Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Enventis Corp | form8k.htm |

Exhibit 99.1

InvestMNt Conference

May 24, 2012

May 24, 2012

NASDAQ: HTCO

Safe Harbor Statement

Information set forth in this presentation contains financial estimates

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may affect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

and other forward-looking statements that are subject to risks and

uncertainties; therefore, actual results might differ materially from such

statements, whether as a result of new information, future events or

otherwise. You are cautioned not to place undue reliance on these

forward-looking statements. A discussion of factors that may affect

future results is contained in HickoryTech’s filings with the Securities

and Exchange Commission. HickoryTech disclaims any obligation to

update and revise statements contained in this presentation based on

new information or otherwise. This presentation also contains certain

non-GAAP financial measures. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP measures are

available in our presentation.

Founded in 1898 as Mankato Citizens Telephone Company

NASDAQ: HTCO, 52-week range: $8.15 - $12.45

Shares outstanding: 13.5 million, Market Cap: $130 million

Quarterly Dividend $0.14, Annualized: $0.56, Yield: 6%

2011 Revenue: $163.5 million

a leading, regional

communications provider

communications provider

Employees: 500

Named by Forbes as one of best 100 small companies

in America

in America

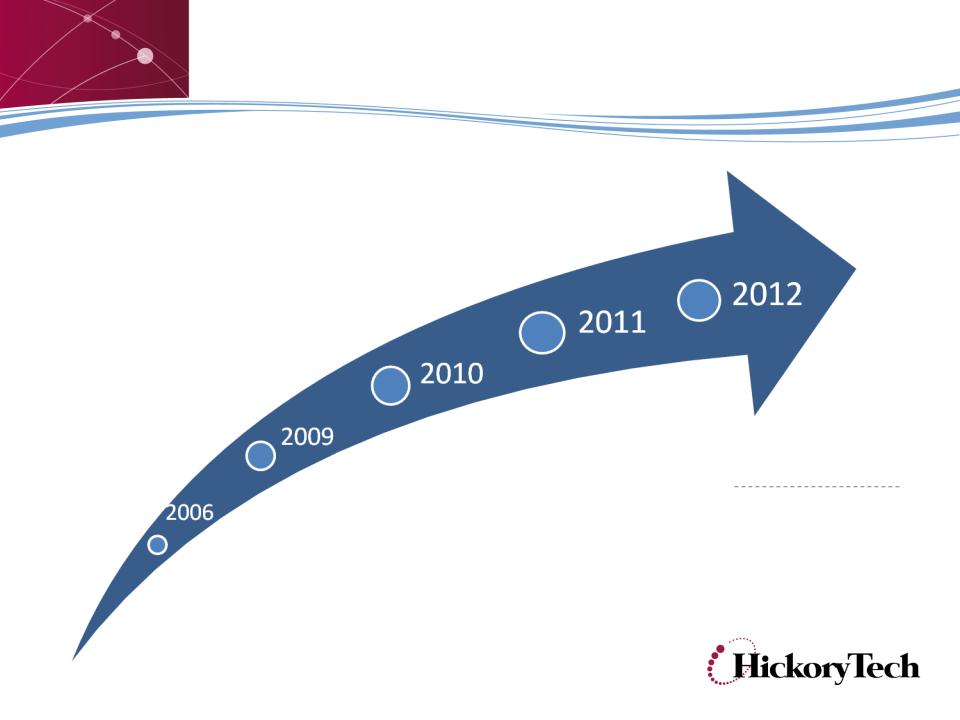

Transforming HickoryTech

Enventis

Acquisition

Acquisition

CP Telecom

Acquisition

Acquisition

Greater MN

Broadband

Collaborative

Project

Initiated

Broadband

Collaborative

Project

Initiated

Close on IdeaOne

Acquisition

Acquisition

Phase 2 of Broadband

Project fiber build

Building a Regional

Communications Company…

Communications Company…

Fiber network

expansion to

So. Dakota,

No. Dakota

expansion to

So. Dakota,

No. Dakota

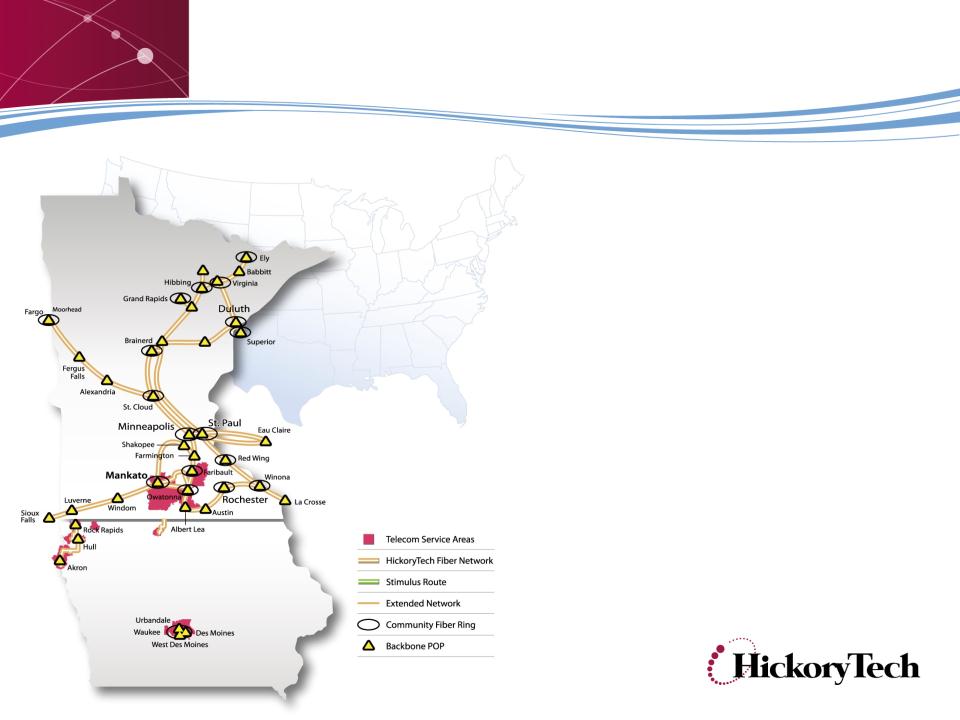

Regional Service Area

• Telecom Service Area -

residential and business

services in southern

Minnesota, northwest Iowa

and Des Moines area

residential and business

services in southern

Minnesota, northwest Iowa

and Des Moines area

Regional Service Area

• Enventis acquisition

(2006) added statewide

fiber network, presence

(2006) added statewide

fiber network, presence

• CP Telecom acquisition

(2009) added commercial

business focus

(2009) added commercial

business focus

• Organic expansion -

Sioux Falls and Fargo

fiber routes (2010)

Sioux Falls and Fargo

fiber routes (2010)

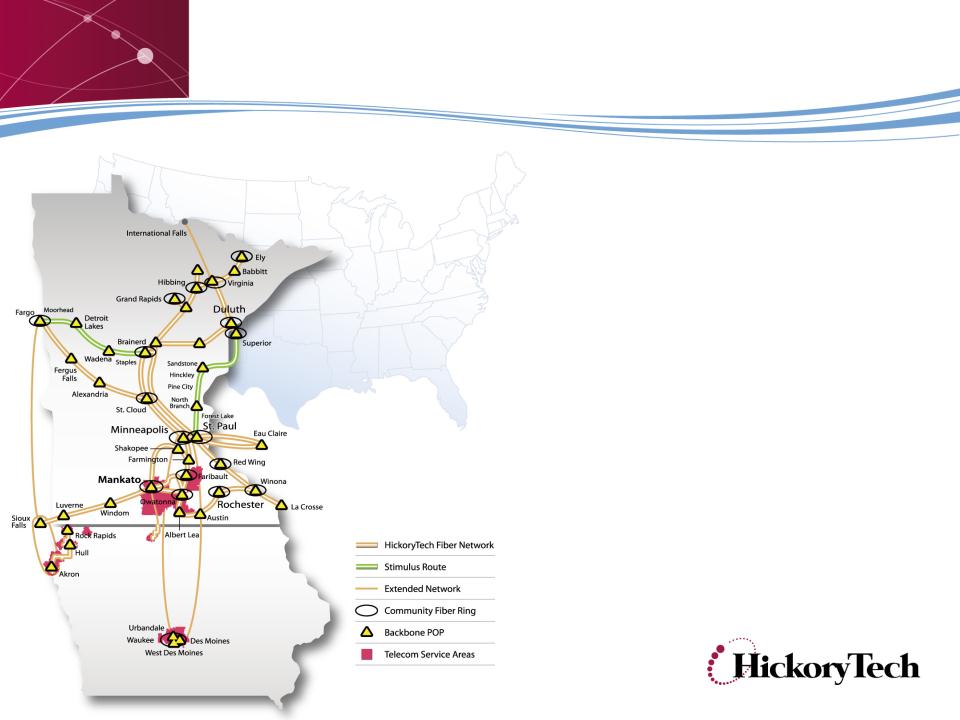

Regional Service Area

Extensive five-state network

includes 3,250 fiber route

miles

includes 3,250 fiber route

miles

•Greater Minnesota

Broadband Project will add

430 fiber route miles

Broadband Project will add

430 fiber route miles

•IdeaOne (2012) acquisition

added 225 fiber route miles

added 225 fiber route miles

Strategic Initiatives

Goal: Diversify Revenue and Increase Shareholder Value

Recent Highlights

IdeaOne Acquisition

|

Close Date

|

March 1, 2012

|

|

IdeaOne

|

CLEC based in Fargo, North Dakota focused on

business customers |

|

Transaction price

|

$28 million, cash transaction with routine

adjustments for capital expenditures and working capital adjustments |

|

Financing structure

|

$22 M of new term debt under existing credit

facility plus $6 M cash |

|

Fiber network

|

225 fiber route miles, 650 lit buildings,

|

|

Employees

|

40 based in Fargo, North Dakota

|

Idea One Acquisition

• Fiber-based communications

provider in Fargo, North Dakota

provider in Fargo, North Dakota

• Fits strategy; primarily business

revenue

revenue

• Further diversification

• Connects with regional fiber

network

network

• Free cash flow accretive in 2012

Diverse Customer Base and Services

Customers range from national carrier to residential

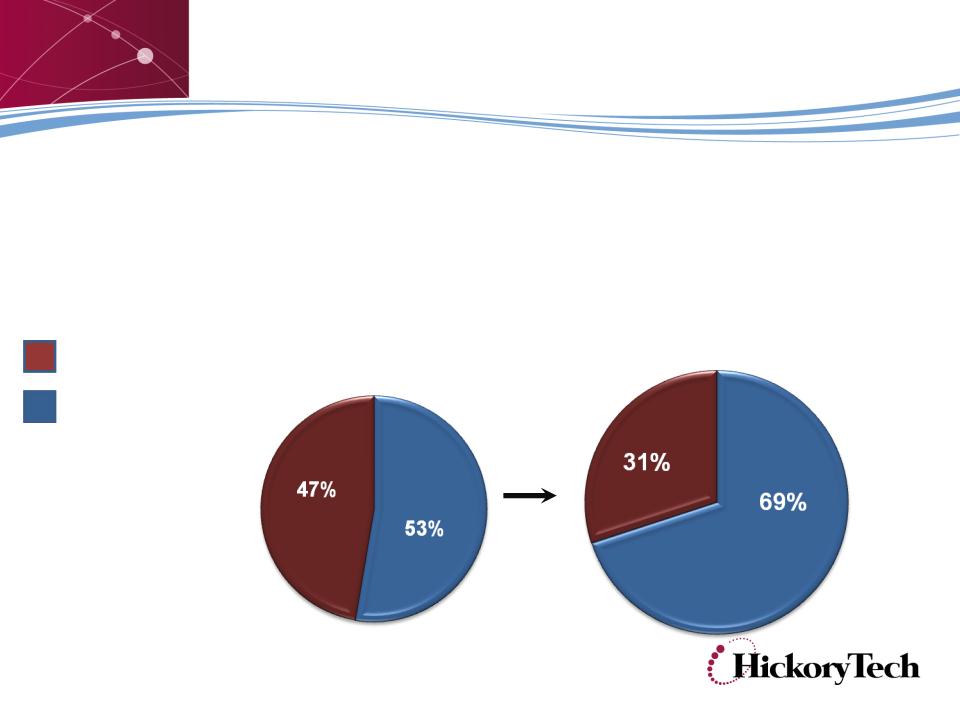

Revenue Growth & Diversification

69% of 2011 revenue was from Business and

Broadband Services

Broadband Services

2006 Revenue

$132.9 M

$132.9 M

2011 Revenue

$163.5 M

$163.5 M

Legacy Telecom

Business &

Broadband

Broadband

EBITDA Growth

• Grew EBITDA

$9.2 M since 2006

$9.2 M since 2006

• Compound annual

growth rate of 5%

growth rate of 5%

($ in Millions)

Shareholder Dividends

Increased dividend in 2011 and 2010

•More than 60 years of dividend payments

•Dividend yield: 5-6%

2011 Free Cash Flow

Free Cash Flow = $19.4 M

Dividend Payout is

38%

38%

Q1-2012: Solid Start to Year

• Strong Financial Performance

Fiber & Data revenue, +22%

Equipment revenue, +67%

Telecom revenue, -6%

Fiber & Data revenue, +22%

Equipment revenue, +67%

Telecom revenue, -6%

• Progress with Greater Minn.

Broadband Collaborative Project

Phase 1 of project 99% complete,

Phase 2 construction in progress

Broadband Collaborative Project

Phase 1 of project 99% complete,

Phase 2 construction in progress

• Strong Balance Sheet

Solid free cash flow, debt of $142

million, cash $20 million

Solid free cash flow, debt of $142

million, cash $20 million

Grew business

revenues and

earnings

revenues and

earnings

Fiber network

expansion,

last-mile fiber builds

expansion,

last-mile fiber builds

Completed

IdeaOne

Acquisition

IdeaOne

Acquisition

HickoryTech Strengths

Diverse revenue streams / markets, emerging

growth through business services and fiber

network expansion

growth through business services and fiber

network expansion

More than 60 years of dividend return, yield 5-6%

Increased dividend in 2011 and 2010

Experienced company with 114-year track record

of financial stability

of financial stability

Strong cash flow, strong balance sheet,

high level of recurring revenue

high level of recurring revenue

Focused on increasing the value of HickoryTech by

growing EBITDA, strategic services, managing debt

growing EBITDA, strategic services, managing debt

Questions

NASDAQ: HTCO

Appendix

• Greater Minnesota Broadband Project

• 2012 Fiscal Outlook

• Debt Balance

• Reconciliation on Non-GAAP

• $24 M project funded with

$16.8 M NTIA Grant Award and

$7.2 M HickoryTech investment

$16.8 M NTIA Grant Award and

$7.2 M HickoryTech investment

• Construction of 430 fiber optic

miles includes two northern routes

miles includes two northern routes

• Partners: education, health care

and state/government entities

and state/government entities

Middle-mile project will add high-

capacity fiber network throughout rural

Minn. and connect anchor institutions

capacity fiber network throughout rural

Minn. and connect anchor institutions

2012 Fiscal Outlook

Outlook provided in Q4 earnings release on March 6, 2012.

Debt Balance

($ in Millions)

Net Debt Balance

Cash on hand

Past acquisitions drove debt increase; history of debt pay down

Enventis

Acquisition

Acquisition

IdeaOne

Acquisition

Acquisition

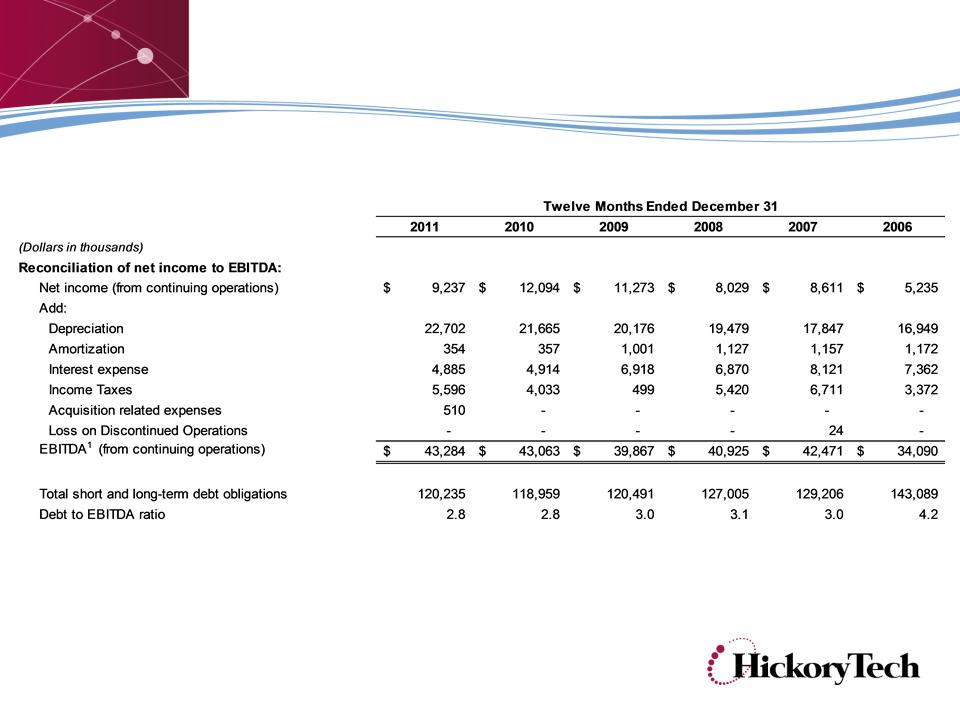

Reconciliation of Non-GAAP

1 EBITDA, a non-GAAP financial measure, is as defined in our debt agreement.

Reconciliation of Non-GAAP

25