Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IDEX CORP /DE/ | d385638d8k.htm |

| EX-99.2 - EX-99.2 - IDEX CORP /DE/ | d385638dex992.htm |

Second Quarter

2012 Earnings Release July 24, 2012

Exhibit 99.1 |

Agenda

2

•

IDEX Mid Year Assessment

•

Q2 2012 Summary

•

2012 Segment Performance

Fluid & Metering

Health & Science

Fire & Safety / Diversified

•

2012 Guidance Update

•

Q&A |

IDEX

Proprietary & Confidential Replay Information

Dial toll–free: 855.859.2056

International: 404.537.3406

Conference ID: #40917655

Log on to: www.idexcorp.com

3 |

IDEX

Proprietary & Confidential Cautionary Statement

Under the Private Securities

Litigation Reform Act

This presentation and discussion will include forward-looking statements.

Our actual performance may differ materially from that indicated

or

suggested

by any such statements. There are a number of factors that could cause those

differences, including those presented in our most recent annual

report

and

other company filings with the SEC.

4 |

IDEX

Proprietary & Confidential IDEX Mid-Year Assessment

5

Solid performance in spite of global economic uncertainty

Operational

Excellence

Growth

Conversion

Innovation

New Products

New Markets

Acquisitions

Commercial

Excellence

Global Deceleration

Strong first quarter followed by slowing second quarter

North America remains strong for industrial and infrastructure-related markets

Weak demand in Europe and slowing growth in China

Growth rates in 2H will slow modestly

Exceptional Operating Performance in Attractive Market Segments

Defensible diversified business with strong global teams delivering exceptional value

Execution: operating margin expansion with laser focus on cash conversion

Strong balance sheet and disciplined approach to deployment of capital

IOP Challenged HST Performance

Uncertainty in several OEM end markets

CVI restructuring continues through year-end |

IDEX

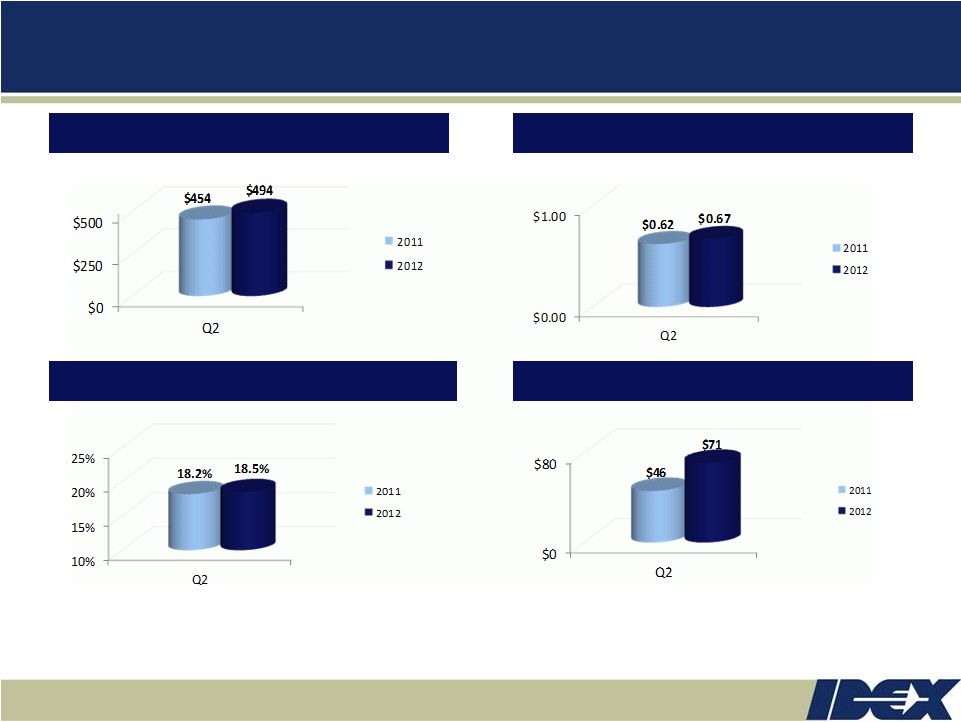

Proprietary & Confidential Total Revenue

Operating Margin*

Free Cash Flow

EPS*

IDEX Q2 2012 Financial Performance

Continued growth, margin expansion and strong cash generation

6

* EPS / Op Margin data adjusted for $2.6M restructuring expense (2012) and $3M CVI inventory

step-up expense (2011) Organic: 6% Growth

8% Growth

30 bps expansion

54% Growth |

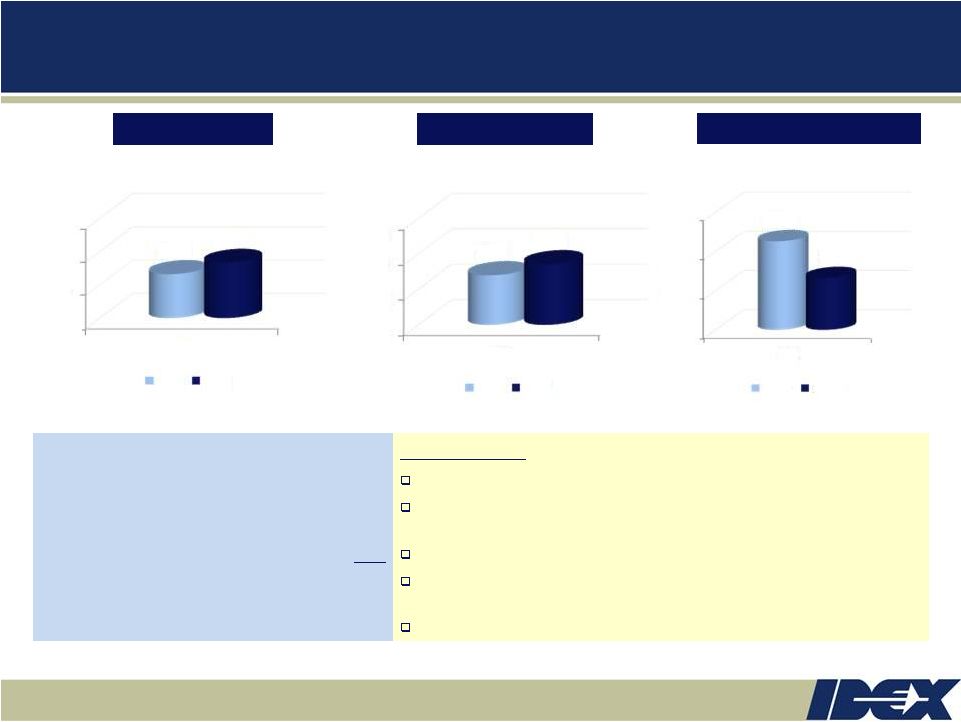

IDEX

Proprietary & Confidential Fluid & Metering

Productivity and strong execution generated margin expansion of 220 bps

7

Q2 Sales Mix:

Organic

+3%

Acquisition

-%

Fx

-2%

Total

+1%

Q2

Summary:

Order softness experienced in Europe and China

Energy, Chemical, Ag strong in NA and emerging markets

Water / Waste water outlook improving in NA, while still challenged

internationally

2H market environment will be volatile; expecting continued slower markets

in Europe

Total Orders

Total Revenue

Operating Margin*

Organic: 3% Growth

220 bps expansion

Organic: 2% Decline

* Op Margin data adjusted for restructuring expense (2012)

$0

$100

$200

$300

Q2

$209

$211

2011

2012

10%

15%

20%

25%

Q2

19.9%

22.1%

2011

2012

$0

$100

$200

$300

Q2

$211

$202

2011

2012 |

IDEX

Proprietary & Confidential Health & Science

8

Q2 Sales Mix:

Organic

+3%

Acquisition

+19%

Fx

-1%

Total

+21%

Q2

Summary:

Acquired Matcon LTD (Material Process Technology “MPT”

Platform)

MPT platform performed well, driven by strong demand for food and pharma

processing equipment (particularly in Asia)

Scientific Fluidics experiencing market softness on inconsistent OEM demand

Optics end markets challenged; right-sizing the business for the bottom of

the cycle

Excluding acquisitions, Op margins expanded modestly

* Op Margin data adjusted for restructuring expense (2012) and $3M CVI inventory step-up expense

(2011) Total Orders

Operating Margin*

$0

$100

$200

$300

Q2

$132

$166

2011

2012

$0

$100

$200

$300

Q2

$140

$171

2011

2012

10%

15%

20%

25%

Q2

21.3%

16.6%

2011

2012

Total Revenue

Right-sizing

Optics

platform

and

global

positioning

are

key

to

segment

recovery

Organic: 7% Growth

Organic: 3% Growth

470 bps contraction

|

IDEX

Proprietary & Confidential Fire & Safety/Diversified

Great performance across diversified businesses

9

Q2 Sales Mix:

Organic

+15%

Acquisition

-

Fx

-5%

Total

+10%

Q2

Summary:

North American Fire markets stabilized, now growing through adjacencies

Fire restructuring activities will begin to provide benefit in FY13

Rescue continues to win internationally despite headline challenges

Dispensing initiated delivery on large replenishment order; domestic markets

improving while European markets are uncertain

Op margins are up 50 bps excluding PY gain on sale of property

* Op Margin data adjusted for restructuring expense (2012)

Total Orders

Total Revenue

Operating Margin*

Organic: 15% Growth

210 bps contraction

Organic: 3% Growth

$0

$50

$100

$150

10%

20%

30%

Q2

25.5%

23.4%

2011

2012

$0

$50

$100

$150

Q2

$104

$102

2011

2012

2011

2012

Q2

$105

$116 |

IDEX

Proprietary & Confidential Outlook: Revised Guidance

10

FY12

Revenue

Adjusted EPS

April 2012 - Prior Guidance

~$2.0 B

$2.80 - $2.85

Q2 miss (Compared to midpoint of prior guidance)

(15)

(0.04) Slower 2H Organic / Cost actions

(30)

(0.06) Optics (Challenging end markets)

(10)

(0.04) Fx impact

(20)

(0.03) ERC acquisition impact

15

0.02 July 2012 - Revised Guidance

~$1.94 B

$2.65 - $2.70 |

IDEX

Proprietary & Confidential Outlook: 2012 Guidance Summary

Q3 2012

Adjusted EPS estimate range: $0.62 –

$0.64

Organic revenue growth of ~ 3%

Negative Fx impact of ~3% to sales (at June 30 rates)

FY 2012

Adjusted EPS estimate range: $2.65 –

$2.70

Organic revenue growth ~ 4-5%

Positive impact of 4% from acquisitions

Operating margin of ~18.5%

Negative Fx impact of ~2% to sales (at June 30 rates)

Other modeling items

Tax rate = ~30%

Cap Ex ~$40M

Free Cash Flow will exceed net income

Continued selective share repurchase

EPS estimate excludes future restructuring, acquisitions and acquisition–related costs and

charges 11 |

IDEX

Proprietary & Confidential Q&A

12 |