Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STAAR SURGICAL CO | v311662_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - STAAR SURGICAL CO | v311662_ex99-1.htm |

Q1 2012 RESULTS Investor Presentation May 2, 2012

SAFE HARBOR All statements in this presentation that are not statements of historical fact are forward - looking statements, including any projections of earnings, revenue , sales, profit margins, cash or other financial items, any statements of the plans, strategies, and objectives of management for future operations, any statements regarding new products, including but not limited to, expectations for success of the ICL or other products in U.S. or international markets, any statements concerning proposed new products and government approval of new products, services or developments, or other future actions of the FDA or other regulators, any statements regarding expectations for the success of our products in the US and the international markets, the outcome of product research and development or any clinical study, any statements regarding future economic conditions or performance, the size of market opportunities statements of belief and any statements of assumptions underlying any of the foregoing. These statements are based on expectations and assumptions as of the date of this presentation and are subject to numerous risks and uncertainties, which could cause actual results to differ materially from those described in the forward - looking statements. The risks and uncertainties include our limited capital resources and limited access to financing, the broad discretion of the FDA and other regulators in approving any medical device and the inherent uncertainty that new devices will be approved, the likelihood of administrative delays, the risk that our global consolidation plans will not yield the expected savings in taxes or cost of goods or expose us to supply interruptions, the negative effect of global recession on sales of products, especially products like the ICL used in non - reimbursed elective procedures, the challenge of managing our foreign subsidiaries, the risk that research and development efforts will not be successful or may be delayed in delivering for launch, the willingness of surgeons and patients to adopt a new product and procedure, and the potential effect of negative publicity about LASIK on the demand for refractive surgery in general in the U.S., and the other factors discussed under the heading “Risk Factors” in our Annual Report on Form 10 - K filed with the SEC on March 8, 2012. STAAR assumes no obligation to update its forward - looking statements to reflect future events or actual outcomes and does not intend to do so. ®

AGENDA Q1 Revenue Results Barry G. Caldwell 2012 Key Metric Review Chief Executive Officer Financial Review Deborah Andrews Project Comet Update Chief Financial Officer Recent Meetings Barry G. Caldwell Technology/New Product Updates Chief Executive Officer Upcoming Investor Events Q&A Session Your Questions ®

2012 Q1 REVENUES Q1 2012 Q1 2011 Improvement ICL Sales $ 8,605 $ 6,897 +$1,708/+25% IOL Sales $ 6,358 $ 7,120 ($762)/ - 11% Core Product Sales $14,963 $14,017 +$946/+7% Other $ 546 $ 832 ($286)/ - 34% Total Sales $15,509 $14,849 +$660/+4.4% ®

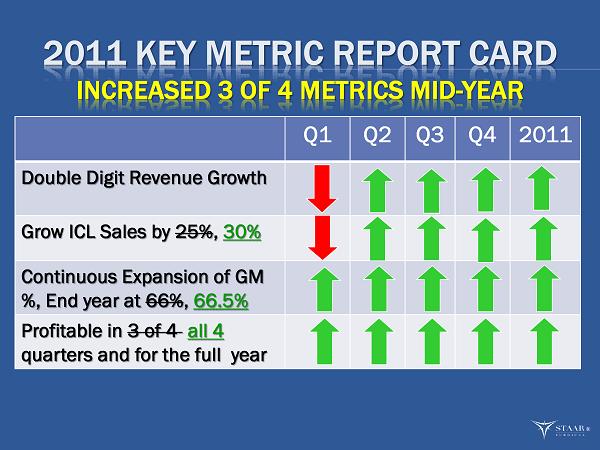

2011 KEY METRIC REPORT CARD INCREASED 3 OF 4 METRICS MID - YEAR Q1 Q2 Q3 Q4 2011 Double Digit Revenue Growth Grow ICL Sales by 25% , 30% Continuous Expansion of GM %, End year at 66% , 66.5% Profitable in 3 of 4 all 4 quarters and for the full year ®

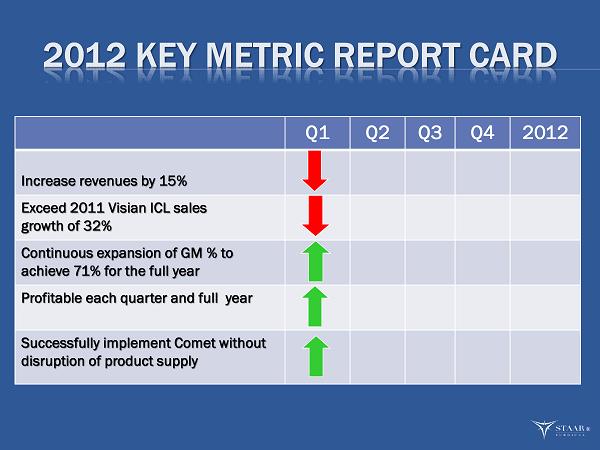

2012 KEY METRIC REPORT CARD Q1 Q2 Q3 Q4 2012 Increase revenues by 15% Exceed 2011 Visian ICL sales growth of 32% Continuous expansion of GM % to achieve 71% for the full year Profitable each quarter and full year Successfully implement Comet without disruption of product supply ®

VISIAN ICL REVENUE GAINS INCREASE OF 25% IN Q1 2012 AND 32% IN 2011 0 1 2 3 4 5 6 7 8 9 10 Q305 Q405 Q106 Q206 Q306 Q406 Q107 Q207 Q307 Q407 Q108 Q208 Q308 Q408 Q109 Q209 Q309 Q409 Q110 Q210 Q310 Q410 Q111 Q211 Q311 Q411 Q112 Milli ons $ ®

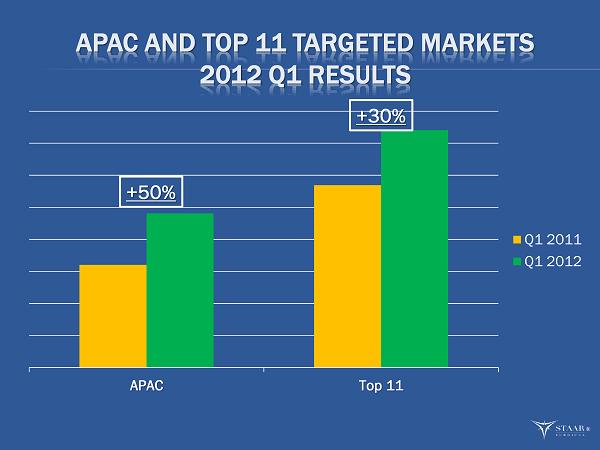

APAC AND TOP 11 TARGETED MARKETS 2012 Q1 RESULTS APAC Top 11 Q1 2011 Q1 2012 +50% +30% ®

KEY ICL ASIA PACIFIC MARKETS 2012 Q1 RESULTS Japan India China Korea Q1 2011 Q1 2012 +93% +47% +110% +37% ®

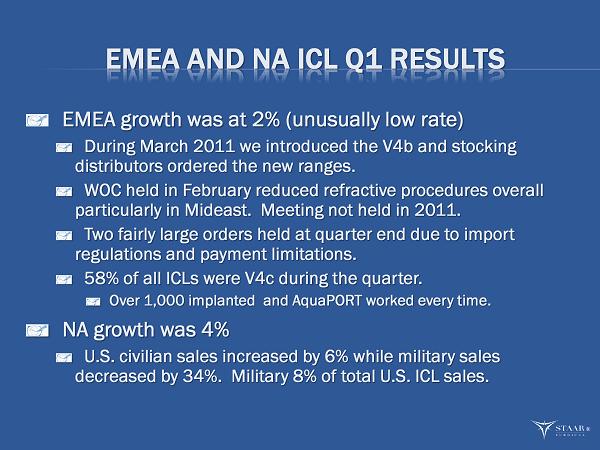

EMEA AND NA ICL Q1 RESULTS EMEA growth was at 2% (unusually low rate) During March 2011 we introduced the V4b and stocking distributors ordered the new ranges. WOC held in February reduced refractive procedures overall particularly in Mideast. Meeting not held in 2011. Two fairly large orders held at quarter end due to import regulations and payment limitations. 58% of all ICLs were V4c during the quarter. Over 1,000 implanted and AquaPORT worked every time. NA growth was 4% U.S. civilian sales increased by 6% while military sales decreased by 34%. Military 8% of total U.S. ICL sales. ®

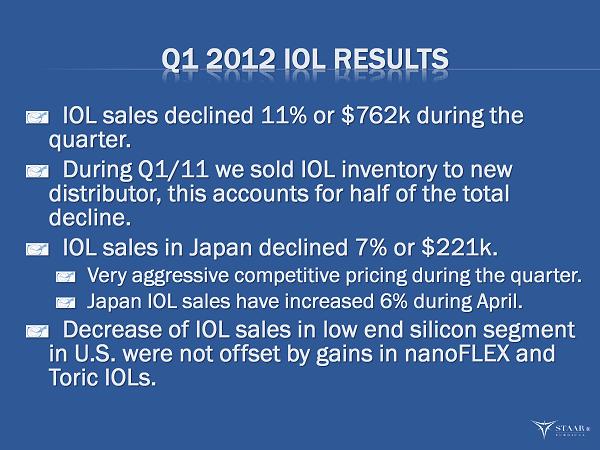

Q1 2012 IOL RESULTS IOL sales declined 11% or $762k during the quarter. During Q1/11 we sold IOL inventory to new distributor, this accounts for half of the total decline. IOL sales in Japan declined 7% or $221k. Very aggressive competitive pricing during the quarter. Japan IOL sales have increased 6% during April. Decrease of IOL sales in low end silicon segment in U.S. were not offset by gains in nanoFLEX and Toric IOLs. ®

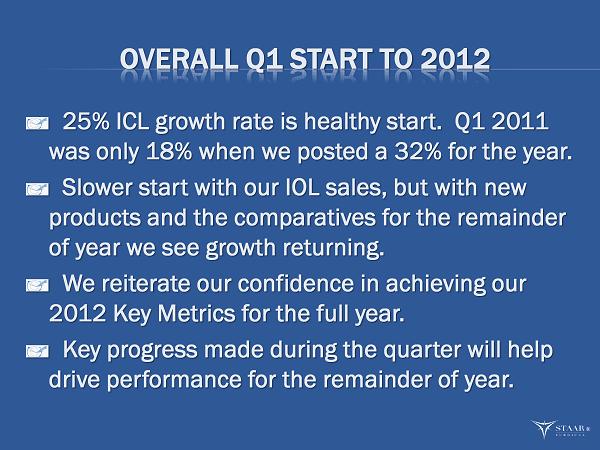

OVERALL Q1 START TO 2012 25% ICL growth rate is healthy start. Q1 2011 was only 18% when we posted a 32% for the year. S lower start with our IOL sales, but with new products and the comparatives for the remainder of year we see growth returning. We reiterate our confidence in achieving our 2012 Key Metrics for the full year. Key progress made during the quarter will help drive performance for the remainder of year. ®

Deborah Andrews Chief Financial Officer FINANCIAL REVIEW MANUFACTURING CONSOLIDATION UPDATE ®

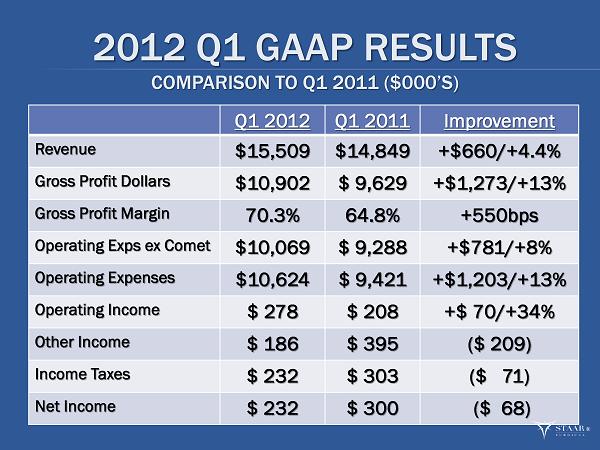

2012 Q1 GAAP RESULTS COMPARISON TO Q1 2011 ($000’S) Q1 2012 Q1 2011 Improvement Revenue $15,509 $14,849 +$660/+4.4% Gross Profit Dollars $10,902 $ 9,629 +$1,273/+13% Gross Profit Margin 70.3% 64.8% +550 bps Operating Exps ex Comet $10,069 $ 9,288 +$781/+8% Operating Expenses $10,624 $ 9,421 +$1,203/+13% Operating Income $ 278 $ 208 +$ 70/+34% Other Income $ 186 $ 395 ($ 209) Income Taxes $ 232 $ 303 ($ 71) Net Income $ 232 $ 300 ($ 68 ) ®

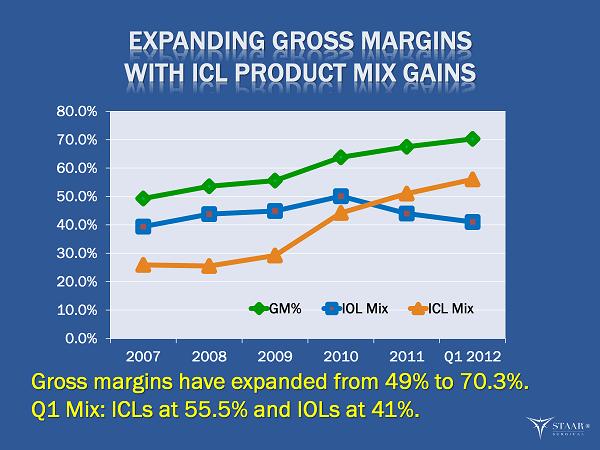

EXPANDING GROSS MARGINS WITH ICL PRODUCT MIX GAINS 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 2007 2008 2009 2010 2011 Q1 2012 GM% IOL Mix ICL Mix Gross margins have expanded from 49% to 70.3%. Q1 Mix: ICLs at 55.5% and IOLs at 41%. ®

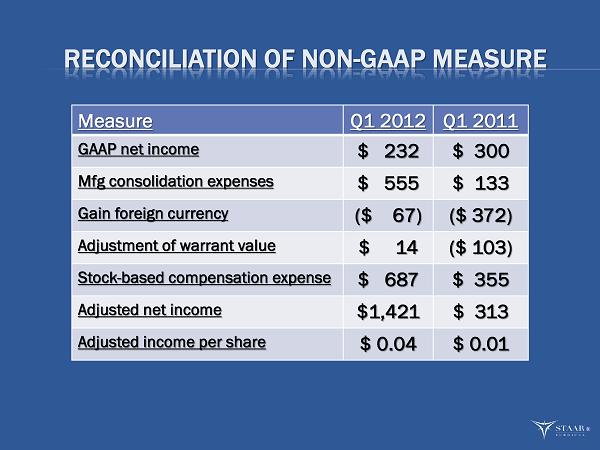

RECONCILIATION OF NON - GAAP MEASURE Measure Q1 2012 Q1 2011 GAAP net income $ 232 $ 300 Mfg consolidation expenses $ 555 $ 133 Gain foreign currency ($ 67) ($ 372) Adjustment of warrant value $ 14 ($ 103) Stock - based compensation expense $ 687 $ 355 Adjusted net income $1,421 $ 313 Adjusted income per share $ 0.04 $ 0.01 ®

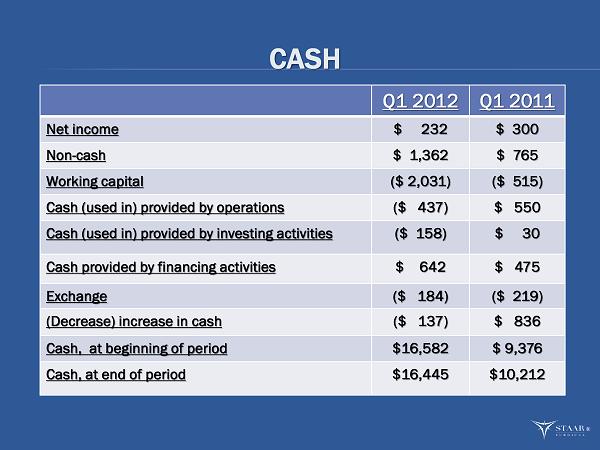

CASH Q1 2012 Q1 2011 Net income $ 232 $ 300 Non - cash $ 1,362 $ 765 Working capital ($ 2,031) ($ 515) Cash (used in) provided by operations ($ 437 ) $ 550 Cash (used in) provided by investing activities ($ 158) $ 30 Cash provided by financing activities $ 642 $ 475 Exchange ($ 184) ($ 219) (Decrease) increase in cash ($ 137) $ 836 Cash, at beginning of period $16,582 $ 9,376 Cash, at end of period $16,445 $10,212 ®

PROJECT COMET UPDATE MANUFACTURING CONSOLIDATION Q1 2012 Expenses Expenses for the quarter were $555k. Total expense for the year $2M to $2.5M. Progress during the quarter. Project teams with detailed schedules for each move Received the regulatory approval three months earlier than expected to ship preloaded IOLs from the U.S. to Japan. Making facility modifications to Monrovia plant. Capital purchases well underway. Expect to be shipping all Preloaded IOLs to Japan from U.S. during the third quarter of 2012. Expect to be shipping first Visian ICLs OUS from U.S. during the first quarter of 2013. ®

Barry G. Caldwell Chief Executive Officer RECENT CONFERENCE SUCCESSES TECHNOLOGY UPDATES UPCOMING INVESTOR EVENTS ®

Q1 KEY OPHTHALMIC CONFERENCES Significantly increased presence at major meetings World Ophthalmology Conference in Abu Dhabi First Mideast ICL Experts Meeting Revolutions in Refractive Surgery Symposium 16 presentations on Visian ICL American Society of Cataract & Refractive Surgeons Welcome reception for over 200 customers 33 presentations on the Visian ICL Investor breakfast featuring Dr. Baikoff from France ®

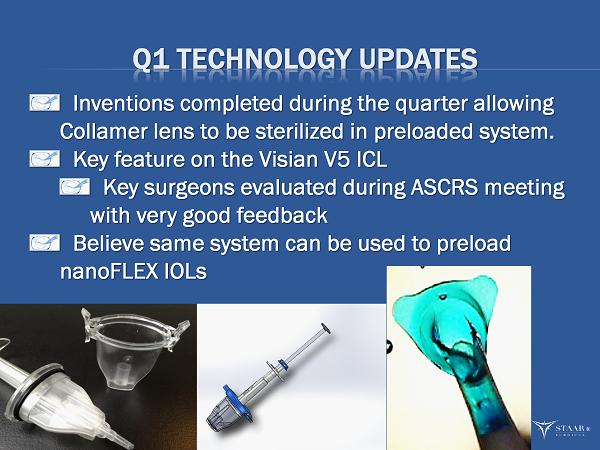

Q1 TECHNOLOGY UPDATES ® Inventions completed during the quarter allowing Collamer lens to be sterilized in preloaded system. Key feature on the Visian V5 ICL Key surgeons evaluated during ASCRS meeting with very good feedback Believe same system can be used to preload nanoFLEX IOLs

Q1 TECHNOLOGY UPDATES nanoFLEX Toric IOL We had planned to start implanting this new IOL during Q1 - it is now planned for Q2 This will allow us to open more markets in Europe to the nanoFLEX IOL as well KS - SP Single Piece Preloaded Acrylic IOL This is an important IOL for Japan and Europe We were having issues with consistent delivery of the IOL into the eye. During the quarter our engineering team in Japan resolved the issues and we can now move to manufacturing these lenses for commercialization ®

2012 KEY METRICS Increase revenues by 15%. Exceed 2011 ICL growth rate of 32%. Continuous expansion of gross margin and achieve 71% for the full year. Profitable each quarter and the full year. Successfully implement mfg. consolidation without disruption to customer service levels and quality ®

UPCOMING INVESTOR EVENTS Deutsche Bank Healthcare Conference May 8th Boston Annual Shareholders Meeting May 14 th Monrovia, California 13 th Annual B. Riley Investor Conference May 23 rd Santa Monica, California Benchmark One on One Conference May 31 st Milwaukee Jefferies Global Healthcare Conference June 7 th New York City Canaccord NDRS June 27 th in Zurich ®

THANK YOU! YOUR QUESTIONS PLEASE ®