Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - GTT Communications, Inc. | form8-ka_484834.htm |

| EX-99.1 - FINANCIAL STATEMENTS - GTT Communications, Inc. | form99-1_484865.htm |

EXHIBIT 99.2

Global Telecom & Technology, Inc.

Unaudited Pro Forma Condensed Combined Financial Information

Introduction

On April 30, 2012, Global Telecom & Technology, Inc. (“GTT”) completed the acquisition of nLayer Communications, Inc. (“nLayer”). Headquartered in Chicago, nLayer is a leading provider of IP transit and Ethernet transport network solutions for business. With this acquisition, GTT enhances its IP and MPLS backbone services, and further expands its service portfolio.

Under the terms of the acquisition agreement, consideration consisted of $12.0 million in cash paid at closing and up to $6.0 million in deferred consideration and assumption of $1.1 million of liabilities.

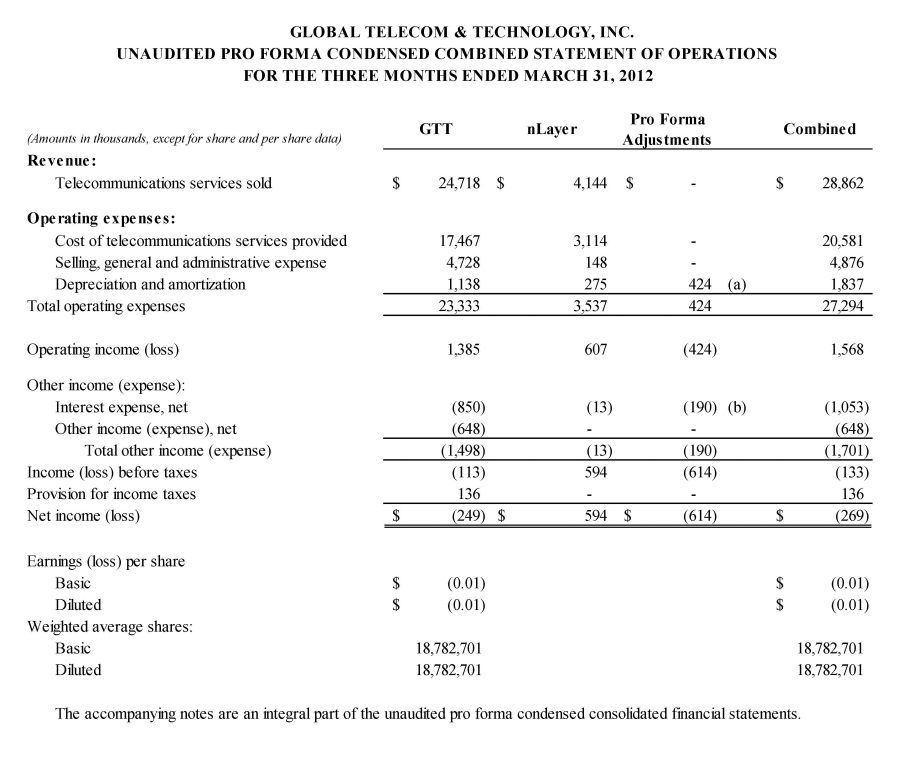

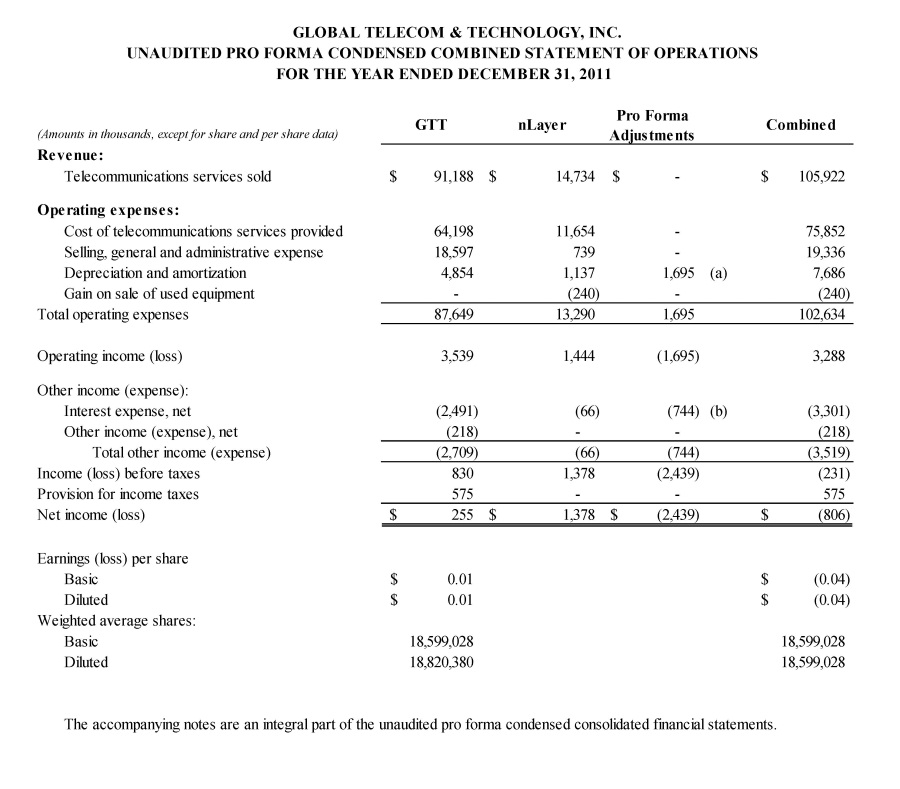

The unaudited pro forma condensed combined balance sheet combines (i) the historical consolidated balance sheets of GTT and nLayer, giving effect to the acquisition as if it had been consummated on January 1, 2012, and (ii) the unaudited pro forma condensed combined statements of operations for the three months ended March 31, 2012 and for the year ended December 31, 2011, giving effect to the acquisition as if it had occurred on January 1, 2012 and 2011, respectively.

The historical consolidated financial statements of GTT and nLayer have been prepared in accordance with accounting principles generally accepted in the United States of America (“US GAAP”). The historical consolidated financial information has been adjusted to give effect to pro forma events that are (i) directly attributable to the merger, (ii) factually supportable, and (iii) with respect to the statement of operations, expected to have a continuing impact on the combined results.

The unaudited pro forma condensed combined financial statements are not necessarily indicative of the operating results or financial position that would have occurred if the merger had been completed at the dates indicated. It may be necessary to further reclassify nLayer’s combined financial statements to conform to those classifications that are determined by the combined company to be most appropriate. While some reclassifications of prior periods have been included in the unaudited pro forma condensed combined financial statements, further reclassifications may be necessary.

The unaudited pro forma condensed combined financial statements were prepared using the acquisition method of accounting with GTT treated as the acquiring entity. Accordingly, consideration paid by GTT to complete the merger with nLayer has been allocated to nLayer’s assets and liabilities based upon their estimated fair values as of the date of completion of the merger.

The pro forma purchase price allocations are preliminary, subject to further adjustments as additional information becomes available and as additional analyses are performed and have been made solely for the purpose of providing the unaudited pro forma condensed combined financial information presented below. GTT estimated the fair value of nLayer’s assets and liabilities based on discussions with nLayer’s management, due diligence and information presented in financial statements. There can be no assurance that the final determination will not result in material changes. GTT expects to incur significant costs associated with integrating GTT’s and nLayer’s businesses. The unaudited pro forma condensed combined financial statements do not reflect the cost of any integration activities or benefits that may result from synergies that may be derived from any integration activities. In addition, the unaudited pro forma condensed combined financial statements do not reflect one-time fees and expenses of approximately $1 million payable by GTT as a result of the merger.

Global Telecom & Technology, Inc.

Notes to Unaudited Pro Forma Condensed Combined Financial Statements

Note 1. Basis of Presentation

The accompanying unaudited pro forma condensed combined financial statements present the pro forma condensed combined financial position and results of operations of the combined company based upon the historical financial statements of GTT and nLayer, after giving effect to the acquisition and adjustments described in these footnotes, and are intended to reflect the impact of the merger on GTT.

The accompanying unaudited pro forma condensed combined financial statements are presented for illustrative purposes only and do not give effect to any cost savings, revenue synergies or restructuring costs which may result from the integration of our and nLayer’s operations.

The unaudited pro forma condensed combined balance sheet reflects the acquisition as if it has been consummated on March 31, 2012 and includes pro forma adjustments for our preliminary valuations of certain intangible assets. The unaudited pro forma condensed combined statements of operations for the three months ended March 31, 2012 and for the year ended December 31, 2011, reflects the acquisition as if it had occurred on January 1, 2012 and 2011, respectively.

The Company and the former stockholders of nLayer are finalizing an agreement to allow GTT to treat the acquisition as an asset purchase. This agreement will result in additional purchase price and goodwill. As a result of the agreement, book and tax bases will be the same.

|

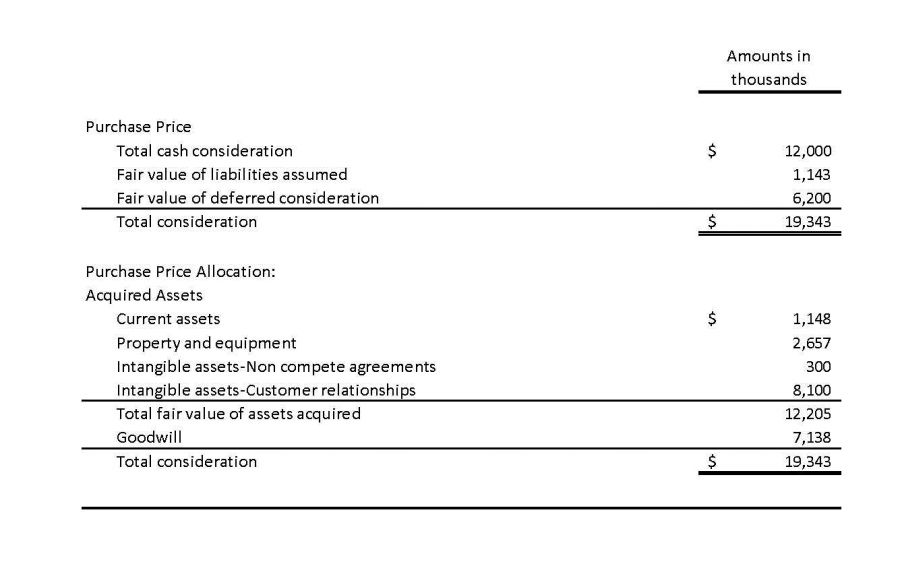

The pro forma condensed combined balance sheet has been adjusted to reflect the preliminary allocation of the purchase price to identifiable net assets acquired and the excess purchase price to goodwill. The purchase price allocation included within these unaudited pro forma condensed combined financial statements is based upon a purchase price of approximately $19.3 million. The preliminary consideration is as presented in the following table. Contingent consideration issued in the transaction is recognized at fair value at acquisition.

|

Upon completion of the fair value assessment after the merger, we anticipate that the estimated purchase price and its allocation may differ from that outlined above primarily due to changes in assets and liabilities between the date of the preliminary assessment and that of closing.

The identifiable intangible assets acquired were valued based on a preliminary valuation and consist of customer relationships and non-compete agreements. Upon completion of the fair value assessment after the merger, we anticipate that the ultimate price allocation may differ from the preliminary assessment outlined above. Any changes to the initial estimates of the fair value of the assets and liabilities will be recorded as adjustments to those assets and liabilities and residual amounts will be allocated to goodwill.

Note 2. Pro Forma Adjustments

|

a.

|

Reflect additional amortization expense related to acquired intangibles as of the beginning of the period.

|

||

|

b.

|

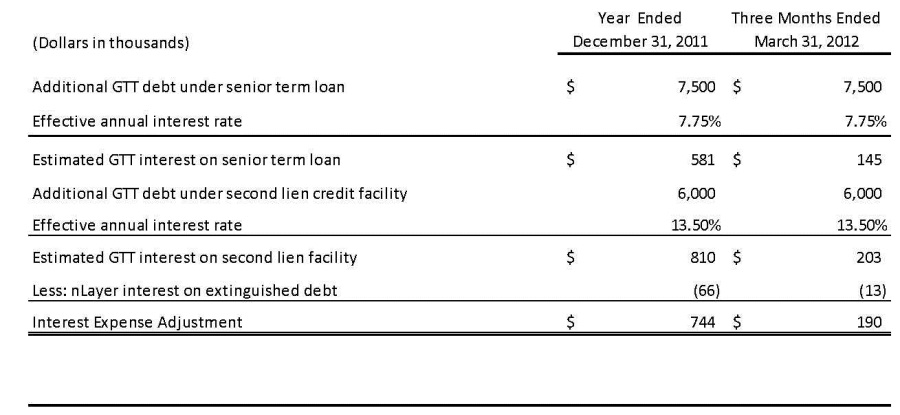

GTT drew $7.5 million under its senior term loan and $6.0 million under a second lien credit facility to finance the transaction. As a result, this adjustment reflects the reduction of nLayer interest expense as a result of GTT’s payoff of nLayer debt as of the beginning of the period, offset by additional debt incurred by GTT.

|

|

c.

|

Reflect additional debt of $7.5 million incurred by GTT on its senior term loan and $6.0 million incurred under a second lien credit facility used to extinguish nLayer debt and cover additional cash needs involved in the transaction. The $6.0 million credit facility was discounted $0.6 million to account for the warrants which are included as a separate liability in other long term liabilities.

|

||

|

d.

|

Cash consideration paid in the transaction (See Note 1).

|

||

|

e.

|

All nLayer and related party debt amounts were extinguished by GTT as part of the $12.0 million cash consideration paid at closing.

|

||

|

f.

|

Intangible assets generated by the transaction represent the customer relationships of $8.1 million and non-compete agreements of $0.3 million.

|

||

|

g.

|

Deferred financing costs of $0.5 million recognized in financing the transaction.

|

||

|

h.

|

The goodwill adjustment of $3.9 million includes the elimination of nLayer’s existing goodwill of $1.2 million, goodwill of $7.1 million created from the acquisition (See Note 1), and working capital differences between the closing at April 30, 2012, compared to March 31, 2012, of $2.1 million.

|

||

|

i.

|

Deferred consideration liability of $6.2 million and $0.6 million of warrant issued in conjunction with second lien credit facility were recognized and measured at fair value as of March 31, 2012.

|

||

|

j.

|

Eliminate the historical stockholders’ equity accounts of nLayer at March 31, 2012.

|