Attached files

| file | filename |

|---|---|

| 8-K/A - FORM 8-K/A - GTT Communications, Inc. | form8-ka_484834.htm |

| EX-99.2 - PRO FORMA FINANCIAL INFORMATION - GTT Communications, Inc. | form99-2_484890.htm |

EXHIBIT 99.1

nLayer Communications, Inc.

Report on Financial Statements

Years Ended December 31, 2011 and 2010

nLAYER COMMUNICATIONS, INC.

Index

Page

Report of Independent Public Accountants 2

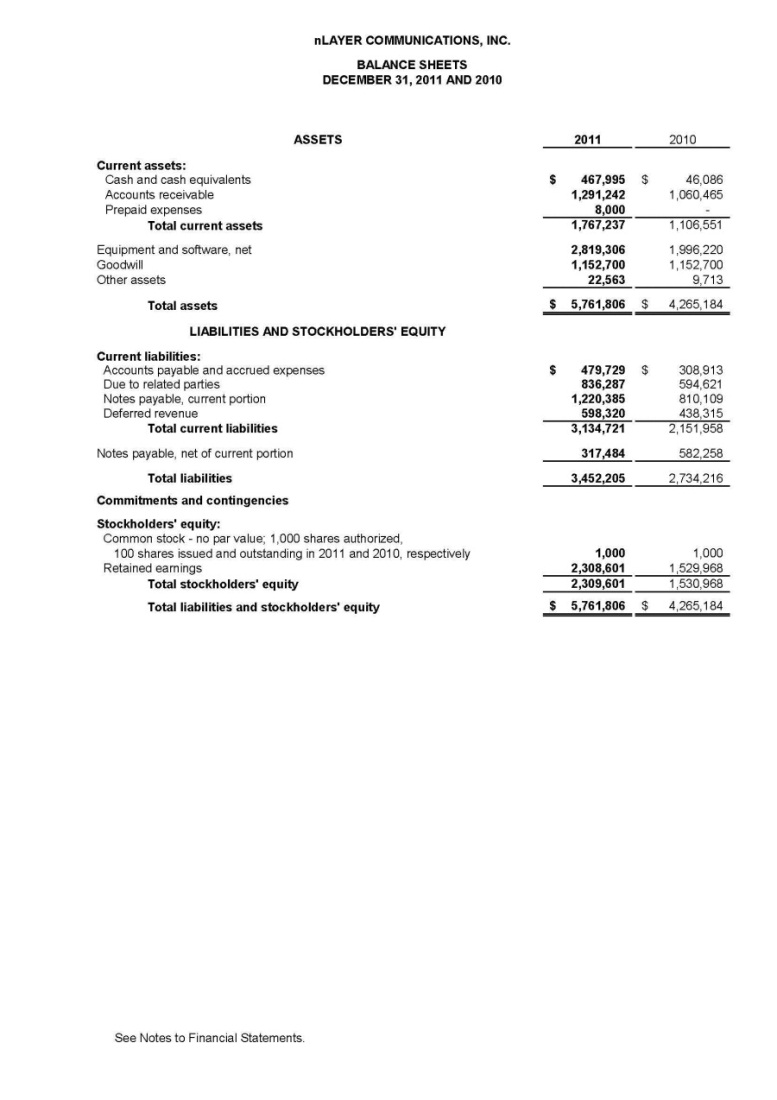

Balance Sheets

December 31, 2011 and 2010 3

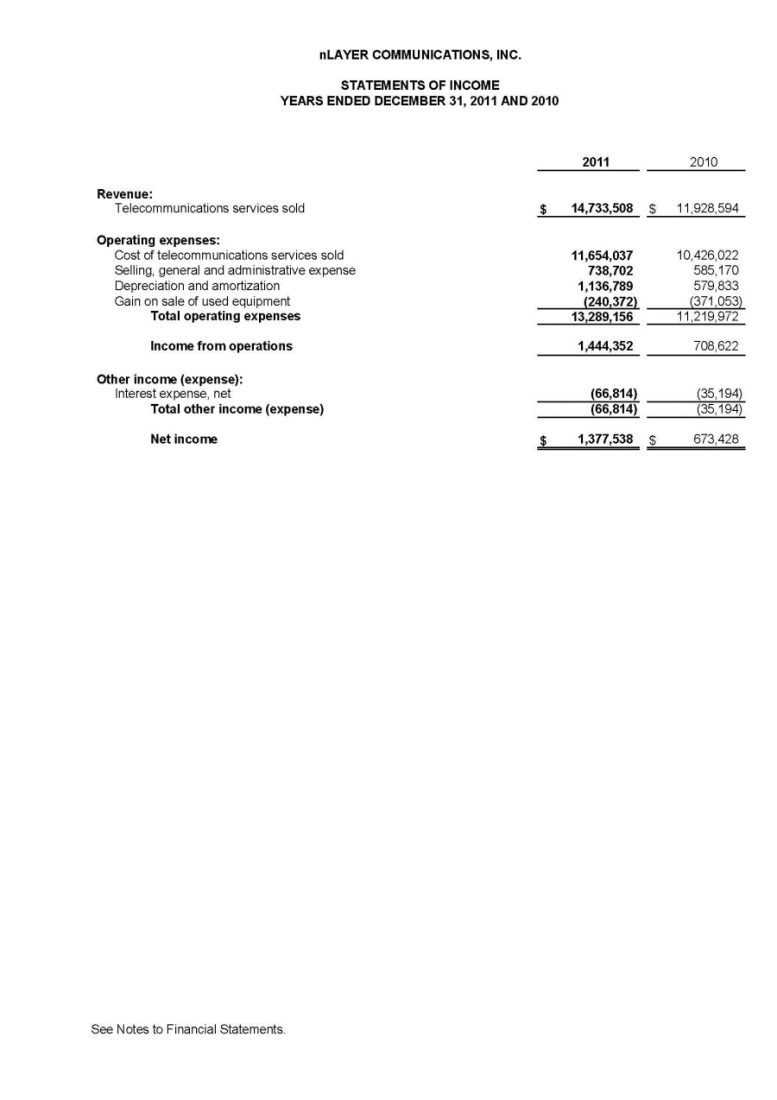

Statements of Income

Years Ended December 31, 2011 and 2010 4

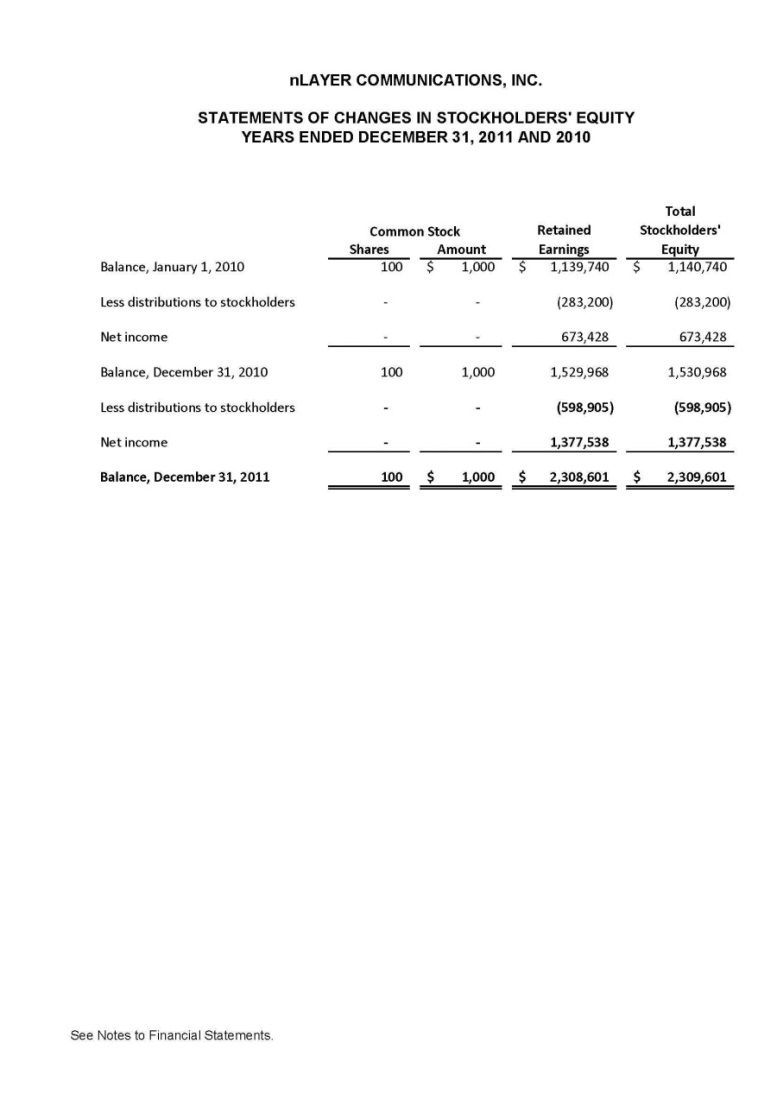

Statements of Changes in Stockholders’ Equity

Years Ended December 31, 2011 and 2010 5

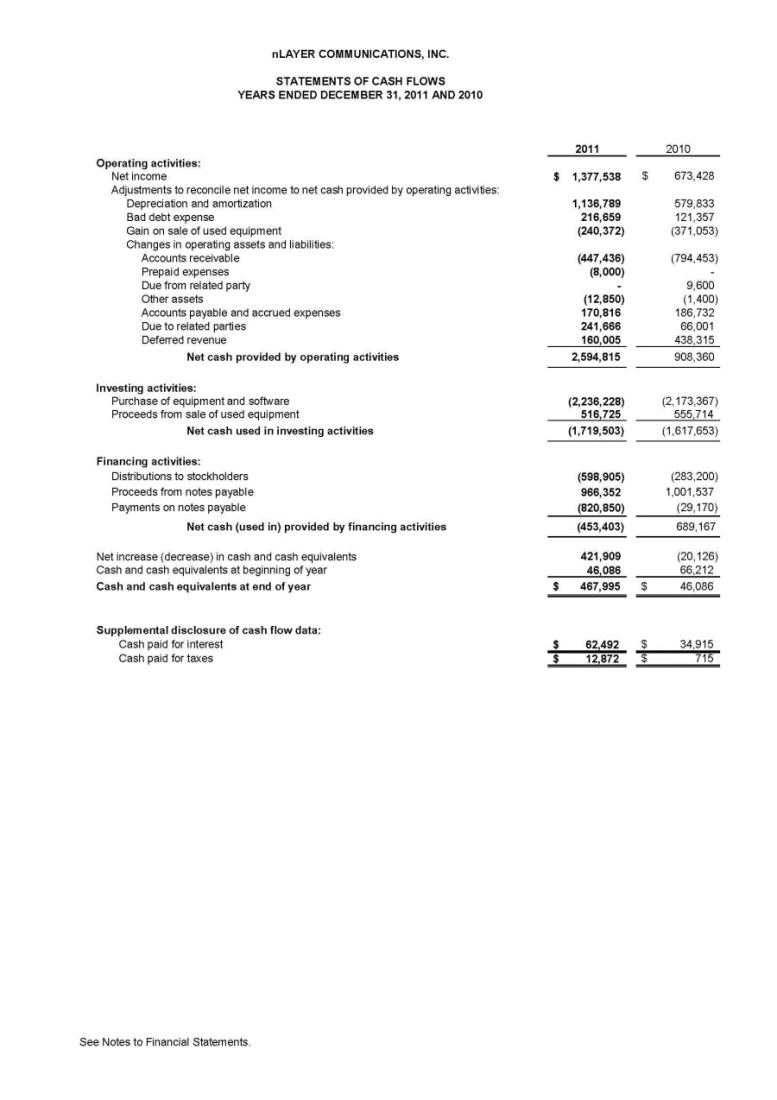

Statements of Cash Flows

Years Ended December 31, 2011 and 2010 6

Notes to Financial Statements 7-13

1

Report of Independent Public Accountants

To the Stockholders and Board of Directors

nLayer Communications, Inc.

We have audited the accompanying balance sheets of nLayer Communications, Inc. as of December 31, 2011 and 2010, and the related statements of income, changes in stockholders’ equity and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of nLayer Communications, Inc. as of December 31, 2011 and 2010, and its results of operations and cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

/s/ J.H. Cohn LLP

Jericho, New York

July 16, 2012

2

3

4

5

6

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

Note 1 – Nature of operations:

nLayer Communications, Inc. is a privately held company headquartered in Chicago, IL where it provides wholesale internet protocol (“IP”) transit, data transport, and managed networking services. The nLayer Network was designed to address the needs of modern companies for higher capacity and better performance from their internet services. The Company owns and operates its own continuously upgraded all-optical internet protocol/multiprotocol label switching (“IP/MPLS”) network. The Company provides service to many leading service providers, content distributors and access networks.

The Company shares administrative office space with Servercentral Network (“Servercentral”), and is under common ownership.

Note 2 – Summary of significant accounting policies:

Basis of presentation:

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Cash and cash equivalents:

The Company considers all cash accounts, which are not subject to withdrawal restrictions or penalties, and all liquid instruments purchased with a maturity of three months or less to be cash equivalents.

Accounts receivable:

The Company’s accounts receivable are recorded at the amount management expects to collect from outstanding balances. Differences between the amount due and the amount management expects to collect are reported in the results of operations of the year in which those differences are determined with an offsetting entry to a valuation allowance for trade accounts receivable. Balances outstanding after management has used reasonable collection efforts are written off through a charge to the valuation allowance. At December 31, 2011 and 2010, no valuation allowance was deemed necessary.

Use of estimates:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

7

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

|

Note 2

|

– Summary of significant accounting policies (continued):

|

Advertising:

Advertising costs, which are included in general and administrative expenses, are expensed as incurred. Advertising costs charged to operations for the years ended December 31, 2011 and 2010 amounted to $2,390 and $13,230, respectively.

Goodwill:

The accounting for the acquisition of nLayer Communications, Inc. in 2007 resulted in recognizing goodwill of $1,152,700. Under accounting principles generally accepted in the United States of America, the carrying amount of goodwill is not amortized but is reduced if management determines that its implied fair value has been impaired. During the years ended December 31, 2011 and 2010, the Company performed an impairment analysis and concluded there were no changes in the carrying amounts of goodwill necessary.

Long-lived assets:

Impairment losses are recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the net carrying amount of the assets. If such changes in circumstances are present, a loss is recognized to the extent the carrying value of the asset and amounts expected to be realized upon its eventual disposition. The Company did not have any impairment of long-lived assets during the years ended December 31, 2011 and 2010.

Equipment and software:

Equipment and software are carried at cost less accumulated depreciation and amortization. Depreciation and amortization have been provided primarily on the accelerated method over the estimated useful lives of the respective assets.

Custom Software 15 Years

Network Equipment 5 Years

Revenue recognition:

The Company’s services are provided pursuant to contracts that typically provide for payments of recurring charges on a monthly basis for use of the services over a committed term. Each service contract has a fixed monthly cost and a fixed term. At the end of the initial term of most service contracts, the contracts roll forward on a month-to-month or other periodic basis and continue to bill at the same fixed recurring rate. If any cancellation or termination charges become due from the customer as a result of early cancellation or termination of a service contract, those amounts are calculated pursuant to a formula specified in each contract. Recurring costs relating to supply contracts are recognized ratably over the term of the contract.

8

Based on the nature of the Company’s billing arrangements, the Company records deferred and unbilled revenue as described below.

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

|

Note 2

|

– Summary of significant accounting policies (concluded):

|

Deferred revenue:

The Company bills its customers for committed amounts of bandwidth services to be used during the subsequent month. Since this billing is for a subsequent period the amount is classified as deferred revenue. The actual amount of service used during any given month cannot be fully determined until the end of the month serviced.

Unbilled revenue:

The Company bills its customers for any excess service in the month subsequent to the month of service. This unbilled revenue is included in accounts receivable.

Income taxes:

The Company, with the consent of its stockholders, has elected to be treated as an "S" Corporation under the applicable sections of the Internal Revenue Code and various state and local regulations. Under these sections, corporate income or loss, in general, is taxable to the stockholders in proportion to their respective interests. In those states and localities where "S" status is not recognized, the Company will continue to be liable for those taxes.

The Company has not identified any uncertain income tax positions that would require recognition at December 31, 2011 and 2010. The Company’s U.S. Federal and state income tax returns prior to fiscal years 2009 respectively, are closed and management continually evaluates expiring statutes of limitations, audits, proposed settlements, changes in tax law and new authoritative rulings. At December 31, 2011 and 2010, the Company did not have any interest and penalties associated with tax matters. The Company’s policy is to recognize any interest and penalties as part of the income tax provision.

|

|

Subsequent events:

|

The Company has evaluated subsequent events through July 16, 2012, the date the financial statements were available to be issued. See Note 8.

|

Note 3

|

– Related party transactions:

|

The stockholders of the Company also own Servercentral. Servercentral purchased bandwidth and wave/fiber for the Company during the years ended 2011 and 2010. The Company reimbursed Servercentral for these purchases in the amount of $556,523 and $415,314 in 2011 and 2010, respectively. These amounts are included in cost of telecommunications services sold on the statements of income.

Servercentral purchased IP and data transit and network services from the Company during 2011 and 2010. Total sales to Servercentral were $853,799 and $1,185,033 in 2011 and 2010, respectively.

9

NLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

|

Note 3

|

– Related party transactions (continued):

|

The Company utilized equipment, owned by Servercentral to service its customers. The Company paid a fee to Servercentral in the amounts of $204,150 and $448,726 in 2011 and 2010, respectively for usage of the equipment, which are included in cost of telecommunications services sold on the statements of income. On June 21, 2011, Servercentral transferred ownership of this equipment to the Company in exchange for a note payable of $653,574. The note was payable in 12 monthly installments of $55,902, including interest at the rate of 5%. The first six payments were made in 2011 leaving the unpaid principal balance of $330,574 as of December 31, 2011. Interest of $13,414 was paid to Servercentral in 2011 and is included in interest expense.

The Company reimbursed Servercentral for the cost of certain personnel, insurance, office supplies and rent in the amounts of $929,413 and $915,614 for 2011 and 2010, respectively. These amounts are included in selling, general and administrative expense on the statements of income.

The Company would settle amounts due with Servercentral against any amounts owed on a monthly basis. As of December 31, 2011 and 2010, the balance due to Servercentral was $836,287 and $594,621, respectively. These amounts are included in due to related parties on the balance sheet.

On February 24, 2010, the Company entered into a $1,500,000 variable Interest loan commitment with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies, as needed. The note is scheduled to mature August 24, 2013. The balance of the note, as of December 31, 2011, is $896,927. nLayer Communications Inc.’s portion of this loan is $619,748 and Servercentral portion of the loan is of $277,179.

On March 30, 2011, the Company entered into a $1,000,000 variable interest line of credit with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies as needed. The note is scheduled to mature September 23, 2014. The balance of the note, as of December 31, 2011, is $569,055. nLayer Communications Inc.’s portion of this loan is $307,547 and Servercentral portion of the loan is of $261,508.

The Company is contingently liable for the two loans entered into jointly with Servercentral. The Company has included its portion of the loans ($927,293 and $972,367 in 2011 and 2010, respectively) in these financial statements. The total amount outstanding on these loans was $1,465,982 and $1,407,253, as of December 31, 2011 an 2010, respectively. The Company is contingently liable for the amount not included on these financial statements, representing Servercentral’s portion, which was $538,689 and $434,886, as of December 31, 2011 and 2010, respectively.

10

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

|

Note 3

|

– Related party transactions (concluded):

|

In 2007, the Company borrowed $420,000 from the stockholders to finance an acquisition of certain equipment, customer lists, and other intangibles. The loan is unsecured and bears interest at the rate of 4%, payable annually. As of December 31, 2011 and 2010, the balance outstanding was $280,000 and $420,000, respectively. Interest of $13,962 and $16,800 was paid to the shareholders in 2011 and 2010, respectively and is included in interest expense.

Servercentral owns 49% of CacheNetworks, LLC (d/b/a CacheFly). There are no transactions between CacheNetworks and the Company.

|

Note 4

|

– Long-term debt:

|

In 2007, the Company borrowed $420,000 from the stockholders to finance an acquisition of certain equipment, customer lists, and other intangibles. The loan is unsecured and bears interest at the rate of 4%, payable annually. As of December 31, 2011 and 2010, the balance outstanding is $280,000 and $420,000, respectively.

On February 24, 2010, the Company entered into a $1,500,000 variable Interest loan commitment with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies, as needed. The note is scheduled to mature August 24, 2013. The first nine payments made in 2010 were for interest only and on November 29, 2010, the terms were changed to a fixed rate of 3.95% with 33 monthly principal and interest payments of $46,442 beginning on December 27, 2010 and ending on August 24, 2013. The balance of the note, as of December 31, 2011, is $896,927. nLayer Communications Inc.’s portion of this loan is $619,746 and Servercentral portion of the loan is of $277,179. Each company is currently making debt service payments in accordance with its pro-rata portion of the note.

On March 30, 2011, the Company entered into a $1,000,000 variable interest line of credit with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies as needed. The note is scheduled to mature September 23, 2014. The first nine payments made in 2011 were for interest only and subsequently the loan period was extended to March 23, 2012 with 30 monthly principal and interest payments of $34,960 beginning on April 23, 2012 and ending on September 23, 2014. Interest is fixed at a rate of 3.95% per year. The balance of the note, as of December 31, 2011, is $569,055. nLayer Communications Inc.’s portion of this loan is $307,547 and Servercentral portion of the loan is of $261,508. Each company will begin making debt service payments in 2012 in accordance with its pro-rata portion of the note.

11

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

Note 4 – Long-term debt (concluded):

The Company is contingently liable for the two loans entered into jointly with Servercentral. The Company has included its portion of the loans ($927,293 and $972,367 in 2011 and 2010, respectively) in these financial statements. The total amount outstanding on these loans was $1,465,982 and $1,407,253, as of December 31, 2011 an 2010, respectively. The Company is contingently liable for the amount not included on these financial statements, representing Servercentral’s portion, which was $538,689 and $434,886, as of December 31, 2011 and 2010, respectively.

On June 21, 2011, nLayer Communications, Inc. purchased from Servercentral certain used network equipment valued at $653,574, in exchange for a note in the same amount, payable in 12 monthly installments of $55,902, including interest at the rate of 5%. The first six payments were made in 2011 leaving the unpaid principal balance of $330,574 as of December 31, 2011.

Principal payment requirements due on the above obligations in each of the years subsequent to December 31, 2011 are as follows:

|

Year Ending

December 31,

|

Amount

|

|||

|

2012

|

$ | 1,220,385 | ||

|

2013

|

317,484 | |||

|

Total

|

$ | 1,537,869 | ||

|

Note 5

|

– Equipment and software:

|

Major classes of equipment and software at December 31, 2011 and 2010 were as follows:

|

2011

|

2010

|

|||||||

|

Network equipment

|

$ | 4,187,738 | $ | 2,450,284 | ||||

|

Custom software

|

225,000 | 225,000 | ||||||

| 4,412,738 | 2,675,284 | |||||||

|

Less accumulated depreciation and amortization

|

1,593,432 | 679,064 | ||||||

|

Totals

|

$ | 2,819,306 | $ | 1,996,220 | ||||

Depreciation and amortization expense was $1,136,789 and $579,833 for 2011 and 2010, respectively.

12

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

|

Note 6

|

– Commitments and contingencies:

|

Lease commitments:

The Company is obligated under various short-term leases for datacenter space. Datacenter rent was $817,360 and $627,738 in 2011 and 2010, respectively.

The Company leases office space from an unrelated party, for temporary office space, on a month-to-month basis. Rent expense for the years ended December 31, 2011 and 2010 was $7,200 and $2,560, respectively.

|

Note 7

|

– Concentration risks:

|

Credit risk:

The Company maintains cash and cash equivalent balances in bank deposit accounts, which are insured by the Federal Deposit Insurance Corporation. From time to time, the Company's balances may exceed these limits. At December 31, 2011 and 2010, there were no uninsured bank balances.

|

Note 8

|

– Subsequent events:

|

During the first quarter of 2012, the Company received $430,945 of proceeds from its credit facility with Chase Bank and the Small Business Administration bringing the outstanding principal balance to $1,000,000.

On April 30, 2012, the Company’s stockholders entered into an agreement to sell and sold all of the equity interests in the Company to Global Telecom & Technology, Inc (“GTT”). In consideration for the equity interests in the Company, GTT paid the sellers $12,000,000 in cash paid at closing, up to $6,000,000 in deferred consideration and assumed $1,100,000 of liabilities, subject to a working capital adjustment and a reduction if the Company’s revenue are lower than specified target levels during the two-year period after the closing of the acquisition.

Immediately following the close of the sale to GTT, the Company paid off amounts due to related parties and amounts due on the notes payable in their entirety.

Subsequent events were evaluated through July 16, 2012, the date that the financial statements were issued.

13

nLayer Communications, Inc.

Report on Financial Statements

Three Months Ended March 31, 2012 and 2011

nLAYER COMMUNICATIONS, INC.

Index

| Page | |

|

Balance Sheets

March 31, 2012 (unaudited)

|

2 |

|

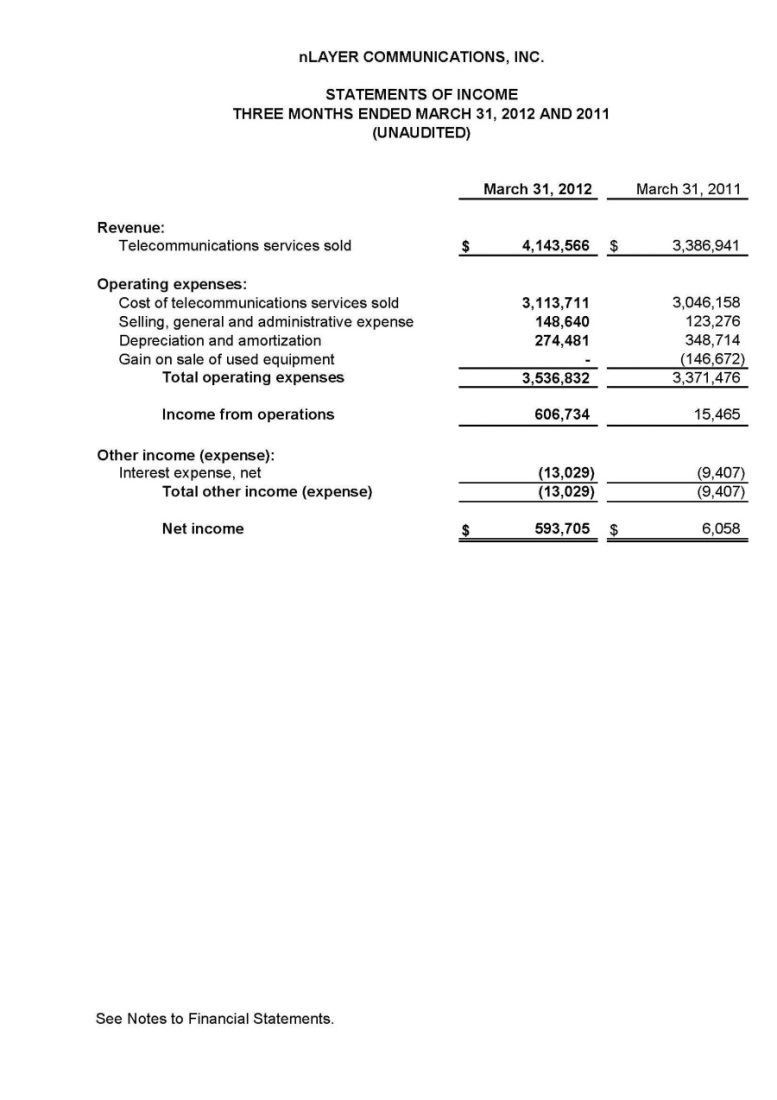

Statements of Income

Three Months Ended March 31, 2012 and 2011 (unaudited)

|

3 |

|

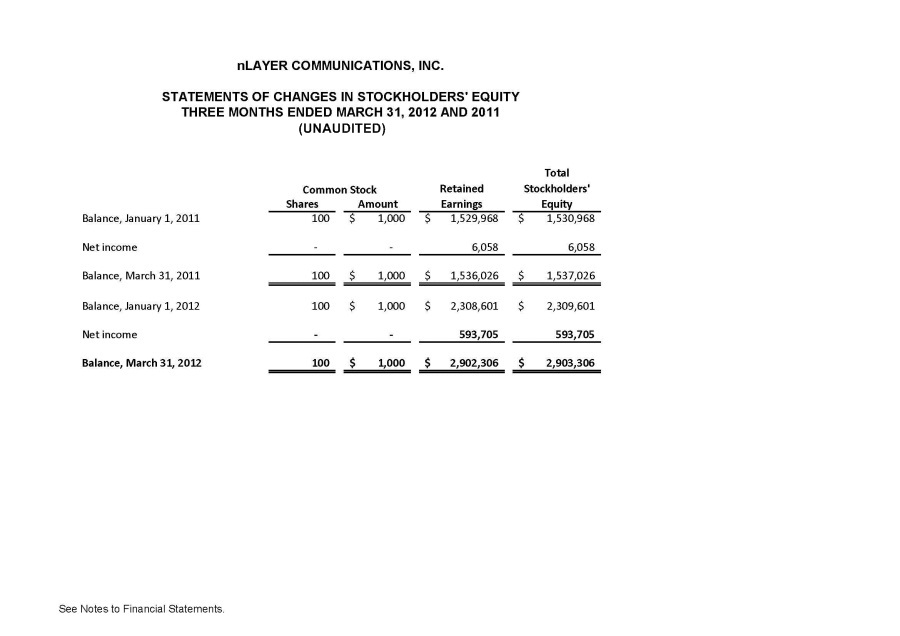

Statements of Changes in Stockholders’ Equity

Three Months Ended March 31, 2012 and 2011 (unaudited)

|

4 |

|

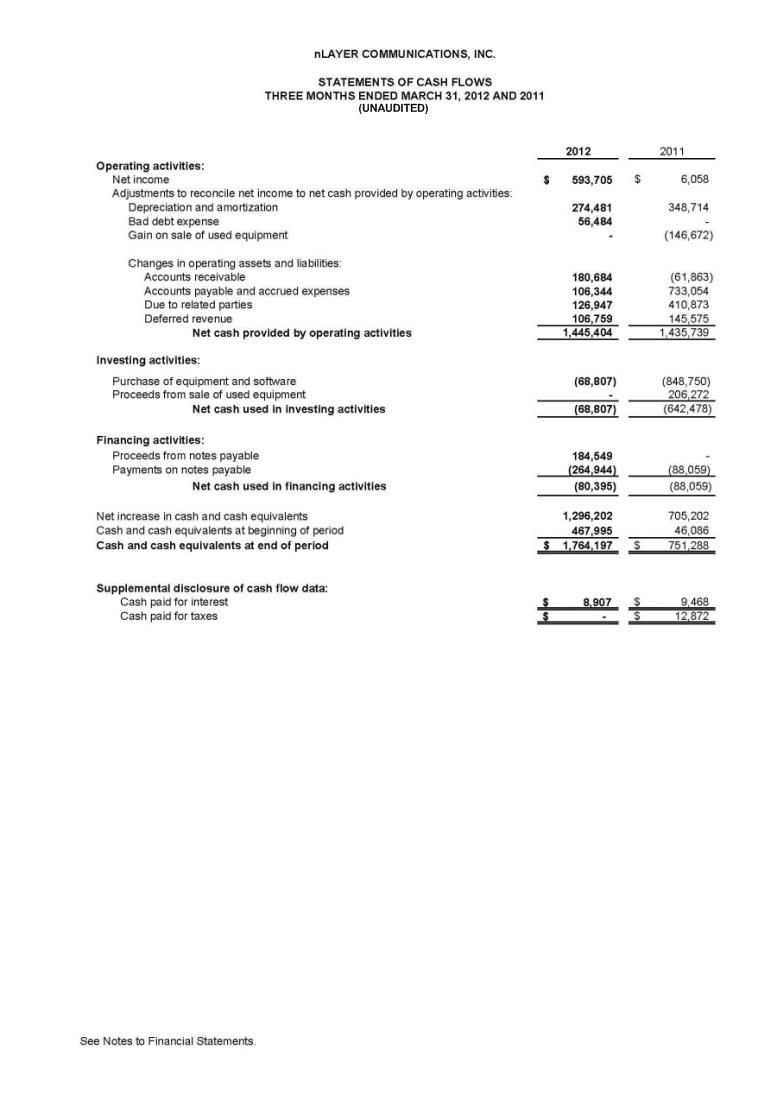

Statements of Cash Flows

Three Months Ended March 31, 2012 and 2011 (unaudited)

|

5 |

| Notes to Financial Statements (unaudited) | 6-13 |

1

2

3

4

5

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

Note 1 – Nature of operations:

nLayer Communications, Inc. is a privately held company headquartered in Chicago, IL where it provides wholesale internet protocol (“IP”) transit, data transport, and managed networking services. The nLayer Network was designed to address the needs of modern companies for higher capacity and better performance from their internet services. The Company owns and operates its own continuously upgraded all-optical internet protocol/multiprotocol label switching (“IP/MPLS”) network. The Company provides service to many leading service providers, content distributors and access networks.

The Company shares administrative office space with Servercentral Network (“Servercentral”), and is under common ownership.

Note 2 – Summary of significant accounting policies:

Basis of presentation:

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America.

Unaudited interim financial statements:

The financial statements reflect all adjustments (consisting primarily of normal recurring adjustments) that are, in the opinion of management, necessary for a fair presentation of the Company’s financial position and the results of operations. The operating results for the three months ended March 31, 2012, are not necessarily indicative of the results to be expected for the full fiscal year 2012 or for any other interim period.

Cash and cash equivalents:

The Company considers all cash accounts, which are not subject to withdrawal restrictions or penalties, and all liquid instruments purchased with a maturity of three months or less to be cash equivalents.

Accounts receivable:

The Company’s accounts receivable are recorded at the amount management expects to collect from outstanding balances. Differences between the amount due and the amount management expects to collect are reported in the results of operations of the year in which those differences are determined with an offsetting entry to a valuation allowance for trade accounts receivable. Balances outstanding after management has used reasonable collection efforts are written off through a charge to the valuation allowance. At March 31, 2012, the valuation allowance was $56,484.

6

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 2

|

– Summary of significant accounting policies (continued):

|

Use of estimates:

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect certain reported amounts and disclosures. Accordingly, actual results could differ from those estimates.

Advertising:

Advertising costs, which are included in general and administrative expenses, are expensed as incurred. Advertising costs charged to operations for the three months ended March 31, 2012 and 2011 amounted to $484 and $979, respectively.

Goodwill:

The accounting for the acquisition of nLayer Communications, Inc. in 2007 resulted in recognizing goodwill of $1,152,700. Under accounting principles generally accepted in the United States of America, the carrying amount of goodwill is not amortized but is reduced if management determines that its implied fair value has been impaired. During the three months ended March 31, 2012, the Company performed an impairment analysis and concluded there were no changes in the carrying amount of goodwill necessary.

Long-lived assets:

Impairment losses are recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the net carrying amount of the assets. If such changes in circumstances are present, a loss is recognized to the extent the carrying value of the asset and amounts expected to be realized upon its eventual disposition. The Company did not have any impairment of long-lived assets during the three months ended March 31, 2012.

Equipment and software:

Equipment and software are carried at cost less accumulated depreciation and amortization. Depreciation and amortization have been provided primarily on the accelerated method over the estimated useful lives of the respective assets.

Custom Software 15 Years

Network Equipment 5 Years

7

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 2

|

– Summary of significant accounting policies (concluded):

|

Revenue recognition:

The Company’s services are provided pursuant to contracts that typically provide for payments of recurring charges on a monthly basis for use of the services over a committed term. Each service contract has a fixed monthly cost and a fixed term. At the end of the initial term of most service contracts, the contracts roll forward on a month-to-month or other periodic basis and continue to bill at the same fixed recurring rate. If any cancellation or termination charges become due from the customer as a result of early cancellation or termination of a service contract, those amounts are calculated pursuant to a formula specified in each contract. Recurring costs relating to supply contracts are recognized ratably over the term of the contract.

Based on the nature of the Company’s billing arrangements, the Company records deferred and unbilled revenue as described below.

Deferred revenue:

The Company bills its customers for committed amounts of bandwidth services to be used during the subsequent month. Since this billing is for a subsequent period the amount is classified as deferred revenue. The actual amount of service used during any given month cannot be fully determined until the end of the month serviced.

Unbilled revenue:

The Company bills its customers for any excess service in the month subsequent to the month of service. This unbilled revenue is included in accounts receivable.

Income taxes:

The Company, with the consent of its stockholders, has elected to be treated as an "S" Corporation under the applicable sections of the Internal Revenue Code and various state and local regulations. Under these sections, corporate income or loss, in general, is taxable to the stockholders in proportion to their respective interests. In those states and localities where "S" status is not recognized, the Company will continue to be liable for those taxes.

The Company has not identified any uncertain income tax positions that would require recognition at March 31, 2012. The Company’s U.S. Federal and state income tax returns prior to fiscal years 2009 respectively, are closed and management continually evaluates expiring statutes of limitations, audits, proposed settlements, changes in tax law and new authoritative rulings. At March 31, 2012, the Company did not have any interest and penalties associated with tax matters. The Company’s policy is to recognize any interest and penalties as part of the income tax provision.

|

|

Subsequent events:

|

The Company has evaluated subsequent events through July 16, 2012, the date the financial statements were available to be issued. See Note 8.

8

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 3

|

– Related party transactions:

|

The stockholders of the Company also own Servercentral. Servercentral purchased bandwidth and wave/fiber for the Company during the three months ended March 31, 2012 and 2011. The Company reimbursed Servercentral for these purchases in the amount of $904,553 and $885,009 in 2012 and 2011, respectively. These amounts are included in cost of telecommunications services sold on the statements of income.

Servercentral purchased IP and data transit and network services from the Company during 2012 and 2011. Total sales to Servercentral were $200,322 and $203,185 in 2012 and 2011, respectively.

The Company utilized equipment, owned by Servercentral to service its customers. The Company paid a fee to Servercentral in the amounts of $0 and $102,075 in 2012 and 2011, respectively for usage of the equipment, which are included in cost of telecommunications services sold on the statements of income. On June 21, 2011, Servercentral transferred ownership of this equipment to the Company in exchange for a note payable of $653,574. The note was payable in 12 monthly installments of $55,902, including interest at the rate of 5%. As of March 31, 2012, the unpaid portion of the note was $166,318. Interest of $3,450 was paid to Servercentral for the three months ended March 31, 2012 and is included in interest expense.

The Company reimbursed Servercentral for the cost of certain personnel, insurance, office supplies and rent in the amounts of $259,003 and $223,411 for 2012 and 2011, respectively. These amounts are included in selling, general and administrative expense on the statements of income.

The Company would settle amounts due with Servercentral against any amounts owed on a monthly basis. As of March 31, 2012, the balance due to Servercentral was $963,234. These amounts are included in due to related parties on the balance sheet.

On February 24, 2010, the Company entered into a $1,500,000 variable Interest loan commitment with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies, as needed. The note is scheduled to mature August 24, 2013. The balance of the note, as of March 31, 2012, is $756,286. nLayer Communications Inc.’s portion of this loan is $529,400 and Servercentral portion of the loan is of $226,886.

9

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 3

|

– Related party transactions (concluded):

|

On March 30, 2011, the Company entered into a $1,000,000 variable interest line of credit with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies as needed. The note is scheduled to mature September 23, 2014. The balance of the note, as of March 31, 2012, is $892,141. nLayer Communications Inc.’s portion of this loan is $481,756 and Servercentral portion of the loan is $410,385.

The Company is contingently liable for the two loans entered into jointly with Servercentral. The Company has included its portion of the loans ($1,011,156 at March 31, 2012) in these financial statements. The total amount outstanding on these loans was $1,648,427, as of March 31, 2012. The Company is contingently liable for the amount not included on these financial statements representing Servercentral’s portion, which was $637,271, as of March 31, 2012.

In 2007, the Company borrowed $420,000 from the stockholders to finance an acquisition of certain equipment, customer lists, and other intangibles. The loan is unsecured and bears interest at the rate of 4%, payable annually. As of March 31, 2012 and 2011, the balance outstanding was $280,000 and $420,000, respectively. No interest was paid to the shareholders for the three months ended March 31, 2012 and 2011, respectively.

Servercentral owns 49% of CacheNetworks, LLC (d/b/a CacheFly). There are no transactions between CacheNetworks and the Company.

|

Note 4

|

– Long-term debt:

|

In 2007, the Company borrowed $420,000 from the stockholders to finance an acquisition of certain equipment, customer lists, and other intangibles. The loan is unsecured and bears interest at the rate of 4%, payable annually. As of March 31, 2012, the balance outstanding is $280,000.

On February 24, 2010, the Company entered into a $1,500,000 variable interest loan commitment with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies, as needed. The note is scheduled to mature August 24, 2013. The first nine payments made in 2010 were for interest only and on November 29, 2010, the terms were changed to a fixed rate of 3.95% with 33 monthly principal and interest payments of $46,442 beginning on December 27, 2010 and ending on August 24, 2013. The balance of the note, as of March 31, 2012, is $756,286. nLayer Communications Inc.’s portion of this loan is $529,400 and Servercentral portion of the loan is of $226,886. Each company is currently making debt service payments in accordance with its pro-rata portion of the note.

10

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 4

|

– Long-term debt (concluded):

|

On March 30, 2011, the Company entered into a $1,000,000 variable interest line of credit with Chase Bank and the Small Business Administration. Servercentral is a co-borrower on the loan, and the loan proceeds were used to purchase additional equipment by both companies as needed. The note is scheduled to mature September 23, 2014. The first nine payments made in 2011 were for interest only and subsequently the loan period was extended to March 23, 2012 with 30 monthly principal and interest payments of $34,960 beginning on April 23, 2012 and ending on September 23, 2014. Interest is fixed at a rate of 3.95% per year. The balance of the note, as of March 31, 2012, is $892,141. nLayer Communications Inc.’s portion of this loan is $481,756 and Servercentral portion of the loan is $410,385. Each company will began making debt service payments in 2012 in accordance with its pro-rata portion of the note.

The Company is contingently liable for the two loans entered into jointly with Servercentral. The Company has included its portion of the loans ($1,011,156 at March 31, 2012) in these financial statements. The total amount outstanding on these loans was $1,648,427, as of March 31, 2012. The Company is contingently liable for the amount not included on these financial statements representing Servercentral’s portion, which was $637,271, as of March 31, 2012.

On June 21, 2011, nLayer Communications, Inc. purchased from Servercentral certain used network equipment valued at $653,574, in exchange for a note in the same amount, payable in 12 monthly installments of $55,902 commencing in July 2011, including interest at the rate of 5%. The unpaid principal balance at March 31, 2012 was $166,318.

Principal payment requirements due on the above obligations in each of the years subsequent to March 31, 2012 are as follows:

|

Period Ending

March 31,

|

Amount

|

|||

|

2013

|

$ | 1,056,129 | ||

|

2014

|

401,345 | |||

|

Total

|

$ | 1,457,474 | ||

11

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 5

|

– Equipment and software:

|

Major classes of equipment and software at March 31, 2012 and 2011 were as follows:

|

2012

|

2011

|

|||||||

|

Network equipment

|

$ | 4,256,544 | $ | 3,154,717 | ||||

|

Custom software

|

225,000 | 225,000 | ||||||

| 4,481,544 | 3,379,717 | |||||||

|

Less accumulated depreciation and amortization

|

1,867,912 | 943,061 | ||||||

|

Totals

|

$ | 2,613,632 | $ | 2,436,656 | ||||

Depreciation and amortization expense was $274,481 and $348,714 for 2012 and 2011, respectively.

|

Note 6

|

– Commitments and contingencies:

|

Lease commitments:

The Company is obligated under various short-term leases for datacenter space. Datacenter rent was $230,074 and $195,619 for the three months ended March 31, 2012 and 2011, respectively.

The Company leases office space from an unrelated party, for temporary office space, on a month-to-month basis. Rent expense for the three months ended March 31, 2012 and 2011 was $1,800 for both periods.

|

Note 7

|

– Concentration risks:

|

Credit risk:

The Company maintains cash and cash equivalent balances in bank deposit accounts, which are insured by the Federal Deposit Insurance Corporation. From time to time, the Company's balances may exceed these limits. At March 31, 2012, there were no uninsured bank balances.

12

nLAYER COMMUNICATIONS, INC.

NOTES TO FINANCIAL STATEMENTS

(UNAUDITED)

|

Note 8

|

– Subsequent events:

|

During April 2012, the Company received $107,859 of proceeds from its credit facility with Chase Bank and the Small Business Administration bringing the outstanding principal balance to $1,000,000.

On April 30, 2012, the Company’s stockholders entered into an agreement to sell and sold all of the equity interests in the Company to Global Telecom & Technology, Inc (“GTT”). In consideration for the equity interests in the Company, GTT paid the sellers $12,000,000 in cash paid at closing, up to $6,000,000 in deferred consideration and assumed $1,100,000 of liabilities, subject to a working capital adjustment and a reduction if the Company’s revenue is lower than specified target levels during the two-year period after the closing of the acquisition.

Immediately following the close of the sale to GTT, the Company paid off amounts due to related parties and amounts due on the notes payable in their entirety.

Subsequent events were evaluated through July 16, 2012, the date that the financial statements were available to be issued.

13