Attached files

| file | filename |

|---|---|

| EX-10.9 - EXHIBIT 10-0 - TERRACE VENTURES INC | v232285_ex10-9.htm |

| EX-32.1 - EXHIBIT 32-1 - TERRACE VENTURES INC | v232285_ex32-1.htm |

| EX-31.1 - EXHIBIT 31-1 - TERRACE VENTURES INC | v232285_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended April 30, 2011

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____ to _____

COMMISSION FILE NUMBER 000-50569

|

TERRACE VENTURES INC.

|

|

(Exact name of registrant as specified in its charter)

|

|

NEVADA

|

91-2147101

|

|

|

State or other jurisdiction of incorporation or organization

|

(I.R.S. Employer Identification No.)

|

|

|

Suite 201, 810 Peace Portal Drive,

|

||

|

Blaine, WA

|

98230

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code

|

(360) 220-5218

|

|

|

Securities registered under Section 12(b) of the Exchange Act:

|

NONE.

|

|

|

Securities registered under Section 12(g) of the Exchange Act:

|

Common Stock, $0.001 Par Value Per Share.

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (s. 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes x No ¨

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $94,059 based on a price of $0.015, being the closing price for the Registrant’s common stock as quoted on the OTC Bulletin Board on October 28, 2010.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of August 12, 2011, the Registrant had 29,470,660 shares of common stock outstanding.

TERRACE VENTURES INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED APRIL 30, 2011

TABLE OF CONTENTS

|

PAGE

|

||

|

PART I

|

3

|

|

|

ITEM 1.

|

BUSINESS.

|

3

|

|

ITEM 1A.

|

RISK FACTORS.

|

9

|

|

ITEM 2.

|

PROPERTIES.

|

12

|

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

13

|

|

PART II

|

14

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

14

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

15

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

18

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

34

|

|

ITEM 9AT.

|

CONTROLS AND PROCEDURES.

|

34

|

|

ITEM 9B.

|

OTHER INFORMATION.

|

35

|

|

PART III

|

36

|

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

36

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION.

|

37

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

38

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

40

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

41

|

|

PART IV

|

41

|

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

|

41

|

|

SIGNATURES

|

43

|

Page 2

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "intend," "anticipate," "believe," "estimate,” "predict," "potential" or "continue", the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Terrace,” and the “Company” mean Terrace Ventures Inc. and its subsidiaries, unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

|

ITEM 1.

|

BUSINESS.

|

Overview

We were incorporated on February 20, 2001 under the laws of the State of Nevada.

Our business plan is to assemble a portfolio of mineral properties with gold potential and to engage in the exploration and development of these properties. We currently have an earn-in agreement to acquire 75% interest in Pengram Corporation's agreement with Scoonover Exploration LLC and JR Exploration LLC (the “Underlying Agreement”) to acquire the Golden Snow Property (as described below).

Recent Corporate Developments

The following corporate developments occurred since the filing of our Form 10-Q for the nine months ended January 31, 2011:

|

1.

|

On March 24, 2011, we issued an aggregate of 20,000,000 shares of our common stock (the "Shares") at a price of $0.01 per Share in separate concurrent private placements. Under our US Private Placement we issued 5,300,000 Shares for cash proceeds of $53,000. The issuance was completed pursuant to the provisions of Rule 506 of Regulation D of the United States Securities Act of 1933, as amended (the “Act”). Under our Foreign Private Placement we issued 14,700,000 Shares for cash proceeds of $147,000. The issuance was completed pursuant to the provisions of Regulation S of the Act.

|

|

2.

|

On April 26, 2011, we entered into an agreement with Pengram Corporation ("Pengram") dated April 26, 2011, as amended on June 29, 2011, (the "Earn-In Agreement"). Under the terms of the Earn-In Agreement, we will earn up to a 75% interest in Pengram's agreement with Scoonover Exploration LLC and JR Exploration LLC (the “Underlying Agreement”) to acquire the Golden Snow Property, consisting of 114 mineral claims located in the Eureka Mining District in Eureka County, Nevada, by paying to Pengram up to $175,000 and expending up to $1,750,000 to do exploration work on the Golden Snow Property. See “Golden Snow Property” Below.

|

|

3.

|

On April 26, 2011, our Board of Directors approved two concurrent private placements as follows:

|

|

|

U.S. Private Placement - Our Board of Directors have approved a private placement offering of up to 2,500,000 shares of our common stock at a price of $0.10 US per share. The offering will be made in the United States to persons who are accredited investors as defined in Regulation D of the Act

|

Page 3

|

|

Foreign Private Placement - Our Board of Directors have also approved a concurrent private placement offering of up to 2,500,000 shares of our common stock at a price of $0.10 US per share to persons who are not “U.S. Persons” as defined in Regulation S of the Securities Act of 1933.

|

|

|

There is no assurance that the U.S. Private Placement or the Foreign Private Placement offerings or any part of them will be completed.

|

GOLDEN SNOW PROJECT

Earn-In Agreement

On April 26, 2011, we entered into an agreement with Pengram Corporation ("Pengram") dated April 26, 2011, as amended on June 29, 2011, (the "Earn-In Agreement"). Under the terms of the Earn-In Agreement, we will earn up to a 75% interest in Pengram's agreement with Scoonover Exploration LLC and JR Exploration LLC (the “Underlying Agreement”) to acquire the Golden Snow Property, consisting of 114 mineral claims located in the Eureka Mining District in Eureka County, Nevada, by paying to Pengram up to $175,000 and expending up to $1,750,000 to do exploration work on the Golden Snow Property as follows:

|

|

(i)

|

The first 25% interest in the Underlying Agreement upon the Company:

|

|

|

a.

|

paying Pengram $25,000 by way of a promissory note, bearing interest at a rate of 10% per annum, due on September 27, 2011;

|

|

|

b.

|

completing exploration expenditures on the Property totalling $250,000 by July 31, 2012.

|

|

|

(ii)

|

An additional 25% interest in the Underlying Agreement upon the Company:

|

|

|

a.

|

paying Pengram $50,000 on or before May 31, 2013;

|

|

|

b.

|

completing exploration expenditures on the Property totalling $500,000 by July 31, 2013:

|

|

|

(iii)

|

An additional 25% interest in the Underlying Agreement upon the Company:

|

|

|

a.

|

paying Pengram $100,000 on or before May 31, 2014;

|

|

|

b.

|

completing exploration expenditures on the Property totalling $1,000,000 by July 31, 2014.

|

The Company is also obligated to pay all advance royalties, county and BLM claim fees and Nevada state taxes during the currency of the Earn-In Agreement.

Description of Property

The Golden Snow Project consists of 114 unpatented mining claims covering approximately 3.5 square miles eight miles southwest of Eureka, Nevada. The titles to the property will expire on September 1, 2011 if we do not renew the claims.

Location, Access, and Physiography

The Golden Snow Project is contiguous to the southern end of Staccato Gold’s Lookout Mountain property, which has identified several mineralized areas.

Page 4

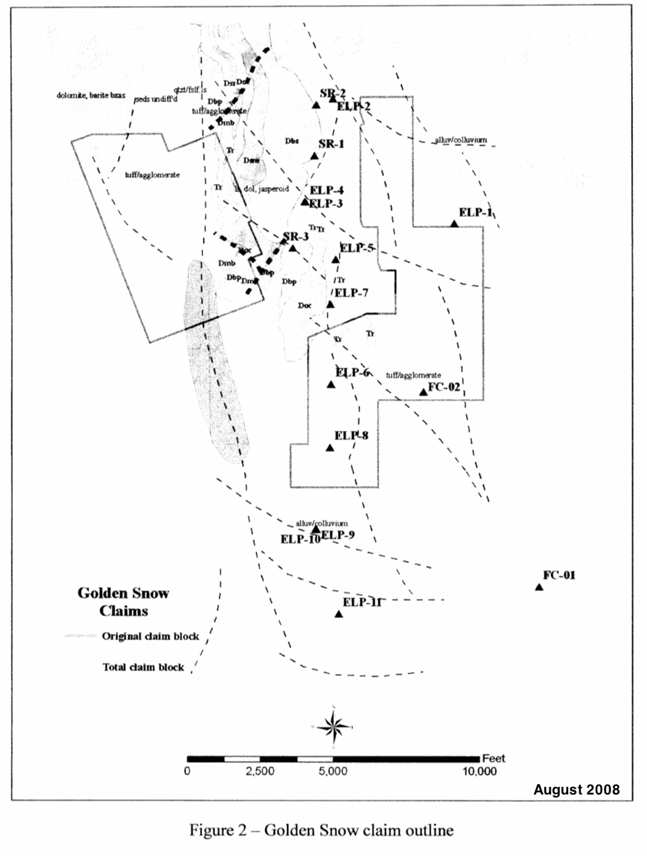

Figure 2

Location of Golden Snow Project

Page 5

Property History

Exploration in the Eureka District commenced in the 1860s. The Company does not have any records of exploration work conducted on the Golden Snow Project prior to 2006.

In 2006, Minterra Resources acquired the Golden Snow Project. After its acquisition, Minterra Resources commenced a gravity survey and a 95 line kilometer ground magnetic survey across the Golden Snow Project. The gravity data identified two up-thrown (horst) blocks and the magnetic data indicate a prominent circular high that is approximately 2,782 feet in diameter and has a similar signature to Eocene age intrusive and extrusive rocks throughout the Eureka District.

In 2007, Minterra Resources completed a 932 sample soil geochemistry program designed to further refine and evaluate the prominent horst-bounding faults. Analysis of the data produced numerous large, coherent, multipoint clusters of anomalous gold, arsenic, antimony, mercury, lead, zinc and barite.

Geology

Many of the sediment-hosted gold deposits in Nevada appear to have developed at or near platform margin/basin margin sites where mineralization is found to be disseminated along the “low-stands” or karsted zone separated different stratigraphic units. The Golden Snow Project is positioned along this major platform margin that extends northwards to Cortez Hills, Pipeline and beyond. Future study of the location of these platform margins may result in the discovery of additional world-class gold deposits in Nevada.

Gold mineralization has come up along the host margin where Devonian age rocks are in contract with the Cambrian age rocks. The mineralization is not only found within the feeder fault, but it is also disseminated out along these “low-stand zones” which are commonly the break between different rock formations. Another example of the same host margin mineralization can be seen in a cross section of the mineralization at Lone Tree. Mineralization has also been discovered along the Wayne Zone Fault, which forms the western edge of the horst, and spreads out along favorable host rocks. Both styles of mineralization appear to potentially exist at the Golden Snow Project.

The geology of the Golden Snow Project has been interpreted to consist of Devonian age rocks striking north/south and trending southward under pediment cover. It has also been interpreted that the Cambrian section is possibly in fault contact with the Devonian section. Both rock types are favorable host rocks for Carlin-style mineralization throughout Nevada, especially in the Eureka Area.

The following sets out the geological units exposed on the Golden Snow Project:

Bay State Dolomite – The Bay State Dolomite is a massive dark grey to black to purplish dolomite which is reported to be 600-850 feet thick in the Eureka Area. The lower portion of this unit is made up of irregular bedded light-grey, dolomite sandstone. The upper portion is in gradational contact with the overlying Devils Gate Limestone.

Sentinel Mountain Dolomite – The Sentinel Mountain Dolomite gradationally overlies Oxyoke Canyon. It is composed of alternating, thick-bedded, coarse-grained, light-gray dolomite and motted, finely laminated, chocolate brown dolomites with a strong petroliferous odor when broken. It ranges in thickness from 410 feet to 600 feet.

Oxyoke Canyon – The Oxyoke is predominantly light gray to brown weathering, fine to medium-grained, quartz sandstone with a dolomatic matrix. It ranges in thickness of less than 20 feet up to 400 feet thick throughout the Eureka Area.

Sadler Ranch – The Sadler Ranch locally has been divided up into an upper and lower dolomite and a middle crinoidal dolomite. The lower dolomite is a medium to thick-bedded, very finely grained, light gray to yellowish-gray dolomite. The middle crinoidal dolomite is a light to medium-gray, poorly bedded, laminated to cross-laminated, crinoidal packstone with thin lenses of mudstone and packstone. The upper dolomite is a medium to thick-bedded, very fine-grained, light-gray laminated dolomite. The thickness of this unit varies from 90 feet to 450 feet.

Page 6

McColley Canyon/Bartine Member – The McColley Canyon is dominantly a medium to thick bedded gray limestone with interbedded light brown-gray fossiliferous and organic-rich dolomite. The Bartine is composed of thin to medium-bedded, medium-gray, fine grained limestone and yellowish argillaceous limestone with abundant brachiopods. Some people combine these units whereas others map them as separate units. These rocks vary from 330 feet to 650 feet thick.

Beacon Peak Dolomite – This unit is a massive, light gray to brown, finely laminated dolomite, with local thin beds of finely laminated dolomite and thin lenses of well rounded, quartz-rich sandstones with a dolomitic matrix. The average thickness is 328 feet.

Mineralization

Two major target zones exist on the Golden Snow Project. These primary targets would be eastern and western boundary of the horst block. Both the eastern and western edge extends for over 15,000 feet as shown by gravity geophysics. Only drill hole ELP-8 drilled close enough to the eastern edge of the gravity high to test for possible mineralization. The remaining holes were either far to east and out into the abyss, or too far west of the eastern horst fault and on top of the gravity high.

A magnetic survey run over the eastern portion of the claim block shows a magnetic high and has been interpreted to be an intrusive as opposed to volcanics. This area is also a potential favorable target area for gold and base-metal mineralization.

Numerous anomalous zones with large, coherent clusters of anomalous gold, arsenic, antimony, mercury, lead and barite have been identified on the Golden Snow Project. The majority of the anomalies appear to be located in the northeastern and eastern and eastern portion of the claim block because of surface or near surface bedrock. These values are probably related to mineralization associated with the buried intrusive. Anomalous arsenic, antimony and mercury are present in the area of the Ratto Fault. Since these minerals are usually formed distal to gold in Carlin-style systems the geochemistry may indicate gold mineralization at depth.

Current Exploration Activities

Subject to obtaining sufficient financing, in the fall of 2011, we plan to retain a consulting geologist to conduct a review of the Golden Snow Project in order to recommend an exploration program. Once our consulting geologist has provided us with their findings, we will determine whether to proceed with an exploration program on these properties.

Compliance with Government Regulations

Exploration and development activities are all subject to stringent national, state and local regulations. All permits for exploration and testing must be obtained through the local Bureau of Land Management (“BLM”) offices of the Department of Interior in the State of Nevada. The granting of permits requires detailed applications and filing of a bond to cover the reclamation of areas of exploration. From time to time, an archaeological clearance may need to be obtained prior to proceeding with any exploration programs.We plan to secure all necessary permits for any future exploration.

We have to apply for and receive permits from the BLM to conduct drilling activities on BLM administered lands. Mining operations are regulated by the Mine and Safety Health Administration (“MSHA”). MSHA inspectors periodically visit projects to monitor health and safety for the workers, and to inspect equipment and installations for code requirements. Workers must have completed MSHA safety training and must take refresher courses annually when working on a project. A safety officer for the project should also on site.

Other regulatory requirements monitor the following:

|

(i)

|

Explosives and explosives handling.

|

Page 7

|

(ii)

|

Use and occupancy of site structures associated with mining.

|

|

(iii)

|

Hazardous materials and waste disposal.

|

|

(iv)

|

State Historic site preservation.

|

|

(v)

|

Archaeological and paleontological finds associated with mining.

|

We believe that we are in compliance with all laws and plan to continue to comply with the laws in the future. We believe that compliance with the laws will not adversely affect its business operations. There is however no assurance that any change in government regulation in the future will not adversely affect our business operations.

Each year we must pay a maintenance fee of $140 per claim to the Nevada State Office of the Bureau of Land Management and on September 1 of each year we must file an affidavit and Notice of Intent to Hold the claims in Mineral County. With respect to the Golden Snow Project, Fish Project and CPG Project, we have paid the required maintenance fees and filed the affidavits required in order to extend the claims to August 31, 2010.

Compliance with Environmental Regulation

We will have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or us in the event that a potentially economic deposit is discovered.

Prior to undertaking mineral exploration activities, we must make application for a permit, if we anticipate disturbing land. A permit is issued after review of a complete and satisfactory application. We do not anticipate any difficulties in obtaining a permit, if needed. If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

|

|

(i)

|

Water discharge will have to meet drinking water standards;

|

|

|

(ii)

|

Dust generation will have to be minimal or otherwise re-mediated;

|

|

|

(iii)

|

Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

|

|

|

(iv)

|

An assessment of all material to be left on the surface will need to be environmentally benign;

|

|

|

(v)

|

Ground water will have to be monitored for any potential contaminants;

|

|

|

(vi)

|

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and

|

|

|

(vii)

|

There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

|

Competition

We are an exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

Page 8

Employees

We have no employees as of the date of this Annual Report on Form 10-K other than our sole executive officer and director. We conduct our business largely through agreements with consultants and arms-length third parties.

Research And Development Expenditures

We have not incurred any research expenditures since our incorporation.

Patents And Trademarks

We do not own, either legally or beneficially, any patent or trademark.

|

ITEM 1A.

|

RISK FACTORS.

|

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

If we do not obtain additional financing, our business will fail.

As of April 30, 2011, we had $2,459 cash on hand and a working capital deficit of $80,358. Our plan of operation calls for significant expenses in order to meet our obligations under the Earn-In Agreement. There is no guarantee that we will exercise our option.

On April 26, 2011, our Board of Directors approved the U.S. Private Placement offering of up to 2,500,000 shares of our common stock at a price of $0.10 per share pursuant to the provisions of Regulation D and a concurrent the Foreign Private Placement offering of up to 2,500,000 shares of our common stock at a price of $0.10 per share to persons who are not “U.S. Persons” as defined in Regulation S of the Securities Act of 1933. There is no assurance that the U.S. Private Placement or the Foreign Private Placement offerings or any part of them will be completed.

Obtaining financing would be subject to a number of factors outside of our control, including market conditions and additional costs and expenses that might exceed current estimates. These factors may make the timing, amount, terms or conditions of financing unavailable to us in which case we will be unable to complete our plan of operation on our mineral properties and to meet our obligations under our option agreements.

We have yet to earn revenue and our ability to sustain our operations is dependent on our ability to raise financing. As a result, our accountants believe there is substantial doubt about our ability to continue as a going concern.

We have a cumulative net loss of $2,076,253 for the period from our inception to April 30, 2011, and have no revenues to date. Our future is dependent upon our ability to obtain financing. Our auditors have expressed substantial doubt about our ability to continue as a going concern given our accumulated losses. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital, we will not be able to complete our business plan. As a result, we may have to liquidate our business and investors may lose their investment. Investors should consider our former auditor's comments when determining if an investment in us is suitable.

Page 9

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no mineral reserves. If we do not find a mineral reserve containing gold or if we cannot explore the mineral reserve, either because we do not have the money to do it or because it will not be economically feasible to do it, we will have to cease operations and you will lose your investment. Mineral exploration, particularly for gold, is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our properties, our production capability is subject to further risks including:

|

-

|

Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for;

|

|

-

|

Availability and costs of financing;

|

|

-

|

Ongoing costs of production; and

|

|

-

|

Environmental compliance regulations and restraints.

|

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near our mineral properties, and such other factors as government regulations, including regulations relating to allowable production, importing and exporting of minerals, and environmental protection.

Given the above noted risks, the chances of finding reserves on our mineral properties are remote and funds expended on exploration will likely be lost.

Even if we discover proven reserves of precious metals on our mineral properties, we may not be able to successfully commence commercial production.

Our mineral properties do not contain any known bodies of ore. If our exploration programs are successful in discovering proven reserves on our mineral properties, we will require additional funds in order to place the mineral properties into commercial production. The expenditures to be made by us in the exploration of mineral properties in all probability will be lost as it is an extremely remote possibility that the mineral claims will contain proven reserves. If our exploration programs are successful in discovering proven reserves, we will require additional funds in order to place the mineral properties into commercial production. The funds required for commercial mineral production can range from several millions to hundreds of millions. We currently do not have sufficient funds to place our mineral claims into commercial production. Obtaining additional financing would be subject to a number of factors, including the market price for gold and the costs of exploring for or mining these materials. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. Because we will need additional financing to fund our exploration activities there is substantial doubt about our ability to continue as a going concern. At this time, there is a risk that we will not be able to obtain such financing as and when needed.

Page 10

We face significant competition in the mineral exploration industry.

We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do in connection with the acquisition of mineral exploration claims and leases on precious metal prospects and in connection with the recruitment and retention of qualified personnel. There is significant competition for precious metals and, as a result, we may be unable to acquire an interest in attractive mineral exploration properties on terms we consider acceptable on a continuing basis.

There is no assurance that we will be able to comply with our obligations under the Earn-In Agreement.

In order comply with our obligations under the Earn-In Agreement we are required to make a series of cash payments and meet the annual claim maintenance fees. In order to meet these payments we will need to obtain substantial financing. If we are unable to meet these payments, we will lose our options to acquire these properties.

Because our sole director and executive officer does not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Howard Thomson, our sole director and executive officer, does not have any formal training as a geologist or in the technical aspects of managing a mineral exploration company. Mr. Thomson’s lack of expertise could cause irreparable harm to our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

Because the prices of metals fluctuate, if the price of metals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those metals and we will cease operations.

Prices of metals are determined by such factors as expectations for inflation, the strength of the United States dollar, global and regional supply and demand, and political and economic conditions and production costs in metals producing regions of the world. The aggregate effect of these factors on metal prices is impossible for us to predict. In addition, the prices of precious metals are sometimes subject to rapid short-term and/or prolonged changes because of speculative activities. The current demand for and supply of these metals affect the metal prices, but not necessarily in the same manner as current supply and demand affect the prices of other commodities. The supply of these metals primarily consists of new production from mining. If the prices of the metals are, for a substantial period, below our foreseeable cost of production, we could cease operations and investors could lose their entire investment.

We may conduct further offerings in the future in which case investors’ shareholdings will be diluted.

We are currently offering securities for gross proceeds of up to $500,000. Since our inception, we have relied on such equity sales of our common stock to fund our operations. We may conduct further equity offerings in the future to finance our current projects or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than that paid by our current stockholders. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, the interests of existing shareholders will be diluted.

The quotation price of our common stock may be volatile, with the result that an investor may not be able to sell any shares acquired at a price equal to or greater than the price paid by the investor.

Our common shares are quoted on the OTCBB under the symbol "TVER”. Companies quoted on the OTCBB have traditionally experienced extreme price and volume fluctuations. In addition, our stock price may be adversely affected by factors that are unrelated or disproportionate to our operating performance. Market fluctuations, as well as general economic, political and market conditions such as recessions, interest rates or international currency fluctuations may adversely affect the market price of our common stock. As a result of this potential volatility and potential lack of a trading market, an investor may not be able to sell any of our common stock that they acquire at a price equal or greater than the price paid by the investor.

Page 11

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. Because our securities constitute “penny stocks” within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the trading price of our common stock is less than $5.00 per share, the common stock will be subject to Rule 15g-9 under the Exchange Act. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that:

|

1.

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

2.

|

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws;

|

|

3.

|

contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

4.

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

5.

|

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

|

|

6.

|

contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

|

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

|

ITEM 2.

|

PROPERTIES.

|

We rent office space at Suite 201, 810 Peace Portal Drive, Blaine, WA 98230, consisting of approximately 1,124 square feet, at a cost of $250 per month. This rental is on a month-to-month basis without a formal contract. We pay a fee of $500 per month for office related services provided in connection with our office rental.

Page 12

Our mineral property is discussed in detail above under the heading “Item 1. Business”.

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

We are not a party to any other legal proceedings and, to our knowledge, no other legal proceedings are pending, threatened or contemplated.

Page 13

PART II

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

MARKET INFORMATION

Our shares are quoted on the OTC Bulletin Board under the symbol “TVER”. The high and the low prices for our shares for each quarter of our last two fiscal years of actual trading were:

|

Quarter Ended

|

High

|

Low

|

||||||

|

Fiscal Year 2011

|

||||||||

|

April 30, 2010

|

$ | 0.13 | $ | 0.0142 | ||||

|

January 31, 2011

|

$ | 0.02 | $ | 0.013 | ||||

|

October 31, 2010

|

$ | 0.015 | $ | 0.015 | ||||

|

July 31, 2010

|

$ | 0.05 | $ | 0.021 | ||||

|

Fiscal Year 2010

|

||||||||

|

April 30, 2010

|

$ | 0.04 | $ | 0.03 | ||||

|

January 31, 2010

|

$ | 0.11 | $ | 0.03 | ||||

|

October 31, 2009

|

$ | 0.15 | $ | 0.04 | ||||

|

July 31, 2009

|

$ | 0.10 | $ | 0.05 | ||||

The above quotations have been adjusted to reflect the 1-for-5 reverse stock split effected October 1, 2009. Quotations provided by the OTC Bulletin Board reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions. The high and low bid price information provided above was obtained from the OTC Bulletin Board. The market quotations provided reflect inter-dealer prices, without retail mark-up, markdown or commission and may not represent actual transactions.

REGISTERED HOLDERS OF OUR COMMON STOCK

As of August 14, 2011, there were one hundred and twenty (120) registered holders of our common stock. We believe that a large number of stockholders hold stock on deposit with their brokers or investment bankers registered in the name of stock depositories.

DIVIDENDS

We have not declared any dividends on our common stock since our inception. There are no dividend restrictions that limit our ability to pay dividends on our common stock in our Articles of Incorporation or bylaws. Chapter 78 of the Nevada Revised Statutes (the “NRS”), does provide certain limitations on our ability to declare dividends. Section 78.288 of Chapter 78 of the NRS prohibits us from declaring dividends where, after giving effect to the distribution of the dividend:

|

(a)

|

we would not be able to pay our debts as they become due in the usual course of business; or

|

|

(b)

|

except as may be allowed by our Articles of Incorporation, our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved at the time of the distribution, to satisfy the preferential rights upon dissolution of stockholders who may have preferential rights and whose preferential rights are superior to those receiving the distribution.

|

We have neither declared nor paid any cash dividends on our capital stock and do not anticipate paying cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance the expansion of our operations. Our board of directors will determine future declaration and payment of dividends, if any, in light of the then-current conditions they deem relevant and in accordance with the Nevada Revised Statutes.

Page 14

RECENT SALES OF UNREGISTERED SECURITIES

Other than as disclosed in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, we did not complete any sales of unregistered securities during the year ended April 30, 2011.

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

PLAN OF OPERATION

Over the next twelve months, our plan of operation is to focus our resources on the exploration of the Gold Snow Property. Subject to obtaining sufficient financing, we plan to retain a consulting geologist to conduct a review of the property in order to recommend an exploration program to be conducted in fall 2011. Once our consulting geologist has provided us with their findings, we will determine whether to proceed with an exploration program on these properties.

During the next twelve months, we will be required to make a number of payments in order to maintain our interest to acquire a 75% interest in the Golden Snow Project. Under the terms of our Earn-In Agreement, in order to keep the Golden Snow Property in good standing, we are required to pay to Pengram: (i) a payment of $25,000 by September 27, 2011; and (ii) the Bureau of Land Management maintenance and claim fees of approximately $15,960 by September 1, 2011. If we are unable to make the payments to Claremont, the Bureau of Land Management we will lose our interest in the Golden Snow Property.

As the agreement is an option, we may decide at any time not to proceed in which case we would not be liable to pay any funds beyond the amounts due at the time we provide notice that we are not proceeding. There is no assurance that we will exercise the option.

As at April 30, 2011, we had $2,459 cash on hand. Accordingly, we have insufficient cash on hand to proceed with our exploration on the Golden Snow Project and meet our ongoing operating costs. As such, we will require substantial financing in order to meet our obligations. There is no assurance that we will be able to acquire such financing on terms that are acceptable to us, or at all.

RESULTS OF OPERATIONS

Summary of Year End Results

|

Year Ended April 30,

|

Percentage | |||||||||||

|

2011

|

2010

|

Increase / (Decrease)

|

||||||||||

|

Revenue

|

$ | — | $ | — | n/a | |||||||

|

Expenses

|

(97,195 | ) | (99,514 | ) | (2.3 | )% | ||||||

|

Net Loss

|

$ | (97,195 | ) | $ | (99,514 | ) | (2.3 | )% | ||||

Revenues

We have not earned any revenues since our inception and we do not anticipate earning revenues in the near future. We are an exploration stage company and are presently seeking and evaluating alternative business opportunities.

Page 15

Operating Expenses

The major components of our expenses for the year ended April 30, 2011 and 2010 are outlined in the table below:

|

Year Ended April 30

|

Percentage | |||||||||||

|

2011

|

2010

|

Increase / (Decrease)

|

||||||||||

|

Accounting

|

$ | 24,570 | $ | 25,320 | (3.0 | )% | ||||||

|

Bank Charges

|

456 | 290 | 57.2 | % | ||||||||

|

Cancelled Merger Costs

|

- | 8,300 | (100.0 | )% | ||||||||

|

Consulting

|

5,500 | - | 100.0 | % | ||||||||

|

Legal

|

27,597 | 29,115 | (5.2 | )% | ||||||||

|

Office Administration

|

30,000 | 30,000 | n/a | |||||||||

|

Regulatory Expenses/Fees

|

6,672 | 3,714 | 79.6 | % | ||||||||

|

Rent

|

1,500 | 1,875 | (20.0 | )% | ||||||||

|

Telephone

|

900 | 900 | n/a | |||||||||

|

Total Operating Expenses

|

$ | 97,195 | $ | 99,514 | (2.3 | )% | ||||||

Our operating expenses decreased from $99,514, during the year ended April 30, 2010, to $97,195, during the year ended April 30, 2011. The decease in our operating expenses is due to decreases in Accounting Legal and Rent and the fact that we recorded Cancelled Merger Costs of $8,300 during the year ended April 30, 2010. This decrease was partially offset by increases in Bank Charges, Consulting and Regulatory Expenses and Fees.

Accounting and legal expenses primarily related to expenses incurred in connection with meeting our ongoing reporting obligations under the Exchange Act.

Office administration expenses consist of amounts incurred to our sole executive officer and director for his management consulting services.

LIQUIDITY AND CAPITAL RESOURCES

Cash Flows

|

Year Ended April 30

|

||||||||

|

2011

|

2010

|

|||||||

|

Net Cash used in Operating Activities

|

$ | (198,710 | ) | $ | 1,037 | |||

|

Net Cash used in Investing Activities

|

(25,000 | ) | — | |||||

|

Net Cash from Financing Activities

|

225,000 | — | ||||||

|

Net Increase (Decrease) in Cash During Period

|

$ | 2,459 | $ | 1,037 | ||||

Working Capital

|

At April 30, 2011

|

At April 30, 2010

|

Percentage

Increase / (Decrease)

|

||||||||||

|

Current Assets

|

$ | 2,459 | $ | 1,169 | 110.4 | % | ||||||

|

Current Liabilities

|

(82,817 | ) | (159,332 | ) | (48.0 | )% | ||||||

|

Working Capital Deficit

|

$ | (80,358 | ) | $ | (158,163 | ) | (49.2 | )% | ||||

We had cash on hand of $2,459 and a working capital deficit of $80,358 as of April 30, 2011 compared to a working capital deficit of $158,163 as of April 30, 2010. The decrease in our working capital deficit is due to a decrease of loans payable and accounts payable and accrued expenses.

Page 16

Financing Requirements

Currently, we do not have sufficient financial resources to meet our ongoing operating expenditures. As such, our ability to complete our plan of operation is dependent upon our ability to obtain additional financing in the near term.

On April 26, 2011, our Board of Directors approved two concurrent private placements as follows:

U.S. Private Placement

our Board of Directors have approved a private placement offering of up to 2,500,000 shares of our common stock at a price of $0.10 US per share. The offering will be made in the United States to persons who are accredited investors as defined in Regulation D of the Securities Act of 1933.

Foreign Private Placement

Our Board of Directors have also approved a concurrent private placement offering of up to 2,500,000 shares of our common stock at a price of $0.10 US per share to persons who are not “U.S. Persons” as defined in Regulation S of the Securities Act of 1933.

The proceeds of the U.S. Private Placement and the Foreign Private Placement offerings will be used to retire corporate indebtedness, complete work on the Company's mineral properties and for general corporate purposes. Under the terms of the private placements, the Company will agree to register for re-sale the shares issued under the private placements within six months of the closing of the private placements.There is no assurance that the U.S. Private Placement or the Foreign Private Placement offerings or any part of them will be completed.

We anticipate continuing to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to our existing shareholders. There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our business operations.

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with United States generally accepted accounting principles requires our management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our management routinely makes judgments and estimates about the effects of matters that are inherently uncertain.

Our significant accounting policies are disclosed in Note 1 to the audited financial statements included in this Annual Report.

Page 17

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

|

Audited Financial Statements for the Years Ended April 30, 2011 and 2010, including:

|

|

|

1.

|

Report of Independent Registered Public Accounting Firm;

|

|

2.

|

Balance Sheets as at April 30, 2011 and 2010;

|

|

3.

|

Statements of Operations and Accumulated Deficit for the years ended April 30, 2011 and 2010 and the period from inception on February 20, 2001 to April 30, 2011;

|

|

4.

|

Statements of Changes in Stockholders’ Equity/Deficit for the period from inception through April 30, 2011;

|

|

5.

|

Statements of Cash Flows for the years ended April 30, 2011 and 2010 and the period from inception to April 30, 2011;

|

|

6.

|

Notes to the Financial Statements; and

|

|

7.

|

Supplemental Statement: Statements of Operating Expenses for the years ended April 30, 2011 and 2010 and the period from inception to April 30, 2011.

|

Page 18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

Terrace Ventures Inc.

Blaine, Washington

We have audited the accompanying balance sheets of Terrace Ventures Inc., an exploration stage company, as of April 30, 2011 and April 30, 2010, and the related statements of operations and accumulated deficit, changes in stockholders’ equity (deficit), and cash flows for the years then ended, and for the period February 20, 2001 (date of inception) to April 30, 2011. These financial statements are the responsibility of Terrace Ventures Inc.’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Terrace Ventures Inc., an exploration stage company, as of April 30, 2011 and April 30, 2010, and the results of its operations, changes in stockholders’ equity (deficit) and cash flows for the years then ended, and for the period February 20, 2001 (date of inception) to April 30, 2011, in conformity with accounting principles generally accepted in The United States of America.

Our audit was made for the purpose of forming an opinion on the basic financial statements taken as a whole. The supplemental statement of operating expenses is presented for the purposes of additional analysis and is not a required part of the basic financial statements, and in our opinion, is fairly stated in all material respects in relation to the basic financial statements taken as a whole.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 9 to the financial statements, the Company has suffered recurring losses from operations, which raise substantial doubt about its ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

Sarna & Company,

|

|

Certified Public Accountants

|

|

Westlake Village, California

|

|

August 15, 2011

|

Page 19

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

BALANCE SHEET

|

APRIL 30,

|

APRIL 30,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current Assets:

|

||||||||

|

Cash

|

$ | 2,459 | $ | 1,169 | ||||

|

Total Current Assets

|

2,459 | 1,169 | ||||||

|

Investment in Mineral Rights

|

25,000 | -0- | ||||||

|

TOTAL ASSETS

|

$ | 27,459 | $ | 1,169 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts Payable and Accrued Expenses

|

$ | 50,817 | $ | 118,132 | ||||

|

Loans Payable

|

6,000 | 27,000 | ||||||

|

Loans Payable – Related Parties

|

1,000 | 14,200 | ||||||

|

Note Payable

|

25,000 | -0- | ||||||

|

Total Current Liabilities

|

82,817 | 159,332 | ||||||

|

Stockholders' Equity:

|

||||||||

|

Common Stock, $0.001 par value 400,000,000 shares authorized, 29,470,660 and 9,470,660 shares issued

|

29,471 | 9,471 | ||||||

|

Additional Paid in Capital

|

1,991,424 | 1,811,424 | ||||||

|

Deficit Accumulated During the Exploration Stage

|

<2,076,253

|

> |

<1,979,058

|

> | ||||

|

Total Stockholders' Equity (Deficit)

|

<55,358

|

> |

<158,163

|

> | ||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

$ | 27,469 | $ | 1,169 | ||||

See Notes to Financial Statements.

Page 20

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF OPERATIONS AND ACCUMULATED DEFICIT

|

YEAR ENDED

|

YEAR ENDED

|

INCEPTION to

|

||||||||||

|

APRIL 30, 2011

|

APRIL 30, 2010

|

APRIL 30, 2011

|

||||||||||

|

Revenues

|

$ | -0- | $ | -0- | $ | -0- | ||||||

|

Operating Expenses

|

<97,195

|

> |

<99,514

|

> |

<1,061,764

|

> | ||||||

|

Loss Before Other Income And Expenses

|

<97,195

|

> |

<99,514

|

> |

<1,061,764

|

> | ||||||

|

Other Income Interest Income

|

-0- | -0- | 14,491 | |||||||||

|

Other Expense Unrealized Loss on Investment

|

-0- | -0- |

<1,028,980

|

> | ||||||||

|

Loss Before Provision for Income Taxes

|

<97,195

|

> |

<99,514

|

> |

<2,076,253

|

> | ||||||

|

Provision for Income Taxes

|

-0- | -0- | -0- | |||||||||

|

Net Loss

|

<97,195

|

> |

<99,514

|

> |

<2,076,253

|

> | ||||||

|

Accumulated Deficit, Beginning of Period

|

<1,979,058

|

> |

<1,879,544

|

> | -0- | |||||||

|

Accumulated Deficit, End of Period

|

$ |

<2,076,253

|

> | $ |

<1,979,058

|

> | $ |

<2,076,253

|

> | |||

|

Net Loss per Share

|

$ | <0.01 | > | $ | <0.01 | > | $ | <0.35 | > | |||

|

Weighted Average Shares Outstanding

|

11,970,660 | 9,470,660 | 6,081,110 | |||||||||

See Notes to Financial Statements.

Page 21

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT)

|

Deficit

|

||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||

|

Common Stock

|

Additional

|

During the

|

Total

|

|||||||||||||||||

|

Dollar

|

Paid in

|

Exploration

|

Stockholders'

|

|||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Stage

|

Equity Deficit)

|

||||||||||||||||

|

Inception, February 20, 2001

|

— | $ | — | $ | — | $ | — | $ | — | |||||||||||

|

Common Stock Issued $0.001 per share April 9, 2001

|

4,000,000 | 400 | 3,600 | — | 4,000 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2001

|

— | — | — | (1,410 | ) | (1,410 | ) | |||||||||||||

|

Balances, April 30, 2001

|

4,000,000 | 400 | 3,600 | (1,410 | ) | 2,590 | ||||||||||||||

|

Common Stock Issued $0.01 per share August 15, 2001

|

2,500,000 | 250 | 24,750 | — | 25,000 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2002

|

— | — | — | (19,196 | ) | (19,196 | ) | |||||||||||||

|

Balances, April 30, 2002

|

6,500,000 | 650 | 28,350 | (20,606 | ) | 8,394 | ||||||||||||||

|

Common Stock Issued $0.10 per share September 30, 2002

|

142,500 | 14 | 14,236 | — | 14,250 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2003

|

— | — | — | (17,632 | ) | (17,632 | ) | |||||||||||||

|

Balances, April 30, 2003

|

6,642,500 | 664 | 42,586 | (38,238 | ) | 5,012 | ||||||||||||||

|

Common Stock Issued $0.10 per share November 6, 2003

|

400,000 | 40 | 39,960 | — | 40,000 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2004

|

— | — | — | (58,708 | ) | (58,708 | ) | |||||||||||||

|

Balances, April 30, 2004

|

7,042,500 | 704 | 82,546 | (96,946 | ) | (13,696 | ) | |||||||||||||

|

Net Loss, Period Ended April 30, 2005

|

— | — | — | (37,532 | ) | (37,532 | ) | |||||||||||||

|

Balances, April 30, 2005

|

7,042,500 | 704 | 82,546 | (134,478 | ) | (51,228 | ) | |||||||||||||

See Notes to Financial Statements.

Page 22

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT) - CONTINUED

|

Deficit

|

||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||

|

Common Stock

|

Additional

|

During the

|

Total

|

|||||||||||||||||

|

Dollar

|

Paid in

|

Exploration

|

Stockholders'

|

|||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Stage

|

Equity (Deficit)

|

||||||||||||||||

|

Balances, April 30, 2005

|

7,042,500 | 704 | 82,546 | (134,478 | ) | (51,228 | ) | |||||||||||||

|

Common Stock Issued $1.00 per share November 23, 2005

|

500,000 | 50 | 499,950 | — | 500,000 | |||||||||||||||

|

4-for-1 Stock Split, December 19, 2005

|

22,627,500 | 29,416 | (29,416 | ) | — | — | ||||||||||||||

|

Common Stock Issued $0.25 per share February 3, 2006

|

400,000 | 400 | 99,600 | — | 100,000 | |||||||||||||||

|

Common Stock Issued $0.25 per share March 13, 2006

|

380,000 | 380 | 94,620 | — | 95,000 | |||||||||||||||

|

Common Stock Issued $0.25 per share March 31, 2006

|

999,920 | 1,000 | 248,980 | — | 249,980 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2006

|

— | — | — | (987,633 | ) | (987,633 | ) | |||||||||||||

|

Balances April 30, 2006

|

31,949,920 | 31,950 | 996,280 | (1,122,111 | ) | (93,881 | ) | |||||||||||||

|

Common Stock Issued $0.25 per share May 24, 2006

|

220,080 | 220 | 54,800 | — | 55,020 | |||||||||||||||

|

Common Stock Issued $0.30 per share June 5, 2006

|

335,000 | 335 | 100,165 | — | 100,500 | |||||||||||||||

|

Common Stock Issued $0.10 per share January 23, 2007

|

1,678,200 | 1,678 | 166,142 | — | 167,820 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2007

|

— | — | — | (301,060 | ) | (301,060 | ) | |||||||||||||

|

Balances April 30, 2007

|

34,183,200 | $ | 34,183 | $ | 1,317,387 | $ | (1,423,171 | ) | $ | (71,601 | ) | |||||||||

See Notes to Financial Statements.

Page 23

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY (DEFICIT) - CONTINUED

|

Deficit

|

||||||||||||||||||||

|

Accumulated

|

||||||||||||||||||||

|

Common Stock

|

Additional

|

During the

|

Total

|

|||||||||||||||||

|

Dollar

|

Paid in

|

Exploration

|

Stockholders'

|

|||||||||||||||||

|

Shares

|

Amount

|

Capital

|

Stage

|

Equity (Deficit)

|

||||||||||||||||

|

Balances April 30, 2007

|

34,183,200 | $ | 34,183 | $ | 1,317,387 | $ | (1,423,171 | ) | $ | (71,601 | ) | |||||||||

|

Common Stock Issued $0.10 per share July 12, 2007

|

2,570,000 | 2,570 | 254,755 | — | 257,325 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2008

|

— | — | — | (100,450 | ) | (100,450 | ) | |||||||||||||

|

Balances April 30, 2008

|

36,753,200 | $ | 36,753 | $ | 1,572,142 | $ | (1,523,621 | ) | $ | 85,274 | ||||||||||

|

Common Stock Issued $0.10 per share October 10, 2008

|

10,000,000 | 10,000 | 190,000 | — | 200,000 | |||||||||||||||

|

Common Stock Issued $0.20 per share April 8, 2009

|

600,000 | 600 | 11,400 | — | 12,000 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2009

|

— | — | — | (355,923 | ) | (355,923 | ) | |||||||||||||

|

Balances April 30, 2009

|

47,353,200 | 47,353 | 1,773,542 | (1,879,544 | ) | (58,649 | ) | |||||||||||||

|

1-for-5 Reverse Stock Split, October 1, 2009

|

(37,882,540 | ) | (37,882 | ) | 37,882 | — | — | |||||||||||||

|

Net Loss, Period Ended April 30, 2010

|

— | — | — | (99,514 | ) | (99,514 | ) | |||||||||||||

|

Balances April 30, 2010

|

9,470,660 | 9,471 | 1,811,424 | (1,979,058 | ) | (158,163 | ) | |||||||||||||

|

Common Stock Issued $0.01 per share March 24, 2011

|

20,000,000 | 20,000 | 180,000 | — | 200,000 | |||||||||||||||

|

Net Loss, Period Ended April 30, 2011

|

— | — | — | (97,195 | ) | (97,195 | ) | |||||||||||||

|

Balances April 30, 2011

|

29,470,660 | 29,471 | 1,991,424 | (2,076,253 | ) | (55,358 | ) | |||||||||||||

See Notes to Financial Statements.

Page 24

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

STATEMENTS OF CASH FLOWS

|

YEAR ENDED

|

YEAR ENDED

|

INCEPTION to

|

||||||||||

|

APRIL 30, 2011

|

APRIL 30, 2010

|

APRIL 30, 2011

|

||||||||||

|

Cash Flows from Operating Activities:

|

||||||||||||

|

Net Loss

|

$ | <97,195 | > | $ | <99,514 | > | $ | <2,076,253 | > | |||

|

Adjustments to Reconcile Net Loss To Net Cash Provided/<Used> by Operating Activities:

|

||||||||||||

|

Unrealized Loss on Investment

|

-0- | -0- | 1,028,980 | |||||||||

|

<Increase>/Decrease in:

|

||||||||||||

|

Loans Receivable

|

-0- | 4,500 | ||||||||||

|

Notes Receivable

|

-0- | -0- | -0- | |||||||||

|

Increase/<Decrease> in:

|

||||||||||||

|

Accounts Payable

|

<67,315

|

> | 54,851 | 50,817 | ||||||||

|

Loans Payable

|

<21,000

|

> | 27,000 | 6,000 | ||||||||

|

Loans Payable – Related Parties

|

<13,200

|

> | 14,200 | 1,000 | ||||||||

|

Net Cash Used by Operating Activities

|

<198,710

|

> | 1,037 |

<989,456

|

> | |||||||

|

Cash Flows from Investing Activities:

|

||||||||||||

|

Investment in Stock

|

-0- | -0- |

<1,028,980

|

> | ||||||||

|

Investment in Mineral Rights

|

<25,000

|

> | -0- |

<25,000

|

> | |||||||

|

Net Cash Used by Investing Activities

|

<25,000

|

> | -0- |

<1,053,980

|

> | |||||||

|

Cash Flows from Financing Activities:

|

||||||||||||

|

Note Payable

|

25,000 | -0- | 25,000 | |||||||||

|

Loans from Shareholders

|

-0- | -0- | 157,395 | |||||||||

|

Payments on Loans

|

-0- | -0- |

<157,395

|

> | ||||||||

|

Proceeds from Issuance of Common Stock

|

200,000 | -0- | 2,020,895 | |||||||||

|

Net Cash Provided by Financing Activities

|

225,000 | -0- | 2,045,895 | |||||||||

|

Net Increase (Decrease) in Cash

|

1,290 | 1,037 | 2,459 | |||||||||

|

Cash at Beginning of Period

|

1,169 | 132 | -0- | |||||||||

|

Cash at End of Period

|

$ | 2,459 | $ | 1,169 | $ | 2,459 | ||||||

See Notes to Financial Statements.

Page 25

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

General

Terrace Ventures Inc. was incorporated on February 20, 2001 in the state of Nevada. The Company acquires and develops certain mineral rights in Canada.

Basis of Presentation

The Company reports revenue and expenses using the accrual method of accounting for financial and tax reporting purposes.

Use of Estimates

Management uses estimates and assumptions in preparing these financial statements in accordance with generally accepted accounting principles. Those estimates and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses.

Exploration Stage Company

In accordance with FASB ASC 915, the Company has been in the exploration stage since its formation and has not yet realized any revenues from its planned operations.

Stock-Based Compensation

Stock-based compensation is accounted for using the Equity-Based Payments to Non-Employees Topic of the FASB ASC (FASB ASC Topic 718), which establishes standards for the accounting for transactions in which an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments. The Company determines the value of stock issued at the date of grant. It also determines at the date of grant, the value of stock at fair market value or the value of services rendered (based on contract or otherwise) whichever is more readily determinable.

Shares issued to employees are expensed upon issuance.

Page 26

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED

Stock-Based Compensation - CONTINUED

The Company uses the fair value method for equity instruments granted to employees and will use the Black Scholes model for measuring the fair value of options, if issued. The stock based fair value compensation is determined as of the date of the grant or the date at which the performance of the services is completed (measurement date) and is recognized over the vesting periods.

No stock options have been issued by Terrace Ventures, Inc.

Mineral Property Acquisition and Exploration Costs

The Company expenses all costs related to the acquisition and exploration of mineral properties in which it has secured exploration rights prior to establishment of proven and probable reserves. To date, the Company has not established the commercial feasibility of any exploration prospects; therefore, all costs are being expensed.

Depreciation, Amortization and Capitalization

The Company records depreciation and amortization when appropriate using both straight-line and declining balance methods over the estimated useful life of the assets (five to seven years).

Expenditures for maintenance and repairs are charged to expense as incurred. Additions, major renewals and replacements that increase the property's useful life are capitalized. Property sold or retired, together with the related accumulated depreciation, is removed from the appropriate accounts and the resultant gain or loss is included in net income.

Income Taxes

The Company accounts for its income taxes in accordance with FASB ASC 740, “Accounting for Income Taxes". Under this statement, a liability method is used whereby deferred tax assets and liabilities are determined based on temporary differences between basis used for financial reporting and income tax reporting purposes. Income taxes are provided based on tax rates in effect at the time such temporary differences are expected to reverse. A valuation allowance is provided for certain deferred tax assets if it is more likely than not, that the Company will not realize the tax assets through future operations.

Page 27

TERRACE VENTURES INC.

(AN EXPLORATION STAGE COMPANY)

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES - CONTINUED

Fair Value of Financial Instruments

FASB ASC 825, “Financial Instruments”, requires the Company to disclose, when reasonably attainable, the fair market values of its assets and liabilities which are deemed to be financial instruments. The Company's financial instruments consist primarily of cash and certain investments.

Investments

Investments that are purchased in other companies are valued at cost less any impairment in the value that is other than temporary in nature.

Per Share Information

The Company follows FASB ASC 260 “Earnings Per Share” which establishes standards for the computation, presentation and disclosure requirements for basic and diluted earnings per share for entities with publicly-held common shares and potential common stock issuances. Basic earnings (loss) per share are computed by dividing net income by the weighted average number of common shares outstanding. In computing diluted earnings per share, the weighted average number of shares outstanding is adjusted to reflect the effect of potentially dilutive securities, such as convertible notes, stock options, and warrants. Common stock equivalent shares are excluded from the computation if their effect is antidilutive.