Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PALMETTO BANCSHARES INC | d355848d8k.htm |

NASDAQ: PLMT

1

Annual Meeting of Shareholders

May 17, 2012

Exhibit 99.1 |

NASDAQ: PLMT

2

Informational Update to Shareholders:

Mike Glenn, Chairman of the Board |

| NASDAQ: PLMT

Board Governance

1.

Reconstituted Board of Directors in October 2010 (2011 = first full year)

2.

Board leadership:

–

Separation of the Chairman and Chief Executive Officer

–

Independent Chairman beginning in January 2012 (and therefore

eliminated the role of the Lead Director in January 2012)

3.

Annual Board and Committee self-assessments, including anonymous

Director surveys of peers

–

Attendance at various Directors colleges and conferences

4.

Board committees

–

Written charters updated annually and published on our website

–

Annual written objectives by Committee

–

Addition of Board oversight of enterprise risk management in 2011

5.

Executive sessions of independent Directors at Board and Committee

meetings

6.

Annual written performance plan and evaluation of the Chief Executive

Officer

3 |

NASDAQ: PLMT

General Board Perspective

•

Observations from an article titled, “Banking’s Secret

Sauce,”

by Jack Milligan in Bank Director Magazine,

1

Quarter

2012

•

The article summarized observations based on a

ranking of the 150 largest publically traded banks

and thrifts in the country based on profitability,

capital strength and asset quality

•

The

article

identifies

a

list

of

traits

that

most

top

ranked banks

have in common

4

st |

NASDAQ: PLMT

Trait #1: Leadership

•

CEOs

are

highly

skilled

managers

–

Who are backed by knowledgeable and

engaged boards

•

These

CEOs

are

leaders

–

Who understand their markets, their

strategies and what it takes to be successful

–

Are strategists who can execute

5 |

NASDAQ: PLMT

Trait #2: Sustainable Strategies

•

The banks employ strategies that:

–

Avoid

activities

that

entail

excessive

risk:

for

example, commercial real estate

concentrations or high-risk residential

mortgages (sub-prime)

–

Escape

the

wasting

effects

of

commoditization:

low-margin and plain vanilla products and

services, and strategies that do not

differentiate in price or features

6 |

NASDAQ: PLMT

Trait #3: Organizational Clarity

•

From the Board flowing through the bank, all

have

a

shared

sense

of

what

it

takes

to

be

successful

•

The

Board

and

senior

management

are

fully

aligned

on strategy

–

And management understands what levers to

pull to deliver optimal performance

7 |

| NASDAQ: PLMT

The Palmetto Bank is on the Right Track

1.

A leadership team that understands our

industry and markets

2.

A knowledgeable and engaged Board

3.

A proactive and tailored strategy that is

being consistently executed and showing

continuously improving results

4.

A sense of urgency with clear focus and

strategic actions to return to profitability

5.

Positioned in the attractive Upstate market

that is exhibiting signs of stability and growth

8 |

NASDAQ: PLMT

Informational Update to Shareholders:

Sam Erwin, Chief Executive Officer

Lee Dixon, Chief Operating and Chief Risk Officer

9 |

NASDAQ: PLMT

10

Non-GAAP Measures and Forward Looking Statements

This presentation contains financial information determined by methods other than in

accordance with Generally Accepted Accounting Principles (“GAAP”)

such as net loss and pre-tax loss excluding credit-related items and one-time charges. Non-

GAAP measures should not be considered as an alternative to any measure of

performance as promulgated under GAAP. Investors

should

consider

the

Company’s

recording

of

provision

for

loan

losses,

loan

workout

expenses,

foreclosed

real

estate

write

downs

and

expenses

and

losses

on

commercial

loans

held

for

sale

in

the

periods

presented

when

assessing

the

performance of the Company. Non-GAAP measures have limitations as analytical

tools, and investors should not consider them in isolation or as a

substitute for analysis of the Company’s results as reported under GAAP.

Certain

statements

in

this

presentation

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation Reform Act of 1995, such as statements relating to future plans and

expectations, and are thus prospective. Such forward-looking

statements

are

identified

by

words

such

as

“believes,”

“expects,”

“anticipates,”

“estimates,”

“intends,”

“plans,”

“targets,”

and “projects,”

as well as similar expressions. Forward-looking statements are subject

to risks, uncertainties, and other factors which could cause actual results

to differ materially from future results expressed or implied by such forward-looking

statements. Factors which could cause actual results to differ materially from the

anticipated results or other expectations expressed in the

forward-looking statements include, but are not limited to: (1) the strength of the United States economy in

general and the strength of the local economies in which the Company conducts its

operations which could result in, among other

things,

a

deterioration

in

the

credit

quality

or

a

reduced

demand

for

credit,

including

the

resultant

effect

on

our

loan

portfolio

and allowance for loan losses and the rate of delinquencies and amounts of

charge-offs, or adverse changes in asset quality in our loan portfolio,

which may result in increased credit risk-related losses and expenses; (2) adverse conditions in the stock

market, the public debt market and other capital markets (including changes in

interest rate conditions) and the impact of such conditions on the Company,

and the timing and amount of future capital raising activities by the Company, if any; and (3) actions

taken by banking regulatory agencies related to the banking industry in general and

the Company or the Bank specifically. The assumptions underlying the

forward-looking statements could prove to be inaccurate. Therefore, we can give no assurance that

the results contemplated in the forward-looking statements will be realized.

The inclusion of this forward-looking information should not be

construed as a representation by our Company or any person that the future events, plans, or expectations

contemplated

by

our

Company

will

be

achieved.

Additional

factors

that

could

cause

our

results

to

differ

materially

from

those

described in the forward-looking statements can be found in our reports (such

as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K) filed with the U.S. Securities and Exchange Commission (the “SEC”)

and

available

at

the

SEC’s

Internet

site

(http://www.sec.gov),

including

the

“Risk

Factors”

included

therein.

All

subsequent

written

and oral forward-looking statements concerning the Company or any person acting

on its behalf is expressly qualified in its entirety

by

the

cautionary

statements

above.

We

do

not

undertake

any

obligation

to

update

any

forward-looking

statement

to

reflect changes in circumstances or events that occur after the date the

forward-looking statements are made. |

| NASDAQ: PLMT

11

Commitments to our Shareholders

1.

Communicate regularly

2.

Provide clear and transparent information

3.

Be accessible and visible

4.

Listen to concerns and suggestions

5.

Continue the rich legacy of our 105-year old

institution

6.

Protect the reputation of The Palmetto Bank

7.

Work hard with dedication and perseverance

to recover and optimize shareholder value |

NASDAQ: PLMT

Industry, Economic and Market Context

12 |

| NASDAQ: PLMT

Industry Context: FDIC Fourth Quarter 2011 Statistics

•

Number of institutions = 7,357 at 12/31/11

–

Down

1,177

(14%)

from

8,534

at

12/31/07

–

Down

7,801

(51%)

from

15,158

at

12/31/90

•

417

failed

banks

since

12/31/07

(7

in

South

Carolina)

•

Industry

on

the

mend

with

highest

net

income

since

2006

and

the

fourth-quarter being the lowest level for quarterly charge-offs since

first quarter 2008

•

Reduction

in

nonperforming

loans

for

seventh

quarter

in

a

row

•

Improving

loan

growth

with

the

fourth

quarter

representing

the

largest quarterly increase since fourth quarter 2007

•

Net

interest

income

and

noninterest

income

both

declined

in

2011 given

–

low interest rate environment

–

regulatory pressure on service charges and fees (second

consecutive year and the fourth year in the last five years)

13 |

| NASDAQ: PLMT

14

Additional Economic and Market Context

•

Difficult economy but optimism for improvement with signs of growth in

some markets in the Upstate

•

Credit

quality

concerns

remain,

but

general

improvement

noted

-

real

estate values remain depressed, but stabilization in certain segments

and markets

•

Tepid loan growth overall and very competitive loan pricing for credit

worthy commercial borrowers

•

Low interest rate environment and high levels of deposits resulting in

compressed net interest margin

•

Focus

on

higher

than

normal

capital

levels,

with

expectations

of

higher

required capital levels in the future

•

Congressional actions with higher costs and additional regulatory

oversight, including the Dodd-Frank Act and Consumer Financial

Protection Bureau |

NASDAQ: PLMT

The Palmetto Bank:

2011 in Review and

2012 Outlook

15 |

| NASDAQ: PLMT

Overall Thoughts on 2011

•

Great progress!

•

Improved credit quality and lower credit losses

•

Increased revenues

•

Reduced expenses

•

Improved earnings

•

Stabilized infrastructure

•

Ongoing talent management

All resulting in a better and sustainable earnings picture

(but not there yet…)

16 |

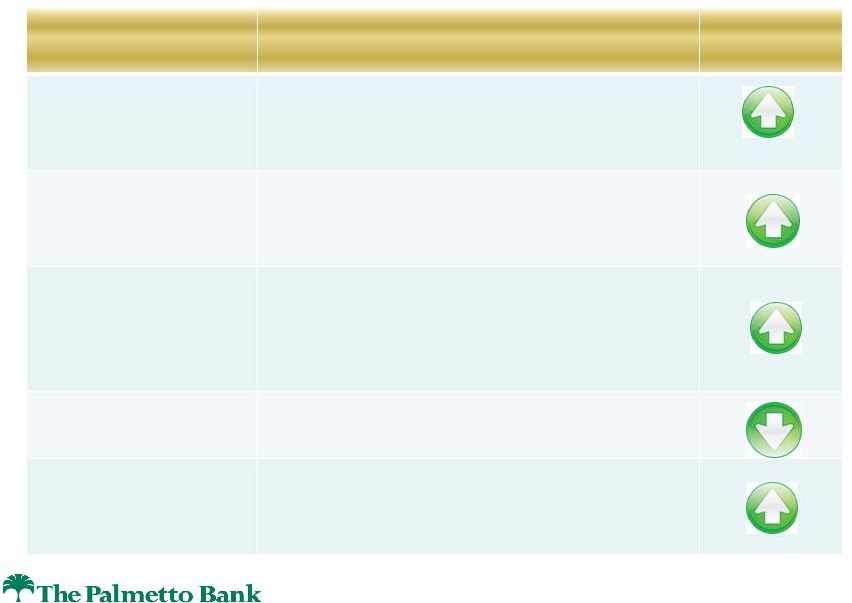

NASDAQ: PLMT

17

Strategic

Initiative

Results

(2011 vs. 2010)

Change

from 2010

Branch Loan

Growth

Production up 66% over 2010

($24.5 million vs. $14.8 million)

Began to outpace runoff

Core Deposit

Growth

Grew core deposits over $37 million

($666 million vs. $629 million)

Fee Income

Growth

Flat growth

($16.8 million vs. $17 million)

Mortgage

Flat production

($90 million vs. $91 million)

Indirect

Increased production by 47%

($24.5 million vs. $16.7 million)

2011 in Review: Retail |

NASDAQ: PLMT

18

Strategic

Initiative

Results

(2011 vs. 2010)

Change

from 2010

Commercial Loan

Portfolio

6% decrease

($549 million vs. $583 million)

New Loan

Production

Documented Calls

395% increase

($109 million vs. $22 million)

Intentional effort to grow business

(2,949 vs. 0 in 2010)

Treasury

Deposits

1.8% increase

($163 million vs. $160 million)

Loan Fees

87% increase

($866 thousand vs. $463 thousand)

2011 in Review: Commercial |

NASDAQ: PLMT

Strategic Initiative

Results

(2011 vs. 2010)

Change

from 2010

Trust

Asset Growth

Assets up $18 million

(7% increase)

Trust

Account Growth

Grew number of accounts 39

(5% increase)

Trust

Net Income

Growth

Net income increase

(22.8% increase)

Brokerage

Asset Growth

Assets down $851 thousand

(5% decrease)

Brokerage

Net Income

Growth

Net income increase

(82% increase)

2011 in Review: Wealth Management

19 |

| NASDAQ: PLMT

2012 Outlook

•

Many of the general economic challenges we faced over the

course of 2011 are continuing into 2012; however some have

begun to moderate

•

Net interest income improvement through continued reduction

in time deposits balances and rates

•

Improving loan production but still a challenge and very

competitive

•

Focus on fee income with elimination of certain deposit service

charge waivers

•

Recurring credit losses expected to be lower, although ongoing

strategic evaluation of problem asset resolution strategies

•

Sustained focus on efficiency and expense reductions

Projected to return to quarterly profitability in 2012

20 |

NASDAQ: PLMT

Strategic Focus

21 |

NASDAQ: PLMT

Evolution of Big Picture Strategic Focus

•

2009

–

Quantify depth of credit loss hole

–

Strategic Project Plan to survive

and thrive

–

Prepare for regulatory agreement

•

2010

–

Raise capital

–

Process improvement

–

Change management

•

2011

–

Performance culture and talent

management

–

Operating earnings

–

Client focus

22

•

2012

–

Profitability

–

Expense reductions

–

Technology

enhancements

–

Palmetto Partnership |

| NASDAQ: PLMT

23

Overall Big Picture Strategy

1.

Retail Bank: primarily manage funding cost through low

cost deposits

2.

Commercial Bank: primarily generate income through

loans

3.

Wealth Management: primarily generate incremental

revenue

4.

Support departments: enable the above with disciplined

expense management and sound risk management

Out-service the big banks and

out-muscle the little banks! |

NASDAQ: PLMT

2012 Strategic Priorities

24 |

NASDAQ: PLMT

25

2012 Strategic Priorities

1.

Return to profitability

2.

Improve asset quality

3.

Exit regulatory agreement

4.

Execute on client service and support

through Palmetto Partnership

5.

Develop a high performing culture and

winning team

Control our own destiny and earn the right to

keep doing it our way! |

NASDAQ: PLMT

1. Return to Profitability

26 |

NASDAQ: PLMT

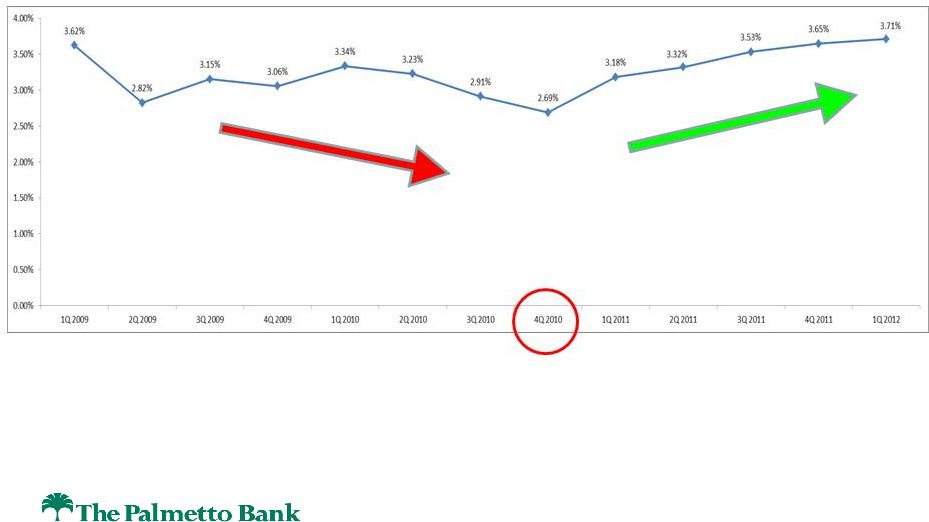

Net Interest Margin

27 |

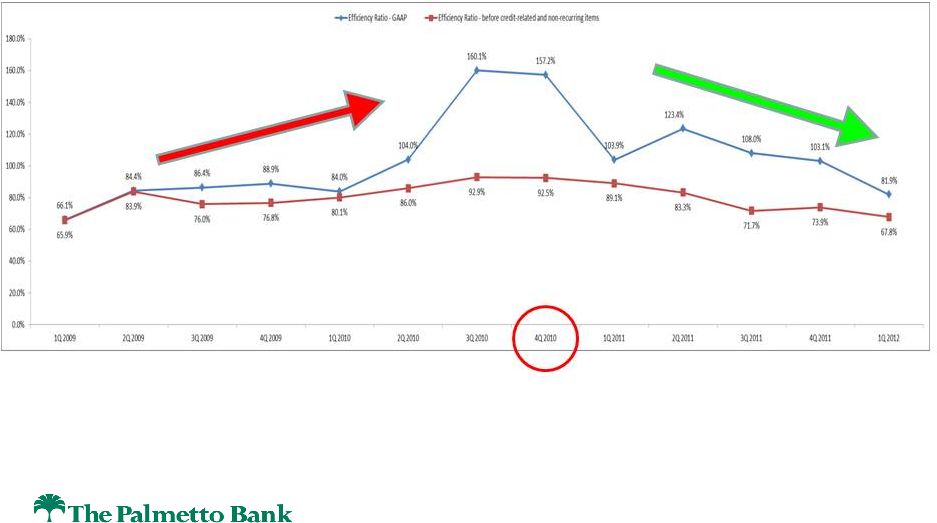

NASDAQ: PLMT

Efficiency Ratio

28 |

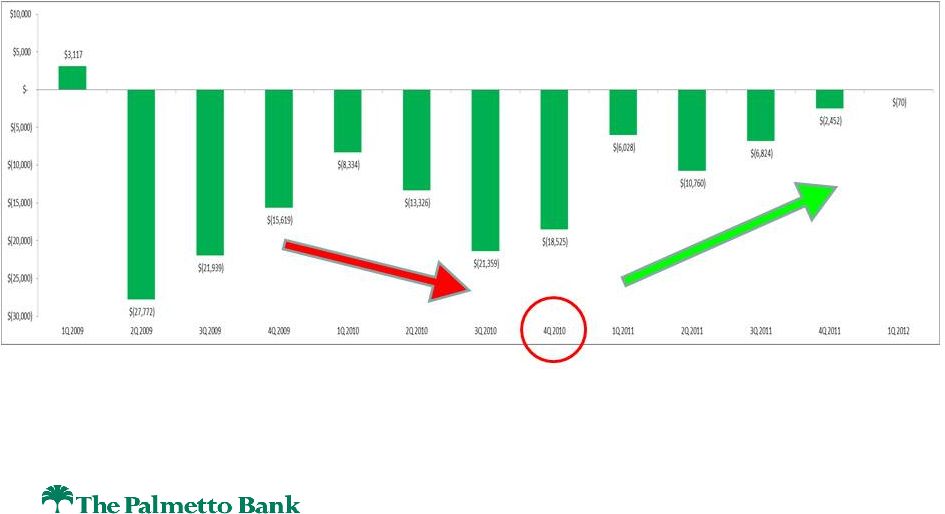

NASDAQ: PLMT

Operating Earnings

29 |

NASDAQ: PLMT

Pre-Tax (Loss) Income

30 |

NASDAQ: PLMT

Return to Profitability

•

$6.2

million

of

annual

expense

Savings

through

Automation,

Vendor

management

and

Efficiency

•

Asset-liability management and Internal Audit co-

sourcing began January 1

•

Branches:

–

Two consolidations completed on March 30

–

Two sales targeted to close in the second quarter

•

Check processing outsourcing and related deposit

statements process on April 27

Most savings start showing up in

second quarter

financial results.

31 |

| NASDAQ: PLMT

Compensation and Benefit Reductions

•

Headcount reduced 20% from peak of 420 at

12/31/08

•

Salary freeze re-instated in 2012

•

Regular 401(k) Plan employer match suspended

in 2012

32 |

| NASDAQ: PLMT

The Path to Profitability

•

Making money on an operating basis even given

–

Low interest rates and flat yield curve

(compressed net interest margin)

–

Higher regulatory costs and revenue

restrictions (lower service charges, higher

FDIC premiums, etc.)

–

High operating expenses from workout mode

and catch up in infrastructure and technology

The core franchise is generating income

on a day-to-day basis.

33 |

NASDAQ: PLMT

2. Improve Asset Quality

34 |

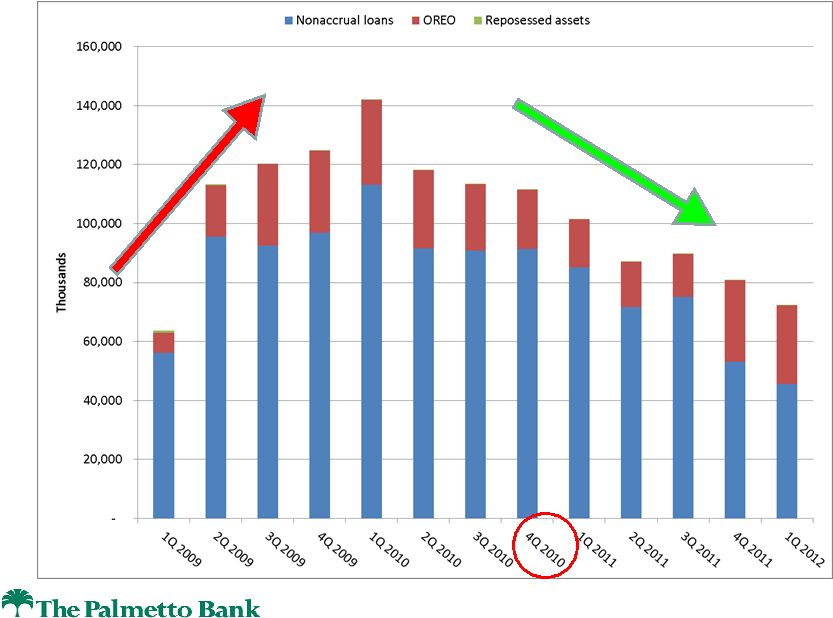

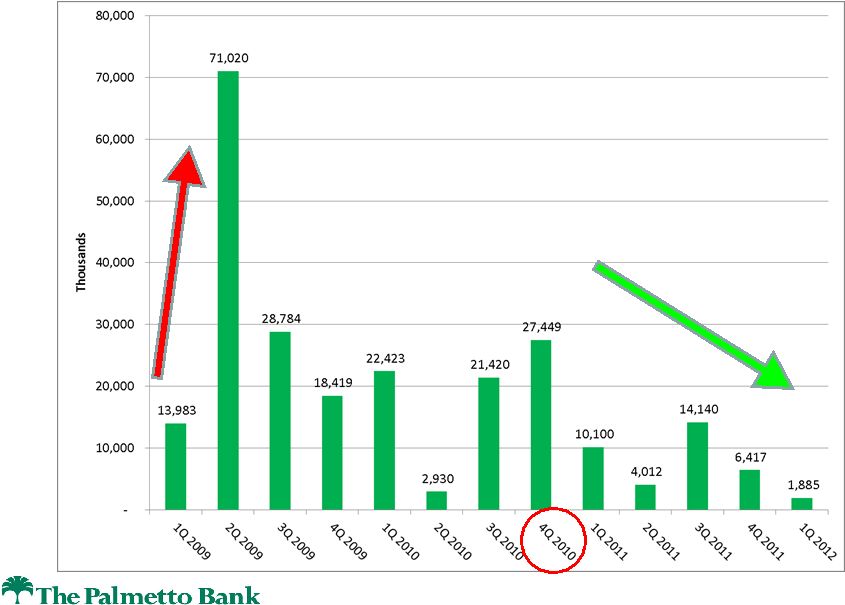

| NASDAQ: PLMT

Return to Profitability and

Improve Credit Quality

•

Objectives are inter-related with financial results driven primarily by

credit losses

•

Significant reduction in problem assets and improving quarterly

trends -

reduced

–

Number of assets

–

Size of assets

–

Losses on assets

•

Strategic decisions continue to sell problem assets at discounts

given ongoing cost to carry (taxes, insurance, legal fees, utilities,

repairs, etc.)

•

Also evaluating sell vs. hold in relation to:

–

Regulatory and investor perspective on aggregate total amount

–

Morale and public perception of quarterly losses

35 |

NASDAQ: PLMT

Nonperforming Assets

36 |

NASDAQ: PLMT

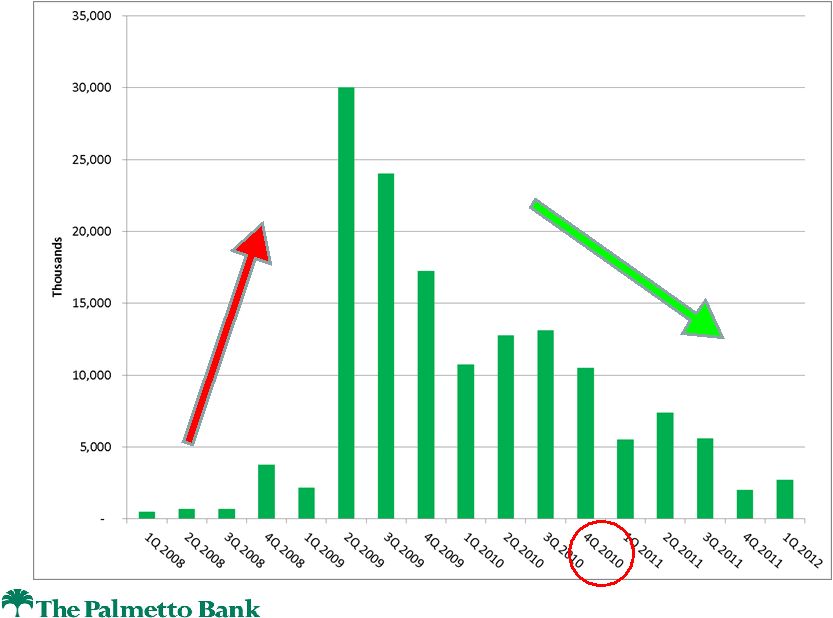

Nonaccrual Loans -

Gross Additions

37 |

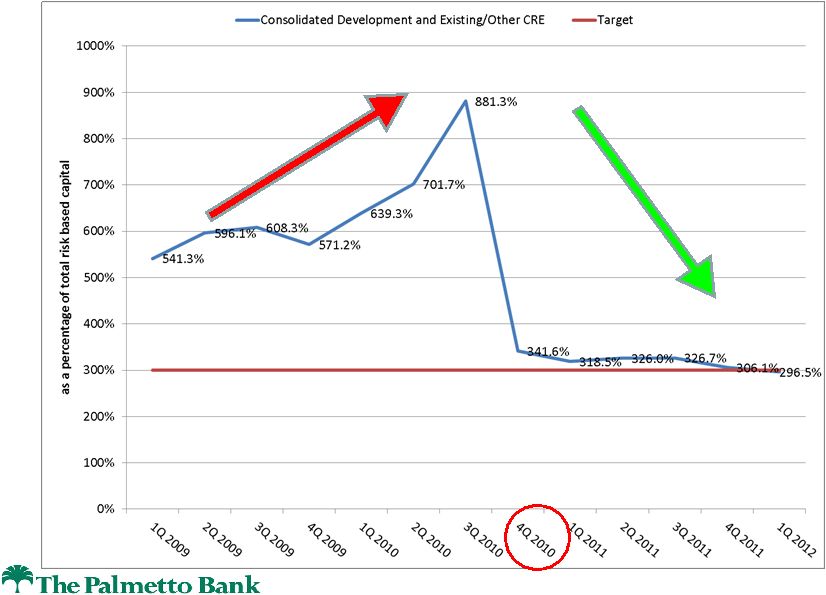

NASDAQ: PLMT

Commercial Real Estate Loans

38 |

NASDAQ: PLMT

Commercial Real Estate Loans

as a Percentage of Total Risk Based Capital

39 |

NASDAQ: PLMT

Provision for Loan Losses

40 |

NASDAQ: PLMT

3. Exit Regulatory Agreement

41 |

| NASDAQ: PLMT

Regulatory Examinations

42

•

FDIC insurance premiums are based in part on the

overall ratings from the annual Safety and

Soundness examinations

–

Starting in the second quarter 2012, our annual

premiums will be reduced by $1 million based

on current deposit levels |

NASDAQ: PLMT

4. Execute on Client Service and Support

through Palmetto Partnership

43 |

NASDAQ: PLMT

The Path To Profitability!

Project

SAVE

The Palmetto

Partnership

Profitability

Driven by...

Executing

Clients

44 |

NASDAQ: PLMT

Technology Upgrades to Meet Client Expectations:

Second Quarter

Upgraded

ATM fleet, locations and capability

March

Upgraded

Telephone Automatic Voice Response Unit

May

Upgraded

Remote Deposit Capture

May

Upgraded

Real Time Internet Banking

May

Upgraded

E-Statement System

May

New

Mobile Friendly Web Site

May

New Mobile Banking

June

New

Deposit Taking/Imaging ATMs

June

New

Electronic Notices Delivered for Loans & Deposits

June

New

Automated Wire Transfer System

June

45 |

NASDAQ: PLMT

Technology Upgrades to Meet Client Expectations:

Third Quarter

46

New

Lockbox System

July

New

Person to Person Payments

July

New

Online Personal Finance System

July

Upgraded

Web Site

July

New

Commercial Positive Pay

September

New ACH Fraud Control

September

New

Electronic Check Recovery

September |

NASDAQ: PLMT

5. Develop a High Performing Culture and

Winning Team

47 |

NASDAQ: PLMT

Critical Elements of Our Evolving Culture

1.

Continuous improvement culture (including

possibility thinking “out of the red box”,

automation, and expense consciousness)

2.

Client service and support culture

Palmetto

Partnership

3.

Performance culture (personally and corporately)

4.

Winning culture!

48

We

Win! |

NASDAQ: PLMT

Closing Thoughts

49 |

| NASDAQ: PLMT

Summary Thoughts on the Path Forward

1.

Significant progress on the path to profitability

2.

Asset quality is being aggressively improved

3.

Substantially completed the transition from “workout”

mode to

“business development”

mode

4.

Clarity of the path forward -

more focused Bank, department, and

individual objectives and expectations

5.

Dedicated team and pride in our service

6.

High expectations to cultivate a performance culture and winning

team

7.

Sense of urgency continues and we insist on results, not activity

8.

We are moving the Bank forward –

with intense focus on the

bulls eye of profitability

Proactive, comprehensive and focused strategic plan being executed

50 |

| NASDAQ: PLMT

51

Value of the Franchise

•

105 year legacy with excellent reputation and strong brand

recognition

•

Historical high performing financial results, with history of innovation

and balanced and fair pricing to our clients

•

Premier deposit-gathering franchise in an attractive banking market

with strong deposit gathering capability

–

4

th

largest bank headquartered in South Carolina

–

6

th

in deposit share in the Upstate and 1

st

of banks

headquartered in South Carolina

–

25 branches in the economically attractive Upstate market along

the Interstate 85 corridor between Atlanta and Charlotte

•

Heritage of deep client relationships and loyalty, with high touch

client service platform to be leveraged for enhanced sales culture

|