as compared to $173.9 million as of December 31, 2010; and Selling $329.1 million in service retained loans to Fannie Mae and Freddie Mac and issued $72.6 million in Ginnie Mae securities through its AmeriHome Mortgage Corp indirect subsidiary, and selling $402.2 million in loans on a service released basis to other investors. During the third quarter 2011, Impac Mortgage received an offer to sell its interest in the title insurance agency. In September and October 2011, the Company sold its interest in Experience 1, Inc., the parent of the title insurance company, for $3.7 million, recording a total gain of approximately $1.9 million. Mortgage and real estate services fees were $56.7 million for the year ended December 31, 2011, compared to $57.2 million for 2010 with the decrease primarily due to the sale of the title company, decrease in portfolio loss mitigation and real estate recovery revenues offset by an increase in mortgage lending net revenues. |

|

|

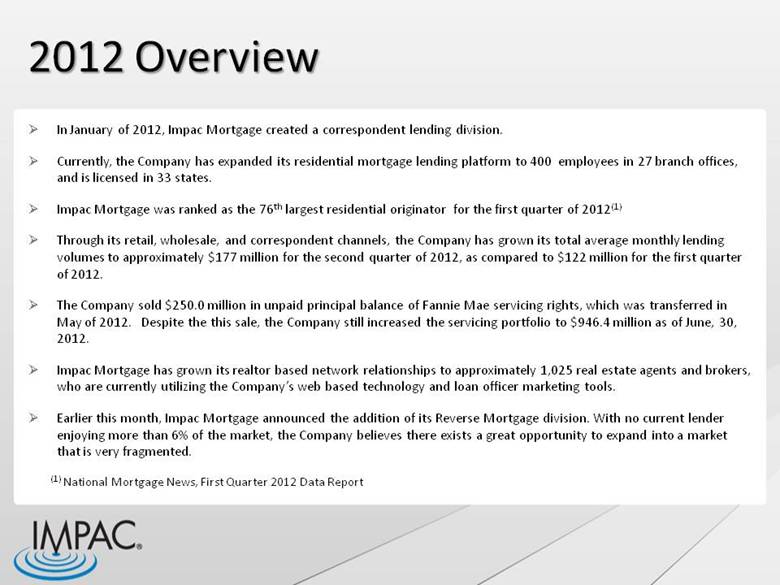

2012 Overview In January of 2012, Impac Mortgage created a correspondent lending division. Currently, the Company has expanded its residential mortgage lending platform to 400 employees in 27 branch offices, and is licensed in 33 states. Impac Mortgage was ranked as the 76th largest residential originator for the first quarter of 2012(1) Through its retail, wholesale, and correspondent channels, the Company has grown its total average monthly lending volumes to approximately $177 million for the second quarter of 2012, as compared to $122 million for the first quarter of 2012. The Company sold $250.0 million in unpaid principal balance of Fannie Mae servicing rights, which was transferred in May of 2012. Despite the this sale, the Company still increased the servicing portfolio to $946.4 million as of June, 30, 2012. Impac Mortgage has grown its realtor based network relationships to approximately 1,025 real estate agents and brokers, who are currently utilizing the Company’s web based technology and loan officer marketing tools. Earlier this month, Impac Mortgage announced the addition of its Reverse Mortgage division. With no current lender enjoying more than 6% of the market, the Company believes there exists a great opportunity to expand into a market that is very fragmented. (1) National Mortgage News, First Quarter 2012 Data Report |

|

|

2012 & 2011 Comparison (in millions) 2012 2011 % Change 2012 2011 % Change Total Fundings $ 518.1 $ 225.8 $ 129% $ 871.6 $ 272.7 $ 220% Wholesale Fundings $ 303.8 $ 163.5 $ 86% 506.8 $ 193.5 $ 162% Retail Fundings $ 132.4 $ 60.5 $ 119% 258.2 $ 76.5 $ 238% Correspondent Fundings $ 81.9 $ 1.8 $ 4450% 106.6 $ 2.6 $ 4000% Government Fundings $ 155.1 $ 71.0 $ 118% $ 242.7 $ 78.6 $ 209% Conventional Fundings $ 363.0 $ 154.8 $ 134% $ 628.9 $ 194.1 $ 224% Service Retained Sales $ 457.1 $ 26.7 $ 1612% $ 749.8 $ 338.0 $ 122% Servicing Portfolio $ 946.4 $ 183.7 $ 415% $ 946.4 $ 183.7 $ 415% Warehouse Capacity $ 145.0 $ 77.5 $ 87% $ 145.0 $ 77.5 $ 87% For the Three Months Ended June 30, For the Six Months Ended June 30, |

|

|

Strategic Update Focus on originating and selling direct to the GSE’s, Fannie Mae, Freddie Mac, and government loans Continue to build the mortgage servicing portfolio Expand lending channels: Retail lending focusing on realtor direct network Correspondent lending focusing on community and regional banks, and credit unions Wholesale lending focusing on vacated opportunities from large national banks Increase purchase money transactions through our realtor direct web based technologies and marketing tools Sale of title and escrow business to focus on the lending expansion Seek capital to support growth of the mortgage servicing portfolio and origination expansion Support expansion and profitability of lending by offering a broader mix of mortgage products eligible for sale to agencies Maximize loss mitigation efforts of the legacy portfolio to support residual portfolio Technology enhancements to support the lending expansion and increased efficiencies The Company does expect to be profitable for the 2nd quarter of 2012 |

|

|

This concludes my prepared remarks, thank you for attending Impac Mortgage Holdings, Inc. 2012 Annual Stockholders’ Meeting. |