UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 22, 2012

Date of Report (Date of earliest event reported)

TERRACE VENTURES INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 000-50569 | 91-2147101 | ||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

810 Peace Portal Drive, Suite 202 Blaine, WA |

98230 | |

| (Address of principal executive offices) | (Zip Code) |

(360) 220-5218

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Current Report constitute "forward-looking statements.” These statements, identified by words such as “plan,” "anticipate," "believe," "estimate," "should," "expect" and similar expressions include our expectations and objectives regarding our future financial position, operating results and business strategy. These statements reflect the current views of management with respect to future events and are subject to risks, uncertainties and other factors that may cause our actual results, performance or achievements, or industry results, to be materially different from those described in the forward-looking statements. Such risks and uncertainties include those set forth under the heading “Risk Factors” and elsewhere in this Current Report. We do not intend to update the forward-looking information to reflect actual results or changes in the factors affecting such forward-looking information. We advise you to carefully review the reports and documents we file from time to time with the SEC, particularly our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

As used in this Current Report on Form 8-K, the terms "we,” "us,” "our,” “Terrace” and the “Company” mean Terrace Ventures Inc., and our wholly owned subsidiaries, unless otherwise indicated. All dollar amounts in this Current Report are in U.S. dollars unless otherwise stated.

| ITEM 3.02 | UNREGISTERED SALE OF EQUITY SECURITIES |

On May 22, 2012, we issued 3,290,000 shares of our common stock at a price of $0.05 per share for proceeds of $164,500 pursuant to Regulation S of the United States Securities Act of 1933 (the “Securities Act”). Each subscriber represented that they were not a “U.S. Person” as that term is defined in Regulation S of the Act.

On May 22, 2012, we issued 400,000 shares of our common stock a price of $0.05 per share for proceeds of $20,000 pursuant to Regulation D of the Securities Act. The subscriber represented that it was an “accredited investor” as defined in Regulation D of the Securities Act.

| ITEM 5.06 | CHANGE IN SHELL COMPANY STATUS |

On April 26, 2011, we entered into an agreement with Pengram Corporation ("Pengram") dated April 26, 2011, as amended on June 29, 2011 (the "Earn-In Agreement") whereby we will earn up to a 75% interest in Pengram's agreement with Scoonover Exploration LLC and JR Exploration LLC (the “Underlying Agreement”) to acquire the Golden Snow Property. The Golden Snow Property consists of 114 mineral claims located in the Eureka Mining District in Eureka County, Nevada. On May 22, 2012, we closed two private placement offerings for proceeds of $184,500 (the “Private Placements”). We have commenced our exploration program on the Golden Snow Property (the “Exploration Program”). As a result of our entry into the Earn-In Agreement, the completion of our Private Placements and the commencement of our Exploration Program, we have ceased to be both a shell company and an issuer described in paragraph (i)(1)(i) of Rule 144 of the Securities Act. Accordingly, we have included in this Current Report on Form 8-K the information that would be required if we were filing a general form for registration of securities on Form 10 as a smaller reporting company.

| 2 |

FORM 10 INFORMATION

BUSINESS

Overview

We were incorporated on February 20, 2001 under the laws of the State of Nevada.

Our business plan is to assemble a portfolio of mineral properties with gold potential and to engage in the exploration and development of these properties. We currently have an earn-in agreement to acquire 75% interest in Pengram Corporation's agreement with Scoonover Exploration LLC and JR Exploration LLC (the “Underlying Agreement”) to acquire the Golden Snow Property. The Golden Snow Property consists of 114 mineral claims located in the Eureka Mining District in Eureka County, Nevada.

Earn-in Agreement

On April 26, 2011, we entered into an agreement with Pengram Corporation ("Pengram") as amended on June 29, 2011, (the "Earn-In Agreement") whereby we will earn up to a 75% interest in Pengram's agreement with Scoonover Exploration LLC and JR Exploration LLC (the “Underlying Agreement”) to acquire the Golden Snow Property by issuing a promissory note to Pengram of $25,000, paying to Pengram up to $150,000 and expending up to $1,750,000 of exploration work on the Golden Snow Property. Under the terms of the Earn-In Agreement, we will exercise our interest in the Underlying Agreement as follows:

| (i) | The first 25% interest in the Underlying Agreement upon us: |

| a. | issuing Pengram a $25,000 promissory note, bearing interest at a rate of 10% per annum, due on September 27, 2011 (which was issued); |

| b. | completing exploration expenditures on the Golden Snow Property totalling $250,000 by July 31, 2012. |

| (ii) | An additional 25% interest in the Underlying Agreement upon us: |

| a. | paying Pengram $50,000 on or before May 31, 2013; |

| b. | completing exploration expenditures on the Golden Snow Property totalling $500,000 by July 31, 2013; |

| (iii) | An additional 25% interest in the Underlying Agreement upon us: |

| (a) | paying Pengram $100,000 on or before May 31, 2014; and |

| (b) | completing exploration expenditures on the Golden Snow Property totalling $1,000,000 by July 31, 2014. |

We are also obligated to pay all advance royalties, county and BLM claim fees and Nevada state taxes during the currency of the Earn-In Agreement. There is no assurance that we be able to perform our obligations under the Earn-In Agreement.

| 3 |

On December 31, 2011, Pengram, in consideration of $5,000 (which has been paid), agreed to accept, in substitution for the $25,000 promissory note set out above, a series of non-interest bearing promissory notes totaling $30,000 payable on the following dates:

| Payment Due Date | Amount | |||

| March 31, 2012 | $ | 5,000.00 | ||

| June 30, 2012 | 5,000.00 | |||

| September 30, 2012 | 10,000.00 | |||

| December 31, 2012 | 10,000.00 | |||

| Total | $ | 30,000.00 | ||

Compliance with Government Regulations

Exploration and development activities are all subject to stringent national, state and local regulations. All permits for exploration and testing must be obtained through the local Bureau of Land Management (“BLM”) offices of the Department of Interior in the State of Nevada. The granting of permits requires detailed applications and filing of a bond to cover the reclamation of areas of exploration. From time to time, an archaeological clearance may need to be obtained before proceeding with any exploration programs. We plan to secure all necessary permits for any future exploration.

We have to apply for and receive permits from the BLM to conduct drilling activities on BLM administered lands. Mining operations are regulated by the Mine and Safety Health Administration (“MSHA”). MSHA inspectors periodically visit projects to monitor health and safety for the workers, and to inspect equipment and installations for code requirements. Workers must have completed MSHA safety training and must take refresher courses annually when working on a project. A safety officer for the project should also on site.

Other regulatory requirements monitor the following:

| (i) | Explosives and explosives handling. |

| (ii) | Use and occupancy of site structures associated with mining. |

| (iii) | Hazardous materials and waste disposal. |

| (iv) | State Historic site preservation. |

| (v) | Archaeological and paleontological finds associated with mining. |

We believe that we are in compliance with all laws and plan to continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect its business operations. There is however no assurance that any change in government regulation in the future will not adversely affect our business operations.

Each year we must pay a maintenance fee of $140 per claim to the Nevada State Office of the Bureau of Land Management and on September 1 of each year we must file an affidavit and Notice of Intent to Hold the claims in Mineral County. With respect to the Golden Snow Project, we have paid the required maintenance fees and filed the affidavits required in order to extend the claims to August 31, 2012.

Compliance with Environmental Regulation

We will have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event that a potentially economic deposit is discovered.

| 4 |

Prior to undertaking mineral exploration activities, we must make application for a permit, if we anticipate disturbing land. A permit is issued after review of a complete and satisfactory application. We do not anticipate any difficulties in obtaining a permit, if needed. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

| (i) | Water discharge will have to meet drinking water standards; |

| (ii) | Dust generation will have to be minimal or otherwise re-mediated; |

| (iii) | Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation; |

| (iv) | An assessment of all material to be left on the surface will need to be environmentally benign; |

| (v) | Ground water will have to be monitored for any potential contaminants; |

| (vi) | The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and |

| (vii) | There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species. |

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Employees

We have no employees as of the date of this Current Report on Form 8-K other than our sole executive officer and director. We conduct our business largely through agreements with consultants and arms-length third parties.

Research And Development Expenditures

We have not incurred any research expenditures since our incorporation.

Patents And Trademarks

We do not own, either legally or beneficially, any patent or trademark.

| 5 |

Reports to Security Holders

We file annual, quarterly and current reports and other information with the Securities and Exchange Commission. You may read and copy any reports, statement or other information that we file with the Commission at the Commission's public reference room at 100 F Street, N.E., Washington, D.C. 20549. Please call the Commission at (202) 551-8090 for further information on the public reference room. These Commission filings are also available to the public from commercial document retrieval services and at the Internet site maintained by the Commission at http://www.sec.gov.

RISK FACTORS

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

If we do not obtain additional financing, our business will fail.

Our plan of operation calls for significant expenses in order to meet our obligations under the Earn-In Agreement. There is no guarantee that we will exercise our option.

On May 22, 2012, we issued 3,290,000 shares of our common stock at a price of $0.05 US per share to persons who are not “U.S. Persons” as defined in Regulation S of the Securities Act and we issued 400,000 shares of our common stock a price of $0.05 per share pursuant to Regulation D of the Securities Act for total proceeds of $184,500.

We do not have other financing arrangements in place. We will require additional financing to meet out our obligations under the Earn-in Agreement. Obtaining financing would be subject to a number of factors outside of our control, including market conditions and additional costs and expenses that might exceed current estimates. These factors may make the timing, amount, terms or conditions of financing unavailable to us in which case we will be unable to complete our plan of operation on our mineral property and to meet our obligations under our Earn-In Agreement

We have yet to earn revenue and our ability to sustain our operations is dependent on our ability to raise financing. As a result, our accountants believe there is substantial doubt about our ability to continue as a going concern.

We have no revenues to date. Our future is dependent upon our ability to obtain financing. Our auditors have expressed substantial doubt about our ability to continue as a going concern given our accumulated losses. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital, we will not be able to complete our business plan. As a result, we may have to liquidate our business and investors may lose their investment. Investors should consider our former auditor's comments when determining if an investment in us is suitable.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of mineral properties . These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

| 6 |

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no mineral reserves. If we do not find a mineral reserve containing gold or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and you will lose your investment. Mineral exploration, particularly for gold, is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our properties, our production capability is subject to further risks including:

| - | Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for; |

| - | Availability and costs of financing; |

| - | Ongoing costs of production; and |

| - | Environmental compliance regulations and restraints. |

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near our mineral properties, and such other factors as government regulations, including regulations relating to allowable production, importing and exporting of minerals, and environmental protection.

Given the above noted risks, the chances of finding reserves on our mineral properties are remote and funds expended on exploration will likely be lost.

Even if we discover proven reserves of precious metals on our mineral property, we may not be able to successfully commence commercial production.

Our mineral property does not contain any known bodies of ore. If our exploration programs are successful in discovering proven reserves on our mineral property, we will require additional funds in order to place the mineral property into commercial production. The expenditures to be made by us in the exploration of our mineral property in all probability will be lost as it is an extremely remote possibility that the mineral claim will contain proven reserves. If our exploration programs are successful in discovering proven reserves, we will require additional funds in order to place our mineral property into commercial production. The funds required for commercial mineral production can range from several millions to hundreds of millions. We currently do not have sufficient funds to place our mineral claims into commercial production. Obtaining additional financing would be subject to a number of factors, including the market price for gold and the costs of exploring for or mining these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Because we will need additional financing to fund our exploration activities there is substantial doubt about our ability to continue as a going concern. At this time, there is a risk that we will not be able to obtain such financing as and when needed.

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of mineral exploration claims and leases on precious metal prospects and in connection with the recruitment and retention of qualified personnel. There is significant competition for precious metals and, as a result, we may be unable to acquire an interest in attractive mineral exploration properties on terms we consider acceptable on a continuing basis.

There is no assurance that we will be able to comply with our obligations under the Earn-In Agreement.

In order comply with our obligations under the Earn-In Agreement we are required to make a series of cash payments and meet the annual claim maintenance fees. In order to meet these payments we will need to obtain substantial financing. If we are unable to meet these payments, we will lose our option to acquire this property.

| 7 |

Because our sole director and executive officer does not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Howard Thomson, our sole director and executive officer, does not have any formal training as a geologist or in the technical aspects of managing a mineral exploration company. Mr. Thomson’s lack of expertise could cause irreparable harm to our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

Because the prices of metals fluctuate, if the price of metals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those metals and we will cease operations.

Prices of metals are determined by such factors as expectations for inflation, the strength of the United States dollar, global and regional supply and demand, and political and economic conditions and production costs in metals producing regions of the world. The aggregate effect of these factors on metal prices is impossible for us to predict. In addition, the prices of precious metals are sometimes subject to rapid short-term and/or prolonged changes because of speculative activities. The current demand for and supply of these metals affect the metal prices, but not necessarily in the same manner as current supply and demand affect the prices of other commodities. The supply of these metals primarily consists of new production from mining. If the prices of the metals are, for a substantial period, below our foreseeable cost of production, we could cease operations and investors could lose their entire investment.

We may conduct further offerings in the future in which case investors’ shareholdings will be diluted.

Since our inception, we have relied on such equity sales of our common stock to fund our operations. We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, the interests of existing shareholders will be diluted.

The quotation price of our common stock may be volatile, with the result that an investor may not be able to sell any shares acquired at a price equal to or greater than the price paid by the investor.

Our common shares are quoted on the OTCBB under the symbol "TVER”. Companies quoted on the OTCBB have traditionally experienced extreme price and volume fluctuations. In addition, our stock price may be adversely affected by factors that are unrelated or disproportionate to our operating performance. Market fluctuations, as well as general economic, political and market conditions such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our common stock. As a result of this potential volatility and potential lack of a trading market, an investor may not be able to sell any of our common stock that they acquire at a price equal or greater than the price paid by the investor.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. Because our securities constitute “penny stocks” within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the trading price of our common stock is less than $5.00 per share, the common stock will be subject to Rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

| 1. | contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; |

| 2. | contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws; |

| 8 |

| 3. | contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; |

| 4. | contains a toll-free telephone number for inquiries on disciplinary actions; |

| 5. | defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and |

| 6. | contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation. |

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

PLAN OF OPERATION

Overview

Over the next twelve months, our plan of operation is to focus our resources on the exploration of the Gold Snow Property. We have commenced an exploration program on the Golden Snow Property. The anticipated costs of the exploration program are as follows:

| Exploration Program Costs | Estimate | Rate ($) | Cost ($) | ||||||||||||

| Geology-Senior | 15 | $ | 650.00 | $ | 9,750 | ||||||||||

| Geology-Junior | 10 | $ | 350.00 | $ | 3,500 | ||||||||||

| Travel and Related Expenses (includes mileage) | $ | 3,375 | |||||||||||||

| Subtotal | $ | 16,625 | |||||||||||||

| Geochemical Sampling (Labor) | 0 | $ | 15 | $ | 0 | ||||||||||

| Geochemical Sampling (Assays) | 100 | $ | 42 | $ | 4,200 | ||||||||||

| Subtotal | $ | 4,200 | |||||||||||||

| Total | $ | 20,825 | |||||||||||||

During the next twelve months, we must complete the following in order to maintain our interest under the Earn-In Agreement and keep the Golden Snow Property in good standing:

| (a) | complete exploration expenditures on the Golden Snow Property totalling $250,000 by July 31, 2012; and |

| (b) | pay the Bureau of Land Management maintenance and claim fees of approximately $15,960 by September 1, 2012. |

As the agreement is an option, we may decide at any time not to proceed in which case we would not be liable to pay any funds beyond the amounts due at the time we provide notice that we are not proceeding. There is no assurance that we will exercise the option.

| 9 |

As the agreement is an option, we may decide at any time not to proceed in which case we would not be liable to pay any funds beyond the amounts due at the time we provide notice that we are not proceeding. There is no assurance that we will exercise the option.

We have insufficient cash on hand to proceed with our exploration on the Golden Snow Project and meet our ongoing operating costs. As such, we will require substantial financing in order to meet our obligations. There is no assurance that we will be able to acquire such financing on terms that are acceptable to us, or at all.

RESULTS OF OPERATIONS

Year End Summary

| Year Ended April 30, | Percentage Increase / | |||||||||||

| 2011 | 2010 | (Decrease) | ||||||||||

| Revenue | $ | -- | $ | -- | n/a | |||||||

| Expenses | (97,195 | ) | (99,514 | ) | (2.3 | )% | ||||||

| Net Loss | $ | (97,195 | ) | $ | (99,514 | ) | (2.3 | )% | ||||

Revenues

We have not earned any revenues since our inception and we do not anticipate earning revenues in the near future. We are an exploration stage company and are presently seeking and evaluating alternative business opportunities.

Operating Expenses

The major components of our expenses for the year ended April 30, 2011 and 2010 are outlined in the table below:

| Year Ended April 30 | Percentage Increase / | |||||||||||

| 2011 | 2010 | (Decrease) | ||||||||||

| Accounting | $ | 24,570 | $ | 25,320 | (3.0 | )% | ||||||

| Bank Charges | 456 | 290 | 57.2 | % | ||||||||

| Cancelled Merger Costs | - | 8,300 | (100.0 | )% | ||||||||

| Consulting | 5,500 | - | 100.0 | % | ||||||||

| Legal | 27,597 | 29,115 | (5.2 | )% | ||||||||

| Office Administration | 30,000 | 30,000 | n/a | |||||||||

| Regulatory Expenses/Fees | 6,672 | 3,714 | 79.6 | % | ||||||||

| Rent | 1,500 | 1,875 | (20.0 | )% | ||||||||

| Telephone | 900 | 900 | n/a | |||||||||

| Total Operating Expenses | $ | 97,195 | $ | 99,514 | (2.3 | )% | ||||||

Our operating expenses decreased from $99,514, during the year ended April 30, 2010, to $97,195, during the year ended April 30, 2011. The decease in our operating expenses is due to decreases in Accounting Legal and Rent and the fact that we recorded Cancelled Merger Costs of $8,300 during the year ended April 30, 2010. This decrease was partially offset by increases in Bank Charges, Consulting and Regulatory Expenses and Fees.

Accounting and legal expenses primarily related to expenses incurred in connection with meeting our ongoing reporting obligations under the Exchange Act.

| 10 |

Office administration expenses consist of amounts incurred to our sole executive officer and director for his management consulting services.

Liquidity and Capital Resources

Cash Flows

| Year Ended April 30 | ||||||||

| 2011 | 2010 | |||||||

| Net Cash used in Operating Activities | $ | (198,710 | ) | $ | (1,037 | ) | ||

| Net Cash used in Investing Activities | (25,000 | ) | -- | |||||

| Net Cash from Financing Activities | 225,000 | -- | ||||||

| Net Increase (Decrease) in Cash During Period | $ | 2,459 | $ | (1,037 | ) | |||

Working Capital

| At April 30, 2011 | At April 30, 2010 | Percentage Increase / (Decrease) | ||||||||||

| Current Assets | $ | 2,459 | $ | 1,169 | 110.4 | % | ||||||

| Current Liabilities | (82,817 | ) | (159,332 | ) | (48.0 | )% | ||||||

| Working Capital Deficit | $ | (80,358 | ) | $ | (158,163 | ) | (49.2 | )% | ||||

We had cash on hand of $2,459 and a working capital deficit of $80,358 as of April 30, 2011 compared to a working capital deficit of $158,163 as of April 30, 2010. The decrease in our working capital deficit is due to a decrease of loans payable and accounts payable and accrued expenses.

Three Months and Nine Months Summary

| Three Months Ended January 31, | Percentage Increase / | Nine Months Ended January 31, | Percentage Increase / | |||||||||||||||||||||

| 2012 | 2011 | (Decrease) | 2012 | 2011 | (Decrease) | |||||||||||||||||||

| Revenue | $ | - | $ | - | n/a | $ | - | $ | - | n/a | ||||||||||||||

| Expenses | (37,910 | ) | (28,998 | ) | 30.7 | % | (125,175 | ) | (70,283 | ) | 78.1 | % | ||||||||||||

| Net Loss | $ | (37,910 | ) | $ | (28,998 | ) | 30.7 | % | $ | (125,175 | ) | $ | (70,283 | ) | 78.1 | % | ||||||||

Revenues

We have not earned any revenues since our inception. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties or if such deposits are discovered, that we will enter into further substantial exploration programs.

| 11 |

Expenses

The major components of our expenses for the three and nine months ended January 31, 2012 and 2011 are outlined in the table below:

| Three Months Ended January 31, | Percentage Increase / | Nine Months Ended January 31, | Percentage Increase / | |||||||||||||||||||||

| 2012 | 2011 | (Decrease) | 2012 | 2011 | (Decrease) | |||||||||||||||||||

| Accounting and Audit | $ | 4,150 | $ | 3,960 | 4.8 | % | $ | 20,680 | $ | 20,420 | 1.3 | % | ||||||||||||

| Bank Charges | 65 | 155 | (58.1 | )% | 205 | 270 | (24.1 | )% | ||||||||||||||||

| Consulting | 1,500 | 1,000 | 50.0 | % | 1,500 | 1,000 | 50.0 | % | ||||||||||||||||

| Foreign Exchange Loss | 905 | - | 100.0 | % | 905 | - | 100.0 | % | ||||||||||||||||

| Interest Expense | 664 | - | 100.0 | % | 1,992 | - | 100.0 | % | ||||||||||||||||

| Legal | 10,770 | 15,614 | (31.0 | )% | 28,550 | 21,883 | 30.5 | % | ||||||||||||||||

| Loan Extension Fees | 10,000 | - | 100.0 | % | 10,000 | - | 100.0 | % | ||||||||||||||||

| Office Administration | 7,500 | 7,500 | 0.0 | % | 22,500 | 22,500 | 0.0 | % | ||||||||||||||||

| Property Maintenance | - | - | n/a | 29,572 | - | 100.0 | % | |||||||||||||||||

| Regulatory Expenses/Fees | 1,563 | 169 | 824.9 | % | 7,278 | 2,410 | 202.0 | % | ||||||||||||||||

| Rent | 375 | 375 | 0.0 | % | 1,125 | 1,125 | 0.0 | % | ||||||||||||||||

| Telephone | 225 | 225 | 0.0 | % | 675 | 675 | 0.0 | % | ||||||||||||||||

| Travel and Entertainment | 193 | - | 100.0 | % | 193 | - | 100.0 | % | ||||||||||||||||

| Total Operating Expenses | $ | 37,910 | $ | 28,998 | 30.7 | % | $ | 125,175 | $ | 70,283 | 78.1 | % | ||||||||||||

Our operating expenses increased from $28,998, during the three months ended January 31, 2011, to $37,910, during the three months ended January 31, 2012. The increase in our operating expenses is due to increases in accounting and audit expenses, consulting fees, interest expense, loan extension fees, regulatory expenses, travel and entertainment expenses, and the recording of a foreign exchange loss. The increase was partially offset by decreases in bank charges and legal fees.

Our operating expenses increased from $70,283, during the nine months ended January 31, 2011, to $125,175, during the nine months ended January 31, 2012. The increase in our operating expenses is due to increases in accounting and audit expenses, consulting fees, interest expense, legal fees, loan extension fees, property maintenance expenses, regulatory expenses, travel and entertainment expenses, and the recording of a foreign exchange loss. The increase in our operating expenses was partially offset by decreases in bank charges.

Accounting and legal expenses primarily relate to expenses incurred in connection with meeting our ongoing reporting obligations under the Exchange Act.

Loan extension fees relate to the $5,000 paid to Pengram in consideration of Pengram accepting four promissory notes totalling $30,000 in place of the previously issued interest bearing promissory note of $25,000.

Office administration expenses consist of amounts incurred to our sole executive officer and director for his management consulting services.

| 12 |

Property maintenance expenses primarily relate to expenses incurred in connection with the Earn-In Agreement with Pengram.

Liquidity and Capital Resources

Working Capital

| At January 31, 2012 | At April 30, 2011 | Percentage Increase / (Decrease) | ||||||||||

| Current Assets | $ | 78,690 | $ | 2,459 | 3,100.1 | % | ||||||

| Current Liabilities | (284,223 | ) | (82,817 | ) | 243.2 | % | ||||||

| Working Capital Deficit | $ | (205,533 | ) | $ | (80,358 | ) | 155.8 | % | ||||

Cash Flows

| Nine Months Ended | ||||||||

| January 31, 2012 | January 31, 2011 | |||||||

| Net Cash Provided by Operating Activities | $ | 76,231 | $ | 127 | ||||

| Net Cash From Investing Activities | - | - | ||||||

| Net Cash Provided By Financing Activities | - | - | ||||||

| Net Increase in Cash During Period | $ | 76,231 | $ | 127 | ||||

We had cash on hand of $78,690 and a working capital deficit of $205,533 as of January 31, 2012 compared to cash on hand of $2,459 and a working capital deficit of $80,358 as of April 30, 2011. The increase in our working capital deficit is due to: (i) an increase in accounts payable and accrued expenses as a result of our lack of capital to meet ongoing costs; (ii) an increase to notes payable in connection with the Earn-In Agreement; and (ii) the fact that we recorded stock subscriptions payable of $164,500.

Financing Requirements

Currently, we do not have sufficient financial resources to meet our ongoing operating expenditures. As such, our ability to complete our plan of operation is dependent upon our ability to obtain additional financing in the near term.

On May 22, 2012, we issued 3,290,000 shares of our common stock at a price of $0.05 per share for proceeds of $164,500 pursuant to Regulation S of the Securities Act. Each subscriber represented that they were not a “U.S. Person” as that term is defined in Regulation S of the Act.

On May 22, 2012, we issued 400,000 shares of our common stock a price of $0.05 per share for proceeds of $20,000 pursuant to Regulation D of the Securities Act. The subscriber represented that it was an “accredited investor” as defined in Regulation D of the Securities Act.

The proceeds of the private placement offerings will be used to retire corporate indebtedness, complete work on our mineral properties and for general corporate purposes.

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our business operations.

| 13 |

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

The preparation of financial statements in conformity with United States generally accepted accounting principles requires our management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our management routinely makes judgments and estimates about the effects of matters that are inherently uncertain.

Our significant accounting policies are disclosed in Note 1 to the annual financial statements included in our previously filed Annual Report of Form 10-K for the fiscal year ended April 30, 2011, filed with the SEC on August 15, 2011.

PROPERTIES

We rent office space at Suite 201, 810 Peace Portal Drive, Blaine, WA 98230, consisting of approximately 1,124 square feet, at a cost of $250 per month. This rental is on a month-to-month basis without a formal contract. We pay a fee of $500 per month for office related services provided in connection with our office rental.

Golden Snow Project

Description of Property

The Golden Snow Project consists of 111 unpatented mining claims covering approximately 3.5 square miles eight miles southwest of Eureka, Nevada. The titles to the property will expire on September 1, 2012 if we do not renew the claims.

| 14 |

Figure 1

Location of Golden Snow Project

Location, Access, and Physiography

The Golden Snow Project is contiguous to the southern end of Staccato Gold’s Lookout Mountain property, which has identified several mineralized areas.

| 15 |

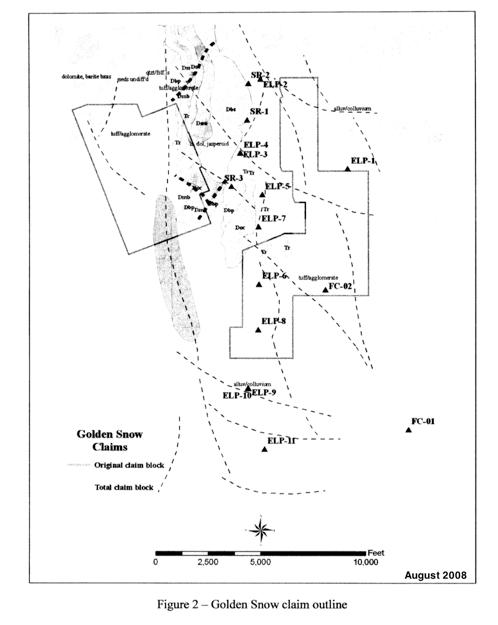

Figure 2

Golden Snow Claim Outline

| 16 |

Property History

Exploration in the Eureka District commenced in the 1860s. The Company does not have any records of exploration work conducted on the Golden Snow Project prior to 2006.

In 2006, Minterra Resources acquired the Golden Snow Project. After its acquisition, Minterra Resources commenced a gravity survey and a 95 line kilometer ground magnetic survey across the Golden Snow Project. The gravity data identified two up-thrown (horst) blocks and the magnetic data indicate a prominent circular high that is approximately 2,782 feet in diameter and has a similar signature to Eocene age intrusive and extrusive rocks throughout the Eureka District.

In 2007, Minterra Resources completed a 932 sample soil geochemistry program designed to further refine and evaluate the prominent horst-bounding faults. Analysis of the data produced numerous large, coherent, multipoint clusters of anomalous gold, arsenic, antimony, mercury, lead, zinc and barite.

Geology

Many of the sediment-hosted gold deposits in Nevada appear to have developed at or near platform margin/basin margin sites where mineralization is found to be disseminated along the “low-stands” or karsted zone separated different stratigraphic units. The Golden Snow Project is positioned along this major platform margin that extends northwards to Cortez Hills, Pipeline and beyond. Future study of the location of these platform margins may result in the discovery of additional world-class gold deposits in Nevada.

Gold mineralization has come up along the host margin where Devonian age rocks are in contract with the Cambrian age rocks. The mineralization is not only found within the feeder fault, but it is also disseminated out along these “low-stand zones” which are commonly the break between different rock formations. Another example of the same host margin mineralization can be seen in a cross section of the mineralization at Lone Tree. Mineralization has also been discovered along the Wayne Zone Fault, which forms the western edge of the horst, and spreads out along favorable host rocks. Both styles of mineralization appear to potentially exist at the Golden Snow Project.

The geology of the Golden Snow Project has been interpreted to consist of Devonian age rocks striking north/south and trending southward under pediment cover. It has also been interpreted that the Cambrian section is possibly in fault contact with the Devonian section. Both rock types are favorable host rocks for Carlin-style mineralization throughout Nevada, especially in the Eureka Area.

The following sets out the geological units exposed on the Golden Snow Project:

Bay State Dolomite – The Bay State Dolomite is a massive dark grey to black to purplish dolomite which is reported to be 600-850 feet thick in the Eureka Area. The lower portion of this unit is made up of irregular bedded light-grey, dolomite sandstone. The upper portion is in gradational contact with the overlying Devils Gate Limestone.

Sentinel Mountain Dolomite – The Sentinel Mountain Dolomite gradationally overlies Oxyoke Canyon. It is composed of alternating, thick-bedded, coarse-grained, light-gray dolomite and motted, finely laminated, chocolate brown dolomites with a strong petroliferous odor when broken. It ranges in thickness from 410 feet to 600 feet.

Oxyoke Canyon – The Oxyoke is predominantly light gray to brown weathering, fine to medium-grained, quartz sandstone with a dolomatic matrix. It ranges in thickness of less than 20 feet up to 400 feet thick throughout the Eureka Area.

Sadler Ranch – The Sadler Ranch locally has been divided up into an upper and lower dolomite and a middle crinoidal dolomite. The lower dolomite is a medium to thick-bedded, very finely grained, light gray to yellowish-gray dolomite. The middle crinoidal dolomite is a light to medium-gray, poorly bedded, laminated to cross-laminated, crinoidal packstone with thin lenses of mudstone and packstone. The upper dolomite is a medium to thick-bedded, very fine-grained, light-gray laminated dolomite. The thickness of this unit varies from 90 feet to 450 feet.

| 17 |

McColley Canyon/Bartine Member – The McColley Canyon is dominantly a medium to thick bedded gray limestone with interbedded light brown-gray fossiliferous and organic-rich dolomite. The Bartine is composed of thin to medium-bedded, medium-gray, fine grained limestone and yellowish argillaceous limestone with abundant brachiopods. Some people combine these units whereas others map them as separate units. These rocks vary from 330 feet to 650 feet thick.

Beacon Peak Dolomite – This unit is a massive, light gray to brown, finely laminated dolomite, with local thin beds of finely laminated dolomite and thin lenses of well rounded, quartz-rich sandstones with a dolomitic matrix. The average thickness is 328 feet.

Mineralization

Two major target zones exist on the Golden Snow Project. These primary targets would be eastern and western boundary of the horst block. Both the eastern and western edge extends for over 15,000 feet as shown by gravity geophysics. Only drill hole ELP-8 drilled close enough to the eastern edge of the gravity high to test for possible mineralization. The remaining holes were either far to east and out into the abyss, or too far west of the eastern horst fault and on top of the gravity high.

A magnetic survey run over the eastern portion of the claim block shows a magnetic high and has been interpreted to be an intrusive as opposed to volcanics. This area is also a potential favorable target area for gold and base-metal mineralization.

Numerous anomalous zones with large, coherent clusters of anomalous gold, arsenic, antimony, mercury, lead and barite have been identified on the Golden Snow Project. The majority of the anomalies appear to be located in the northeastern and eastern and eastern portion of the claim block because of surface or near surface bedrock. These values are probably related to mineralization associated with the buried intrusive. Anomalous arsenic, antimony and mercury are present in the area of the Ratto Fault. Since these minerals are usually formed distal to gold in Carlin-style systems the geochemistry may indicate gold mineralization at depth.

Current Exploration Activities

We have commenced a project-scale (1:2400) mapping and rock chip sampling which was proposed to identify the gold-bearing fault and/or fault corridors coming from the Timberline Resources property located immediately north of the Golden Snow property. Once our consulting geologist has provided us with his findings, we will determine whether to proceed further with our exploration program.

| 18 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of May 22, 2012 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities, (ii) each of our directors and each of our named executive officers (as defined under Item 402(m)(2) of Regulation S-K), and (iii) officers and directors as a group. Unless otherwise indicated, the shareholders listed possess sole voting and investment power with respect to the shares shown.

| Title of Class |

Name and Address of Beneficial Owner |

Number of Shares of Common Stock(1) | Percentage of Common Stock(1) |

|

DIRECTORS AND OFFICERS | |||

| Common Stock |

Howard Thomson CEO, CFO, President, Secretary, Treasurer & Director |

450,000 Shares (direct) |

1.4% |

| Common Stock |

All Officers and Directors as a Group (1 person) |

450,000 Shares

|

1.4% |

|

5% SHAREHOLDERS | |||

| Common Stock |

George Hatch 5% Holder 18555 2nd Avenue, |

2,128,016 Shares (direct) |

6.4% |

| (1) | Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on May 22, 2012. As of May 22, 2012, there were 33,166,660 shares of our common stock issued and outstanding. |

| 19 |

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the name and positions of our sole executive officer and director.

| Name | Age | Positions |

| Howard Thomson | 66 |

President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer and Sole Director |

Set forth below is a brief description of the background and business experience of our sole executive officer and director:

Howard Thomson is our President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer, and the sole member of our Board of Directors. Mr. Thomson was appointed a director on January 16, 2006 and has served as our President, Secretary, Treasurer, Chief Executive Officer and Chief Financial Officer since January 16, 2006. Mr. Thomson was employed from 1981 to 1998 in senior management positions with the Bank of Montreal, including five years as Branch Manager, four years as Regional Marketing Manager and five years as Senior Private Banker. Mr. Thomson retired from the Bank of Montreal in 1998. From February 1999 to August 2006, Mr. Thomson served as a director and officer of Royalite Petroleum Company Inc. (formerly Worldbid Corporation), a public company quoted on the OTC Bulletin Board, engaged in the acquisition and exploration of oil and gas properties. Since February 16, 2008, Mr. Thomson has served as the sole executive officer and sole director of Greenlite Ventures Inc., a public company quoted on the OTC Bulletin Board, engaged in the business of marketing carbon credits.

Mr. Thomson provides his services on a part-time basis as required for our business. Mr. Thomson presently commits approximately 6 to 8 hours a week of his business time to our business.

Significant Employees

We have no significant employees other than our sole executive officer and director.

Terms of Office

Our sole director is elected to hold office until the next annual meeting of the shareholders and until his respective successor(s) has been elected and qualified. Our sole executive officer is appointed by our board of directors and holds office until removed by our board of directors or until his successor(s) is appointed.

| 20 |

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth the total compensation paid or accrued to our named executive officers, as that term is defined in Item 402(m)(2) of Regulation S-K , and to our directors, during our last two completed fiscal years.

| SUMMARY COMPENSATION TABLE | |||||||||

| Name & Principal Position | Year |

Salary ($) |

Bonus ($) |

Stock Awards ($) |

Option Awards ($) |

Non-Equity Incentive Plan Compensation ($) |

Nonqualified Deferred Compensation Earnings ($) |

All Other Compensation ($) |

Total ($) |

|

Howard Thomson President, Secretary, Treasurer, CEO & CFO

|

2011 2010

|

$30,000 $30,000

|

$0 $0 |

$0 $0 |

$0 $0 |

$0 $0 |

$0 $0 |

$0 $0 |

$30,000 $30,000

|

Outstanding Equity Awards at Fiscal Year End

As at April 30, 2011, we had no outstanding equity awards.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

None of the following parties has, in the last two years, had any material interest, direct or indirect, in any transaction with us or in any presently proposed transaction that has or will materially affect us:

| · | Any of our directors or officers; |

| · | Any person proposed as a nominee for election as a director; |

| · | Any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to our outstanding shares of common stock; |

| · | Any of our promoters; and |

| · | Any member of the immediate family (including spouse, parents, children, siblings and in-laws) of any of the foregoing persons. |

Director Independence

Our common stock is quoted on the OTC Bulletin Board inter-dealer quotation system, which does not have director independence requirements. Under NASDAQ Rule 5605(a)(2), a director is not considered to be independent if he or she is also an executive officer or employee of the corporation. Our sole director, Howard Thomson, is also our sole executive officer. As a result, we do not have any independent directors.

As a result of our limited operating history and minimal resources, our management believes that it will have difficulty in attracting independent directors. In addition, we would likely be required to obtain directors and officers insurance coverage in order to attract and retain independent directors. Our management believes that the costs associated with maintaining such insurance is prohibitive at this time.

LEGAL PROCEEDINGS

We are not a party to any material legal proceedings and, to our knowledge, no such proceedings are threatened or contemplated.

| 21 |

MARKET PRICE OF AND DIVIDENDS ON THE REGISTRANT’S COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Market Information

Our shares are quoted on the OTC Bulletin Board under the symbol “TVER”. The high and the low prices for our shares for each of our last eleven fiscal quarters of actual trading were:

|

Quarter Ended |

High |

Low

|

| Fiscal Year 2012 | ||

| January 31, 2012 | $0.06 | $0.023 |

| October 31, 2011 | $0.125 | $0.03 |

| July 31, 2011 | $0.09 | $0.04 |

| Fiscal Year 2011 | ||

| April 30, 2011 | $0.13 | $0.0142 |

| January 31, 2011 | $0.02 | $0.013 |

| October 31, 2010 | $0.015 | $0.015 |

| July 31, 2010 | $0.05 | $0.021 |

| Fiscal Year 2010 | ||

| April 30, 2010 | $0.04 | $0.03 |

| January 31, 2010 | $0.11 | $0.03 |

| October 31, 2009 | $0.15 | $0.04 |

| July 31, 2009 | $0.10 | $0.05 |

The above quotations have been adjusted to reflect the 1-for-5 reverse stock split effected October 1, 2009. Quotations provided by the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions. The high and low bid price information provided above was obtained from the OTC Bulletin Board. The market quotations provided reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

Registered Holders of Our Common Stock

As of May 22, 2012, there were one hundred and twenty one (141) registered holders of our common stock. We believe that a large number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

Dividends

We have neither declared nor paid any cash dividends on our capital stock since our inception and do not contemplate paying cash dividends in the foreseeable future. It is anticipated that earnings, if any, will be retained for the operation of our business. Our board of directors will determine future dividend declarations and payments, if any, in light of the then-current conditions they deem relevant and in accordance with the Nevada Revised Statutes.

There are no restrictions in our articles of incorporation or in our bylaws which prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of a dividend:

| (a) | We would not be able to pay our debts as they become due in the usual course of business; or |

| 22 |

| (c) | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving distributions. |

RECENT SALES OF UNREGISTERED SECURITIES

On April 8, 2009, we issued 600,000 units (each a “Unit”) at a price of $0.02 per Unit pursuant to Regulation S of the Act. Each Unit comprised of one share of our common stock and one share purchase warrant. Each warrant entitled the subscriber to purchase one share of the Company’s common stock for a period expiring two years from the date of issue at an exercise price equal to $0.03 per share.

Effective October 1, 2009, we amended our Articles of Incorporation in accordance with Article 78.207 of Chapter 78 of the Nevada Revised Statutes by decreasing our issued and authorized common stock on a one-for-five basis (the “Reverse Split”).

On March 24, 2011, we issued an aggregate of 20,000,000 shares of our common stock at a price of $0.01 per share in separate concurrent private placement offerings for aggregate proceeds of $200,000 as described below:

US Private Placement – we issued 5,300,000 shares for cash proceeds of $53,000. The issuances were completed pursuant to the provisions of Rule 506 of Regulation D of the Act. Each subscriber represented that they were an accredited investor as defined under Regulation D of the Act.

Foreign Private Placement – we issued 14,700,000 shares for cash proceeds of $147,000. The issuances were completed pursuant to the provisions of Regulation S of the Act. We did not engage in a distribution of this offering in the United States. Each of the subscribers represented that they were not “US persons” as defined in Regulation S of the Act and that they were not acquiring the shares for the account or benefit of a US person.

On May 22, 2012, we issued 3,290,000 shares of our common stock at a price of $0.05 per share for proceeds of $164,500 pursuant to Regulation S of the Securities Act. Each subscriber represented that they were not a “U.S. Person” as that term is defined in Regulation S of the Act.

On May 22, 2012, we issued 400,000 shares of our common stock a price of $0.05 per share for proceeds of $20,000 pursuant to Regulation D of the Securities Act. The subscriber represented that it was an “accredited investor” as defined in Regulation D of the Securities Act.

DESCRIPTION OF REGISTRANT’S SECURITIES

Common Stock

Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders, including the election of directors. Holders of not less than two-percent 2% of the outstanding shares entitled to vote, represented in person or by proxy, are necessary to constitute a quorum at any meeting of our stockholders. Except as otherwise required by law, the Articles of Incorporation, or the Bylaws, all action taken by the holders of a majority of the votes cast, excluding abstentions, at any meeting at which a quorum is present shall be valid and binding upon the corporation; provided, however, that directors shall be elected by a plurality of the votes of the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors. A vote by the holders of a majority of our outstanding shares is required to effectuate certain fundamental corporate changes such as liquidation, merger or an amendment to our Articles of Incorporation. Our Articles of Incorporation do not provide for cumulative voting in the election of directors.

Subject to any preferential rights of any outstanding series of preferred stock created by our board of directors from time to time, the holders of shares of our common stock will be entitled to such cash dividends as may be declared from time to time by our board of directors from funds available therefor.

| 23 |

Subject to any preferential rights of any outstanding series of preferred stock created from time to time by our board of directors, upon liquidation, dissolution or winding up, the holders of shares of our common stock will be entitled to receive pro rata all assets available for distribution to such holders.

In the event of any merger or consolidation with or into another company in connection with which shares of our common stock are converted into or exchangeable for shares of stock, other securities or property (including cash), all holders of our common stock will be entitled to receive the same kind and amount of shares of stock and other securities and property (including cash).

Holders of our common stock have no pre-emptive rights, no conversion rights and there are no redemption provisions applicable to our common stock.

Dividends

We have neither declared nor paid any cash dividends on our capital stock since our inception and do not contemplate paying cash dividends in the foreseeable future. It is anticipated that earnings, if any, will be retained for the operation of our business. Our board of directors will determine future dividend declarations and payments, if any, in light of the then-current conditions they deem relevant and in accordance with the Nevada Revised Statutes.

There are no restrictions in our articles of incorporation or in our bylaws, which prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of a dividend:

| (a) | We would not be able to pay our debts as they become due in the usual course of business; or |

| (b) | Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving distributions. |

Share Purchase Warrants

We have not issued and do not have outstanding any warrants to purchase shares of our common stock.

Options

We have not issued and do not have outstanding any options to purchase shares of our common stock.

Convertible Securities

We have not issued and do not have outstanding any securities convertible into shares of our common stock or any rights convertible or exchangeable into shares of our common stock.

| 24 |

INDEMNIFICATION OF DIRECTORS AND OFFICERS

Our officers and directors are indemnified as provided by the NRS and our bylaws.

Under the NRS, director immunity from liability to a company or its stockholders for monetary liabilities applies automatically unless it is specifically limited by a company’s articles of incorporation that is not the case with our articles of incorporation. Excepted from that immunity are:

| (1) | a willful failure to deal fairly with the company or its stockholders in connection with a matter in which the director has a material conflict of interest; |

| (2) | a violation of criminal law (unless the director had reasonable cause to believe that his or her conduct was lawful or no reasonable cause to believe that his or her conduct was unlawful); |

| (3) | a transaction from which the director derived an improper personal profit; and |

| (4) | willful misconduct. |

Our bylaws provide that we will indemnify our directors and officers to the fullest extent not prohibited by Nevada law; provided, however, that we may modify the extent of such indemnification by individual contracts with our directors and officers; and, provided, further, that we shall not be required to indemnify any director or officer in connection with any proceeding (or part thereof) initiated by such person unless:

| (1) | such indemnification is expressly required to be made by law; |

| (2) | the proceeding was authorized by our Board of Directors; |

| (3) | such indemnification is provided by us, in our sole discretion, pursuant to the powers vested us under Nevada law; or |

| (4) | such indemnification is required to be made pursuant to the bylaws. |

Our bylaws provide that we will advance to any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative, by reason of the fact that he is or was a director or officer, of the company, or is or was serving at the request of the company as a director or executive officer of another company, partnership, joint venture, trust or other enterprise, prior to the final disposition of the proceeding, promptly following request therefore, all expenses incurred by any director or officer in connection with such proceeding upon receipt of an undertaking by or on behalf of such person to repay said amounts if it should be determined ultimately that such person is not entitled to be indemnified under our bylaws or otherwise.

Our bylaws provide that no advance shall be made by us to an officer of the company, except by reason of the fact that such officer is or was a director of the company in which event this paragraph shall not apply, in any action, suit or proceeding, whether civil, criminal, administrative or investigative, if a determination is reasonably and promptly made: (a) by the board of directors by a majority vote of a quorum consisting of directors who were not parties to the proceeding, or (b) if such quorum is not obtainable, or, even if obtainable, a quorum of disinterested directors so directs, by independent legal counsel in a written opinion, that the facts known to the decision-making party at the time such determination is made demonstrate clearly and convincingly that such person acted in bad faith or in a manner that such person did not believe to be in or not opposed to the best interests of the company.

| 25 |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

FINANCIAL STATEMENTS AND EXHIBITS.

Audited financial statements for the years ended April 30, 2011, and 2010 were previously filed on our Annual Report of Form 10-K for the fiscal year ended April 30, 2011, filed with the SEC on August 15, 2011.

Interim financials statements for the three and nine months ended January 31, 2012, and 2011 were previously filed on our Quarterly Report on Form 10-Q for the fiscal quarter ended January 31, 2012, filed with the SEC on March 21, 2012.

| (d) | Exhibits |

The following exhibits are either provided with this Current Report or are incorporated herein by reference:

| Exhibit Number | Description of Exhibit |

| 3.1 | Articles of Incorporation.(1) |

| 3.2 | Certificate of Change to Authorized Capital effective December 19, 2005.(2) |

| 3.3 | Bylaws.(1) |

| 10.1 | 2006 Stock Incentive Plan.(4) |

| 10.2 | Stock Option Agreement between the Company and Howard Thomson dated March 31, 2006.(4) |

| 10.3 | Management Consulting Agreement dated March 21, 2006 between the Company and Howard Thomson.(4) |

| 10.4 | Interim Agreement dated July 9, 2008 between the Company and Pyro Pharmaceuticals, Inc.(5) |

| 10.5 | Amendment Agreement dated September 26, 2008 to the Interim Agreement dated July 9, 2008 between the Company and Pyro Pharmaceuticals, Inc.(6) |

| 10.6 | Share Purchase Agreement dated April 29, 2009 among Terrace Ventures Inc., Marktech Acquisition Corp., Worldbid International Inc. and Geobiz Systems Inc.(7) |

| 10.7 | Amendment Agreement to Share Purchase Agreement dated August 12, 2009 among Terrace Ventures Inc., Marktech Acquisition Corp., Worldbid International Inc. and Geobiz Systems Inc.(8) |

| 10.8 | Earn-In Agreement (Golden Snow) dated April 26, 2011 between Pengram Corporation and Terrace Ventures Inc.(9) |

| 10.9 | Earn-In Extension Agreement (Golden Snow) dated June 29, 2011 between Pengram Corporation and Terrace Ventures Inc.(10) |

| 14.1 | Code of Ethics.(3) |

Notes:

| (1) | Filed with the SEC as an exhibit to our Registration Statement on Form 10-SB originally filed on February 2, 2004. |

| (2) | Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on December 27, 2005. |

| (3) | Filed with the SEC as an exhibit to our Annual Report on Form 10-KSB filed on September 8, 2004. |

| (4) | Filed with the SEC as an exhibit to our Quarterly Report on Form 10-QSB filed on March 22, 2006. |

| (5) | Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on July 15, 2008. |

| (6) | Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on October 2, 2008. |

| (7) | Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on April 29, 2009. |

| (8) | Filed with the SEC as an exhibit to our Annual Report on Form 10-K filed on August 13, 2009. |

| (9) | Filed with the SEC as an exhibit to our Current Report on Form 8-K filed on April 28, 2011. |

| (10) | Filed with the SEC as an exhibit to our Annual Report on Form 10-K filed on August 15, 2011. |

| 26 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TERRACE VENTURES INC. | ||

| Date: May 22, 2012 | By: | /s/ Howard Thomson |

| HOWARD THOMSON Chief Executive Officer, Chief Financial Officer, President, Secretary and Treasurer | ||

| 27 |