Attached files

| file | filename |

|---|---|

| 8-K - FULTON FINANCIAL CORP | ffc8k.htm |

April 30, 2012

1

Please remember that during today’s program, representatives of Fulton may make forward-

looking statements with respect to Fulton’s financial condition, results of operations and

business.

looking statements with respect to Fulton’s financial condition, results of operations and

business.

These forward-looking statements are not guarantees of future performance and are subject to

risks, uncertainties and other factors, some of which are beyond Fulton’s control and difficult

to predict and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

risks, uncertainties and other factors, some of which are beyond Fulton’s control and difficult

to predict and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

Fulton undertakes no obligation, other than required by law, to update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise.

looking statements, whether as a result of new information, future events or otherwise.

In our quarterly earnings releases and other material news releases which our available

on our website at www.fult.com, we include our safe harbor statement on forward-looking

statements; we refer you to this section of those news releases and the statement is

incorporated into this presentation.

on our website at www.fult.com, we include our safe harbor statement on forward-looking

statements; we refer you to this section of those news releases and the statement is

incorporated into this presentation.

For a more complete discussion of certain risks and uncertainties affecting Fulton,

please see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” set forth in Fulton’s filings

with the Securities and Exchange Commission.

please see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” set forth in Fulton’s filings

with the Securities and Exchange Commission.

FORWARD-LOOKING STATEMENT

2

3

TODAY’S MEETING

n Tape recorders and cameras are not permitted in

the meeting.

the meeting.

n The display of placards and/or signs is prohibited.

n Please be considerate of others -- silence or turn

off your cell phone during the meeting.

off your cell phone during the meeting.

n Any questions and comments should be directed

to the chairperson of the meeting during the

Question and Answer period. Please remember to

state your name prior to asking your question.

to the chairperson of the meeting during the

Question and Answer period. Please remember to

state your name prior to asking your question.

WELCOME AND OPENING REMARKS

4

5

TODAY’S AGENDA

n Business Meeting

u Proposals:

= Election of directors

= Say on Pay

= Ratification of appointment of independent auditor

u Introductions

u Results of Voting

u Conclusion of Business Meeting

n Management Presentation

n Questions and Answers

CORPORATE WEBSITE: WWW.FULT.COM

6

April 30, 2012

7

8

JEFFREY G. ALBERTSON

9

JOE N. BALLARD

10

JOHN M. BOND, JR.

11

CRAIG A. DALLY

12

PATRICK J. FREER

13

RUFUS A. FULTON, JR.

14

GEORGE W. HODGES

15

WILLEM KOOYKER

16

DONALD W. LESHER, JR.

17

ALBERT MORRISON III

18

GARY A. STEWART

19

E. PHILIP WENGER

20

IN MEMORIAM: JOHN O. SHIRK

21

April 30, 2012

22

CHARLIE NUGENT

23

JIM SHREINER

24

CRAIG HILL

25

CRAIG RODA

26

April 30, 2012

27

GERRY NAU

28

29

JILL CARSON

ROCCO DELVECCHIO

30

31

DAVE HANSON

BRYAN HOLMES

32

33

CURT MYERS

34

JOHN SCALDARA

35

ANGELA SNYDER

36

MIKE WIMER

37

April 30, 2012

38

REFLECTIONS ON 2011

39

Significant progress and improvement

n Earnings per share growth

n Improvement in ROA

n Better asset quality

n Good core deposit growth

n Margin expansion

n Expense control

HIGHLIGHTS OF 2011

40

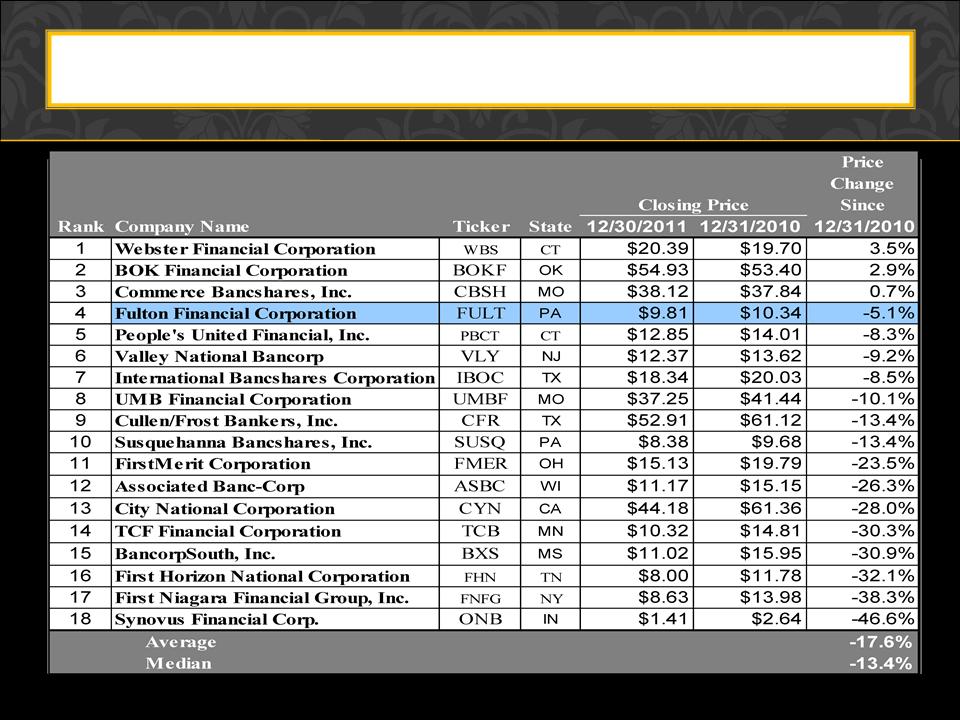

PEER BANKS

n Associated Banc-Corp

n BancorpSouth, Inc.

n BOK Financial Corporation

n City National Corporation

n Commerce Bancshares, Inc.

n Cullen/Frost Bankers, Inc.

n First Horizon National

Corporation

Corporation

n FirstMerit Corporation

n First Niagara Financial

Group, Inc.

Group, Inc.

n International Bancshares

Corporation

Corporation

n Peoples United Financial, Inc.

n Susquehanna Bancshares, Inc.

n Synovus Financial Corp.

n TCF Financial Corporation

n UMB Financial Corporation

n Valley National Bancorp

n Webster Financial Corp.

41

2011 EARNINGS GROWTH

42

EPS

EPS

TN

STOCK PRICE - 12-MONTH CHANGE

43

BB&T Buy

Bank of America/Merrill Lynch Underperform

Barclays Capital Overweight

Boenning & Scattergood Neutral

Credit Suisse Neutral

FBR Capital Markets Outperform

Guggenheim Partners Buy

Janney Montgomery Scott Buy

Jefferies and Company Hold

Keefe, Bruyette & Woods Market Perform

Raymond James Market Perform

Sterne Agee Neutral

Stifel, Nicolaus & Co. Buy

Sandler O’Neill Hold

Standard & Poor’s Hold

SunTrust Robinson Humphrey Buy

ANALYST RECOMMENDATIONS

44

RETURN ON AVERAGE ASSETS

2011 CREDIT QUALITY IMPROVEMENT

n Net charge-offs increased slightly

n Non-performing assets decreased

n Provision for credit losses decreased

46

AVERAGE CORE DEPOSIT GROWTH

47

AVERAGE LOAN GROWTH

48

NET INTEREST MARGIN

49

n Employees completed 334 Lean initiatives

n Result: $4.5 million in savings to

our company

our company

n We will continue to benefit in 2012

and beyond

and beyond

2011 LEAN IMPROVEMENT RESULTS

50

EFFICIENCY RATIO

51

MERGER OF NEW JERSEY BANKS

52

n 2011 Greenwich Excellence Awards in

Middle Market Banking

Middle Market Banking

n Fulton Bank, N.A. won in 2 categories

§ Overall Satisfaction in Banking

§ Treasury Management

n National and Regional winner

n Criteria: $10 - $500 million in sales

n 11,500 business interviews

GREENWICH ASSOCIATES

53

53

n Care, Listen, Understand, Deliver

n 600 Experience Champions

and Ambassadors

and Ambassadors

n Learning sessions helped

employee connect with the

“bigger picture”

employee connect with the

“bigger picture”

2011 CUSTOMER EXPERIENCE

54

Why do we pay so much attention to Our Promise?

n Satisfied customers will increase the business

they bring to us

they bring to us

n More households and more products

Customer Experience

+ strong sales efforts

RESULTS!

CUSTOMER EXPERIENCE

55

Retail households

Year-end 2010 households: 243,125

Year-end 2011 households: 243,292

Commercial households

Year-end 2010 households: 64,832

Year-end 2011 households: 67,382

Total household increase: 2,717

2011 SALES RESULTS

56

57

Please remember that during today’s program, representatives of Fulton may make forward-

looking statements with respect to Fulton’s financial condition, results of operations and

business.

looking statements with respect to Fulton’s financial condition, results of operations and

business.

These forward-looking statements are not guarantees of future performance and are subject to

risks, uncertainties and other factors, some of which are beyond Fulton’s control and difficult

to predict and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

risks, uncertainties and other factors, some of which are beyond Fulton’s control and difficult

to predict and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

Fulton undertakes no obligation, other than required by law, to update or revise any forward-

looking statements, whether as a result of new information, future events or otherwise.

looking statements, whether as a result of new information, future events or otherwise.

In our quarterly earnings releases and other material news releases which our available

on our website at www.fult.com, we include our safe harbor statement on forward-looking

statements; we refer you to this section of those news releases and the statement is

incorporated into this presentation.

on our website at www.fult.com, we include our safe harbor statement on forward-looking

statements; we refer you to this section of those news releases and the statement is

incorporated into this presentation.

For a more complete discussion of certain risks and uncertainties affecting Fulton,

please see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” set forth in Fulton’s filings

with the Securities and Exchange Commission.

please see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations” set forth in Fulton’s filings

with the Securities and Exchange Commission.

FORWARD-LOOKING STATEMENT

58

|

|

Fulton Financial

12/31/11

|

Basel III (1)

|

|

Total Risk-Based Capital Ratio

|

15.20%

|

10.50%

|

|

Tier 1 Risk-Based Capital Ratio(2)

|

12.70%

|

8.50%

|

|

Leverage Capital Ratio

|

10.30%

|

TBD

|

|

Common Equity Ratio (3)

|

11.30%

|

7.00%

|

|

Tangible Common Equity Ratio(4)

|

9.15%

|

NA

|

CAPITAL

(1) Fully phased-in requirements, with 2.50% conservation buffer; FFC has approximately

$300 million of capital in excess of these Basel III requirements.

$300 million of capital in excess of these Basel III requirements.

(2) 12/31/11 ratio incudes existing trust preferred securities.

(3) Tier 1 common equity to risk-weighted assets.

(4) GAAP tangible equity to total tangible assets.

59

POTENTIAL USES OF CAPITAL

n Dividends to shareholders

n Repurchase stock

n Strategic acquisitions

n Support organic growth

60

n Increased 4 out of last 5 quarters

n Dividend yield: approximately 2.7%

n Evaluated quarterly by the FFC board

n Will look to increase it further as our

earnings and the economy improve

earnings and the economy improve

DIVIDENDS

61

n Limited opportunity in 2011

n Do not foresee much change in 2012

n Bank consolidation may increase -

based on economy and new capital

requirements

based on economy and new capital

requirements

ACQUISITIONS CLIMATE

62

The Dodd-Frank Act

n The most comprehensive reform of the

financial system in decades (1,000 pages)

financial system in decades (1,000 pages)

n Enacted following the recent national

financial crisis

financial crisis

n Increased compliance requirements

in many areas: retail, commercial, mortgage

in many areas: retail, commercial, mortgage

n Makes managing expenses more challenge for

our industry

our industry

THE REGULATORY ENVIRONMENT

63

n Upgrades our core data processing system

n Enables us to more directly address

customers’ financial needs

customers’ financial needs

n Reduces back-office tasks

and paperwork

and paperwork

n Provides a more effective

sales tool

sales tool

THE STAR PROJECT

64

n Continue to reduce our credit costs

n Loan growth

n Provide a superior customer experience

n Leverage opportunities to increase our

market share

market share

IMPROVE OUR RETURN ON ASSETS

65

New construction

n Waugh Chapel (MD)

n Seven Oaks (MD)

n Exton (PA)

n Warrington (PA)

n Madison (NJ)

n Manahawkin (NJ)

Relocations/upgrades

n Oxford (PA)

n McGovern Avenue (PA)

n Branmar (DE)

n Newport News (VA)

n Williamsport (PA)

66

2012 BRANCH PLANS

NEW BRANCH PROTOTYPE

We will increase shareholder value and enrich

the communities we serve by creating financial

success together with our customers and career

success together with our employees.

the communities we serve by creating financial

success together with our customers and career

success together with our employees.

OUR ULTIMATE GOAL

68

A SMOOTH TRANSITION

69

70

QUESTIONS AND ANSWERS

Please remember to:

n Use the microphones in front of room

n Ask only one question to give other

shareholders a chance

shareholders a chance

n State your name before you ask your

question

question

April 30, 2012

71