Attached files

| file | filename |

|---|---|

| 8-K - NORTHWESTERN CORP | a8-k.htm |

Utility Shareholders of SD – Regional Meeting – Aberdeen, SD Best Western- Ramkota Hotel June 12, 2012

2 Forward looking statements During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s public filings with the SEC. 2

3 Who we are Financial update Investment opportunity outlook Outline

4 Who we are Our Vision: Enriching lives through a safe, sustainable energy future Our Mission: Working together to deliver safe, reliable and innovative energy solutions Our Values: Safety Excellence Respect Value Integrity Community Environment

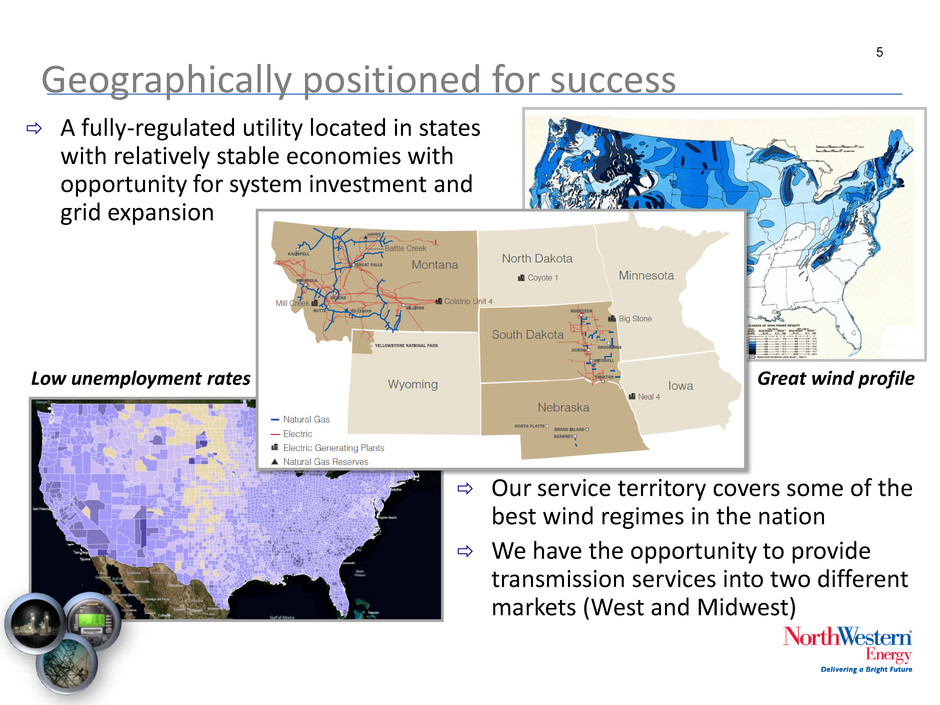

5 Geographically positioned for success Our service territory covers some of the best wind regimes in the nation We have the opportunity to provide transmission services into two different markets (West and Midwest) Great wind profile Low unemployment rates A fully-regulated utility located in states with relatively stable economies with opportunity for system investment and grid expansion

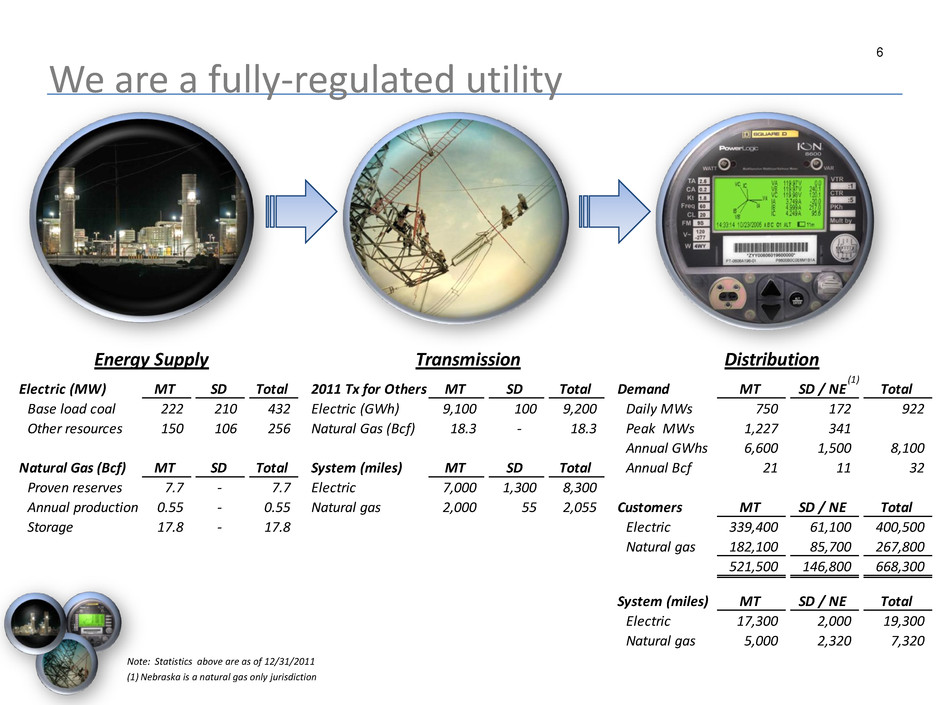

6 We are a fully-regulated utility Note: Statistics above are as of 12/31/2011 (1) Nebraska is a natural gas only jurisdiction (1) Energy Supply Transmission Distribution Electric (MW) MT SD Total 2011 Tx for Others MT SD Total Demand MT SD / NE Total Base load coal 222 210 432 Electric (GWh) 9,100 100 9,200 Daily MWs 750 172 922 Other resources 150 106 256 Natural Gas (Bcf) 18.3 - 18.3 Peak MWs 1,227 341 Annual GWhs 6,600 1,500 8,100 Natural Gas (Bcf) MT SD Total System (miles) MT SD Total Annual Bcf 21 11 32 Proven reserves 7.7 - 7.7 Electric 7,000 1,300 8,300 Annual production 0.55 - 0.55 Natural gas 2,000 55 2,055 Customers MT SD / NE Total Storage 17.8 - 17.8 Electric 339,400 61,100 400,500 Natural gas 182,100 85,700 267,800 521,500 146,800 668,300 System (miles) MT SD / NE Total Electric 17,300 2,000 19,300 Natural gas 5,000 2,320 7,320

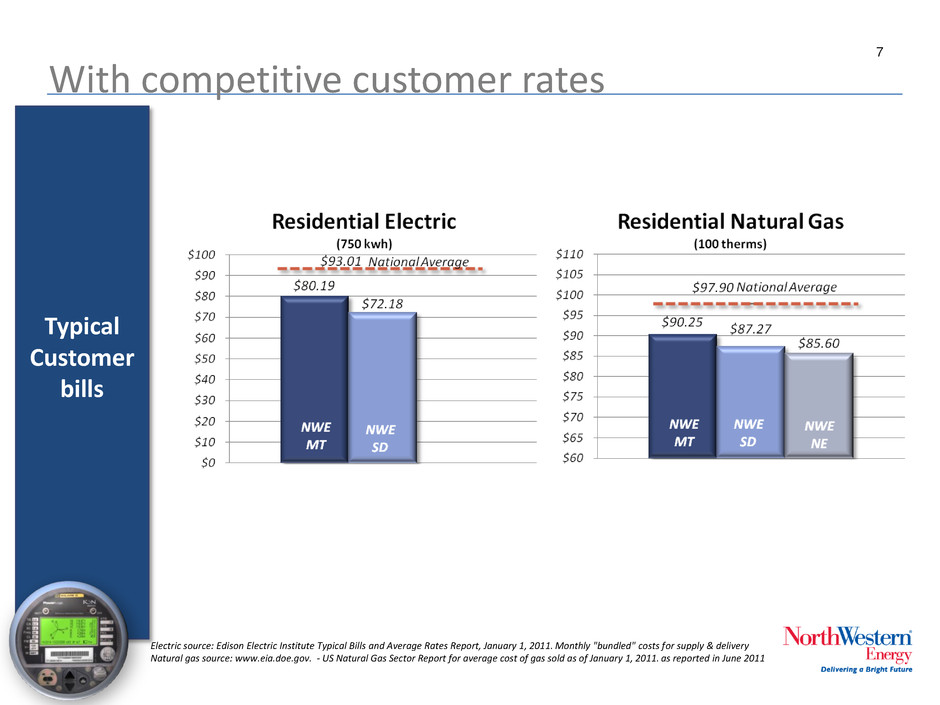

7 With competitive customer rates Electric source: Edison Electric Institute Typical Bills and Average Rates Report, January 1, 2011. Monthly "bundled" costs for supply & delivery Natural gas source: www.eia.doe.gov. - US Natural Gas Sector Report for average cost of gas sold as of January 1, 2011. as reported in June 2011 Typical Customer bills

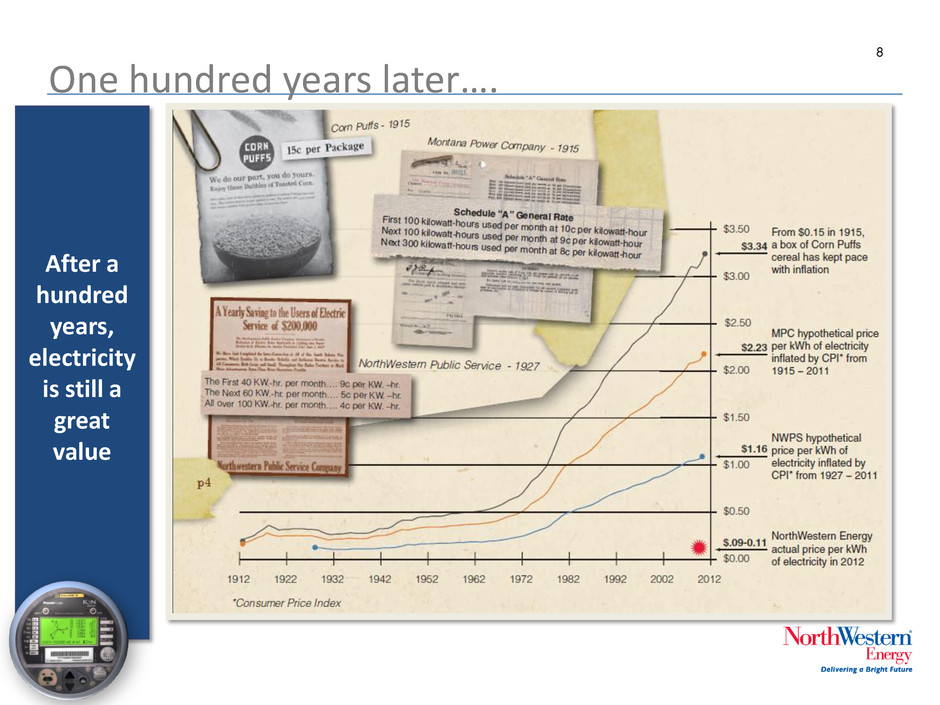

8 One hundred years later…. After a hundred years, electricity is still a great value

9 Who we are Financial update Investment opportunity outlook Outline

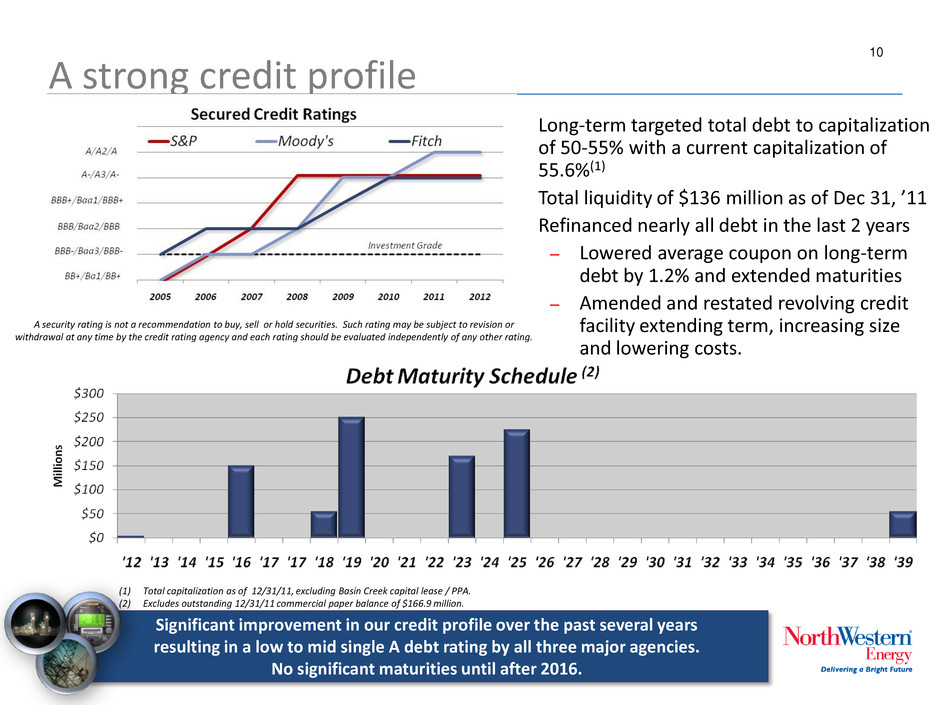

10 A strong credit profile (1) Total capitalization as of 12/31/11, excluding Basin Creek capital lease / PPA. (2) Excludes outstanding 12/31/11 commercial paper balance of $166.9 million. Significant improvement in our credit profile over the past several years resulting in a low to mid single A debt rating by all three major agencies. No significant maturities until after 2016. Long-term targeted total debt to capitalization of 50-55% with a current capitalization of 55.6%(1) Total liquidity of $136 million as of Dec 31, ’11 Refinanced nearly all debt in the last 2 years – Lowered average coupon on long-term debt by 1.2% and extended maturities – Amended and restated revolving credit facility extending term, increasing size and lowering costs. A security rating is not a recommendation to buy, sell or hold securities. Such rating may be subject to revision or withdrawal at any time by the credit rating agency and each rating should be evaluated independently of any other rating.

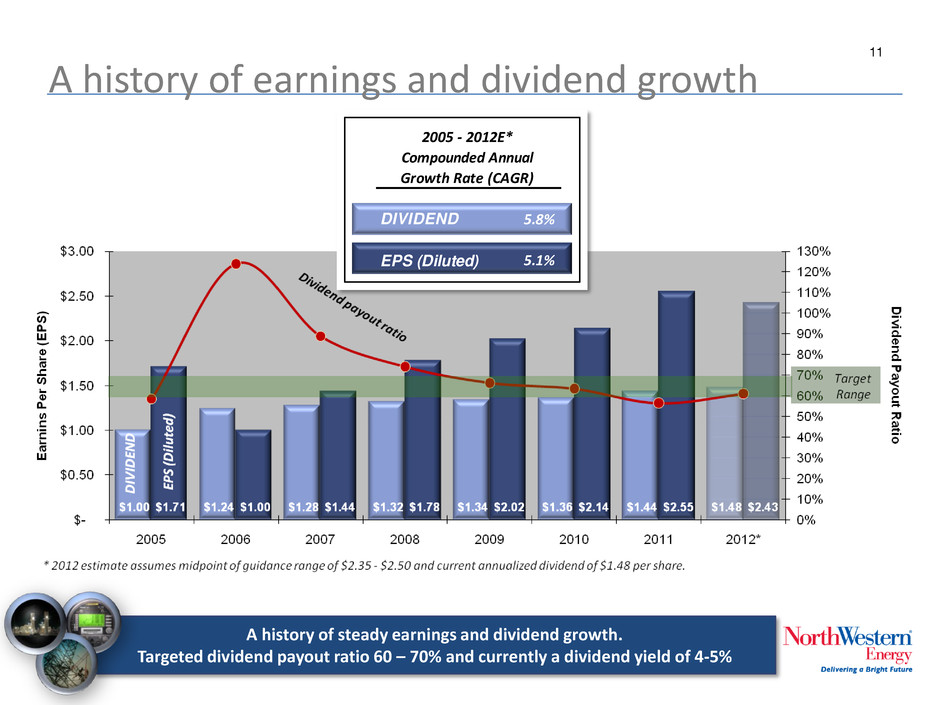

11 A history of earnings and dividend growth A history of steady earnings and dividend growth. Targeted dividend payout ratio 60 – 70% and currently a dividend yield of 4-5% 2005 - 2012E* Compounded Annual Growth Rate (CAGR) DIVIDEND 5.8% EPS (Diluted) 5.1%

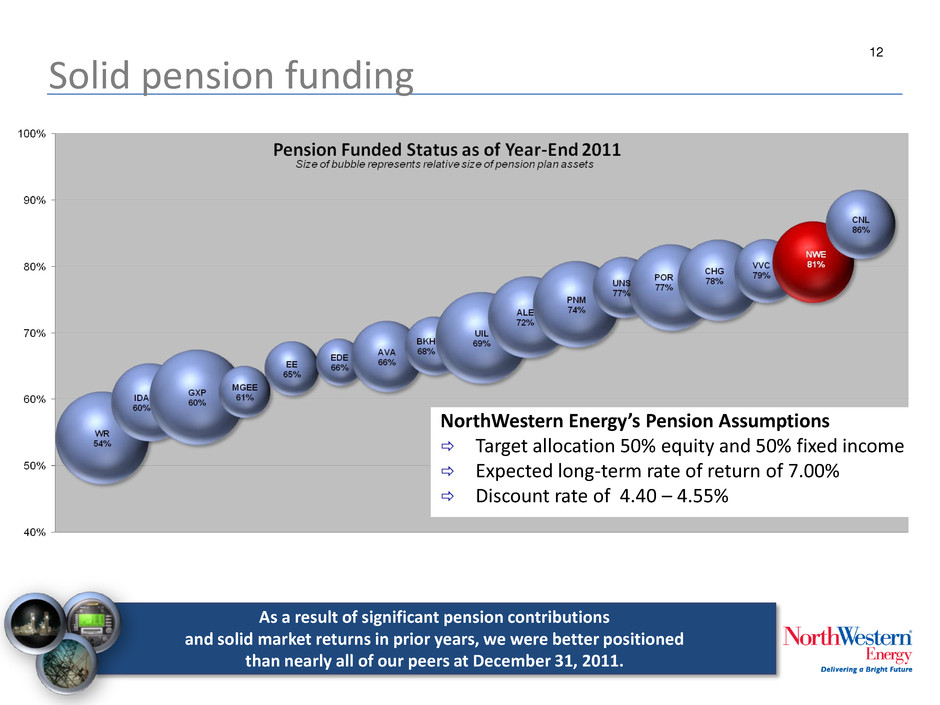

12 Solid pension funding 12 As a result of significant pension contributions and solid market returns in prior years, we were better positioned than nearly all of our peers at December 31, 2011. NorthWestern Energy’s Pension Assumptions Target allocation 50% equity and 50% fixed income Expected long-term rate of return of 7.00% Discount rate of 4.40 – 4.55%

13 Who we are Financial update Investment opportunity outlook Outline

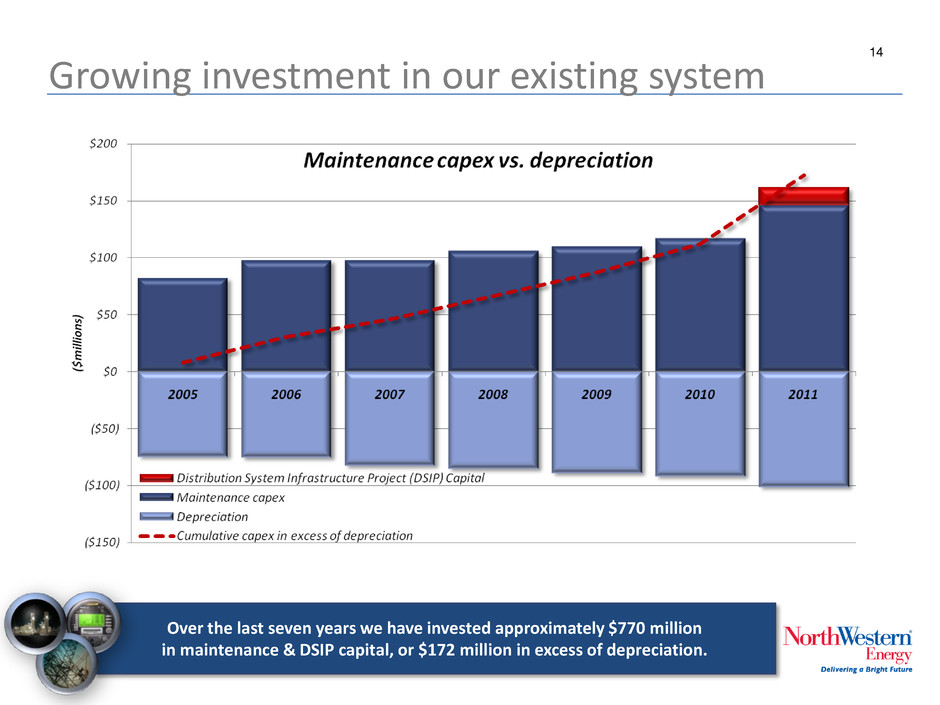

14 Growing investment in our existing system Over the last seven years we have invested approximately $770 million in maintenance & DSIP capital, or $172 million in excess of depreciation.

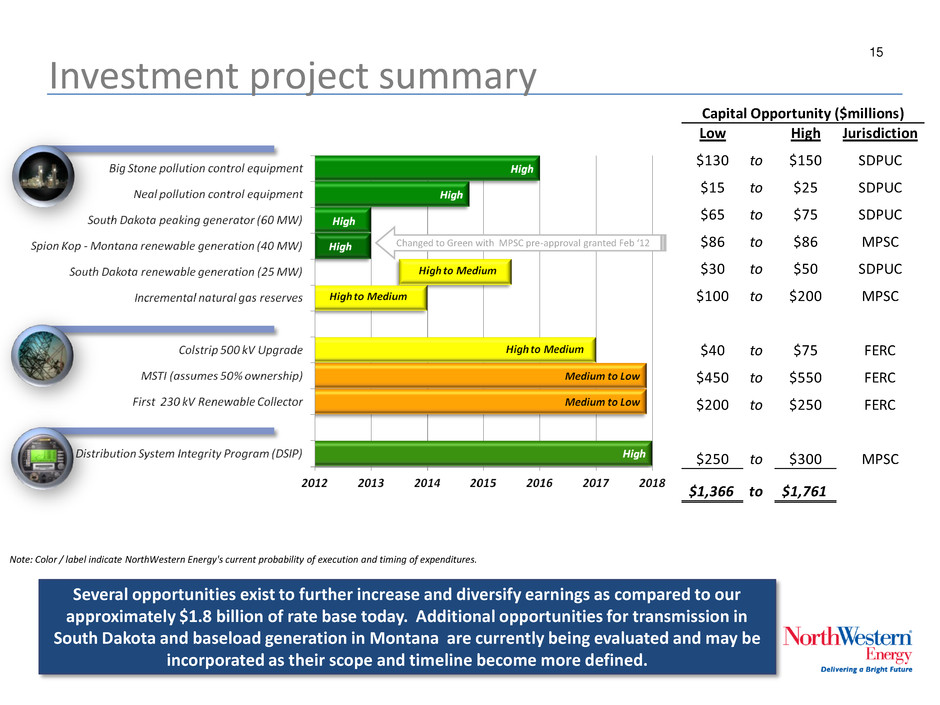

15 Investment project summary Several opportunities exist to further increase and diversify earnings as compared to our approximately $1.8 billion of rate base today. Additional opportunities for transmission in South Dakota and baseload generation in Montana are currently being evaluated and may be incorporated as their scope and timeline become more defined. Note: Color / label indicate NorthWestern Energy's current probability of execution and timing of expenditures. Changed to Green with MPSC pre-approval granted Feb ‘12 Capital Opportunity ($millions) Low High Jurisdiction $130 to $150 SDPUC $15 to $25 SDPUC $65 to $75 SDPUC $86 to $86 MPSC $30 to $50 SDPUC $100 to $200 MPSC $40 to $75 FERC $450 to $550 FERC $200 to $250 FERC $250 to $300 MPSC $1,366 to $1,7612018

16 Conclusion Fully- regulated utility Financially sound Strong cash flows Attractive dividend Realistic investment opportunities to invest Free Cash Flow

17 Questions? Thank you from all of us at NorthWestern Energy.