Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SANFILIPPO JOHN B & SON INC | d365734d8k.htm |

Investor

Meetings

6/2012

Exhibit 99.1 |

®

2

Forward Looking Statements

Forward Looking Statements

Some of the statements in this presentation constitute “forward-looking

statements”

about John B. Sanfilippo & Son, Inc. Such statements include, in

particular, statements about our plans, strategies, business prospects, changes

and trends in our business and the markets in which we operate. In some

cases, you can identify forward-looking statements by the use of words

such as “may,”

“will,”

“could,”

“would,”

“should,”

“expect,”

“plan,”

“anticipate,”

“intend,”

“believe,”

“estimate,”

“forecast,”

“predict,”

“propose,”

“potential”

or “continue”

or

the negative of those terms or other comparable terminology. These statements

represent our present expectations or beliefs concerning future events and

are not guarantees. Such statements speak only as of the date they are made,

and we do not undertake any obligation to update any forward-looking

statement. We caution that forward-looking statements are qualified by

important factors, risks and uncertainties, that could cause actual results

to differ materially from those in the forward looking statements. Our

periodic reports filed with the Securities and Exchange Commission,

including our Forms 10-K and 10-Q and any amendments thereto,

describe some of these factors. |

Introduction

to

JBSS |

®

4

Who We Are -

Who We Are -

JBSS

JBSS

•

One of the largest nut processors in the world with $700

million net sales for the last four fiscal quarters

•

State-of-the-art nut processing capabilities, including what we

believe is the single largest nut processing facility in the

world

•

A North American market leader in every major selling

channel

–

from

consumer/retail

and

commercial

ingredients

to contract manufacturing and export/international

•

Dual consumer strategy of branded nut and dried fruit

programs (Fisher, Orchard Valley Harvest) as well as private

brands

•

Procurement expertise with senior buyers averaging over 20+

years experience

•

Profitable business with strong growth prospects both

domestically and throughout the world |

®

5

To be the global source for nuts, committed to quality,

expertise and innovation that delivers an unmatched

experience to our customer and consumer

.

Integrity

People

Investment

Corporate Vision

Core Values

Safety

Resource Conservation

Customer Driven

Innovation

Execution

Quality

Continuous Improvement

Who We Are -

Who We Are -

JBSS

JBSS |

®

6

Who We Are –

Who We Are –

JBSS Business

JBSS Business

•

Consumer

Channel

–

sale

of

nuts

and

dried

fruits

to

major

food retailers

•

Branded Business:

•

Fisher

Baking

-

#2

national

market

share*

•

Fisher

Snack

–

Established

Midwest

brand

•

Orchard

Valley

Harvest

–

full

line

natural

nuts &

dried fruit products sold into Produce section of

food retailers

•

Private Brand Business:

•

Predominantly snack nuts sold under retailers’

own brands

* As measured by Nielsen Food, Drug and Mass merchandiser (Including Wal-Mart) 52 Weeks

Ending 5/12/12 |

®

7

Who We Are –

Who We Are –

JBSS Business

JBSS Business

•

Commercial

Ingredients

Channel

–

sale

of

nuts

as

ingredients

to foodservice suppliers, other food manufacturers, and

prepared food processors (consolidation of former Industrial

& Foodservice Channels)

•

Contract

Manufacturing

Channel

–

third

party

processing

for

branded food players

•

International

Channel

–

sale

of

Fisher

snack

nuts

and

private

brand nut products outside the United States

|

®

8

•

Diversified nut

business with high

emphasis on bulk &

ingredient sales to

industrial, foodservice

and international

customers

•

Packaged goods sold

to consumers

approximately half of

total sales

Where We’ve Been –

Where We’ve Been –

FY 2007

FY 2007

Total FY 2007 Sales: $541 Million

Total FY 2007 Sales: $541 Million |

®

9

•

Strategic use of

acquisitions to drive

future growth and

profitability –

Orchard

Valley Harvest

•

Shifting company profile

away from riskier

commodity business to

more value-added

consumer business

•

Focus on building our

branded (Fisher and

Orchard Valley Harvest)

business both

domestically and

internationally

Where We Are Today –

Where We Are Today –

FY 2011

FY 2011

Total FY 2011 Sales: $674 million

Total FY 2011 Sales: $674 million

*

* Combination of former foodservice and industrial channels |

®

10

We Are Experts In Every Nut Type

We Are Experts In Every Nut Type

•

Complete product portfolio of

nuts.

•

Comprehensive variety of

value-added products

•

Wide assortment of other

snack products

•

Highly versatile product

styles, sizes and packaging,

customized to customer

specifications

•

Benefits

•

Appeals to major

customers

•

Reduces product

concentration risks

FY 2011 Gross Sales by Nut Type |

Almonds

Walnuts

Pecans

Peanuts

We Are Experts in Procurement

We Are Experts in Procurement

®

11 |

®

12

Pecans, Pine Nuts

Mexico

Cashews

Vietnam

Pine Nuts

China

We Are Experts in Procurement

We Are Experts in Procurement

South Africa

Macadamias

Guatemala

Macadamias

Australia

Macadamias

India

Cashews

Turkey

Hazelnuts

Brazil

Cashews

Hawaii

Macadamias |

®

13

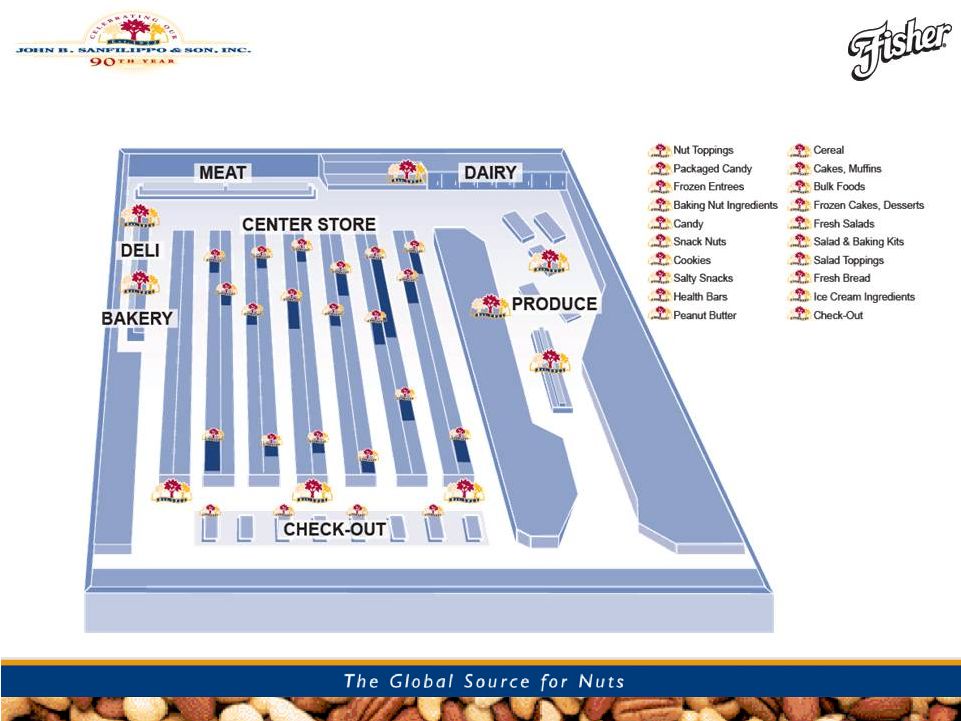

We Reach Consumers in 20+ In-Store Points

We Reach Consumers in 20+ In-Store Points |

14

Orchards

Cold Storage

Shelling, Sizing,

Blanching,

Slicing/Dicing

Roasting/Panning/

Enrobing

Packaging

Cleaning & Inspection

Shipping

JBSS

is

the

only

US

vertically

integrated

major

nut

processor

and

sheller

of

3

major

nut

types

-

peanuts,

pecans

and

walnuts

We Have Total Supply Chain Knowledge

We Have Total Supply Chain Knowledge

14

Starts at

the Grower

Consumer

Commercial

Ingredients

Contract Mfg

International

Ends Delivered to You

® |

15

®

Elgin, IL

San Antonio

Houston

Our Facilities Are Strategically Located

Our Facilities Are Strategically Located

•

Across the country production/distribution locations give JBSS

logistical advantages in serving its Customers as reflected in quick

reaction times and efficient shipping costs

15 |

16

®

•

1 Million Square Feet

•

350,000 sq. ft. warehouse and distribution

•

160,000 sq ft. segregated cooler storage

•

480,000 sq ft. manufacturing

•

100,000 sq ft. office

•

Comprehensive Allergen Prevention

Programs

•

State-of-the-art warehouse management

system

•

Individual cooler storage: one for peanuts,

one for tree nuts

•

Separated processing and production

rooms

•

Dedicated manufacturing equipment for

peanut-shared and tree nut processing

•

Robust

Quality

Systems

–

SQF

Level

2

•

Infinity / QRS Systems

•

Quasi positive release on all raw material,

work-in-process and finished goods

•

Organic Certification

Shared

Shared

Coolers

Coolers

Tree Nut

Tree Nut

Coolers

Coolers

Peanut

Peanut

Coolers

Coolers

Elgin, IL

Elgin, IL

State-of-the Art World Class Facility

State-of-the Art World Class Facility

16 |

17

We Launched Over 200 New Products in FY 2011

We Launched Over 200 New Products in FY 2011

Across Diversified Channels

Across Diversified Channels

182 new items in Consumer Channel

13 new items in Commercial Ingredients Channel

8 new items in Export Channel

16 new items for Contract Manufacturing Channel

17

•

•

•

•

® |

®

18

We Are The Preferred Private Brand Supplier

We Are The Preferred Private Brand Supplier

9-Time Category Colonel Award Winner 9-Time Category Colonel Award Winner

NUTS/ SEEDS/ TRAIL MIX -

NUTS/ SEEDS/ TRAIL MIX -

PL Buyer Magazine

PL Buyer Magazine |

19

®

JBSS 2012 Strategy

JBSS 2012 Strategy

19 |

Growing

with Fisher

and OVH

® |

®

21

We are Reinventing Fisher Baking

We are Reinventing Fisher Baking

*

* Quantitative paired comparison test – online study by Bluechip Marketing Worldwide

March 2011 |

®

22

We are Reinventing Fisher Baking

We are Reinventing Fisher Baking

Share

20.1

20.1

vs. YAG

+0.7

+0.7

Share

32.8

32.8

vs. YAG

(7.8)

(7.8)

Share

1.5

1.5

vs. YAG

(0.6)

(0.6)

Source: Nielsen – Food, Drug and Mass merchandiser data 12 Weeks Ended 5/12/12, includes

Wal-Mart Homescan data |

®

23

We are Reinventing Fisher Snack

We are Reinventing Fisher Snack |

®

24

Orchard Valley Harvest Acquisition May 2010

Orchard Valley Harvest Acquisition May 2010

•

Who: Leading diversified supplier of branded

and private label nut and dried fruit products

in the produce category

•

Rationale: (i) expand JBSS portfolio and

market presence into the store perimeter (ii)

acquire platform to build a truly national

produce nut program, (iii) broaden JBSS’

product breadth and production capabilities

•

Final purchase price:

$40.5 million

•

OVH

2009

Net

Sales:

$59.3

million

•

Purchase price to net sales: 0.7X |

®

25

We Are Reinventing Orchard Valley Harvest

We Are Reinventing Orchard Valley Harvest |

®

26

We Are Reinventing Orchard Valley Harvest

We Are Reinventing Orchard Valley Harvest |

®

27

We Are Investing in Social Media

We Are Investing in Social Media

Investing in Facebook, Twitter etc.

Investing in Facebook, Twitter etc.

Facebook Fisher Nuts Fans |

®

28

We Are Growing Fisher Snack Internationally

We Are Growing Fisher Snack Internationally

Selling in China since 12/10; SIAL Food Show

Selling in China since 12/10; SIAL Food Show |

®

29

We Are Expanding Fisher Snack Internationally

We Are Expanding Fisher Snack Internationally |

®

30

We Are Opening an Office In Shanghai

We Are Opening an Office In Shanghai

Anticipated Opening:

Early FY 2013 |

JBSS

Financials |

®

32

Nut Industry Has Experienced Record High Prices

Nut Industry Has Experienced Record High Prices |

®

33

Yet JBSS Has Become More Efficient

Yet JBSS Has Become More Efficient

Sales Per Employee*

* Fiscal net sales / average number of employees as reported on

Form 10-K. Temporary employees not included. |

®

34

JBSS

JBSS

Net

Net

Sales

Sales

FYs

FYs

1991-

1991-

2011

2011

&

&

L4Q

L4Q

Ended

Ended

Q3

Q3

2012

2012

($ Millions)

Note: FY 1997 reflects stub year

Item Rationalization,

De-emphasized

Commodity Sales,

Lower Prices

Low Carb Diet Run Up

Higher Prices,

OVH

acquisition |

®

35

JBSS Stockholders Equity FYE 1991-

JBSS Stockholders Equity FYE 1991-

2011 & Q3 2012

2011 & Q3 2012

($ Millions) |

®

36

JBSS Total Outstanding Debt As % of Net Sales

JBSS Total Outstanding Debt As % of Net Sales

FY’s 1991 –

FY’s 1991 –

L4Q Q3 2012

L4Q Q3 2012

Note: FY 1997 reflects stub year |

®

37

EBITDA consists of earnings before interest, taxes, depreciation,

amortization and noncontrolling interest. EBITDA is not a measurement

of financial performance under accounting principles generally accepted

in

the

United

States

of

America

("GAAP"),

and

does

not

represent

cash

flow from operations. EBITDA is presented solely as a supplemental

disclosure because management believes that it is important in

evaluating JBSS's financial performance and market valuation. In

conformity

with

Regulation

G,

a

reconciliation

of

EBITDA

to the most

directly comparable financial measures calculated and presented in

accordance

with

GAAP

is

presented

in

the

following

slide.

EBITDA |

®

38

Reconciliation of Net Income (Loss) to EBITDA*

Reconciliation of Net Income (Loss) to EBITDA*

*

EBITDA

is

a

non-GAAP

measure.

See

slide

entitled

“

EBITDA”

for

management’s

purpose

for

including

this

measure

in

this

presentation.

(In $,000's)

FY2002

FY2003

FY2004

FY2005

FY2006

FY2007

FY2008

FY2009

FY2010

FY2011

L4Q Q312

NET INCOME (LOSS)

7,691

15,027

22,630

14,499

(16,721)

(13,577)

(5,957)

6,917

14,425

2,835

15,445

INTEREST EXPENSE

5,757

4,681

3,434

3,998

6,516

9,347

10,502

7,646

5,653

6,444

5,707

INCOME TAX EXPENSE

(BENEFIT)

5,044

9,607

14,468

9,269

(8,689)

(7,520)

(897)

(259)

8,447

(49)

7,382

OVH GOODWILL

IMPAIRMENT

5,662

5,662

DEPRECIATION &

AMORTIZATION

10,428

11,248

11,190

10,501

10,000

13,584

15,742

15,922

15,825

16,968

17,151

EBITDA

28,920

40,563

51,722

38,267

(8,894)

1,834

19,390

30,226

44,350

31,860

51,347

NET SALES

352,799

419,677

520,811

581,729

579,564

540,858

541,771

553,846

561,633

674,212

700,251

EBITDA MARGIN (%

OF NET SALES)

8.2%

9.7%

9.9%

6.6%

(1.5%)

0.3%

3.6%

5.5%

7.9%

3.9%

7.3%

POUNDS SOLD

211,960

250,629

284,576

278,741

248,137

246,142

221,958

217,465

224,302

232,746

219,224

EBITDA PER LBS

SOLD

0.136

0.162

0.182

0.137

(0.036)

0.007

0.087

0.139

0.198

0.113

0.234 |

®

39

EBITDA*

EBITDA*

* EBITDA

is

a

non-GAAP

measure.

See

slide

entitled

“Reconciliation

of

Net

Income

(Loss)

to

EBITDA”

for

reconciliation

to

GAAP

measure

($ Thousands) |

®

40

EBITDA* Margin (% of Net Sales)

EBITDA* Margin (% of Net Sales)

* EBITDA

is

a

non-GAAP

measure.

See

slide

entitled

“Reconciliation

of

Net

Income

(Loss)

to

EBITDA”

for

reconciliation

to

GAAP

measure |

®

41

EBITDA* Per Pound Sold

EBITDA* Per Pound Sold

* EBITDA

is

a

non-GAAP

measure.

See

slide

entitled

“Reconciliation

of

Net

Income

(Loss)

to

EBITDA”

for

reconciliation

to

GAAP

measure |

®

42

JBSS Common Stock

JBSS Common Stock

Outperforms S&P 500

Outperforms S&P 500

and Russell 2000 since Market Bottom

and Russell 2000 since Market Bottom |

®

43

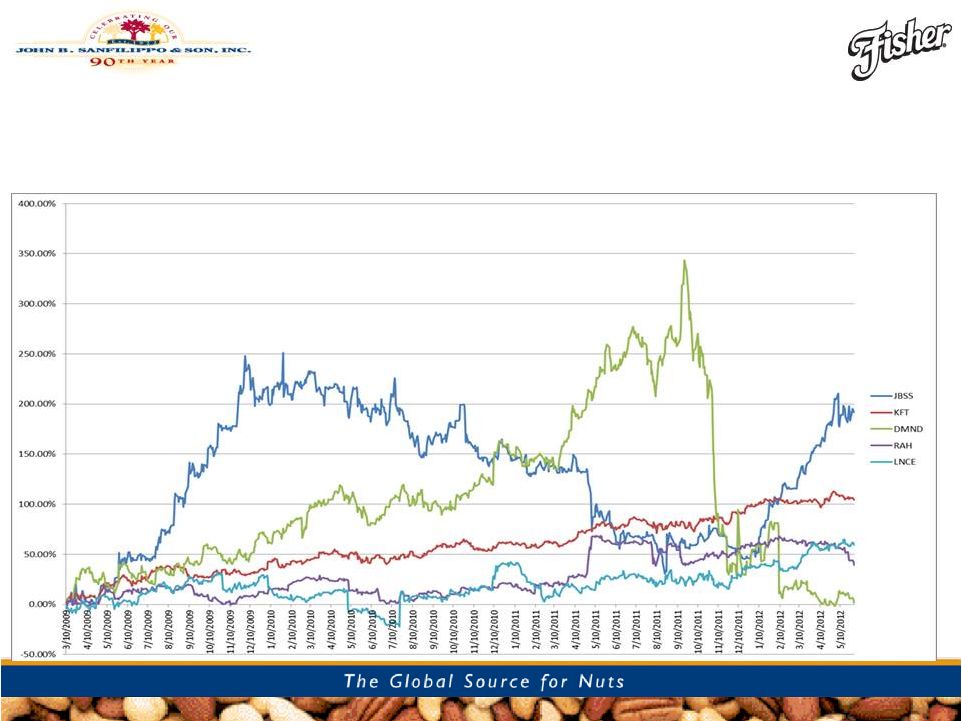

JBSS Common Stock Outperforms Diamond,

JBSS Common Stock Outperforms Diamond,

Ralcorp, Kraft and Snyder’s-Lance Since

Ralcorp, Kraft and Snyder’s-Lance Since

Market Bottom

Market Bottom |

Thank

You |