Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - Vitacost.com, Inc. | v315324_8k.htm |

Vitacost.com Analyst Day Thursday June 7, 2012

3 Agenda ▪ Jeff Horowitz –CEO Company Highlights & SKU Expansion ▪ David Zucker, Ph.D. –CMO Marketing Strategy ▪ Bert Wegner –COO Expand & Optimize Fulfillment ▪ Brian Helman –CFO Financial Performance & LT Goals

4 Except for historical information contained herein, the statemen ts in this presentation are forward -looking and made pursuant to the safe harbor provisions of the Private Secur ities Litigation Reform Act of 1995. Forward - looking statements made herein, which include statements regardi ng the Company’s future growth prospects, five year target operating model and future financial performance, the Company’s customer acquisition strategy and expectations regarding the pace of customer growth, the Comp any’s plans to invest in and the timing of infrastructure improvements, and the Company’s expectations regarding improved fulfillment costs and outbound productivity, involve known and unknown risks and uncertainties,which may cause the Company’s actual results in current or future periods to differ materially from those ant icipated or projected herein. Those risks and uncertainties include, among other things, the current global ec onomic downturn or recession; difficulty expanding the Company’s distribution facilities; significant competition in the Compan y’s industry; unfavorable publicity or consumer perception of the Company’s products on the Internet; the incurrence of material product liability and product recall costs; inability to defend intellec tual property claims; costs of compliance and the Company’s failure to comply with government regulations; the Company’s failure to keep pace with the demands of customers for new products; disruptions in the Company ’s manufacturing system, including information technology systems, or losses of manufacturing certifications; o r the lack of long-term experience with human consumption of some of the Company’s products with innovative ingredients. Those and other risks a re more fully described in the Company’s filings with the Securities and Exchange Commission, includingthe Company’s Form 10-K for the full year ended December 31, 2011 and in the Company's subsequent filings with the Securities and Exchange Commission made prior to or after the date hereof. Safe Harbor Summary

5 Jeffrey Horowitz Chief Executive Officer

6 Vision "To enrich lives, inspire wellness, and support a healthy lifestyle with the best products available at the best prices."

7 Company Highlights ▪ Market Leader in Online Health & Wellness Products ▪ Positive Category Dynamics ▪ Unique, Competitive Position ▪ Rebuilt Management –Significant Industry Experience ▪ Execution of Growth Initiatives

8 Market Leader Revenue CAGR 27% $ in mil Customer Base CAGR 26%

Value Proposition To Customers

10 Attractive Industry Dynamics Health and Wellness Mega Trend Increasing Consumer Awareness Favorable Demographics Rising Healthcare Costs

11 Total US Supplements –$28B Source: NBJ 2011 Direct Selling Report US Supplements –All Channels US Supplements –Online Channel CAGR 14.9% CAGR 4.2% $ in Billions $ in Billions

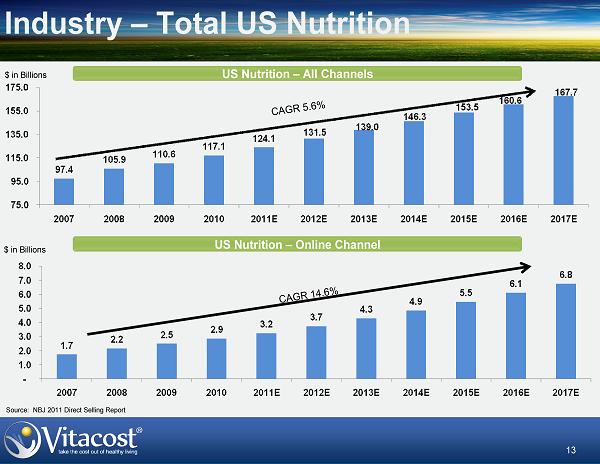

12 Industry –Total US Nutrition -$117B Source: NBJ 2011 Direct Selling Report ($ Billions)

13 Industry –Total US Nutrition Source: NBJ 2011 Direct Selling Report US Nutrition –All Channels US Nutrition –Online Channel CAGR 14.6% CAGR 5.6% $ in Billions $ in Billions

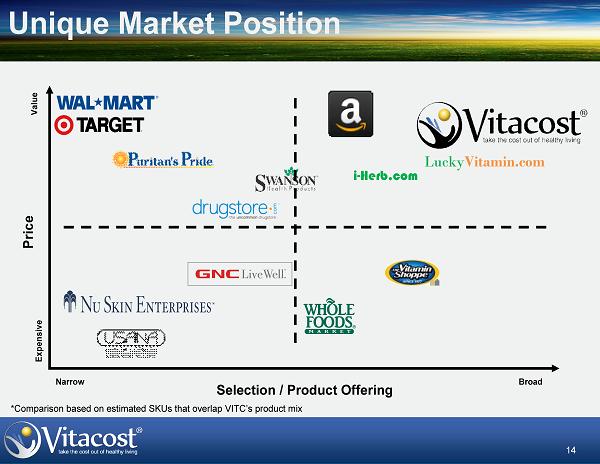

14 Unique Market Position Selection / Product Offering Price Narrow Broad Expensive Value LuckyVitamin.com i-Herb.com *Comparison based on estimated SKUs that overlap VITC’s product mix

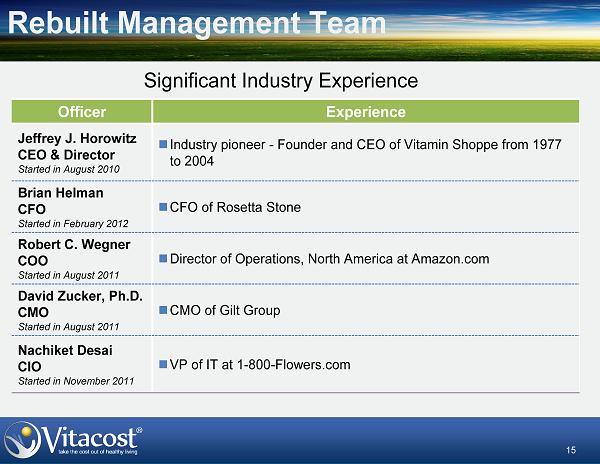

15 Rebuilt Management Team Officer Experience Jeffrey J. Horowitz CEO & Director Started in August 2010 Industry pioneer -Founder and CEO of Vitamin Shoppe from 1977 to 2004 Brian Helman CFO Started in February 2012 CFO of Rosetta Stone Robert C.Wegner COO Started in August 2011 Director of Operations, North America at Amazon.com David Zucker, Ph.D. CMO Started in August 2011 CMO of Gilt Group Nachiket Desai CIO Started in November 2011 VP of IT at 1-800-Flowers.com Significant Industry Experience

16 Significant Accomplishments to Date ▪ Reinitiated New Proprietary Product Development ▪ Strategic Addition of SKUs in Faster Growing Categories ▪ Significantly Accelerated New Customer Growth ▪ Expanded and Optimized Fulfillment Capabilities ▪ Reduced Shipping Costs ▪ Redesigned Website and Updated Mobile Apps

17 Product Expansion

18 Executing on Sales Growth Initiatives ▪Expand Product Offerings ▪ Expand Customer Base ▪ Increase Brand and Company Awareness ▪ Increase Lifetime Value ▪ International Expansion

19 Expand Product Offerings ▪ 37,000+ SKUs ▪ Launching > 175 Proprietary SKUs in 2012 ▪ Expanding Third Party SKUs into Fast Growing Categories such as Food, Beauty and Sports Nutrition ▪ Recent FC Expansion Capacity > 50,000 SKUs at Each of the Two Locations

20 Expand Product Offerings -Proprietary Proprietary Products ▪92% of Proprietary is VMHS ▪14% y/y growth in 1Q12 ▪926 SKUs as of 1Q12 ▪> 175 New Products Launching in 2012 ▪23% of 1Q12 Total Product Revenue

21 Transitioned NSI to Vitacost Brand ▪ Strengthens Vitacost Brand Equity ▪ Clarifies Value Proposition to Customers ▪ Completed during 4Q11 Before After

22 Expand Product Offerings -Current Mix Third Party Products ▪36,000+ SKUs ▪~1,600 Brands ▪77% of 1Q12 Product Revenue VMHS Sports Nutrition Beauty Natural / Organic Food Other

23 Criteria for New Product Selection ▪ Highly Analytical Approach ▪ Searches on Vitacost.com, Google & Competitors ▪ Low Risk Initial Buys ▪ Purchase Small Amount of Inventory ▪ Rigorous Analysis of Sales ▪ Discontinue Unproductive SKUs

24 Transformation Into Broad Health and Wellness Provider Product Mix as a Percentage of Sales ▪ 1Q12 VMHS up 15% y/y ▪ 1Q12 Non-VMHS up 66% y/y

25 We Take the Cost Out of Healthy Living Shopping Basket of Top 75 Food SKUs (1) Vitacost.com and Whole Foods prices as of 5/30/12: Certainproducts on Vitacost.com sold in limited quantities. 22% Savings with Vitacost.com $362.07 $281.38

David Zucker, Ph.D. Chief Marketing Officer

27 Executing on Sales Growth Initiatives ▪ Expand Product Offerings ▪Expand Customer Base ▪ Increase Brand and Company Awareness ▪ Increase Lifetime Value ▪ International Expansion

28 Focus Expand Reach Increase LTV Exposure to Vitacost.com Purchase

29 Expand Customer Base New Customers up 152% y/y in 1Q12! # in 000s

30 Winning in All Channels Affiliates & Partnerships Refer-A- Friend SEM & SEO New and Returning Customers Mobile Social Media

31 Customer Acquisition Cost ▪ Allocate 100% of Paid Marketing to New Customers ▪ Make $ on 2 nd Order

32 Vitacost Customer Source: Appended demographic data and Merkle US database •Demographic data appended to existing and new customers •Average age 49.8: •Dropped 2 years in last 9 months •Now at the US average •Predominantly female 70% and married 83% •71% have at least some college education (56% US) •Average income: •$80k compared to $50k for US •More likely to have younger children •Over index for interests: •Health foods 228 •Sports 150 •Dieting 130 •Pets 128

33 Search Engines SEM CAC down 37% y/y in 1Q12 Revenue from SEO up 37% y/y in 1Q12

34 Affiliates ▪Affiliate CAC Down 41% Y/Y in 1Q12 ▪Affiliate Network Continues to Grow

35 Refer-A-Friend –Huge Success! ▪ Program Launched mid 4Q11 ▪ New Customer Receives $10 Off Initial Order and ‘Refer-er’Receives $10 Credit to Use on a Future Purchase ▪ Program Generated ~80,000 New Customers through 1Q12 ▪ High Repeat Rates ▪ Launching Phase II of RAF in 2H12

36 Mobile –Pushing the Envelope ▪ 4Q11 -Relaunched Mobile Site and Introduced Vitacost Apps ▪ 1Q12 –Launched New Features for Mobile Site ▪ 2Q12 –Launched New Features for Apps ▪ 2H12 –Further Upgrades Expected iPhone App iPad

37 Social Media

38 Executing on Sales Growth Initiatives ▪ Expand Product Offerings ▪ Expand Customer Base ▪Increase Brand and Company Awareness ▪ Increase Lifetime Value ▪ International Expansion

39 New Logo and Corporate Slogan ▪ To enrich lives, inspire wellness, and support a healthy lifestyle with the best products available at the best prices. Circle: Protection, Trust, Global Hand: Nurturing, Touch, Dexterity Ball: Sun, Energy and Fun

40 Website Relaunched in February Old –‘Red’Site New –‘Blue’Site

41 National Media Campaign Radio Print

42 Expanded Online Content Expert Generated Content wellnesstimes.com User Generated Content momonomics.com

43 Expanded Online Content/Partnerships

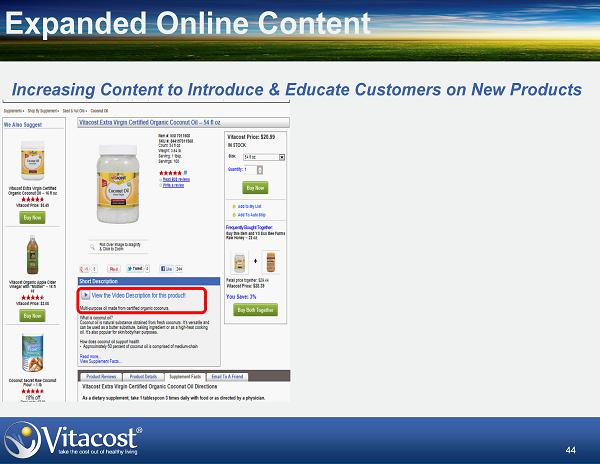

44 Expanded Online Content Increasing Content to Introduce & Educate Customers on New Products

45 Coconut Oil Video

46 Executing on Sales Growth Initiatives ▪ Expand Product Offerings ▪ Expand Customer Base ▪ Increase Brand and Company Awareness ▪Increase Lifetime Value ▪ International Expansion

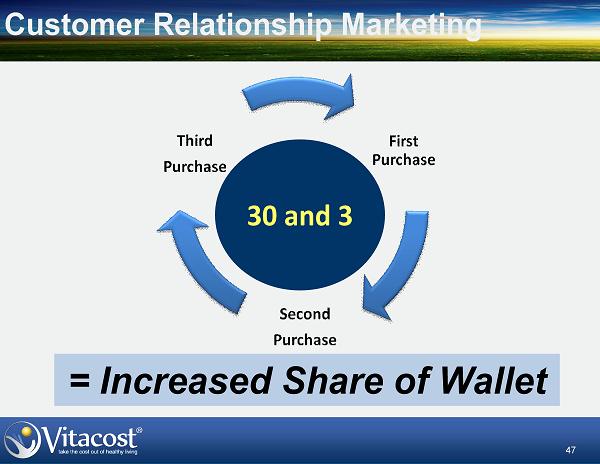

47 Customer Relationship Marketing 30 and 3 = Increased Share of Wallet

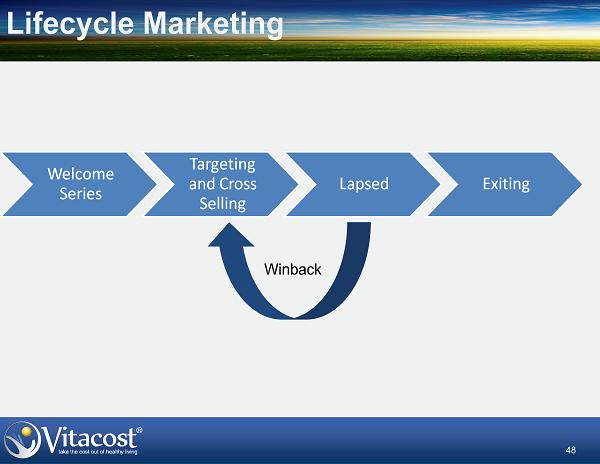

48 Lifecycle Marketing Winback

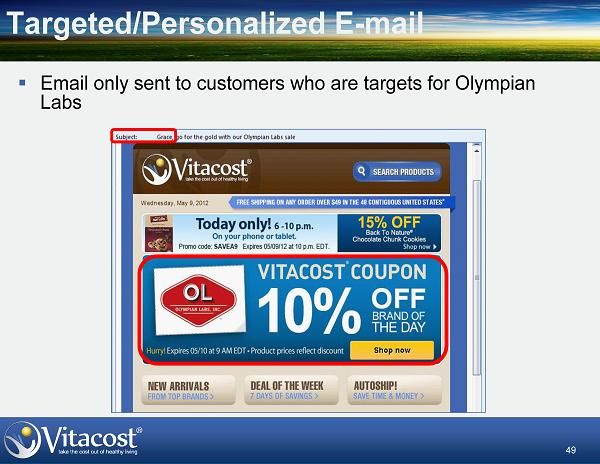

49 Targeted/Personalized E-mail ▪ Email only sent to customers who are targets for Olympian Labs

50 Website Category Redesign Before After ▪Launched May 2012 Improvements: ▪Updated Categorization ▪Re-designed Category Pages ▪Added Sub-category Pages

51 Cross-selling Opportunities

52 Website Upgrade –Personalization Features Added ▪Launched on Product Pages ▪Orders with Personalized Products Have Higher AOV and Units per Order

53 Website Upgrade –Add to Cart Add to Cart w/out Going to Cart Persistent Mini Cart

54 Relaunch AutoShip Program ▪Lowest Price Guarantee ▪Enhanced Usability ▪CSR Management Tool ▪Enhanced Communications ▪Rewards and Free Offer

55 Executing on Sales Growth Initiatives ▪ Expand Product Offerings ▪ Expand Customer Base ▪ Increase Brand and Company Awareness ▪ Increase Lifetime Value ▪International Expansion

56 International Opportunity Vitacost.com ▪ Significant Long-term Opportunity ▪ Currently Ship to 43 Countries ▪ Largest Presence in Canada, UK, Australia, China and Japan

57 Marketing Strategy Summary ▪ Focused on New Customer Growth & Gaining Efficiency in CAC ▪ Focused on Optimizing Customer Lifetime Value & ROI ▪ Improving Customer Shopping Experience Across All Channels

58 Bert Wegner Chief Operating Officer

59 Expand & Optimize Fulfillment ▪Increase Distribution Capacity to Support Higher Levels of Sales Growth ▪Improving Operating Efficiencies ▪Improving Customer Experience ▪Phase II Software/Throughput Upgrade to be Completed 2H12 ▪Investment in 3 rd Fulfillment Center Deferred to 2013

60 Phase I –FC Upgrade Phase 1 –Material Handling and Storage: Completed ▪Construction Complete ▪ In Testing Phase ▪ Increased Storage Capacity at Each Facility to >50,000 SKUs

61 Improving Customer Experience ▪ Increasing Order Processing • Increases Hourly Shipment Capacity • Improves Labor Productivity ▪ Reducing Delivery Time ▪ Enables Zip Codes to Flow Naturally Through Shortest Transportation Zone

62 Improving Operating Efficiency ▪ Increasing Labor Productivity ▪ New Fulfillment Methodology ▪ Kaizen Training ▪ Building Smart Software ▪ Reducing Special Handling Costs ▪ Installed New Shrink Wrap Machines at Both Locations ▪ Increases Speed While Delivering Better Presentation and Protection

63 ‘Before’and ‘After’Video

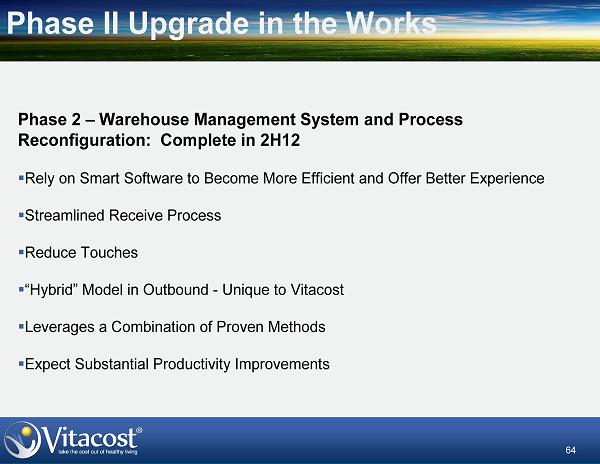

64 Phase II Upgrade in the Works Phase 2 –Warehouse Management System and Process Reconfiguration: Complete in 2H12 ▪Rely on Smart Software to Become More Efficient and Offer BetterExperience ▪Streamlined Receive Process ▪Reduce Touches ▪“Hybrid”Model in Outbound -Unique to Vitacost ▪Leverages a Combination of Proven Methods ▪Expect Substantial Productivity Improvements

65 Transportation Costs ▪ Initiated Freight Savings Program in 3Q11 ▪ Freight Savings Booked in CGS ▪ Fees Paid Related to Freight Savings Program Booked in Fulfillment ▪ Contract Obligation Expires in 4Q 2013 ▪ Cost per Package Down 14% Y/Y in 1Q12 ▪ Will see incremental improvements by reducing long zone shippingout of NV ▪ Reviewing opportunity of increased usage of poly bags for non-fragile items. ▪ Started research on reducing inbound freight costs and improving our international experience

66 Fulfillment Cost per Order ▪ Significant Improvement Expected by Year-end 2012 ▪ Order Consolidation ▪ Streamlined Receive ▪ Lean Manufacturing Principles ▪ Faster Packaging ▪ Reported Fulfillment Costs include fixed expenses for merchandising and supply chain ▪ 1Q12 Fulfillment Cost per Order Flat Y/Y Ex Fee Related to Freight Reduction Program ▪ Variable expenses include warehouse labor and shipping supplies ▪ Fixed expenses include salaried employees, rent, depreciation, etc. ▪ 1Q12 Fulfillment Cost per Order Down Slightly from 4Q11 ▪ Significant Improvement Expected by Year-end 2012 *Fulfillment cost per order excludes fees related to freight reduction program

67 Brian Helman Chief Financial Officer

68 Historical Sales vs. EBITDA Quarterly Revenue $ in MM $ in MM # of new customers Up 12% Y/Y Up 22% Y/Y Up 26% Y/Y Up 14% Y/Y Up 31% Y/Y New Customer Growth & EBITDA Investment in customer acquisition

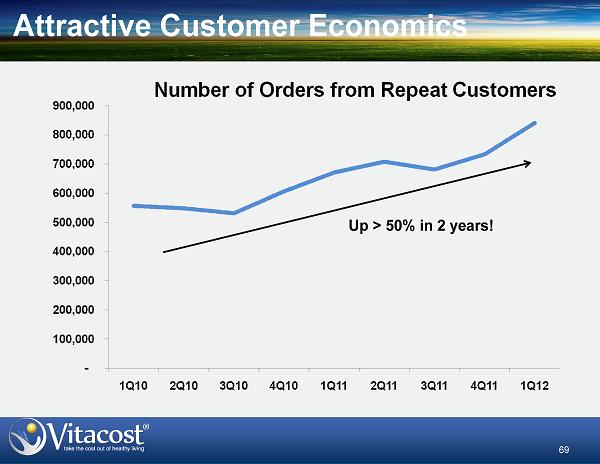

69 Attractive Customer Economics Up > 50% in 2 years!

70 1Q12 Financial Highlights ▪ Strong Revenue Growth Driven by 416,000 Total New customers ▪ Stabilization in GM from 4Q11 ▪ Fulfillment Cost per Order Flat Y/Y Ex Fees Related to Freight Savings Program ▪ Variable CAC Ex Amazon Flat Y/Y ▪ Gaining Leverage on G&A Revenue Gross Profit Up 31% Y/Y $15.4 $19.1 Up 25% Y/Y GM 24.1% GM 22.9% $ in MM $ in MM

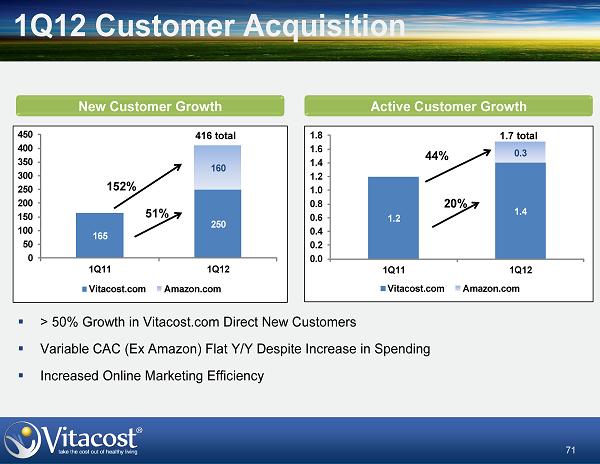

71 1Q12 Customer Acquisition ▪ > 50% Growth in Vitacost.com Direct New Customers ▪ Variable CAC (Ex Amazon) Flat Y/Y Despite Increase in Spending ▪ Increased Online Marketing Efficiency New Customer Growth Active Customer Growth (# in 000s) (# in MM) 165 250 160 0 50 100 150 200 250 300 350 400 450 1Q11 1Q12 Vitacost.com Amazon.com 416 total 152% 51% 1.2 1.4 0.3 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 1Q11 1Q12 Vitacost.com Amazon.com 1.7 total 44% 20%

72 1Q12 Customer Dynamics ▪ Vitacost.com AOV Excluding RAF and Amazon -$74 ▪ Focusing on LTV Growth Not AOV (# in 000s) Orders AOV 1,295 total 55% 30%

73 Amazon 1Q12 ▪ Increasing Customer Awareness ▪ AMZN Customers Loyal to AMZN ▪ 16% of Total Orders ▪ 7% of Revenue ▪ AOV of $30 ▪ Positive Margin After Selling Fees

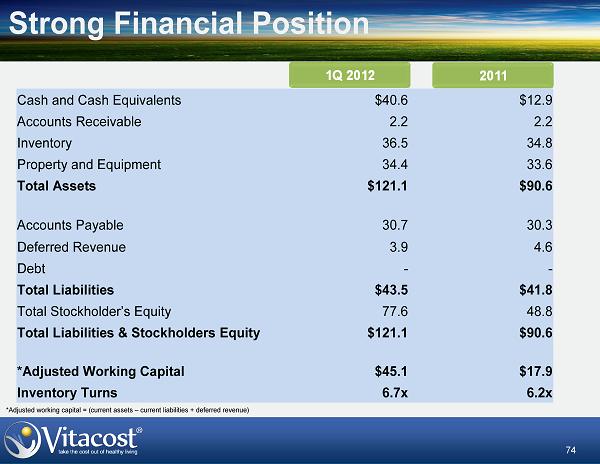

74 Strong Financial Position Cash and Cash Equivalents $40.6 $12.9 Accounts Receivable 2.2 2.2 Inventory 36.5 34.8 Property and Equipment 34.4 33.6 Total Assets $121.1 $90.6 Accounts Payable 30.7 30.3 Deferred Revenue 3.9 4.6 Debt - - Total Liabilities $43.5 $41.8 Total Stockholder’s Equity 77.6 48.8 Total Liabilities & Stockholders Equity $121.1 $90.6 *Adjusted Working Capital $45.1 $17.9 Inventory Turns 6.7x 6.2x *Adjusted working capital = (current assets –current liabilities + deferred revenue)

75 Target Operating Model Revenue 15-20% growth % of Revenue Gross Margin 22-25% Fulfillment 6-8% Sales & Marketing 6-8% General & Administrative 5-7% Add back: Depreciation & Amortization 1-2% *Adjusted EBITDA Margin 6-10% 5-year *Adjusted EBITDA excludes depreciation, amortization, stock-based compensation and certain other expenses