Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - WESTWOOD HOLDINGS GROUP INC | d382852d8k.htm |

10 Year

Anniversary July 2012

Exhibit 99.1 |

Key

Objectives: 2002 -

2012

•

Build a firm that transcends a talented founder by creating a world-class research

department supporting multiple products that produce superior returns for our

clients. •

Manage

our

company

the

same

way

as

companies

that

we

would

own

in

our

clients’

portfolios:

•

Generate strong free cash flow

•

High incidence of insider ownership across all levels of the business

•

Shareholder friendly philosophy of sharing excess cash in the form of dividend or

stock buybacks

•

Stable to improving Return on Equity

•

Meaningful dividend payout

•

Strong and improving balance sheet

•

Strong record of value creation

•

Acquire mutual fund assets opportunistically and private wealth businesses selectively

•

Build high quality businesses where demand supports potential for growth

•

Support our community with both time and resources

•

Create shareholder value and perform well vs. our peers and the broad market indices

2 |

Domestic

Research Groups Westwood

International

Consumer/Health Care

(CASH)

Energy/Materials/Utilities

(EMU)

Financials/REITs

(MONEY)

Industrials/Technology

(CHIPS)

Global

Research

•

43 People

•

Attended schools in 10

states

•

2 countries (US, China)

•

7 CFA Charterholders

•

8 advanced degrees

•

14 Investment Professionals

•

93 People

•

Attended schools in

23 states

•

8 countries

•

28 CFA Charterholders

•

32 Advanced degrees

•

38 Investment Professionals

Long-Term Employee Retention

24 of 43 (55%) people employed in 2002 are still at Westwood*

33 of 52 (63%) people including Omaha are still at Westwood

*Departures: 11 family/retirement; 4 new positions; 4 involuntary

3

Our Employees -

2012

Our Employees -

2002

Create

a

world

class,

independent

Research

Department

staffed

with

talented

professionals |

Develop and

Support Multiple Product Investment Strategies LargeCap Value

Balanced

Enhanced Balanced

Fixed Income

LargeCap Value –

SRI

REIT

SMidCap Value

AllCap Value

4

Income

Opportunity

MLP

SmallCap

Value

130/30

MidCap

Value

Global

Strategic

Diversification

SMidCap

Value

Plus+

Dividend

Growth

Emerging

Markets

Emerging

Markets

Plus+

Global

Equity

Global

Dividend

New

products

introduced

LargeCap Value

Balanced

Enhanced Balanced

Fixed Income

LargeCap Value –

SRI

REIT

SMidCap Value

AllCap Value

7

16

4

2002

2012

International

Domestic

Investment Strategies Offered |

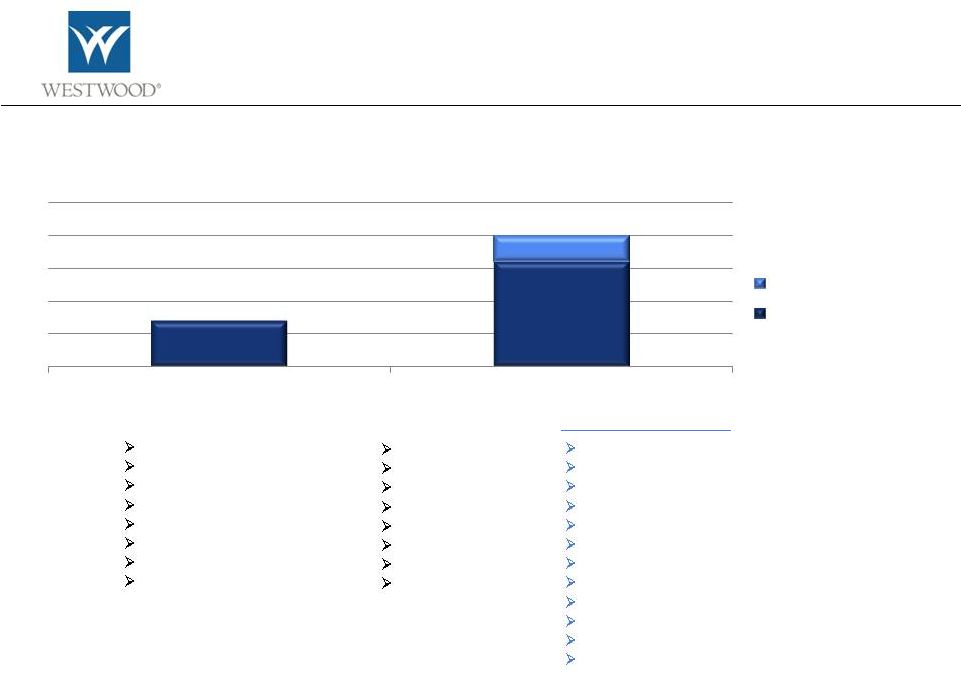

Generate

Superior Performance for our Clients 5

0%

1%

2%

3%

4%

5%

6%

7%

LargeCap Value

Dividend Growth

AllCap Value

SMidCap Value

Annualized Alpha Generation

July

1,

2002

–

June

30,

2012 |

Generate

Superior Performance for our Clients 6

0%

1%

2%

3%

4%

5%

Income Opportunity

MLP

SmallCap Value

Annualized Alpha Generation of Newer Products

Jan ‘03 –

June ‘12

Jan ‘03 –

June ‘12

Jan ‘04 –

June ‘12

Inception

–

June

30,

2012 |

Manage

our

company

in

the

same

manner

as

portfolio

companies

Peer

Comparison

Generate strong free cash flow

High incidence of insider ownership across all levels of the business

Shareholder friendly philosophy of sharing excess cash in the form of

dividend or stock buybacks

Stable to improving Return on Equity

Meaningful dividend payout

Strong and improving balance sheet

Strong record of value creation

Westwood

Peer Median

Return on Equity

22.5%

22.1%

Current Yield

4.0%

2.6%

Dividend Payout

68%

42%

Debt/Capital

0%

17%

Insider Ownership

32%

9%

7

Peer group: AB, AMG, ART, BEN, BLK, CLMS, CNS, DHIL, EPHC, EV, FII, GBL, IVZ, JNS, PZN,

TROW, VRTS, WDR |

Manage

our

company

in

the

same

manner

as

portfolio

companies

8

GAMCO Investors

Third Avenue Management LLC

BlackRock

The Vanguard Group Inc.

Dimensional Fund Advisors, Inc.

Northern Trust Investments

Royce & Associates LLC

State Street Global Advisors

Directors and employees own 32% of Westwood

Shareholders maintaining ownership for the past decade (since inception):

2002

Shareholders maintaining ownership for the past five years:

2007

Insider

Ownership |

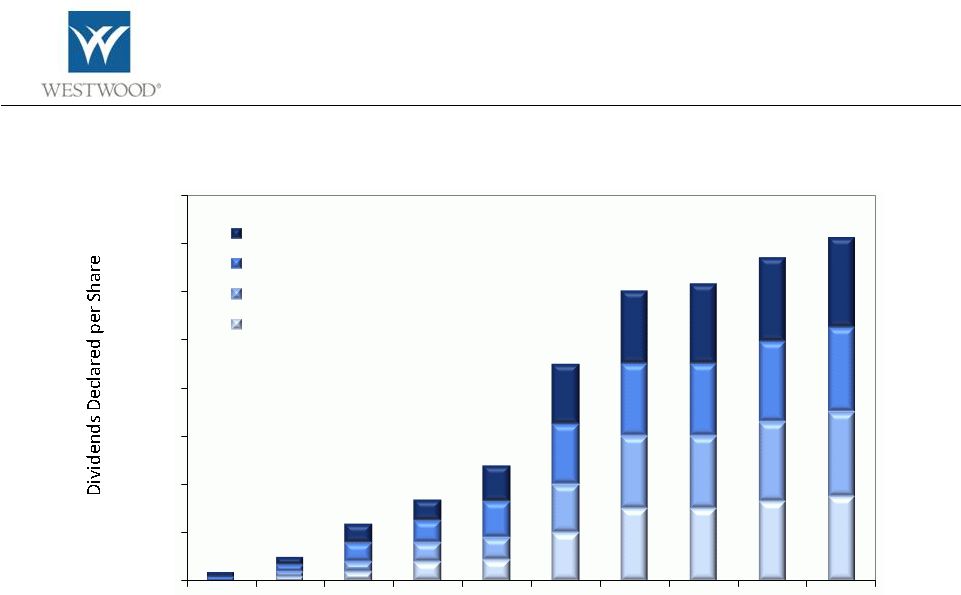

Quarterly

Dividend History (per share) Excludes special dividends

Manage

our

company

in

the

same

manner

as

portfolio

companies

Support

a

growing

dividend

9

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$1.60

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

Q4

Q3

Q2

Q1 |

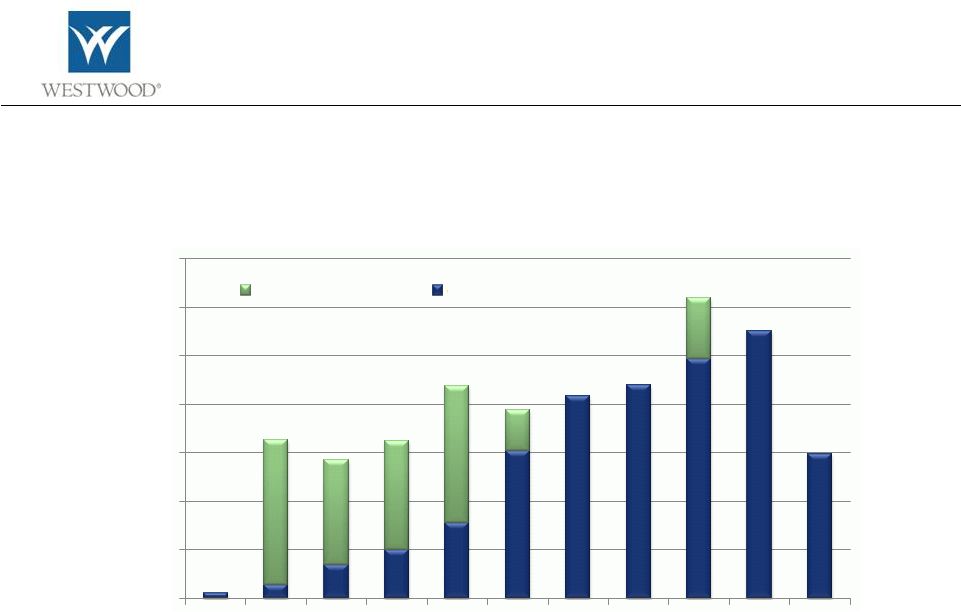

Manage

our

company

in

the

same

manner

as

portfolio

companies

Dividend

History

($

per

year)

*data as of 6/30/12

•

We have paid total dividends of $82 million since we have been public ($12.02/share)

•

WHG Dividend Yield 4.0% vs. asset management peer group median at 2.6%*

10

$0

$2,000,000

$4,000,000

$6,000,000

$8,000,000

$10,000,000

$12,000,000

$14,000,000

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

YTD 2012

Special Dividends

Quarterly Dividends |

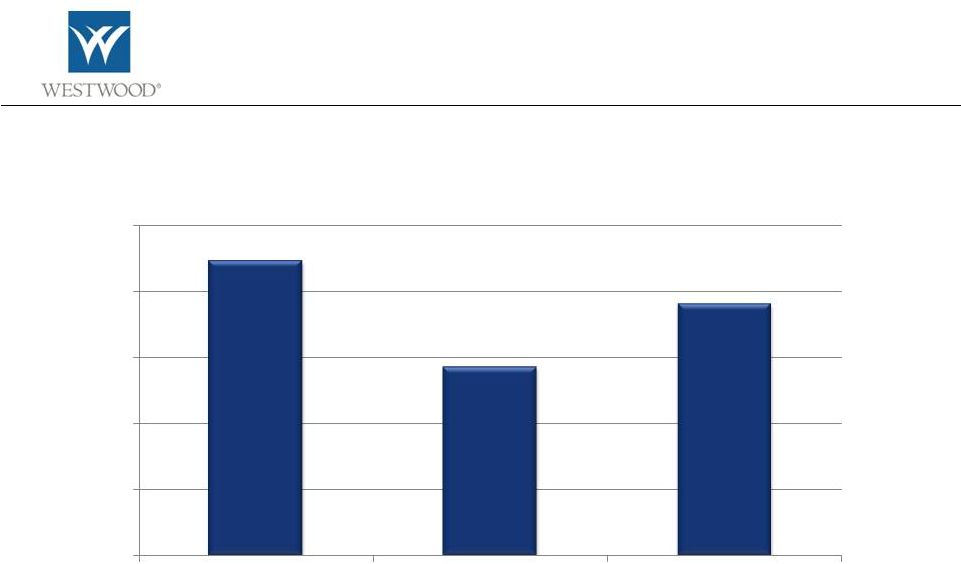

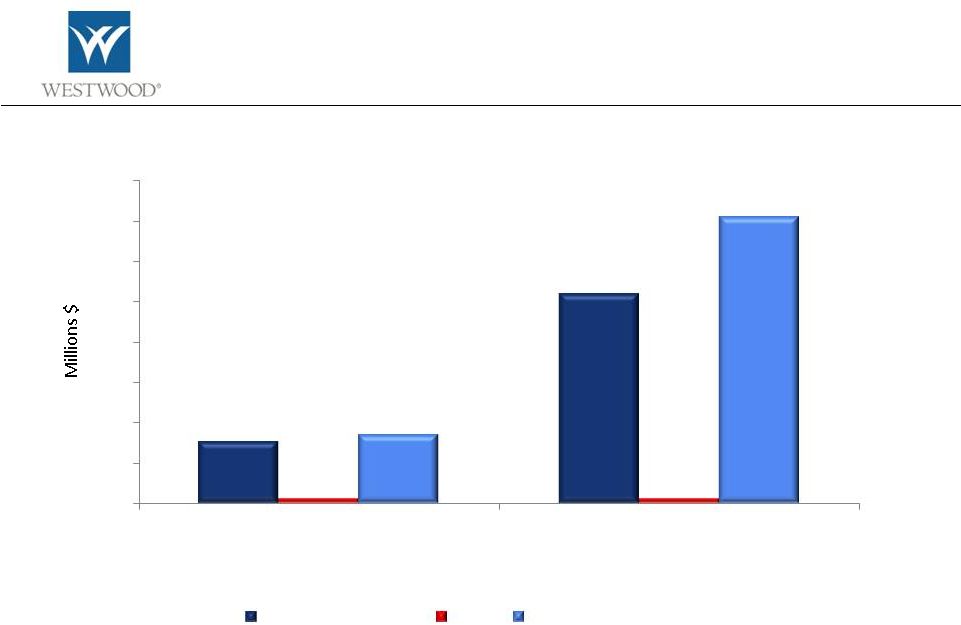

Manage

our

company

in

the

same

manner

as

portfolio

companies

11

$15

$52

13.0% CAGR

Debt, $0

Debt, $0

$17

$71

15.7% CAGR

$0

$10

$20

$30

$40

$50

$60

$70

$80

6/30/2002

6/30/2012

Cash & Investments

Debt

Shareholders' Equity

Maintain

conservative

and

growing

balance

sheet |

Philadelphia

Fund McCarthy Group Advisors

12

•

Timely opportunity to purchase assets to enhance asset growth of

Westwood

Funds

•

Attractive, growing market with limited competition

•

Strong cultural alignment of values

•

High average account balances

•

Strong financial operating history

•

Will benefit from our operational efficiencies and product depth

Acquire

mutual

fund

assets

opportunistically

and

private

wealth

businesses

selectively |

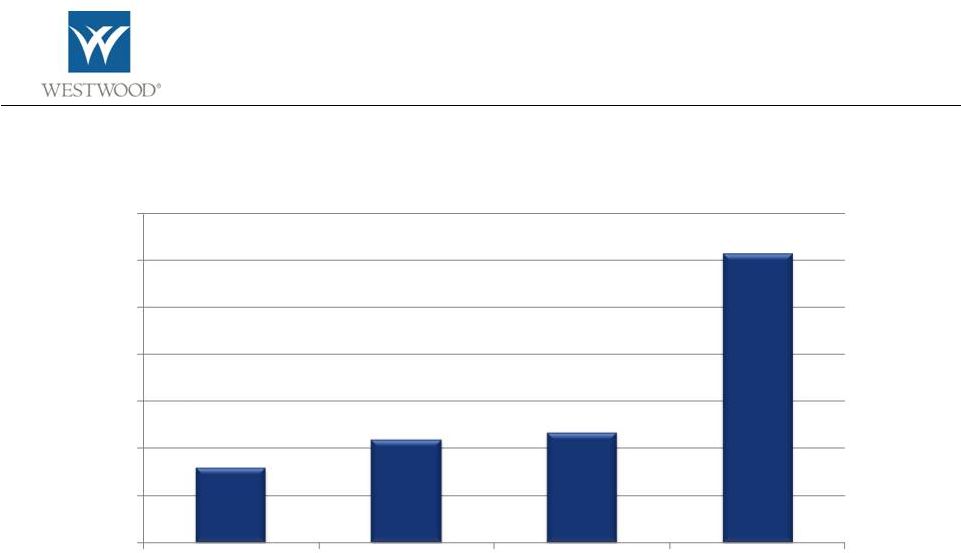

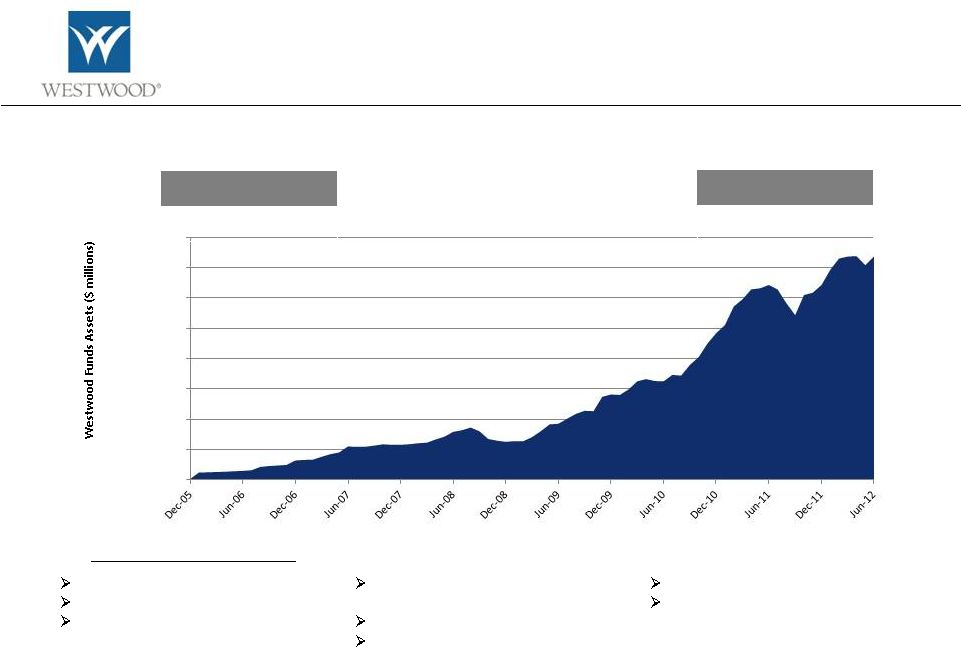

Build

high

quality

businesses

where

demand

supports

potential

for

growth

2002

$0

2012

$1.5 billion

13

Westwood Funds™

Lineup:

Mutual fund assets have grown to 11% of total AUM

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

$1,600

Data as of 6/30/2012

Balanced Fund (WHGBX)

Dividend Growth Fund (WHGDX)

Short Duration High Yield Fund

(WHGHX)

Income Opportunity Fund (WHGIX,

WWIAX)

LargeCap

Value Fund (WHGLX, WWLAX)

SMidCap

Fund (WHGMX)

SMidCap

Plus Fund (WHGPX)

SmallCap

Value Fund (WHGSX) |

Build

high

quality

businesses

where

demand

supports

potential

for

growth

Westwood International Advisors

14

•

Consensus view of Global and Emerging markets as more of an

attractive growth opportunity for investors vs. developed markets

•

Plan sponsors continue to re-balance asset allocation models with

increased allocations to global and emerging market equities

•

Westwood International Advisors team has demonstrated success in

the

past and has been well received by prospective institutional clients

|

Committed

to

supporting

our

community

with

both

time

and

resources

Served 27,300 meals

15

Sponsored and helped

build 7 houses |

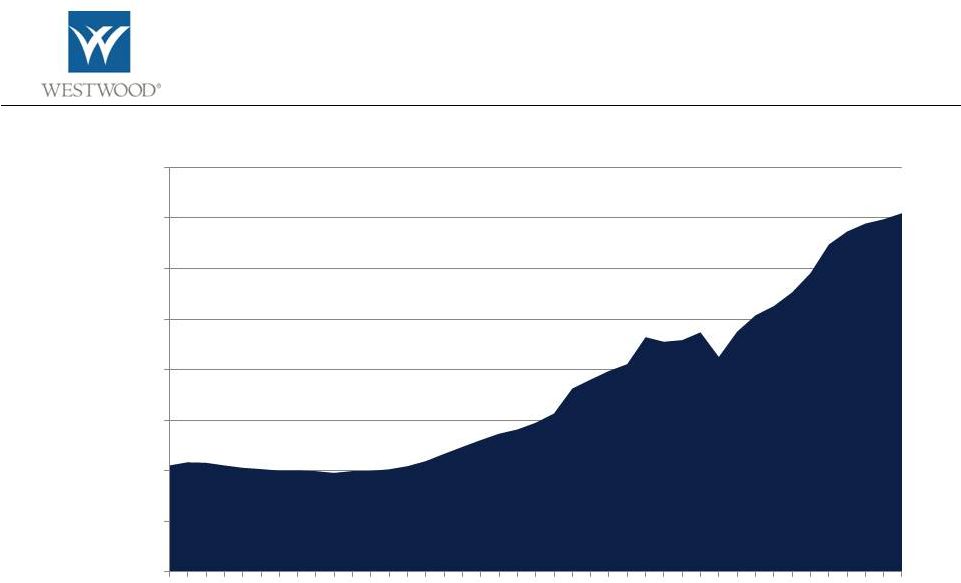

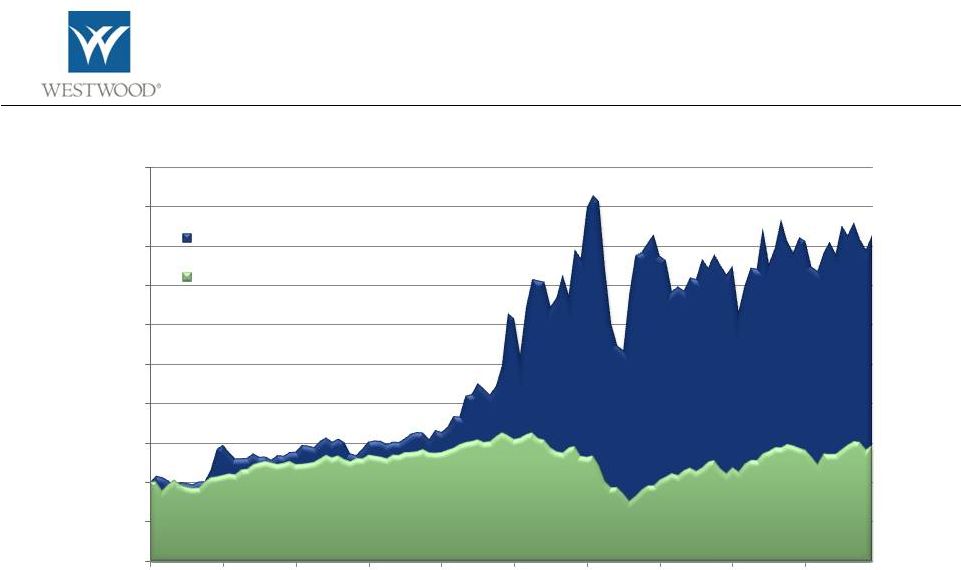

Trailing

twelve months 16

$0

$10,000,000

$20,000,000

$30,000,000

$40,000,000

$50,000,000

$60,000,000

$70,000,000

$80,000,000

Q2

2002

Q4

2002

Q2

2003

Q4

2003

Q2

2004

Q4

2004

Q2

2005

Q4

2005

Q2

2006

Q4

2006

Q2

2007

Q4

2007

Q2

2008

Q4

2008

Q2

2009

Q4

2009

Q2

2010

Q4

2010

Q2

2011

Q4

2011

Q2

2012

Create

shareholder

value

and

perform

well

vs.

peers

and

market

Revenue

History |

Create

shareholder

value

and

perform

well

vs.

peers

and

market

Market

Cap

History

17

$65

$115

$165

$215

$265

$315

$365 |

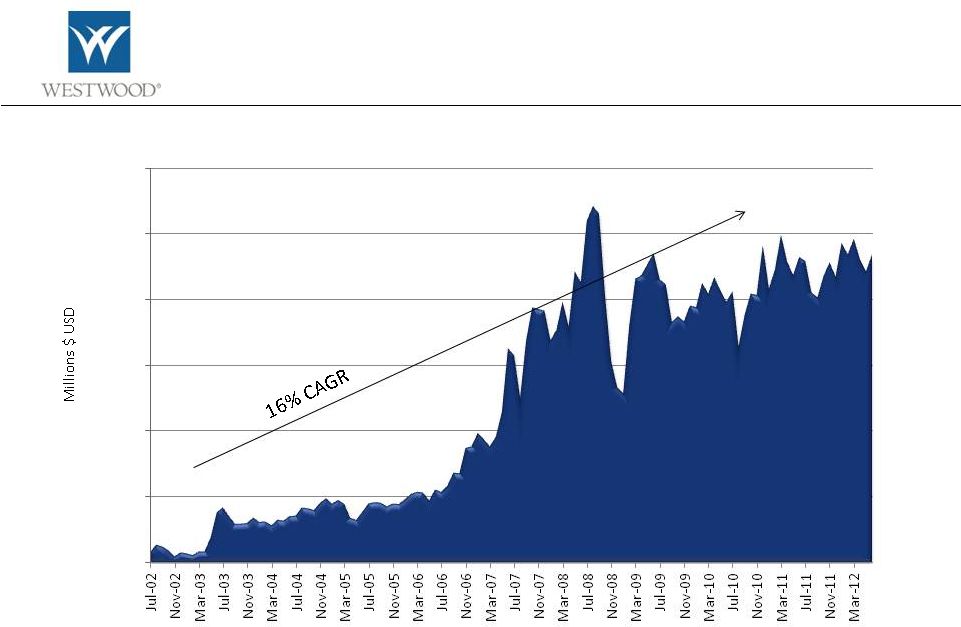

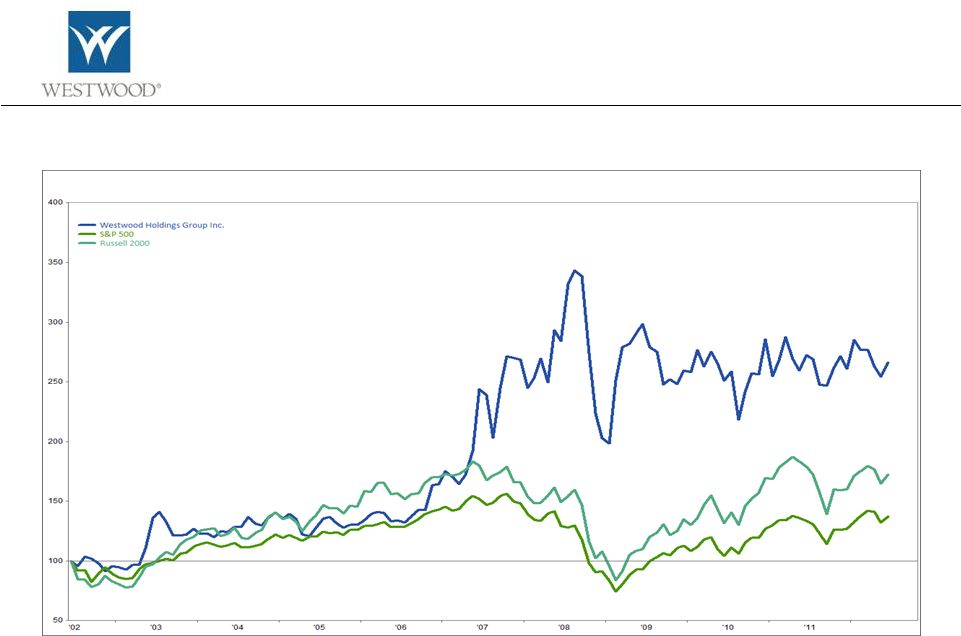

Market Cap

History WHG vs. S&P 500

Indexed to 100 at 7/31/02

Create

shareholder

value

and

perform

well

vs.

peers

and

market

Market

Cap

History

vs.

broad

market

18

0

50

100

150

200

250

300

350

400

450

500

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

WHG Market Value (15.7% annual growth)

S&P 500 Market Value (3.9% annual growth) |

19

Create

shareholder

value

and

perform

well

vs.

peers

and

market

Performance

Comparison

WHG

vs.

S&P

500

and

Russell

2000

Since listing on the NYSE in June 2002, WHG has outperformed both the S&P 500 and the

Russell 2000 indices Time Period: 6/02 –

6/12

All values indexed to 100

Source: FactSet |

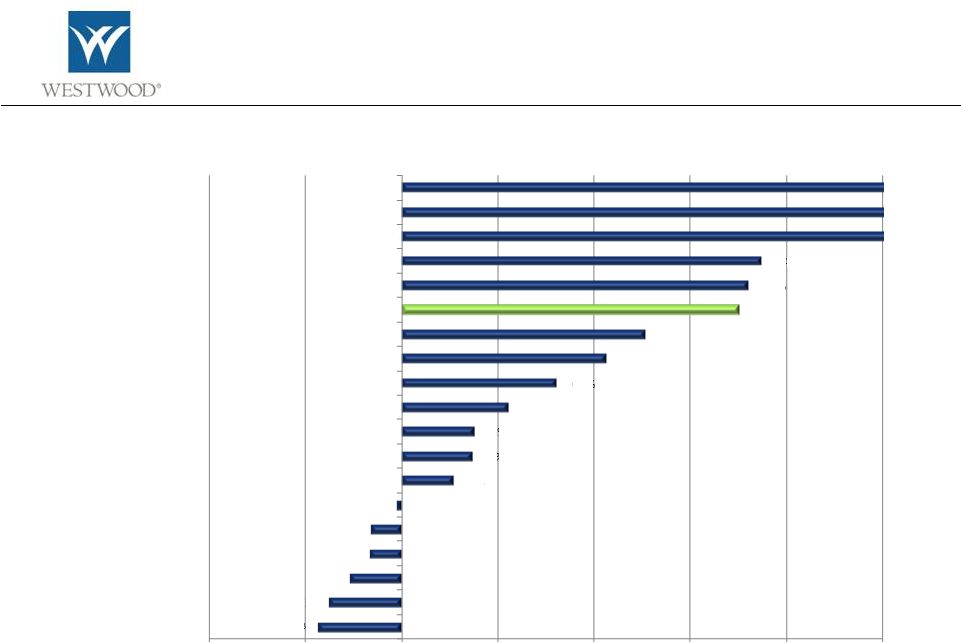

Total Return

Since 2002 WHG Spin-off *data as of 6/30/12

Create

shareholder

value

and

perform

well

vs.

peers

and

market

Create

shareholder

value

together

+

20

Artio Global Investors

Pzena Investment Mgmt

Janus Capital Group Inc.

Calamos Asset Management

AllianceBernstein Holding LP

Federated Investors, Inc.

Gamco Investors

Invesco Ltd.

Waddell & Reed Financial

Eaton Vance Corp.

Affiliated Managers Group

Franklin Resources

Cohen & Steers

WHG

BlackRock, Inc.

T. Rowe Price Group

Virtus Investment Partners

Epoch Holding Corp

Diamond Hill Investment Group

-

200%

-

100%

0%

100%

200%

300%

400%

500%

-86%

-75%

54%

-33%

-32%

-5%

54%

74%

76%

112%

162%

213%

254%

350%

361%

374%

2032%

1739%

671%

- |

Employees

– 10 years +

21

Susan Byrne

Richard Jarvis

Patricia Fraze

Kellie Stark

Brian Casey

Randy Root

C. J. MacDonald

Michelle Neber

Jackie Finley

Stefanie kennedy

Marcie Russmann

Kim Calhoun

Denise Vermett

Sylvia Fry

Crystal Leiva

Andrea McMahon

Rolanda Williams

Jean Kenkel

Kari Saenz

Mark Freeman

Melissa McMillian

Art Burtscher

Susan Ware

Nora Donnelly

Lisa Dong

Monica Cornwall

Jay Singhania

Susan Burkhard

Bill Hardcastle

Kim Gor

Craig Whitten |

Employees

– 5 years +

22

Graham

Wong

Todd Williams

Porter Montgomery

David Spika

Scott

Lawson

Laura Willmann

Julie Gerron

Michael Wall

Ragen Stienke

Kara Axley

Nicholas Wilwerding

Nick English

Martha Gummer

Clodette Turner

Mark Dunbar

Joan Bonn

Natalie Harrison |

Domestic

Equity Strategies SmallCap

Value

1/1/04

SMidCap

Value *

1/1/02

closed

SMidCap

Value Plus+

7/1/10

MidCap

Value

10/1/07

LargeCap

Value

1/1/87

AllCap

Value

7/1/02

Dividend

Growth

11/1/93

Specialized Solutions

Income Opportunity

1/1/03

LargeCap

Value

–

Socially

Responsible Investing

1/1/98

Infrastructure

Renewal

1/1/03

Enhanced Balanced™

1/1/93

*The institutional track record started January 1, 2002.

Westwood

Products

Global/Emerging Markets Strategies

Global Equity

7/1/12

Global Dividend

7/1/12

Emerging Markets

7/1/12

Emerging Markets Plus+

7/1/12

23

Master Limited Partnership |

Improving

Business Mix 24 |