Attached files

| file | filename |

|---|---|

| 8-K - 8-K CURRENT REPORT - VICTORY OILFIELD TECH, INC. | v316375_8k.htm |

| EX-8.01A - EXHIBIT 8.01A - VICTORY OILFIELD TECH, INC. | v316375_ex801a.htm |

Victory Energy Corporation www.vyey.com 06/18/2012 1 June 18, 2012

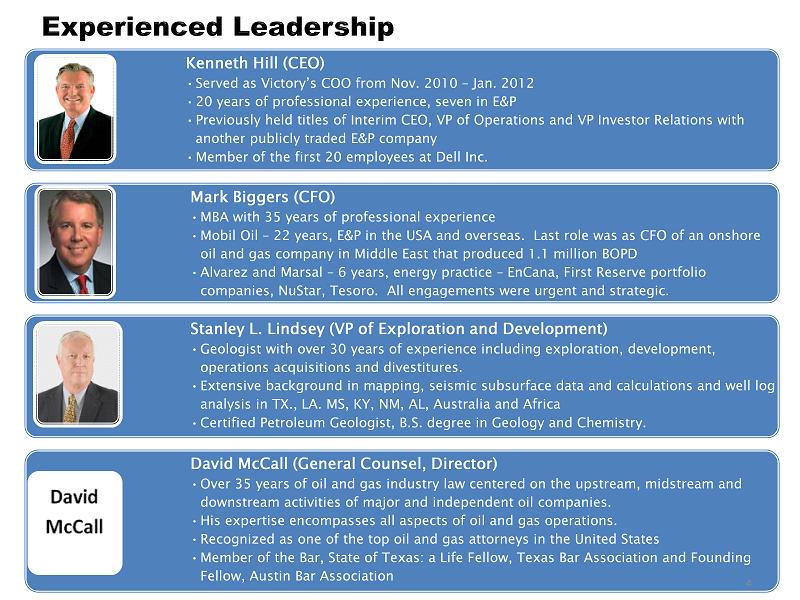

Kenneth Hill (CEO) • Served as Victory’s COO from Nov. 2010 – Jan. 2012 • 20 years of professional experience, seven in E&P • Previously held titles of Interim CEO, VP of Operations and VP Investor Relations with another publicly traded E&P company • Member of the first 20 employees at Dell Inc. Mark Biggers (CFO) • MBA with 35 years of professional experience • Mobil Oil – 22 years, E&P in the USA and overseas. Last role was as CFO of an onshore oil and gas company in Middle East that produced 1.1 million BOPD • Alvarez and Marsal – 6 years, energy practice – EnCana, First Reserve portfolio companies, NuStar, Tesoro. All engagements were urgent and strategic. Stanley L. Lindsey (VP of Exploration and Development) • Geologist with over 30 years of experience including exploration, development, operations acquisitions and divestitures. • Extensive background in mapping, seismic subsurface data and calculations and well log analysis in TX., LA. MS, KY, NM, AL, Australia and Africa • Certified Petroleum Geologist, B.S. degree in Geology and Chemistry. David McCall (General Counsel, Director) • Over 35 years of oil and gas industry law centered on the upstream, midstream and downstream activities of major and independent oil companies. • His expertise encompasses all aspects of oil and gas operations. • Recognized as one of the top oil and gas attorneys in the United States • Member of the Bar, State of Texas: a Life Fellow, Texas Bar Association and Founding Fellow, Austin Bar Association 4

Victory Energy Corporation www.vyey.com 06/18/2012 5 Price (June 16, 2012) $0.80 Fiscal Year-End: December Symbol / Exchange: VYEY / OTCQB Diluted Common Shares Outstanding: 27,510,418 Market Capitalization: 22,008,334 Average Daily Volume: 5,459 3 months ending: 3/31/2012 3/31/2011 Total Revenues $63,965 $85,786 EPS ($0.46) ($0.30) Capitalization ($mm) 3/31/2012 12/31/2011 Cash & Cash Equivalents $872,367 $475,623 Senior Convertible Debt 0 632,534 Shareholders' Equity 2,083,942 (582,519) Total Capitalization 2,083,942 50,015 Reserve Data 12/31/2011 Proved Developed Reserves (mmcf) Natural Gas (mcf) 686,020 Crude Oil (bbl) 6,750.0 PV-10 Value $1,083,520 Stock Data Financial Data (unaudited) Stock Price (Year-to-date)

Victory Energy Corporation www.vyey.com 06/18/2012 • Deploy a higher percentage of capital towards E&P development • Target longer - life, quality prospects with improved PUD opportunity • Expand strategic relationships and geographical reach • Leverage internal geological capabilities Increase Reserves • Reduce F&D costs; shift investment mix to include higher working interest projects with upside potential; focus more on oil and liquids • Reduce G&A expense; relocate our “back office” to Texas • Achieve higher annual production rates Improve Returns • Convert debt to equity (Q1) • Implement reverse stock split (concluded January 13, 2012 ) • Leverage both private equity and Aurora sources to provide additional development funds (underway) Manage Balance Sheet 6

Victory Energy Corporation www.vyey.com 06/18/2012 7

Victory Energy Corporation www.vyey.com 06/18/2012 8 $2,747 $3,593 $2,959 $2,500 $1,250 $ - $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 2012 2013 2014 2015 2016 2017 Capital (millions) Capital Requirements – Current Property Opportunity Only Estimated Capital Spend » All estimates are based on data available as of 6/18/2012 » All estimates assume additional capital is acquired by the company » Additional property / prospects will be added beyond current proprty held » Schedules may vary based on rig availability and other factors

Victory Energy Corporation www.vyey.com 06/18/2012 9 121.09 339.65 697.13 937.02 958.57 938.15 218.56 357.48 239.89 21.55 0 0 0 100 200 300 400 500 600 700 800 900 1000 2012 2013 2014 2015 2016 2017 BOE (Thousands) Reserves – Current Property Opportunity Begin Balance Net Additions » All estimates are based on data available as of 6/18/2012 » Booked reserves may differ and are dependent on individual well results and independent reserve analysis » All estimates assume additional capital is acquired by the company » Additional property / prospects will be added beyond current property held » Schedules may vary based on rig availability and other factors

Victory Energy Corporation www.vyey.com 06/18/2012 10 9.8 20.5 25.8 25.3 25.3 19.9 12.4 34.7 41.4 39.5 38.3 30.5 0 10 20 30 40 50 60 70 2012 2013 2014 2015 2016 2017 BOE (Thousands) Annual Production – Current Property Opportunity Gas Oil » All estimates are based on data available as of 6/18/2012 » Booked reserves may differ and are dependent on individual well results and independent reserve analysis » All estimates assume additional capital is acquired by the company » Additional property / prospects will be added beyond current property held » Schedules may vary based on rig availability and other factors

Victory Energy Corporation www.vyey.com 06/18/2012 • Manage and grow current prospects where VYEY holds a 1% to 10 % WI • Bootleg Canyon offers additional drilling on its 4,944 held acres with typical per well reserves exceeding 250,000 Barrels of Oil Equivalent (BOE). (includes behind pipe estimates) • Pinetop offers potential for nine new wells with EUR average of 426,741 BOE • Adams - Baggett offers shale recompletion opportunities • Chapman Ranch offers two wells, each with 224,166 recoverable BOE. Run the Business Optimize Development of Existing Smaller WI Properties • Begin 320 acre, sixteen well Lightnin’ project, with focus on 115,140 and 228,000 EUR BOE analogous well completions in the area. 25% WI. • Complete internally generated 3D seismic controlled prospects that offer 100% WI, estimated ultimate recovery potential above 75,000 BOE. First well (SRV) was announced June 5 th has EUR of 75,397. VYEY holds a 50% WI. • Conclude property acquisition of new prospect that offers 100% WI, 3D seismic control, up to 1,000 acres (15 wells), with mid - case EUR of 110,000 BOE per well. • Secure financing for continuous drilling program on these prospects Add to the Business Acquire 25% to 100% Working Interest Oil Holdings • Secure financing and development partners for the acquisition of multiple oil shale prospect targets that are already identified. • Focus on Wolfcamp and Cline oil shale opportunities. Both vertical and horizontal. • $5M - $45M of private equity to be sourced • 25% to 100% WI available • 200,000 – 500,000 EUR BOE per well Game Changer Acquire Resource Play Acreage Ahead of Cost Curve 11 1 2 3

Victory Energy Corporation www.vyey.com 06/18/2012 13 2012 AQUISTION AND DEVELOPMENT HIGHLIGHTS TO DATE

Victory Energy Corporation www.vyey.com 06/18/2012 15 LIGHTNIN’ PROSPECT Per Well EUR Range 115,140 – 228,000 BOE

Victory Energy Corporation www.vyey.com 06/18/2012 16 Per Well Assumptions Well cost to the 100% $1.55M VYEY working interest 5% Net Revenue interest 3.75% Well Costs to working interest $78,000 Description Acquired April 2012 (320 acres) Located in Nueces County, TX Conventional drilling play (vertical) Two wells planned First well spud on June 8th 3D with strong well control Frio Sands (8,200’) Operator is Mohican Operating (Corpus Christi, TX) Production Model Anticipated 30 - day IP Rate • Oil (BO/PD) 245 • Gas ( Mcf /PD) 185 Spud to sales (Days) 90 Mean EUR (BOE) per well 224,166 Mean EUR (BOE) two wells 448,332

Victory Energy Corporation www.vyey.com 06/18/2012 18 Description Acquired June 2012 (355 acres) Located in Colorado County, TX. Internally generated by Victory Re - entry of previously producing well in the Star - Lite Field 3D seismic controlled Target formation Wilcox A3 (9,545’) Total Depth 9,700’ Estimated first spud date in Q4 Operator is CAGO Inc. (College Station, TX) Production Models Anticipated 30 - day IP Rate • Oil (BO/PD) 30 • Gas ( Mcf /PD) 400 Spud to sales (days) 90 Mean EUR (BOE) per well 75,397 Per Well Assumptions Well cost to 100% $350,000 VYEY working interest 50% VYEY net revenue interest 40% Well costs to WI $175,000

Victory Energy Corporation www.vyey.com 06/18/2012 20 2011 AQUISTION AND DEVELOPMENT HIGHLIGHTS

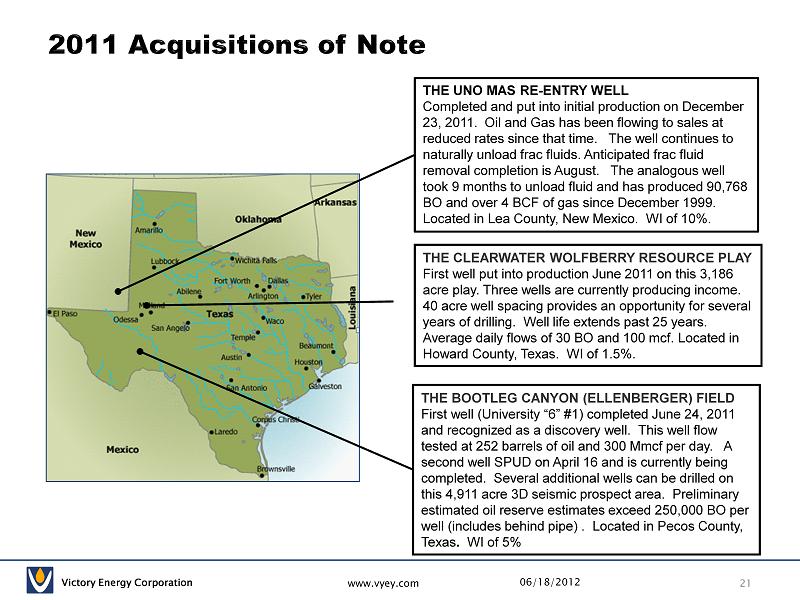

Victory Energy Corporation www.vyey.com 06/18/2012 21 THE UNO MAS RE - ENTRY WELL Completed and put into initial production on December 23, 2011. Oil and Gas has been flowing to sales at reduced rates since that time. The well continues to naturally unload frac fluids . Anticipated frac fluid removal completion is August. The analogous well took 9 months to unload fluid and has produced 90,768 BO and over 4 BCF of gas since December 1999. Located in Lea County, New Mexico. WI of 10%. THE BOOTLEG CANYON (ELLENBERGER) FIELD First well (University “6” #1) completed June 24, 2011 and recognized as a discovery well. This well flow tested at 252 barrels of oil and 300 Mmcf per day. A second well SPUD on April 16 and is currently being completed. Several additional wells can be drilled on this 4,911 acre 3D seismic prospect area. Preliminary estimated oil reserve estimates exceed 250,000 BO per well (includes behind pipe) . Located in Pecos County, Texas . WI of 5% THE CLEARWATER WOLFBERRY RESOURCE PLAY First well put into production June 2011 on this 3,186 acre play. Three wells are currently producing income. 40 acre well spacing provides an opportunity for several years of drilling. Well life extends past 25 years. Average daily flows of 30 BO and 100 mcf. Located in Howard County, Texas. WI of 1.5%.

Victory Energy Corporation www.vyey.com 06/18/2012 22 STRATEGY ELEMENT 3 – ACQUIRE RESOURCE PLAY DEVELOPMENT ACREAGE AHEAD OF THE COST CURVE

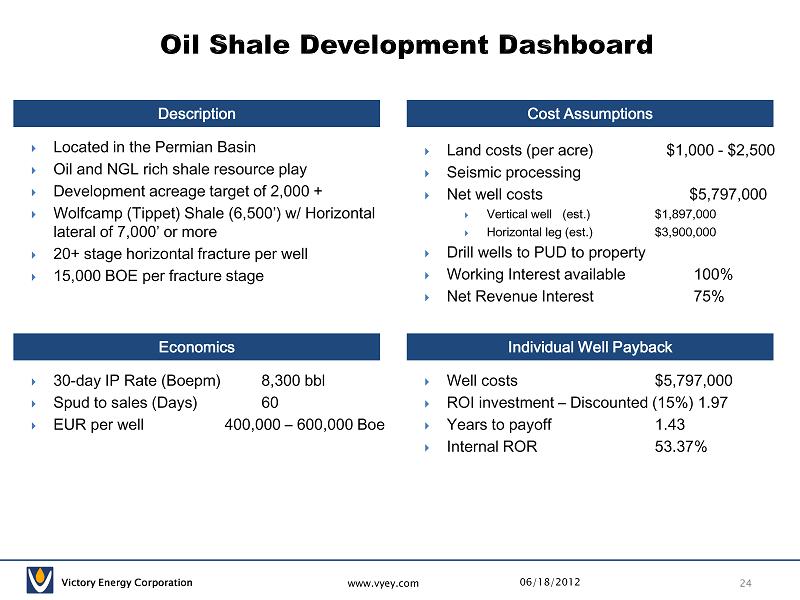

Victory Energy Corporation www.vyey.com 06/18/2012 23 As the Number of Wells Drilled Increased 1. The learning curve has been established by others 2. Completion techniques for optimal EUR have been established and can be replicated 3. Lower cost acreage positions remain 4. Geoscience and other technical data provide solid guidance for analogous well log analysis and soil testing.

Victory Energy Corporation www.vyey.com 06/18/2012 25 COMPANY STRUCTURE

Victory Energy Corporation www.vyey.com 06/18/2012 The Aurora partnership provides an ongoing capital structure for a 5 year relationship that is fiscally designed to accelerate Victory Energy into a “phase 3” type of capital opportunity and a move from the OTC to a superior capital market. Victory Energy Corporation’s legacy oil & gas interests are held by the Aurora Energy Partnership during the 5 year term of the partnership agreement. Partners in Aurora are Victory Energy Corporation and The Navitus Energy Group. (50% each) The agreement with Aurora provides Victory a direct line to an established capital source of up to $15 million and can be used by Victory for any purpose . Victory has the right to acquire additional capital from sources outside of this agreement. Victory is the Managing Partner and thus can continue to report Aurora’s consolidated results in accordance with accounting rules 26

Victory Energy Corporation www.vyey.com 06/18/2012 Access to exploration project deal flow is very strong Management team has technical and financial expertise, as well as significant industry experience Stronger balance sheet – look for improved liquidity » Reverse stock split completed in early January » Capital raise of $1.87m in late January » Debt conversion to $0 completed in February » Access to additional bridge capital from Aurora Energy Partners (up to $15M) » Strong private equity investment candidate Development prioritization – portfolio mix will shift toward more oil and liquids and a higher working interest participation; Victory will make more “strategic” investments that have longer term potential. Our opportunity pipeline has never been stronger. Result – lower F&D costs; higher volumes, incremental revenue and higher EBITDA; longer life assets 27

Victory Energy Corporation www.vyey.com 06/18/2012 Contact Information 28 Kenny Hill (CEO) Khill@vyey.com Ph. 512 - 347 - 7300 Cell 512 - 423 - 2547 Fax 866 - 234 - 9806 Mark W Biggers (CFO) Mbiggers@vyey.com Ph. 512 - 347 - 7300 Cell 210 - 630 - 1296 Fax 866 - 234 - 9806 Texas Office 3355 Bee Caves Road Suite 608 Austin, Texas 78746