Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUMAN GENOME SCIENCES INC | d339062d8k.htm |

| EX-99.1 - EX-99.1 - HUMAN GENOME SCIENCES INC | d339062dex991.htm |

Exhibit 99.2

| CONFERENCE CALL & WEBCAST April 24, 2012 |

| 2 NOTE REGARDING FORWARD-LOOKING STATEMENTS This presentation includes statements that are forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include those regarding our expectations for BENLYSTA(r), darapladib, and other assets, business goals for 2012, and our financial guidance. These forward-looking statements are based on our current intentions, beliefs and expectations regarding future events. We cannot guarantee that any forward-looking statement will be accurate. Investors should realize that if underlying assumptions prove inaccurate or unknown risks or uncertainties materialize, actual results could differ materially from our expectations. Investors are, therefore, cautioned not to place undue reliance on any forward-looking statement. Any forward-looking statement speaks only as of the date of this presentation, and, except as required by law, we do not undertake to update any forward- looking statement to reflect new information, events or circumstances. Some important factors that could cause our actual results to differ from our expectations in these forward-looking statements include: our lack of commercial experience and dependence on the sales growth of BENLYSTA; any failure to commercialize BENLYSTA successfully; the occurrence of adverse safety events with our products; changes in the availability of reimbursement for BENLYSTA; the inherent uncertainty of the timing, success of, and expense associated with, research, development, regulatory approval and commercialization of pipeline products, including darapladib, and new indications for existing products; substantial competition in our industry, including from branded and generic products; the highly regulated nature of our business; uncertainty regarding our intellectual property rights and those of others; the ability to manufacture at appropriate scale, and in compliance with regulatory requirements, to meet market demand for our products; our substantial indebtedness and lease obligations; our dependence on collaborations over which we may not always have full control; foreign exchange rate valuations and fluctuations; the impact of our acquisitions and strategic transactions; changes in the health care industry in the U.S. and other countries, including government laws and regulations relating to sales and promotion, reimbursement and pricing generally; significant litigation adverse to the company, including product liability and patent infringement claims; our ability to attract and retain key personnel; and increased scrutiny of the health care industry by government agencies and state attorneys general resulting in investigations and prosecutions. The foregoing list sets forth many, but not all, of the factors that could cause actual results to differ from our expectations in any forward- looking statement. Investors should consider this cautionary statement, as well as the risk factors identified in our periodic reports filed with the SEC, when evaluating our forward-looking statements HGS, Human Genome Sciences, and BENLYSTA are trademarks of Human Genome Sciences, Inc. Other trademarks referenced are the property of their respective owners. |

| We remain confident in the future potential of HGS and our Board is committed to maximizing shareholder value BENLYSTA - a blockbuster in progress BENLYSTA is the first drug in >50 years to be approved for the treatment of Lupus Lupus is a complicated disease with a unique treatment approach - physicians "try, observe, then adopt" Our market research indicates that most physicians are now "trying" BENLYSTA; real world efficacy is favorable, therefore we expect adoption rates to increase more rapidly The U.S. market represents a $7+ billion opportunity We have equal operational rights and share 50% of worldwide profits with GSK Darapladib - a blockbuster in the making Novel treatment for 30+ million cardiovascular disease patients We retain a 10% worldwide sales royalty AND 20% co-promotion / profit share option (in North America and Europe) Upon a change of control, our financial and commercial rights to all programs are fully transferable Pipeline represents a significant upside opportunity for shareholders Balance sheet is strong - $799 million cash and $701 million debt $2.4 billion in NOLs Unsolicited GSK proposal does not reflect the inherent value of the company EXECUTIVE SUMMARY 3 |

| Clinical and Regulatory Success: The only treatment to complete randomized placebo-controlled Phase 3 trials successfully in patients with SLE A broad label reflecting success in the clinic1 Strong Market Demand: 90%+ intent-to-use BENLYSTA among rheumatologists Estimated initial U.S. market of ~200,000 patients Significant opportunity outside the U.S. Additional Drivers of Growth Beyond Entry in SLE: Significant investment underway Subcutaneous formulation may enable weekly self-administration (initiated in Q4 2011) Phase III trials for new indications, vasculitis and lupus nephritis (initiation expected in 2H 2012) Exploratory / proof-of concept studies in many other diseases and syndromes Strong intellectual property rights and limited near term competition: Patent protection through 2025 BENLYSTA(r): THE FIRST DRUG IN 50 YEARS TO TREAT LUPUS 4 1BENLYSTA is indicated in the U.S. for the treatment of adult patients with active, autoantibody- positive, systemic lupus erythematosus who are receiving standard therapy. Limitations of Use: The efficacy of BENLYSTA has not been evaluated in patients with severe active lupus nephritis or severe active central nervous system lupus. BENLYSTA has not been studied in combination with other biologics or intravenous cyclophosphamide. Use of BENLYSTA is not recommended in these situations. |

| SLE IS A UNIQUE AND COMPLICATED DISEASE, WHICH IMPACTS THE RATE OF NEW TREATMENT ADOPTION 5 A chronic, life-threatening autoimmune disease, complicated by the following: Often affects multiple organ systems simultaneously (skin, joint and immunologic most common) Broad set of symptoms, including severe pain, extreme fatigue, swollen joints, skin rash and kidney problems Symptoms wax and wane Mortality rate 2-5x normal Eyes and Mucous Membranes Heart and Lungs Skin Gastrointestinal System Reproductive System Musculoskeletal System Joints Kidneys Central Nervous System Blood Due to the complexity of the disease, physicians often take time to identify patients that would benefit from treatment |

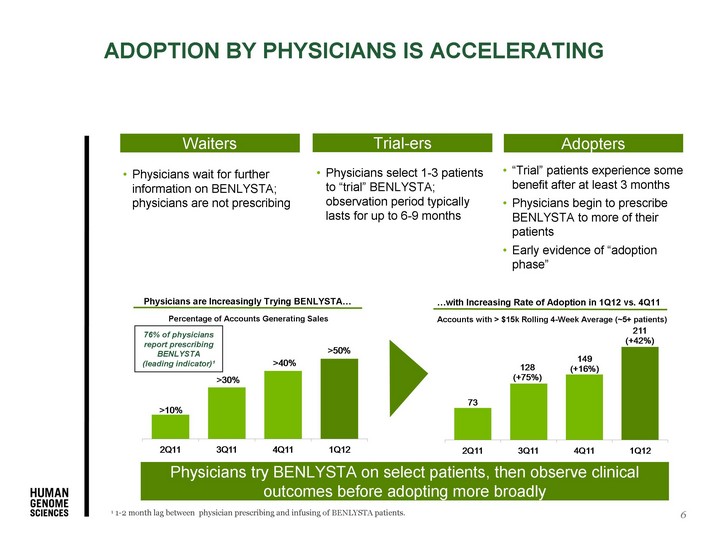

| 6 ADOPTION BY PHYSICIANS IS ACCELERATING Waiters ...with Increasing Rate of Adoption in 1Q12 vs. 4Q11 Physicians try BENLYSTA on select patients, then observe clinical outcomes before adopting more broadly Accounts with > $15k Rolling 4-Week Average (~5+ patients) Physicians are Increasingly Trying BENLYSTA... Percentage of Accounts Generating Sales 1 1-2 month lag between physician prescribing and infusing of BENLYSTA patients. 76% of physicians report prescribing BENLYSTA (leading indicator)1 Physicians wait for further information on BENLYSTA; physicians are not prescribing Physicians select 1-3 patients to "trial" BENLYSTA; observation period typically lasts for up to 6-9 months "Trial" patients experience some benefit after at least 3 months Physicians begin to prescribe BENLYSTA to more of their patients Early evidence of "adoption phase" Trial-ers Adopters |

| IN MARKET RESEARCH, PHYSICIANS PERCEIVE PATIENTS ARE EXPERIENCING BENEFIT1 Manifestations of SLE Symptoms Triggering BENLYSTA Prescription ~ % of Patients Fatigue 86% Arthritis 83% Rash 62% Anti-dsDNA Positive 61% Inability to Taper Steroids 56% Low Complement Level 42% Hematologic 39% Serositis 37% Renal 20% CNS 8% Other 5% 7 7% Unchanged 90% Improved 2% Worsened Source: Physician Pulse Study, Fielded February 8-16, n=81 rheumatologists, n=127 patients treated with BENLYSTA for greater than 3 months 1 Physician perceptions from actual use do not necessarily reflect efficacy observed in placebo-controlled clinical trials 2% Mixed Percent of Patients with Benefit in At Least One Manifestation Following At Least 3 Months of BENLYSTA Treatment |

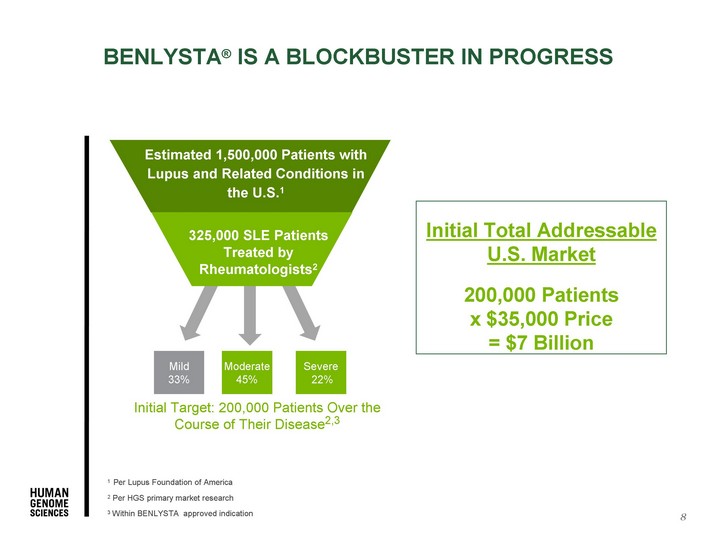

| Moderate 45% Severe 22% Initial Target: 200,000 Patients Over the Course of Their Disease2,3 Estimated 1,500,000 Patients with Lupus and Related Conditions in the U.S.1 325,000 SLE Patients Treated by Rheumatologists2 8 1 Per Lupus Foundation of America 2 Per HGS primary market research 3 Within BENLYSTA approved indication Mild 33% BENLYSTA(r) IS A BLOCKBUSTER IN PROGRESS Initial Total Addressable U.S. Market 200,000 Patients x $35,000 Price = $7 Billion |

| PIPELINE PROVIDES UPSIDE OPPORTUNITY FOR OUR SHAREHOLDERS 9 Raxibacumab Inhalation Anthrax3 BENLYSTA(r) Systemic Lupus1, 2 Type 2 Diabetes Albiglutide Darapladib Cardiovascular Disease Marketed BENLYSTA Vasculitis4 BENLYSTA Active Lupus Nephritis4 Alzheimer's Disease Rilapladib |

| First in class small molecule inhibitor of Lp-PLA2, an enzyme associated with formation of atherosclerotic plaques Target implicated in the inflammatory component of plaque formation Large epidemiological trials have identified Lp-PLA2 as an independent risk factor (from LDL cholesterol) for coronary heart disease and ischemic stroke GSK is committing capital and resources to developing darapladib GSK management has placed emphasis on darapladib The combined Phase 3 clinical program for darapladib is one of the largest ever conducted to evaluate any cardiovascular medication Two Phase 3 registration studies ongoing to determine whether darapladib can reduce future cardiovascular events versus existing standard of care therapy STABILITY study: ~15,800 patients with chronic coronary artery disease; initiated in December 2008 and now fully enrolled SOLID-TIMI 52: >13,000 patients with acute coronary syndrome (ACS); initiated in December 2009 and now fully enrolled If commercialized, HGS will earn 10% royalty on WW sales and has a 20% co- promotion / profit-share option in North America and Europe DARAPLADIB - DISCOVERED BY GSK USING HGS TECHNOLOGY 10 |

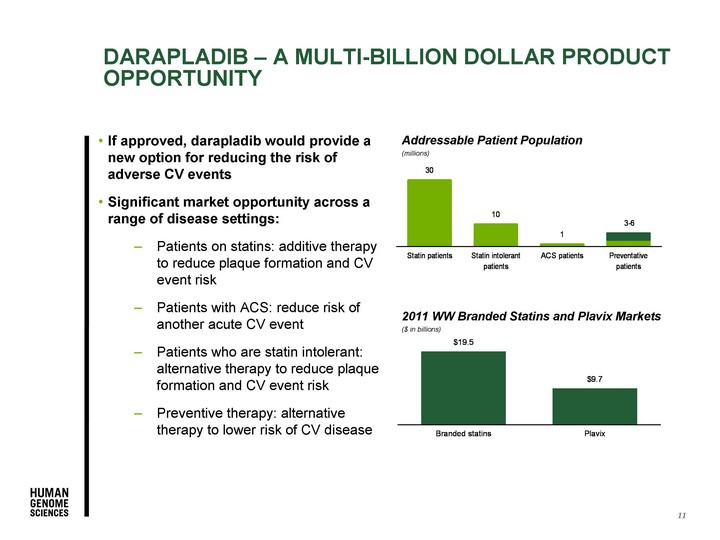

| 2011 WW Branded Statins and Plavix Markets ($ in billions) Addressable Patient Population (millions) DARAPLADIB - A MULTI-BILLION DOLLAR PRODUCT OPPORTUNITY 11 If approved, darapladib would provide a new option for reducing the risk of adverse CV events Significant market opportunity across a range of disease settings: Patients on statins: additive therapy to reduce plaque formation and CV event risk Patients with ACS: reduce risk of another acute CV event Patients who are statin intolerant: alternative therapy to reduce plaque formation and CV event risk Preventive therapy: alternative therapy to lower risk of CV disease |

| OTHER PIPELINE OPPORTUNITIES - BALANCED PORTFOLIO OF PARTNERED AND WHOLLY OWNED PRODUCT CANDIDATES 12 Raxibacumab for inhalation anthrax Monoclonal antibody generating revenue under U.S. government contract Albiglutide for Type 2 diabetes (T2D) Once weekly GLP-1 agonist discovered by HGS and licensed to GSK Initial Phase 3 data available with additional studies reporting in 2012; progressing towards WW regulatory filings HGS to receive milestones and royalties (net single digit royalties on WW sales) Will compete vs. Victoza and Byetta/Bydureon in GLP-1 market Rilapladib for Alzheimer's disease Small molecule inhibitor of Lp-PLA2 discovered by GSK using HGS technology GSK is conducting a Phase 2 biomarker study in Alzheimer's disease If commercialized, HGS will receive 10% royalties on WW sales and has a 20% co- promotion option in North America and Europe Mapatumumab for cancer Monoclonal antibody to TRAIL receptor Randomized Phase 2 study ongoing in advanced hepatocellular carcinoma (HCC) HGS has worldwide rights ex-Japan HGS1036 for cancer Biologic to human fibroblast growth factor (FGF) Phase 1b combination studies to begin in 2012 in multiple solid tumors In-licensed from FivePrime; HGS maintains rights in the US, Canada and EU |

| Significant NOL value $2.4 billion in net operating losses (NOLs) are a valuable tax asset Strong balance sheet Cash on hand of $799 million provides capital base for continued BENLYSTA launch, pipeline execution and near-term debt maturity $207 million 2.25% Convertible Notes due August 2012 $495 million 3% Convertible Notes due 2018 World class biologics manufacturing capabilities Currently manufacture worldwide BENLYSTA commercial product with sufficient capacity for 2-3 years of future growth Partnership with Lonza to triple BENLYSTA manufacturing capacity NOTABLE OPERATIONAL AND FINANCIAL ASSETS 13 |

| NO ADVERSE CHANGE-OF-CONTROL PROVISIONS TIED TO GSK PARTNERSHIP 14 In change of control, all of HGS' rights flow to acquiror Full transferability of BENLYSTA, darapladib, albiglutide and rilapladib rights and economics to a third party acquiror No loss of economic or operational control relative to status quo BENLYSTA 50% co-promotion / profit share and equal HGS operational rights remain unchanged Potential royalties from GSK on approved products remain unchanged 20% co-promotion / profit share option for darapladib and rilapladib in North America and Europe remains unchanged |

| We remain confident in the future potential of HGS and our Board is committed to maximizing shareholder value BENLYSTA - a blockbuster in progress Darapladib - a blockbuster in the making Upon a change of control, our financial and commercial rights to all programs are fully transferable Pipeline represents a significant upside opportunity for shareholders Balance sheet is strong - $799 million cash and $701 million debt $2.4 billion NOLs Unsolicited GSK proposal does not capture the inherent value of HGS HGS does not intend to discuss the status of its strategic review unless and until a specific transaction has been approved SUMMARY OF HGS VALUE PROPOSITION 15 |