Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ELAH Holdings, Inc. | d357399d8k.htm |

B. Riley

Investor Conference May 2012

Exhibit 99.1 |

CAUTIONARY

STATEMENT This

presentation

may

contain

certain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995,

including

statements

with

regard

to

the

future

performance

of

Signature

Group

Holdings,

Inc.

(“Signature”

or

the

“Company”).

Words

such

as

“believes,”

“expects,”

“projects,”

“anticipates,”

and

“future”

or

similar

expressions

are

intended

to

identify

forward-looking

statements.

These

forward-looking

statements

are

subject

to

the

inherent

uncertainties

in

predicting

future

results

and

conditions.

Certain

factors

could

cause

actual

results

to

differ

materially

from

those

projected

in

these

forward-looking

statements,

and

such

factors

are

identified

from

time

to

time

in

our

filings

with

the

Securities

and

Exchange

Commission.

Pursuant

to

the

Private

Securities

Litigation

Reform

Act

of

1995,

Signature

undertakes

no

obligation

to

publicly

update

or

revise

any

forward-looking

statements, whether as a result of new information, future events or otherwise.

No

representation

or

warranty,

express

or

implied,

is

made

as

to

the

accuracy

or

completeness

of

the

information

contained

herein,

and

nothing

shall

be

relied

upon

as

a

promise

or

representation

as

to

the

future of the Company.

For

more

specific

financial

information

please

refer

to

the

Company’s

Annual

Report

on

form

10-K

for

the

year

ended

December

31,

2011,

the

Quarterly

Report

on

form

10-Q

for

the

quarter

ended

March,

31, 2012 and other SEC filings.

2 |

OVERVIEW

3

Signature Group Holdings, Inc.

Reorganization

On June 11, 2010, Fremont General Corporation (“Fremont”)

emerged from bankruptcy and was renamed Signature Group

Holdings, Inc.

Facilities

Headquartered in Sherman Oaks, CA

Corporate development office in New York, NY

Ticker

SGGH, traded on OTCQX

Cash

$52.8 million (1)

Assets

$139.2 million (1)

NOLs

$889.9 million as of 12/31/2011 –

Expire beginning in 2027 (Federal)

Shareholder Equity

$63.3 million (1)

Shares Outstanding

119,931,857 as of May 11, 2012

(1) Information provided as of March 31, 2012 |

HISTORY

Over the past two years we have addressed numerous legacy challenges which

include:

–

Become current with our periodic reporting requirements under the Securities

Exchange Act of 1934 as amended, which included filing three Annual Reports on Form

10-K and seven Quarterly Reports on Form 10-Q within an 18 month period

–

Resolved in excess of 200 legal proceedings associated with Fremont and its

subsidiaries –

Implemented value maximizing strategies for the residential loan

portfolio and other

assets, including significant divestitures

–

Monitored and managed the repurchase demands relating to Fremont’s legacy

residential loan sales

–

Reduced staffing and expenses associated with the Fremont legacy

operations

–

Rebuilt an experienced accounting and finance team

4 |

OPERATIONS

Actively seek acquisition opportunities

–

North American Breaker Company acquired July 2011

–

Cosmed Inc. formed in February 2011 to acquire the assets of Costru, LLC

Acquire and originate debt opportunities through Signature Special Situations

Position the Company to take advantage of its net operating loss

carryforwards

Legacy clean-up and wind-down of the discontinued operations

5 |

ACQUISITIONS

Target Transactions

EBITDA of $7 million to $25 million

Enterprise values up to $300

million

Equity investments up to $100

million

Larger investments are achievable

Industry agnostic

Key Acquisition Criteria

Proven and committed management

team with the ability to operate

autonomously

Market leading or niche oriented

Sustainable business that can be held

long term

Low capital expenditures

6

Ideal Situations

Companies that do not have a natural strategic buyer or stand alone IPO potential

Private equity or hedge fund holdings which need an exit per LP requirements

Companies with limited or declining tax deductions

Non-core divisions of larger enterprises

Family businesses seeking to diversify holdings |

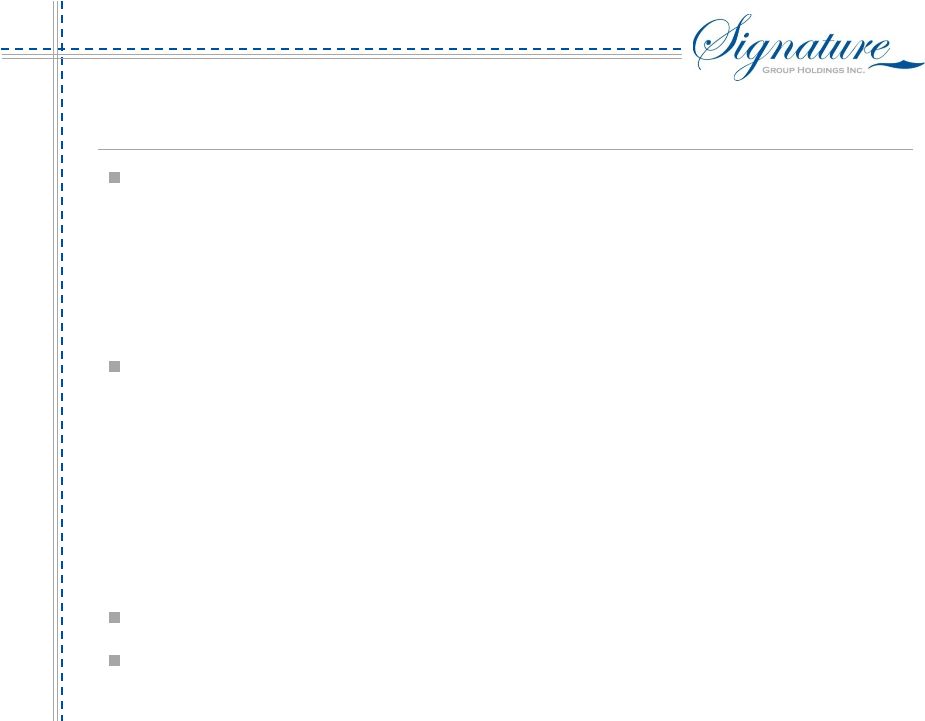

NORTH

AMERICAN BREAKER COMPANY Wholly owned subsidiary acquired July 29, 2011

Aggregate purchase price consideration of approximately $36.9

million with a net cash outlay of $10.9 million after giving effect

to a debt financing facility closed in September 2011

Highly profitable distributor of specialty electrical components,

primarily circuit breakers, to electrical wholesalers throughout

the country

–

Gross Margins approaching 40%

–

Q1 2012 over Q1 2011 sales growth of 14.9%

–

Minimal capital expenditures

7

Low risk business model

–

“Need it now”

product

–

Operates in steady replacement market

–

Strong national market presence

Headquarters and warehouse in Burbank CA

Four regional centers -

Dallas, TX, Chicago, IL, Orland, FL, Cranbury, NJ

1 day

2 days

3 days

Ground Transit Time: |

SIGNATURE

SPECIAL SITUATIONS Seek debt opportunities with significant upside potential that

generate high risk adjusted returns in the form of:

–

Interest Income

–

Fees

–

Recovery of discounted principal balances

–

Market value appreciation

Asset types considered include:

–

Distressed and sub-performing debt

–

Secured loans

–

Real estate mortgages

–

Corporate bonds

–

Tranche B loans

–

Public and private debt

–

Annuity streams

Positions are frequently purchased at a discount

Maintain focus on managing downside risk and exposure

8 |

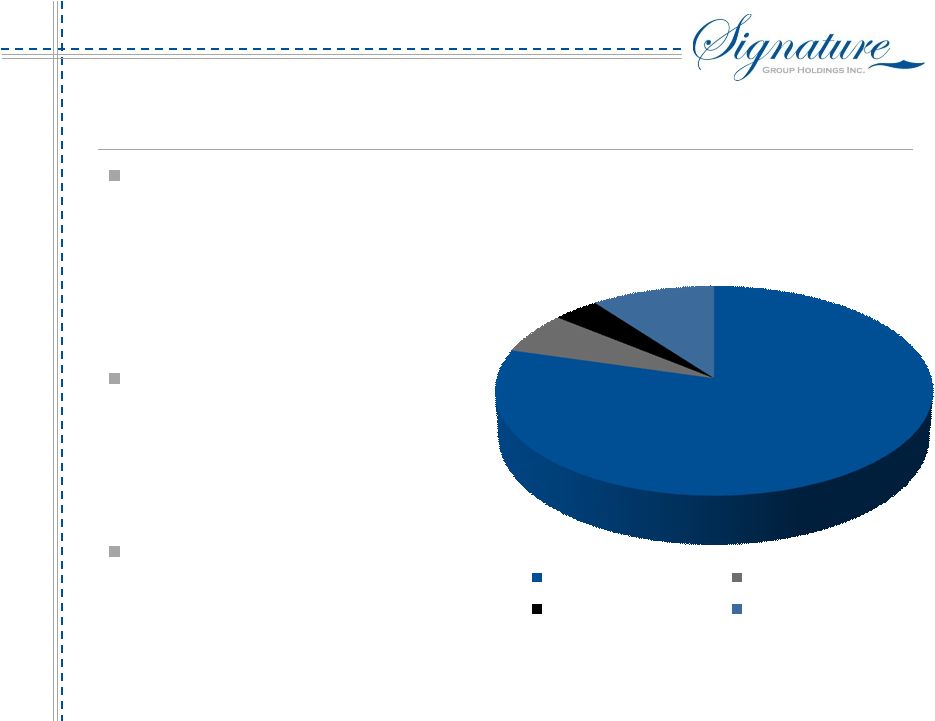

DISCONTINUED

OPERATIONS – LEGACY MATTERS

Monetize assets through an actively

managed approach

–

$58.0 million UPB subprime residential loan

portfolio (1)

–

$2.7 million REO prior to allowance (1)

–

$2.0 million FHLB Stock (1)

–

CRA Assets

Monitor repurchase demands for

Fremont’s subprime loan originations

–

Total outstanding repurchase claims of

approximately

$101.7

million

(1)

–

Repurchase reserve of $8.3 million (1)

–

No new demands or activity since June 2011

Manage and resolve ongoing and new

legacy related litigation

(1) As of March31, 2012

9

62

5

3

8

Outstanding Litigation

(Number of Cases as of 3/31/2012)

Home Borrower

FIL Securitization

Fremont Employment

Plaintiff -

Mortgage Fraud |

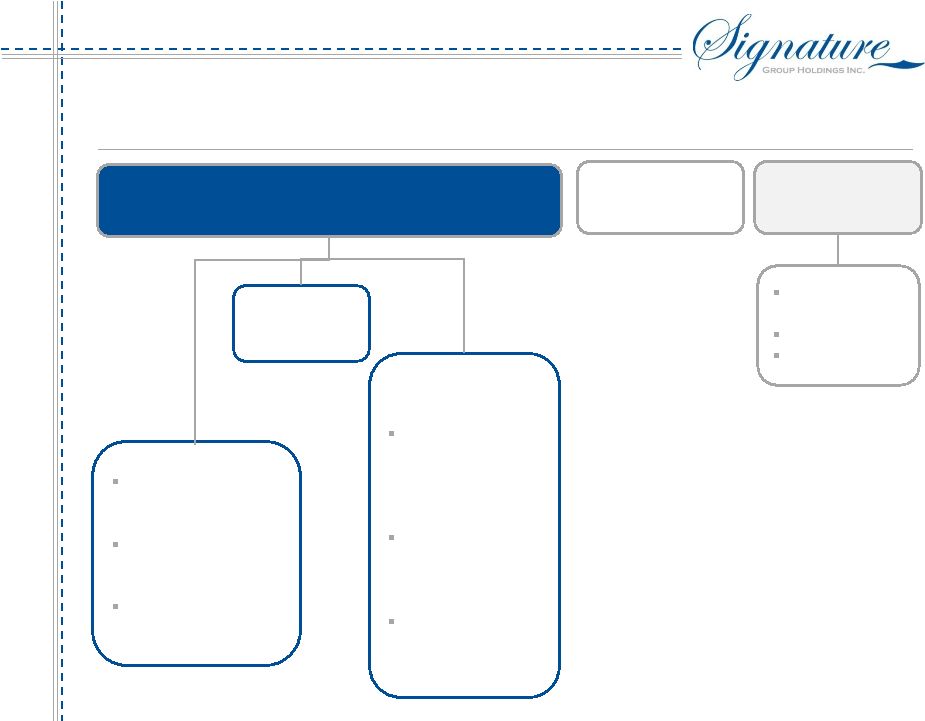

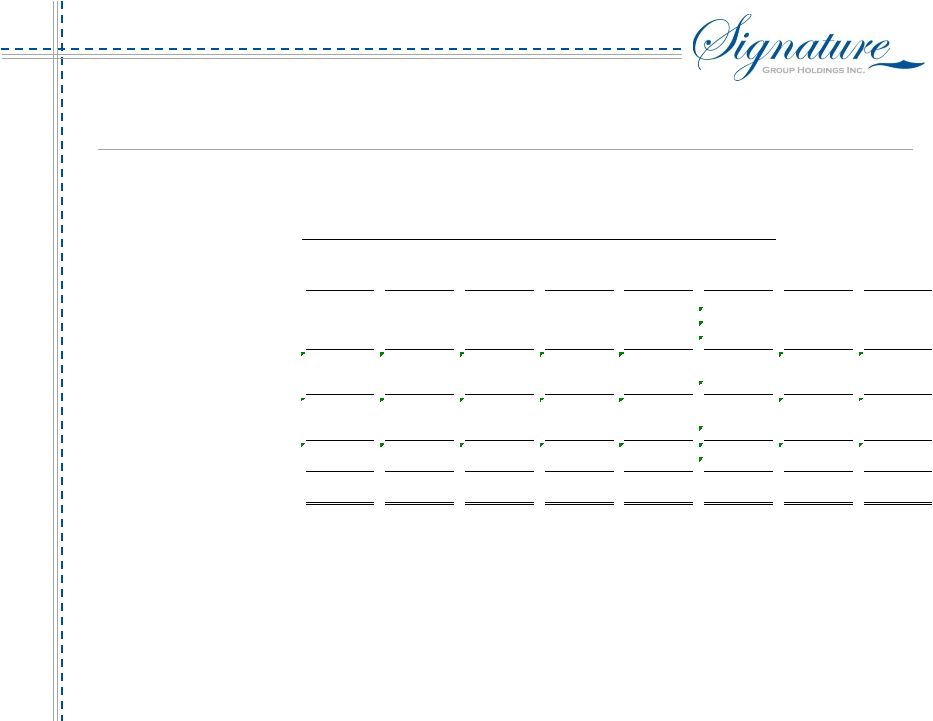

SIGNATURE’S MATERIAL COMPONENTS

10

Continuing Operations

Discontinued

Operations

Signature Special

Situations

Effective 4/1/2012

performing

residential loans

reclassified from

Disc Ops

Commercial loans

of $4.2mm and

preferred equity of

$2mm

Public bond

investment current

carrying value of

$8.1mm

NABCO

3 months ending

3/31/2012 revenue:

$7.8mm

3 months ending

3/31/2012 EBITDA:

$2.0mm

Total assets at

3/31/2012: $38.0mm

Cash

$52.8mm as of

3/31/12

NOLs

$889mm as of

12/31/11

Non-performing

LHFS

FHLB Stock

REO |

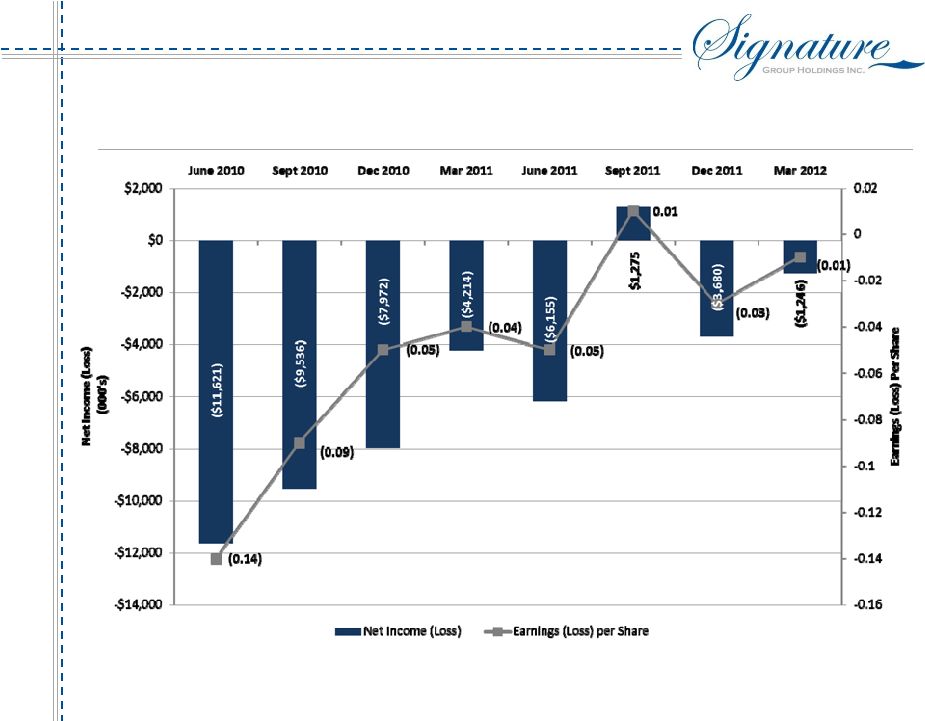

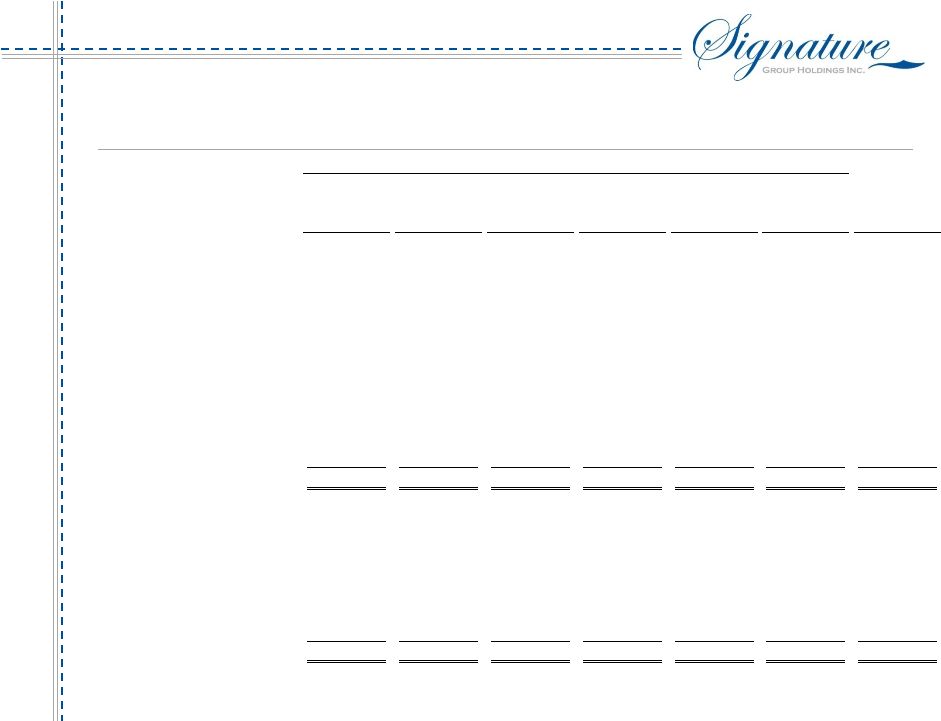

QUARTERLY

NET INCOME (LOSS) AND EPS 11 |

NON-GAAP

FINANCIAL MEASURES* 12

(Dollars in thousands)

Three months ended March 31, 2012:

NABCO

Cosmed

Net earnings (loss)

$

657 $

(95) Plus:

Interest

317

75

Income tax expense

438

3

Depreciation

15

3

Amortization of intangibles and other purchase accounting adjustments

587

18

EBITDA

2,014

4

Adjustments:

Change in fair value of contingent consideration

74

0

Reversal of accrued compensation

0

(95)

Adjusted EBITDA

$ 2,014

$ (91)

*See Signature’s 1

st

Quarter 10-Q for full disclosure

Evaluate operating subsidiaries based on EBITDA and Adjusted EBITDA, Non-GAAP

measures

EBITDA calculated as earnings before interest, taxes, depreciation and amortization

Adjusted EBITDA then removes or adds back certain items as identified below

|

CONSOLIDATED

STATEMENT OF OPERATIONS (UNAUDITED) 13

(Dollars in thousands, except per share amounts)

2012

2011

Revenues:

Net sales

8,041

$

546

$

Interest

731

156

Total revenues

8,772

702

Expenses:

Cost of goods sold

4,947

273

Selling, general and administrative

819

610

Compensation

2,224

279

Professional fees

1,747

1,076

Amortization of intangibles

605

26

Interest

1,113

888

Total expenses

11,455

3,152

Other income (expense):

Change in fair value of common stock warrant liability

3

801

Other (expense) income

(74)

281

Total other income (expense)

(71)

1,082

Loss from continuing operations before reorganization items, netand income taxes

(2,754)

(1,368)

Reorganization items, net

95

499

Loss from continuing operations before income taxes

(2,849)

(1,867)

Income tax expense (benefit)

49

(99)

Loss from continuing operations

(2,898)

(1,768)

Earnings (loss) from discontinued operations, net of income taxes

1,652

(2,406)

Net loss

(1,246)

(4,174)

Loss attributable to noncontrolling interest

-

40

Net loss attributable to Signature Group Holdings, Inc.

(1,246)

$

(4,214)

$

EARNINGS (LOSS) PER SHARE:

Basic and diluted:

Loss from continuing operations

(0.03)

$

(0.02)

$

Earnings (loss) from discontinued operations, net of income

taxes 0.02

(0.02)

Net loss attributable to Signature Group Holdings, Inc.

(0.01)

$

(0.04)

$

Three Months Ended

March 31, |

CONSOLIDATED

BALANCE SHEETS 14

March 31,

December 31,

52,439

4,991

3,750

4,112

8,681

6,978

18,180

2,487

41,400

143,018

5,116

5,916

3,597

51,613

1,403

11,536

79,181

1,151

446,805

(384,315)

196

143,018

63,837

63,837

(Dollars in thousands, except per share amounts)

2012

2011

(Unaudited)

ASSETS

Cash and cash equivalents

52,688

$

$

Investment securities, available for sale

8,116

Loans receivable, net

5,478

Trade and other receivables, net

3,925

Inventories

9,579

Intangible assets, net

6,365

Goodwill

18,180

Other assets

2,585

Assets of discontinued operations

32,249

TOTAL ASSETS

139,165

$

$

LIABILITIES AND SHAREHOLDERS' EQUITY

Liabilities:

Lines of credit

3,066

$

$

Accrued expenses and other liabilities

5,553

Contingent consideration

3,671

Long-term debt

51,413

Common stock warrant liability

1,400

Liabilities of discontinued operations

10,759

TOTAL LIABILITIES

75,862

Commitments and contingencies

Shareholders' equity:

Preferred stock, $0.01 par value; 10,000,000 shares authorized; none issued or

outstanding -

-

Common stock, $0.01 par value; 190,000,000 shares authorized; 119,098,524 and

117,431,856

shares issued and outstanding at March 31, 2012 and December 31,2011, respectively

1,156

Additional paid-in capital

447,151

Accumulated deficit

(385,561)

Accumulated other comprehensive income

557

Total

shareholders‘

equity -

Signature Group Holdings, Inc.

63,303

Noncontrolling interest

-

-

TOTAL SHAREHOLDERS' EQUITY

63,303

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

139,165

$

$

|

SEGMENT

INCOME STATEMENTS 15

12,304

13,322

(71)

(1,089)

(1,197)

(1,246)

(1,246)

Continuing Operations

(Dollars in thousands)

Signature

Special

Situtations

NABCO

Cosmed

Corporate

and Other

Eliminations

Total

Discontinued

Operations

Total

Three months ended March 31, 2012:

Revenues

870

$

7,843

$

198

$

163

$

(302)

$

8,772

$

3,532

$

$

Expenses

157

6,675

289

4,636

(302)

11,455

1,867

Other income (expense)

-

(73)

(1)

3

-

(71)

-

Earnings (loss) before reorganization items, net

and income taxes

713

1,095

(92)

(4,470)

-

(2,754)

1,665

Reorganization items, net

-

-

-

95

-

95

13

108

Earnings (loss) before income taxes and loss

attributable to noncontrolling interest

713

1,095

(92)

(4,565)

-

(2,849)

1,652

Income tax expense (benefit)

19

438

3

(411)

-

49

-

49

Net earnings (loss)

694

657

(95)

(4,154)

-

(2,898)

1,652

Loss attributable to noncontrolling interest

-

-

-

-

-

-

-

-

Net earnings (loss) attributable to Signature

Group Holdings, Inc.

694

$

657

$

(95)

$

(4,154)

$

-

$

(2,898)

$

1,652

$

$

|

SEGMENT

BALANCE SHEETS 16

Continuing Operations

(Dollars in thousands)

Signature

Special

Situtations

NABCO

Cosmed

Corporate

and Other

Eliminations

Total

Discontinued

Operations

March 31, 2012

Cash and cash equivalents

239

$

595

$

73

$

51,781

$

-

$

52,688

$

117

$

Investment securities, available for sale

8,116

-

-

-

-

8,116

-

Loans receivable, net

5,478

-

-

-

-

5,478

-

Trade and other receivables, net

-

3,805

120

-

-

3,925

-

Inventories

-

8,757

822

-

-

9,579

-

Intangible assets, net

-

6,113

252

-

-

6,365

-

Goodwill

-

17,780

400

-

-

18,180

-

Deferred tax assets

-

-

-

1,791

(1,791)

-

-

Loans held for sale, net

-

-

-

-

-

-

26,000

Commercial real estate investments

-

-

-

-

-

-

110

Real estate owned, net

-

-

-

-

-

-

2,000

Intercompany receivable

6,553

14

-

10,668

(17,235)

-

-

Other assets

1,239

914

11

1,883

(1,462)

2,585

4,022

Total assets

21,625

$

37,978

$

1,678

$

66,123

$

(20,488)

$

106,916

$

32,249

$

Lines of credit

-

$

3,066

$

-

$

-

$

-

$

3,066

$

-

$

Accrued expenses and other liabilities

309

3,261

55

3,318

(1,462)

5,481

2,509

Contingent consideration

-

3,671

-

-

-

3,671

-

Long-term debt

-

12,413

-

39,000

-

51,413

-

Common stock warrant liability

-

-

-

1,400

-

1,400

-

Repurchase reserve

-

-

-

-

-

-

8,250

Deferred tax liabilities

-

1,863

-

-

(1,791)

72

-

Intercompany payable

10,668

4,203

2,350

14

(17,235)

-

-

Total liabilities

10,977

$

28,477

$

2,405

$

43,732

$

(20,488)

$

65,103

$

10,759

$

|