Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ASB Bancorp Inc | d357921d8k.htm |

Annual

Meeting of Shareholders Asheville, NC

May 24, 2012

NASDAQ | ASBB

Exhibit 99.1 |

| This

presentation, as well as other written communications made from time to time by the Company and its

subsidiaries and oral communications made from time to time by authorized officers of the

Company, may contain

statements

relating

to

the

future

results

of

the

Company

(including

certain

projections

and

business

trends)

that

are

considered

“forward-looking

statements”

as

defined

in

the

Private

Securities

Litigation

Reform

Act of 1995 (the PSLRA). Such forward-looking statements may be identified by the use of

such words as “believe,”

“expect,”

“anticipate,”

“should,”

“planned,”

“estimated,”

“intend”

and

“potential.”

For

these

statements,

the

Company

claims

the

protection

of

the

safe

harbor

for

forward-looking

statements

contained

in

the PSLRA.

The Company cautions you that a number of important factors could cause actual results to

differ materially from those currently anticipated in any forward-looking

statement. Such factors include, but are not limited to: prevailing economic and

geopolitical conditions; changes in interest rates, loan demand, real estate values and

competition; changes in accounting principles, policies, and guidelines; changes in any

applicable law, rule, regulation or practice with respect to tax or legal issues; and

other economic, competitive, governmental, regulatory and technological factors

affecting the Company’s operations, pricing, products and services and other

factors that may be described in the Company’s annual report on Form 10-K and quarterly reports on

Form 10-Q as filed with the Securities and Exchange Commission. The forward-looking

statements are made as of the date of this presentation, and, except as may be

required by applicable law or regulation, the Company

assumes no obligation to update the forward-looking statements or to update the reasons

why actual results could differ from those projected in the forward-looking

statements. NASDAQ | ASBB

Forward-Looking Statements

| 2 |

| •

Introduction

•

Profile and Executive Management

•

Market Area and Geographic Footprint

•

Financial Performance

•

Stock Information

•

Selected Balance Sheet Data

•

Selected Income Statement Data

•

Competitive Environment

•

Deposit Market Share

•

Changes in Competitors

•

Objectives

•

Near Term

•

Longer Term

NASDAQ | ASBB

Overview

| 3 |

NASDAQ |

ASBB Introduction

| 4 |

| •

$800 million community bank with 13

offices and 170 employees in Western

North Carolina

•

Founded in 1936

•

Largest community bank chartered and

headquartered in Asheville, NC

•

Converted from the mutual form of

ownership on October 11, 2011

NASDAQ | ASBB

Profile

| 5 |

NASDAQ |

ASBB Executive Management

| 6

Role

Years in

Banking

Suzanne DeFerie

(age 55)

President &

Chief Executive Officer

20 years

Kirby Tyndall

(age 57)

Executive Vice President &

Chief Financial Officer

22 years

David Kozak

(age 51)

Executive Vice President &

Chief Lending Officer

27 years

Fred Martin

(age 42)

Executive Vice President &

Chief Information Officer

16 years |

| •

Nestled in the Blue Ridge and Great Smoky Mountains, the

Asheville area attracts newcomers and tourists with its

astounding quality of life and welcoming entrepreneurial

environment.

•

Known for its culinary delights, history, architecture, natural

settings and as a Mecca for adventure lovers, Asheville has

something for everyone.

•

Often

called

“San

Francisco

of

the

East

and

Paris

of

the

South”

–

Asheville is one of the Southeast’s most progressive and vibrant

cities.

•

“Millions

of

foodies

can’t

be

wrong”

–

Asheville

named

a

Top

10

Food

&

Wine

Destination

in

the

U.S.,

Trip

Advisor

Travelers'

Choice

2011

NASDAQ | ASBB

Market: “Asheville – any way you like it”

| 7 |

•

Asheville Metro population:

417,012

•

March 2012 Metro

Unemployment: 7.9%

–

Down from high of 9.2% in June

2009

–

NC current rate is 9.7%

•

Average home price (2011):

$236,492

•

Median income: $43,445

•

Major Industries:

–

Government

–

Healthcare

–

Tourism

| 8

NASDAQ | ASBB

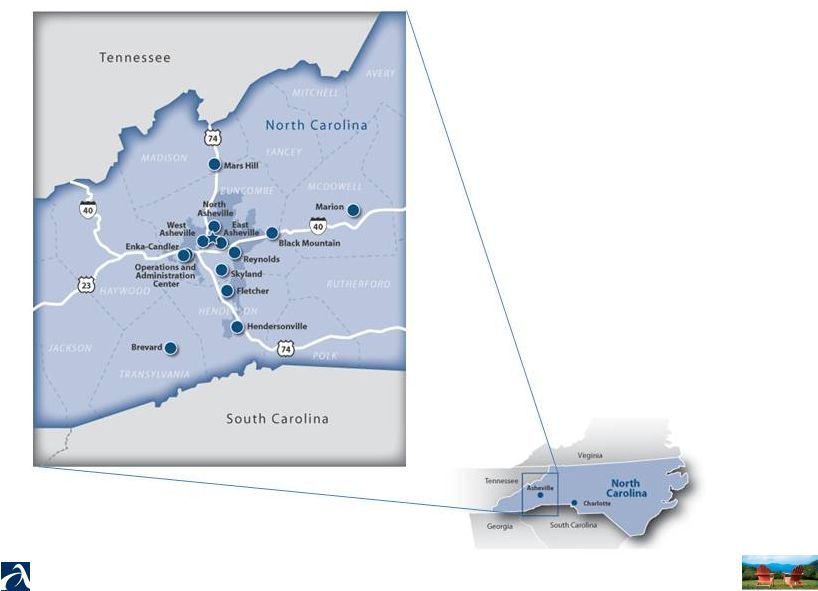

Geographic Footprint |

NASDAQ |

ASBB Financial Performance:

2011 in Review

| 9 |

| NASDAQ Global

Market ASBB

Conversion closing

October 11, 2011

Offering price

$10.00

Opening price (10/12/11)

$11.50

Book value per share (3/31/12)

$20.66

Shares issued

5,584,551 shares

ESOP shares purchased

446,764 shares

NASDAQ | ASBB

Stock Information

| 10 |

December 31,

2011 ($ in millions)

Total assets

$ 790.9

Cash and cash equivalents

72.3

Investment securities

249.1

Gross loans, net of deferred fees

432.9

Deposits

608.2

Borrowings

60.0

Total equity

115.6

NASDAQ | ASBB

Selected Balance Sheet Data

| 11 |

NASDAQ |

ASBB Selected Balance Sheet —

Loans

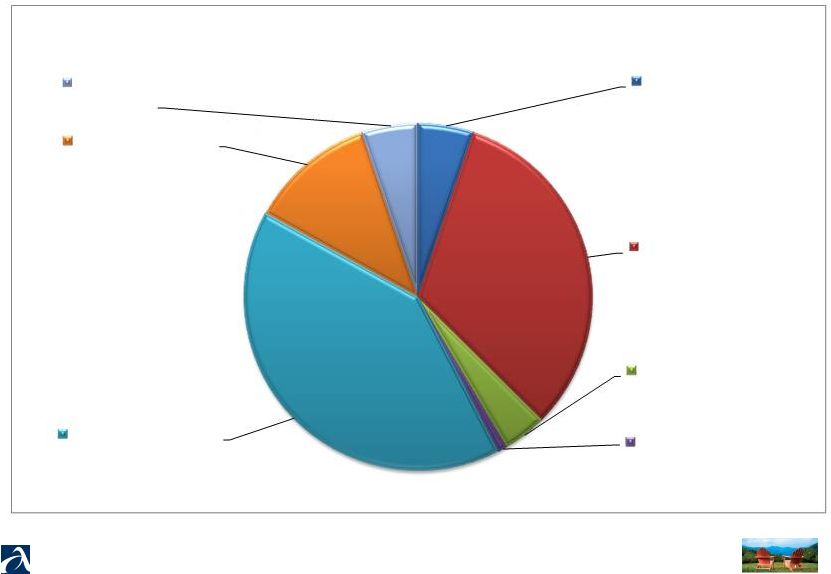

| 12

Commercial

Construction & Land

Development

$22.4 5%

Commercial Mortgage

$139.9 32%

Commercial &

Industrial

$17.5 4%

Non-commercial

Construction & Land

Development

$3.9 1%

Residential Mortgage

$175.9 41%

Revolving Mortgage

$51.0 12%

Consumer

$22.6 5%

Loan Composition ($ mil)

December 31, 2011 |

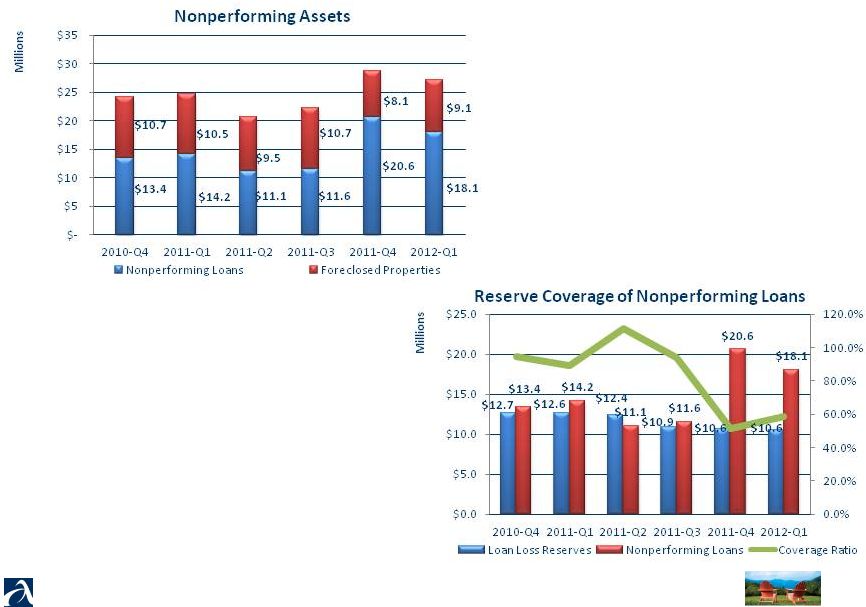

NASDAQ |

ASBB Selected Balance Sheet —

Asset Quality

| 13 |

NASDAQ |

ASBB Selected Balance Sheet —

Deposits

| 14

Noninterest-bearing

Demand Accounts

$54.1 9%

NOW Accounts

$132.8 22%

Savings Accounts

$24.9 4%

Money Market

Accounts

$137.9 23%

Certificate Accounts

$258.5 42%

Deposit Composition ($ mil)

December 31, 2011 |

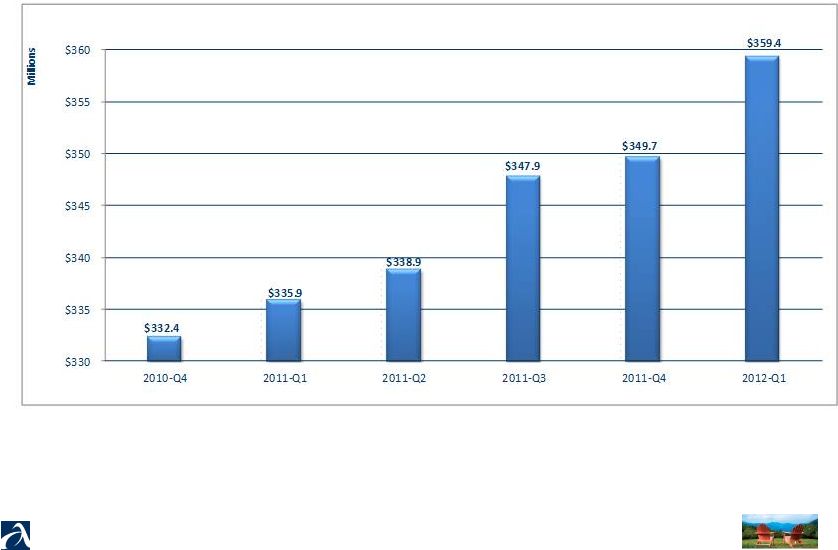

NASDAQ |

ASBB Selected Balance Sheet—Core Deposits

*

| 15

* Excludes all time deposits (retail, jumbo and brokered). |

NASDAQ |

ASBB Selected Balance Sheet —

Capital

| 16 |

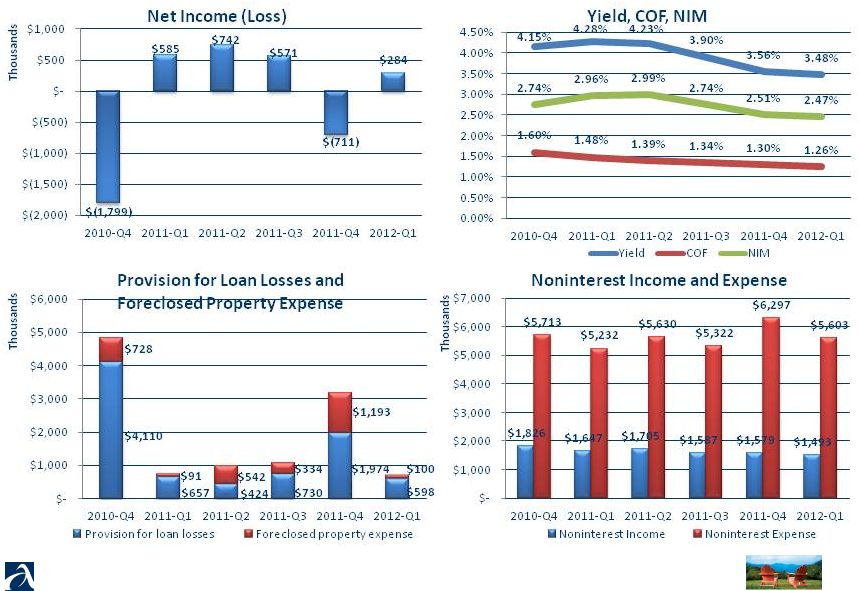

NASDAQ |

ASBB Selected Income Statement Trends

| 17

(excludes securities

gains/losses) |

NASDAQ |

ASBB Competitive Environment

| 18 |

NASDAQ |

ASBB Deposit Market Share: 5 County Region

| 19

Institution

Offices

Deposits

($000)

Market

Share

Institution

Offices

Deposits

($000)

Market

Share

Wells Fargo Bank

17

$1,348,649

19.9%

United Community

4

$ 133,003

2.0%

First Citizens Bank

22

1,223,659

18.0%

First Bank

5

115,320

1.7%

Asheville Savings

13

617,912

9.1%

Blue Ridge Savings

5

109,804

1.6%

Mountain 1st

7

455,227

6.7%

Capital Bank

4

100,005

1.5%

HomeTrust Bank

6

442,068

6.5%

Forest Commercial

1

83,242

1.2%

Bank of America

10

436,157

6.4%

Fifth Third Bank

4

67,128

1.0%

SunTrust Bank

13

434,967

6.4%

Black Mtn Savings

1

31,287

0.5%

BB&T

8

374,715

5.5%

Pisgah Community

1

29,448

0.4%

TD Bank

10

300,806

4.4%

Southern Community

1

24,501

0.4%

RBC Bank

8

254,509

3.8%

GreenBank

1

10,133

0.2%

Macon Bank

3

192,944

2.8%

Woodforest Natl

3

2,265

0.0%

Institutions: 22

147

$6,787,749

100.0% |

Institution

Description of Change

Deposits

($000s)

Market

Share

Wells Fargo

Acquired Wachovia

$1,348,649

19.9%

TD Bank

Acquired Carolina First

300,806

4.4%

PNC Bank

Acquired RBC

254,509

3.8%

First Bank

Acquired Bank of Asheville (FDIC)

115,320

1.7%

Bank of N Carolina

Acquired Blue Ridge Savings (FDIC)

109,804

1.6%

Capital Bank

Recapitalized by PE

100,005

1.5%

Forest Commercial

2008 de novo entry

83,242

1.2%

Pisgah Community

2008 de novo entry

29,448

0.4%

Capital Bank

Acquired GreenBank

10,133

0.2%

Institutions: 9

$2,351,916

34.7%

NASDAQ |

ASBB

Changes in Competitors

| 20 |

NASDAQ |

ASBB Objectives

| 21 |

| •

Goal #1 –

Profitable loan growth and

continued improvement in asset quality –

most significant drivers of profitability

•

Capitalize on market competitor opportunities

•

Grow core deposits to maintain low funding

costs

NASDAQ | ASBB

Near Term Objectives

| 22 |

| •

Evaluation of capital management strategies,

such as share repurchases and cash dividends

•

Share repurchases permitted after one year

anniversary of conversion

•

Share repurchases decisions will consider capital

needs, price and volume of shares

•

Cash dividend decisions will consider sustainable

current earnings and other alternative uses of

capital, such as share repurchases

NASDAQ | ASBB

Near Term Objectives, cont.

| 23 |

| •

Continued evaluation of regulatory reform

impact

•

Expansion of in market opportunities, with

both potential branch locations and continued

leveraging of technology based delivery

systems

•

Evaluation of acquisition opportunities, both

in market and surrounding areas

NASDAQ | ASBB

Longer Term Objectives

| 24 |

NASDAQ |

ASBBQ |