Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HANCOCK WHITNEY CORP | d351920d8k.htm |

Gulf South Bank

Conference

May 14, 2012

Gulf South Bank

Conference

May 14, 2012 |

Carl Chaney

President & CEO |

Forward-Looking

Statements

Forward-Looking

Statements

During this presentation we may make forward-looking

statements. Forward-looking statements provide projections of

results of operations or of financial condition or state other

forward-looking information, such as expectations about future

conditions and descriptions of plans and strategies for the future.

Hancock’s ability to accurately project results or predict

the effects of future plans or strategies is inherently

limited.

We believe that the expectations reflected in the forward-looking

statements are based on reasonable assumptions, but actual

results and performance could differ materially from

those set forth in the forward-looking statements. Factors

that could cause actual results to differ from those expressed

in the Company's forward-looking statements include, but are

not limited to, those outlined in Hancock's SEC filings, including the “Risk Factors”

section of the Company’s form 10-K and 10-Q.

Hancock does not intend, and undertakes no obligation, to update

or revise any forward-

looking statements, and you are cautioned not to place undue reliance

on such forward- looking statements.

3 |

•

Systems integration

completed March 16,

2012

•

Approximately $1.6B

of assets transferred

•

Consolidated 30

branches

Whitney Integration

Completed

4 |

•

Professional consulting

groups assisted with the

integration

•

Over 300 associates logged

over 1 million hours

•

Executed almost 13,500 test

scripts; completed more than

1,700 separate tasks

•

Extremely satisfied with the

success of the conversion

A Successful

A Successful

Systems Conversion

Systems Conversion

5 |

•

Diversified footprint across the Gulf South

•

2 well-known Gulf Coast brands

•

Loyal customer base and attractive deposit funding

•

Diversified revenue stream with strong earnings momentum

•

Leading market share in key MSAs

A Premier Gulf South

Financial Services Franchise

Whitney Bank

Hancock Bank

6 |

•

Basically in line with our expectations

•

Reflect comments made during 4Q11 earnings conference call

•

Reflect a certain level of distraction from systems conversion

•

Reflect in part beginning of the year seasonality of both balance

sheet and operating expense

•

Fundamentals of the combined company remain strong

•

Focused on achieving remaining merger efficiencies and growing

these two well-known Gulf South brands

First Quarter

First Quarter

2012 Results

2012 Results

As of March 31, 2012

7 |

Michael Achary

Chief Financial Officer |

First Quarter 2012

Earnings Summary

First Quarter 2012

Earnings Summary

* A reconciliation of net income to operating income and pre-tax,

pre-provision income is included in the appendix. **

Noninterest expense

as

a

percent

of

total

revenue

(TE)

before

amortization

of

purchased

intangibles,

securities

transactions

and

merger

expenses.

As of March 31, 2012

9

($s in millions; except per share data)

Operating Income*

$40.5

$45.1

Operating E.P.S.(diluted)*

$.47

$.53

Return on

Assets (operating)*

0.85%

0.93%

Merger Costs

$33.9

$40.2

Net Income

$18.5

$19.0

Earnings Per Share

(diluted)

$.21

$.22

Pre-

Tax, Pre-Provision Income*

$69.2

$76.5

Net Interest Margin

4.43%

4.39%

Net Charge

offs non

covered

0.25%

0.40%

Tangible Common Equity

8.27%

7.96%

Efficiency Ratio**

67.81%

65.39%

1Q12

4Q11

-

- |

Retaining Legacy Business;

Retaining Legacy Business;

Generating New Business

Generating New Business

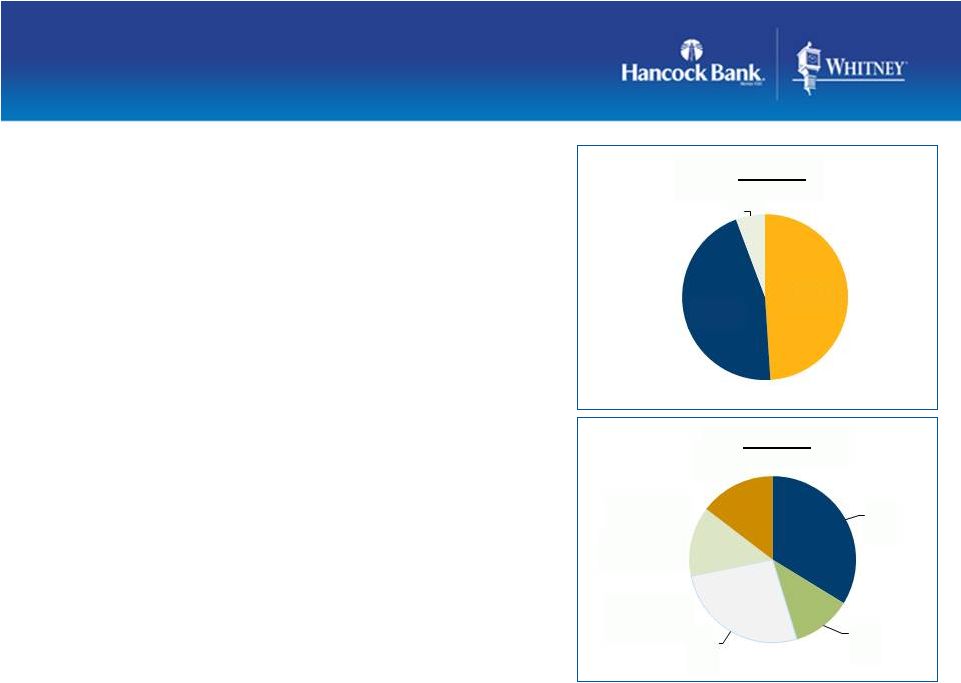

•

Total loans $11.1B

(Average loans increased $50 million compared to 4Q11)

•

Loans virtually flat linked-quarter

(after adjusting for the decline in the covered Peoples First

portfolio) •

Funded over $500 million of new loans

throughout the company’s footprint from

both existing and new customers

•

Growth in construction, residential mortgage,

consumer loans

•

Seasonal payoffs on C&I credits

•

Decline in commercial real estate loans reflect in part

scheduled payoffs and paydowns

As of March 31, 2012

10

Originated

49%

Acquired

45%

Peoples First

Loan Mix

6%

C&I

34%

C&D

11%

CRE

%

Residential

mortgage

14%

Consumer

14%

Loan Mix

27 |

Strong Core Deposit

Strong Core Deposit

Funding

Funding

•

Total deposits $15.4B

(Average deposits virtually unchanged from 4Q11)

•

Historically both banks build deposits at

year-end with some deposit runoff in the

first quarter

•

Funding mix remained strong

–

Low cost of funds (38bps); down 6bps from 4Q11

–

Noninterest bearing demand deposits (DDA)

comprised 34% of total period-end deposits

•

$1.2B in CDs maturing over the next 2

quarters at average rate of .92%

As of March 31, 2012

11

$0

$500

$1,000

CDs Maturing

CDs Maturing

2Q12

3Q12

funds

10%

Deposit Mix

DDA

35%

Public

Time

deposits

18%

Interest

bearing

transaction

37% |

Strong, Stable

Strong, Stable

Net Interest Margin

Net Interest Margin

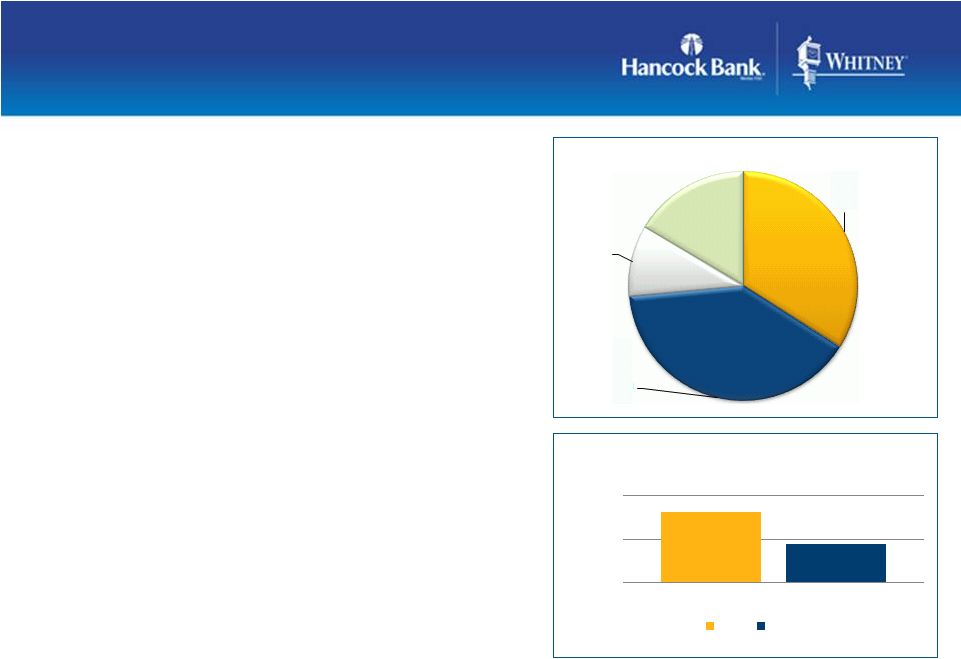

•

Net interest margin 4.43% up 4bps

linked-quarter

–

Approximately 43bps of the NIM was related to

net accretion of Whitney purchase accounting

adjustments

–

Accretion amounts are reevaluated quarterly

•

Reflects a favorable shift in funding

sources, a decline in funding costs,

offset by a decline in loan yields

•

Expect the NIM will remain relatively

stable over the next couple of quarters

–

Deployment of excess liquidity and CD repricing

will continue to favorably impact margin and help

offset earning asset repricing headwinds

* Excludes impact of Whitney purchase accounting adjustments

** Impact of Whitney purchase accounting adjustments.

As of March 31, 2012

Net Interest Margin

12

4.03%

4.08%

4.02%

4.00%

0.08%

0.24%

0.37%

0.43%

3.60%

3.80%

4.00%

4.20%

4.40%

4.60%

2Q11

3Q11

4Q11

1Q12

"Core" NIM*

PAA** |

Working To Enhance

Working To Enhance

Fee Growth

Fee Growth

•

Noninterest income totaled $61.5 million in 1Q12

•

Remaining restrictions on interchange rates related to the Durbin

Amendment anticipated in 3Q12

–

Expected to cost an additional $2 million per quarter compared to

current levels –

New products and services expected to offset approximately 40% of the

anticipated loss of income •

Cross-sell opportunities expected to generate additional fee

income –

Private Banking

–

Treasury Management

–

International Banking

–

Insurance

As of March 31, 2012

13 |

Focused On Realization

Focused On Realization

Of Remaining Cost Synergies

Of Remaining Cost Synergies

•

Operating expense totaled $172 million in 1Q12, up $6 million from

4Q11* –

Amortization of intangibles increased $1.1 million

–

Personnel expense increased $3.4 million, primarily related to an

increase in benefits –

ORE expense increased $2.3 million

•

Additional cost savings were not expected during the first quarter of

2012 due to the core systems conversion

–

Additional cost savings will be generated beginning in the second

quarter as a result of completing the systems conversion and

closing branches •

Efficiency ratio 67.81% in 1Q12**

–

Short term target: 62-63%

–

Longer term target: less than 60%

As of March 31, 2012

* Excludes merger costs

** Noninterest expense as a percent of total revenue (TE) before

amortization of purchased intangibles and securities transactions and

merger expenses 14 |

Sam Kendricks

Chief Credit Officer |

Credit Quality

Credit Quality

Stable

Stable

•

Allowance for loan losses was $142 million, up from $125 million

at year-end 2011

–

Most of the increase related to the FDIC covered Peoples First

portfolio •

Provision for loan losses was $10 million

•

Net charge-offs totaled $7 million, or 0.25%, related to the

non- covered portfolio

•

ALLL/loans was 1.55% (excluding the impact of the Whitney

acquired loans and FDIC covered loans)

•

Total nonperforming assets increased $11 million

linked-quarter –

Mainly related to an increase in legacy Hancock NPLs

As of March 31, 2012

16 |

Whitney Acquired Portfolio

Whitney Acquired Portfolio

Performing Positively

Performing Positively

•

Whitney acquired portfolio performing positively

•

Peoples First portfolio covered by a FDIC loss-sharing

agreement •

Increase in legacy Hancock nonaccrual loans

•

Impacted by a few credits previously identified as problems

•

Mainly commercial real estate credits in Louisiana

•

Remain cautious on the economic recovery

•

Conservative in our review of credits

As of March 31, 2012

17 |

Carl

Chaney

President

&

CEO |

•

Organic/

De Novo Growth

•

Organic/

De Novo Growth

Opportunities For

Growth

Opportunities For

Growth

•

Live Bank

Transactions

•

Live Bank

Transactions

•

FDIC-Assisted

Acquisitions

•

FDIC-Assisted

Acquisitions

19 |

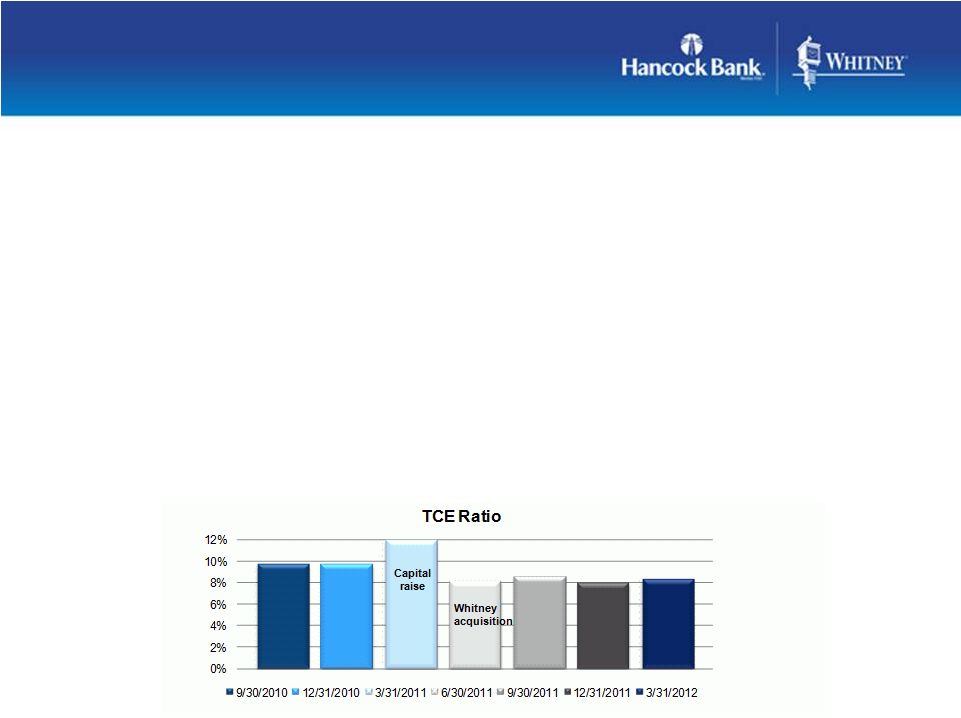

•

TCE ratio improved to 8.27% from year-end 2011

•

TCE ratio target: 8% minimum

•

Expect to build capital in the near term

•

Many opportunities to deploy excess capital

•

Primary: Expansion through organic growth and M&A

•

Secondary: Stock buybacks or increased dividends

Well-Capitalized

Well-Capitalized

Company

Company

As of March 31, 2012

20 |

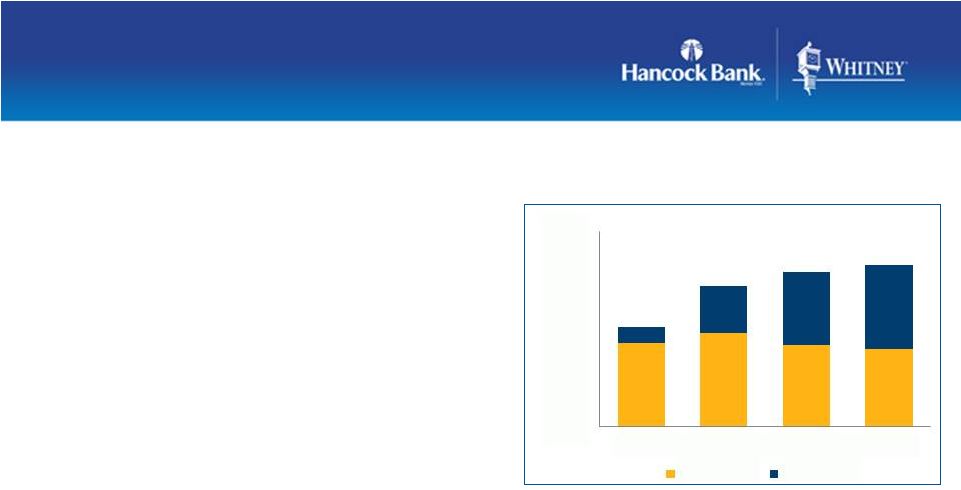

Well Positioned For

Well Positioned For

The Future

The Future

Premier Gulf South franchise

History of effective capital management

Superior liquidity

Conservative credit culture

Enhanced earnings potential

Well positioned for future growth

Focused on shareholder value creation

Notes:

1.

As of 12/31/2011

2.

KRX index of 50 regional U.S. banks

3.

BKX index of 24 large-cap U.S. banks

10-Year

Total

Return

(1)

180%

42%

33%

(13%)

(60)

0

60

120

180

240

Large Cap

Peers

(3)

Regional

Peers

(2)

S&P 500

Index

21 |

Gulf South Bank

Conference

May 14, 2012

Gulf South Bank

Conference

May 14, 2012 |

Appendix |

Non-GAAP

Reconciliation

Non-GAAP

Non-GAAP

Reconciliation

Reconciliation

(amounts in thousands)

(unaudited)

3/31/2012

12/31/2011

3/31/2011

Income Statement

Interest income

$191,716

$196,500

$82,533

Interest income (TE)

194,665

199,453

85,405

Interest expense

15,428

18,131

15,769

Net interest income (TE)

179,237

181,322

69,636

Provision for loan losses

10,015

11,512

8,822

Noninterest income excluding

securities transactions

61,494

60,592

34,183

Securities transactions gains/(losses)

12

(20)

(51)

Noninterest expense

205,463

205,610

73,019

Income before income taxes

22,316

21,819

19,055

Income tax expense

3,821

2,854

3,727

Net income

$18,495

$18,965

$15,328

Merger-related expenses

33,913

40,202

1,588

Securities transactions gains/(losses)

12

(20)

(51)

Taxes on adjustments

11,865

14,078

574

Operating income (a)

$40,531

$45,109

$16,393

Difference between interest income and interest income (TE)

$2,949

$2,953

$2,872

Provision for loan losses

10,015

11,512

8,822

Merger-related expenses

33,913

40,202

1,588

Less securities transactions gains/(losses)

12

(20)

(51)

Income tax expense

3,821

2,854

3,727

Pre-tax, pre-provision profit (PTPP) (b)

$69,181

$76,506

$32,388

Three Months Ended

(a) Net income less tax-effected merger costs and securities gains/losses. Management believes

that this is a useful financial measure because it enables investors to assess ongoing

operations. (b) Pre-tax pre-provision profit (PTPP) is total revenue less

noninterest expense, merger items, and securities transactions. Management believes that PTPP

profit is a useful financial measure because it enables investors and others to assess the Company’s ability to generate capital to cover credit

losses through a credit cycle.

24 |

Investor

Contacts

Investor

Investor

Contacts

Contacts

Carl J. Chaney –

President & CEO

carl.chaney@hancockbank.com

Trisha

Voltz

Carlson

-

SVP,

Investor

Relations

trisha.carlson@hancockbank.com

Hancock Holding Company

P.O. Box 4019, Gulfport, MS 39502

Phone: 228.868.4000 or 1.800.522.6542

www.hancockbank.com

or www.whitneybank.com

Michael M. Achary –

EVP & CFO

michael.achary@hancockbank.com

25 |