Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DITECH HOLDING Corp | d362670d8k.htm |

Exhibit 99.1

| Keefe, Bruyette & Woods Mortgage Finance Conference June 5, 2012 |

| Legal Disclaimers Disclaimer and Cautionary Note Regarding Forward-Looking Statements This press release contains forward-looking statements, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Walter Investment's plans, beliefs, objectives, expectations and intentions and other statements that are not historical or current facts. Forward-looking statements are based on Walter Investment's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Walter Investment's results to differ materially from current expectations include, but are not limited to: Walter Investment's ability to implement its strategic initiatives, particularly as they relate to our ability to develop new business, including the implementation of delinquency flow programs and the receipt of new business, which are both subject to customer demand and approval, and the availability of MSRs at acceptable prices, along with the availability of capital to purchase MSRs; the Company's ability to earn anticipated levels of performance and incentive fees on serviced business; continued performance of the loans and residuals segment; economic, political and market conditions and fluctuations, government and industry regulation, including any new regulation, increased costs, and/or decrease in revenues that may result from increased scrutiny by government regulators and customers on lender-placed insurance; interest rate risk and U.S. competition; and other factors detailed in Walter Investment's 2011 Annual Report on Form 10-K and other periodic reports filed with the U.S. Securities and Exchange Commission. In addition, these statements are based on a number of assumptions that are subject to change. Accordingly, actual results may be materially higher or lower than those projected. The inclusion of such projections herein should not be regarded as a representation by Walter Investment that the projections will prove to be correct. This press release speaks only as of this date. Walter Investment disclaims any duty to update the information herein. Non-GAAP Financial Measures To supplement Walter Investment's consolidated financial statements prepared in accordance with GAAP and to better reflect period-over-period comparisons, Walter Investment uses non-GAAP financial measures of performance, financial position, or cash flows that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure, calculated and presented in accordance with GAAP. Non-GAAP financial measures do not replace and are not superior to the presentation of GAAP financial results, but are provided to (i) measure the Company's financial performance excluding depreciation and amortization costs, corporate and MSR facility interest expense, transaction and merger integration-related costs, certain other non-cash adjustments, the net impact of the consolidated Non-Residual Trust VIEs and certain other items as defined by our first and second lien credit agreements, including, but not limited to pro-forma synergies, (ii) provide investors a means of evaluating our core operating performance and (iii) improve overall understanding of Walter Investment's current financial performance and its prospects for the future. Specifically, Walter Investment believes the non-GAAP financial results provide useful information to both management and investors regarding certain additional financial and business trends relating to financial condition and operating results. In addition, management uses these measures for reviewing financial results and evaluating financial performance. The non-GAAP adjustments for all periods presented are based upon information and assumptions available as of the date of this presentation. 1 |

| WAC: An Attractive Investment Opportunity 2 WAC is highly focused on delivering significant returns to shareholders. |

| Proactive Portfolio Management Purchase and Transfer of Servicing Rights is Sensible, Proactive Portfolio Management "One key strategy we have used is the purchase and transfer of servicing responsibilities for high foreclosure-risk loans from traditional servicers to specialty servicers. We believe this approach will help borrowers to either avoid or resolve delinquency and steer clear of foreclosure. It provides significant benefits and makes good economic sense because: Specialty servicers are better positioned to offer high-touch assistance to homeowners. Servicing transfers are intended to benefit Fannie Mae - and ultimately taxpayers - by lowering defaults and credit-related losses among the affected loans. Transfers can help servicers by freeing up employees they can devote to their remaining Fannie Mae portfolio, which we believe will improve the credit performance on those loans too." - Excerpted from FM Commentary , Terry Edwards, FNMA Executive Vice President ,Credit Portfolio Management January 24, 2012 3 |

| Why Servicing is Moving to Specialty Servicers Active portfolio management - to improve servicing, regulatory compliance and credit performance. Higher capital requirements - market and regulatory (Basel III) driven. Increasing regulation. High costs to bring servicing up to the standards required of and provided by specialty servicers. Determinations/decisions by many financial institutions that certain mortgage origination and servicing activities are "non-core". Consolidation and contraction of servicing capacity. High barriers to entry for potential new entrants into the sector. 4 WAC is one of only a few specialty servicers with the capacity, expertise and scale necessary to attract significant servicing transfers. |

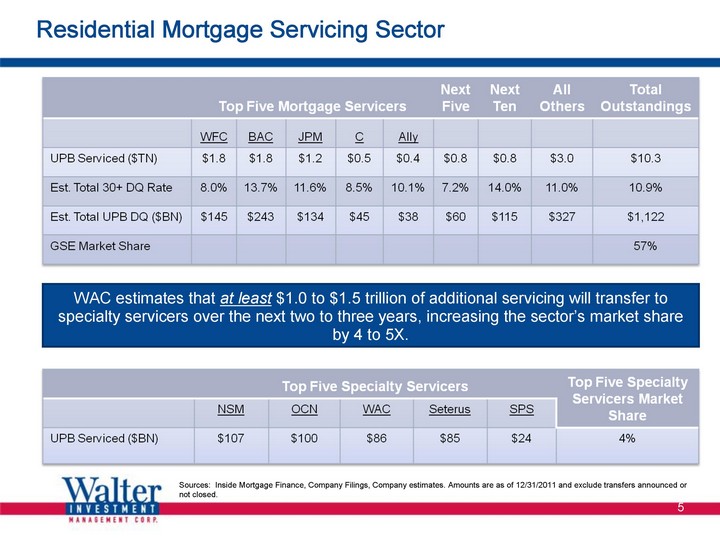

| Residential Mortgage Servicing Sector 5 Sources: Inside Mortgage Finance, Company Filings, Company estimates. Amounts are as of 12/31/2011 and exclude transfers announced or not closed. WAC estimates that at least $1.0 to $1.5 trillion of additional servicing will transfer to specialty servicers over the next two to three years, increasing the sector's market share by 4 to 5X. |

| Delinquency Flow Programs 6 |

| 2012 Servicing Pipeline 2012 Servicing Pipeline 7 2012 New Business Accomplished predominantly through subservicing Strategically important flow arrangements are coming on-line Opportunistic MSR purchases Diverse pipeline driving both near-term growth and long-term sustainability. |

| Building a Sustainable Model 8 Flow Programs, Outsourcing and Private Label Grounded in the long-term value proposition we offer clients for improved credit performance and regulatory compliance Current and developing relationships will be important contributors to flow programs Future of flow is in both delinquent and high-risk assets, as well as newly originated and current product Originations Will be used as a means to extend and replenish the portfolio, providing a strong contribution to overall portfolio growth Asset Management Proven track record as a high-quality manager of whole loans Affiliation with a highly regarded specialty servicer is an advantage MSR Acquisitions As capital flows to riskier originations, MSR will be created that originators have little appetite to retain Standing as a favored partner with track record of performance gives us an edge on acquisitions |

| Q1 2012 Highlights 9 Operational Performance Successfully boarded over 25,000 subserviced accounts with UPB of $2.2 billion. Finished the quarter with servicing portfolio of over 1,032,000 accounts with UPB of $86 billion. Legacy serviced and owned portfolios continue to perform well and meet management's expectations. Capital-light, Relationship Based Approach Lowers risk and drives high-margin recurring fee- based business from the owners of credit. Deep client relationships enhance business sustainability. Allows Walter Investment to remain patient and deliberate in the execution of strategies to drive the sustainability of the business. Financial Performance Core earnings of $20.6 million after taxes, or $0.71 per share Pro Forma Adjusted EBITDA of $59.1 million. Incentive and performance fees of $23.0 million increased 27% over Q4 2011. Key Takeaways Continued strong earnings and EBITDA. Pipeline robust and maturing. Announced first flow program to begin June 15. Strong future upside from delinquency flow programs, incentive fees and managed growth in new business. |

| WAC: An Attractive Investment Opportunity 10 WAC is highly focused on delivering significant returns to shareholders. |

| Appendix |

| 12 Use of Non-GAAP Measures Generally Accepted Accounting Principles ("GAAP") is the term used to refer to the standard framework of guidelines for financial accounting. GAAP includes the standards, conventions, and rules accountants follow in recording and summarizing transactions and in the preparation of financial statements. In addition to reporting financial results in accordance with GAAP, the Company has provided non-GAAP financial measures, which it believes are useful to help investors better understand its financial performance, competitive position and prospects for the future. Core earnings (pre-tax and after-tax) ,core earnings per share and Pro Forma Adjusted EBITDA are financial measures that are not in accordance with GAAP. See the Non-GAAP Reconciliations above for a reconciliation of these measures to the most directly comparable GAAP financial measures. Core earnings (pre-tax and after-tax) and core earnings per share measure the Company's financial performance excluding depreciation and amortization costs related to business combination transactions, transaction and merger integration-related costs, certain other non-cash adjustments, and the net impact of the consolidated Non-Residual Trust VIEs. Pro Forma adjusted EBITDA measures the Company's financial performance excluding depreciation and amortization costs, corporate and MSR facility interest expense, transaction and merger integration-related costs, certain other non-cash adjustments, the net impact of the consolidated Non-Residual Trust VIEs and certain other items as defined by our first and second lien credit agreements, including, but not limited to pro-forma synergies. Core earnings (pre-tax and after-tax) and core earnings per share may also include other adjustments, as applicable based upon facts and circumstances, consistent with the intent of providing investors a means of evaluating our core operating performance. The Company believes that these Non-GAAP Financial Measures can be useful to investors because they provide a means by which investors can evaluate the Company's underlying key drivers and operating performance of the business, exclusive of certain adjustments and activities that investors may consider to be unrelated to the underlying economic performance of the business for a given period. Use of Core Earnings and Pro Forma Adjusted EBITDA by Management The Company manages the business based upon the achievement of core earnings, Pro Forma Adjusted EBITDA and similar targets and has designed certain management incentives based upon the achievement of Pro Forma Adjusted EBITDA in order to assess the underlying operational performance of the continuing operations of the business for the year and to have a basis to compare underlying operating results to prior and future periods. Limitations on the Use of Core Earnings and Pro Forma Adjusted EBITDA Since core earnings (pre-tax and after-tax) and core earnings per share measure the Company's financial performance excluding depreciation and amortization costs related to acquisitions, transaction and merger integration-related costs, certain other non-cash adjustments, and the net impact of the consolidated Non-Residual Trust VIEs, they may not reflect all amounts associated with our results as determined in accordance with GAAP. Pro Forma Adjusted EBITDA measures the Company's financial performance excluding depreciation and amortization costs, corporate and MSR facility interest expense, transaction and merger integration-related costs, certain other non-cash adjustments, the net impact of the consolidated Non-Residual Trust VIEs and certain other items as defined by our first and second lien credit agreements, including, but not limited to pro-forma synergies, they may not reflect all amounts associated with our results as determined in accordance with GAAP Core earnings (pre-tax and after-tax), core earnings per share and Pro Forma Adjusted EBITDA involve differences from segment profit (loss), income (loss) before income taxes, net income (loss), basic earnings (loss) per share and diluted earnings (loss) per share computed in accordance with GAAP. Core earnings (pre-tax and after-tax) ,core earnings per share and Pro Forma Adjusted EBITDA should be considered as supplementary to, and not as a substitute for, segment profit (loss), income (loss) before income taxes, net income (loss), basic earnings (loss) per share and diluted earnings (loss) per share computed in accordance with GAAP as a measure of the Company's financial performance. Any non-GAAP measures should be considered in context with the GAAP financial presentation and should not be considered in isolation or as a substitute for GAAP earnings. Further, the non-GAAP measures presented by Walter Investment may be defined or calculated differently from similarly titled measures of other companies. . . |

| Core Earnings and Pro Forma Adjusted EBITDA 13 Pro Forma Adjusted EBITDA is presented in accordance with its definition in the Company's credit agreements and represents income before income taxes, depreciation and amortization, interest expense on corporate debt, transaction and integration related costs, the net effect of the non-residual VIEs and certain other non-cash income and expense items. Pro Forma Adjusted EBITDA also includes an adjustment to reflect pro-forma synergies and, for periods prior to the acquisition, adjustments to reflect Green Tree as having been acquired at the beginning of the year. ($ in millions, except per share amounts) |

| FM Commentary Purchase and Transfer of Servicing Rights is Sensible, Proactive Portfolio Management The overwhelming majority - more than 93 percent - of Fannie Mae's single-family conventional mortgages were paid on time as of the end of September, 2011. For loans that are at a heightened risk of becoming or remaining delinquent, we often seek ways to improve servicer performance in providing homeowners with foreclosure prevention options and executing on loss mitigation alternatives. One key strategy we have used is the purchase and transfer of servicing responsibilities for high foreclosure-risk loans from traditional servicers to specialty servicers. We believe this approach will help borrowers to either avoid or resolve delinquency and steer clear of foreclosure. It provides significant benefits and makes good economic sense because: Specialty servicers are better positioned to offer high-touch assistance to homeowners. Servicing transfers are intended to benefit Fannie Mae - and ultimately taxpayers - by lowering defaults and credit-related losses among the affected loans. Transfers can help servicers by freeing up employees they can devote to their remaining Fannie Mae portfolio, which we believe will improve the credit performance on those loans too. We have employed servicing transfers for troubled loans for several years, yet recent transfers have generated questions about Fannie Mae's motivation for such transfers and the potential risks. Our motivation is simple - Fannie Mae already owns the credit risk on these loans. We are working to reduce that risk by leveraging servicers that are better geared to handle difficult cases and help homeowners avoid foreclosure wherever possible. Time is of the essence in terms of improving outcomes for borrowers and protecting American taxpayers. It is important that each servicing transfer proceeds in a way that is as smooth and efficient as possible in order to avoid any missteps that could affect or confuse the borrower or unnecessarily complicate the transfer. For this reason, where possible, we work with the original servicer to facilitate the transfer of servicing obligations through a negotiated process. However, where necessary and warranted, we will consider terminating a servicer's contract in order to protect our rights. We currently work primarily with four specialty servicers who are helping us reduce credit losses by working diligently to contact and assist homeowners with the solution that best addresses their situation. These servicers possess the infrastructure and experience needed to take on the volume of business we send their way. We carefully consider the impact of our portfolio management decisions. We believe that better servicing of at-risk loans through targeted servicing transfers is smart portfolio management. Ultimately we believe this strategy will provide better results for homeowners and taxpayers, and we are committed to achieving those goals. Terry Edwards Executive Vice President Credit Portfolio Management January 24, 2012 The views expressed in these articles reflect the personal views of the authors, and do not necessarily reflect the views or policies of any other person, including Fannie Mae or its Conservator. Any figures or estimates included in an article are solely the responsibility of the author. 14 |