Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2010

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-14758

Questcor Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| California | 33-0476164 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1300 North Kellogg Drive, Suite D Anaheim, California |

92807 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code:

(714) 786-4200

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, no par value |

Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| ¨ Large accelerated filer | þ Accelerated filer | ¨ Non-accelerated filer | ¨ Smaller reporting company | |||

| (Do not check if a smaller reporting company) | ||||||

Indicate by check mark whether the Registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting and non-voting Common Stock held by non-affiliates of the Registrant was approximately $586,926,000 as of June 30, 2010.

As of January 31, 2011 the Registrant had 62,442,748 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report incorporates by reference information from the definitive Proxy Statement for Questcor Pharmaceuticals, Inc.’s 2011 Annual Meeting of Shareholders.

Table of Contents

| Page | ||||||

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

8 | |||||

| Item 1B. |

16 | |||||

| Item 2. |

16 | |||||

| Item 3. |

17 | |||||

| Item 4. |

17 | |||||

| PART II | ||||||

| Item 5. |

18 | |||||

| Item 6. |

20 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 | ||||

| Item 7A. |

30 | |||||

| Item 8. |

30 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

30 | ||||

| Item 9A. |

30 | |||||

| Item 9B. |

33 | |||||

| PART III | ||||||

| Item 10. |

33 | |||||

| Item 11. |

34 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters |

34 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

34 | ||||

| Item 14. |

34 | |||||

| PART IV | ||||||

| Item 15. |

35 | |||||

| 39 | ||||||

2

Table of Contents

QUESTCOR PHARMACEUTICALS, INC.

PART I

References in this Annual Report on Form 10-K to “Questcor”, “we”, “our”, “us”, or the “Company” refer to Questcor Pharmaceuticals, Inc. This Annual Report on Form 10-K contains forward-looking statements based on expectations, estimates and projections as of the date of this filing. Actual results may differ materially from those expressed in forward-looking statements. See Item 7 of Part II—“Management’s Discussion and Analysis of Financial Condition and Results of Operations—Forward-Looking Statements.”

We obtained the market data and industry information contained in this Annual Report on Form 10-K from internal surveys, estimates, reports and studies, as appropriate, as well as from market research, publicly available information and industry publications. Although we believe our internal surveys, estimates, reports, studies and market research, as well as industry publications are reliable, we have not independently verified such information, and as such, we do not make any representation as to its accuracy.

Overview

We are a biopharmaceutical company whose primary product helps patients with serious, difficult-to-treat medical conditions. Our primary product is H.P. Acthar® Gel (repository corticotropin injection), or Acthar, an injectable drug that is approved by the U.S. Food and Drug Administration, or FDA. Acthar is only available in a multi-use vial. We derive substantially all of our net sales from the sale of Acthar in the U.S. and do not have operations outside of the U.S. However, we own the worldwide rights to Acthar. Acthar is approved for the treatment of 19 indications, though we currently generate most of our net sales from two indications: the treatment of acute exacerbations of multiple sclerosis, or MS, in adults, and the treatment of infantile spasms, or IS, in infants and children under two years of age. We are also exploring the other therapeutic areas where Acthar is approved, including the use of Acthar to induce a diuresis or a remission of proteinuria in the nephrotic syndrome without uremia of the idiopathic type or due to lupus erythematosus. As a current on-label indication for Acthar, we have commenced a small pilot sales effort to attempt to generate incremental net sales and better understand the commercial opportunity for Acthar in this indication. We are also exploring the possibility of pursuing FDA approval of additional indications not currently on the Acthar label where there is high unmet medical need.

Brief descriptions of the diseases and conditions that Acthar is currently approved to treat are as follows:

| • | MS causes the immune system to attack the protective covering of the nerves, leading to impaired sensory and motor nerve function, and, in most cases, some degree of disability. The myelin sheath is a protective covering around a portion of nerve cells that allows the cells to transmit impulses effectively. In MS, the myelin sheath is damaged, causing varying symptoms that include increased difficulty moving and progressive weakness. An exacerbation is a sudden worsening of these symptoms. The goal of treatment by neurologists of an MS exacerbation is to return the patient to the level of functionality that existed before the exacerbation occurred. Neurologists generally do not prescribe Acthar unless the primary treatment, intravenous steroids, is not suitable, including where the MS patient has not adequately responded to, cannot tolerate or has inadequate venous access for intravenous steroids. Acthar has been used as a second line treatment to treat MS exacerbations for the last several years. Treatment for MS exacerbations using Acthar generally requires two vials. Acthar and steroids are the only drugs currently approved for the treatment of MS exacerbations. |

| • | IS is a specific type of epilepsy seen in infancy and very early childhood; it is also known as West Syndrome. IS is characterized by spasms and a specific pattern of electroencephalography, or EEG, called hypsarrhythmia. The onset of infantile spasms is usually in the first year of life. IS is considered a medical emergency because the normal developmental process for the baby is adversely impacted. The prognosis for patients with IS is generally poor. Significant developmental delay and potentially death may result if IS is not treated successfully. The goal of child neurologists in treating IS is to eliminate both the spasms and the hypsarrhythmia. We believe that many child neurologists who treat IS consider Acthar the treatment of choice although other treatments are also used. Only one other product is approved for the treatment of IS. Acthar has been used to treat IS for many decades. Acthar was approved by the FDA for the treatment of IS on October 15, 2010 and has received Orphan Drug designation relating to the treatment of IS. The treatment for IS using Acthar generally requires four to five vials, although sometimes fewer vials are used. |

3

Table of Contents

| • | Nephrotic syndrome, or NS, occurs when there is a malfunction in the kidney’s filtering system (glomeruli) causing protein in the blood to leak into the urine (proteinuria). The result is fluid accumulating in the body, and prolonged proteinuria has been shown to cause kidney failure, or end-stage renal disease, or ESRD. Patients who reach ESRD require kidney dialysis or kidney transplantation surgery. NS can be classified by the damage occurring to different cells in the kidney, for example, idiopathic membraneous nephropathy (IMN) or focal segmented glomerular sclerosis (FSGS). The goal of nephrologists in treating proteinuria is to reduce the level of proteinuria by 50% or more. Proteinuria associated with IMN, FSGS and lupus nephritis are included in the labeled indication for Acthar. While physicians have not yet developed a common dosing administration protocol for Acthar in treating NS, treatment regimens for NS have historically used six to ten vials of Acthar in treating each NS patient. In addition to Acthar, steroids are the only other treatment approved by the FDA for the treatment of NS. |

In addition to the preceding indications, the new Acthar label includes other indications organized under the following disease states:

| • | Rheumatic Disorders: As adjunctive therapy for short-term administration (to tide the patient over an acute episode or exacerbation) in Psoriatic arthritis; Rheumatoid arthritis, including juvenile rheumatoid arthritis (selected cases may require low-dose maintenance therapy); and Ankylosing spondylitis. |

| • | Collagen Diseases: During an exacerbation or as maintenance therapy in selected cases of systemic lupus erythematosus and systemic dermatomyositis (polymyositis). |

| • | Dermatologic Diseases: Severe erythema multiforme and Stevens-Johnson syndrome. |

| • | Allergic States: Serum sickness. |

| • | Ophthalmic Diseases: Severe acute and chronic allergic and inflammatory processes involving the eye and its adnexa such as keratitis, iritis, iridocyclitis, diffuse posterior uveitis and choroiditis; optic neuritis; chorioretinitis; and anterior segment inflammation. |

| • | Respiratory Diseases: Symptomatic sarcoidosis. |

Acthar has also been used to treat other conditions not on the label of approved indications for Acthar. During the year ended December 31, 2010, we believe physicians wrote prescriptions for Acthar for a variety of conditions that are not on its label of approved indications, including the following: Opsoclonus Myoclonus, Adrenal Insufficiency, Landau-Kleffner Syndrome, Myasthenia Gravis, Neurosarcoidosis, and Ulcerative Colitis.

Our other product is Doral® (quazepam), which is indicated for the treatment of insomnia characterized by difficulty in falling asleep, frequent nocturnal awakenings, and/or early morning awakenings. We own the U.S. rights to and have modest sales of Doral.

Our total net sales were $115.1 million for the year ended December 31, 2010 as compared to $88.3 million and $95.2 million for the years ended December 31, 2009 and 2008, respectively. Approximately 99% of our net sales in all three years were from Acthar. Our net income applicable to common shareholders was $35.1 million for the year ended December 31, 2010 as compared to $26.6 million and $35.3 million for the years ended December 31, 2009 and 2008, respectively. As of December 31, 2010, our cash, cash equivalents and short-term investments totaled $114.8 million as compared to $75.7 million as of December 31, 2009.

We have registered trademarks on H.P. Acthar® Gel and Doral®. Any other trademark, trade name or service mark appearing in this document belongs to its respective holder. We believe that our trademarks, trade names and service marks have value and play an important role in our business efforts. We own all the worldwide rights for Acthar and the U.S. manufacturing, marketing and distribution rights for Doral.

Sales and Marketing

We have a highly trained sales force with significant experience in the pharmaceutical industry. During the fourth quarter of 2010, we completed our previously announced plan to expand the size of our commercial organization including all territorial re-alignments. Our expanded MS sales force of 77 sales representatives and 15 sales managers continues to allow us to build upon positive growth trends in prescriptions of Acthar for the treatment of exacerbations associated with MS. With the FDA’s October 2010 approval of our supplement new drug application, or sNDA, our expanded MS sales force will also market Acthar to child neurologists for the treatment of IS. In addition, we have recently hired a five person sales force to promote Acthar for the on-label indications associated with NS.

4

Table of Contents

Customers and Distribution

In the U.S., our exclusive customer for Acthar is CuraScript Specialty Distribution, Inc., or CuraScript SD. We sell Acthar at a discount from our list price to CuraScript SD, which then resells Acthar primarily to approximately 12 specialty pharmacies, including CuraScript Specialty Pharmacy, or CuraScript SP, and to children’s hospitals. Effective January 1, 2011, our price to CuraScript SD was $24,195 per vial. We sell Doral to pharmaceutical wholesalers, who resell Doral primarily to retail pharmacies and hospitals.

We have engaged Integrated Commercialization Services, Inc., or ICS, to act as our exclusive agent for commercial shipment of our products to our customers. In addition to distribution services, ICS provides us with related services, including product storage, returns, customer support, and administrative support.

After Acthar and Doral are manufactured, they are shipped to ICS where the drugs are warehoused. Upon receiving orders from CuraScript SD, ICS ships Acthar to Curascript SD. Upon receiving orders from national distributors, ICS ships Doral to those customers.

We recognize revenue when we have persuasive evidence that an arrangement, agreement or contract exists, when title for our product and risk of loss have passed to our customer, the price we charge for our product is fixed or is readily determinable, and we are reasonably assured of collecting the amounts owed under the resulting receivable. For Acthar, this occurs when CuraScript SD accepts a shipment of Acthar based on its order of Acthar from ICS. For sales of both our products, we do not require collateral from our customers.

Government Insurance Program Reimbursement

A portion of our end-user vial demand for Acthar is for patients covered under Medicaid, Medicare and other government-related programs. As required by Federal regulations, we provide rebates and discounts in connection with these programs such as Tricare and the Veterans Administration, or VA. As a result of Medicaid rebates, we do not generate any net sales with respect to Medicaid sales, but we do generate net sales with respect to Medicare sales, Tricare sales and sales made to the VA. As a result of the enactment of the Patient Protection and Affordable Care Act of 2010 and the Healthcare and Education Affordability Reconciliation Act of 2010, signed into law on March 23, 2010 and March 30, 2010, respectively, or the Healthcare Reform Acts, a greater proportion of our sales of Acthar have been subject to Medicaid rebates, although the per vial rebate amount decreased to 100% of our Average Manufacturers Price, or AMP. For Medicare, starting January 1, 2011, we pay a rebate under the Healthcare Reform Acts. However, this rebate is estimated to be less than 10% of the price of Acthar.

See Item 1A “Risk Factors: Risks Associated with Government Regulations and Health Care Reform” for a discussion of additional risks related to reimbursement.

Competition

The pharmaceutical and biotechnology industries are intensely competitive and subject to rapid and significant technological change. A number of companies are pursuing the development of pharmaceuticals and products that target the same diseases and conditions that Acthar is currently approved to treat or which we may seek to add to the label of approved indications for Acthar. There are products and treatments on the market that compete with Acthar.

Most of our competitors are larger than us and have substantially greater financial, marketing and technical resources than we have. If any of our present or future competitors develop new products that are superior to Acthar, our performance may be materially and adversely affected.

The current success of our business strategy likely will attract additional competition. See Item 1A “Risk Factors: Risks Associated with Acthar” for a discussion of additional risks related to competition.

Manufacturing

Acthar is derived from the extraction and purification of porcine pituitary glands through complicated processes, and is difficult to manufacture. Acthar bulk concentrate, the active pharmaceutical ingredient, or API, used in Acthar, is processed in several stages to produce a highly purified raw material for formulation. We have a supply agreement with Bio Vectra, Inc., or Bio Vectra, to produce this API. We have a supply agreement with Cangene bioPharma, Inc., or Cangene, to manufacture commercial quantities of Acthar in sterile solution. Currently, both Bio Vectra and Cangene are our sole source suppliers for Acthar. While we have received approval from the FDA for the Acthar finished vials and API, transfers to new contract manufacturers, the processes used to manufacture and test Acthar are complex and subject to FDA inspection and approval. Acthar has a shelf life of 18 months from the date of manufacture.

5

Table of Contents

We have a supply agreement with Meda Pharmaceuticals, or Meda, to manufacture commercial quantities of Doral. Currently, Meda is our sole source supplier for Doral. Doral has a shelf life of 60 months from the date of manufacture.

We cannot assure you that any of our API or finished goods contract manufacturers will continue to meet our requirements for quality, quantity and timeliness. Also we cannot assure you that our contract manufacturers will be able to meet all of the FDA’s current good manufacturing practice, or cGMP, requirements.

Our dependence upon others for the manufacture of API or our finished products may adversely affect the future profit margin on the sale of those products and our ability to develop and deliver products on a timely and competitive basis. We do not have substitute suppliers for our products although we strive to plan appropriately and maintain safety stocks of product to cover unforeseen events at manufacturing sites.

See Item 1A “Risk Factors: Risks Associated with Acthar” for a discussion of additional risks related to manufacturing.

Research and Development

During the years ended December 31, 2010, 2009 and 2008, we spent $10.9 million, $9.7 million and $10.6 million, respectively, on research and development activities.

We plan to continue our research and development efforts to explore the use of Acthar as a therapeutic alternative for the treatment of nephrotic syndrome. In 2010, we provided funding for investigator-initiated studies conducted in patients with idiopathic membranous nephropathy (on-label) and diabetic nephropathy (not on-label). Based on the results of these investigations, we currently intend to conduct a Phase IV dose response clinical trial for idiopathic membranous nephropathy and a Phase II dose response clinical trial for diabetic nephropathy in 2011. If we initiate and conduct these dose response clinical trials, we will significantly increase our research and development expenses for 2011 through 2013. We also may pursue additional clinical trials to evaluate the use of Acthar to treat other therapeutic uses, including conditions which are currently not on the label of approved indications for Acthar.

See Item 1A “Risk Factors: Risks Associated with Acthar” for a discussion of additional risks related to research and development.

Patents and Proprietary Rights

The FDA first approved the use of Acthar in 1952. While Acthar is no longer subject to patent protection, Acthar has received orphan drug designation from the FDA, which provides Acthar with a seven-year exclusivity period that began in October 2010. During the exclusivity period, the FDA is prohibited from approving any other adrenocorticotropic hormone (ACTH) formulation for the treatment of IS unless the other formulation is demonstrated to be clinically superior to Acthar.

Our success depends partially upon our ability to maintain confidentiality and operate without infringing upon the proprietary rights of third parties. We rely primarily on a combination of copyright, trademark and trade secret laws, confidentiality procedures, and contractual provisions to protect our intellectual property. We also have a U.S. patent related to Doral.

Our efforts to protect our intellectual property may not be adequate. Our competitors may independently develop similar technology or duplicate our products or services. Unauthorized parties may infringe upon or misappropriate our products, services or proprietary information. In addition, the laws of some foreign countries do not protect proprietary rights as well as the laws of the United States. In the future, litigation may be necessary to enforce our intellectual property rights or to determine the validity and scope of the proprietary rights of others. Any such litigation could be time consuming and costly.

We could be subject to intellectual property infringement claims as we expand our product and service offerings and the number of competitors increases. Defending against these claims, even if the claims are without merit, could be expensive and divert our attention from our operations. If we become liable to third parties for infringing upon their intellectual property rights, we could be required to pay a substantial damage award and be forced to develop non-infringing technology, obtain a license or cease using the applications that contain the infringing technology or content. We may be unable to develop non-infringing technology or content or obtain a license on commercially reasonable terms, or at all.

See Item 1A “Risk Factors: Risks Associated with Acthar” for a discussion of additional risks related to patents and proprietary rights.

6

Table of Contents

Government Regulation of Acthar and Doral

Our pharmaceutical products are subject to extensive government regulation in the United States. FDA regulations govern the research, development, testing, manufacture, quality control, labeling, storage, record-keeping, approval, sale, distribution, advertising and promotion of our products.

The FDA testing and approval process for new indications for previously approved drugs requires substantial time, effort and money. We cannot assure you that any application we submit to the FDA will be timely approved, if ever.

The FDA may withdraw product approval for non-compliance with regulatory requirements or if safety or efficacy problems occur after the product reaches the market. The FDA also has the power to require changes in labeling or to prevent further marketing of a product based on the results of these post-marketing programs.

The facilities, procedures, and operations of our contract manufacturers must be determined to be adequate by the FDA before a new drug application or supplemental new drug application is approved. Additionally, manufacturing facilities are subject to inspections by the FDA for compliance with cGMP, licensing specifications, and other FDA regulations on an on-going basis. Vendors that supply us finished products or components used to manufacture, package and label products are subject to similar regulations and period inspections.

Following such inspections, the FDA may issue notices on Form 483 and issue Warning Letters that could cause us to modify certain activities identified during the inspection. The FDA generally issues a Form 483 notice at the conclusion of an FDA inspection and lists conditions the FDA investigators believe may violate cGMP or other FDA regulations. FDA guidelines specify that a Warning Letter be issued only for violations of “regulatory significance” for which the failure to adequately and promptly achieve correction may be expected to result in an enforcement action.

In addition, the FDA imposes a number of complex regulatory requirements on entities that advertise and promote pharmaceuticals, including but not limited to, standards and regulations for direct-to-consumer advertising, off-label promotion, industry-sponsored scientific and educational activities and promotional activities involving the internet.

Failure to comply with FDA and governmental regulations can result in fines, unanticipated compliance expenditures, recall or seizure of products, total or partial suspension of production and/or distribution, suspension of the FDA’s review of new drug applications or supplemental new drug applications, injunctions, disqualification from participation in government reimbursement programs and criminal prosecution. Any of these actions or events could have a material adverse effect on us.

Human Resources

During 2010, we completed a sales force expansion. As of January 31, 2011, we had 152 full-time employees, 113 of whom are engaged in sales and commercialization activities.

Our continued success will depend in large part on our ability to attract and retain key employees. We believe that our relationship with our employees is good. None of our employees is represented by a collective bargaining agreement, nor have we experienced work stoppages.

General Information

We incorporated in California in September 1992 as Cypros Pharmaceutical Corporation. In November 1999, we changed our name to Questcor Pharmaceuticals, Inc. In the third quarter of 2010, we moved our corporate headquarters to southern California and we are now located at 1300 North Kellogg Drive, Suite D, Anaheim, California 92807, and our telephone number is (714) 786-4200.

We make the following reports available on our website, at www.questcor.com, free of charge as soon as practicable after filing with the U.S. Securities and Exchange Commission, or SEC:

| • | Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, our proxy statements on Schedule 14A, and amendments to these reports and statements; |

| • | Our policies related to corporate governance, including our Code of Ethics and Conduct which apply to our directors, officers and employees (including our principal executive officer and principal financial and accounting officer) that we have adopted to meet the requirements set forth in the rules and regulations of the SEC and its corporate governance principles; and |

7

Table of Contents

| • | The charters of the Audit, Compensation and Nomination & Corporate Governance Committees of our Board of Directors. |

All such reports are also available free of charge via EDGAR through the SEC website www.sec.gov. In addition, the public may read and copy material filed by us with the SEC at the SEC’s public reference room located at 100 F St., NE, Washington, D.C., 20549. Information regarding operation of the SEC’s public reference room can be obtained by calling the SEC at 1-800-SEC-0330. The contents of our website are not incorporated by reference into this Annual Report.

Risks Associated with Acthar

Substantially all of our net sales and profits are derived from Acthar.

For the year ended December 31, 2010, sales of Acthar for the treatment of acute exacerbations of MS and for the treatment of IS represented approximately 99% of our total net sales. We expect to continue to rely on sales of Acthar for these two conditions for substantially all of our net sales and profits for the foreseeable future. In the fourth quarter of 2010, we substantially increased the size of our sales force, but we cannot provide assurance that this sales force expansion will result in increased sales of Acthar. The primary course of treatment for MS exacerbations is intravenous corticosteroids and there is a limited history of, or clinical data regarding, the use of Acthar to treat patients who do not respond adequately to steroids or for whom steroids are not suitable. Further, over the past several years disease modifying agents have been increasingly prescribed to treat the underlying disease state of MS, and the success of these treatments could reduce the overall incidence rate of acute exacerbations for MS including acute exacerbations of MS in patients who might be candidates for being treated with Acthar.

The demand for Acthar to treat IS is highly variable, and we cannot predict whether we will continue to generate significant net sales from sales of Acthar for the treatment of IS.

If the demand for Acthar declines, if third-party payors refuse to provide reimbursement for purchases of Acthar, if a greater proportion of our Acthar unit sales is comprised of product dispensed to Medicaid eligible patients where we do not recognize any net sales, our net sales from the sale of Acthar would decline. If the cost to produce Acthar increases, our gross margins on the sale of Acthar would decline. If our net sales or gross margins from the sale of Acthar decline, our ability to generate profits would be harmed.

We utilize CuraScript SD, a third-party specialty distributor, to distribute Acthar. We rely on CuraScript SD for all of our proceeds from sales of Acthar in the United States. The outsourcing of our distribution function is complex, and we may experience difficulties that could reduce, delay or stop shipments of Acthar. If we encounter such distribution problems, and we are unable to quickly enter into a similar agreement with another specialty distributor on substantially similar terms, Acthar distribution could become disrupted, resulting in lost revenues or customer dissatisfaction.

The manufacture of Acthar is a highly exacting and complex process and, if any of our suppliers encounters problems manufacturing products, our business could suffer.

Biological products such as Acthar require production processes that are significantly more complicated than those required for chemical pharmaceuticals, due in part to strict regulatory requirements. Problems may arise during manufacturing for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials, natural disasters, and environmental factors. In addition, we currently use single suppliers for our products and materials.

If problems arise during the production of a batch of product, that batch of product may have to be discarded. Among other impacts to our business, lost batches could lead to increased costs, lost revenue, damage to our reputation and customer relations, time and expense spent investigating the cause of such problems and, depending on the cause, similar losses with respect to other batches of Acthar. If we do not discover problems before Acthar is released to the market, we also may incur recall and product liability costs. To the extent that one of our suppliers experiences significant manufacturing problems, these could have a material adverse effect on our revenues and profitability.

8

Table of Contents

Acthar is derived from the extraction and purification of porcine pituitary glands through complicated processes, and, as a result, Acthar is difficult to manufacture. We have a supply agreement with BioVectra to produce the active pharmaceutical ingredient in Acthar. Our supply agreement with BioVectra continues until written notice of no less than 12 months is given by either us or BioVectra. If either party terminates the agreement, BioVectra is obligated under the agreement to continue to provide manufacturing services for up to four years after termination. In the event of termination, if we were unable to enter into a new supply agreement on substantially similar terms with a new manufacturer, or are unable to obtain FDA approval for a new manufacturer, in such four year period, we may not be able to manufacture or sell Acthar, which would result in a substantial loss of revenues and damage to our business.

We have a supply agreement with Cangene to produce our finished vials of Acthar. Our supply agreement with Cangene is in effect until terminated by either party upon 12 months notice. If Cangene terminates the agreement, Cangene is obligated under the agreement to continue to provide manufacturing services for up to three years after the termination. If either party cancels the supply agreement, and we are unable to enter into a new supply agreement on substantially similar terms with a new manufacturer, or are unable to obtain FDA approval for a new manufacturer, we may not be able to manufacture or sell Acthar, which would result in a substantial loss of revenues and damage to our business.

Both BioVectra and Cangene are our contract manufacturers that produce Acthar. The manufacturing process for Acthar is complex and these contract manufacturers may not be able to meet our needs with respect to timing, cost, quantity or quality. All of our contract manufacturers are sole-source manufacturers and no currently qualified alternative suppliers exist. If either of these agreements terminate, and we are unable to contract for a sufficient supply of Acthar on acceptable terms, or if we encounter delays or difficulties in our relationships with our manufacturers, we will lose the ability to fulfill orders and thus will lose sales. Moreover, our contract manufacturers must continually adhere to current good manufacturing practices enforced by the FDA. If the facilities of these manufacturers cannot pass an inspection, supply would be disrupted. Failure to obtain products for sale for any reason may result in an inability to meet Acthar demand and a loss of potential revenues.

We have no patent protection for Acthar, and potential competitive products to Acthar may reduce or eliminate our commercial opportunity.

Acthar was first approved by the FDA in 1952, and the patent for Acthar has expired. While the FDA has provided Acthar with orphan designation for the treatment of IS, the FDA could approve another ACTH formulation for the treatment of IS if it is demonstrated to be clinically superior to Acthar or if we are unable to supply sufficient amounts of Acthar. We have no intellectual property or regulatory-based market exclusivity with respect to MS exacerbations or any other indication or condition we might target.

The pharmaceutical and biotechnology industries are intensely competitive and subject to rapid and significant technological change, and a number of companies are pursuing the development of pharmaceuticals and products that target the same diseases and conditions that we target. Some of the companies developing competing technologies and products have significantly greater financial resources and expertise in development, manufacturing, obtaining regulatory approvals, and marketing than we do. Other smaller companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. In the event we are successful in expanding the therapeutic uses for Acthar, other companies may dedicate greater resources to develop and introduce generic versions of Acthar and other competitive therapies for the same diseases and conditions that we target. We cannot predict with accuracy the timing or impact of the introduction of potentially competitive products or their possible effect on our sales. If a competitor applied to the FDA for a generic or bio similar version of Acthar or any competitive product not based on ACTH, we would not receive any notice from the FDA about the existence of the application. Further, the announcement of a filing with the FDA relating to a potentially competitive product could have an adverse effect on our business and share price, regardless of the ultimate outcome of such filing.

If we are successful in growing our sales in the MS and nephrotic syndrome markets or in developing other markets for Acthar, our increasing the overall sales volume of Acthar may lead other companies to dedicate greater resources to develop and introduce generic versions of Acthar or other competitive therapies for the diseases and conditions that we target.

Our strategy to generate revenue from sales of Acthar to treat Nephrotic Syndrome might not be successful.

In connection with the FDA’s October 2010 approval of our sNDA to add the treatment of IS to the label of approved indications for Acthar, the overall label for Acthar was modernized and there are now 19 approved indications, including the treatment of acute exacerbations of MS, the treatment of IS and the use of Acthar to induce a diuresis or a remission of proteinuria in the nephrotic syndrome without uremia of the idiopathic type or that due to lupus erythematosus.

9

Table of Contents

There is limited data on the efficacy of Acthar in the treatment of nephrotic syndrome. It is unclear what amount of clinical or other data physicians will require prior to deciding whether or not to use Acthar in the treatment of nephrotic syndrome. Acthar is not approved for all forms of nephrotic syndrome. We currently intend to conduct a Phase IV dose response clinical trial to evaluate the use of Acthar to treat membranous nephropathy, an on-label indication, and a Phase II dose response clinical trial to evaluate the use of Acthar to treat diabetic nephropathy, an indication not on our current label. These trials will require the expenditure of significant financial and management resources and we cannot assure you these trials will result in data that supports the use of Acthar to treat these conditions. Further, even if one or more of these trials produce positive data, it is unclear whether the Phase IV dose response clinical trial will result in doctors prescribing Acthar for the treatment of membranous nephropathy or whether the Phase II dose response clinical trial will provide a basis to pursue the addition of diabetic nephropathy to the label of approved indications for Acthar. Such approval would require one or more additional clinical studies and the preparation and submission of an sNDA with the FDA, and we cannot assure you that any such submission would ultimately be approved by the FDA.

Our attempts to further develop other therapeutic uses for Acthar may be unsuccessful.

Commercializing products is time consuming, expensive and unpredictable. We cannot assure you that we will be able to, either by ourselves or in collaboration with others, successfully develop or commercialize new therapeutic uses for Acthar, even those uses which are on our current label, complete clinical trials, obtain regulatory approvals, or gain market acceptance for such uses.

Should we decide to collaborate with third parties in the development or commercialization of new therapeutic uses for Acthar, such collaboration may require us to commit substantial effort and expense in seeking out, evaluating and negotiating collaboration agreements, which expense maybe incurred without achieving our desired results and which effort involves inherent risks, including uncertainties due to matters that may affect the successful development or commercialization of such uses, as well as the possibility of contractual disagreements with regard to terms such as proprietary rights, license scope or termination rights. It may be necessary for us to enter into arrangements with other pharmaceutical companies in order to effectively market any new therapeutic uses for Acthar. We cannot assure you that we will be successful in entering into such arrangements on terms favorable to us or at all.

Once developed, a number of factors may affect negatively the market acceptance of additional therapeutic uses for Acthar, including, among others:

| • | the price of Acthar relative to other therapies for the same or similar treatments; |

| • | the perception by patients, physicians and other members of the health care community of the safety and efficacy of Acthar for their prescribed treatments; |

| • | the availability of third-party reimbursement for Acthar and related treatments; |

| • | our ability to fund our sales and marketing efforts; and |

| • | the effectiveness of our sales and marketing efforts. |

In addition, our ability to market and promote Acthar is restricted to the indications and labeling claims approved by the FDA. If we are unable to obtain approval for additional labeled indications for Acthar, or if we are unable to successfully commercialize existing labeled indications, our sales and marketing efforts and market acceptance and the commercial potential of Acthar may be negatively affected.

We depend primarily on third parties to assist us in our research and development.

We have limited ability to conduct our own clinical trial and research and development projects and we rely upon third-party vendors to plan, conduct and report on clinical trials for uses of Acthar. In the event that any of these vendors has unforeseen issues that negatively impact the quality of its work, our ability to evaluate clinical results may also be negatively impacted. As a result, a clinical trial failure could adversely affect our ability to develop data to support the use of Acthar in the treatment of on-label indications or file for or gain regulatory approvals for new indications on a timely basis. In addition, any one of these vendors could determine that its own research and development requirements or those of other parties, takes precedence over the research and development they provide to us. Though we believe we have made efforts to mitigate this risk by working with multiple, simultaneous third-party developers and increasing our own research and development capabilities, we could experience a development gap if a substantial number of our clinical trial vendors choose to prioritize other projects over our development projects. This prioritization could cause a gap in our research and development timelines until we achieve further advancement of our own capabilities. Any gap could impact our ability to develop and commercialize other therapeutic uses for Acthar.

10

Table of Contents

We will not be able to commercialize additional therapeutic uses for Acthar if pre-clinical trials do not produce successful results or if clinical trials do not demonstrate safety and efficacy in humans.

The regulatory process, which may include extensive pre-clinical trials and clinical trials of Acthar to establish its safety and efficacy in a new therapeutic area, is uncertain, can span many years, and requires the expenditure of substantial time and resources to ensure compliance with complex regulations. Should we fail to comply with applicable regulations, possible regulatory actions could include warning letters, fines, damages, injunctions, civil penalties, recalls, seizures of our products and criminal prosecution. These actions could result in, among other things, substantial modifications to our business practices and operations; refunds, recalls or a total or partial shutdown of production in one or more of our suppliers’ facilities while our suppliers remedy the alleged violation; the inability to obtain future pre-market clearances or approvals; and withdrawals or suspensions of Acthar from the market. Any of these events could disrupt our business and have a material adverse effect on our revenues and financial condition.

In addition, data obtained from pre-clinical and clinical activities are susceptible to varying interpretations that could delay, limit or prevent regulatory approval or clearance. Also, we may encounter delays or rejections based upon changes in regulatory policy during the development period and the period of review of any application for regulatory approval or clearance for Acthar.

Regulatory approval, if granted, may entail limitations on the indicated uses for which Acthar may be marketed that could limit the potential market. Regulatory approvals, once granted, may be withdrawn if problems occur after initial marketing. Furthermore, manufacturers of approved products are subject to pervasive review, including compliance with detailed regulations governing FDA good manufacturing practices. The FDA periodically revises the good manufacturing practices regulations and requires manufacturers to remain current with the latest regulations.

Our success will depend on the success of the pre-clinical and clinical trials conducted by us and our clinical trial vendors. It can take several years to complete the pre-clinical and clinical trials of a new therapeutic use, and a failure of one or more of these pre-clinical or clinical trials can occur at any stage of testing. We believe that the development of new therapeutic uses for Acthar involves significant risks at each stage of testing. If pre-clinical or clinical trial difficulties and failures arise, new therapeutic uses for Acthar may never be approved for sale or become commercially viable.

In addition, the possibility exists that:

| • | the results from early pre-clinical or clinical trials may not be statistically significant or predictive of results that will be obtained from expanded, advanced clinical trials; |

| • | a proposed new use for Acthar may not exhibit the expected therapeutic results in humans, may cause harmful side effects or have other unexpected characteristics that may delay or preclude regulatory approval or limit commercial use even if approved; |

| • | institutional review boards or regulators, including the FDA, may hold, suspend or terminate our pre-clinical or clinical research or the pre-clinical or clinical trials of Acthar for various reasons, including noncompliance with regulatory requirements or if, in their opinion, the participating subjects are being exposed to unacceptable health risks; |

| • | our pre-clinical or clinical trials may produce negative, inconsistent or inconclusive results, and we may decide, or regulators may require us, to conduct additional pre-clinical or clinical trials; |

| • | the cost of our pre-clinical or clinical trials may be greater than we currently anticipate; and |

| • | the difficulties and risks associated with pre-clinical and clinical trials may result in the failure to receive regulatory approval to continue to test or to sell Acthar in new therapeutic uses or the inability to commercialize Acthar for any of these therapeutic uses. |

Risks Associated with Government Regulation and Health Care Reform

Changes in the health care regulatory environment may adversely affect our business.

The Healthcare Reform Acts substantially change the way health care is financed by both governmental and private insurers, and could have a material adverse effect on our future business, cash flows, financial condition and results of operations, including by operation of the following provisions:

11

Table of Contents

| • | Effective March 23, 2010, Medicaid managed care programs became eligible for drug rebates. This expanded eligibility affected our rebate liability for those state entities which had Medicaid managed care programs, but had not previously taken legislative action at the state level to permit drugs provided to Medicaid managed care patients to be eligible for Medicaid rebates (approximately 28 states). |

| • | Effective January 1, 2011, pharmaceutical companies, including Questcor, must provide rebates to cover a portion of the Medicare Part D coverage gap or “donut hole,” which is a portion of the gap between Medicare funding and Medicare recipients’ drug deductibles. Approximately 25% of our sales for MS are to Medicare insureds. We estimate our obligation could be as much as $1,800 per Medicare insured in 2011. At our current sales levels, we estimate that this obligation would be less than $0.5 million per year. |

| • | Effective January 1, 2011, the U.S. Federal government will allocate an annual fee among manufacturers of branded prescription drugs based on their market share for specified government programs. The Healthcare Reform Acts determine an individual manufacturer’s market share as the ratio of its aggregate sales of branded prescription drugs during the preceding calendar year as a percentage of the aggregate branded prescription drug sales for all covered manufacturers. |

| • | We expect the number of Medicaid patients to increase gradually through 2014. We further expect this expansion more likely to impact the number of adults in Medicaid because many states have already set their eligibility criteria for children at or above the level designated in the Healthcare Reform Acts. An increase in the proportion of patients who receive Acthar and who are covered by Medicaid could adversely affect our net sales. |

In addition, substantial new provisions affecting compliance also have been added, which may require us to modify our business practices with health care practitioners. Our failure to comply with these new provisions may subject us to significant penalties or enforcement actions, either of which may negatively impact the results of our operations or business.

Presently, uncertainty exists as many of the specific determinations necessary to implement the Healthcare Reform Acts have yet to be decided and communicated to industry participants. For example, while we have established a reserve for Medicaid MCO, the affected states have only begun to bill us for Medicaid MCO rebates, as many of the states are still implementing their internal systems in order to submit Medicaid rebates claims to us. Additionally, we do not yet know when we will be required to provide discounts to the additional hospitals eligible to participate under the 340(B) program. We have made several estimates with regard to important assumptions relevant to determining the financial impact of the Healthcare Reform Acts on our business due to the lack of availability of both certain information and complete understanding of how the process of applying the Healthcare Reform Acts will be implemented.

In addition, Congress and the President may make additional refinements to the Healthcare Reform Acts which may have an additional, potential negative impact on our overall financial position, results of operations and cash flows. At this time, we cannot predict the full impact of the Healthcare Reform Acts, or the timing and impact of any future rules or regulations promulgated to implement the Healthcare Reform Acts.

We may be negatively affected by lower reimbursement levels.

Our ability to generate net sales is affected by the availability of third-party reimbursement for Acthar, and our ability to generate net sales will be diminished if we fail to maintain an adequate level of reimbursement for Acthar from such third-party payors.

Acthar is a high priced drug and the sale of Acthar depends in part on the availability of reimbursement from third-party payors such as private insurance plans. In the United States, there have been, and we expect there will continue to be, a number of state and federal proposals that limit the amount that private insurance plans may pay to reimburse the cost of drugs, including Acthar. We believe the increasing emphasis on managed care in the United States has and will continue to put pressure on the price and usage of Acthar. In addition, current third-party reimbursement policies for Acthar may change at any time. Negative changes in reimbursement or our failure to obtain reimbursement for Acthar may reduce the demand for, or the price of, Acthar, which could result in lower Acthar net sales, thereby weakening our competitive position and negatively impacting our results of operations.

Medicaid eligible patients and government entities may account for a greater proportion of our Acthar unit sales resulting in reduced net sales.

Our net sales may be adversely affected by laws and regulations reducing reimbursement rates. Administrative or judicial interpretations of such laws and regulations could also force us to reduce our reimbursement rates or increase the amount of

12

Table of Contents

chargebacks paid to certain government entities. The sources and amounts of our revenues are determined by a number of factors, including the rates of reimbursement among payors. Changes in the payor mix among private pay, Medicaid, and government programs usage may significantly affect our profitability.

A portion of the estimated end-user vial demand for Acthar is for patients covered under Medicaid and other government-related programs. As required by Federal regulations, we provide rebates related to Acthar dispensed to a significant percentage of Medicaid patients. In addition, certain other government-supported agencies are permitted to purchase Acthar for a nominal amount from our specialty distributor, which then charges the discount back to us. As a result of these rebates and chargebacks, we do not generate any net sales with respect to sales that are subject to rebates or chargebacks. As a result of the enactment of the Healthcare Reform Acts, it is possible that a greater proportion of Acthar sales will be subject to these rebates and chargebacks, reducing our net sales. Additionally, there could be changes to Medicaid regulations resulting in higher rebates and chargebacks, which would reduce our net sales further.

The interpretation of laws and regulations may negatively affect the amount we are able to charge government agencies for Acthar, or may negatively affect our financial results. For example, on March 17, 2009, the Department of Defense issued final regulations under the Fiscal Year 2008 National Defense Authorization Act which interpreted such Act to expand a government health care program, Tricare, to include prescription drugs dispensed by Tricare retail network pharmacies, retroactively effective as of January 28, 2008. As a result, we established a sales reserve of $3.5 million for Tricare rebates as of the year ended December 31, 2009 which covered 100% of our estimated liability for the time period January 28, 2008 through December 31, 2009. Effective January 1, 2010, we entered into a new pricing agreement with the Veterans Administration, resulting in a rebate for pharmaceutical products utilized through the Tricare Retail Pharmacy program during 2010 of $5,670 per vial, or a reduction of $14,865 from the previous rebates of $20,535. As a result, we recorded additional sales reserves of $1.2 million for the year ended December 31, 2010, for which we received invoices for $0.6 million.

We may be negatively affected by unforeseen invoicing of historical Medicaid sales.

We provide a rebate related to Acthar dispensed to Medicaid eligible patients in instances where regulations provide for such a rebate. The rebate per unit formula results in a rebate amount equal to 100% of our price to CuraScript SD. We multiply the rebate amount per unit by the estimated rebate units to arrive at the reserve for the period. This reserve is deducted from gross sales in the determination of net sales. The Medicaid rebates associated with end user demand for a period are mostly paid to the states by the end of the quarter following the quarter in which the rebate reserve is established. As a result, at the end of each quarter we must estimate the amount of Medicaid sales in that quarter and such estimates could prove to be inaccurate. Revisions in the Medicaid rebate estimates are charged to income in the period in which the information that gives rise to the revision becomes known. However, certain states may provide their requested rebates to us on a delayed basis, which would negatively affect future financial performance in periods occurring after the period in which the original reserved Medicaid rebate accrual occurred. For example, in the third quarter of 2009, we received higher than anticipated amounts of Medicaid rebates related to prior period Acthar usage. In connection with our receipt of invoices related to these rebates, we increased our rebate reserve which reduced net sales in the third quarter of 2009 by approximately $4.6 million. In connection with the enactment of the Healthcare Reform Acts and the adoption of Medicaid Managed Care Organizations, or Medicaid MCO, we increased our reserves for Medicaid rebates. In the absence of historical data for Medicaid MCO, we based this portion of our Medicaid reserve on national statistics. The various states have only begun to bill us for Medicaid MCO rebates and we cannot assure you that our reserves for Medicaid MCO related rebates are adequate.

We are currently subject to numerous governmental regulations and it can be costly to comply with these regulations and to develop compliant products and processes.

No assurance can be given that we will remain in compliance with currently applicable FDA and other regulatory requirements for Acthar. These requirements include, among other things, regulations regarding manufacturing practices, product labeling and post-marketing reporting, including adverse event reports and field alerts due to product quality concerns. Additionally, the facilities and procedures of our suppliers are subject to ongoing regulation, including periodic inspection by the FDA and other regulatory authorities. Any new use of Acthar that we develop must receive all relevant regulatory approvals or clearances before it may be marketed in a particular country.

From time to time, Acthar is prescribed for various conditions that are not on the label of approved indications. While physicians may lawfully prescribe Acthar for off-label uses, any promotion by us of any off-label uses would be unlawful. Some of our practices that are intended to respond to questions from physicians with respect to off-label uses of Acthar without engaging in off-label promotion could nonetheless be construed by the FDA as off-label promotion. Although we have policies and procedures in place designed to help assure ongoing compliance with regulatory requirements regarding off-label promotion, some non-compliant actions may nonetheless occur or be deemed by regulatory authorities to have occurred. The Department of Justice has in recent years

13

Table of Contents

initiated a number of investigations and enforcement action against pharmaceutical manufacturers alleged to have engaged in off-label promotion, and it, or other regulatory authorities, could take action against us if they believe we are promoting or have promoted Acthar for off-label use.

In addition, we cannot predict the extent of governmental regulations or the impact of new governmental regulations that may result in a delay in the development, production and marketing of Acthar. As such, we may be required to incur significant costs to comply with current or future laws or regulations.

Other Risks Associated with our Business

Our business and operations have experienced rapid growth. If we fail to effectively manage our growth, our business and operating results could be harmed.

We have experienced rapid growth in our headcount and operations, which has placed, and will continue to place, significant demands on our management and, operational and financial infrastructure. To effectively manage this growth, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. These systems enhancements and improvements will require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

The loss of our key management personnel or failure to integrate new management personnel could have an adverse impact on future operations.

We are highly dependent on the services of the principal members of our senior management team, and the loss of a member of senior management could create significant disruption in our ability to provide Acthar to our customers. We do not carry key person life insurance for our senior management or other personnel. Additionally, the future potential growth and expansion of our business is expected to place increased demands on our management skills and resources. Recruiting and retaining management and operational personnel to perform sales and marketing, financial operations, clinical development, regulatory affairs, quality assurance, medical affairs and contract manufacturing in the future will also be critical to our success. We do not know if we will be able to attract and retain skilled and experienced management and operational personnel in the future on acceptable terms given the intense competition among numerous pharmaceutical and biotechnology companies for such personnel. If we are unable to hire necessary skilled personnel in the future, our business could be harmed.

Our financial results can be negatively impacted by economic downturns.

Downturns in the general economic environment present us with several potential challenges. In challenging economies and periods of increased unemployment, a greater percentage of our unit volume may be subject to reimbursement under Medicaid and other government programs. This shifting in payor mix can negatively impact our financial results because of the resulting decrease in our net sales. In addition, third-party payors such as private insurance companies may be less willing to satisfy their reimbursement obligations in a timely matter, or at all.

As a result of downturns in the economy, there may be a disruption or delay in the performance of our third-party contractors, suppliers or collaborators, including CuraScript SD. If CuraScript SD is unable to satisfy its commitments to us, our business would be adversely affected because of our reliance upon CuraScript SD for our sales and distribution. There may be a disruption or delay in the performance of our third-party manufacturers for Acthar. If such third-party manufacturers are unable to satisfy their commitments to us, our business would be adversely affected because of the resulting supply disruption.

Downturns in the capital markets may have a negative impact on the market values of the investments in our investment portfolio. We cannot predict future market conditions or market liquidity and we cannot assure you that the markets for these securities will not deteriorate or that the institutions that hold these investments will be able to meet their debt obligations at the time we may need to liquidate such investments or until such time as the investments mature.

If we are unable to protect our proprietary rights, we may lose our competitive position and future revenues.

We do not have a patent on Acthar. However, our success will depend in part on our ability to do the following:

| • | protect our trade secrets, |

14

Table of Contents

| • | operate without infringing upon the proprietary rights of others, and |

| • | prevent others from infringing on our proprietary rights. |

We will only be able to protect our proprietary rights from unauthorized use by third parties to the extent that these rights are covered by valid and enforceable patents or are effectively maintained as trade secrets and are otherwise protectable under applicable law.

We rely on trade secrets and proprietary know-how for Acthar. We currently seek protection, in part, through confidentiality and proprietary information agreements. These agreements may not provide meaningful protection or adequate remedies for proprietary technology in the event of unauthorized use or disclosure of confidential and proprietary information. The parties may not comply with or may breach these agreements. Furthermore, our trade secrets may otherwise become known to, or be independently developed by, competitors.

Our success will further depend, in part, on our ability to operate without infringing the proprietary rights of others. If our activities infringe on patents owned by others, we could incur substantial costs in defending ourselves in suits brought against a licensor or us. Should Acthar or its associated technologies be found to infringe on patents issued to third parties, the manufacture, use and sale of Acthar could be enjoined, and we could be required to pay substantial damages. In addition, we, in connection with the development and use of Acthar and its associated technologies, may be required to obtain licenses to patents or other proprietary rights of third parties, which may not be made available on terms acceptable to us.

If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which could have a negative market reaction.

Section 404 of the Sarbanes-Oxley Act of 2002 requires us to report on, and requires our independent registered public accounting firm to attest to, the effectiveness of our internal control over financial reporting. At December 31, 2010, our management determined that we were compliant and we have an ongoing program to perform the system and process evaluation and testing necessary to continue to comply with these requirements. Accordingly, we continue to incur expenses and will devote management resources to Section 404 compliance as necessary. Further, effective internal controls including controls with respect to cash and cash equivalents, and procedures are necessary for us to provide reliable financial reports. If our internal controls and procedures become ineffective, we may not be able to provide reliable financial reports, our business and operating results could be harmed and current and potential shareholders may not have confidence in our financial reporting.

If product liability lawsuits are successfully brought against us or we become subject to other forms of litigation, we may incur substantial liabilities and costs and may be required to limit commercialization of Acthar.

Our business exposes us to potential liability risks that are inherent in the manufacturing, testing and marketing of pharmaceutical products. The use of Acthar, including in connection with clinical trials, may expose us to product liability claims and possible adverse publicity. Under a 2009 United States Supreme Court ruling, FDA approval of a drug does not prevent the filing of product liability claims in state courts, potentially making it more costly and time consuming to defend against such claims. Product liability insurance for the pharmaceutical industry is generally expensive, if available at all. We currently have product liability insurance for claims up to $10 million. However, if we are unable to maintain insurance coverage at acceptable costs, in a sufficient amount, or at all, or if we become subject to a product liability claim, our reputation, stock price and ability to devote the necessary resources to the commercialization of Acthar could be negatively impacted.

Business interruptions could limit our ability to operate our business.

Our operations, including those of our suppliers, are vulnerable to damage or interruption from computer viruses, human error, natural disasters, and telecommunications failures, intentional acts of vandalism and similar events. We have not established a formal disaster recovery plan, and our back-up operations and our business interruption insurance may not be adequate to compensate us for losses that occur. A significant business interruption could result in losses or damages incurred by us and require us to cease or curtail our operations.

15

Table of Contents

Risks Related to our Common Stock

Our stock price has a history of volatility, and an investment in our stock could decline in value.

The price of our common stock is subject to significant volatility. The closing price per share of our common stock ranged in value from $3.49 to $15.46 during the two year period ended December 31, 2010. Any number of events, both internal and external to us, may continue to affect our stock price. For example, our quarterly revenues or earnings or losses can fluctuate based on the buying patterns of our specialty distributor and our end users. In the event that patient demand for Acthar is less than our sales to our specialty distributor, excess Acthar inventories may result at our specialty distributor, which may impact future Acthar sales. Other potential events that could affect our stock price include, without limitation, our quarterly and yearly revenues and earnings or losses; announcement by us or our competitors regarding Acthar development efforts, including the status of regulatory approval applications; the outcome of legal proceedings; the launch of competing products or the public notice of an FDA filing relating to a potential competitive product; our ability to obtain product from our contract manufacturers; and the resolution of (or failure to resolve) disputes with collaboration partners.

We have significant stock option overhang which could dilute your investment.

We have a substantial overhang of common stock due to a low average exercise price of employee stock options. The future exercise of employee stock options could cause substantial dilution, which may negatively affect the market price of our shares.

We have certain anti-takeover provisions in place.

Certain provisions of our Amended and Restated Articles of Incorporation and the California General Corporation Law could discourage a third-party from acquiring, or make it more difficult for a third-party to acquire, control of our company without approval of our board of directors. These provisions could also limit the price that certain investors might be willing to pay in the future for shares of our common stock. Certain provisions allow the board of directors to authorize the issuance of preferred stock with rights superior to those of the common stock. We are also subject to Section 1101(e) of the California General Corporation Law, which, among other things, limits the ability of a majority shareholder holding more than 50% but less than 90% of the outstanding shares of a California corporation from consummating a cash-out merger.

Item 1B. Unresolved Staff Comments

None.

We do not own any real property. We currently lease space in four locations.

| • | We lease 23,000 square feet of office and warehouse space in Union City, California under a lease agreement that expires in March 2011. This facility is occupied by our Commercial Development, Sales and Marketing, Medical Affairs, Contract Manufacturing, Quality Control and Quality Assurance departments. In connection with the expiration of this lease, these functions are being moved to our Hayward, California facility. |

| • | We lease 30,000 square feet of laboratory and office space in Hayward, California under a master lease that expires in November 2012. Effective November 2010, we subleased 9,000 square feet of the facility through November 2012 and effective September 2010, we subleased 4,500 square feet on a month-to-month basis. The remainder of the lease will be occupied by Questcor following the expiration of the Union City lease in March 2011. |

| • | We lease 6,200 square feet of office space in Ellicott City, Maryland under a lease agreement that expires in October 2015. This facility is occupied by our Product Development and Regulatory Affairs departments. |

| • | We lease 4,400 square feet of office space in Anaheim, California under a lease agreement that expires in October 2014. This facility is occupied by our Executive, Finance and Administration departments, and serves as our corporate headquarters. |

We believe that our current leased office space is sufficient to meet our current business requirements and that additional office space will be available on commercially reasonable terms if required.

16

Table of Contents

Questcor operates in a highly regulated industry. We are subject to the regulatory authority of the SEC, the FDA and numerous other federal and state governmental agencies including state Attorney General Offices, which have become more active in investigating the business practices of pharmaceutical companies. From time to time, we receive requests for information from various governmental agencies. In addition, from time to time, we may become involved in litigation relating to claims arising from our ordinary course of business. We are not aware of any claims or actions pending or threatened against us, the ultimate disposition of which we believe would have a material adverse effect on us.

Item 4. (Removed and Reserved)

17

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity; Related Shareholder Matters and Issuer Purchases of Equity Securities

Price Range of Common Stock

Our common stock is listed on the NASDAQ Global market under the symbol “QCOR.” The following table shows the high and low sale prices for our common stock as reported by The NASDAQ Global Market during the calendar quarters indicated:

| High | Low | |||||||

| Year Ended December 31, 2009 |

||||||||

| First Quarter |

$ | 9.63 | $ | 4.36 | ||||

| Second Quarter |

5.49 | 3.10 | ||||||

| Third Quarter |

6.79 | 4.97 | ||||||

| Fourth Quarter |

5.69 | 3.33 | ||||||

| Year Ended December 31, 2010 |

||||||||

| First Quarter |

8.67 | 4.26 | ||||||

| Second Quarter |

11.62 | 7.84 | ||||||

| Third Quarter |

11.63 | 8.89 | ||||||

| Fourth Quarter |

15.57 | 9.33 | ||||||

| Year Ended December 31, 2011 |

||||||||

| First Quarter (through February 18, 2011) |

$ | 16.67 | $ | 13.51 | ||||

Stock Performance Graph

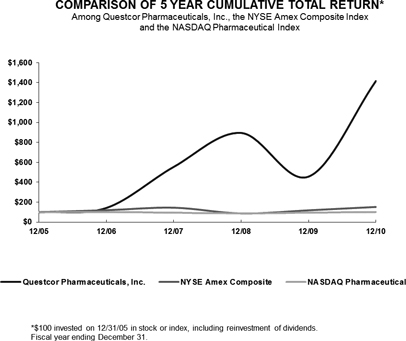

The following graph compares our total cumulative shareholder return as compared to the NYSE Amex Composite Index and the NASDAQ Pharmaceutical Index for the period beginning on December 31, 2005 and ending on December 31, 2010. Total shareholder return assumes $100.00 invested at the beginning of the period in our common stock, the stocks represented by the NYSE Amex Composite Index and the NASDAQ Pharmaceutical Index, respectively. Total return assumes reinvestment of dividends. We have not paid dividends on our common stock.

This stock performance graph shall not be considered soliciting material and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Act, whether made on, before or after the date of this filing and irrespective of any general incorporation language in such filing.

18

Table of Contents

Holders of Common Stock

As of January 31, 2011, there were approximately 159 shareholders of record of our common stock based upon the records of our transfer agent which do not include beneficial owners of common stock whose shares are held in the names of various securities brokers, dealers and registered clearing agencies.

Stock Repurchases

See “Liquidity and Capital Resources — Financing Cash Flows” in Management’s Discussion and Analysis of Financial Condition and Results of Operations in Part II, Item 7 of this Form 10-K for information on our stock repurchases.

Dividend Policy

We have never declared or paid any cash dividends on our common stock. Any future cash dividends will depend on future earnings, capital requirements, our financial condition and other factors deemed relevant by our board of directors.

19

Table of Contents

Equity Compensation Plans

For information regarding our equity compensation plans please see Item 12 of this Annual Report.

Item 6. Selected Financial Data

The following table sets forth certain financial data with respect to our business. The selected consolidated financial data should be read in conjunction with our Consolidated Financial Statements and related Notes and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and other information contained elsewhere in this Annual Report.

| Years Ended December 31, | ||||||||||||||||||||