Attached files

Trinity Capital Corporation

Annual Meeting

May 17, 2012

IN MEMORIAM

Harold T. Moore

1929 - 2012

George Cowan

1920 - 2012

1

Performance

2

GROSS DOMESTIC PRODUCT

Source: US Commerce Department Bureau of Economic Analysis

3

UNEMPLOYMENT RATE

US Unemployment

8.1% April 2012

NM Unemployment

7.2% March 2012

Source: Federal Reserve Bank of St. Louis

4

NET INCOME

*1st Quarter 2012 Results Annualized

5

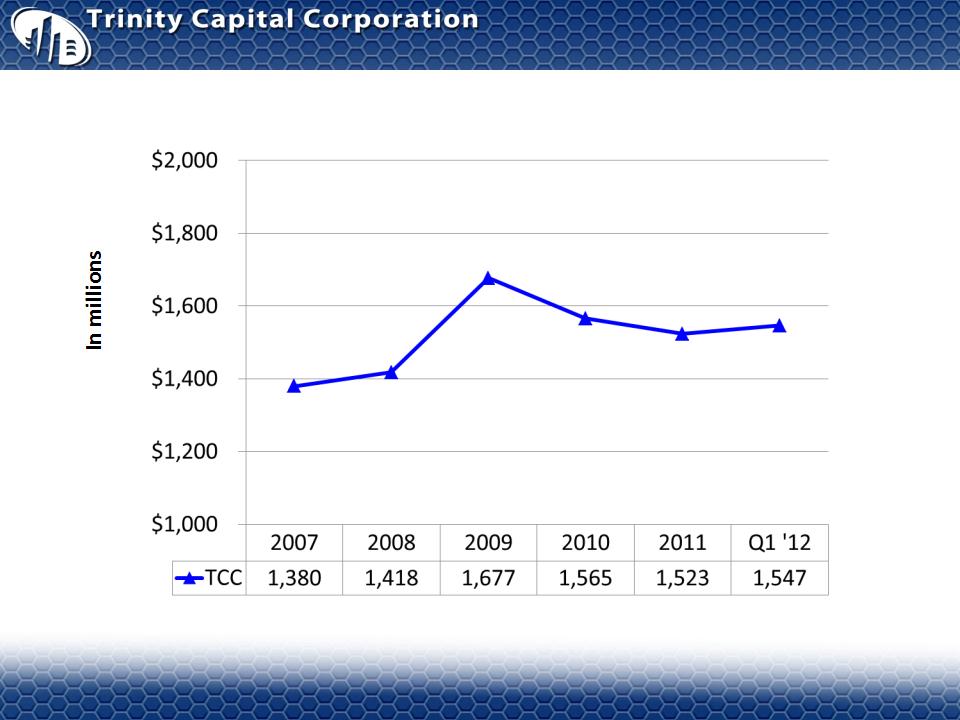

TOTAL ASSETS

6

DIVIDENDS

7

LEVERAGE CAPITAL

RATIO

RATIO

BHCPR Peer = Bank Holding Company Performance Report - $1 to $3B

Not available

8

NET CHARGE-OFF/

AVERAGE LOANS

EFFICIENCY

Not available

NON-PERFORMING ASSETS/

TOTAL ASSETS

Not available

NET CHARGE-OFFS

*1st Quarter 2012 Annualized

BHCPR Peer = Bank Holding Company Performance Report - $1 to $3B

ANNUAL LOAN GROWTH

Not available

ANNUAL DEPOSIT GROWTH

*1st Quarter 2012 Results Annualized

QNM VIDEO

9

Transcript of Video: Senator Jeff Bingaman (D-New Mexico) 4/4/2012

“Good afternoon. First I would like to say thank you to Quality New Mexico

(QNM) for this wonderful honor. It’s been my pleasure to support the activities

of QNM over the last twenty years. And I would also like to thank Bill Enloe. For

those such as Bill Enloe who have taken on the challenge offered by QNM the

benefits are tremendous as we can see by the success of Los Alamos National

Bank (LANB). Bill not only improved his bank, he improved the quality of life for

his employees and the banking services for all New Mexicans. LANB is now the

largest community bank in New Mexico and the largest mortgage lender. When

other banks where turning away potential borrowers, during the recession, Bill

was opening more branches to reach more customers. “

(QNM) for this wonderful honor. It’s been my pleasure to support the activities

of QNM over the last twenty years. And I would also like to thank Bill Enloe. For

those such as Bill Enloe who have taken on the challenge offered by QNM the

benefits are tremendous as we can see by the success of Los Alamos National

Bank (LANB). Bill not only improved his bank, he improved the quality of life for

his employees and the banking services for all New Mexicans. LANB is now the

largest community bank in New Mexico and the largest mortgage lender. When

other banks where turning away potential borrowers, during the recession, Bill

was opening more branches to reach more customers. “

[Video Clip Excluded]

Opportunities

10

OPPORTUNITIES

• Geographic & Demographic

• TCC’s Capabilities

• Financial Environment

Uniquely Positioned

11

OPPORTUNITIES

• Southwestern U.S.

• Growth Communities

• Strong Core Customer Base

Geographic & Demographic

12

OPPORTUNITIES

13

OPPORTUNITIES

• Asset Size

• Product & Service Lines

• Talent

TCC Capabilities

14

OPPORTUNITIES

• Reputation

• Branch Strategy

• Fewer Competitors

• Regulatory Pressures

Financial Environment

15

Questions

16