Attached files

| file | filename |

|---|---|

| 8-K - 8-K -- FIRST QUARTER 2012 RESULTS - CAPITAL ONE FINANCIAL CORP | d336765d8k.htm |

| EX-99.2 - EXHIBIT 99.2 - CAPITAL ONE FINANCIAL CORP | d336765dex992.htm |

| EX-99.1 - EXHIBIT 99.1 - CAPITAL ONE FINANCIAL CORP | d336765dex991.htm |

First Quarter 2012

Results April 19, 2012

Exhibit 99.3 |

| 2

April 19, 2012

Forward-Looking Statements

Please note that the following materials containing information regarding Capital One's financial

performance speak only as of the particular date or dates indicated in these materials. Capital

One does not undertake any obligation to update or revise any of the information contained herein whether as a result of new information,

future events or otherwise.

Certain statements in this presentation and other oral and written statements made by Capital One from

time to time are forward-looking statements, including those that discuss, among other

things: strategies, goals, outlook or other non-historical matters; projections, revenues, income, returns, expenses, capital measures,

accruals for claims in litigation and for other claims against Capital One, earnings per share or other

financial measures for Capital One; future financial and operating results; Capital One's plans,

objectives, expectations and intentions; the projected impact and benefits of the acquisition of

ING Direct (the "ING Direct Transaction") and the pending acquisition of HSBC's U.S.

credit card business (the "HSBC Transaction" and, with the ING Direct Transaction, the "Transactions");

and the assumptions that underlie these matters.

To the extent that any such information is forward-looking, it is intended to fit within the safe

harbor for forward-looking information provided by the Private Securities Litigation Reform

Act of 1995. Numerous factors could cause Capital One's actual results to differ materially from

those described in such forward- looking statements, including, among other things: general

economic and business conditions in the U.S., the U.K., Canada and Capital One’s local markets,

including conditions affecting employment levels, interest rates, consumer income and confidence,

spending and savings that may affect consumer bankruptcies, defaults, charge-offs and deposit

activity; an increase or decrease in credit losses (including increases due to a worsening of general economic conditions in the

credit environment); the possibility that Capital One will not receive third-party consents

necessary to fully realize the anticipated benefits of the HSBC Transaction; the possibility that

Capital One may not fully realize the projected cost savings and other projected benefits of the Transactions; changes in the anticipated timing

for

closing

the

HSBC

Transaction;

difficulties

and

delays

in

integrating

the

assets

and

businesses

acquired

in

the

Transactions;

business disruption during the

pendency of or following the Transactions; diversion of management time on issues related to the

Transactions, including integration of the assets and businesses acquired; reputational risks and

the reaction of customers and counterparties to the Transactions; disruptions relating to the Transactions negatively impacting

Capital One’s ability to maintain relationships with customers, employees and suppliers; changes in

asset quality and credit risk as a result of the Transactions; the accuracy of estimates and

assumptions Capital One uses to determine the fair value of assets acquired and liabilities assumed in

the Transactions, and the potential

for its estimates or assumptions to change as additional information becomes available and Capital One

completes the accounting analysis of the Transactions; financial, legal, regulatory, tax or

accounting changes or actions, including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the

regulations promulgated thereunder; developments, changes or actions relating to any litigation matter

involving Capital One; the inability to sustain revenue and earnings growth; increases or

decreases in interest rates; Capital One’s ability to access the capital markets at attractive rates and terms to capitalize and fund its

operations and future growth; the success of Capital One’s marketing efforts in attracting and

retaining customers; increases or decreases in Capital One’s aggregate loan balances or the

number of customers and the growth rate and composition thereof, including increases or decreases

resulting from factors such as

shifting

product

mix,

amount

of

actual

marketing

expenses

Capital

One

incurs

and

attrition

of

loan

balances;

the

level

of

future

repurchase or indemnification

requests Capital One may receive, the actual future performance of mortgage loans relating to such

requests, the success rates of claimants against it, any developments in litigation and the

actual recoveries Capital One may make on any collateral relating to claims against it; the

amount and rate of deposit growth; changes in the reputation of or expectations regarding the

financial services industry or Capital One with respect to practices, products or financial

condition; any significant disruption in Capital One’s operations or technology platform;

Capital One’s ability to maintain a compliance infrastructure suitable for its size and

complexity; Capital One’s ability to control costs; the amount of, and rate of growth in, its

expenses as its business develops or changes or as it expands into new market

areas;

Capital

One’s

ability

to

execute

on

its

strategic

and

operational

plans;

any

significant

disruption

of,

or

loss

of

public

confidence

in,

the

United States

Mail service affecting Capital One’s response rates and consumer payments; Capital One’s

ability to recruit and retain experienced personnel to assist in the management and operations of

new products and services; changes in the labor and employment markets; fraud or misconduct by Capital One’s customers,

employees or business partners; competition from providers of products and services that compete with

Capital One’s businesses; and other risk factors set forth from time to time in reports that

Capital One files with the Securities and Exchange Commission, including, but not limited to, the Annual Report on Form 10-K for

the year ended December 31, 2011.

You should carefully consider the factors discussed above in evaluating these forward-looking

statements. All information in these slides is based on the consolidated results of Capital One

Financial Corporation, unless otherwise noted. A reconciliation of any non-GAAP financial measures included in this

presentation can be found in Capital One's most recent Current Report on Form 8-K filed April 19,

2012, available on its website at www.capitalone.com under "Investors."

|

| 3

April 19, 2012

First Quarter 2012 Highlights

•

Q1 2012 net income was $1,403MM, or $2.72 per share, compared with Q4 2011 net income of

$407MM, or $0.88 per share

–

$1.56 per share excluding INGD related bargain purchase gain

–

Higher revenue due to impacts of the INGD acquisition, slightly higher loan balances and absence of Q4

2011 negative items

–

Lower provision expense driven by lower charge-offs and larger ALLL release

–

Lower non-interest expense driven by seasonally lower marketing expense and flat operating expense

•

Legacy operating expenses of ($2.0B)

•

Partially

offset

by

impact

of

merger-related

expenses

and

a

half

quarter of INGD expenses

–

Rep & Warranty expense of ($169M); ($95M) related to GSE settlement

•

ING Direct USA (INGD) acquisition closed on February 17, 2012

–

Merger-related impacts on Q1 2012 earnings include:

–

Bargain purchase gain increased non-interest income by $594M

–

Mark-to-market loss on related swap hedge of ($78M) in non-interest income

–

Loan premium amortization expense of ($30M) in interest income

–

Transaction and merger-related expenses of ($65M) in non-interest expense

–

Core deposit intangibles and other intangible amortization of ($12M )in operating expense

–

Half quarter impacts on Q1 2012 earnings excluding merger related impacts:

–

Revenue of ~ $185M

–

Non-interest expense of ~ ($77M) |

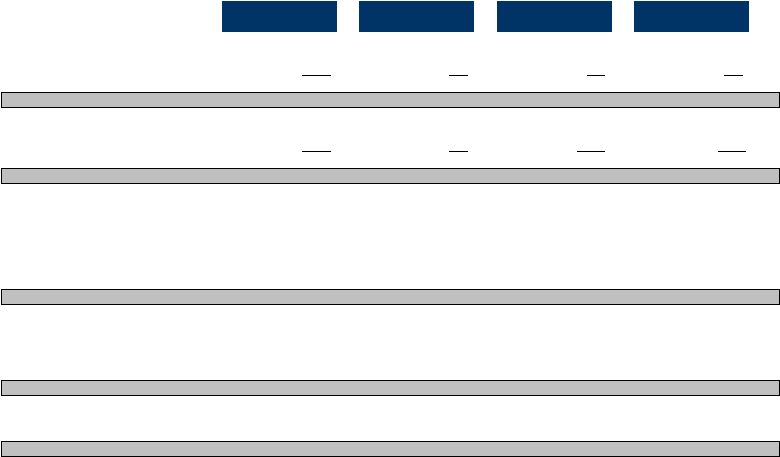

4

April 19, 2012

First quarter 2012 earnings reflected a significant impact from the

acquisition of ING Direct

*INGD impacts are estimated direct impacts post acquisition, including transaction & merger related

expenses ** Includes ~$25M of HSBC transaction & merger-related expenses

**

Actual

Est. INGD* Impact

COF (excl. est INGD)

Actual

$MM

Q1'12

Q1'12

Q1'12

Q4'11

Net Interest Income

3,414

$

136

$

3,278

$

3,182

$

Non-Interest Income

1,521

535

986

868

Total Revenue

4,935

671

4,264

4,050

$

Marketing

321

8

313

420

Operating Expense

2,183

150

2,033

2,198

Non-Interest Expense

2,504

158

2,346

2,618

Pre-Provision Earnings (before tax)

2,431

513

1,918

1,432

Net Charge-offs

780

1

779

884

Other

(17)

-

(17)

7

Allowance Build (Release)

(190)

-

(190)

(30)

Provision Expense

573

1

572

861

Pretax Income

1,858

512

1,346

571

Taxes

353

(23)

376

160

Operating Earnings (after tax)

1,505

535

970

411

Discontinued Operations, net of tax

(102)

-

(102)

(4)

Total Company (after tax)

1,403

$

535

$

868

$

407

$

|

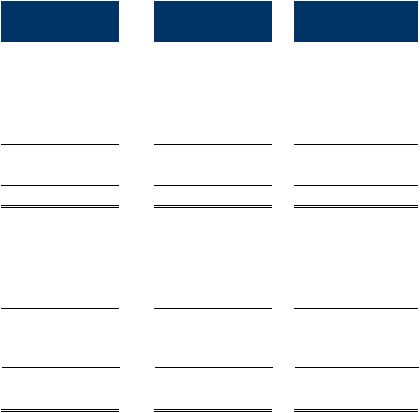

5

April 19, 2012

The addition of ING Direct’s assets & liabilities had a significant impact

on our first quarter balance sheet

$B

3/31/2012

INGD Impacts

12/31/2011

2/17/2012

Assets:

Cash and cash equivalents

31.7

$

20.1

$

6.6

$

Securities

60.8

30.6

38.8

Loans held for investment

173.8

40.4

135.9

Less: Allowance for loan and lease losses

(4.0)

-

(4.3)

Net loans held for investment

169.8

40.4

131.6

Other Assets

32.2

3.0

29.0

Total assets

294.5

$

94.1

$

206.0

$

Liabilities:

Deposits

216.5

$

84.4

$

128.2

$

Debt

32.9

-

39.5

Other liabilities

8.1

0.2

8.6

Total liabilities

257.5

84.6

176.3

Stockholders' Equity:

37.0

-

29.7

Total liabilities and stockholders' equity

294.5

$

84.6

$

206.0

$

|

6

April 19, 2012

The quarterly NIM decrease was caused by the addition of ING Direct

Average Balances & Margin Highlights

Average

Yield/

Average

Yield/

(Dollars in millions)

Balance

Rate

Balance

Rate

Interest-earning assets:

Loans held for investment

$

152,900

9.56

%

131,581

$

10.46

%

Investment securities

50,543

2.36

39,005

2.50

Cash equivalents and other

16,803

0.62

5,685

1.20

Total interest-earning assets

$

220,246

7.23

%

176,271

$

8.40

%

Interest-bearing liabilities:

Total interest-bearing deposits

$

151,625

0.82

%

109,914

$

0.96

%

Securitized debt obligations

16,185

1.98

16,780

1.91

Senior and subordinated notes

3.43

10,237

3.48

Other borrowings

3.61

7,794

4.41

Total interest-bearing liabilities

$

1.20

%

144,725

$

1.43

%

Impact of non-interest bearing deposits

0.17

%

0.25

%

Net interest margin

6.20

%

7.22

%

2012 Q1

2011 Q4

10,268

9,541

187,619 |

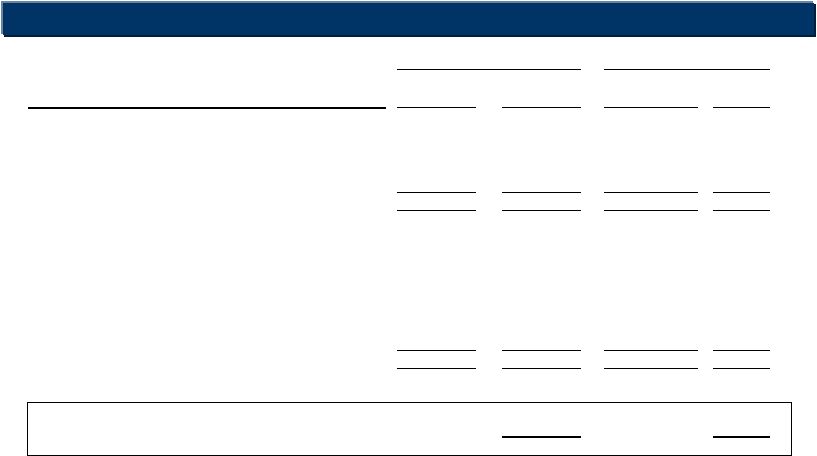

7

April 19, 2012

Our capital position was strengthened by issuance of deal related

shares and strong earnings

1

Tier 1 common ratio is a regulatory capital measure calculated based on Tier 1 common capital divided

by risk-weighted assets. See "Exhibit 99.2—Table 13: Reconciliation of

Non-GAAP Measures and Calculation of Regulatory Capital Measures" for the calculation of this ratio.

Tier

1

Common

Ratio

(Basel

I)

1

8.4%

9.4%

10.0%

9.7%

11.9%

0%

2%

4%

6%

8%

10%

12%

14%

Q111

Q211

Q311

Q411

Q112

Disallowed DTA

RWA

EOP Loans

(1.4)

142

124

Tier 1 common capital

including disallowed DTA

($B)

13.4

Tier 1 common capital

12.0

(0.6)

146

129

14.3

13.7

(0.2)

149

130

15.1

14.9

(0.5)

155

15.6

15.1

136

(0.9)

183

22.6

21.7

174 |

| 8

April 19, 2012

The acquisition of HSBC’s US Credit Card business will significantly

impact results in the second quarter and beyond

•

Significant earnings impact from:

–

Allowance for non-impaired loans and finance charge & fee reserve (FCFR) build

–

Purchase accounting

•

PCCR

•

Fair Value of delinquent and current loans

•

Other assets and intangibles

–

Transaction and merger-related expenses

•

Capital Impact

–

Expected to bring 2Q 2012 Tier 1 common ratio to mid-9% range

•

Increased risk weighted assets

•

Lower earnings due to above impacts

–

Capital generative beginning in Q3 2012 |

9

April 19, 2012

Domestic Card Financial Highlights

Commentary

•

5% year-over-year loan

growth; expected seasonal

decline in Q1

•

Strong year-over-year

growth in purchase

volumes, new accounts

•

Revenue margin decline

driven by unique items;

loan yields stable

•

NIE decline on lower

marketing and lower

operating expense

•

Underlying improvement

trend in charge-off and

delinquency rates, aided

by expected seasonal

tailwinds

Domestic Card delivered strong profits, improving credit and year-

over-year growth in loans and purchase volumes

2012

2011

2011

(Dollars in millions)

Q1

Q4

Q1

Net interest income

1,713

1,706

1,651

Non-interest income

497

613

583

Total revenue

2,210

2,319

2,234

Provision for credit losses

361

519

230

Non-interest expense

1,052

1,183

990

Income from continuing operations before taxes

797

617

1,014

Income tax provision

282

222

360

Income from continuing operations, net of tax

515

$

395

$

654

$

Selected metrics:

Period-end loans held for investment

53,173

$

56,609

$

50,570

$

Average loans held for investment

54,131

54,403

51,889

Average yield on loans held for investment

14.11

%

14.05

%

14.42

%

Revenue margin

16.33

17.05

17.22

Net charge-off rate

3.92

4.07

6.20

30+ day deliquency rate

3.25

3.66

3.59

Purchase volume

31,418

$

34,586

$

25,024

$ |

10

April 19, 2012

Consumer Banking Financial Highlights

Commentary

2012

2011

2011

(Dollars in millions)

Q1

Q4

Q1

Earnings:

Net interest income

1,288

$

1,105

$

983

$

Non-interest income

176

152

186

Total revenue

1,464

1,257

1,169

Provision for credit losses

174

180

95

Non-interest expense

943

893

740

Income from continuing operations before taxes

347

184

334

Income tax provision

123

67

119

Income from continuing operations, net of tax

224

$

117

$

215

$

Selected metrics:

Period-end loans held for investment

77,300

$

36,315

$

34,306

$

Average loans held for investment

56,263

35,791

34,236

Average yield on loans held for investment

7.20

%

9.46

%

9.60

%

Auto loan originations

4,270

$

3,586

$

2,571

$

Period-end deposits

176,007

88,540

86,355

Average deposits

129,915

88,390

83,884

Deposit interest expense rate

0.73

%

0.84

%

1.06

%

Core deposit intangible amortization

37

$

31

$

35

$

Net charge-off rate

0.77

%

1.65

%

1.57

%

Net charge-off rate (excluding acquired loans)

1.29

1.87

1.82

Nonperforming loans as a % of loans held for investment

0.77

1.79

1.84

Nonperforming asset rate

0.82

1.94

2.00

30+ day performing delinquency rate

1.63

4.47

3.42

30+ day performing delinquency rate (excluding acquired

loans)

3.63

5.06

3.98

30+ day deliquency rate

—

5.99

4.96

Period-end loans serviced for others

17,586

$

17,998

$

19,956

$

•

Trends in loan and deposit

balances, revenue, NIE,

and yields all driven by

addition of ING Direct on

2/17/12

•

$1.8 billion growth in auto

loans, strong growth in

auto loan originations

•

Modestly lower provision

expense:

–

Mix shift to home

loans

–

Lower home loan

charge-off rate

–

Seasonal

improvement in

auto credit

–

Partially offset by

allowance build for

auto loan growth

The addition of ING Direct and strong Auto Finance performance

drove Consumer Banking results |

11

April 19, 2012

Commercial Banking Financial Highlights

Commentary

2012

2011

2011

(Dollars in millions)

Q1

Q4

Q1

Earnings:

Net interest income

431

$

425

$

376

$

Non-interest income

85

87

71

Total revenue

516

512

447

Provision for credit losses

(69)

76

(16)

Non-interest expense

261

254

212

Income from continuing operations before taxes

324

182

251

Income tax provision

114

65

89

Income from continuing operations, net of tax

210

$

117

$

162

$

Selected metrics:

Period-end loans held for investment

34,906

$

34,327

$

30,265

$

Average loans held for investment

34,032

32,843

30,027

Average yield on loans held for investment

4.47

%

4.70

%

4.81

%

Period-end deposits

28,046

$

26,683

$

24,336

$

Average deposits

27,569

26,185

24,232

Deposit interest expense rate

0.37

%

0.42

%

0.55

%

Core deposit intangible amortization

9

$

9

$

11

$

Net charge-off rate

0.19

%

0.62

%

0.80

%

Nonperforming loans as a percentage of loans

held for investment

1.15

1.08

1.83

Nonperforming asset rate

1.23

1.17

1.94

•

15% year-over-year

growth in loans, deposits,

and revenue

•

Increases in NIE more

than offset by

improvements in provision

•

Charge-off rate improved;

NPA rate relatively stable

The Commercial Banking business continues to deliver strong and

steady performance |

12

April 19, 2012

We expect strong loan growth in several of our businesses to be

largely offset by significant run-off portfolios

Run-off Portfolios

(expected annual run-off)

Growth Opportunities

•

Auto Finance

•

Domestic Card

•

Commercial Banking

•

Consumer Banking (~$8.5 billion)

–

Home Loans inherited in acquisitions

•

Domestic Card (~$1.8 billion)

–

Portions of HSBC U.S. credit card

portfolio

–

Closed End Loans (ILs)

•

Commercial Banking (~$150 million)

–

Small Ticket CRE |

13

April 19, 2012

Building a Great

Customer Franchise

Strong Returns and

Capital Generation

Sure-footed Integration

We are focused on delivering sustained shareholder value |

|