Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ALION SCIENCE & TECHNOLOGY CORP | d369291d8k.htm |

Exhibit 10.44

| INVESTOR PRESENTATION June 19, 2012 CONFIDENTIAL |

| Forward Looking Statements: This presentation also contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that involve known and unknown risks and uncertainties. These statements are based on management's views and assumptions and relate to the Company's future plans, objectives, expectations and intentions and are for illustrative purposes only. These statements may be identified by the use of words such as "believe," "expect," "intend," "plan," "anticipate," "likely," "will," "pro forma," "forecast," "projections," "could," "estimate," "may," "potential," "should," "would," and similar expressions. Any statement herein other than a statement of historical fact or opinion is a forward looking statement. Actual results may differ materially from the Company's expectations. Factors that could cause actual results to differ materially from those anticipated include but are not limited to factors discussed in the Company's annual report on Form 10-K and subsequent quarterly reports on Form 10-Q filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management's views. The Company undertakes no obligation to update any of the forward-looking statements made herein, whether as a result of new information, future events, changes in expectations or otherwise. This discussion addresses only continuing operations as of the date hereof. Disclaimer |

| Business Overview Contract Backlog Industry Update Financial Summary Summary Table of Contents |

| BUSINESS OVERVIEW |

| Dr. Bahman Atefi Chairman and Chief Executive Officer Over 30 years experience in management of research and development government services organizations Leadership and vision resulting in founding of Alion as a 100% employee-owned company Led 13 successful acquisitions by IITRI and Alion Internationally recognized for development of real-time risk management tools for the nuclear power industry B.S. in Electrical Engineering from Cornell and a Doctor of Science degree in Nuclear Engineering from MIT Stacy Mendler Chief Operating Officer and Executive Vice President Barry Broadus Chief Financial Officer (Acting) Presenters Over 25 years in senior management positions in government technology solutions companies Expertise in corporate operations, government contracting and acquisitions Successful integration of 13 acquisitions by IITRI and Alion Specializes in strategic development, contracts management, human resources, IT, marketing and communications B.B.A in Marketing from James Madison University and M.S. in Contracts and Acquisition Management from Florida Institute of Technology Over 25 years experience in corporate financial management Expertise in financial management, budgeting and planning, government contracting, complex deal structures, financial modeling and pricing 12 years at EDS - key assignment was Controller, Military Systems Business Unit 4 years at SAIC - last assignment was Vice President and Business Unit Controller responsible for a $600 million energy, environment and infrastructure business unit B.S. in Accounting from University of Alabama; CPA, Commonwealth of Virginia |

| Company Overview Alion is a premier provider of technology solutions and operational support to the Federal Government for national defense, intelligence, homeland security and other mission critical government areas Building upon 75 years of history, Alion has a revenue CAGR of 2.9% over the past 5 years Services the "sweet spot" of large and growing areas of government budgets Stable and predictable revenue and cash flow Significant $5.86 billion backlog Low risk contract mix Long-term relationships with diverse customer base (over 850 active contracts) 100% ESOP-owned, C-Corporation, no federal taxes for the foreseeable future LTM 3/31/12 revenue of $771.0 million and Consolidated EBITDA of $65.6 million |

| Business Update Continue to see sizeable base-load opportunities Processing substantial number of tasks through single source IAC contracts and extension of WSTIAC will allow Alion to continue growing Won recompete of TEAMSUB, $542 million, 5 year contract in support of the U.S. Navy Strong push to expand margins through higher T&M and FFP work and international business: Won two FFP contracts for thermal-hydraulics and structural analysis to help Korean Hydro and Nuclear Power meet nuclear safety requirements Pursuing FFP contract to design an Offshore Patrol Vessel (OPV) for a shipyard in India Discussions with SEASPAN in Canada continue about initial tasks Multiple Naval Architecture and Marine Engineering bids in India and one major bid in Israel Focus on liquidity and DSO |

| Vision and Strategy Acquire new technologies that complement core competencies Attract highly skilled employees and continue enhancement of training initiatives Invest in internal R&D to complement customer-funded R&D Operate world-renowned research facilities and laboratories Broaden Existing Core Competencies Leverage Experience and Reputation to Expand Market Share Strong Financial Performance and Increase Scale Expand existing capabilities to new customers Increase market share and achieve higher growth than government technology solutions market Exploit current ID / IQ contract vehicles to maximize ceiling values Continue growth in business and operating efficiency Positioned to win business through competitive cost structure Increase scale through organic growth and strategic acquisitions Significant scale benefits, including ability to bid on larger contract awards Margin expansion through higher percentage of time and materials and fixed price contracts and international naval architecture and marine engineering work |

| Alion Core Business Areas Naval Architecture & Marine Engineering Defense Operations Modeling & Simulation Technology Design, Engineering, Integration and Assessment Ship and system design and engineering Mission needs and Analysis of Alternatives Program and acquisition management Production management and life cycle support Military Transformation and Operational Support Enterprise Management and Decision Support Net-centric Operations and C4ISR Acquisition Strategy and Policy, Budget Analysis and Program Execution Training, Experimentation, Wargaming and Analysis Live/Virtual/Constructive Multi- dimensional Simulation Development Human Performance Improvement Serious Games Development IT Architecture and Integration Wireless Spectrum Management Rapid Prototyping Nuclear Power Plant Design, Engineering and Safety Analysis Urban nuclear detection systems Services Key Customers Revenues U.S. Navy U.S. Coast Guard International navies Commercial marine clients Oil exploration companies Office of Naval Research Office of Secretary of Defense U.S. Air Force U.S. Air Forces Central Command U.S. Marine Corps PEO STRI Army Research Lab Department of Homeland Security Naval Warfare Development Command Naval Air Warfare Center (NAWC) U.S. Air Forces Europe U.S. Special Operations Command Air Force Research Lab Department of Labor Defense Threat Reduction Agency Domestic & International Nuclear Utilities DISA U.S. Army 2011 Revenue: $335.3 million 2011 Revenue: $192.5 million 2011 Revenue: $141.2 million 2011 Revenue: $118.3 million |

| Large Long-Term Customers & Programs LPD-17 PROGRAM MANAGEMENT SUPPORT Support construction of the LPD-17 class amphibious warship including engineering studies, and test and evaluation during acceptance trials at sea SEAPORT-E SHIP DESIGN SERVICES (SEA 05D) Engineering and detailed design, analysis of alternatives and support from concept studies throughout various phases of ship design DDG-51 ACQUISITION SUPPORT Support the construction of the DDG-51 combatant, its redesign for ballistic missile defense, and integration into the fleet including design and engineering studies, and test and evaluation during acceptance trials at sea SHIPS F PROGRAM MANAGEMENT Support NAVSEA's program office that provides for maintenance of the Navy fleet in-service including scheduled maintenance availability planning, emergency maintenance planning, engineering studies, training and test and evaluation |

| Large Long-Term Customers & Programs INTEGRATED WARFARE SHIPS (IWS) 3.0 Test and evaluation, acquisition, and life- cycle management support for all Navy surface ship missiles, missile launchers and gun systems for both new construction (DDG-51, LPD-17, LCS, CVN) and the fleet in-service PROGRAM MANAGEMENT SUPPORT (PMS) 377 Support construction of all classes of amphibious ships including engineering studies, and test and evaluation during acceptance trials at sea PROFESSIONAL SUPPORT SERVICES (PSS) Project management, financial management, foreign military sales services, acquisition management and configuration management for combat systems |

| SECRETARY OF THE AIR FORCE TECHNICAL AND ANALYTICAL SUPPORT (SAFTAS) Technical and programmatic support to Assistant Secretary of the Air Force for Acquisition Under Secretary for Space Acquisition Joint Strike Fighter Program Office Large Long-Term Customers & Programs OFFICE OF THE SECRETARY OF DEFENSE Defense Technical Information Center (DTIC) Research, development, engineering and technical assistance to Modeling and Simulation Information Analysis Center (IAC) Weapons Systems Technology IAC Advanced Materials and Manufacturing Technologies IAC Systems, Networks, Information Technology and Modeling and Simulation Multiple Award Contract (SNIM) |

| New Growth Opportunities Program Test and Evaluation Department of Homeland Security (DHS) International Cyber Security Special Forces Command (SOCOM) Intelligence, Surveillance and Reconnaissance |

| CONTRACT BACKLOG |

| Funded, Unfunded and Ceiling Backlog Backlog represents an estimate, as of a specific date, of the remaining future revenue anticipated from existing contracts Funded backlog is the value of contracts awarded whose funding has been authorized by the customer, less revenue previously recognized under the same contracts Unfunded backlog is the estimated value of additional funding not yet authorized by customers on existing contracts Ceiling backlog is the value reasonably available on the IDIQ contracts for future tasking Total backlog is over 7.5x revenue and provides significant visibility into future revenue streams FY 2012 Q2 backlog strong at $369 million funded, $1.95 billion unfunded and $3.53 billion ceiling value to total $5.86 billion FY 2011 overall win rate of 59%; win rate on recompetes is 84% ($ in millions) (1) Identified for remainder of FY2013- FY2015. (2) As of Q2 FY2012. Tracking & Pursuing(1): $14.3 billion Submitted(2): $2.5 billion In process(2): $485 mm Large Contract Backlog and Strong Revenue Visibility Pipeline of Opportunities |

| Recent Wins > $75 Million |

| INDUSTRY UPDATE |

| Cost reduction initiatives to achieve $480 billion over 10 years Reduce the size of the Army from 570,000 troops to 520,000 troops or less Reduce Marine Corps from 209,000 troops to 186,000 troops Reduction in personnel costs, pay, healthcare and other benefits Reduction in nuclear arsenals from 5,000 to 1,500 Areas emphasized for further investments include Special Operations Forces, UAVs and cyber security ($ in billions) Source: DoD, Credit Suisse estimates We are here Korea Vietnam Reagan buildup Iraq/ Afghanistan U.S. budget backdrop will remain the key driver until the inevitable adverse geopolitical event forces a re-assessment. November elections may trigger a temporary move, up or down ($ in billions, unless otherwise stated) Source: DoD, Company data, Credit Suisse estimates Korea Vietnam Reagan buildup GW Bush WWII Defense Budget Outlook U.S. defense spending history and spending as % of US GDP Long-term U.S. defense budget (base + OCO) - constant FY2011 $ Projections for future years ($ in billions) |

| Defense Outlook Creates Opportunities for Alion Government Priorities President's January 2012 military priorities emphasize presence in Western Pacific and Southwest Asia Four Aegis platforms home ported to allow remaining ballistic missile cruisers and destroyers to deploy to Western Pacific Worn out, damaged and destroyed equipment from Iraq and Afghanistan to be replaced Increased use of modeling and simulation throughout a system's life cycle NSA, DoD and DHS increasing focus on cyber threats Special Forces Command (SOCOM) is getting additional troops and funding Opportunities Army and Marine Corps funding major reset of equipment Sea based missile defense will continue to expand Strong support to SOCOM in production of mobile technology and repair complex (MTRCs) and rapid equipment manufacturing Modeling and simulation and serious games are basis for future training Cyber security will remain as a threat Navy shipbuilding to continue as planned (300 ship platform) |

| Sequestration: January 2, 2013 Budget Control Act of Aug 2011 (BCA) Congress must approve deficit reduction or face sequestration starting January 2nd, 2013 Sequestration: $1.2 trillion ($109 billion / 9 years) from the budget for 2013- 2021 Cuts shared between: DoD & Non-defense discretionary budget authority Approximately $55 billion from each of above from 2013 to 2021 This is 10 % annual DoD cut and 7.8% non-defense (on top of caps in the BCA) Exempt: SS, Federal retirement, Medicaid, Medicare limited to 2% Automatic, equally distributed cuts across accounts, not by line items Significant ambiguity: OMB implements, Agencies and Congress advised Overseas Contingency Operations (OCO)($88 billion) may be included The most likely scenario is 6-12 month extension of the law to allow more negotiations post election and lame duck session |

| FINANCIAL SUMMARY |

| Financial update Q2 Revenue provided positive growth; strong contract backlog Margins improving due to implementation of efficiencies & cost reductions Liquidity solid, steady / predictable cash inflows, managing cash outflows ($ in millions) (1) Current revolver size of $35 million. $3.7 million letters of credit outstanding. |

| SUMMARY |

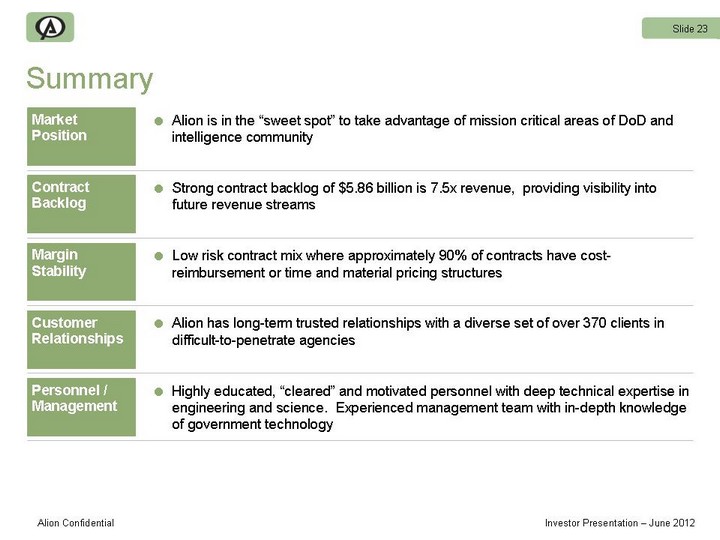

| Summary Market Position Contract Backlog Margin Stability Customer Relationships Personnel / Management Alion is in the "sweet spot" to take advantage of mission critical areas of DoD and intelligence community Strong contract backlog of $5.86 billion is 7.5x revenue, providing visibility into future revenue streams Low risk contract mix where approximately 90% of contracts have cost- reimbursement or time and material pricing structures Alion has long-term trusted relationships with a diverse set of over 370 clients in difficult-to-penetrate agencies Highly educated, "cleared" and motivated personnel with deep technical expertise in engineering and science. Experienced management team with in-depth knowledge of government technology |