Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - QUESTCOR PHARMACEUTICALS INC | d360089d8k.htm |

June 6,

2012 Jeffries

NASDAQ:

QCOR

NASDAQ:

QCOR

Exhibit 99.1

1 |

2

Safe Harbor Statement

2

Note: Except for the historical information contained herein, this press release contains

forward-looking statements that have been made pursuant to the Private Securities

Litigation Reform Act of 1995. These statements relate to future events or our future

financial performance. In some cases, you can identify forward-looking statements by terminology such as

"believes," "continue," "could," "estimates," "expects,"

"growth," "may," "plans," "potential," "should," "substantial" or

"will" or the negative of such terms and other comparable terminology. These statements

are only predictions. Actual events or results may differ materially. Factors that could

cause or contribute to such differences include, but are not limited to, the following:

Our reliance on Acthar for substantially all of our net sales and profits; Reductions in vials used per

prescription resulting from changes in treatment regimens by physicians or patient compliance

with physician recommendations; The complex nature of our manufacturing process and the

potential for supply disruptions or other business disruptions; The lack of patent

protection for Acthar; and the possible FDA approval and market introduction of

competitive products; Our ability to continue to generate revenue from sales of Acthar to treat

on-label indications associated with NS, and our ability to develop other therapeutic

uses for Acthar; Research and development risks, including risks associated with

Questcor's work in the area of NS and potential work in the area of Lupus, and our reliance on third-

parties to conduct research and development and the ability of research and development to

generate successful results; Our ability to comply with federal and state regulations,

including regulations relating to pharmaceutical sales and marketing practices;

Regulatory changes or other policy actions by governmental authorities and other third parties in

connection with U.S. health care reform or efforts to reduce federal and state government

deficits; Our ability to receive high reimbursement levels from third party payers; An

increase in the proportion of our Acthar unit sales comprised of Medicaid-eligible

patients and government entities; Our ability to estimate reserves required for Acthar used by

government entities and Medicaid-eligible patients and the impact that unforeseen

invoicing of historical Medicaid prescriptions may have upon our results; Our ability to

effectively manage our growth, including the expansion of our NS selling effort, and our

reliance on key personnel; The impact to our business caused by economic conditions; Our ability to

protect our proprietary rights; The risk of product liability lawsuits; Unforeseen business

interruptions and security breache Volatility in Questcor's monthly and quarterly Acthar

shipments, estimated channel inventory and end-user demand, as well as volatility in

our stock price; and Other risks discussed in Questcor's annual report on Form 10-K for the year ended

December 31, 2011 as filed with the Securities and Exchange Commission, or SEC, on February 22,

2012, and other documents filed with the SEC. The risk

factors and other information contained in these documents should be considered in evaluating Questcor's

prospects and future financial performance.

|

3

A biopharmaceutical company whose

product, Acthar, helps patients with serious,

difficult-to-treat medical conditions

A biopharmaceutical company whose

product, Acthar, helps patients with serious,

difficult-to-treat medical conditions

Questcor

3 |

4

Flagship Product:

Flagship Product:

•

Profitable, cash flow positive, $122M** in cash, debt-free

•

Profitable, cash flow positive, $122M** in cash, debt-free

•

19 approved indications

•

19 approved indications

Key Markets*:

Key Markets*:

•

Nephrotic Syndrome, Multiple Sclerosis, Infantile Spasms

•

Several billion dollar market opportunity

•

Nephrotic Syndrome, Multiple Sclerosis, Infantile Spasms

•

Several billion dollar market opportunity

Strategy:

Strategy:

•

Continue to grow Acthar sales in each key market

•

Develop Rheumatology and other on-label markets for Acthar

•

Continue to grow Acthar sales in each key market

•

Develop Rheumatology and other on-label markets for Acthar

Financials:

Financials:

*In

this

presentation,

the

terms

“Nephrotic

Syndrome,”

“Multiple

Sclerosis,”

and

“Infantile

Spasms,”

and

their

abbreviations,

refer

to

the

on-label

indications

for

Acthar

associated

with

such

conditions.

Investors

should

refer

to

the

FDA

approved

Acthar

label,

which

can

be

found

at

http://www.acthar.com/files/Acthar-PI.pdf

.

**As

of

6/4/12

Questcor Overview

4 |

5

5

Questcor

Strategy

-

Pursue

Acthar

Markets

Nephrotic Syndrome (NS)

Multiple Sclerosis (MS)

Infantile Spasms (IS)

Rheumatology |

•

Characterized by excessive spilling of protein

from the kidneys into the urine (proteinuria)

•

Can result in end-stage renal disease (ESRD),

dialysis, transplant

•

Acthar is approved “to induce a diuresis or a

remission of proteinuria in the nephrotic syndrome

without uremia of the idiopathic type or that due to

lupus erythematosus”

•

Significant unmet need

–

Few treatment options

–

Goal of therapy is the significant reduction

of proteinuria

Acthar and Nephrotic Syndrome (NS)

6 |

Paid Rxs

Paid Rxs

5

NS Scripts-Strong Continued Growth

7

28

Notes: Historical trend information is not necessarily indicative of future results. Acthar is

marketed for the on-label indication of nephrotic syndrome, though the chart includes

"Related Conditions" - diagnoses that are either alternative descriptions of the

condition or are closely related to the medical condition which is the focus of the chart. About 5% of

the prescriptions in the tables are for related conditions. Yellow numbers in the bars

show the number of NS sales representatives making calls for the majority of the quarter.Q3

‘11 included expansion and training of new sales people. |

Neurodegenerative disorder

Acute treatment for relapses

Neurodegenerative disorder

Acute treatment for relapses

Acthar and Multiple Sclerosis (MS)

Potential

target for

8

43% get better or

much better

27% get only a

little better

30% stay the same

or get worse

ACTHAR is approved for MS exacerbations, without reference to first line or second

line use but is generally positioned as second

line

as

a

matter

of

marketing

strategy.

See

http://www.acthar.com/files/Acthar-PI.pdf

for

specific

label

information.

*Nickerson, et al (2011) |

Notes: Historical trend information is not necessarily indicative of future

results. Acthar is marketed for the on-label indication of MS

exacerbations

in

adults,

though

the

chart

includes

"Related

Conditions"

-

diagnoses

that

are

either

alternative

descriptions

of

the

condition

or

are closely related to the medical condition which is the focus of the chart. About

5% of the prescriptions in the tables are for related conditions. Yellow

numbers in the bars show the number of MS sales representatives making calls for the majority of the quarter.

Notes: Historical trend information is not necessarily indicative of future

results. Acthar is marketed for the on-label indication of MS

exacerbations

in

adults,

though

the

chart

includes

"Related

Conditions"

-

diagnoses

that

are

either

alternative

descriptions

of

the

condition

or

are closely related to the medical condition which is the focus of the chart. About

5% of the prescriptions in the tables are for related conditions. Yellow

numbers in the bars show the number of MS sales representatives making calls for the majority of the quarter.

77

77

30

30

38

38

MS Scripts-Record of Consistent Growth

Paid Rxs

9 |

•

Devastating, refractory form of childhood epilepsy

•

Unsuccessful treatment may leave infant with

permanent developmental disabilities

•

Ultra-rare orphan disorder

•

Acthar currently used to treat 40-50% of IS patients

•

Targeting select institutions

•

Devastating, refractory form of childhood epilepsy

•

Unsuccessful treatment may leave infant with

permanent developmental disabilities

•

Ultra-rare orphan disorder

•

Acthar currently used to treat 40-50% of IS patients

•

Targeting select institutions

Acthar and Infantile Spasms (IS)

10 |

•

4 key indications on the Acthar label*

–

Systemic lupus erythematosus (Lupus)

–

Polymyositis/Dermatomyositis (PM/DM)

–

Psoriatic arthritis

–

Rheumatoid arthritis

•

High unmet need; difficult to treat

•

Serious health risk if unsuccessfully treated

•

Significant patient population (multi $B opportunity)

•

4 key indications on the Acthar label*

–

Systemic lupus erythematosus (Lupus)

–

Polymyositis/Dermatomyositis (PM/DM)

–

Psoriatic arthritis

–

Rheumatoid arthritis

•

High unmet need; difficult to treat

•

Serious health risk if unsuccessfully treated

•

Significant patient population (multi $B opportunity)

Rheumatology

11

*See

http://www.acthar.com/files/Acthar-PI.pdf

for

specific

label

information. |

Profitable

Profitable

Debt Free

Debt Free

Cash Flow Positive

Cash Flow Positive

Financials

12 |

Growth in

Shipped Vials 13

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

Q1-10

Q2-10

Q3-10

Q4-10

Q1-11

Q2-11

Q3-11

Q4-11

Q1-12

Shipped Vials |

Q1

– 2012

Q1 –

2011

Net Sales ($M)

$96.0

$36.8

Gross Margin

94%

95%

Operating Income ($M)

$57.3

$16.4

Fully Diluted, GAAP EPS

$0.58

$0.17

Q1-2012 Financial Results

•

First quarter vials shipped: 4,111

•

First quarter cash flow from operations: $40.9M

•

Medicaid reserves continue to appear adequate

•

798,285 shares repurchased during Q1-2012

Record Net Sales (up 161%) and Solid Earnings (EPS up 241%)

Record Net Sales (up 161%) and Solid Earnings (EPS up 241%)

14 |

•

Paid Rxs April and May 2012 (estimated)

•

Shipped 1,560 vials in May 2012

–

Compares to 1,350 vials in April 2012 and 4,111 vials in Q1-12

–

Channel inventory level in the normal range on 5/31/2012

•

Operating expenses expected to be up about $10 million in

Q2-2012 over Q1-2012 and another $5 million in Q3-2012

•

Paid Rxs April and May 2012 (estimated)

•

Shipped 1,560 vials in May 2012

–

Compares to 1,350 vials in April 2012 and 4,111 vials in Q1-12

–

Channel inventory level in the normal range on 5/31/2012

•

Operating expenses expected to be up about $10 million in

Q2-2012 over Q1-2012 and another $5 million in Q3-2012

April-May 2012 Metrics

Notes:

Paid

Rx

information

based

on

internal

estimates.

The

table

includes

"Related

Conditions"

-

diagnoses

that

are

either

alternative

descriptions of the condition or are closely related to the medical condition which

is the focus of the chart. About 5% of the prescriptions in the tables are

for related conditions. Notes:

Paid

Rx

information

based

on

internal

estimates.

The

table

includes

"Related

Conditions"

-

diagnoses

that

are

either

alternative

descriptions of the condition or are closely related to the medical condition which

is the focus of the chart. About 5% of the prescriptions in the tables are

for related conditions. DX

April 2012

May 2012

NS

94

100-110

MS

339

360-370

IS

31

30-35

15 |

•

2.2 Million Preferred share buyback

•

17.7 Common share buyback

•

$264 million returned to shareholders in stock buybacks

–

Average repurchase price per share: $13.23

•

59.6

million shares currently outstanding

•

5.0 million share added to buyback authorization

•

4.7 million shares remain on buyback authorization

•

2.2 Million Preferred share buyback

•

17.7 Common share buyback

•

$264 million returned to shareholders in stock buybacks

–

Average repurchase price per share: $13.23

•

59.6

million shares currently outstanding

•

5.0 million share added to buyback authorization

•

4.7 million shares remain on buyback authorization

Share Repurchases: 19.9 Million Shares

Note: all information as of 6/4/12

16 |

•

4.5M shares repurchased during 2012, driven by:

–

Sales/EPS increase

–

NS market traction

–

Sales force expansion

–

Rheumatology opportunity

•

4.5M shares repurchased during 2012, driven by:

–

Sales/EPS increase

–

NS market traction

–

Sales force expansion

–

Rheumatology opportunity

2012 Repurchase Activity

Repurchased shares significantly improved EPS

Q1-2012 EPS accretion from share repurchase through 3/31/2012: 24%

17 |

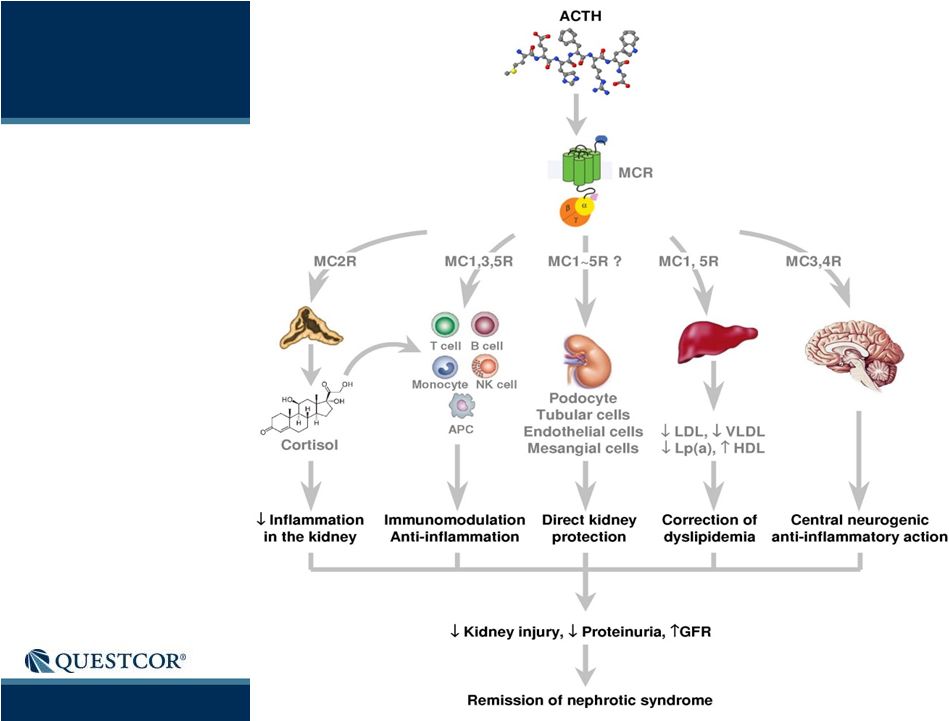

How Does Acthar

Work? •

Acthar treats autoimmune conditions across a variety of organ systems (CNS,

kidney, etc.)

•

Acthar appears to modulate the immune system and associated inflammatory

response through binding to melanocortin receptors

•

The

primary

melanocortin

peptide

(ACTH)

in

Acthar

binds

to

all

5

melanocortin

receptors (MCR1-5); other active peptides are in Acthar as well

–

Indirect effect: Acthar triggers the production of cortisol and

other adrenal

compounds through binding to MCR2 receptors

–

Direct effect: Acthar acts directly at the cellular level by binding to melanocortin

receptors on immune cells and cells in the targeted tissues (e.g., kidney podocytes)

•

All the active ingredients of Acthar have yet to be fully characterized and the

mechanism of action and pharmacokinetic profile of Acthar are not fully known

•

Acthar treats autoimmune conditions across a variety of organ systems (CNS,

kidney, etc.)

•

Acthar appears to modulate the immune system and associated inflammatory

response through binding to melanocortin receptors

•

The

primary

melanocortin

peptide

(ACTH)

in

Acthar

binds

to

all

5

melanocortin

receptors (MCR1-5); other active peptides are in Acthar as well

–

Indirect effect: Acthar triggers the production of cortisol and

other adrenal

compounds through binding to MCR2 receptors

–

Direct effect: Acthar acts directly at the cellular level by binding to melanocortin

receptors on immune cells and cells in the targeted tissues (e.g., kidney podocytes)

•

All the active ingredients of Acthar have yet to be fully characterized and the

mechanism of action and pharmacokinetic profile of Acthar are not fully known

18 |

•

Difficult/impossible to reverse engineer ACTHAR

–

Not well characterized

•

Complex pharmacology

–

Not well characterized

•

Clinical trial(s) required

•

Difficult/impossible to reverse engineer ACTHAR

–

Not well characterized

•

Complex pharmacology

–

Not well characterized

•

Clinical trial(s) required

Biosimilar Pathway Difficult/Impossible

19 |

Market

Rx Value

Market Size*

MS

$40-50K

$1B+

NS

$150-250K

$1B+

IS

$100-125K

$100M

Rheumatology

Various

$1B+

Other

Various

Unknown

Total

$3B+

Acthar Market Opportunity

*Based on company estimates

20 |

21

Market

Approximate

Annualized Net Sales

Run Rate*

Approximate

Annualized Level of

Business**

MS

$160-175M

$160-175M

NS

$125-140M

$165-180M

IS

$40-50M

$40-50M

NS Business Already Significant

Note: Figures do not represent actual net sales ranges for the quarter ended March

31, 2012 * Figures

based

on

estimates

of

vials

shipped

to

patients

within

each

therapeutic

area

in

the

quarter,

multiplied

by

4.

** Figures represent Q1-2012 new paid prescriptions times estimated vials per

script over treatment regimen, multiplied by 4. |

22

•

Expand NS promotion effort

•

Expand MS promotion effort

•

Maintain IS promotion effort

•

Initiate pilot rheumatology promotion activity

•

Develop other markets for Acthar

•

No unrelated business development efforts planned

•

Expand NS promotion effort

•

Expand MS promotion effort

•

Maintain IS promotion effort

•

Initiate pilot rheumatology promotion activity

•

Develop other markets for Acthar

•

No unrelated business development efforts planned

Strategic Plan-

Focus on the Embedded Pipeline in Acthar

–

Acthar is its own pipeline with many other on-label indications

and many possible other therapeutic uses

–

Further define and develop the unique characteristics of Acthar |

23

Rheumatology Sales Pilot

Neuro Hiring

& Training

From 77 to

109 reps

Neuro

Sizing &

Alignment

Neph Hiring &

Training

From 28 to 58

reps

Neph Sizing &

Alignment

Sales Force Expansion-

Outlook for 2012

Q1-12

Q1-12

Q2

Q2

Q3

Q3

Q4

Q4

Q1-13

Q1-13 |

24

•

Generating more data

for on-label indications

–

NS

–

MS

–

IS

–

Rheumatology

•

Generating more data

for on-label indications

–

NS

–

MS

–

IS

–

Rheumatology

•

Investigating Acthar in

potential new indications

–

Diabetic nephropathy

–

Autism

–

Traumatic brain injury

–

ALS

–

Migraine

•

Investigating Acthar in

potential new indications

–

Diabetic nephropathy

–

Autism

–

Traumatic brain injury

–

ALS

–

Migraine

Over 40 Acthar R&D and Investigator

Initiated Research Studies

Understanding Acthar:

Understanding Acthar:

the science of how it works

the science of how it works |

25

Acthar has sustainable competitive

advantages-without FDA approval risk

Acthar is approved for 19 indications-many

in large markets with sizable unmet need

Sales in NS and MS are growing,

yet market penetration is low

Developing new vertical market -

Rheum

High margins provide good

operating leverage

Profitable, cash flow positive, no debt

Investment Highlights

25 |

June 6,

2012 Jeffries

NASDAQ:

QCOR

26 |

27

Pro-opiomelanocortin (POMC) in the Pituitary

ACTH is a Melanocortin Peptide Derived from |

28

MCR

Prevalent Tissue/Cells with Receptor

MC1R

Podocytes

Renal Mesangial Cells

Endothelial Cells (Glomerular, Tubular, Vascular)

Tubular Epithelial Cells

Macrophages

Melanocytes

Immune/Inflammatory Cells

Kerantinocytes

CNS

MC2R

Adrenal Cortex (Steroidogenesis), Adipocytes

Adapted from Gong 2011, Catania 2004, Schioth 1997

Affinity of Melanocortin Peptides and

Distribution of Receptor Subtypes |

29

MCR

Prevalent Tissue/Cells with Receptor

MC3R

CNS

Macrophages

MC4R

Podocytes

Renal Mesangial Cells (?)

Endothelial Cells (Glomerular, Tubular)

Tubular Epithelial Cells

CNS

MC5R

CNS

Exocrine Glands

Lymphocytes

Podocytes

Adapted from Gong 2011, Catania 2004, Schioth 1997

Affinity of Melanocortin Peptides and

Distribution of Receptor Subtypes |

MOA of

Acthar in NS

Adapted From Gong 2011

Acthar,

Melanocortin Peptides

Acthar,

Melanocortin Peptides |

31

15-30

reps

30-38

reps

38-77

reps

Monthly MS Scripts History

Notes: Historical trend information is not necessarily indicative of future

results. Acthar is marketed for the on-label indication of MS

exacerbations

in

adults,

though

the

chart

includes

"Related

Conditions"

-

diagnoses

that

are

either

alternative

descriptions

of

the

condition

or

are closely related to the medical condition which is the focus of the chart. About

5% of the prescriptions in the tables are for related conditions. Notes:

Historical trend information is not necessarily indicative of future results. Acthar is marketed for the on-label indication of MS

exacerbations

in

adults,

though

the

chart

includes

"Related

Conditions"

-

diagnoses

that

are

either

alternative

descriptions

of

the

condition

or

are closely related to the medical condition which is the focus of the chart. About

5% of the prescriptions in the tables are for related conditions. 250

300

350

400

0

50

100

150

200

250

300

350

400

0

50

100

150

200 |