Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - CNO Financial Group, Inc. | form8-k06132012morganstanl.htm |

Morgan Stanley Financials Conference June 13, 2012 Exhibit 99.1

CNO Financial Group 2

CNO Financial Group 3 Forward-Looking Statements Cautionary Statement Regarding Forward-Looking Statements. Our statements, trend analyses and other information contained in these materials relative to markets for CNO Financial’s products and trends in CNO Financial’s operations or financial results, as well as other statements, contain forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. Forward-looking statements typically are identified by the use of terms such as “anticipate,” “believe,” “plan,” “estimate,” “expect,” “project,” “intend,” “may,” “will,” “would,” “contemplate,” “possible,” “attempt,” “seek,” “should,” “could,” “goal,” “target,” “on track,” “comfortable with,” “optimistic” and similar words, although some forward-looking statements are expressed differently. You should consider statements that contain these words carefully because they describe our expectations, plans, strategies and goals and our beliefs concerning future business conditions, our results of operations, financial position, and our business outlook or they state other ‘‘forward-looking’’ information based on currently available information. Assumptions and other important factors that could cause our actual results to differ materially from those anticipated in our forward-looking statements include, among other things: (i) changes in or sustained low interest rates causing a reduction in investment income, the margins of our fixed annuity and life insurance businesses, and sales of, and demand for, our products; (ii) general economic, market and political conditions, including the performance and fluctuations of the financial markets which may affect the value of our investments as well as our ability to raise capital or refinance existing indebtedness and the cost of doing so; (iii) the ultimate outcome of lawsuits filed against us and other legal and regulatory proceedings to which we are subject; (iv) our ability to make changes to certain non- guaranteed elements of our life insurance products; (v) our ability to obtain adequate and timely rate increases on our health products, including our long-term care business; (vi) the receipt of any required regulatory approvals for dividend and surplus debenture interest payments from our insurance subsidiaries; (vii) mortality, morbidity, the increased cost and usage of health care services, persistency, the adequacy of our previous reserve estimates and other factors which may affect the profitability of our insurance products; (viii) changes in our assumptions related to deferred acquisition costs or the present value of future profits; (ix) the recoverability of our deferred tax assets and the effect of potential ownership changes and tax rate changes on their value; (x) our assumption that the positions we take on our tax return filings, including our position that our 7.0% convertible senior debentures due 2016 will not be treated as stock for purposes of Section 382 of the Internal Revenue Code of 1986, as amended, and will not trigger an ownership change, will not be successfully challenged by the Internal Revenue Service; (xi) changes in accounting principles and the interpretation thereof (including changes in principles related to accounting for deferred acquisition costs); (xii) our ability to continue to satisfy the financial ratio and balance requirements and other covenants of our debt agreements; (xiii) our ability to achieve anticipated expense reductions and levels of operational efficiencies including improvements in claims adjudication and continued automation and rationalization of operating systems, (xiv) performance and valuation of our investments, including the impact of realized losses (including other-than-temporary impairment charges); (xv) our ability to identify products and markets in which we can compete effectively against competitors with greater market share, higher ratings, greater financial resources and stronger brand recognition; (xvi) our ability to generate sufficient liquidity to meet our debt service obligations and other cash needs; (xvii) our ability to maintain effective controls over financial reporting; (xviii) our ability to continue to recruit and retain productive agents and distribution partners and customer response to new products, distribution channels and marketing initiatives; (xix) our ability to achieve eventual upgrades of the financial strength ratings of CNO Financial and our insurance company subsidiaries as well as the impact of our ratings on our business, our ability to access capital and the cost of capital; (xx) the risk factors or uncertainties listed from time to time in our filings with the Securities and Exchange Commission; (xxi) regulatory changes or actions, including those relating to regulation of the financial affairs of our insurance companies, such as the payment of dividends and surplus debenture interest to us, regulation of the sale, underwriting and pricing of products, and health care regulation affecting health insurance products; and (xxii) changes in the Federal income tax laws and regulations which may affect or eliminate the relative tax advantages of some of our products or affect the value of our deferred tax assets. Other factors and assumptions not identified above are also relevant to the forward-looking statements, and if they prove incorrect, could also cause actual results to differ materially from those projected. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements. Our forward-looking statements speak only as of the date made. We assume no obligation to update or to publicly announce the results of any revisions to any of the forward- looking statements to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements.

CNO Financial Group 4 Non-GAAP Measures This presentation contains financial measures that differ from the comparable measures under Generally Accepted Accounting Principles (GAAP). Reconciliations between these non-GAAP measures and the comparable GAAP measures are included in the Appendix. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investors – SEC Filings” section of CNO’s website, www.CNOinc.com.

CNO Financial Group 5 CNO Fundamentals Well positioned in the growing and underserved senior and middle income market Strong risk management Track record of strong execution Building core value drivers Well capitalized and generating significant excess capital

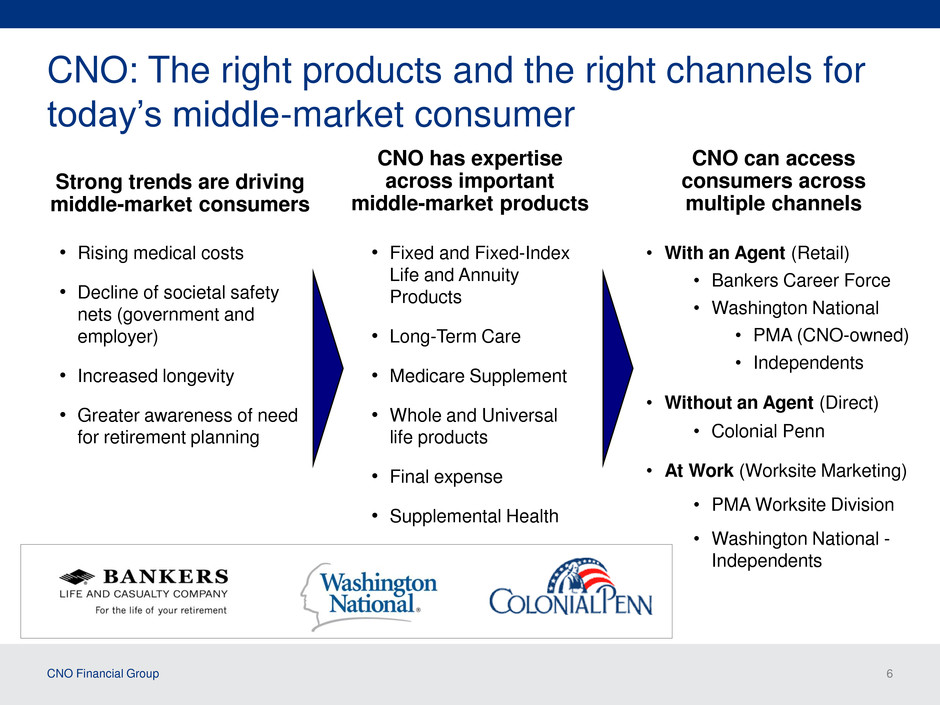

CNO Financial Group 6 • Fixed and Fixed-Index Life and Annuity Products • Long-Term Care • Medicare Supplement • Whole and Universal life products • Final expense • Supplemental Health CNO can access consumers across multiple channels • With an Agent (Retail) • Bankers Career Force • Washington National • PMA (CNO-owned) • Independents • Without an Agent (Direct) • Colonial Penn • At Work (Worksite Marketing) • PMA Worksite Division • Washington National - Independents • Rising medical costs • Decline of societal safety nets (government and employer) • Increased longevity • Greater awareness of need for retirement planning CNO has expertise across important middle-market products Strong trends are driving middle-market consumers CNO: The right products and the right channels for today’s middle-market consumer

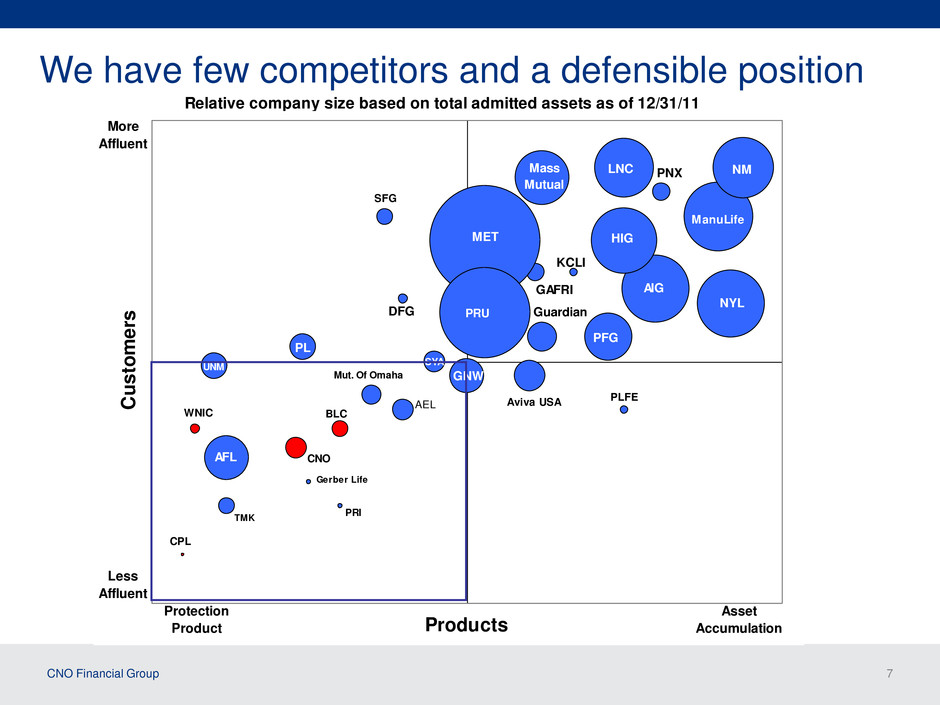

CNO Financial Group 7 AEL AFL AIG Aviva USA DFG Gerber Life GAFRI GNW Guardian HIG ManuLife KCLI LNCMass Mutual MET Mut. Of Omaha NM NYL PFG PL PNX PLFE PRU WNIC SFG TMK UNM BLC CPL CNO PRI SYA Products C us to m er s More Affluent Less Affluent Protection Product Asset Accumulation Relative company size based on total admitted assets as of 12/31/11 We have few competitors and a defensible position

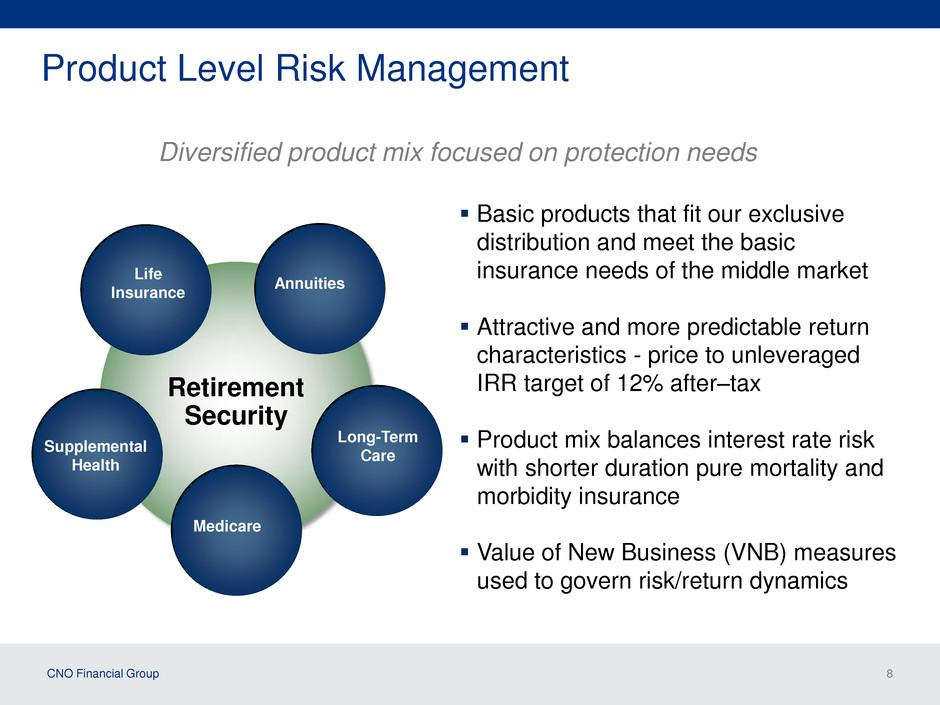

CNO Financial Group 8 Product Level Risk Management Diversified product mix focused on protection needs Retirement Security Medicare Annuities Supplemental Health Long-Term Care Life Insurance Basic products that fit our exclusive distribution and meet the basic insurance needs of the middle market Attractive and more predictable return characteristics - price to unleveraged IRR target of 12% after–tax Product mix balances interest rate risk with shorter duration pure mortality and morbidity insurance Value of New Business (VNB) measures used to govern risk/return dynamics

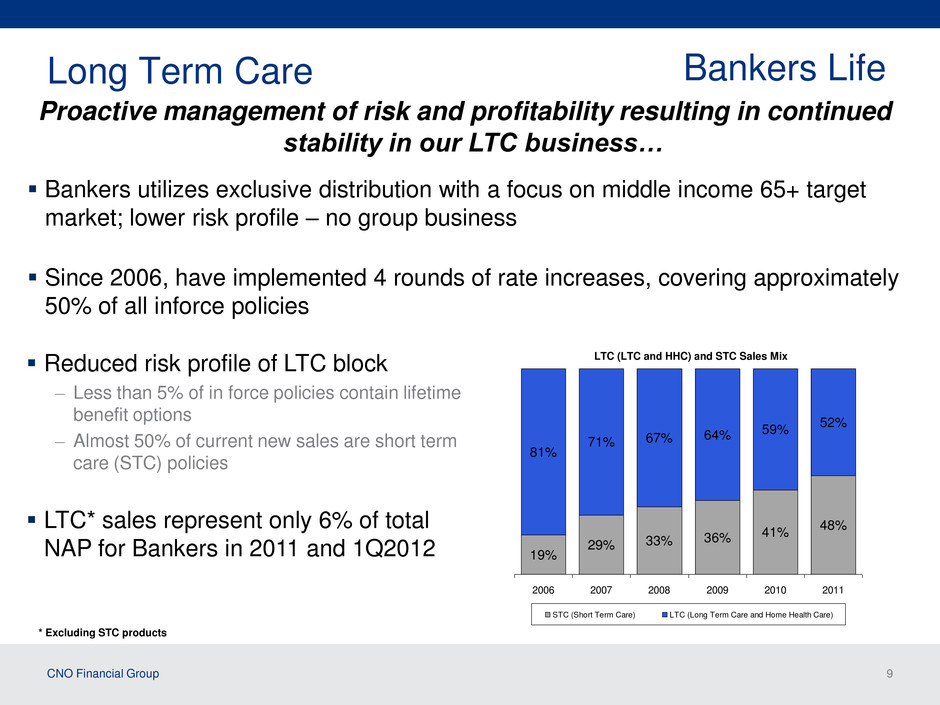

CNO Financial Group 9 LTC (LTC and HHC) and STC Sales Mix 19% 29% 33% 36% 41% 48% 81% 71% 67% 64% 59% 52% 2006 2007 2008 2009 2010 2011 STC (Short Term Care) LTC (Long Term Care and Home Health Care) Long Term Care Bankers Life Bankers utilizes exclusive distribution with a focus on middle income 65+ target market; lower risk profile – no group business Since 2006, have implemented 4 rounds of rate increases, covering approximately 50% of all inforce policies Reduced risk profile of LTC block – Less than 5% of in force policies contain lifetime benefit options – Almost 50% of current new sales are short term care (STC) policies LTC* sales represent only 6% of total NAP for Bankers in 2011 and 1Q2012 Proactive management of risk and profitability resulting in continued stability in our LTC business… * Excluding STC products

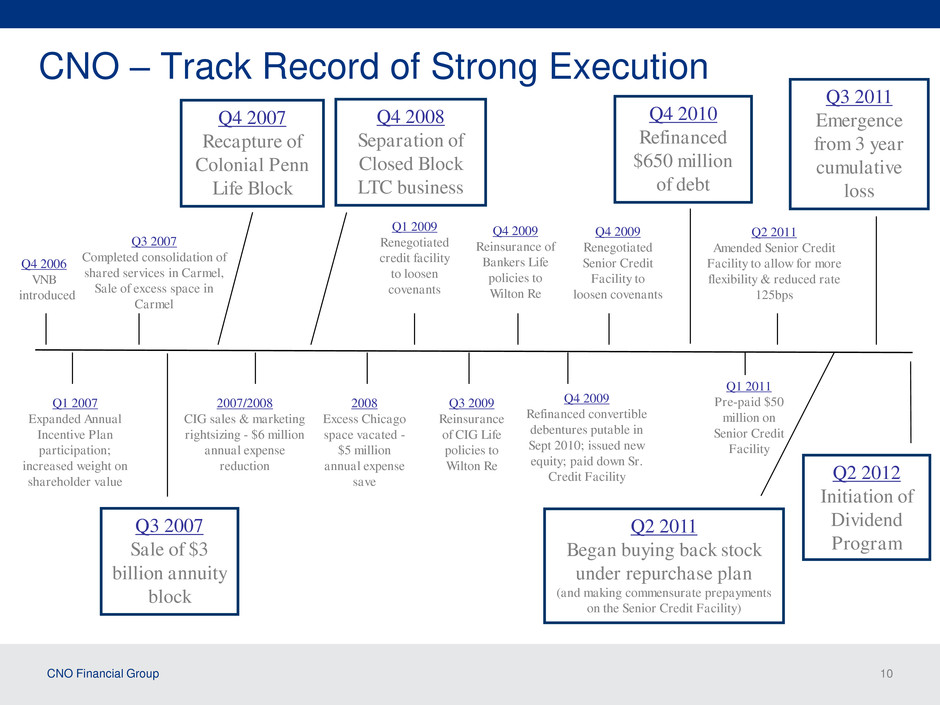

CNO Financial Group 10 CNO – Track Record of Strong Execution Q4 2008 Separation of Closed Block LTC business Q4 2006 VNB introduced 2007/2008 CIG sales & marketing rightsizing - $6 million annual expense reduction 2008 Excess Chicago space vacated - $5 million annual expense save Q4 2007 Recapture of Colonial Penn Life Block Q3 2007 Sale of $3 billion annuity block Q3 2007 Completed consolidation of shared services in Carmel, Sale of excess space in Carmel Q1 2009 Renegotiated credit facility to loosen covenants Q1 2007 Expanded Annual Incentive Plan participation; increased weight on shareholder value Q3 2009 Reinsurance of CIG Life policies to Wilton Re Q4 2010 Refinanced $650 million of debt Q4 2009 Reinsurance of Bankers Life policies to Wilton Re Q4 2009 Refinanced convertible debentures putable in Sept 2010; issued new equity; paid down Sr. Credit Facility Q4 2009 Renegotiated Senior Credit Facility to loosen covenants Q1 2011 Pre-paid $50 million on Senior Credit Facility Q2 2011 Amended Senior Credit Facility to allow for more flexibility & reduced rate 125bps Q2 2011 Began buying back stock under repurchase plan (and making commensurate prepayments on the Senior Credit Facility) Q3 2011 Emergence from 3 year cumulative loss Q2 2012 Initiation of Dividend Program

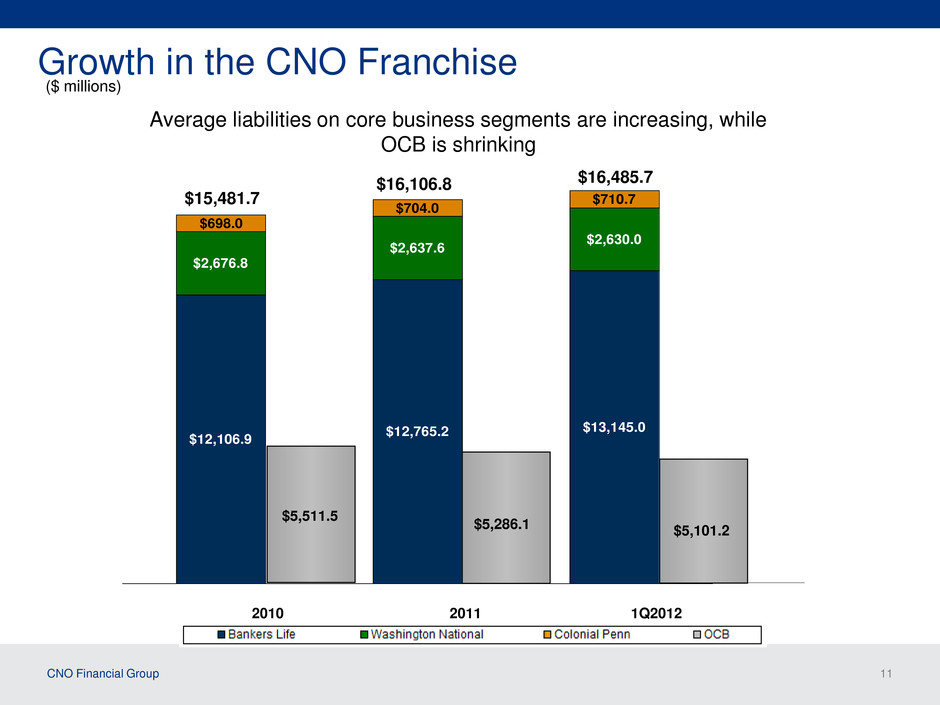

CNO Financial Group 11 $12,106.9 $12,765.2 $13,145.0 $2,676.8 $2,637.6 $2,630.0 $704.0 $710.7 $698.0 Growth in the CNO Franchise ($ millions) $16,485.7 Average liabilities on core business segments are increasing, while OCB is shrinking $15,481.7 $16,106.8 2010 2011 1Q2012 $5,511.5 $5,286.1 $5,101.2

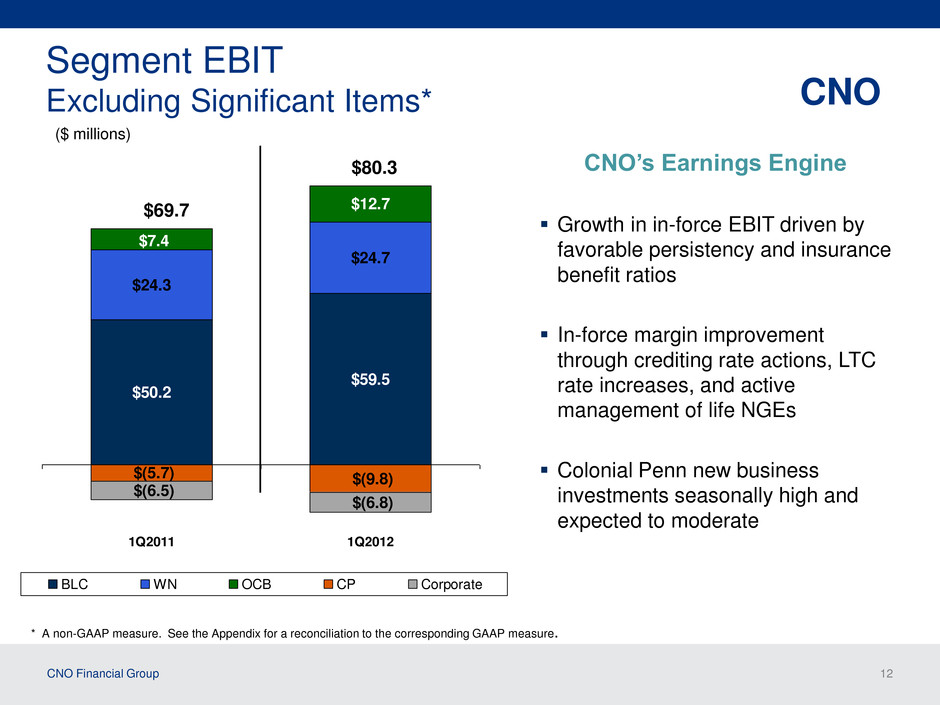

CNO Financial Group 12 $50.2 $59.5 $24.3 $24.7 $12.7 $(5.7) $(9.8) $(6.5) $(6.8) $7.4 1Q2011 1Q2012 BLC WN OCB CP Corporate Segment EBIT Excluding Significant Items* CNO ($ millions) * A non-GAAP measure. See the Appendix for a reconciliation to the corresponding GAAP measure. $80.3 $69.7 CNO’s Earnings Engine Growth in in-force EBIT driven by favorable persistency and insurance benefit ratios In-force margin improvement through crediting rate actions, LTC rate increases, and active management of life NGEs Colonial Penn new business investments seasonally high and expected to moderate

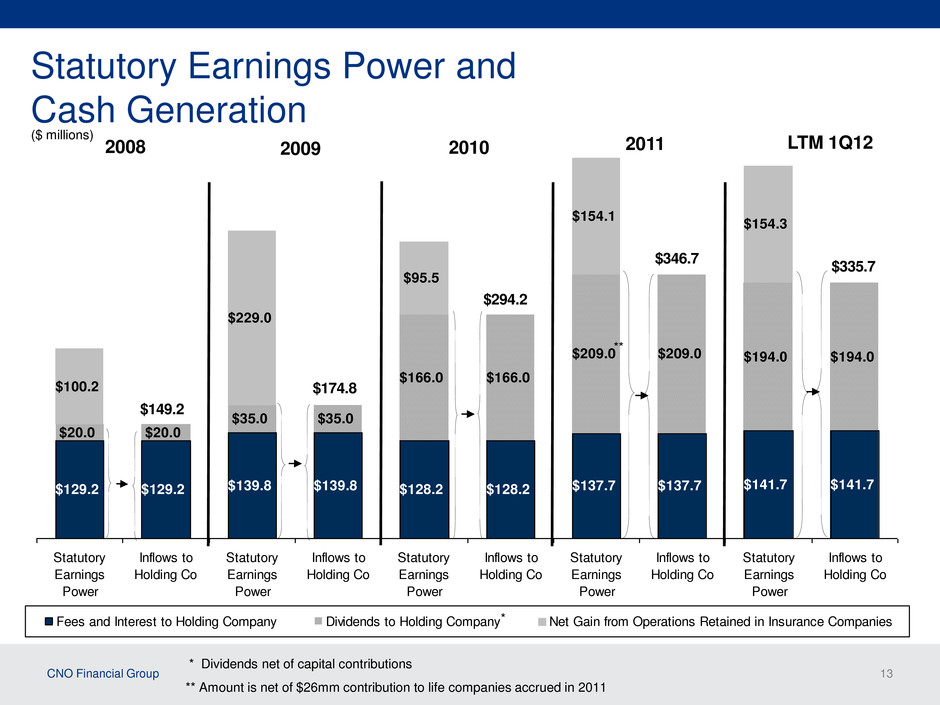

CNO Financial Group 13 $129.2 $139.8 $128.2 $137.7 $141.7 $20.0 $35.0 $166.0 $209.0 $194.0 $100.2 $229.0 $95.5 $154.1 $154.3 $129.2 $139.8 $128.2 $137.7 $141.7 $20.0 $35.0 $166.0 $209.0 $194.0 $335.7 $346.7 $294.2 $174.8 $149.2 Statutory Earnings Power Inflows to Holding Co Statutory Earnings Power Inflows to Holding Co Statutory Earnings Power Inflows to Holding Co Statutory Earnings Power Inflows to Holding Co Statutory Earnings Power Inflows to Holding Co Fees and Interest to Holding Company Dividends to Holding Company Net Gain from Operations Retained in Insurance Companies ($ millions) 2008 LTM 1Q12 Statutory Earnings Power and Cash Generation * Dividends net of capital contributions * ** ** Amount is net of $26mm contribution to life companies accrued in 2011 2010 2009 2011

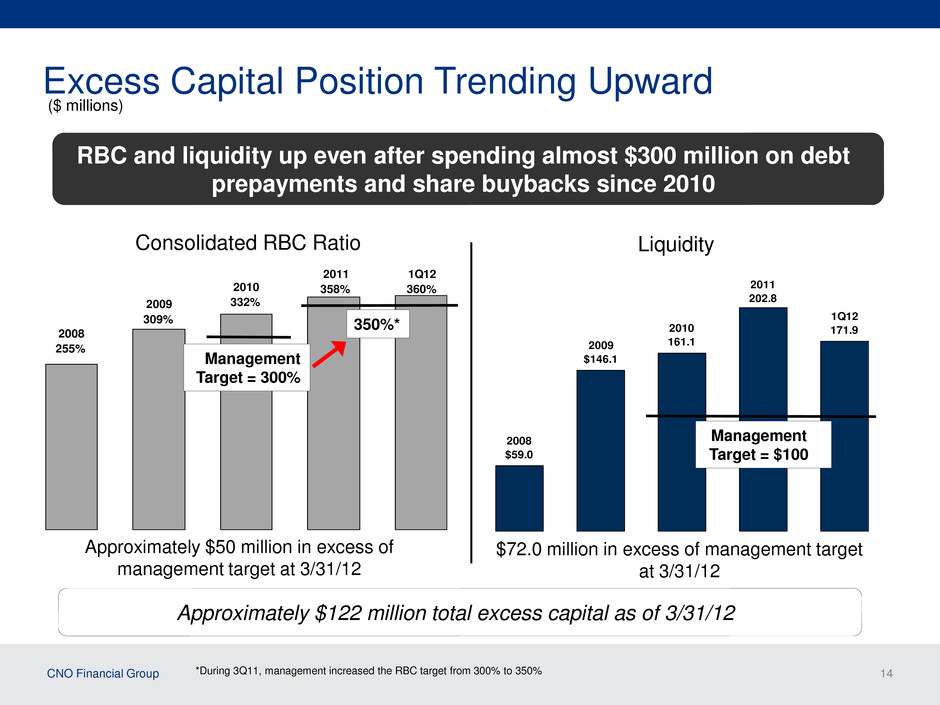

CNO Financial Group 14 2008 255% 2009 309% 2010 332% 2011 358% 1Q12 360% 2008 $59.0 2009 $146.1 2010 161.1 2011 202.8 1Q12 171.9 Excess Capital Position Trending Upward Consolidated RBC Ratio Liquidity ($ millions) Approximately $50 million in excess of management target at 3/31/12 $72.0 million in excess of management target at 3/31/12 350%* Management Target = $100 Management Target = 300% *During 3Q11, management increased the RBC target from 300% to 350% Approximately $122 million total excess capital as of 3/31/12 RBC and liquidity up even after spending almost $300 million on debt prepayments and share buybacks since 2010

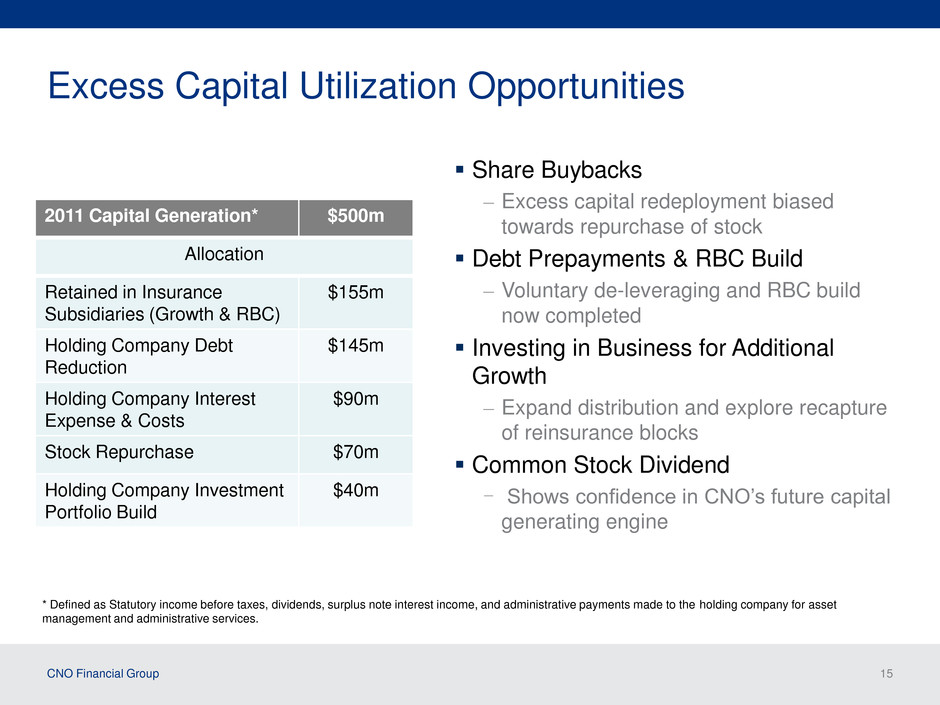

CNO Financial Group 15 Excess Capital Utilization Opportunities Share Buybacks – Excess capital redeployment biased towards repurchase of stock Debt Prepayments & RBC Build – Voluntary de-leveraging and RBC build now completed Investing in Business for Additional Growth – Expand distribution and explore recapture of reinsurance blocks Common Stock Dividend - Shows confidence in CNO’s future capital generating engine 2011 Capital Generation* $500m Allocation Retained in Insurance Subsidiaries (Growth & RBC) $155m Holding Company Debt Reduction $145m Holding Company Interest Expense & Costs $90m Stock Repurchase $70m Holding Company Investment Portfolio Build $40m * Defined as Statutory income before taxes, dividends, surplus note interest income, and administrative payments made to the holding company for asset management and administrative services.

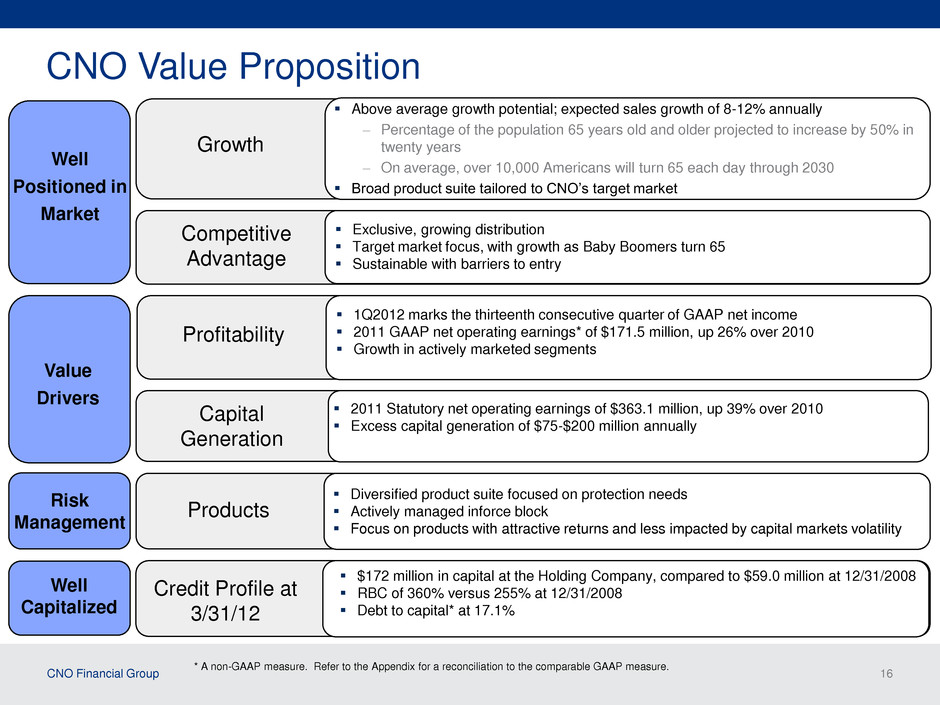

CNO Financial Group 16 CNO Value Proposition Competitive Advantage Exclusive, growing distribution Target market focus, with growth as Baby Boomers turn 65 Sustainable with barriers to entry Products Diversified product suite focused on protection needs Actively managed inforce block Focus on products with attractive returns and less impacted by capital markets volatility Value Drivers Well Positioned in Market Well Capitalized Risk Management Profitability 1Q2012 marks the thirteenth consecutive quarter of GAAP net income 2011 GAAP net operating earnings* of $171.5 million, up 26% over 2010 Growth in actively marketed segments Growth Above average growth potential; expected sales growth of 8-12% annually – Percentage of the population 65 years old and older projected to increase by 50% in twenty years – On average, over 10,000 Americans will turn 65 each day through 2030 Broad product suite tailored to CNO’s target market Capital Generation 2011 Statutory net operating earnings of $363.1 million, up 39% over 2010 Excess capital generation of $75-$200 million annually * A non-GAAP measure. Refer to the Appendix for a reconciliation to the comparable GAAP measure. Credit Profile at 3/31/12 $172 million in capital at the Holding Company, compared to $59.0 million at 12/31/2008 RBC of 360% versus 255% at 12/31/2008 Debt to capital* at 17.1%

Questions and Answers

Appendix

CNO Financial Group 19 The following provides additional information regarding certain non-GAAP measures used in this presentation. A non-GAAP measure is a numerical measure of a company’s performance, financial position, or cash flows that excludes or includes amounts that are normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. While management believes these measures are useful to enhance understanding and comparability of our financial results, these non-GAAP measures should not be considered as substitutes for the most directly comparable GAAP measures. Additional information concerning non-GAAP measures is included in our periodic filings with the Securities and Exchange Commission that are available in the “Investor – SEC Filings” section of our website, www.CNOinc.com. Information Related to Certain Non-GAAP Financial Measures

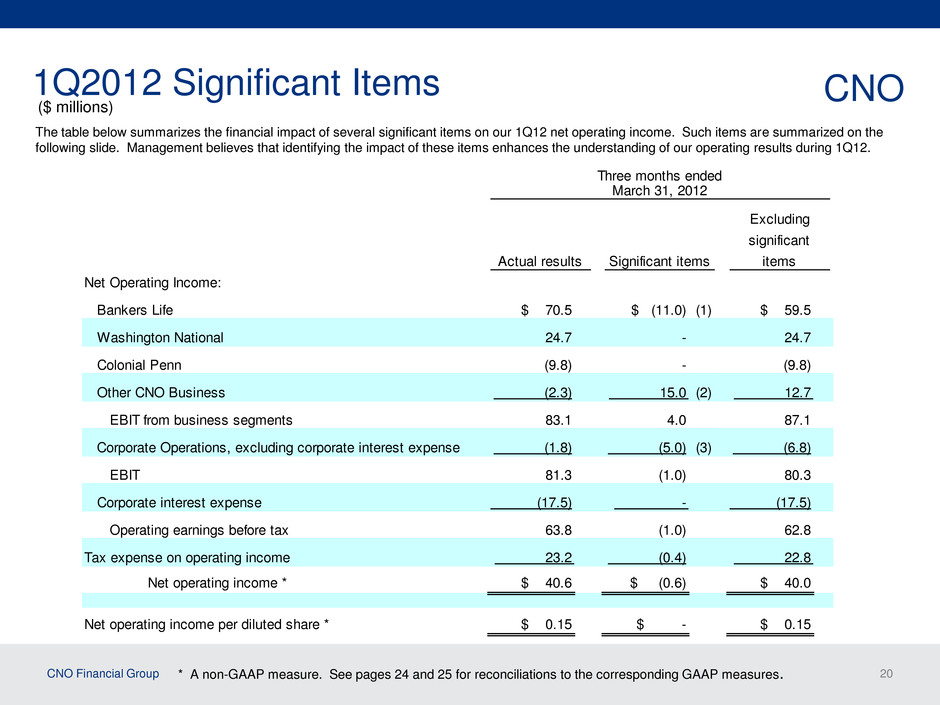

CNO Financial Group 20 1Q2012 Significant Items CNO ($ millions) The table below summarizes the financial impact of several significant items on our 1Q12 net operating income. Such items are summarized on the following slide. Management believes that identifying the impact of these items enhances the understanding of our operating results during 1Q12. * A non-GAAP measure. See pages 24 and 25 for reconciliations to the corresponding GAAP measures. Net Operating Income: Bankers Life $ 70.5 $ (11.0) (1) $ 59.5 Washington National Colonial Penn Other CNO Business (2) EBIT from business segments Corporate Operations, excluding corporate interest expense (3) EBIT Corporate interest expense Operating earnings before tax T x xp se on operating income Net operating income * $ 40.6 $ (0.6) $ 40.0 Net operating income per diluted share * $ 0.15 $ - $ 0.15 Three months ended March 31, 2012 Actual results Significant items Excluding significant items 24.7 - 24.7 (9.8) - (9.8) (2.3) 15.0 12.7 83.1 4.0 87.1 (1.8) (5.0) (6.8) 81.3 (1.0) 80.3 (17.5) - (17.5) 63.8 (1.0) 62.8 23.2 (0.4) 22.8

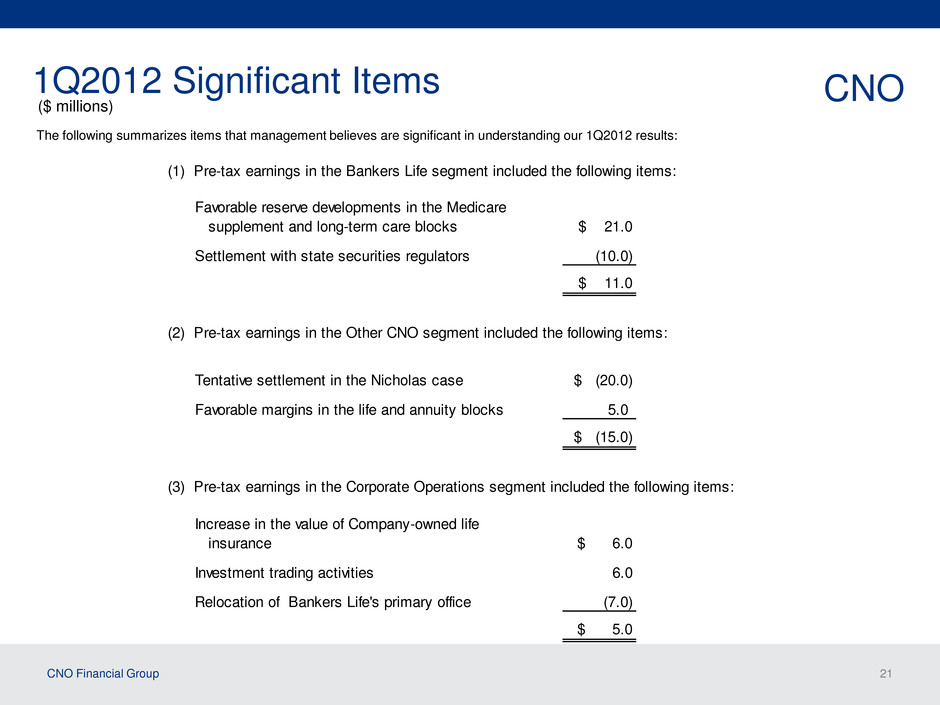

CNO Financial Group 21 1Q2012 Significant Items CNO ($ millions) The following summarizes items that management believes are significant in understanding our 1Q2012 results: (1) Pre-tax earnings in the Bankers Life segment included the following items: Favorable reserve developments in the Medicare supplement and long-term care blocks $ 21.0 Settlement with state securities regulators (10.0) $ 11.0 (2) Pre-tax earnings in the Other CNO segment included the following items: Tentative settlement in the Nicholas case $ (20.0) Favorable margins in the life and annuity blocks 5.0 $ (15.0) (3) Pre-tax earnings in the Corporate Operations segment included the following items: Increase in the value of Company-owned life insurance $ 6.0 Investment trading activities 6.0 Relocation of Bankers Life's primary office (7.0) $ 5.0

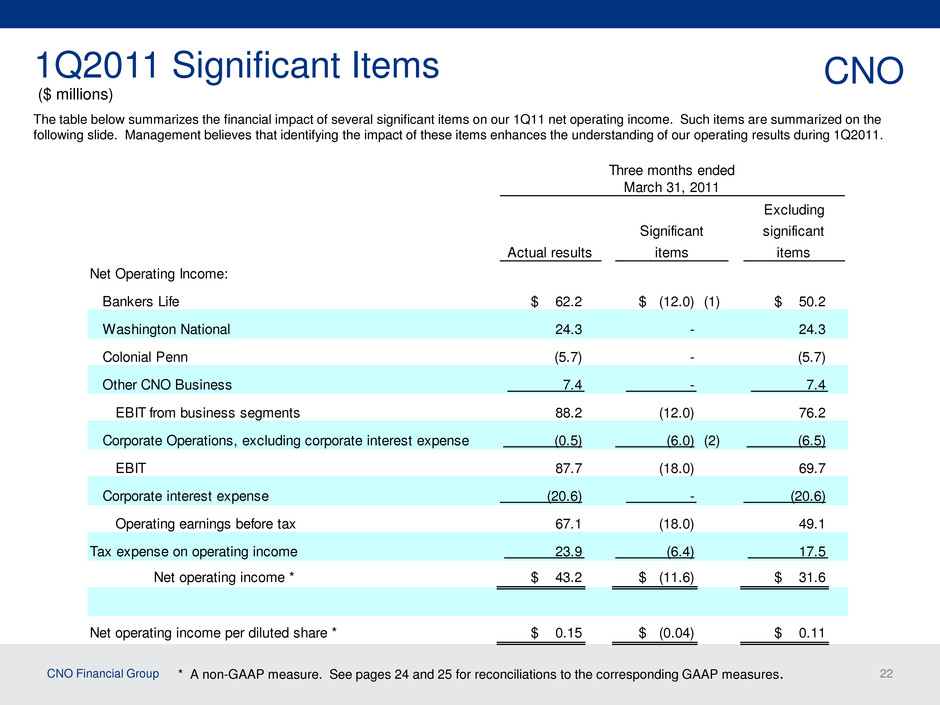

CNO Financial Group 22 1Q2011 Significant Items CNO ($ millions) The table below summarizes the financial impact of several significant items on our 1Q11 net operating income. Such items are summarized on the following slide. Management believes that identifying the impact of these items enhances the understanding of our operating results during 1Q2011. Net Operating Income: Bankers Life $ 62.2 $ (12.0) (1) $ 50.2 Washington National Colonial Penn Other CNO Business EBIT from business segments Corporate Operations, excluding corporate interest expense (2) EBIT Corporate interest expense Operating earnings before tax Tax expense on operating income Net operating income * $ 43.2 $ (11.6) $ 31.6 Net operating income per diluted share * $ 0.15 $ (0.04) $ 0.11 67.1 (18.0) 49.1 23.9 (6.4) 17.5 87.7 (18.0) 69.7 (20.6) - (20.6) 88.2 (12.0) 76.2 (0.5) (6.0) (6.5) (5.7) - (5.7) 7.4 - 7.4 24.3 - 24.3 Three months ended March 31, 2011 Actual results Significant items Excluding significant items * A non-GAAP measure. See pages 24 and 25 for reconciliations to the corresponding GAAP measures.

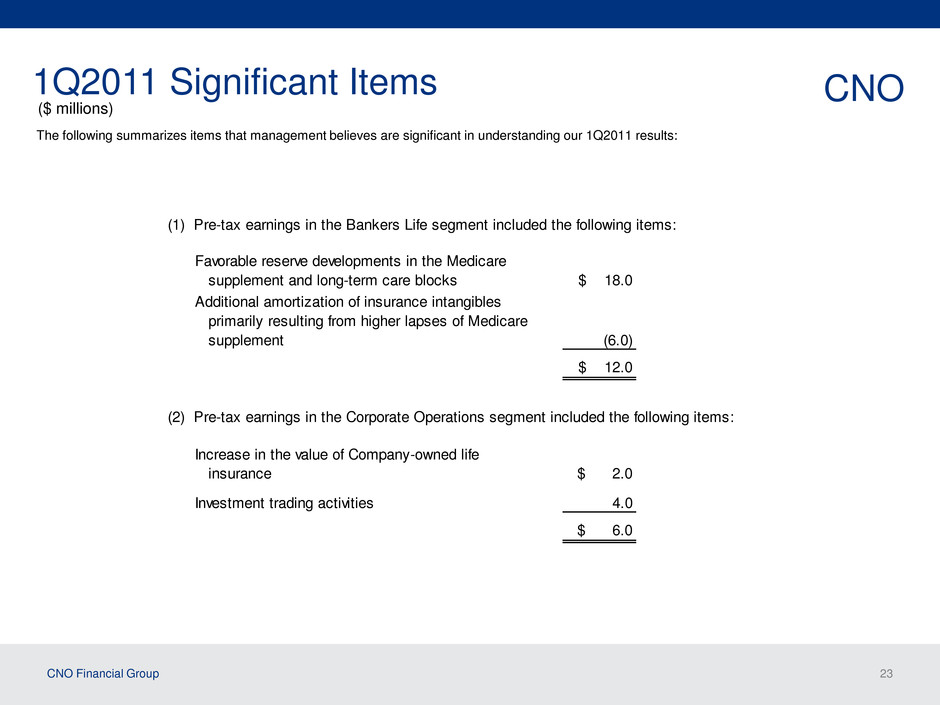

CNO Financial Group 23 1Q2011 Significant Items CNO ($ millions) The following summarizes items that management believes are significant in understanding our 1Q2011 results: (1) Pre-tax earnings in the Bankers Life segment included the following items: Favorable reserve developments in the Medicare supplement and long-term care blocks $ 18.0 Additional amortization of insurance intangibles primarily resulting from higher lapses of Medicare supplement (6.0) $ 12.0 (2) Pre-tax earnings in the Corporate Operations segment included the following items: Increase in the value of Company-owned life insurance $ 2.0 Investment trading activities 4.0 $ 6.0

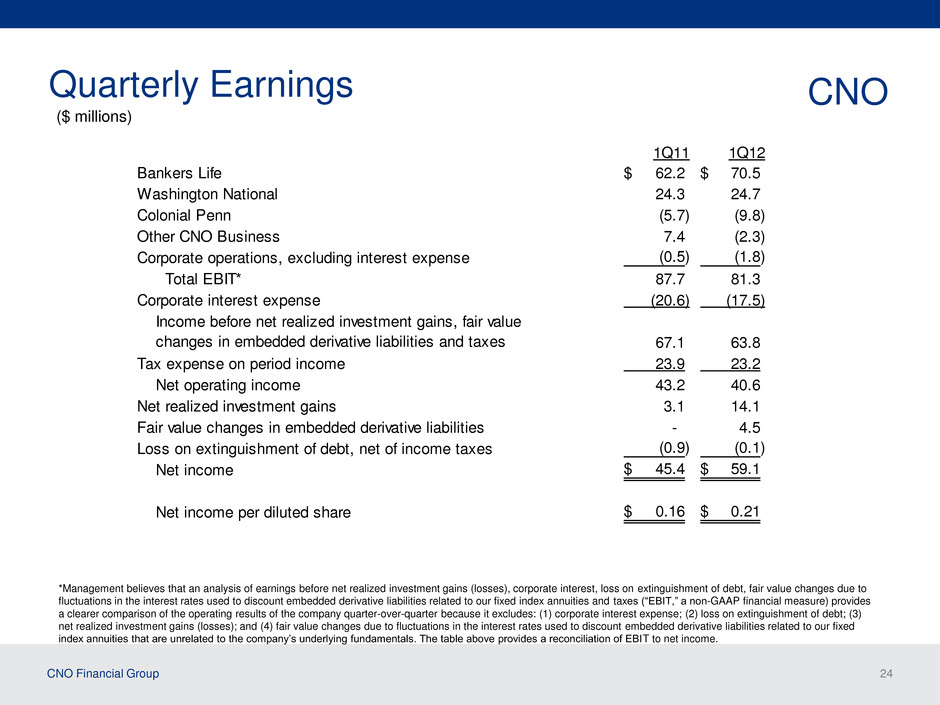

CNO Financial Group 24 Quarterly Earnings CNO *Management believes that an analysis of earnings before net realized investment gains (losses), corporate interest, loss on extinguishment of debt, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and taxes (“EBIT,” a non-GAAP financial measure) provides a clearer comparison of the operating results of the company quarter-over-quarter because it excludes: (1) corporate interest expense; (2) loss on extinguishment of debt; (3) net realized investment gains (losses); and (4) fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities that are unrelated to the company’s underlying fundamentals. The table above provides a reconciliation of EBIT to net income. 1Q11 1Q12 Bankers Life 62.2$ 70.5$ Washington National 24.3 24.7 Colonial Penn (5.7) (9.8) Other CNO Business 7.4 (2.3) Corporate operations, excluding interest expense (0.5) (1.8) Total EBIT* 87.7 81.3 Corporate interest expense (20.6) (17.5) 67.1 63.8 Tax expense on period income 23.9 23.2 Net operating income 43.2 40.6 Net realized investment gains 3.1 14.1 Fair value changes in embedded derivative liabilities - 4.5 Loss on extinguishment of debt, net of income taxes (0.9) (0.1) Net income 45.4$ 59.1$ Net income per diluted share 0.16$ 0.21$ Income before net realized investment gains, fair value changes in embedded derivative liabilities and taxes ($ millions)

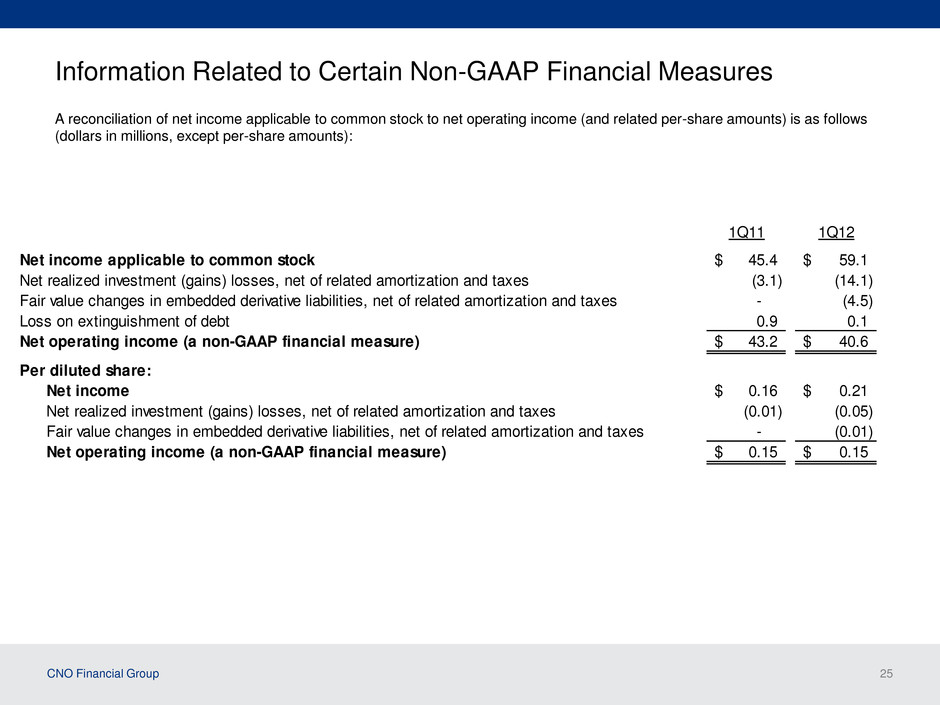

CNO Financial Group 25 Information Related to Certain Non-GAAP Financial Measures A reconciliation of net income applicable to common stock to net operating income (and related per-share amounts) is as follows (dollars in millions, except per-share amounts): 1Q11 1Q12 Net income applicable to common stock 45.4$ 59.1$ Net realized investment (gains) losses, net of related amortization and taxes (3.1) (14.1) Fair value changes in embedded derivative liabilities, net of related amortization and taxes - (4.5) Loss on extinguishment of debt 0.9 0.1 Net operating income (a non-GAAP financial measure) 43.2$ 40.6$ Per diluted share: Net income 0.16$ 0.21$ Net realized investment (gains) losses, net of related amortization and taxes (0.01) (0.05) Fair value changes in embedded derivative liabilities, net of related amortization and taxes - (0.01) Net operating income (a non-GAAP financial measure) 0.15$ 0.15$

CNO Financial Group 26 Operating earnings measures Management believes that an analysis of net income applicable to common stock before loss on extinguishment or modification of debt, net realized gains or losses, fair value changes due to fluctuations in the interest rates used to discount embedded derivative liabilities related to our fixed index annuities and increases or decreases to our valuation allowance for deferred tax assets (“net operating income,” a non-GAAP financial measure) is important to evaluate the performance of the Company and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because these items are unrelated to the Company’s continuing operations. Information Related to Certain Non-GAAP Financial Measures

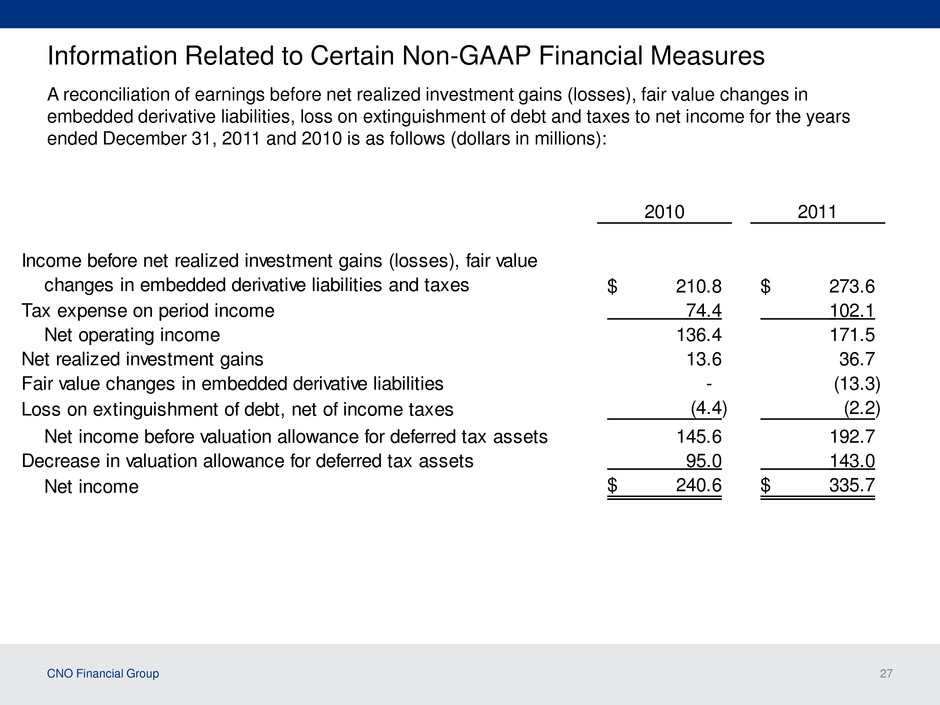

CNO Financial Group 27 Information Related to Certain Non-GAAP Financial Measures A reconciliation of earnings before net realized investment gains (losses), fair value changes in embedded derivative liabilities, loss on extinguishment of debt and taxes to net income for the years ended December 31, 2011 and 2010 is as follows (dollars in millions): 2010 2011 210.8$ 273.6$ Tax exp n e on period income 74.4 102.1 Net operating income 136.4 171.5 Net realized investment gains 13.6 36.7 Fair value changes in embedded derivative liabilities - (13.3) Loss on extinguishment of debt, net of income taxes (4.4) (2.2) Net income before valuation allowance for deferred tax assets 145.6 192.7 Decrease in valuation allowance for deferred tax assets 95.0 143.0 Net income 240.6$ 335.7$ Income before net realized investment gains (losses), fair value changes in embedded derivative liabilities and taxes

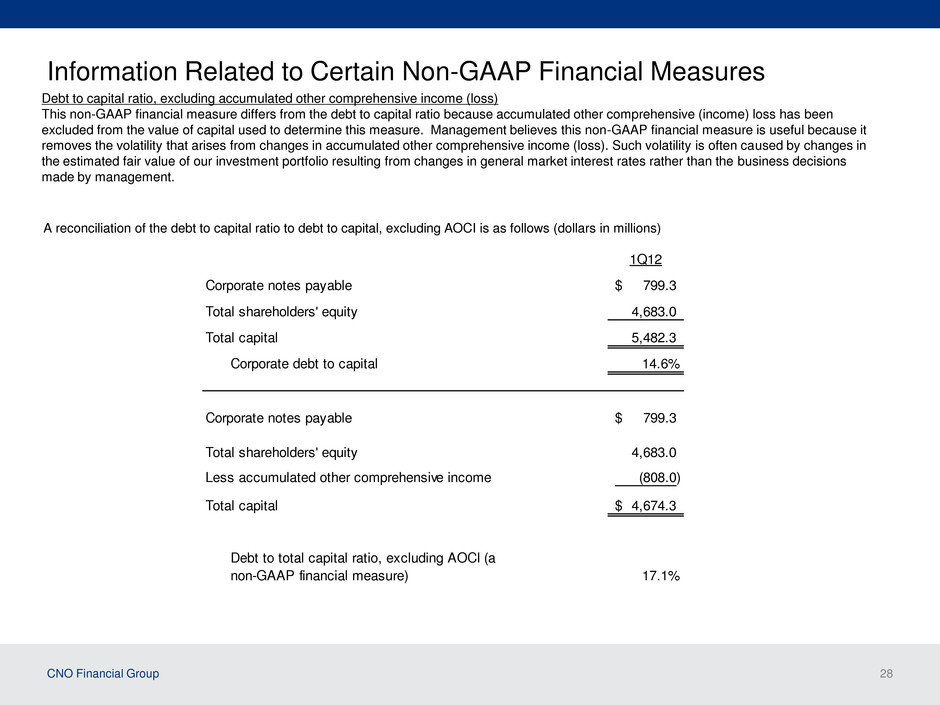

CNO Financial Group 28 Information Related to Certain Non-GAAP Financial Measures A reconciliation of the debt to capital ratio to debt to capital, excluding AOCI is as follows (dollars in millions) 1Q12 Corporate notes payable 799.3$ Total shareholders' equity 4,683.0 Total capital 5,482.3 Corporate debt to capital 14.6% Corporate notes payable 799.3$ Total shareholders' equity 4,683.0 Less accumulated other comprehensive income (808.0) Total capital 4,674.3$ Debt to total capital ratio, excluding AOCI (a non-GAAP financial measure) 17.1% Debt to capital ratio, excluding accumulated other comprehensive income (loss) This non-GAAP financial measure differs from the debt to capital ratio because accumulated other comprehensive (income) loss has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP financial measure is useful because it removes the volatility that arises from changes in accumulated other comprehensive income (loss). Such volatility is often caused by changes in the estimated fair value of our investment portfolio resulting from changes in general market interest rates rather than the business decisions made by management.