Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SeaBright Holdings, Inc. | shi_8k-072312.htm |

Exhibit 10.1

EMPLOYMENT AGREEMENT

This Employment Agreement (“Agreement”), dated as of July , 2012, (the “Effective Date”) is made and entered into by and between SeaBright Insurance Company an Illinois domiciled insurance company and wholly-owned subsidiary of SeaBright Holdings, Inc. (collectively, “Employer”), and Neal A. Fuller (“Executive”).

WHEREAS, Employer and Executive entered into a Revised Offer Letter (“Offer Letter”) on August 25, 2011, through which Executive agreed to certain terms in exchange for a position of employment with Employer as Senior Vice President Chief Financial Officer and Assistant Secretary, a copy of which Offer Letter is attached hereto as Exhibit “A”;

WHEREAS, Employer and Executive entered into an Amendment to Employment Offer Letter Agreement (“Offer Letter Amendment”) on February 21, 2012, a copy of which Offer Letter Amendment is attached hereto as Exhibit “B”;

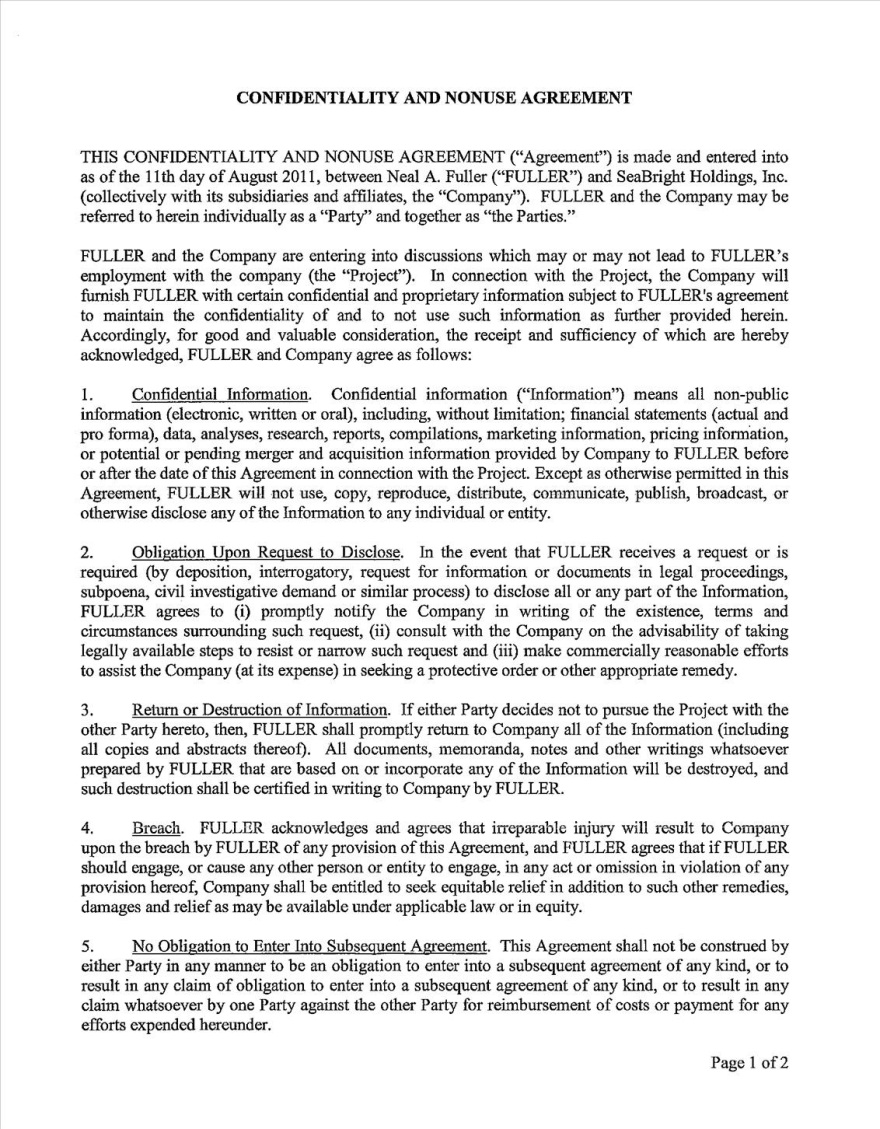

WHEREAS, Employer and its parent company, SeaBright Holdings, Inc., a Delaware Corporation and all of its subsidiary companies on the one hand, and Executive on the other hand entered into a Confidentiality and Nonuse Agreement on August 11, 2011 through which Executive agreed to maintain the confidentiality of Employer’s Proprietary Information and through which Executive acknowledged Employer’s ownership of certain intellectual property, a copy of which Confidentiality and Nonuse Agreement is attached hereto as Exhibit “C”;

WHEREAS, Executive continues in his position of Senior Vice President, Chief Financial Officer and Assistant Secretary without change or interruption; and

WHEREAS, Executive and Employer now wish to terminate and supersede their respective obligations under the August 25, 2012 Offer Letter and the February 21, 2012 Offer Letter Amendment, and to be bound by the terms of this Agreement.

NOW THEREFORE, in consideration of the foregoing recitals, which shall constitute a part of this Agreement, and of the mutual promises contained herein, and intending to be legally bound, the parties agree as follows:

1. PERIOD OF EMPLOYMENT. Executive will be employed by Employer on an at will basis subject to the provisions of Section 4.

2. POSITION AND RESPONSIBILITIES.

(a) Position. Executive accepts continued employment with Employer as Senior Vice President, Chief Financial Officer and Assistant Secretary and shall perform all services appropriate to that position, as well as such other services as may be assigned by Employer. Executive shall devote his best efforts and full-time attention to the performance of his duties. Executive shall be subject to the direction of Employer, which shall retain full control of the means and methods by which he performs the above services and of the place(s) at which all services are rendered. Executive shall be expected to travel if necessary or advisable in order to meet the obligations of his position.

1

(b) Other Activity. Except upon the prior written consent of Employer, Executive (during the Period of Employment) shall not (i) accept any other employment; or (ii) engage, directly or indirectly, in any other business, commercial, or professional activity (whether or not pursued for pecuniary advantage) that is competitive with Employer, creates a conflict of interest with Employer, or otherwise interferes with the business of Employer or any Affiliate (and shall immediately cease any such ongoing activity that becomes so competitive, begins to create such a conflict or begins to interfere with the business of Employer or any Affiliate). An “Affiliate” shall mean any person or entity that directly or indirectly controls, is controlled by, or is under common control with Employer.

3. COMPENSATION AND BENEFITS.

(a) Salary. In consideration of the services to be rendered under this Agreement, Employer shall pay Executive per year (“Base Salary”) of $350,000, payable in regular installments in accordance with Employer’s general payroll policies for salaried employees, in effect from time to time. All compensation and comparable payments to be paid to Executive under this Agreement shall be less all applicable withholdings required by law. Executive’s Base Salary will be reviewed for market and performance adjustments within ninety (90) days of the beginning of each calendar year during the Period of Employment by Employer’s Board of Directors (the “Board”) and may be adjusted after such review in the Board’s sole discretion.

(b) Sign-on Bonus. Executive received a sign on bonus of $65,000 on September 15, 2011. This bonus is subject to 100% recapture should Executive not be employed by Employer or not be an employee in good standing twelve (12) months from the bonus payment date. This recapture provision will not apply if Employer experiences a material change in control and, as a result, Executive’s position is eliminated or Executive’s compensation package is substantially reduced.

(c) Bonus. Executive will be eligible to receive an annual bonus in a target amount equal to 65% of Executive’s Base Salary, earned as of December 31st of each year, based upon achievement by Executive and achievement by Employer of performance criteria and other goals established by the Board (after consultation with Employer) on an annual basis prior to the commencement of each calendar year or as soon as reasonably practicable thereafter. The bonus payable in respect of any given year during the Period of Employment shall be paid within thirty (30) days following the delivery of Employer’s annual audited statutory financial statements for such year. Executive must be employed by Employer on the last day of the calendar year for which any bonus relates in order to receive any such bonus hereunder. The target amount of Executive’s bonus as set forth above will be reviewed for market and performance adjustments within sixty-five (65) days of the beginning of each calendar year during the Period of Employment by the Board and may be adjusted after such review in the Board’s sole discretion.

2

(d) Benefits. Executive shall be entitled to vacation leave in accordance with Employer’s standard policies for salaried employees, in effect from time to time. Effective upon hire, Executive is entitled to an amount equal to four weeks vacation annually, plus floating holidays as provided in Employer’s vacation policy and holiday schedule. Executive's vacation allowance accrues based on date of hire. As Executive becomes eligible, he shall have the right to participate in and to receive benefits from all present and future benefit plans specified in Employer’s policies and generally made available to salaried employees of Employer from time to time. The amount and extent of benefits to which Executive is entitled shall be governed by the specific benefit plan, as amended. Executive also shall be entitled to any benefits or compensation tied to termination as described in Section 4. Employer reserves the ability, in its sole discretion, to adjust benefits provided to Executive in connection with the adjustment of benefits to salaried employees. No statement concerning benefits or compensation to which Executive is entitled shall alter in any way the term of this Agreement, any renewal thereof, or its termination.

(e) Expenses. Employer shall reimburse Executive for reasonable travel and other business expenses incurred by Executive in the performance of his duties, subject to reasonable documentation thereof and in accordance with Employer’s policies in effect from time to time.

(f) Sign-On Restricted Stock. Effective October 19, 2011 (the date of grant), Employer granted Executive 75,076 shares of restricted stock equaling $500,006 on the date of grant, awarded pursuant to SeaBright Holdings, Inc.’s Amended and Restated 2005 Long-Term Equity Incentive Plan (the “2005 Plan”) as amended and restated as of April 4, 2012. This grant made in connection with Executive’s sign-on is subject to Employer’s customary vesting schedule which is three year “cliff vesting.” Upon the third anniversary of the date of the grant, the restricted stock shall vest 100%. Prior to vesting, restricted stock may not be sold, pledged or transferred and is subject to other conditions and restrictions more fully described in the Plan.

(g) Restricted Stock and Incentive Stock Option Guarantee. For the 2012 performance year only, Executive is also entitled to a restricted stock and an incentive stock option award guarantee with a total value of $350,000, such award to be 75% restricted stock and 25% incentive stock options. This Agreement contemplates that the foregoing restricted stock and incentive stock option awards totaling $350,000 will be made in the first quarter of calendar year 2013, subject to the approval of the Compensation Committee, with the restricted stock cliff vesting in 2016 and the incentive stock options vesting ratably over 4 years. All shares of restricted stock and incentive stock options are granted on the terms and conditions pursuant to the 2005 Plan, attached to and incorporated into this Agreement as Exhibit D.

3

(h) Withholding. Any and all payments made pursuant to this Agreement shall be subject to all withholding required in accordance with applicable federal, state or local law.

4. TERMINATION OF EMPLOYMENT.

(a) By Employer Without Cause. At any time, Employer may terminate Executive without Cause (as defined below), effective as of the date specified in a written notice from Employer to Executive. Employer may discipline or demote Executive with or without Cause and with or without prior notice. Employer may discipline, demote, or dismiss Executive as provided in this Section 4 notwithstanding anything to the contrary contained in or arising from any statements, policies or practices of Employer relating to the employment, discipline, or termination of its employees. If Executive’s employment with Employer is terminated by Employer without Cause, Executive shall be entitled to continue to receive his Base Salary payable in regular installments as special severance payments from the date of termination for a period of twelve (12) months thereafter, or until Executive obtains other employment (but with it being understood that Executive shall be under no duty to seek alternative employment during the Severance Period), whichever first occurs (the “Severance Period”), if and only if Executive has executed and delivered to Employer the General Release substantially in form and substance as set forth in Exhibit E attached hereto and only so long as Executive has not revoked or breached the provisions of the General Release or breached the provisions of this Agreement or any ancillary agreement and does not apply for unemployment compensation chargeable to Employer during the Severance Period, and Executive shall not be entitled to any other salary, compensation or benefits after termination of the Period of Employment, except as specifically provided for in Employer’s employee benefit plans or as otherwise expressly required by applicable law (such as COBRA). Notwithstanding anything to the contrary contained in this Section 4(a), in the event Executive breaches the provisions of this Agreement or any ancillary agreement, the severance amounts payable by Employer under this Section 4(a) shall not terminate unless and until more than ten (10) days have elapsed from and after the date written notice of such breach has been delivered to Executive without such breach having been cured during such 10-day period.

4

(b) By Employer For Cause. At any time, and without prior notice (except as otherwise provided in the definition of Cause set forth below), Employer may terminate Executive for Cause. Employer shall pay Executive all compensation then due and owing; thereafter, all of Employer’s obligations under this Agreement shall cease. Termination shall be for “Cause” if Executive: (i) is inattentive to his lawful duties after at least one written notice has been provided to Executive and Executive has failed to cure the same within a 30-day period thereafter; (ii) reports to work under the influence of alcohol or illegal drugs, or uses illegal drugs (whether or not at the workplace); (iii) engages in conduct causing the Employer public disgrace or disrepute or economic harm; (iv) breaches his duty of loyalty to Employer or engages in any acts of dishonesty or fraud with respect to Employer or any of its business relations; (v) is convicted of a felony or any crime involving dishonesty, breach of trust, or physical or emotional harm to any person (or enters a plea of guilty or nolo contendere with respect thereto); (vi) breaches any material term of this Agreement, any ancillary agreement or any other agreement between Executive and Employer or any of Employer's Affiliates and such breach (if capable of cure) is not cured within thirty (30) days following written notice thereof from Employer, except that Executive acknowledges that a breach of his obligations under Section 2(b) of this Agreement cannot be cured; (vii) is insubordinate; (viii) engages in improper conduct towards any employee or agent of Employer or Employer's Affiliates; or (ix) is terminated for substandard performance. For purposes of this Agreement, “substandard performance” shall be defined as willful refusal to perform or substantial disregard of duties properly assigned by Employer or their Affiliates. The Board shall give Executive written notice of the Board’s concern over Executive’s performance, and Executive shall have thirty (30) days to prepare for a meeting with the Board, at which time Executive may present any information on market competitive conditions and any other factors bearing on his and Employer’s performance. After consideration of these and such other factors as the Board may deem relevant, if a majority of the Board determines in good faith that Employer’s future performance would be best served by a change in management, the Board may terminate Executive’s employment for “substandard performance” following the expiration of such 30-day period.

(c) Voluntary Termination by Executive. At any time, Executive may terminate his employment for any reason, with or without cause, by providing Employer at least thirty (30) days’ advance written notice. Employer shall have the option, in its complete discretion, to make Executive’s termination effective at any time prior to the end of such notice period. On the date of such termination, Employer shall pay Executive all compensation then due and owing through such date; and, thereafter, all of Employer’s obligations under this Agreement shall cease.

(d) Termination Upon Death or Permanent Disability. Executive’s employment with Employer shall also terminate upon Executive’s death or permanent mental or physical disability or other incapacity (as determined by the Board in its good faith judgment). Upon any such termination, Employer shall pay Executive (or Executive’s estate or legal representative or guardian) all compensation then due and owing; thereafter, all of Employer’s obligations under this Agreement shall cease.

(e) Termination of Compensation. Except as otherwise expressly provided herein, all of Executive’s rights to salary, bonuses, employee benefits and other compensation hereunder which would have accrued or become payable after the termination or expiration of the Period of Employment shall cease upon such termination or expiration, other than those expressly required under applicable law (such as COBRA).

5

(f) Termination Obligations.

(i) Executive agrees that all property, including, without limitation, all equipment, tangible Proprietary Information (as defined below), documents, books, records, reports, notes, contracts, lists, computer disks (and other computer-generated files and data), and copies thereof, created on any medium and furnished to, obtained by, or prepared by Executive in the course of or incident to his employment, belongs to Employer and shall be returned promptly to Employer upon termination of the Period of Employment.

(ii) All employee and other benefits to which Executive is otherwise entitled shall cease upon Executive’s termination, unless explicitly continued either under this Agreement or under any specific written policy or benefit plan of Employer.

(iii) Upon termination of the Period of Employment, Executive shall be deemed to have resigned from all offices and directorships then held with Employer or any Affiliate.

(iv) The representations and warranties contained in this Agreement and Executive’s obligations under this Section 4(f) shall survive the termination of the Period of Employment and the expiration of this Agreement.

(g) For sixty (60) days following any termination of the Period of Employment, Executive shall cooperate in a reasonable manner with Employer in all matters relating to the winding up of pending work on behalf of Employer and the orderly transfer of work to other employees of Employer. At all times following any termination of the Period of Employment, Executive shall also cooperate in the defense of any action brought by any third party against Employer that relates in any way to Executive’s acts or omissions while employed by Employer; provided that Employer shall reimburse Executive for his reasonable out-of-pocket expenses after being provided with reasonable documentation of such expenses.

5. NONCOMPETITION. Executive acknowledges and agrees with Employer that Executive’s services to Employer are unique in nature and that Employer’s goodwill would be irreparably damaged if Executive were to provide similar services to any person or entity competing with Employer or engaged in a similar business. Executive accordingly covenants and agrees with Employer that:

(a) Commencing with the termination of Executive’s employment with Employer for any reason and continuing for 1 year from said termination date (the “Non-Competition Period”), Executive shall not directly or indirectly, either for himself or for any other individual, corporation, partnership, joint venture or other entity, participate in any business (including, without limitation, any division, group or franchise of a larger organization) anywhere in the world which engages or which proposes to engage in the promotion, service, underwriting, issuance or sale of insurance policies providing United States Longshoremen and Harbor Worker’s coverage, other coverage under the Jones Act, State Act workers’ compensation insurance, related workers’ compensation or similar insurance or reinsurance, or any alternative dispute resolution insurance or which engages in or proposes to engage in any other business hereafter conducted by Employer or its Affiliates prior to Executive’s termination (collectively, the “USL&H Business”). For purposes of this Agreement, the term “participate in” shall include, without limitation, having any direct or indirect interest in any corporation, partnership, joint venture or other entity, whether as a sole proprietor, owner, stockholder, partner, joint venturer, creditor or otherwise, or rendering any direct or indirect service or assistance to any individual, corporation, partnership, joint venture and other business entity (whether as a director, officer, manager, supervisor, employee, agent, consultant or otherwise). Without limiting the generality of the foregoing, Executive agrees that during the Non-Competition Period he will not, directly or indirectly, either for himself or for any other individual, corporation, partnership, joint venture or other entity, form or acquire any insurance company licensed to write or service USL&H Business.

6

(b) If, at any time of enforcement of this Agreement, a court or arbitrator shall hold that the duration, scope or area restrictions, stated herein are unreasonable under circumstances then existing, the parties hereto agree that the maximum period, scope or geographic area reasonable under such circumstances shall be substituted for the stated period, scope or geographic area reasonable under such circumstances and that the court shall be allowed and directed to revise the restrictions contained herein to cover the maximum period, scope and area permitted by law.

(c) In the event of an alleged breach or violation by Executive of Section 5 of this Agreement during the 1 year Non-Competition Period beginning on the date of Executive’s termination and continuing for 1 year thereafter, the period of Executive’s non-competition shall be tolled until such alleged breach or violation has been duly cured.

(d) Executive agrees that the restrictions contained in this Section 5 are reasonable and that Executive has received adequate and valuable consideration in exchange therefore.

6. NONSOLICITATION. Commencing with the termination of Executive’s employment with Employer for any reason, and continuing for 1 year from said termination date, Executive shall not directly or indirectly induce or attempt to induce any employee of Employer to leave the employ of Employer or their Affiliates, or in any way interfere with the relationship between Employer or their Affiliates and any employee thereof (other than through general advertisements for employment not directed at employees of Employer).

7. NONDISCLOSURE AND NONUSE OF PROPRIETARY INFORMATION.

(a) Executive shall not disclose or use at any time, either during his employment with Employer or thereafter, any Proprietary Information (as defined below) of which Executive is or becomes aware, whether or not such information is developed by him, except to the extent that such disclosure or use is directly related to and required by Executive’s performance of duties assigned to Executive by Employer. Executive shall take all appropriate steps to safeguard Proprietary Information and to protect it against disclosure, misuse, espionage, loss and theft. The foregoing shall not, however, prohibit disclosure by Executive of Proprietary Information that has been published in a form generally available to the public prior to the date Executive proposes to disclose such information. Information shall not be deemed to have been published merely because individual portions of the information have been separately published, but only if all material features comprising such information have been published in combination.

7

(b) As used in this Agreement, the term “Proprietary Information” means all information of a confidential or proprietary nature (whether or not specifically labeled or identified as “confidential”), in any form or medium, that relates to or results from the business, historical or projected financial results, products, services or research or development of Employer or their Affiliates or their respective suppliers, distributors, customers, independent contractors or other business relations. Proprietary Information includes, but is not limited to, the following: (i) internal business information (including, without limitation, historical and projected financial information and budgets and information relating to strategic and staffing plans and practices, business, training, marketing, promotional and sales plans and practices, cost, rate and pricing structures and accounting and business methods); (ii) identities of, individual requirements of, specific contractual arrangements with, and information about, Employer’s and their Affiliates’ suppliers, distributors, customers, independent contractors or other business relations and their confidential information; (iii) trade secrets, technology, know-how, compilations of data and analyses, techniques, systems, formulae, research, records, reports, manuals, flow charts, documentation, models, data and data bases relating thereto; (iv) computer software, including, without limitation, operating systems, applications and program listings; (v) inventions, innovations, ideas, devices, improvements, developments, methods, processes, designs, analyses, drawings, photographs, reports and all similar or related information (whether or not patentable and whether or not reduced to practice); (vi) copyrightable works; (vii) intellectual property of every kind and description; and (viii) all similar and related information in whatever form.

8. EMPLOYER’S OWNERSHIP OF INTELLECTUAL PROPERTY.

(a) In the event that Executive at any time during the term of his employment, and at anytime during said term including during non-working hours and when Executive is engaged in activity outside the course and scope of his employment with Employer, generates, authors, conceives, develops, acquires, makes, reduces to practice or contributes to any idea, discovery, trade secret, invention, innovation, improvement, development, method of doing business, process, program, design, analysis, drawing, report, data, software, firmware, logo, device, method, product or any similar or related information (whether or not patentable or reduced to practice or comprising Proprietary Information), any copyrightable work (whether or not comprising Proprietary Information) or any other form of Proprietary Information which is related to Employer’s business or actual or demonstrably anticipated research or development (collectively, “Intellectual Property”), Executive acknowledges that such Intellectual Property is and shall be the exclusive property of Employer. Any copyrightable work prepared in whole or in part by Executive shall be deemed “a work made for hire” to the maximum extent permitted under Section 201(b) of the 1976 Copyright Act as amended, and Employer shall own all of the rights comprised in the copyright therein. Without limiting the generality of the foregoing, Executive hereby assigns his entire right, title and interest in and to all Intellectual Property to Employer. Executive shall promptly and fully disclose all Intellectual Property to Employer and shall cooperate with Employer to protect Employer’s interests in and rights to such Intellectual Property (including, without limitation, providing reasonable assistance in securing patent protection and copyright registrations and executing all documents as reasonably requested by Employer, whether such requests occur prior to or after termination of Executive’s employment with Employer).

8

(b) Notwithstanding the foregoing, however, Employer shall not own and Executive shall have no obligation to assign to Employer any invention otherwise falling within the definition of Intellectual Property for which no equipment, supplies, facility, or trade secret information of Employer was used and that was developed entirely on Executive’s own time, unless: (i) such Intellectual Property relates (A) to Employer’s business or (B) to their actual or demonstrably anticipated research or development, or (ii) the Intellectual Property results from any work performed by him for them under this Agreement. Executive has identified and described in detail on an attachment hereto initialed by each of the undersigned party’s or their authorized representatives, all Intellectual Property that is or was owned by him or was written, discovered, made, conceived or first reduced to practice by him alone or jointly with another person prior to his employment under this Agreement. If no such Intellectual Property is listed, Executive represents to Employer that he does not now nor has he ever owned, nor has he made, any such Intellectual Property.

9. ARBITRATION.

(a) Arbitrable Claims. To the fullest extent permitted by law, all disputes between Executive (and his attorneys, successors, and assigns) and Employer (and their Affiliates, shareholders, directors, officers, employees, agents, successors, attorneys, and assigns) of any kind whatsoever, including, without limitation, all disputes relating in any manner to the employment or termination of Executive, and all disputes arising under this Agreement (“Arbitrable Claims”) shall be resolved by arbitration. All persons and entities specified in the preceding sentence (other than Employer and Executive) shall be considered third-party beneficiaries of the rights and obligations created by this Section on Arbitration. Arbitrable Claims shall include, but are not limited to, contract (express or implied) and tort claims of all kinds, as well as all claims based on any federal, state, or local law, statute, or regulation, excepting only claims under applicable workers’ compensation law and unemployment insurance claims. By way of example and not in limitation of the foregoing, Arbitrable Claims shall include (to the fullest extent permitted by law) any claims arising under Title VII of the Civil Rights Act of 1964, the Age Discrimination in Employment Act, the Americans with Disabilities Act, and the Rev. Code of Washington Sections 49.45.010 et seq. and 49.60.010 et seq., as well as any claims asserting wrongful termination, harassment, breach of contract, breach of the covenant of good faith and fair dealing, negligent or intentional infliction of emotional distress, negligent or intentional misrepresentation, negligent or intentional interference with contract or prospective economic advantage, defamation, invasion of privacy, and claims related to disability.

9

(b) Procedure. Arbitration of Arbitrable Claims shall be in accordance with the National Rules for the Resolution of Employment Disputes of the “American Arbitration Association, as amended (“AAA Employment Rules”), as augmented in this Agreement. Arbitration shall be initiated by providing notice to the other party in accordance with the notice provisions included in Paragraph 11. The notice of initiating arbitration shall also include a statement of the claim(s) asserted and the facts upon which the claim(s) are based. Arbitration shall be final and binding upon the parties and shall be the exclusive remedy for all Arbitrable Claims. Either party may bring an action in court to compel arbitration under this Agreement and to enforce an arbitration award. Otherwise, neither party shall initiate or prosecute any lawsuit or administrative action in any way related to any Arbitrable Claim. Notwithstanding the foregoing, either party may, at its option, seek injunctive relief with a federal court in the State of Washington or state court in King County, Washington. All arbitration hearings under this Agreement shall be conducted in King County, Washington. The decision of the arbitrator shall be in writing and shall include a statement of the essential conclusions and findings upon which the decision is based. THE PARTIES HEREBY WAIVE ANY RIGHTS THEY MAY HAVE TO TRIAL BY JURY IN REGARD TO ARBITRABLE CLAIMS, INCLUDING WITHOUT LIMITATION ANY RIGHT TO TRIAL BY JURY AS TO THE MAKING, EXISTENCE, VALIDITY, OR ENFORCEABILITY OF THE AGREEMENT TO ARBITRATE.

(c) Arbitrator Selection and Authority. All disputes involving Arbitrable Claims shall be decided by a single arbitrator. The arbitrator shall be selected by mutual agreement of the parties within thirty (30) days of the effective date of the notice initiating the arbitration. If the parties cannot agree on an arbitrator, then at each party’s own expense, each party shall select an interim arbitrator and those two interim arbitrators will collaborate to select one arbitrator who will hear the claim. The arbitrator who will hear the claim must have at least ten (10) years of experience with the subject matter at issue (i.e., employment law), be a member of the State Bar of Washington, actively engaged in the practice of law or arbitration or a retired Judge from the State of Washington. The interim arbitrators shall select the arbitrator within thirty (30) days from the date of the notice that the parties were unable to agree upon an arbitrator. The interim arbitrators shall thereafter have no further jurisdiction over the matter. The arbitrator shall have only such authority to award equitable relief, damages, costs, and fees as a court would have for the particular claim(s) asserted. The fees of the arbitrator shall be paid by the non-prevailing party. If the allocation of responsibility for payment of the arbitrator’s fees would render the obligation to arbitrate unenforceable, the parties authorize the arbitrator to modify the allocation as necessary to preserve enforceability. The arbitrator shall have exclusive authority to resolve all Arbitrable Claims, including, but not limited to, whether any particular claim is arbitrable and whether all or any part of this Agreement is void or unenforceable.

10

(d) Confidentiality. All proceedings and all documents prepared in connection with any Arbitrable Claim shall be confidential and, unless otherwise required by law, the subject matter thereof shall not be disclosed to any person other than the parties to the proceedings, their counsel, witnesses and experts, the arbitrator, and, if involved, the court and court staff. All documents filed with the arbitrator or with a court shall be filed under seal. The parties shall stipulate to all arbitration and court orders necessary to effectuate fully the provisions of this subsection concerning confidentiality.

(e) Continuing Obligation. The rights and obligations of Executive and Employer set forth in this Section 9 shall survive the termination of Executive’s employment and the expiration of this Agreement.

10. EXECUTIVE’S REPRESENTATIONS. Executive hereby represents and warrants to Employer that (i) the execution, delivery and performance of this Agreement by Executive does not and shall not conflict with, breach, violate or cause a default under any contract, agreement, instrument, order, judgment or decree to which Executive is a party or by which he is bound, (ii) Executive is not a party to or bound by any employment agreement, noncompete agreement or confidentiality agreement with any other person or entity and (iii) upon the execution and delivery of this Agreement by Employer, this Agreement shall be the valid and binding obligation of Executive, enforceable in accordance with its terms.

11. NOTICES. Any notice or other communication under this Agreement must be in writing and shall be effective upon delivery by hand, or three (3) business days after deposit in the United States mail, postage prepaid, certified or registered, and addressed to the Employer or to Executive at he corresponding address below. Executive shall be obligated to notify Employer in writing of any change in his address. Notice of change of address shall be effective only when done in accordance with this Section.

Employer’s Notice Address:

SeaBright Insurance Company

1501 4th Avenue, Suite 2600

Seattle, WA 98101

Attn: Chief Executive Officer

Facsimile: (206) 269-8901

Executive’s Notice Address:

Neal A. Fuller

1141 Edmonds Street

Edmonds, WA 98020

12. ACTION BY EMPLOYER. All actions required or permitted to be taken under this Agreement by Employer, including, without limitation, exercise of discretion, consents, waivers, and amendments to this Agreement, shall be made and authorized only by the chief executive officer of Employer.

11

13. INTEGRATION. This Agreement is intended to be the final, complete, and exclusive statement of the terms of Executive’s employment by Employer. This Agreement supersedes all other prior and contemporaneous agreements and statements, whether written or oral, express or implied, pertaining in any manner to the employment of Executive, and it may not be contradicted by evidence of any prior or contemporaneous statements or agreements. To the extent that the practices, policies, or procedures of Employer, now or in the future, apply to Executive and are consistent with the terms of this Agreement, the provisions of this Agreement shall control.

14. AMENDMENTS; WAIVERS. This Agreement may not be amended except by an instrument in writing, signed by each of the parties. No failure to exercise and no delay in exercising any right, remedy, or power under this Agreement shall operate as a waiver thereof, nor shall any single or partial exercise of any right, remedy, or power under this Agreement preclude any other or further exercise thereof, or the exercise of any other right, remedy, or power provided herein or by law or in equity.

15. ASSIGNMENT; SUCCESSORS AND ASSIGNS. Executive agrees that he will not assign, sell, transfer, delegate, or otherwise dispose of, whether voluntarily or involuntarily, or by operation of law, any rights or obligations under this Agreement. Any such purported assignment, transfer, or delegation shall be null and void. Nothing in this Agreement shall prevent the consolidation of Employer with, or its merger into, any other entity, or the sale by Employer of all or substantially all of its assets, or the assignment by Employer of any rights or obligations under this Agreement. Subject to the foregoing, this Agreement shall be binding upon and shall inure to the benefit of the parties and their respective heirs, legal representatives, successors, and permitted assigns, and shall not benefit any person or entity other than those specifically enumerated in this Agreement.

16. SEVERABILITY. If any provision of this Agreement is held by an arbitrator or a court of competent jurisdiction to be invalid, unenforceable, or void, the remaining provisions of this Addendum and the Employment Agreement shall remain in full force and effect.

17. ATTORNEYS’ FEES. In any legal action, arbitration, or other proceeding brought to enforce or interpret the terms of this Agreement, the prevailing party shall be entitled to recover reasonable attorneys’ fees and costs.

18. GOVERNING LAW. This Agreement shall be governed by and construed in accordance with the law of the State of Washington.

19. INTERPRETATION. This Agreement shall be construed as a whole, according to its fair meaning, and not in favor of or against any party. By way of example and not in limitation, this Agreement shall not be construed in favor of the party receiving a benefit nor against the party responsible for any particular language in this Agreement. Captions are used for reference purposes only and should be ignored in the interpretation of this Agreement.

12

20. EMPLOYEE ACKNOWLEDGMENT. Executive acknowledges that he has had the opportunity to consult legal counsel in regard to this Agreement, that he has read and understands this Agreement, that he is fully aware of its legal effect, and that he has entered into it freely and voluntarily and based on his own judgment and not on any representations or promises other than those contained in this Agreement. Executive acknowledges and agrees that the restrictions contained in Section 5 of this Agreement are reasonable and that Executive has received adequate and valuable consideration in exchange therefore.

21. CODE SECTION 409A COMPLIANCE.

(a) The intent of the parties is that payments and benefits under this Agreement comply with Internal Revenue Code Section 409A and the regulations and guidance promulgated thereunder (collectively “Code Section 409A”) and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted to be in compliance therewith. To the extent that any provision hereof is modified in order to comply with Code Section 409A, such modification shall be made in good faith and shall, to the maximum extent reasonably possible, maintain the original intent and economic benefit to Executive and Employer of the applicable provision without violating the provisions of Code Section 409A. In no event whatsoever shall Employer be liable for any additional tax, interest or penalty that may be imposed on Executive by Code Section 409A or damages for failing to comply with Code Section 409A.

(b) A termination of employment shall not be deemed to have occurred for purposes of any provision of this Agreement providing for the payment of any amount or benefit upon or following a termination of employment unless such termination is also a “separation from service” within the meaning of Code Section 409A and, for purposes of any such provision of this Agreement, references to a “termination,” “termination of employment” or like terms shall mean “separation from service.” Notwithstanding any other payment schedule provided herein to the contrary, if Executive is deemed on the date of termination to be a “specified employee” within the meaning of that term under Code Section 409A(a)(2)(B), then with regard to any payment or the provision of any benefit that is considered “nonqualified deferred compensation” under Code Section 409A payable on account of a “separation from service,” such payment or benefit shall be made on the date which is the earlier of (i) the expiration of the six (6)-month period measured from the date of Executive’s “separation from service,” and (B) the date of Executive’s death, to the extent required under Code Section 409A. Upon the expiration of the foregoing delay period, all payments and benefits delayed pursuant to this Section (whether they would have otherwise been payable in a single sum or in installments in the absence of such delay) shall be paid or reimbursed to Executive in a lump sum, and all remaining payments and benefits due under this Agreement shall be paid or provided in accordance with the normal payment dates specified for them herein.

13

(c) To the extent that severance payments or benefits pursuant to this Agreement are conditioned upon the execution and delivery by Executive of a release of claims, Executive shall forfeit all rights to such payments and benefits unless such release is signed and delivered (and no longer subject to revocation, if applicable) within sixty (60) days following the date of Executive’s termination of employment. If the foregoing release is executed and delivered and no longer subject to revocation as provided in the preceding sentence, then the following shall apply:

(i) To the extent that any such cash payment or continuing benefit to be provided is not “nonqualified deferred compensation” for purposes of Code Section 409A, then such payment or benefit shall commence upon the first scheduled payment date immediately following the date that the release is executed, delivered and no longer subject to revocation (the “Release Effective Date”). The first such cash payment shall include payment of all amounts that otherwise would have been due prior to the Release Effective Date under the terms of this Agreement applied as though such payments commenced immediately upon Executive’s termination of employment, and any payment made thereafter shall continue as provided herein.

(ii) To the extent that any such cash payment or continuing benefit to be provided is “nonqualified deferred compensation” for purposes of Code Section 409A, then such payments or benefits shall be made or commence upon the sixtieth (60th) day following Executive’s termination of employment. The first such cash payment shall include payment of all amounts that otherwise would have been due prior thereto under the terms of this Agreement had such payments commenced immediately upon Executive’s termination of employment, and any payment made thereafter shall continue as provided herein.

(d) To the extent that any expense reimbursement or in-kind benefit under this Agreement constitutes “non-qualified deferred compensation” for purposes of Code Section 409A, (i) such expense or other reimbursement hereunder shall be made on or prior to the last day of the taxable year following the taxable year in which such expenses were incurred by Executive, (ii) any right to reimbursement or in-kind benefits will not be subject to liquidation or exchange for another benefit, and (iii) no such reimbursement, expenses eligible for reimbursement, or in-kind benefits provided in any taxable year shall in any way affect the expenses eligible for reimbursement, or in-kind benefits to be provided, in any other taxable year.

(e) For purposes of Code Section 409A, Executive’s right to receive installment payments pursuant to this Agreement shall be treated as a right to receive a series of separate and distinct payments. Whenever a payment under this Agreement specifies a payment period with reference to a number of days, the actual date of payment within the specified period shall be within the sole discretion of Employer.

(f) Notwithstanding any other provision of this Agreement to the contrary, in no event shall any payment under this Agreement that constitutes “nonqualified deferred compensation” for purposes of Code Section 409A be subject to offset by any other amount unless otherwise permitted by Code Section 409A.

14

(g) Unless this Agreement provides a specified and objectively determinable payment schedule to the contrary, to the extent that any payment of base salary or other compensation is to be paid for a specified continuing period of time beyond the date of Executive’s termination of employment in accordance with Employer’s payroll practices (or other similar term), the payments of such base salary or other compensation shall be made upon such schedule as in effect upon the date of termination, but no less frequently than monthly.

(h) Any annual bonus payable to Executive in accordance with the provisions of Section 3(b) hereof shall be paid in the calendar year following the calendar year to which such bonus relates at the same time bonuses are paid to other senior executive officers of Employer generally.”

[Remainder of page intentionally left blank]

15

The parties have duly executed this Agreement as of the date first written above.

| EXECUTIVE | |||

|

|

By:

|

||

| Neal A. Fuller | |||

|

SEABRIGHT INSURANCE COMPANY

|

|||

|

By:

|

|||

| John G. Pasqualetto | |||

| Its: Chief Executive Officer | |||

16

EXHIBIT A

17

18

19

20

21

22

EXHIBIT B

23

24

25

EXHIBIT C

26

27

EXHIBIT D

SeaBright Holdings, Inc.

Amended and Restated 2005 Long-Term Equity Incentive Plan

|

1.

|

Purpose

|

This plan shall be known as the SeaBright Insurance Holdings, Inc. Amended and Restated 2005 Long-Term Equity Incentive Plan (the “Plan”). The purpose of the Plan shall be to promote the long-term growth and profitability of SeaBright Insurance Holdings, Inc. (the “Company”) and its Subsidiaries by (i) providing certain directors, officers and employees of, and certain other individuals who perform services for, the Company and its Subsidiaries with incentives to maximize stockholder value and otherwise contribute to the success of the Company and (ii) enabling the Company to attract, retain and reward the best available persons for positions of responsibility. Grants of incentive or non-qualified stock options, restricted stock, restricted stock units, deferred stock units, performance awards, Section 162(m) Awards or any combination of the foregoing may be made under the Plan.

|

2.

|

Definitions

|

(a) “Board of Directors” and “Board” mean the board of directors of the Company.

(b) “Cause” means, unless otherwise determined by the Committee at the time of grant of an award, the occurrence of one or more of the following events:

(i) Conviction of a felony or any crime or offense lesser than a felony involving the property of the Company or a Subsidiary; or

(ii) Conduct that has caused demonstrable and serious injury to the Company or a Subsidiary, monetary or otherwise; or

(iii) Willful refusal to perform or substantial disregard of duties properly assigned, as determined by the Company or a Subsidiary, as the case may be; or

(iv) Breach of duty of loyalty to the Company or a Subsidiary or other act of fraud or dishonesty with respect to the Company or a Subsidiary.

(c) “Change in Control” means, unless otherwise determined by the Committee at the time of grant of an award, the occurrence of one of the following events:

(i) if any “person” or “group” as those terms are used in Sections 13(d) and 14(d) of the Exchange Act or any successors thereto, other than an Exempt Person, is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act or any successor thereto), directly or indirectly, of securities of the Company representing 50% or more of the combined voting power of the Company’s then outstanding securities; or

(ii) during any period of two consecutive years, individuals who at the beginning of such period constitute the Board and any new directors whose election by the Board or nomination for election by the Company’s stockholders was approved by at least two-thirds of the directors then still in office who either were directors at the beginning of the period or whose election was previously so approved, cease for any reason to constitute a majority thereof; or

28

(iii) consummation of a merger or consolidation of the Company with any other corporation, other than a merger or consolidation (A) which would result in all or a portion of the voting securities of the Company outstanding immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) more than 50% of the combined voting power of the voting securities of the Company or such surviving entity outstanding immediately after such merger or consolidation or (B) by which the corporate existence of the Company is not affected and following which the Company’s chief executive officer and directors retain their positions with the Company (and constitute at least a majority of the Board); or

(iv) consummation of a plan of complete liquidation of the Company or a sale or disposition by the Company of all or substantially all the Company’s assets, other than a sale to an Exempt Person.

(d) “Code” means the Internal Revenue Code of 1986, as amended.

(e) “Committee” means the Compensation Committee of the Board, which shall consist solely of two or more members of the Board.

(f) “Common Stock” means the Common Stock, par value $0.01 per share, of the Company, and any other shares into which such stock may be changed by reason of a recapitalization, reorganization, merger, consolidation or any other change in the corporate structure or capital stock of the Company.

(g) “Competition ” is deemed to occur if a person whose employment with the Company or its Subsidiaries has terminated obtains a position as a full-time or part-time employee of, as a member of the board of directors of, or as a consultant or advisor with or to, or acquires an ownership interest in excess of 5% of, a corporation, partnership, firm or other entity that engages in any of the businesses of the Company or any Subsidiary with which the person was involved in a management role at any time during his or her last five years of employment with or other service for the Company or any Subsidiaries.

(h) “Disability” means a disability that would entitle an eligible participant to payment of monthly disability payments under any Company disability plan or as otherwise determined by the Committee. Notwithstanding the foregoing, for purposes of the grant of an award subject to Section 409A of the Code that is settled or distributed upon a “Disability,” “Disability” means for that purpose that a participant is disabled under Sections 409A(a)(2)(C)(i) or (ii) of the Code.

(i) “Exchange Act” means the Securities Exchange Act of 1934, as amended.

(j) “Exempt Person” means (i) Summit Master Company, LLC, Summit Partners, LLC, Summit Partners, L.P. or any of their affiliates, (ii) any person, entity or group under the control of any party included in clause (i), or (iii) any employee benefit plan of the Company or a trustee or other administrator or fiduciary holding securities under an employee benefit plan of the Company.

(k) “Family Member ” has the meaning given to such term in General Instructions A.1(a)(5) to Form S-8 under the Securities Act of 1933, as amended, and any successor thereto.

29

(l) “Fair Market Value ” of a share of Common Stock of the Company means, as of the date in question, the officially-quoted closing selling price of the stock (or if no selling price is quoted, the bid price) on the principal securities exchange on which the Common Stock is then listed for trading (including for this purpose the Nasdaq National Market) (the “Market”) for the applicable trading day or, if the Common Stock is not then listed or quoted in the Market, the Fair Market Value shall be the fair value of the Common Stock determined in good faith by the Board taking into account the requirements of Section 409A of the Code; provided, however, that when shares received upon exercise of an option are immediately sold in the open market, the net sale price received may be used to determine the Fair Market Value of any shares used to pay the exercise price or applicable withholding taxes and to compute the withholding taxes. For purposes of the grant of any stock option under the Plan that is intended to be exempt from the requirements of Section 409A of the Code, Fair Markey Value may be determined in any manner permitted under Section 409A of the Code.

(m) “Incentive Stock Option” means an option conforming to the requirements of Section 422 of the Code and any successor thereto.

(n) “Involuntary Termination ” means, unless otherwise determined by the Committee at the time of grant of an award, (i) the participant’s involuntary dismissal or discharge by the Company or a Subsidiary or by its or their successor for reasons other than Cause or (ii) such individual’s voluntary resignation following (A) a change in his or her position with the Company which materially reduces his or her level of responsibility, (B) a reduction in his or her level of compensation (base salary or any target incentive compensation) by more than ten percent or (C) a relocation of such individual’s place of employment by more than fifty (50) miles, provided and only if such change, reduction or relocation is effected by the Company or a Subsidiary or by its or their successor without the participant’s written consent.

(o) “Non-Employee Director” has the meaning given to such term in Rule 16b-3 under the Exchange Act and any successor thereto.

(p) “Non-qualified Stock Option” means any stock option other than an Incentive Stock Option.

(q) “Other Company Securities ” mean securities of the Company other than Common Stock, which may include, without limitation, unbundled stock units or components thereof, debentures, preferred stock, warrants and securities convertible into or exchangeable for Common Stock or other property.

(r) “Performance Goals” has the meaning set forth on Exhibit A.

(s) “Retirement” means, unless otherwise determined by the Committee at the time of grant of an award, retirement as defined under any Company pension plan or retirement program or termination of one’s employment on retirement with the approval of the Committee.

(t) “Section 162(m) Award” means any award under the Plan that is intended to qualify for the “performance-based” compensation exception under Section 162(m) of the Code and the treasury regulations and other official guidance promulgated thereunder.

(u) “Subsidiary ” means a corporation or other entity of which outstanding shares or ownership interests representing 50% or more of the combined voting power of such corporation or other entity entitled to elect the management thereof, or such lesser percentage as may be approved by the Committee, are owned directly or indirectly by the Company. Notwithstanding the foregoing, for purposes of the grant of any Incentive Stock Option, “Subsidiary” means any subsidiary corporation of the Company within the meaning of Section 424(f) of the Code.

30

|

3.

|

Administration

|

The Plan shall be administered by the Committee; provided that the Board may, in its discretion, at any time and from time to time, resolve to administer the Plan, in which case the term “Committee” shall be deemed to mean the Board for all purposes herein. Subject to the provisions of the Plan, the Committee shall be authorized to (i) select persons to participate in the Plan, (ii) determine the form and substance of grants made under the Plan to each participant, and the conditions and restrictions, if any, subject to which such grants will be made, (iii) certify that the conditions and restrictions applicable to any grant have been met, (iv) modify the terms of grants made under the Plan, (v) interpret the Plan and grants made thereunder, (vi) make any adjustments necessary or desirable in connection with grants made under the Plan to eligible participants located outside the United States and (vii) adopt, amend, or rescind such rules and regulations, and make such other determinations, for carrying out the Plan as it may deem appropriate. Decisions of the Committee on all matters relating to the Plan shall be in the Committee’s sole discretion and shall be conclusive and binding on all parties. The validity, construction, and effect of the Plan and any rules and regulations relating to the Plan shall be determined in accordance with applicable federal and state laws and rules and regulations promulgated pursuant thereto and the rules and regulations of the principal securities exchange on which the Common Stock is then listed for trading. No member of the Committee and no officer of the Company shall be liable for any action taken or omitted to be taken by such member, by any other member of the Committee or by any officer of the Company in connection with the performance of duties under the Plan, except for such person’s own willful misconduct or as expressly provided by statute.

The expenses of the Plan shall be borne by the Company. The Plan shall not be required to establish any special or separate fund or make any other segregation of assets to assume the payment of any award under the Plan, and rights to the payment of such awards shall be no greater than the rights of the Company’s general creditors.

|

4.

|

Shares Available for the Plan.

|

Subject to adjustments as provided in Section 16 hereof, an aggregate of three million sixty-five thousand forty-one (3,065,041) Shares of Common Stock may be issued pursuant to the Plan, plus an automatic annual increase on the first day of each of the Company’s fiscal years beginning in 2011 and ending in 2015 equal to the lesser of (i) two percent (2%) of the shares of Common Stock outstanding on the last day of the immediately preceding fiscal year, and (ii) 750,000 such (collectively, the “Shares”). Notwithstanding the foregoing, the maximum aggregate number of Shares that may be issued pursuant to Incentive Stock Options under the Plan shall not exceed three million sixty-five thousand forty-one (3,065,041) Shares (subject to adjustments as provided in Section 16 hereof), and such number shall not be subject to annual adjustment as described in the preceding sentence.

Such Shares may be in whole or in part authorized and unissued or held by the Company as treasury shares. If any grant under the Plan expires or terminates unexercised, becomes unexercisable or is forfeited as to any Shares, then such unpurchased or forfeited Shares shall thereafter be available for further grants under the Plan.

31

Without limiting the generality of the foregoing provisions of this Section 4 or the generality of the provisions of Sections 3, 6 or 18 or any other section of this Plan, the Committee may, at any time or from time to time, and on such terms and conditions (that are consistent with and not in contravention of the other provisions of this Plan) as the Committee may, in its sole discretion, determine, enter into agreements (or take other actions with respect to the options) for new options containing terms (including exercise prices) more (or less) favorable than the outstanding options.

The maximum number of Shares of Common Stock subject to any award of Incentive Stock Options, Non-qualified Stock Options, or other types of award under the Plan for which the grant of such award or the lapse of the relevant restriction period is subject to the attainment of Performance Goals, which may be granted under the Plan during any calendar year of the Company to any eligible participant in the Plan shall be 300,000 Shares per type of award (which shall be subject to any further increase or decrease pursuant to Section 16). Each performance award to be paid in Shares shall be referenced to one share of Common Stock and shall be charged against the available Shares under this Plan at the time the unit value measurement is converted to a referenced number of Shares of Common Stock in accordance with Section 10. There are no annual individual share limitations on awards of restricted stock, restricted stock units, deferred stock units or performance awards that are not intended to be Section 162(m) Awards. The maximum cash payment under any performance award payable in cash to any eligible participant in the Plan with respect to any calendar year and for which the payment of such award is subject to the attainment of Performance Goals shall be $5,000,000. The foregoing individual participant limitations shall be cumulative; that is, to the extent that Shares of Common Stock for which awards are permitted to be granted to an eligible participant during a calendar year are not covered by an award to such eligible participant in a calendar year, the number of Shares of Common Stock available for awards to such eligible participant shall automatically increase in the subsequent calendar years during the term of the Plan until used.

|

5.

|

Participation

|

Participation in the Plan shall be limited to those directors (including Non-Employee Directors), officers (including non-employee officers) and employees of, and other individuals performing services for, the Company and its Subsidiaries selected by the Committee (including participants located outside the United States). Nothing in the Plan or in any grant thereunder shall confer any right on a participant to continue in the service or employ as a director or officer of or in the performance of services for the Company or a Subsidiary or shall interfere in any way with the right of the Company or a Subsidiary to terminate the employment or performance of services or to reduce the compensation or responsibilities of a participant at any time. By accepting any award under the Plan, each participant and each person claiming under or through him or her shall be conclusively deemed to have indicated his or her acceptance and ratification of, and consent to, any action taken under the Plan by the Company, the Board or the Committee.

Incentive Stock Options or Non-qualified Stock Options, restricted stock awards, restricted stock unit or deferred stock unit awards, performance awards, or any combination thereof, may be granted to such persons and for such number of Shares as the Committee shall determine (such individuals to whom grants are made being sometimes herein called “optionees” or “grantees,” as the case may be). Determinations made by the Committee under the Plan need not be uniform and may be made selectively among eligible individuals under the Plan, whether or not such individuals are similarly situated. A grant of any type made hereunder in any one year to an eligible participant shall neither guarantee nor preclude a further grant of that or any other type to such participant in that year or subsequent years.

32

|

6.

|

Incentive and Non-qualified Options

|

The Committee may from time to time grant to eligible participants Incentive Stock Options, Non-qualified Stock Options, or any combination thereof; provided that the Committee may grant Incentive Stock Options only to eligible employees of the Company or its Subsidiaries. The options granted shall take such form as the Committee shall determine, subject to the following terms and conditions.

It is the Company’s intent that Non-qualified Stock Options granted under the Plan not be classified as Incentive Stock Options, that Incentive Stock Options be consistent with and contain or be deemed to contain all provisions required under Section 422 of the Code and any successor thereto, and that any ambiguities in construction be interpreted in order to effectuate such intent. If an Incentive Stock Option granted under the Plan does not qualify as such for any reason, then to the extent of such non-qualification, the stock option represented thereby shall be regarded as a Non-qualified Stock Option duly granted under the Plan, provided that such stock option otherwise meets the Plan’s requirements for Non-qualified Stock Options.

(a) Price

The price per Share deliverable upon the exercise of each option (“exercise price”) may not be less than 100% of the Fair Market Value of a share of Common Stock as of the date of grant of the option, and in the case of the grant of any Incentive Stock Option to an employee who, at the time of the grant, owns more than 10% of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries, the exercise price may not be less than 110% of the Fair Market Value of a share of Common Stock as of the date of grant of the option, in each case unless otherwise permitted by Section 422 of the Code or any successor thereto.

(b) Payment

Options may be exercised, in whole or in part, upon payment of the exercise price of the Shares to be acquired. Unless otherwise determined by the Committee, payment shall be made (i) in cash (including check, bank draft, money order or wire transfer of immediately available funds), (ii) by delivery of outstanding shares of Common Stock with a Fair Market Value on the date of exercise equal to the aggregate exercise price payable with respect to the options’ exercise, (iii) by simultaneous sale through a broker reasonably acceptable to the Committee of Shares acquired on exercise, as permitted under Regulation T of the Federal Reserve Board or (iv) by any combination of the foregoing.

In the event a grantee elects to pay the exercise price payable with respect to an option pursuant to clause (ii) above, (A) only a whole number of share(s) of Common Stock (and not fractional shares of Common Stock) may be tendered in payment, (B) such grantee must present evidence acceptable to the Company that he or she has owns any such shares of Common Stock tendered in payment of the exercise price prior to the date of exercise, and (C) Common Stock must be delivered to the Company. Delivery for this purpose may, at the election of the grantee, be made either by (1) physical delivery of the certificate(s) for all such shares of Common Stock tendered in payment of the price, accompanied by duly executed instruments of transfer in a form acceptable to the Company, or (2) direction to the grantee’s broker to transfer, by book entry, such shares of Common Stock from a brokerage account of the grantee to a brokerage account specified by the Company. When payment of the exercise price is made by delivery of Common Stock, the difference, if any, between the aggregate exercise price payable with respect to the option being exercised and the Fair Market Value of the shares of Common Stock tendered in payment (plus any applicable taxes) shall be paid in cash. No grantee may tender shares of Common Stock having a Fair Market Value exceeding the aggregate exercise price payable with respect to the option being exercised (plus any applicable taxes).

33

(c) Terms of Options

The term during which each option may be exercised shall be determined by the Committee, but if required by the Code and except as otherwise provided herein, no option shall be exercisable in whole or in part more than ten years from the date it is granted, and no Incentive Stock Option granted to an employee who at the time of the grant owns more than 10% of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries shall be exercisable more than five years from the date it is granted. All rights to purchase Shares pursuant to an option shall, unless sooner terminated, expire at the date designated by the Committee. The

Committee shall determine the date on which each option shall become exercisable and may provide that an option shall become exercisable in installments. The Shares constituting each installment may be purchased in whole or in part at any time after such installment becomes exercisable, subject to such minimum exercise requirements as may be designated by the Committee. Prior to the exercise of an option and delivery of the Shares represented thereby, the optionee shall have no rights as a stockholder with respect to any Shares covered by such outstanding option (including any dividend or voting rights).

(d) Limitations on Grants

If required by the Code, the aggregate Fair Market Value (determined as of the grant date) of Shares for which an Incentive Stock Option is exercisable for the first time during any calendar year under all equity incentive plans of the Company and its Subsidiaries (as defined in Section 422 of the Code or any successor thereto) may not exceed $100,000.

(e) Termination; Forfeiture

(i) Death or Disability

Unless otherwise determined by the Committee at the time of grant of an award, if a participant ceases to be a director, officer or employee of, or to perform other services for, the Company or any Subsidiary due to death or Disability, all of the participant’s options shall become fully vested and exercisable and shall remain so for a period of 180 days from the date of such death or Disability, but in no event after the expiration date of the options; provided that the participant does not engage in Competition during such 180-day period unless he or she received written consent to do so from the Board or the Committee; provided further that the Board or Committee may extend such exercise period (and related non-competition period) in its discretion, but in no event may such extended exercise period extend beyond the expiration date of the options. Notwithstanding the foregoing, if the Disability giving rise to the termination of employment is not within the meaning of Section 22(e)(3) of the Code or any successor thereto, Incentive Stock Options not exercised by such participant within 90 days after the date of termination of employment will cease to qualify as Incentive Stock Options and will be treated as Non-qualified Stock Options under the Plan if required to be so treated under the Code.

34

(ii) Retirement

Unless otherwise determined by the Committee at the time of grant of an award, if a participant ceases to be a director, officer or employee of, or to perform other services for, the Company or any Subsidiary upon the occurrence of his or her Retirement, (A) all of the participant’s options that were exercisable on the date of Retirement shall remain exercisable for, and shall otherwise terminate at the end of, a period of 90 days after the date of Retirement, but in no event after the expiration date of the options; provided that the participant does not engage in Competition during such 90 day period unless he or she receives written consent to do so from the Board or the Committee; provided further that the Board or Committee may extend such exercise period (and related non-competition period) in its discretion, but in no event may such extended exercise period extend beyond the expiration date of the options, and (B) all of the participant’s options that were not exercisable on the date of Retirement shall be forfeited immediately upon such Retirement; provided, however, that such options may become fully vested and exercisable in the discretion of the Committee. Notwithstanding the foregoing, Incentive Stock Options not exercised by such participant within 90 days after Retirement will cease to qualify as Incentive Stock Options and will be treated as Non-qualified Stock Options under the Plan if required to be so treated under the Code.

(iii) Discharge for Cause

Unless otherwise determined by the Committee, if a participant ceases to be a director, officer or employee of , or to perform other services for, the Company or a Subsidiary due to Cause, all of the participant’s options shall expire and be forfeited immediately upon such cessation, whether or not then exercisable.

(iv) Other Termination

Unless otherwise determined by the Committee, if a participant ceases to be a director, officer or employee of, or to otherwise perform services for, the Company or a Subsidiary for any reason other than death, Disability,

Retirement or Cause, (A) all of the participant’s options that were exercisable on the date of such cessation shall remain exercisable for, and shall otherwise terminate at the end of, a period of 30 days after the date of such cessation, but in no event after the expiration date of the options; provided that the participant does not engage in Competition during such 30-day period unless he or she receives written consent to do so from the Board or the Committee; provided further that the Board or Committee may extend such exercise period (and related non-competition period) in its discretion, but in no event may such extended exercise period extend beyond the expiration date of the options, and (B) all of the participant’s options that were not exercisable on the date of such cessation shall be forfeited immediately upon such cessation.

(v) Change in Control

Unless otherwise determined by the Committee at the time of grant of an award, if there is a Change in Control of the Company and a participant is terminated from being a director, officer or employee of, or from performing other services for the Company or a Subsidiary through an “Involuntary Termination” effected within forty-eight (48) months following the effective date of such Change in Control, all of participant’s options shall automatically accelerate and become fully vested and exercisable. Any option so accelerated will remain exercisable until the earlier of (i) the expiration of the option term or (ii) the end of a one- year period measured from the date of the Involuntary Termination as defined herein. In addition, the Committee shall have the authority to grant options that become fully vested and exercisable automatically upon a Change in Control, whether or not the grantee is subsequently terminated.

35

(f) Forfeiture

If a participant exercises any of his or her options and, within one year thereafter, either (i) is terminated from the Company or a Subsidiary for any of the reasons specified in the definition of “Cause” set forth in Section 2(b), or (ii) engages in Competition without having received written consent to do so from the Board or the Committee, then the participant may, in the discretion of the Committee, be required to pay the Company the gain represented by the difference between the aggregate selling price of the Shares acquired upon the options’ exercise (or, if the Shares were not then sold, their aggregate Fair Market Value on the date of exercise) and the aggregate exercise price of the options exercised (the “Option Gain”), without regard to any subsequent increase or decrease in the Fair Market Value of the Common Stock. In addition, the Company may, in its discretion, deduct from any payment of any kind (including salary or bonus) otherwise due to any such participant an amount equal to the Option Gain, provided, however, that no such deduction may occur from any payment that is characterized as “nonqualified deferred compensation” to the extent that such deduction would result in adverse tax consequences under Section 409A of the Code.

(g) Repricings of Options Prohibited.

Notwithstanding any other provision of the Plan to the contrary, outstanding Incentive Stock Options and Non-qualified Stock Options may not be modified to reduce the exercise price thereof nor may a new stock option with a lower exercise price be substituted for a surrendered stock option nor, subject to the provisions of Section 16 of the Plan, may a stock option be cancelled for cash or another award, unless such action is approved by the stockholders of the Company.

|

7.

|

Section 162(m) Awards

|

Awards of Incentive Stock Options and Non-qualified Stock Options granted under the Plan are intended by their terms to qualify as Section 162(m) Awards. Awards of restricted stock, restricted stock units, deferred stock units and performance awards granted under the Plan may qualify as Section 162(m) Awards if the awards are granted or become payable or vested based upon the achievement of Performance Goals in accordance with this Section 7.

In the case of an award of restricted stock, restricted stock units, deferred stock units or a performance award that is intended to be a Section 162(m) Award, the Committee shall make such determinations with respect to such an award and shall establish the objective performance criteria and the individual target award (if any) applicable to each participant or class of participants in writing within ninety (90) days after the beginning of the applicable performance period (or such other time period as is required under Section 162(m) of the Code) and while the outcome of the Performance Goals is substantially uncertain. The applicable performance criteria shall be based on one or more of the Performance Goals set forth in Exhibit A hereto.

36

Subject to the provisions of the Plan, the Committee shall, in its sole discretion, have authority to determine the eligible participants to whom, and the time or times at which, Section 162(m) Awards shall be made, the vesting and payment provisions applicable to such awards, and all other terms and conditions of such awards. As and to the extent required by Section 162(m) of the Code, the terms of an award that is a Section 162(m) Award must state, in terms of an objective formula or standard, the method of computing the amount of compensation payable under the award, and must preclude discretion to increase the amount of compensation payable under the terms of the award (but may allow the Committee discretion to decrease the amount of compensation payable).