Attached files

| file | filename |

|---|---|

| 8-K - NATIONAL PENN BANCSHARES, INC FORM 8-K - NATIONAL PENN BANCSHARES INC | npb8k.htm |

EXHIBIT 99.1

SLIDE PRESENTATION

2nd Quarter 2012

Earnings Webcast

National Penn Bancshares, Inc.

5

Safe Harbor Regarding Forward Looking Statements

This presentation contains forward-looking information about National Penn Bancshares, Inc. that is intended to be covered by the safe harbor for forward-looking statements

provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. These statements can be identified by

the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,’’ “project,” ”could,” “plan,’’ “goal,” “potential,” “pro forma,” “seek,” “intend,’’ or “anticipate’’

or the negative thereof or comparable terminology, and include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions),

statements regarding plans, objectives, expectations or consequences of announced transactions, and statements about the future performance, operations, products and

services of National Penn and its subsidiaries. National Penn cautions readers not to place undue reliance on these statements.

provided by the Private Securities Litigation Reform Act of 1995. Forward-looking statements are statements that are not historical facts. These statements can be identified by

the use of forward-looking terminology such as “believe,” “expect,” “may,” “will,” “should,’’ “project,” ”could,” “plan,’’ “goal,” “potential,” “pro forma,” “seek,” “intend,’’ or “anticipate’’

or the negative thereof or comparable terminology, and include discussions of strategy, financial projections, guidance and estimates (including their underlying assumptions),

statements regarding plans, objectives, expectations or consequences of announced transactions, and statements about the future performance, operations, products and

services of National Penn and its subsidiaries. National Penn cautions readers not to place undue reliance on these statements.

National Penn’s business and operations are subject to a variety of risks, uncertainties and other factors. Consequently, actual results and experience may materially differ

from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected

include, but are not limited to, the following: regulatory requirements or other actions mandated by National Penn’s regulators, recent and ongoing changes to the state and

federal regulatory schemes under which National Penn and other financial services companies operate (including the Dodd-Frank Act and regulations adopted or to be adopted

to implement that Act), deterioration in the credit quality of loans, the effect of credit risk exposure, the geographic concentration of National Penn’s operations, declines in the

value of National Penn’s assets and the effect of any resulting impairment charges, National Penn’s ability to raise capital and maintain capital levels; increases in operating

costs (including those mandated by National Penn’s regulators), competition for personnel and from other financial institutions, variations in interest rates, interruptions or

breaches of National Penn’s security systems, the development and maintenance of National Penn’s information technology, the ability of National Penn and its subsidiaries to

pay dividends, and the nature and frequency of litigation and other similar proceedings to which National Penn may be a party . These risks and others are described in greater

detail in National Penn’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as well as in National Penn’s Quarterly Reports on Form 10-Q and other

documents filed by National Penn with the SEC after the date thereof. National Penn makes no commitment to revise or update any forward-looking statements in order to reflect

events or circumstances occurring or existing after the date any forward-looking statement is made.

from those contained in any forward-looking statements. Such risks, uncertainties and other factors that could cause actual results and experience to differ from those projected

include, but are not limited to, the following: regulatory requirements or other actions mandated by National Penn’s regulators, recent and ongoing changes to the state and

federal regulatory schemes under which National Penn and other financial services companies operate (including the Dodd-Frank Act and regulations adopted or to be adopted

to implement that Act), deterioration in the credit quality of loans, the effect of credit risk exposure, the geographic concentration of National Penn’s operations, declines in the

value of National Penn’s assets and the effect of any resulting impairment charges, National Penn’s ability to raise capital and maintain capital levels; increases in operating

costs (including those mandated by National Penn’s regulators), competition for personnel and from other financial institutions, variations in interest rates, interruptions or

breaches of National Penn’s security systems, the development and maintenance of National Penn’s information technology, the ability of National Penn and its subsidiaries to

pay dividends, and the nature and frequency of litigation and other similar proceedings to which National Penn may be a party . These risks and others are described in greater

detail in National Penn’s Annual Report on Form 10-K for the fiscal year ended December 31, 2011, as well as in National Penn’s Quarterly Reports on Form 10-Q and other

documents filed by National Penn with the SEC after the date thereof. National Penn makes no commitment to revise or update any forward-looking statements in order to reflect

events or circumstances occurring or existing after the date any forward-looking statement is made.

Non-GAAP Financial Measures

This presentation contains supplemental financial information determined by methods other than in accordance with Accounting Principles Generally Accepted in the United

States of America (“GAAP”). National Penn’s management uses these non-GAAP measures in its analysis of National Penn’s performance. These measures should not be

considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP. Management believes

the presentation of the following non-GAAP financial measures, which exclude the impact of the specified items, provides useful supplemental information that is essential to a

proper understanding of the financial results of National Penn.

States of America (“GAAP”). National Penn’s management uses these non-GAAP measures in its analysis of National Penn’s performance. These measures should not be

considered a substitute for GAAP basis measures nor should they be viewed as a substitute for operating results determined in accordance with GAAP. Management believes

the presentation of the following non-GAAP financial measures, which exclude the impact of the specified items, provides useful supplemental information that is essential to a

proper understanding of the financial results of National Penn.

• Tangible common equity excludes goodwill and intangible assets and preferred equity. Banking and financial institution regulators also exclude goodwill and

intangible assets from shareholders’ equity when assessing the capital adequacy of a financial institution. Tangible common equity provides a method to assess

the company’s tangible capital trends.

intangible assets from shareholders’ equity when assessing the capital adequacy of a financial institution. Tangible common equity provides a method to assess

the company’s tangible capital trends.

• Tangible book value expresses tangible common equity on a per-share basis. Tangible book value provides a method to assess the level of tangible net assets on

a per-share basis.

a per-share basis.

• Adjusted net income and return on assets exclude the effects of certain gains and losses, adjusted for taxes when applicable. Adjusted net income and returns

provide methods to assess earnings performance by excluding items that management believes are not comparable among the periods presented.

provide methods to assess earnings performance by excluding items that management believes are not comparable among the periods presented.

• Efficiency ratio expresses operating expenses as a percentage of fully-taxable equivalent net interest income plus non-interest income. Operating expenses

exclude items from non-interest expense that management believes are not comparable among the periods presented. Non-interest income is adjusted to also

exclude items that management believes are not comparable among the periods presented. Efficiency ratio is used as a method for management to assess its

operating expense level and to compare to financial institutions of varying sizes.

exclude items from non-interest expense that management believes are not comparable among the periods presented. Non-interest income is adjusted to also

exclude items that management believes are not comparable among the periods presented. Efficiency ratio is used as a method for management to assess its

operating expense level and to compare to financial institutions of varying sizes.

Management believes the use of non-GAAP measures will help readers compare National Penn’s current results to those of prior periods as presented in the accompanying

Financial Highlights and financial data tables.

Financial Highlights and financial data tables.

2

6

Q2 2012 Highlights

• Continued strong earnings performance

• Maintained superior asset quality

• Continued to provide increased returns of capital to

our shareholders

our shareholders

• Increased quarterly common stock cash dividend from

$0.07 to $0.09 per share - 5th consecutive increase

$0.07 to $0.09 per share - 5th consecutive increase

• Repurchased 2.2 million common shares

• Enhanced strong capital position providing for future

capital management opportunities.

capital management opportunities.

3

7

Consistent Quarterly Earnings

4

*A Non-GAAP measure.

8

5

*A Non-GAAP measure.

9

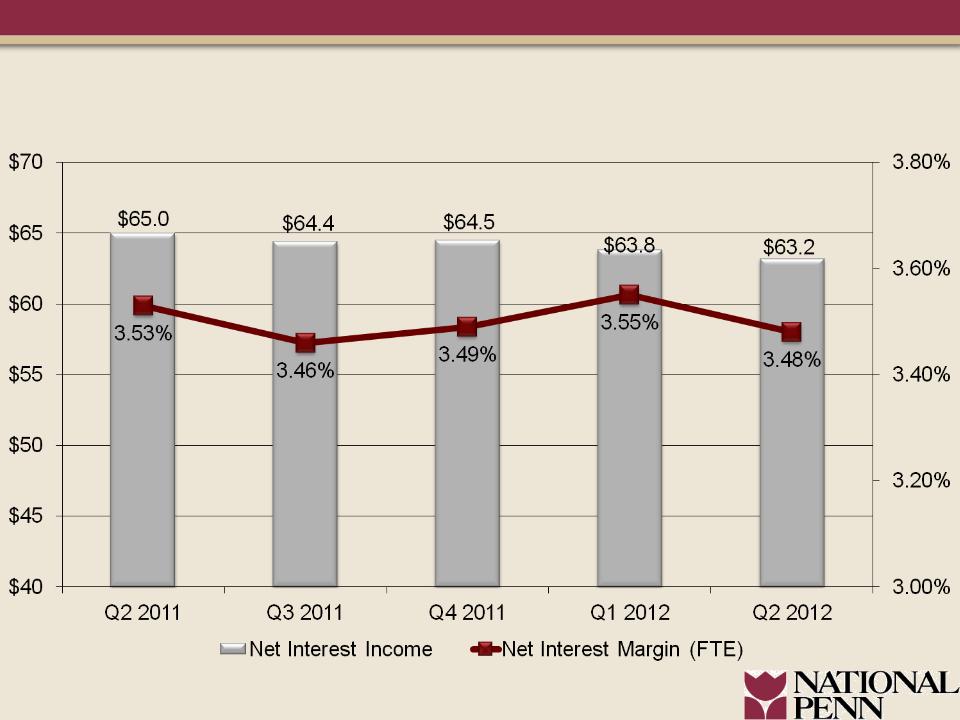

Net Interest Income and Margin

6

($millions)

10

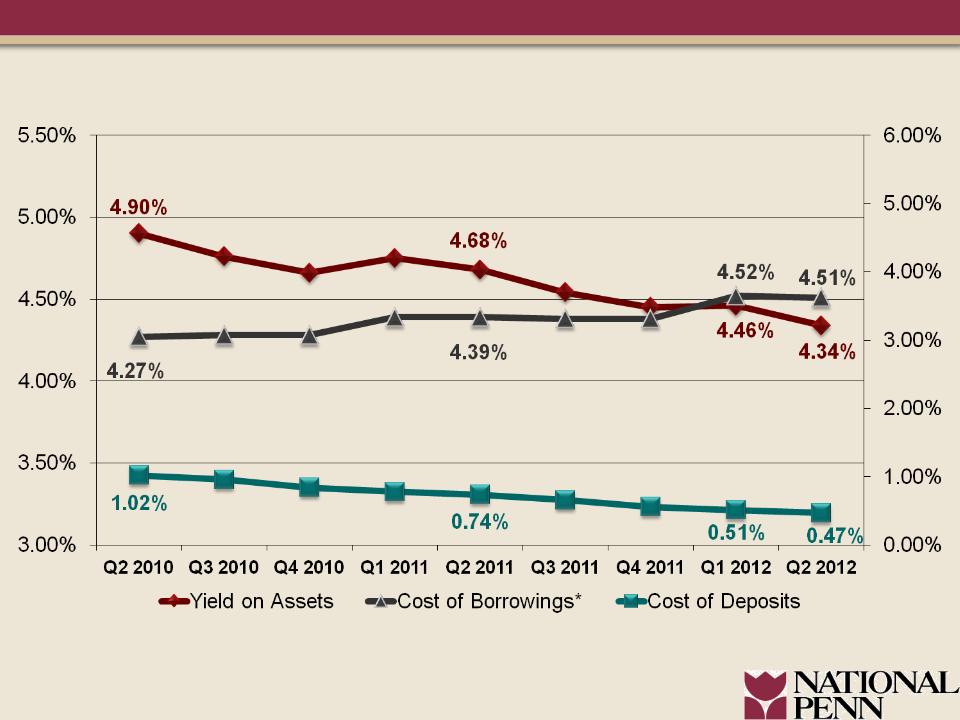

Net Interest Margin Component Trends

7

*Cost of borrowings excludes customer cash management repurchase agreements and subordinated debentures.

11

Loan Trends

8

($millions)

$5,179

$5,161

$5,188

$5,202

$5,211

12

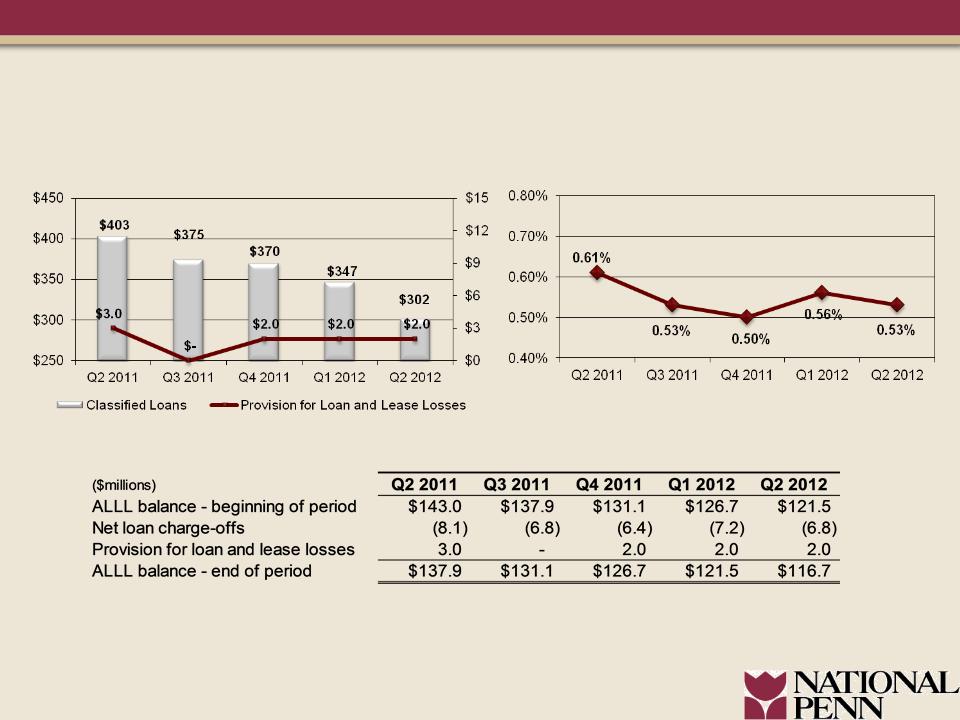

Positive Asset Quality Trends

9

*Annualized

Net Charge-Offs / Average Loans*

($millions)

($millions)

Classified Loans and Provision

13

Strong Asset Quality vs Peers

10

Non-performing loans include non-accrual loans and renegotiated loans

Peer data per SNL as of 3/31/12

Refer to the Appendix for peer listing

Non-Performing Loans as a % of Total Loans

Q1 2012 Peer Average = 2.26%

14

Strong Reserve Coverage vs Peers

11

Non-performing loans include non-accrual loans and renegotiated loans

Peer data per SNL as of 3/31/12

Refer to the Appendix for peer listing

15

Non-Interest Income

12

16

Disciplined Expense Management

13

17

Strong Capital Position

14

18

NPBC Common Share Repurchases

|

Total NPBC common shares repurchased 2Q12

|

2,157,502

|

|

Weighted average repurchase price

|

$8.62

|

|

Total cost of shares repurchased

|

$18.6 million

|

|

|

|

|

Tangible book value per share @ 3.31.12

|

$6.09

|

|

Tangible book value per share @ 6.30.12

|

$6.18

|

15

19

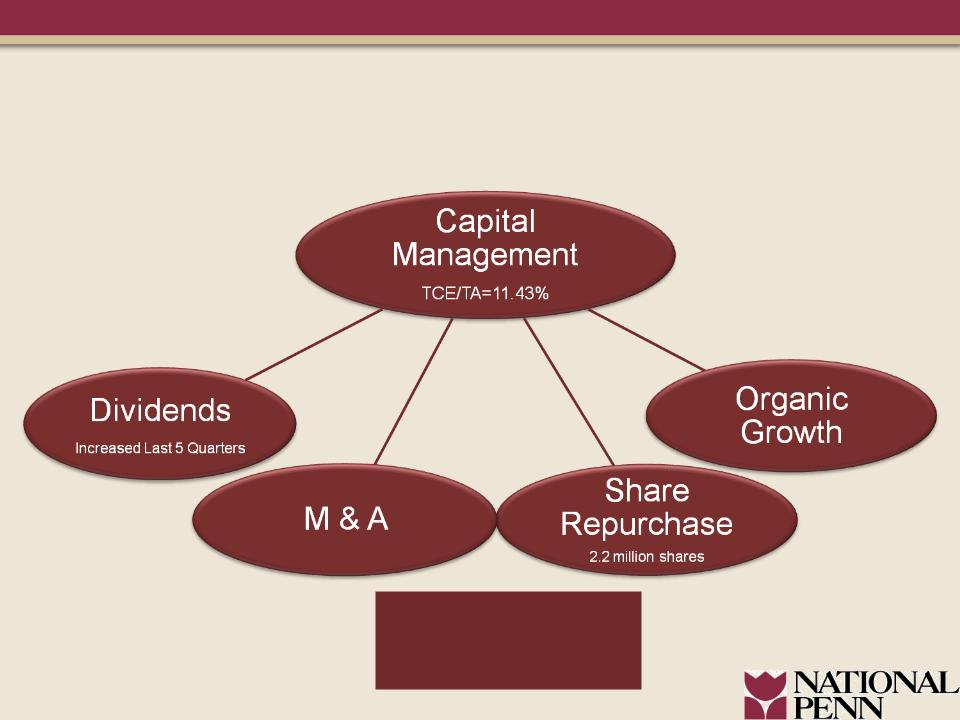

Capital Management Opportunities

($millions)

16

20

17

Enhancing Shareholder Value Through

Capital Management Opportunities

Capital Management Opportunities

Evaluate Initiatives

Considering Proposed

Capital Regulations

Considering Proposed

Capital Regulations

21

• Utilize strength of balance sheet as competitive

advantage

advantage

• Win market share

• Maintain strong asset quality

• Re-risk appropriately

• Patient and disciplined approach

• Enhance shareholder value

18

Executing on our Strategic Plan

#4 - J.D. Power and

Associates® U.S. Retail

Banking Satisfaction

StudySM for the

Associates® U.S. Retail

Banking Satisfaction

StudySM for the

Mid-Atlantic Region

Forbes - America’s Best and Worst Banks, December 13, 2011.

J.D. Power and Associates® 2012 Retail Banking Satisfaction StudySM, April, 2012.

22

APPENDIX

19

23

NPBC Peer Group- 2009 Proxy Statement*

20

*Note: Wilmington Trust (WL) excluded from peer data beginning with data for 1Q 2011 due to acquisition by M&T.

Whitney Holding Company (WTNY) excluded from peer data beginning with 2Q 2011 due to acquisition

by Hancock Holding Co. (HBHC).

|

Peer

|

Ticker

|

Assets as of 3/31/12

($billions)

|

|

Bancorp South, Inc.

|

BXS

|

$13.3

|

|

F.N.B Corporation

|

FNB

|

11.7

|

|

First Midwest Bancorp, Inc

|

FMBI

|

8.0

|

|

First Niagara Financial Group, Inc.

|

FNFG

|

35.5

|

|

FirstMerit Corporation

|

FMER

|

14.7

|

|

Fulton Financial Corporation

|

FULT

|

16.5

|

|

MB Financial, Inc.

|

MBFI

|

9.7

|

|

Old National Bancorp

|

ONB

|

8.6

|

|

Susquehanna Bancshares, Inc.

|

SUSQ

|

17.8

|

|

Trustmark Corporation

|

TRMK

|

9.9

|

|

Valley National Bancorp

|

VLY

|

16.0

|

|

Wintrust Financial Corp

|

WTFC

|

16.2

|

24

Improved Deposit Mix

21

($millions)

25

NPBC Trust Preferred Securities

(Ticker: NPBCO)

(Ticker: NPBCO)

22

26