Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Matson, Inc. | form8kabh.htm |

1

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: A Premier Hawaii Real Estate & Land Company

June 18-22, 2012

2

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Statements in this presentation that set forth

expectations or predictions are based on

facts and situations that are known to us as

of June 18, 2012.

expectations or predictions are based on

facts and situations that are known to us as

of June 18, 2012.

Actual results may differ materially, due to

risks and uncertainties, such as those

described on pages 20-39 of A & B II, Inc.’s

Form 10 and our other subsequent filings

with the SEC. Statements in this

presentation are not guarantees of future

performance. We do not undertake any

obligation to update our forward-looking

statements.

risks and uncertainties, such as those

described on pages 20-39 of A & B II, Inc.’s

Form 10 and our other subsequent filings

with the SEC. Statements in this

presentation are not guarantees of future

performance. We do not undertake any

obligation to update our forward-looking

statements.

Forward-Looking Statements

3

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Alexander & Baldwin Overview and Evolution

§ Agribusiness (Hawaiian Commercial & Sugar Co.)

– 12 acres on Maui eventually led to 3 sugar plantations, 130,000 acres

– Foundation for our real estate & shipping businesses

– Today: State’s largest farmer, only remaining sugar plantation

§ Real Estate (A&B Properties)

– Development of master-planned community on Maui for sugar workers

– Entitlement & development of other non-sugar lands

– Land sales led to 1031 acquisition of Mainland commercial properties

– Today: State’s most active real estate investor

§ Shipping (Matson)

– Transportation of raw sugar to West Coast refinery

– A wholly owned subsidiary in 1969

– Today: Primary carrier to Hawaii & Guam, weekly service to China & nationwide

provider of logistics services

provider of logistics services

4

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

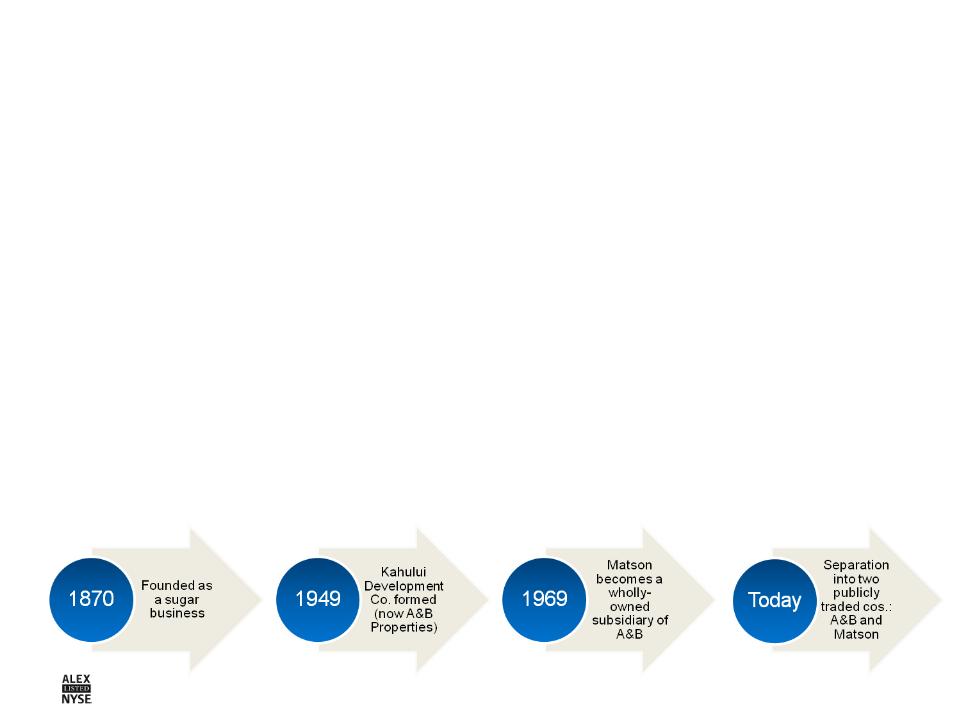

Key Milestones

Completed

Completed

Separation Approved on June 8, 2012

§ Received IRS letter ruling on tax-free nature of spin off

§ Form 10 declared effective by the SEC

§ Post-separation financing in place

§ Merger and reorganization completed

Important

Dates

Dates

§ Record: Monday, June 18, 2012, 5:00PM EDT

§ Distribution: Friday, June 29, 2012, 4:00PM EDT

§ First day of “regular way” trading for A&B (NYSE: ALEX)

and Matson (NYSE: MATX): Monday, July 2, 2012

and Matson (NYSE: MATX): Monday, July 2, 2012

Three-Way

Trading

Information

Trading

Information

§ June 14 through the distribution date

§ A&B Holdings, Inc. stock trading “regular way” until the

distribution date under the symbol “ALEX”

distribution date under the symbol “ALEX”

§ Matson ex-distribution trading under the symbol “MATX WI”

§ New A&B stock when issued trading under the symbol

“ALEX WI”

“ALEX WI”

5

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Unique assets

& competitive

strengths

& competitive

strengths

The “New A&B”

Tangible

§ 88,000 acres primarily on Maui and Kauai

§ 7.9 million square feet of high-quality commercial properties in

Hawaii & Mainland

Hawaii & Mainland

§ Robust Hawaii development pipeline (fully entitled) of over

3,500 residential and commercial units

3,500 residential and commercial units

§ 36,000-acre sugar plantation - a future energy business

§ Strong balance sheet & ample debt capacity

Intangible

§ A staff with deep experience, network & understanding of Hawaii

§ Reputation for integrity, performance & commitment to the community

§ Disciplined underwriting & investment

Track record of success

Attractive “Hawaii Play”: well positioned to capitalize on Hawaii upside

A PREMIER HAWAII REAL ESTATE & LAND COMPANY

6

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

How Our Land Businesses Fit Together

7

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Real Estate Development & Investment Strategy

§ Focus on entitlement and

development of core

Hawaii lands

development of core

Hawaii lands

§ Invest in high-returning real

estate opportunities in Hawaii

estate opportunities in Hawaii

– Diversify to new markets and

asset classes

asset classes

– Leverage market knowledge

and expertise

and expertise

§ Scale and stage development

portfolio to market opportunity

portfolio to market opportunity

– Ready inventory to meet

market demand

market demand

§ Utilize strategic joint ventures

8

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Leasing Strategy

§ Active portfolio management

– Maximize cash flow to support

development activities

development activities

– Optimize asset values

§ Reinvest land and commercial

property sales proceeds, on a

tax-advantaged basis, into

commercial property

investments having favorable

growth prospects

property sales proceeds, on a

tax-advantaged basis, into

commercial property

investments having favorable

growth prospects

§ Opportunistic migration of

portfolio to Hawaii over time

portfolio to Hawaii over time

9

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Land Stewardship Strategy

§ Employ lands at highest

and best use

and best use

§ Identify and pursue

entitlements, developments and

transactions that enhance the

value of raw landholdings

entitlements, developments and

transactions that enhance the

value of raw landholdings

§ Optimize cash flow to cover the

cost of maintaining land and

infrastructure

cost of maintaining land and

infrastructure

§ Target renewable energy

growth for strategically

located land parcels

growth for strategically

located land parcels

10

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: Investment Thesis

§ Unique assets & competitive strengths

§ Proven track record

§ Embedded growth opportunities in a

development pipeline positioned for market

recovery

development pipeline positioned for market

recovery

§ Hawaii economy at a positive inflection point

§ Healthy balance sheet & liquidity

§ Best public company vehicle for capitalizing

on Hawaii’s upside and creating long-term

shareholder value

on Hawaii’s upside and creating long-term

shareholder value

11

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

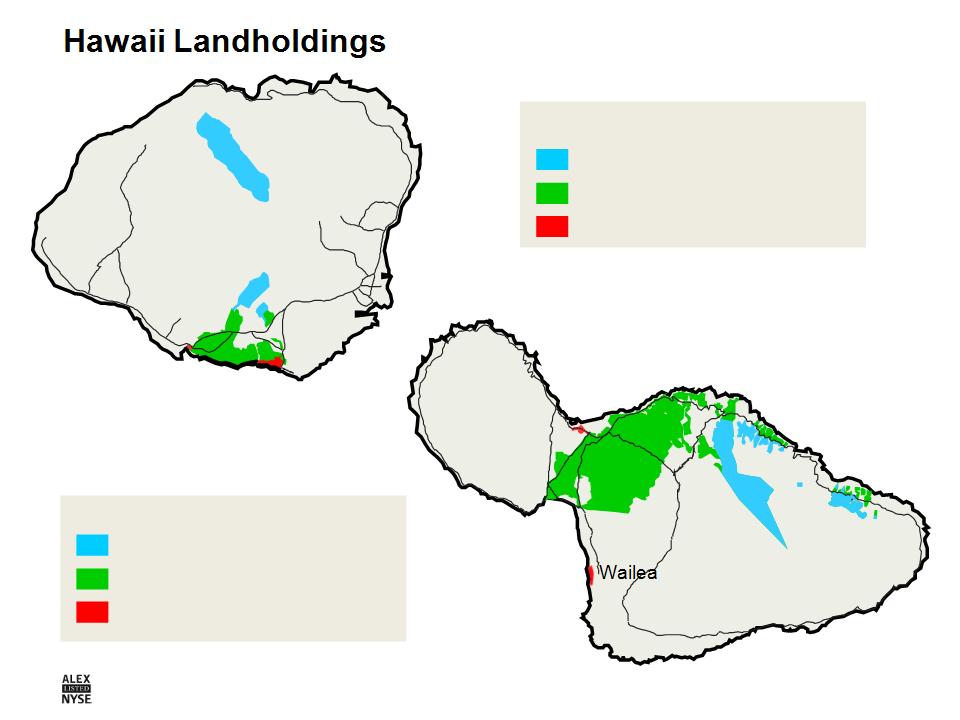

Kihei

Kahului

Conservation 15,850 acres

Agriculture 50,831 acres

Urban/Entitled 559 acres

Maui - 67,240 acres

* Includes 961 acres at Kukui’ula joint venture

Conservation 13,320 acres

Agriculture 6,944 acres

Urban/Entitled1,072 acres*

Kauai - 21,366 acres

Lihue

Poipu

Wainiha

Princeville

12

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

|

|

Product

Type

|

Planned units,

lots or sf |

Current

Status

|

2012

|

2013

|

2014 and

Beyond |

|

Kai Malu at Wailea

|

Resort Res.

|

150 units

|

|

|

|

|

|

Wailea MF-11

|

Resort Res.

|

12 lots

|

|

|

|

|

|

Wailea MF-19

|

Resort Res.

|

9 lots

|

|

|

|

|

|

Additional Wailea

|

Resort Res.

|

400-600 units

|

|

|

|

|

|

Haliimaile

|

Primary Res.

|

170 lots

|

|

|

|

|

|

Aina ‘O Kane

|

Primary Res.

|

103 units

|

|

|

|

|

|

Kahului Town Center

|

Retail/Primary Res.

|

440 units, 225,000 sf

|

|

|

|

|

|

Maui Business Park II

|

Commercial

|

131 lots on 155

salable acres |

|

|

|

|

|

Kukui’ula

|

Resort Res.

|

up to 1,500 units on

640 saleable acres |

|

|

|

|

|

Brydeswood

|

Primary Res.

|

24 lots

|

|

|

|

|

|

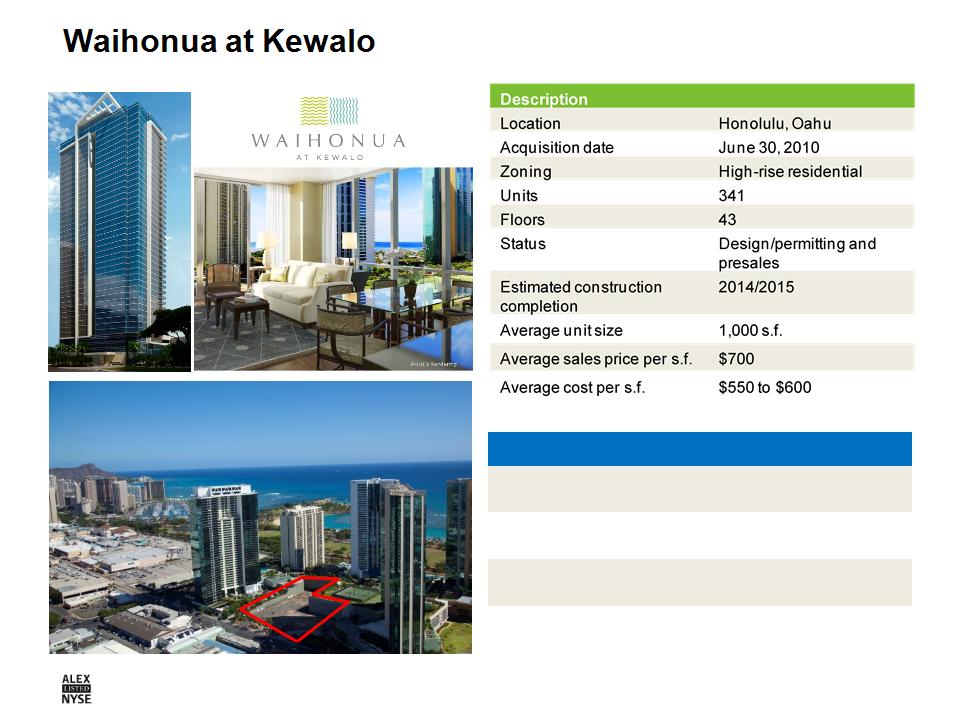

Waihonua

|

Primary Res.

|

341 units

|

|

|

|

|

|

Gateway at Mililani Mauka

|

Retail

|

28,400 sf

|

|

|

|

|

|

Gateway South

|

Office

|

20,000 sf

|

|

|

|

|

|

Ka Milo at Mauna Lani

|

Resort Res.

|

137 units

|

|

|

|

|

Robust Development Pipeline

Entitled

Constructed

Under Construction

Timing of closings

Developing for lease

13

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

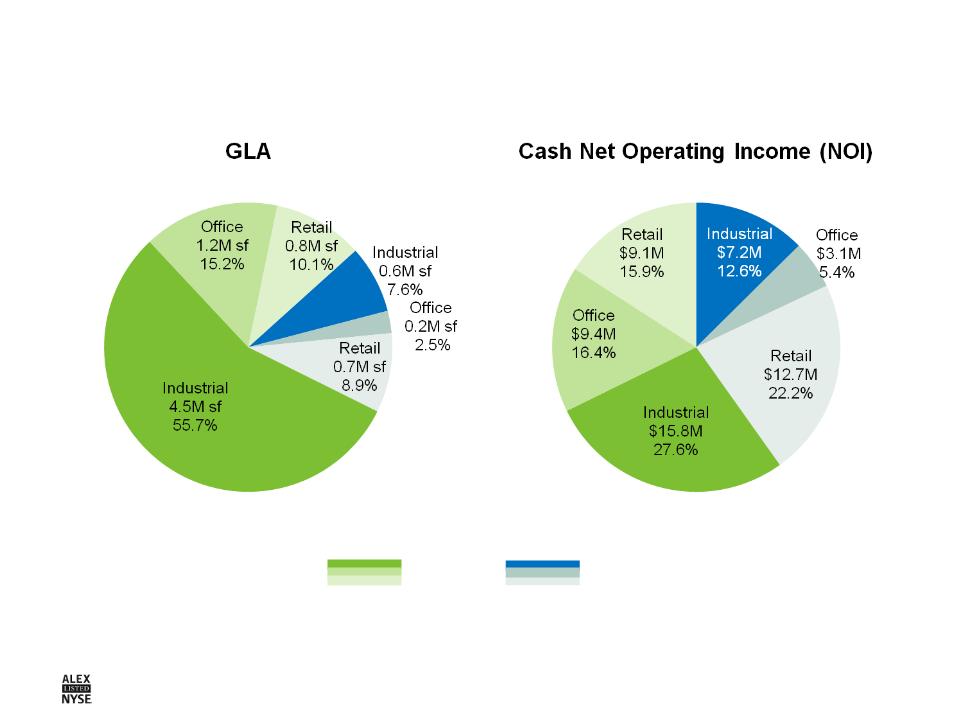

* Includes cash NOI of $3.5M from Hawaii unimproved properties and cash NOI from properties sold in 2011

Note: See appendix for statement regarding the Company's use of non-GAAP financial measures and a reconciliaton of GAAP to non-GAAP

measures.

Mainland

Hawaii

7.9M sf

$60.8M*

Diversified Commercial Portfolio

14

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

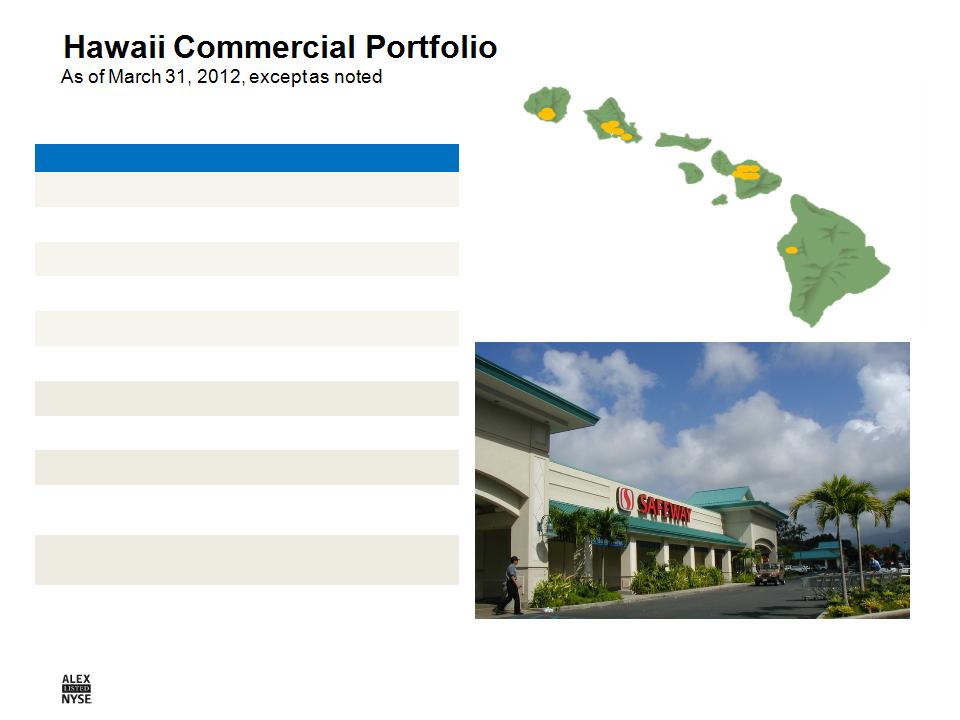

|

|

|

|

Number of properties

|

21

|

|

Square feet

|

|

|

Industrial

|

565K

|

|

Office

|

170K

|

|

Retail

|

698K

|

|

Total

|

1.4M

|

|

Occupancy

|

91%

|

|

Outstanding debt

|

-

|

|

Portfolio cash NOI (2011)1

|

$23.0M

|

|

Portfolio cash NOI to total

portfolio NOI |

40%

|

|

Cash NOI from Hawaii

ground leases |

$3.5M

|

|

Total Hawaii cash NOI

|

$26.5M

|

Note: See appendix for statement regarding the Company’s use of non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures

15

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Mainland Commercial Portfolio

As of March 31, 2012, except as noted

As of March 31, 2012, except as noted

|

|

|

|

Number of properties

|

23

|

|

Square feet

|

|

|

Industrial

|

4.5M

|

|

Office

|

1.3M

|

|

Retail

|

0.7M

|

|

Total

|

6.5M

|

|

Occupancy

|

93%

|

|

Outstanding debt

|

$28.2M

|

|

Cash NOI (2011)

|

$34.3M

|

|

Cash NOI to total portfolio

|

60%

|

Note: See appendix for statement regarding the Company’s use of non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures

16

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Market Knowledge & Expertise

§ Real estate team with extremely deep and broad acquisition,

development and asset management expertise

development and asset management expertise

§ Competitive advantages when competing with both smaller, local

investors and large Mainland institutional investors for Hawaii deals

investors and large Mainland institutional investors for Hawaii deals

– Local knowledge and expertise that out-of-state investors can’t match

– Financial capacity, expertise and liquidity advantage over

most local investors

most local investors

§ Investment “sweet spot” from $10 million to $50 million, but

look at everything from $2 million to $200 million

look at everything from $2 million to $200 million

|

Colliers Hawaii Year-End 2011 Investment

Market Report |

Local Investors

|

Out-of-State

Investors |

|

Avg. Purchase Price

|

$4.4M

|

$19.2M

|

|

Total Investments

|

$409M

|

$825M

|

|

Purchase Price to Assessed Value

|

74.3%

|

122.3%

|

17

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: Investment Thesis

§ Unique assets & competitive strengths

§ Proven track record

§ Embedded growth opportunities in a

development pipeline positioned for market

recovery

development pipeline positioned for market

recovery

§ Hawaii economy at a positive inflection point

§ Healthy balance sheet & liquidity

§ Best public company vehicle for capitalizing

on Hawaii’s upside and creating long-term

shareholder value

on Hawaii’s upside and creating long-term

shareholder value

18

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

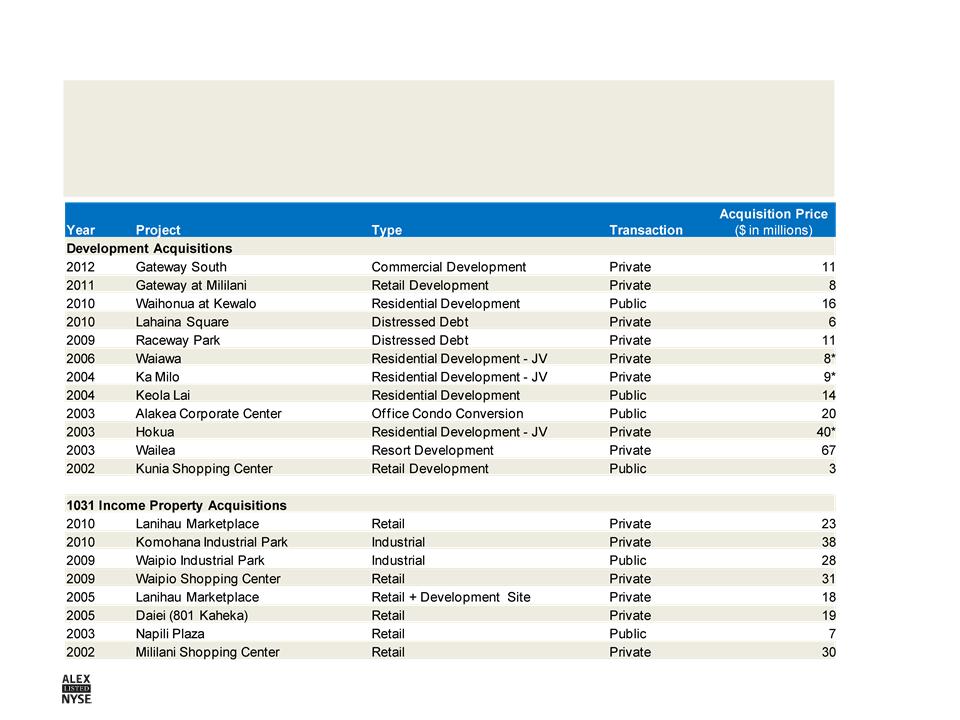

Successful Hawaii Track Record

§ Since 2000, invested $800 million in Hawaii development projects

($420 million completed)

($420 million completed)

§ Returns on completed projects averaged 22%

19

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

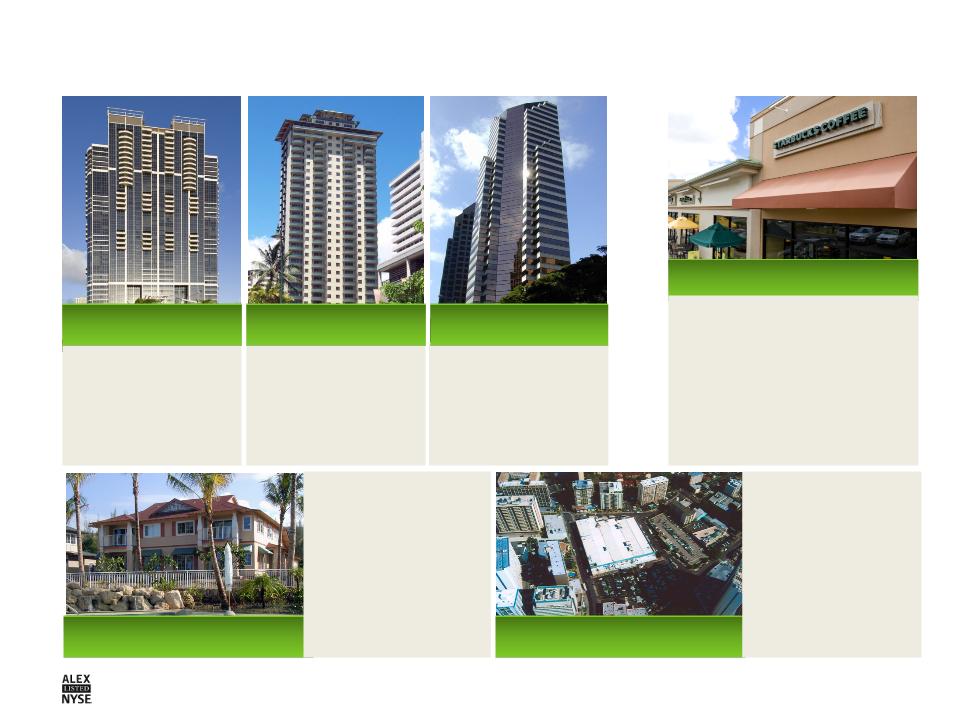

Successful Development Track Record

352-unit high-rise

residential

condominium near

downtown Honolulu.

$224M revenue

generated.

residential

condominium near

downtown Honolulu.

$224M revenue

generated.

100-unit condominium

with surrounding

ocean and mountain

views in Waikiki.

$63M revenue

generated.

with surrounding

ocean and mountain

views in Waikiki.

$63M revenue

generated.

Conversion of office

building into office

condominium. $35M

revenue generated

(including leasing).

building into office

condominium. $35M

revenue generated

(including leasing).

Keola Lai

Lanikea

Alakea Corporate

Tower

Tower

Kai Lani

Partnered with a

prominent local home

builder to develop

116-residential

condominiums in the

Ko Olina Resort. The

project sold out over

14 months, generating

$57M in revenue.

prominent local home

builder to develop

116-residential

condominiums in the

Ko Olina Resort. The

project sold out over

14 months, generating

$57M in revenue.

Daiei (Retail)

Originally acquired

4-acre site for a

potential condo

development.

Opportunistic sale at

market peak for gain

similar to the gain

expected from

development.

4-acre site for a

potential condo

development.

Opportunistic sale at

market peak for gain

similar to the gain

expected from

development.

Kunia Shopping Center

Development of 60,400 s.f.

retail space on 4.6 acres.

Designed to serve the growing

suburban area of Kunia on

Oahu. Held asset in portfolio.

Built to a 13.4% cap rate.

retail space on 4.6 acres.

Designed to serve the growing

suburban area of Kunia on

Oahu. Held asset in portfolio.

Built to a 13.4% cap rate.

20

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: Investment Thesis

§ Unique assets & competitive strengths

§ Proven track record

§ Embedded growth opportunities in a

development pipeline positioned for

market recovery

development pipeline positioned for

market recovery

§ Hawaii economy at a positive inflection point

§ Healthy balance sheet & liquidity

§ Best public company vehicle for capitalizing

on Hawaii’s upside and creating long-term

shareholder value

on Hawaii’s upside and creating long-term

shareholder value

21

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

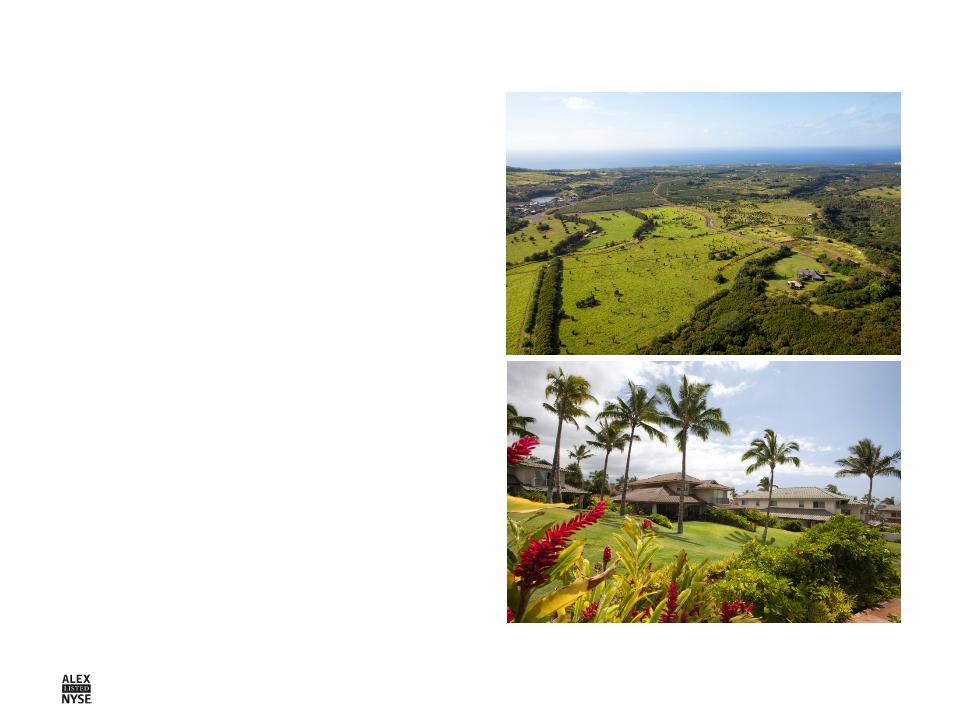

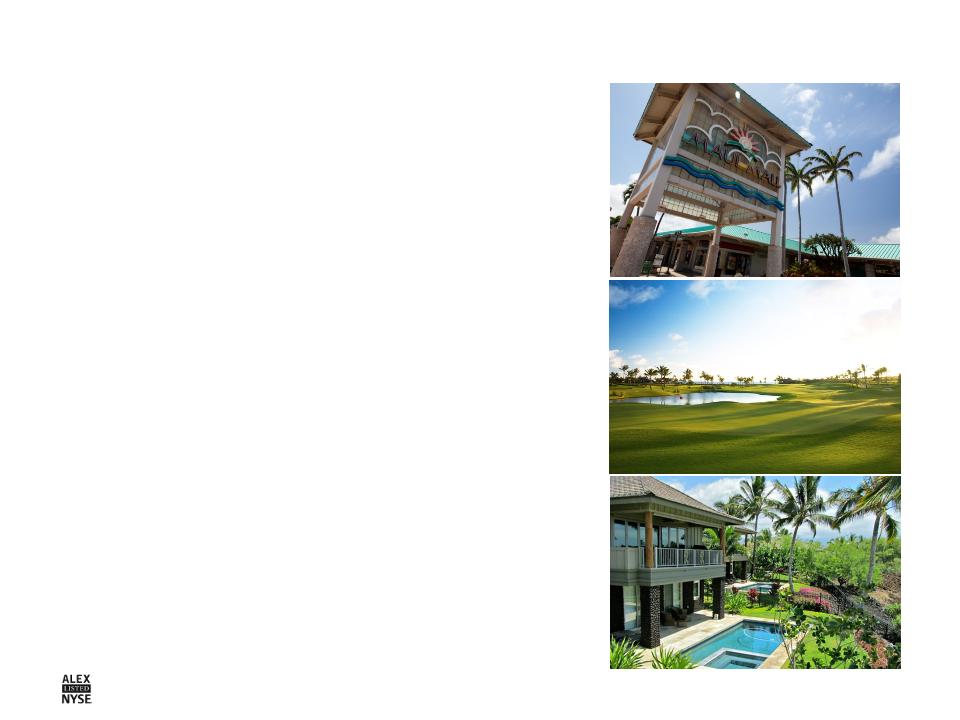

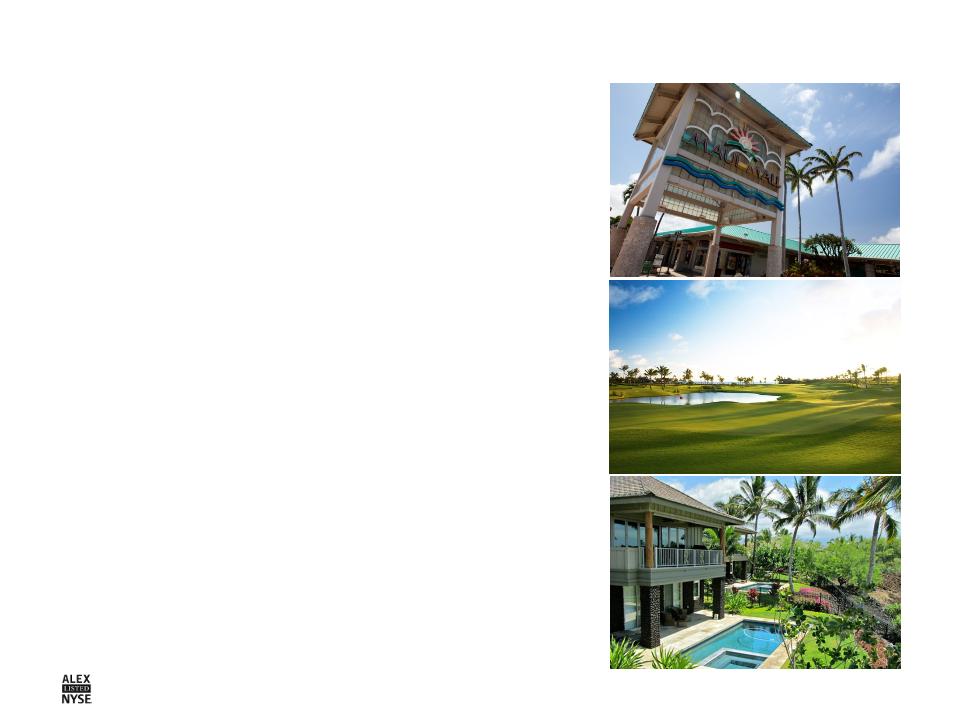

Kukui’ula

|

Overview

|

|

§ Incomparable product with limited competition

|

|

§ Offsite infrastructure complete for 450 additional lots

|

|

§ Attractive price points relative to other luxury resort

communities in Hawaii |

|

§ Positive sales momentum building:

– Increased overall sales activity

– Good market response to built product

– Increased vertical construction

– Increased 3rd party developer interest

|

|

§ Overall, 83 lots closed; 5 sold; 82 available at

June 14, 2012 |

22

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

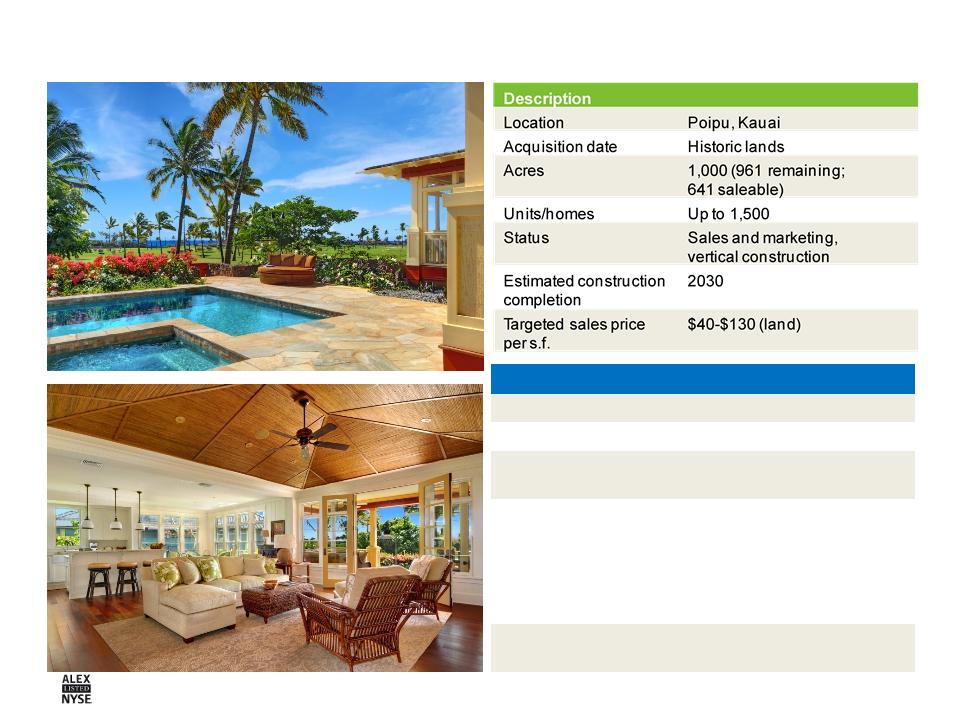

Wailea

|

Fully Entitled Acreage

|

Acres

|

|

Acquisition/Improvements

|

270

|

|

Contributed to JV/Sold

|

(103)

|

|

Remaining

|

167

|

|

Lots for sale

|

14

|

|

Under development

|

24

|

|

Future development

|

129

|

§ Original developer in the 1970s and 1980s

§ Sold in 1989, repurchased 270 acres in

2003 for $67 million

2003 for $67 million

§ Sold/developed 100 acres, recapturing

investment

investment

§ 167 remaining acres fully zoned for

residential and commercial uses with a plan

for up to 700 units

residential and commercial uses with a plan

for up to 700 units

§ 38 acres in active development

Future

development

development

Active

development/

sales

development/

sales

Sold

23

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Maui Business Park II

|

Description

|

|

|

Location

|

Kahului, Maui

|

|

Acquisition date

|

Historic lands

|

|

Zoning

|

Light industrial

|

|

Acres

|

179 (155 saleable)

|

|

Lots

|

131

|

|

Status

|

Construction and presales

|

|

Estimated

construction completion |

2019

|

|

Targeted sales price

per s.f. |

$40-$60

|

|

Overview

|

|

§ Well-located in Central Maui, near Kahului Airport,

Harbor and Maui’s primary residential district |

|

§ Adjacent to MBPI, which A&B transformed into

Maui’s primary retail destination |

|

§ Limited competition over the next 20 years

|

|

§ Offsite infrastructure work completed

|

|

§ 4-acre parcel sold to Costco in January 2012 for

$38 per square foot |

Phase I

Phase II

24

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

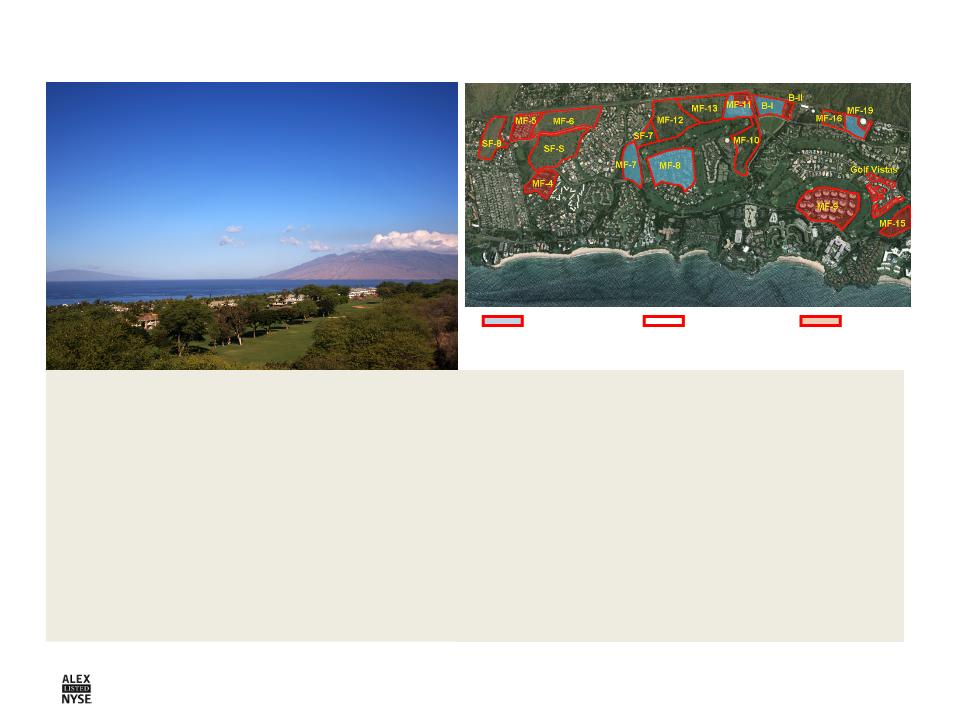

|

Overview

|

|

§ Extremely well located near shopping, restaurants

and beaches |

|

§ Successful navigation of complex permitting process

|

|

§ Limited new product during development timeframe

|

|

§ 203 binding + 17 nonbinding sales as of

June 14, 2012 ($156M in sale value) |

25

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Gateway at Mililani Mauka

|

Description

|

Gateway at Mililani

|

Gateway South

|

|

Location

|

Mililani, Oahu

|

Mililani, Oahu

|

|

Projected

Acquisition |

December 2011

|

June 2012

|

|

Stabilized

NOI |

$1.0 million

|

$1.4 M

|

|

Zoning

|

B-1 Business

|

B-1 Business

|

|

Acres

|

4.35

|

4.2

|

|

GLA

(in sq. ft.) |

28,400 (future),

5,900 (existing) |

20,000 (future),

18,700 (existing) |

|

Occupancy

|

100%

|

100%

|

|

Est.

construction start |

3Q12

|

To be determined

|

|

Est.

construction completion |

2013

|

To be determined

|

|

Funded by

|

1031 exchange funds

|

1031 exchange funds

|

|

Future

|

Office/retail

|

Office/retail

|

|

Status

|

Under construction

|

Pre-development

planning in progress |

26

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Future Kaka'ako Project

§ Long-term option to purchase

a 3.3-acre fully-zoned high-rise

condominium site in urban

Honolulu

a 3.3-acre fully-zoned high-rise

condominium site in urban

Honolulu

§ Kaka'ako site targeted for

high-rise condominium

high-rise condominium

– 468 units total, including tower

and surrounding town homes

and surrounding town homes

– Slated for pre-sales in 2013,

completion in 2016

completion in 2016

§ Thorough evaluation of

Kaka'ako market and site

underway

Kaka'ako market and site

underway

27

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

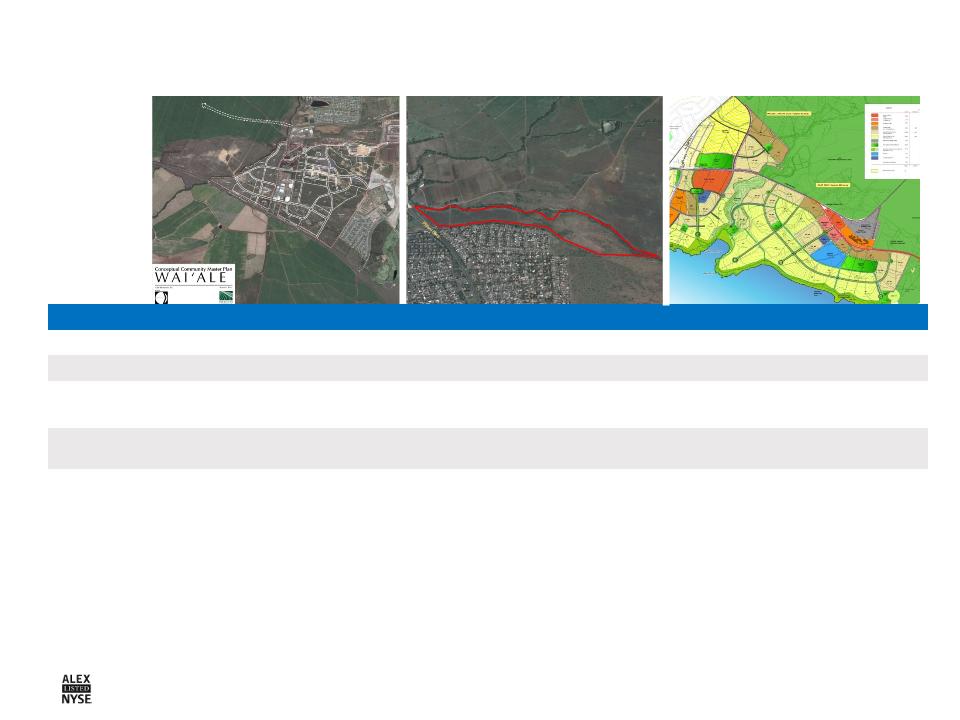

|

Waiale

|

Kihei Residential

|

Ele’ele Expansion

|

|

|

Target

|

Primary Residential

|

Primary Residential

|

Primary Residential

|

|

Location

|

Central Maui

|

Maui’s South Shore

|

Kauai’s South Shore

|

|

Project Size

(acres/units) |

545 acres/2,550 units

|

95 acres/600 units

|

840 acres

|

|

Project

description |

Master-planned community

|

Residential subdivision

|

Master-planned community

|

|

Current

Status |

The State Land Use Commission

(SLUC) approved the designation of the land from agriculture to urban in June 2012. The Company is proceeding with County zoning. |

The SLUC approved the designation of

the land from agriculture to urban in January 2009. The Planning Commission approved the zoning change and community plan amendment applications. Applications have been transmitted to City Council for review and final approval. |

Being pursued through Kauai’s multi-

year General Plan Update Process. Working through the process to ensure the inclusion of Eleele, and related recreational and commercial uses, as an appropriate future urban growth area. |

Entitlement Areas of Focus

28

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

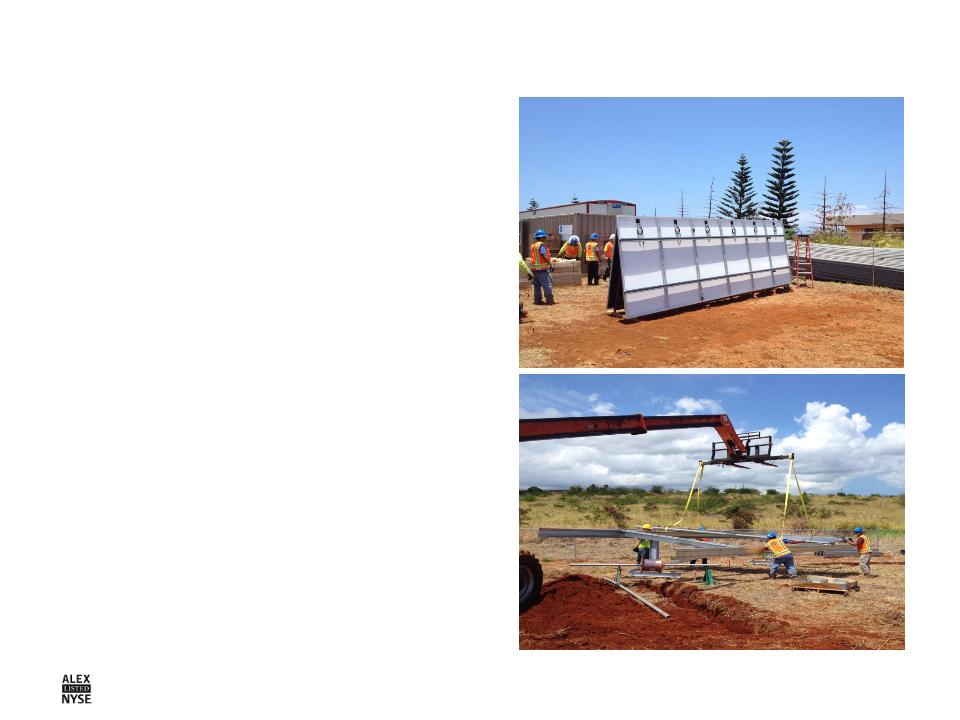

§ 6-MW (AC) facility built on 20-acres

of Company-owned land

of Company-owned land

§ 20-year fixed rate agreement to sell

power generated to local utility at

$200 per MW

power generated to local utility at

$200 per MW

§ All-in development cost of $25M to

$27M

$27M

§ Payback in under 5 years, aided by

substantial federal and state tax

credits in first year

substantial federal and state tax

credits in first year

§ Project proceeding on schedule for

late 2012 completion

late 2012 completion

Port Allen Solar Project

Value Creation from Land Stewardship Activities

Value Creation from Land Stewardship Activities

29

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

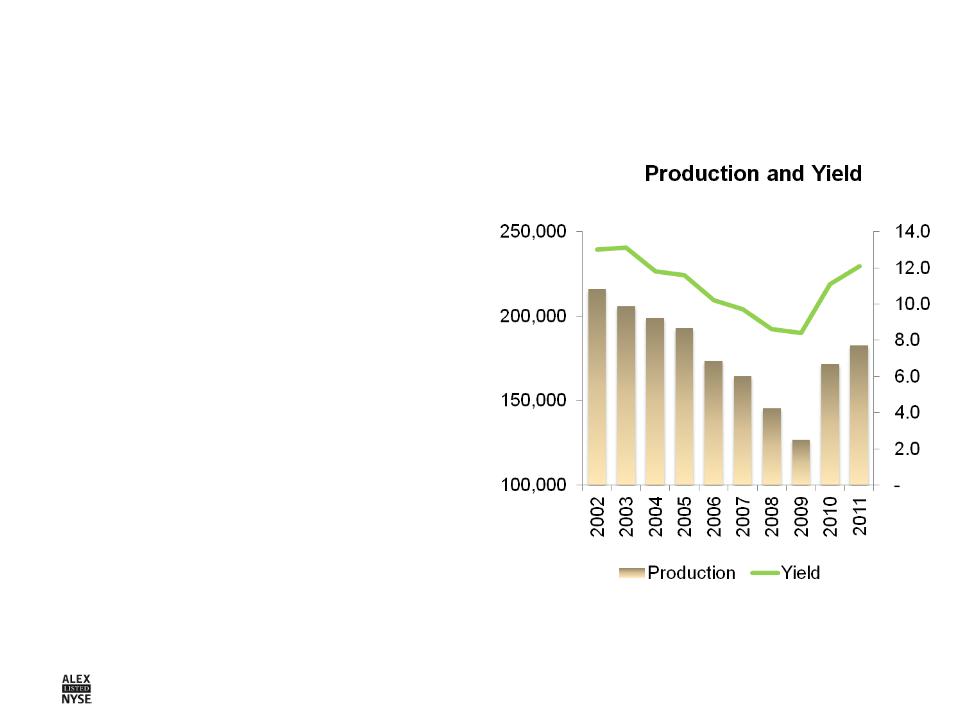

Value Creation from Land Stewardship Activities

§ HC&S: 36,000-acre Maui sugar

plantation (35,500 owned acres)

plantation (35,500 owned acres)

§ McBryde Resources: 4,000 acres

leased for farming operations

(coffee and corn) on Kauai

leased for farming operations

(coffee and corn) on Kauai

§ Focused on de-risking operations

§ Significant renewable energy

provider on Maui (hydro and

bagasse) and Kauai (hydro and

planned solar)

provider on Maui (hydro and

bagasse) and Kauai (hydro and

planned solar)

§ Expansion of renewable energy

under evaluation using $12M of

Federal research grants

under evaluation using $12M of

Federal research grants

30

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: Investment Thesis

§ Unique assets & competitive strengths

§ Proven track record

§ Embedded growth opportunities in a

development pipeline positioned for market

recovery

development pipeline positioned for market

recovery

§ Hawaii economy at a positive inflection

point

point

§ Healthy balance sheet & liquidity

§ Best public company vehicle for capitalizing

on Hawaii’s upside and creating long-term

shareholder value

on Hawaii’s upside and creating long-term

shareholder value

31

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

§ Positive trends in key economic indicators

– Strong performance trends for Hawaii’s visitor industry

– 2011 near-record year

– April YTD expenditures up 17% and arrivals up 9%

– 2012 outlook for record arrivals and expenditures

– Unemployment declining and relatively low at 6.3% v. 8.1% for U.S.

– YTD May bankruptcies down 25%

– YOY median prices for Oahu homes in May $664,000, up 12%

§ Catalysts for future growth

– Military

– Rail

– International tourism, especially from China and Korea

Hawaii Economy at a Positive Inflection Point

Sources: Hawaii Tourism Authority, May 31, 2012; Department of Labor and Industrial Relations Report, April 2012; DBEDT Quarterly Statistical &

Economic Report, 2nd Quarter 2012 http://hawaii.gov/dbedt; Hawaii Bankruptcy Court http://www.hib.uscourts.gov/stats/index_stats.html;

Honolulu Board of Realtors, June 7, 2012

Economic Report, 2nd Quarter 2012 http://hawaii.gov/dbedt; Hawaii Bankruptcy Court http://www.hib.uscourts.gov/stats/index_stats.html;

Honolulu Board of Realtors, June 7, 2012

Data provided for informational purposes only; no endorsement of forecast implied.

32

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

The China Potential for Hawaii

Source: Title Guaranty (RE Transactions); Hawaii Tourism Authority (Visitor #’s); National Bureau of Statistics of China (Population);

Japan Ministry of Internal Affairs and Communications (Population)

|

Japan

|

2009

|

2010

|

2011

|

|

Number of Visitors (in millions)

|

1.2

|

1.2

|

1.2

|

|

Real Estate Investment (in millions)

|

$278.9

|

$263.4

|

$274.0

|

|

Average Investment (in millions)

|

$1.1

|

$1.2

|

$1.0

|

|

Population (in millions)

|

127.5

|

128.1

|

127.8

|

|

China

|

2009

|

2010

|

2011

|

|

Number of Visitors

|

41,900

|

61,500

|

79,500

|

|

Real Estate Investment

|

?

|

?

|

?

|

|

Population (in billions)

|

1.33

|

1.34

|

1.35

|

33

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: Investment Thesis

§ Unique assets & competitive strengths

§ Proven track record

§ Embedded growth opportunities in a

development pipeline positioned for market

recovery

development pipeline positioned for market

recovery

§ Hawaii economy at a positive inflection point

§ Healthy balance sheet & liquidity

§ Best public company vehicle for capitalizing

on Hawaii’s upside and creating long-term

shareholder value

on Hawaii’s upside and creating long-term

shareholder value

34

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

|

Capital Structure

|

Capacity/

Limit (in millions)

|

Pro Forma at

Separation (in millions, unaudited)

|

|

Prudential Term Debt

|

$300

|

$207

|

|

Revolver Debt

|

$260

|

$50

|

|

Existing Mortgages on Commercial

Portfolio Properties |

-

|

$29

|

|

Total Debt

|

-

|

$286

|

|

Undrawn Capacity

|

-

|

$303

|

|

Statistics

|

Pro Forma at Separation

|

|

Debt to Debt + Equity

|

25%

|

|

Debt to Total Assets

|

20%

|

|

5-Year Average Debt Maturities (2012-2016)

|

$15M

|

|

5-Year Range of Debt Maturities (2012-2016)

|

$14M to $19M

|

|

5-Year Average EBITDA (2007-2011)

|

$129M

|

35

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

A&B: Investment Thesis

§ Unique assets & competitive strengths

§ Proven track record

§ Embedded growth opportunities in a

development pipeline positioned for market

recovery

development pipeline positioned for market

recovery

§ Hawaii economy at a positive inflection point

§ Healthy balance sheet & liquidity

§ Best public company vehicle for

capitalizing on Hawaii’s upside and

creating long-term shareholder value

capitalizing on Hawaii’s upside and

creating long-term shareholder value

36

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

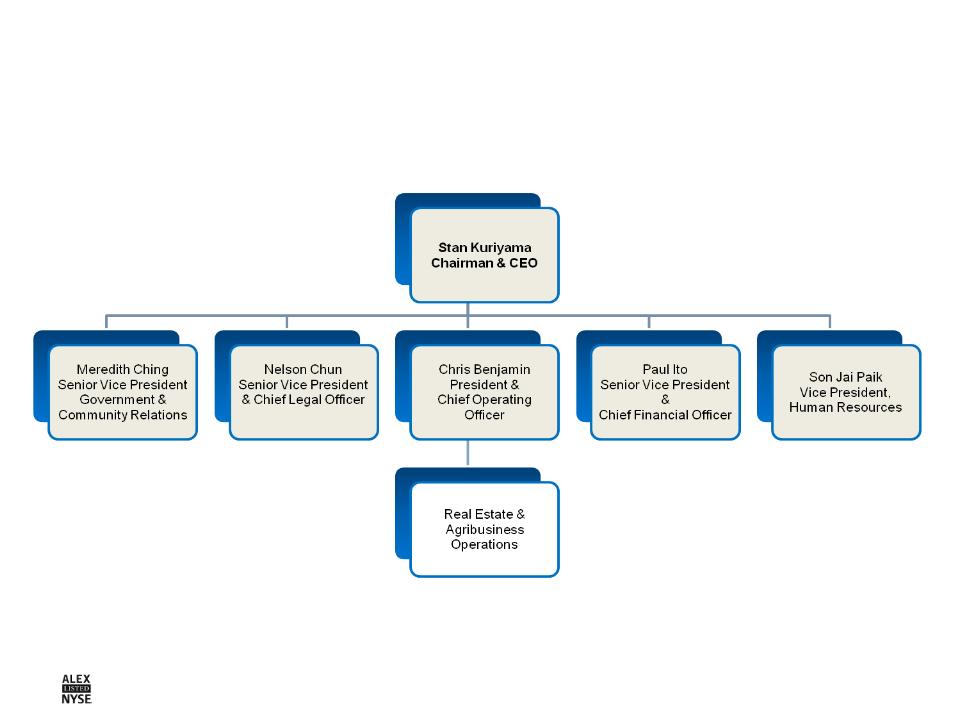

Appendix A: Leadership

37

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Board of Directors

Stanley M. Kuriyama

Chairman and Chief Executive Officer, Alexander & Baldwin, Inc.

Chairman and Chief Executive Officer, Alexander & Baldwin, Inc.

W. Allen Doane

Retired Chairman of the Board and Chief Executive Officer, Alexander & Baldwin, Inc.

Retired Chairman of the Board and Chief Executive Officer, Alexander & Baldwin, Inc.

Walter A. Dods, Jr.

Chairman of the Board, Matson and Retired Chairman and Chief Executive Officer of BancWest

and First Hawaiian Bank

Chairman of the Board, Matson and Retired Chairman and Chief Executive Officer of BancWest

and First Hawaiian Bank

Robert S. Harrison

President and Chief Executive Officer, First Hawaiian Bank

President and Chief Executive Officer, First Hawaiian Bank

Charles G. King

President, King Auto Center

President, King Auto Center

Douglas M. Pasquale

Director of Ventas, Inc. and Retired Chairman of the Board and Chief Executive Officer,

National Health Properties, Inc.

Director of Ventas, Inc. and Retired Chairman of the Board and Chief Executive Officer,

National Health Properties, Inc.

Michele K. Saito

President, Farmers Insurance Hawaii

President, Farmers Insurance Hawaii

Jeffrey N. Watanabe

Chairman of the Board, Hawaiian Electric Industries, Inc. and Retired Founder of Watanabe Ing

LLP, a Limited Liability Law Partnership

Chairman of the Board, Hawaiian Electric Industries, Inc. and Retired Founder of Watanabe Ing

LLP, a Limited Liability Law Partnership

Eric K. Yeaman

President and Chief Executive Officer, Hawaiian Telcom

President and Chief Executive Officer, Hawaiian Telcom

38

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Management Team

New A&B

New A&B

39

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Appendix B: Organization & Financial Overview

40

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

RE Leasing Segment

RE Sales Segment

Agribusiness Segment

41

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

2 See appendix for statement regarding the Company’s use of non-GAAP financial measures and a reconciliation of GAAP to non-GAAP measures; Cash NOI is not adjusted

for changes in discontinued operations from sales of commercial real estate after the year indicated.

for changes in discontinued operations from sales of commercial real estate after the year indicated.

3 Excludes 1031 exchanges; maintenance capital expenditures average between $15M and $20M annually.

42

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

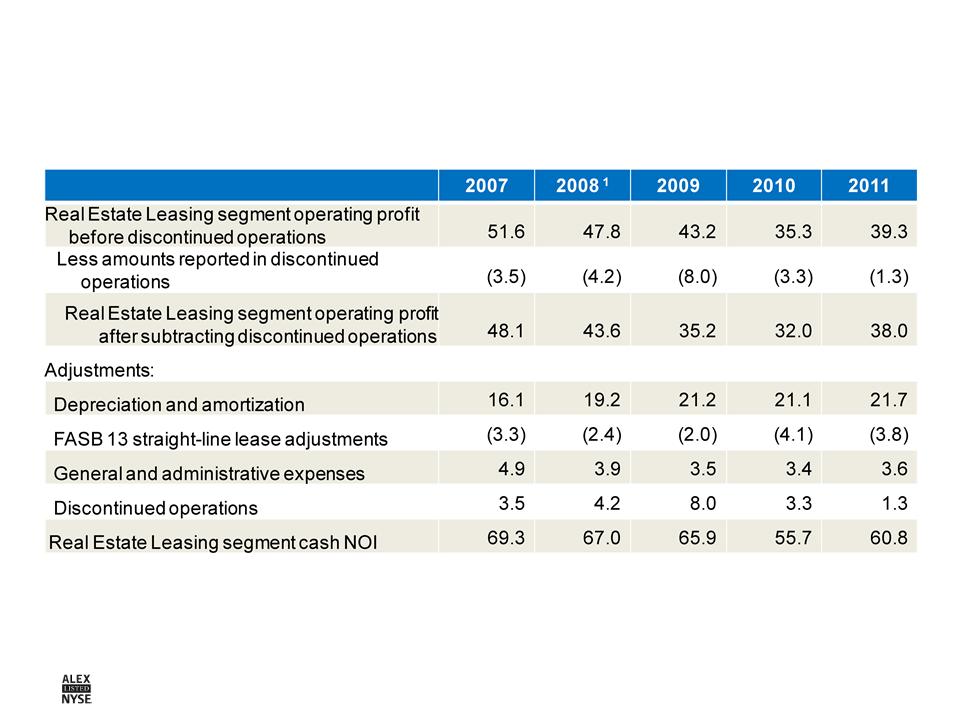

Management’s Use of Non-GAAP Financial Measures

The Company presents cash NOI, which is a non-GAAP measure derived from real estate

revenues (determined in accordance with GAAP, less straight-line rental adjustments) minus

property operating expenses (determined in accordance with GAAP). Cash NOI does not have

any standardized meaning prescribed by GAAP, and therefore, may differ from definitions of

cash NOI used by other companies. Cash NOI should not be considered as an alternative to net

income (determined in accordance with GAAP) as an indicator of the Company’s financial

performance, or as an alternative to cash flow from operating activities as a measure of the

Company’s liquidity. Cash NOI is commonly used as a measure of operating performance

because it is an indicator of the return on property investment, and provides a method of

comparing property performance over time. Cash NOI excludes general and administrative

expenses, straight-line rental adjustments, interest income, interest expense, depreciation and

amortization, and gains on sales of interests in real estate. The Company believes that the Real

Estate Leasing segment’s operating profit after subtracting discontinued operations is the most

directly comparable GAAP measurement to cash NOI. A required reconciliation of Real Estate

Leasing operating profit to Real Estate Leasing segment cash NOI is presented on slide 43.

revenues (determined in accordance with GAAP, less straight-line rental adjustments) minus

property operating expenses (determined in accordance with GAAP). Cash NOI does not have

any standardized meaning prescribed by GAAP, and therefore, may differ from definitions of

cash NOI used by other companies. Cash NOI should not be considered as an alternative to net

income (determined in accordance with GAAP) as an indicator of the Company’s financial

performance, or as an alternative to cash flow from operating activities as a measure of the

Company’s liquidity. Cash NOI is commonly used as a measure of operating performance

because it is an indicator of the return on property investment, and provides a method of

comparing property performance over time. Cash NOI excludes general and administrative

expenses, straight-line rental adjustments, interest income, interest expense, depreciation and

amortization, and gains on sales of interests in real estate. The Company believes that the Real

Estate Leasing segment’s operating profit after subtracting discontinued operations is the most

directly comparable GAAP measurement to cash NOI. A required reconciliation of Real Estate

Leasing operating profit to Real Estate Leasing segment cash NOI is presented on slide 43.

43

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Reconciliation of Leasing Operating Profit to Cash NOI

Dollars in Millions

Dollars in Millions

1 Includes Kahului Shopping Center business interruption payment of $1.5 million

Note: Discontinued operations are not adjusted for sales of commercial real estate occurring after the indicated year.

44

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Appendix C: Landholdings and Valuation

45

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Valuation Methodologies - Overall Approach

§ “Sum-of-the-parts” approach to perform a net asset valuation (NAV)

most commonly used

most commonly used

‒ Break down holdings into key asset classes

‒ Value assets within asset class using one or more methodologies

‒ Sum and subtract certain liabilities

§ A&B does not routinely perform such valuations

§ Valuations will require analysts to make a number of assumptions on key

factors which will have a material impact on resultant value (e.g., cap rates,

construction spending timing, sales absorption)

factors which will have a material impact on resultant value (e.g., cap rates,

construction spending timing, sales absorption)

46

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Valuation Data Sources

|

Asset Class

|

Information & Data Sources

|

|

Income properties

|

|

|

Commercial properties

|

Company : 10-K, RE Supplement, Presentations, Website, Form 10

Third Party: Commercial Property Brokers, REITs, NAREIT, CCIM, Hawaii public

companies, commercial property sales listing websites (e.g., Loopnet) |

|

Ground leases

|

Company: RE Supplement, 10-K, Website,

Third Party: Maui/Kauai Boards of Realtors

|

|

Development lands

|

|

|

Active developments

|

Company: 10-K, RE Supplement, Presentations, Website, Form 10

Third Party: Hawaii public companies, developers, Maui/Kauai Boards of Realtors

|

|

Future or planned dev.

|

Company: 10-K, RE Supplement, Presentations, Website, Form 10

Third Party: Commercial Property Brokers, Hawaii public companies, commercial property

sales listing websites (e.g., Loopnet) |

|

Core Ag & conservation lands

|

|

|

Maui

|

Company: 10-K, RE Supplement, Presentations, Website, Form 10

Third Party: Maui Board of Realtors, Maui public company

|

|

Kauai

|

Company: 10-K, RE Supplement, Presentations, Website, Form 10

Third Party: Kauai Board of Realtors

|

|

Non-core Ag & conservation

lands |

Company: 10-K, RE Supplement, Presentations, Website, Form 10

Third Party: Maui/Kauai Board of Realtors, Hawaii public companies

|

47

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Total Landholdings

As of 12/31/11

|

Description

|

Maui

|

Kauai

|

Oahu

|

Big Island

|

Mainland

|

Total Acres

|

|

Fully entitled

|

|

|

|

|

|

|

|

Hawaii - development/other

|

|

|

|

|

|

|

|

Active development/sales

|

217

|

-

|

7

|

-

|

-

|

224

|

|

Future development

|

188

|

44

|

-

|

-

|

-

|

232

|

|

Ground leases to third parties

|

64

|

1

|

-

|

-

|

-

|

65

|

|

Land used by affiliates

|

22

|

4

|

-

|

-

|

-

|

26

|

|

Other, including land not planned for development

|

17

|

54

|

-

|

-

|

-

|

71

|

|

Total Hawaii - development/other

|

508

|

103

|

7

|

-

|

-

|

618

|

|

Mainland - development

|

|

|

|

|

28

|

28

|

|

Hawaii - commercial improved properties

|

51

|

8

|

63

|

10

|

-

|

132

|

|

Mainland - commercial improved properties

|

-

|

-

|

-

|

-

|

443

|

443

|

|

Subtotal - fully entitled

|

559

|

111

|

70

|

10

|

471

|

1,221

|

|

|

|

|

|

|

|

|

|

Agricultural, pasture and miscellaneous

|

|

|

|

|

|

|

|

Hawaiian Commercial & Sugar Company

|

35,500

|

-

|

-

|

-

|

-

|

35,500

|

|

Leased to third parties

|

7,150

|

4,620

|

-

|

-

|

-

|

11,770

|

|

Other agricultural, pasture and misc. purposes

|

8,181

|

2,324

|

-

|

-

|

-

|

10,505

|

|

Subtotal - agricultural, pasture & misc.

|

50,831

|

6,944

|

-

|

-

|

-

|

57,775

|

|

|

|

|

|

|

|

|

|

Watershed/conservation

|

|

|

|

|

|

|

|

Wainiha Valley

|

-

|

10,120

|

-

|

-

|

-

|

10,120

|

|

Other Kauai

|

-

|

3,200

|

-

|

-

|

-

|

3,200

|

|

Maui

|

15,850

|

-

|

-

|

-

|

-

|

15,850

|

|

Subtotal - watershed/conservation

|

15,850

|

13,320

|

-

|

-

|

-

|

29,170

|

|

|

|

|

|

|

|

|

|

Total landholdings

|

67,240

|

20,375

|

70

|

10

|

471

|

88,166

|

|

|

|

|

|

|

|

|

1

1 Of this acreage, roughly 10,000 acres represents lands that have higher sale or development potential.

48

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

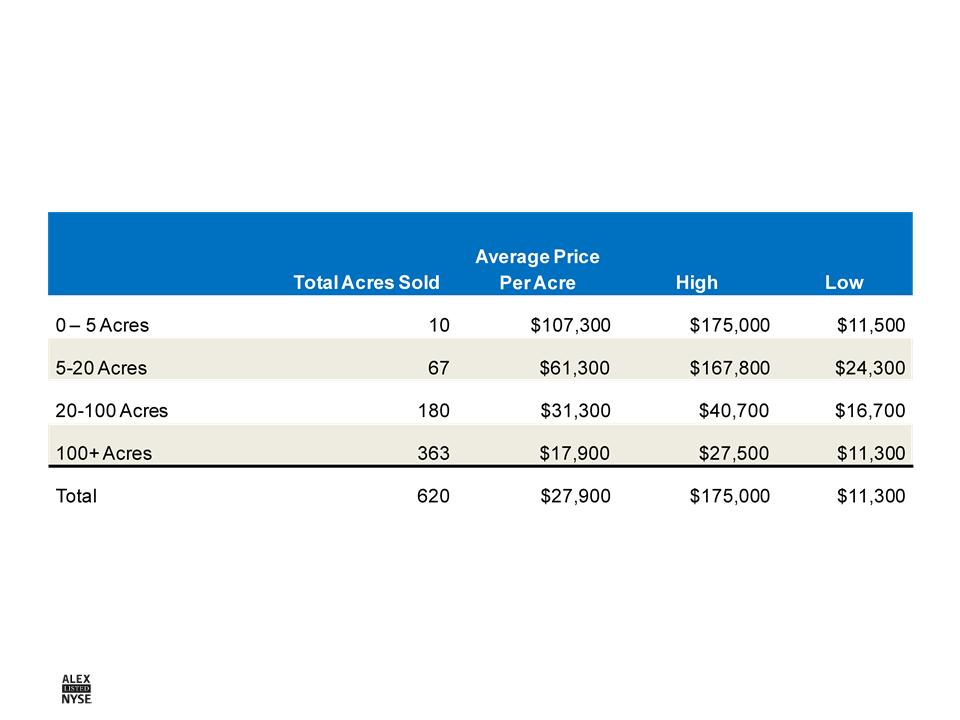

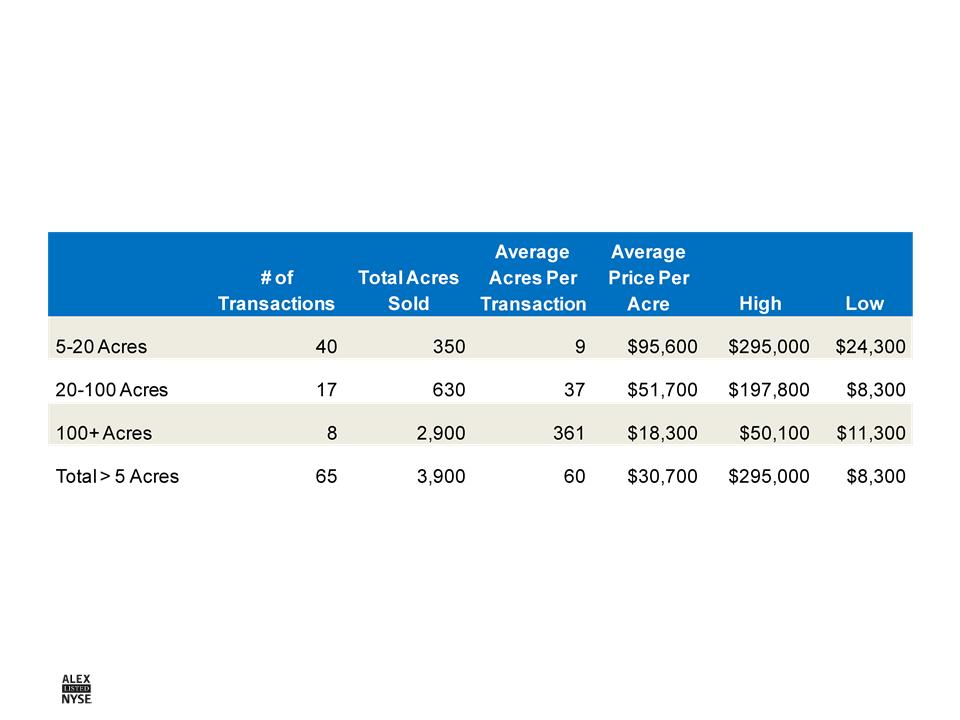

Valuation Methodologies -

A&B Ag Zoned Land 5-Year Sales Data

A&B Ag Zoned Land 5-Year Sales Data

A&B Ag Zoned Land Sales Transactions

2007 to 2011

A&B’s gross margin on unimproved land sales averaged 87% from 2007-2011

49

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

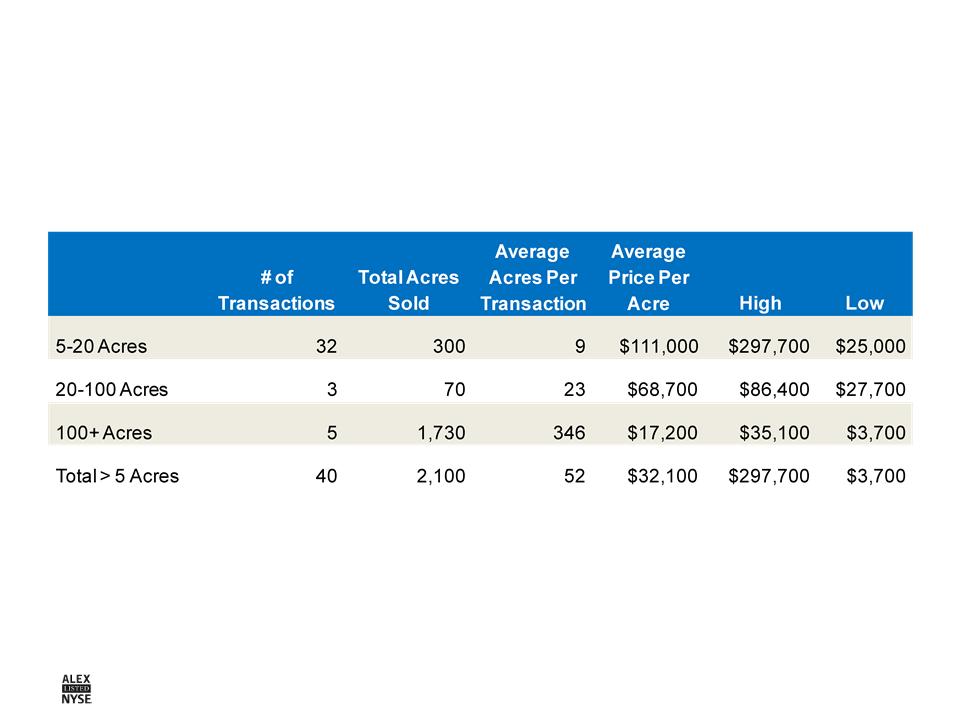

Valuation Methodologies - Market Data

North Shore/Upcountry Maui Ag Zoned Land Sales Comps

(Haiku /Kula /Makawao /Olinda)

2006 to 2011

Source: A&B compilation and analysis of Maui Board of Realtors data

50

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Valuation Methodologies - Market Data

Kauai Ag Zoned Land Sales Comps

2007 to 2010

Source: A&B compilation and analysis of Hawaii Information Service data

51

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Appendix D: Hawaii Economic Data

52

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Key Hawaii Economic Indicators

|

Indicator

(% Change YOY, except

unemployment rate) |

2009

DBEDT

|

2010

DBEDT

|

2011

DBEDT

|

2012F

|

2013F

|

2014F

|

|||

|

UHERO

|

DBEDT

|

UHERO

|

DBEDT

|

UHERO

|

DBEDT

|

||||

|

Real Gross

Domestic Product |

(2.6)

|

1.2

|

1.2

|

2.2

|

2.2

|

3.1

|

2.3

|

3.6

|

2.4

|

|

Visitor Arrivals

|

(4.4)

|

7.7

|

3.8

|

5.2

|

6.5

|

2.5

|

2.2

|

1.7

|

2.4

|

|

Real Personal

Income |

(1.4)

|

1.5

|

0.7

|

1.5

|

1.7

|

2.7

|

2.1

|

2.9

|

2.6

|

|

Unemployment

Rate |

6.8

|

6.6

|

6.3

|

6.1

|

NF

|

5.4

|

NF

|

4.9

|

NF

|

|

Building Permits

|

(29.0)

|

9.7

|

(26.2)

|

48.3

|

NF

|

6.2

|

NF

|

12.0

|

NF

|

Sources: University of Hawaii Economic Research Organization (UHERO), State Forecast, May11, 2012 ,and Hawaii Construction Forecast, March 16, 2012,

http://www.uhero.hawaii.edu/ ; Hawaii Department of Business, Economic Development & Tourism (DBEDT), 2nd Quarter 2012 Report http://hawaii.gov/dbedt.

http://www.uhero.hawaii.edu/ ; Hawaii Department of Business, Economic Development & Tourism (DBEDT), 2nd Quarter 2012 Report http://hawaii.gov/dbedt.

Data provided for informational purposes only; no endorsement implied.

NF: Not forecasted

53

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Hawaii Economic Indicators

As of April 30, 2012

As of April 30, 2012

1Increase in building permits primarily due to increase in alterations and additions.

2 Months of inventory is a Honolulu Board of Realtors figure for the month of May 2012

Sources: Hawaii Tourism Authority, Monthly Visitor Statistics, April 2012; DBEDT Monthly Economic Indicators, April 2012; Title Guaranty Report, April 2012; Hawaii

Department of Labor and Industrial Relations.

Department of Labor and Industrial Relations.

Data provided for informational purposes only; no endorsement implied.

|

|

YTD

|

% Change From

2011 |

|

Visitors (by air)

|

|

|

|

Arrivals (millions)

|

2.6

|

8.6

|

|

Expenditures (billions)

|

$4.8

|

16.6

|

|

Building permits (millions)

|

$703.4

|

23.11

|

|

Oahu residential real estate

|

|

|

|

Median home prices

|

$607,000

|

6.9

|

|

Home volumes

|

853

|

(1.5)

|

|

Home months of inventory (May)2

|

3.7

|

(35.1)

|

|

Median condo prices

|

$310,000

|

0.9

|

|

Condo volumes

|

1,200

|

(6.8)

|

|

Condo months of inventory (May) 2

|

4.4

|

(24.1)

|

|

Unemployment rate (April)

|

6.3

|

(0.3)

|

54

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

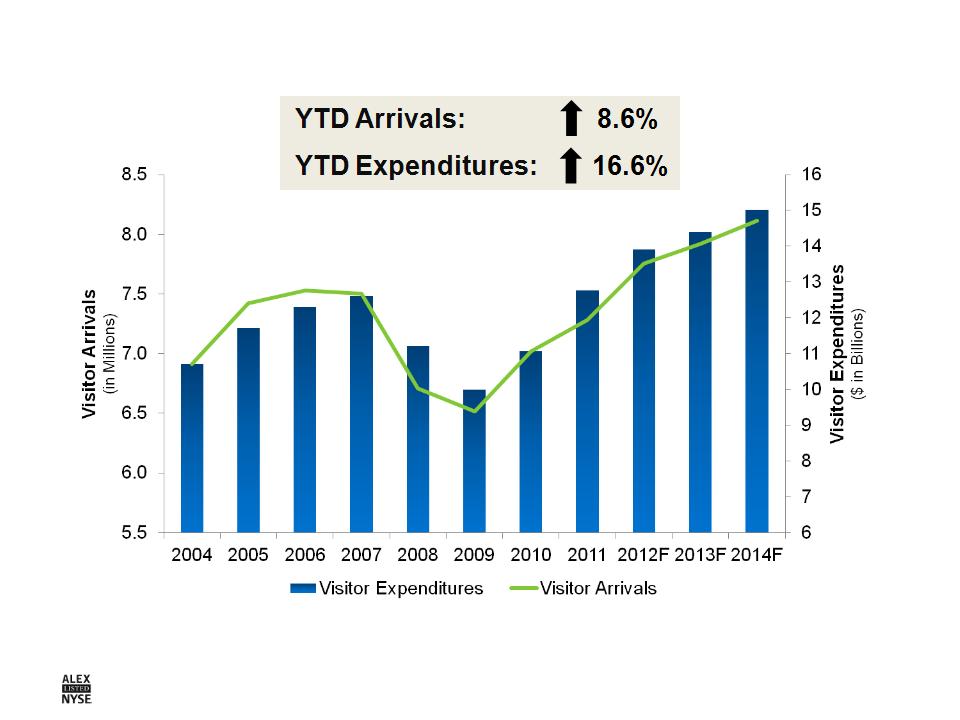

Visitor Arrivals and Expenditures

Source: DBEDT Quarterly Statistical & Economic Report, 2nd Quarter 2012 http://hawaii.gov/dbedt;

Hawaii Tourism April 2012 Visitor Highlights http://www.hawaiitourismauthority.org

Hawaii Tourism April 2012 Visitor Highlights http://www.hawaiitourismauthority.org

Data provided for informational purposes only; no endorsement of forecast implied.

55

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

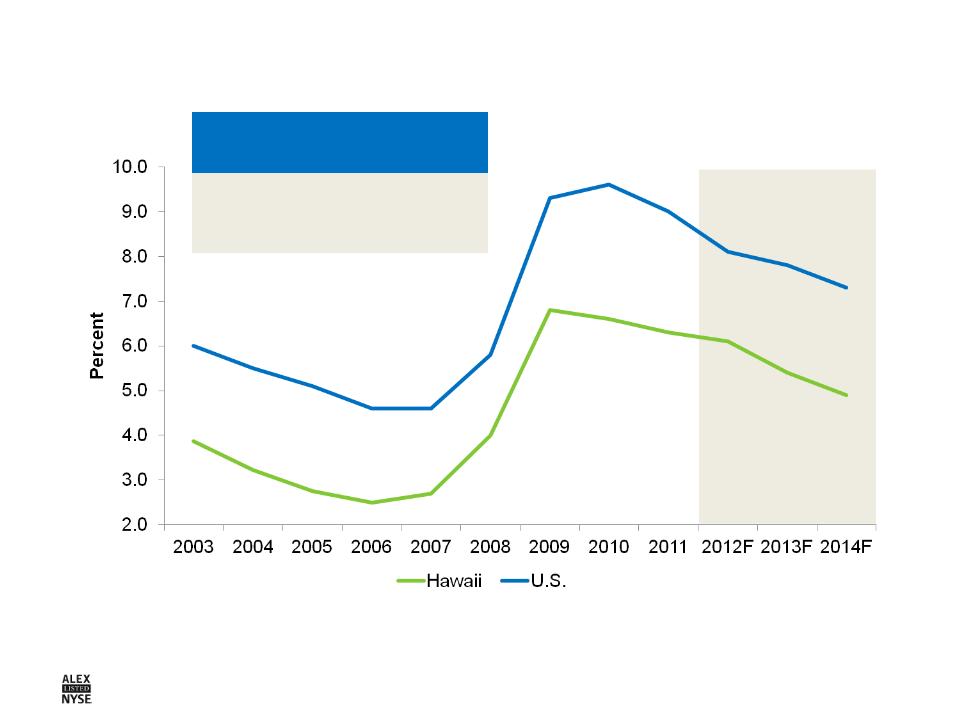

Hawaii and U.S. Unemployment Rate

Sources: DBEDT Quarterly Statistical & Economic Report, 2nd Quarter 2012 http://hawaii.gov/dbedt; UHERO State Forecast Update, May11, 2012

http://www.uhero.hawaii.edu/; United States Department of Labor, Unemployment Data; Bloomberg Composite Forecast as of June 6, 2012

http://www.uhero.hawaii.edu/; United States Department of Labor, Unemployment Data; Bloomberg Composite Forecast as of June 6, 2012

Data provided for informational purposes only; no endorsement of forecast implied.

|

Hawaii Average

Unemployment |

|

April 2012 - 6.3%

|

|

April 2011 - 6.6%

|

56

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Hawaii Real Estate Overview

Residential Real Estate Resales; YTD Ended May 31, 2012

Residential Real Estate Resales; YTD Ended May 31, 2012

|

County

|

Single Family Homes

|

Condominiums

|

||||||

|

Sales

|

%

Change from 2011 |

Median

Price |

%

Change from 2011 |

Sales

|

%

Change from 2011 |

Median

Price |

%

Change from 2011 |

|

|

Hawaii

|

658

|

(3)

|

241,500

|

(2)

|

252

|

(8)

|

256,250

|

27

|

|

Kauai

|

170

|

16

|

452,500

|

(9)

|

126

|

(1)

|

285,000

|

38

|

|

Maui

|

353

|

(3)

|

435,000

|

(3)

|

544

|

0

|

347,300

|

6

|

|

Oahu

|

1,099

|

(1)

|

619,000

|

8

|

1,586

|

(4)

|

310,000

|

2

|

|

Total

|

2,280

|

(1)

|

|

|

2,508

|

(3)

|

|

|

Source: Title Guaranty Sales of Existing Homes & Condominiums report, May 2012

Data provided for informational purposes only; no endorsement implied.

57

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Hawaii Real Estate Overview - Oahu

Oahu Single Family Homes and Condo Resales

Oahu Single Family Homes and Condo Resales

Source: Title Guaranty Sales of Existing Homes & Condominiums report, Honolulu Board of Realtors March 2012.

Data provided for informational purposes only; no endorsement implied.

Data provided for informational purposes only; no endorsement implied.

58

A&B: A Premier Hawaii Real Estate & Land Company ● June 18-22, 2012

Hawaii Real Estate Overview

Oahu Commercial Markets as of March 31, 2012, except for Retail

Oahu Commercial Markets as of March 31, 2012, except for Retail

|

Retail*

|

|

|

YTD net absorption

|

154,308 SF

|

|

Vacancy rate

|

4.26%

|

|

Average asking

rent range |

$2.70 - $3.53

PSF/MO |

|

Average operating

expense |

$1.08 PSF/MO

|

|

Industrial

|

|

|

YTD net absorption

|

19,925 SF

|

|

Vacancy rate

|

4.72%

|

|

Average asking rent

NNN |

$0.95 PSF/MO

|

|

Average operating

expense |

$0.32 PSF/MO

|

|

Office

|

|

|

YTD net absorption

|

(8,033) SF

|

|

Vacancy rate

|

13.60%

|

|

Average full

asking rent |

$2.84 PSF/MO

|

|

Average operating

expense |

$1.27 PSF/MO

|

* Retail data as of May 31,2012 or for the period from November 1, 2011 to May 31, 2012.

Sources: Colliers International Oahu First Quarter 2012, Office and Industrial Market Reports; Colliers International Mid Year 2012, Retail Market Report

Data provided for informational purposes only; no endorsement implied.