Attached files

Annual Shareholder Meeting

April 17, 2012

Exhibit 99.1

2

Safe Harbor Statement

This presentation includes “forward-looking statements” within the meaning of Section

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our business strategy, our prospects and our

financial position. These statements can be identified by the use of forward-looking

terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,”

“should,” “could,” or “anticipates” or the negative or other variation of these similar

words, or by discussions of strategy or risks and uncertainties. These statements are

based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary

materially from the Company’s expectations and projections. Important factors that

could cause actual results to differ materially from such forward-looking statements

include, without limitation, risks related to the following:

27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding, among other things, our business strategy, our prospects and our

financial position. These statements can be identified by the use of forward-looking

terminology such as “believes,” “estimates,” “expects,” “intends,” “may,” “will,”

“should,” “could,” or “anticipates” or the negative or other variation of these similar

words, or by discussions of strategy or risks and uncertainties. These statements are

based on current expectations of future events. If underlying assumptions prove

inaccurate or unknown risks or uncertainties materialize, actual results could vary

materially from the Company’s expectations and projections. Important factors that

could cause actual results to differ materially from such forward-looking statements

include, without limitation, risks related to the following:

qIncreasing competition in the communications industry; and

qA complex and uncertain regulatory environment.

A further list and description of these risks, uncertainties and other factors can be found

in the Company’s SEC filings which are available online at www.sec.gov,

www.shentel.com or on request from the Company. The Company does not undertake

to update any forward-looking statements as a result of new information or future

events or developments

in the Company’s SEC filings which are available online at www.sec.gov,

www.shentel.com or on request from the Company. The Company does not undertake

to update any forward-looking statements as a result of new information or future

events or developments

3

Use of Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures that are not

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating

activities and exclude the effects of certain operating, capital and financing costs and

may differ from comparable information provided by other companies, and they should

not be considered in isolation, as an alternative to, or more meaningful than measures

of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the

industry and are presented because Shentel believes they provide relevant and useful

information to investors. Shentel utilizes these financial performance measures to

assess its ability to meet future capital expenditure and working capital requirements, to

incur indebtedness if necessary, return investment to shareholders and to fund

continued growth. Shentel also uses these financial performance measures to evaluate

the performance of its businesses and for budget planning purposes.

determined in accordance with US generally accepted accounting principles. These

financial performance measures are not indicative of cash provided or used by operating

activities and exclude the effects of certain operating, capital and financing costs and

may differ from comparable information provided by other companies, and they should

not be considered in isolation, as an alternative to, or more meaningful than measures

of financial performance determined in accordance with US generally accepted

accounting principles. These financial performance measures are commonly used in the

industry and are presented because Shentel believes they provide relevant and useful

information to investors. Shentel utilizes these financial performance measures to

assess its ability to meet future capital expenditure and working capital requirements, to

incur indebtedness if necessary, return investment to shareholders and to fund

continued growth. Shentel also uses these financial performance measures to evaluate

the performance of its businesses and for budget planning purposes.

Annual Shareholder Meeting

April 17, 2012

4

Web

Maps

Shopping

Music

Video

6

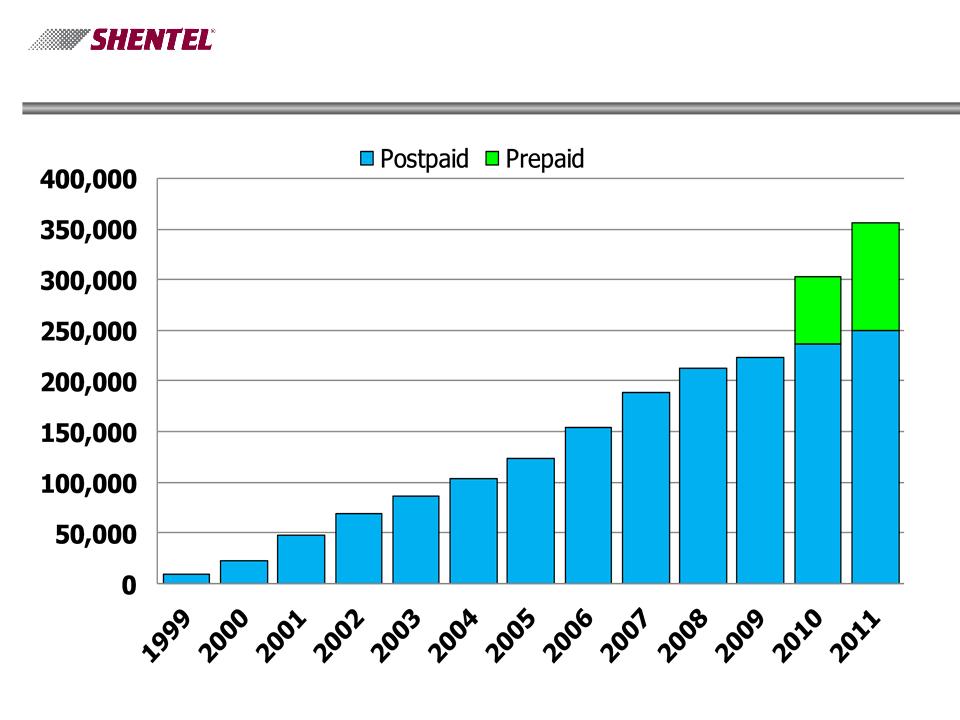

PCS Subscriber Growth History

7

Total Change in Stock Price

Note: Adjusted for stock splits and as of the end of year close.

8

Total Change in Dividends per Share

Note: Adjusted for stock splits.

9

Earle MacKenzie

COO and EVP

10

Key Operational Results - Wireless

PCS Retail Subscribers (000s)

11

Key Operational Results - Wireless

PCS Net Additions

12

How Does Shentel’s Wireless Compare?

2011 Results (in thousands)

Verizon

AT&T

Sprint

Shentel

US

Cellular

Cellular

Alltel

(ATNI)

(ATNI)

T-

Mobile

Mobile

nTelos

Covered

POPs

POPs

296,000

313,000

277,800

46,888

4,500

280,200

5,915

2011 Net

Adds or

(Loss)

Adds or

(Loss)

5,419

7,699

5,111

54..

(186)

(10)

(1,232)

(18)

Total Subs

107,798

103,247

55,021

5,891

582

33,734

415

Penetration

36.4%

33.0%

19.8%

17.3%.

12.6%

12.9%

12.4%

7.0%

Note: All metrics include wholesale subscribers.

13

Key Operational Results - Wireless

PCS Gross Billed Data & Voice

14

Investing in the Future

q Keeps Shentel’s network aligned with Sprint’s

q Allows Shentel to remain competitive with Verizon and

AT&T

AT&T

q Improve customers’ experience

q Provide 4G LTE service in entire coverage area

q Provide better in building and overall coverage

q Gives Shentel potential to leverage investment

q Convert existing iDEN customers to our network

15

Profile of the Sprint Nextel Relationship - Postpaid

q Contract

Ø Initial term to 2024

Ø Two 10 year renewals

Ø Defined exit value

based on DCF

based on DCF

q Net Service Fee of 12%

(14% maximum):

(14% maximum):

Ø Billing

Ø Customer care

Ø Long distance

Ø Travel/Roaming

Ø National channel

handset subsidies

handset subsidies

q Access to Additional

Spectrum

Spectrum

Ø G Block - PCS

Ø 800Mhz - iDEN

q Management Fee of 8%

(Fixed for life of contract)

(Fixed for life of contract)

Ø Spectrum

Ø Brand

Ø National platform

Ø Access to Sprint

vendors on similar

terms

vendors on similar

terms

16

Network Vision - 2012 & 2013

q Plan to upgrade 274 cell sites in 2012 and the remaining

236 in 2013 including:

236 in 2013 including:

Ø Multi-modal base station at each site

Ø Expanded backhaul capacity

Ø LTE in the PCS G-block

Ø Voice service in the 800Mhz block

q Expect to launch LTE as early as Q3 2012

17

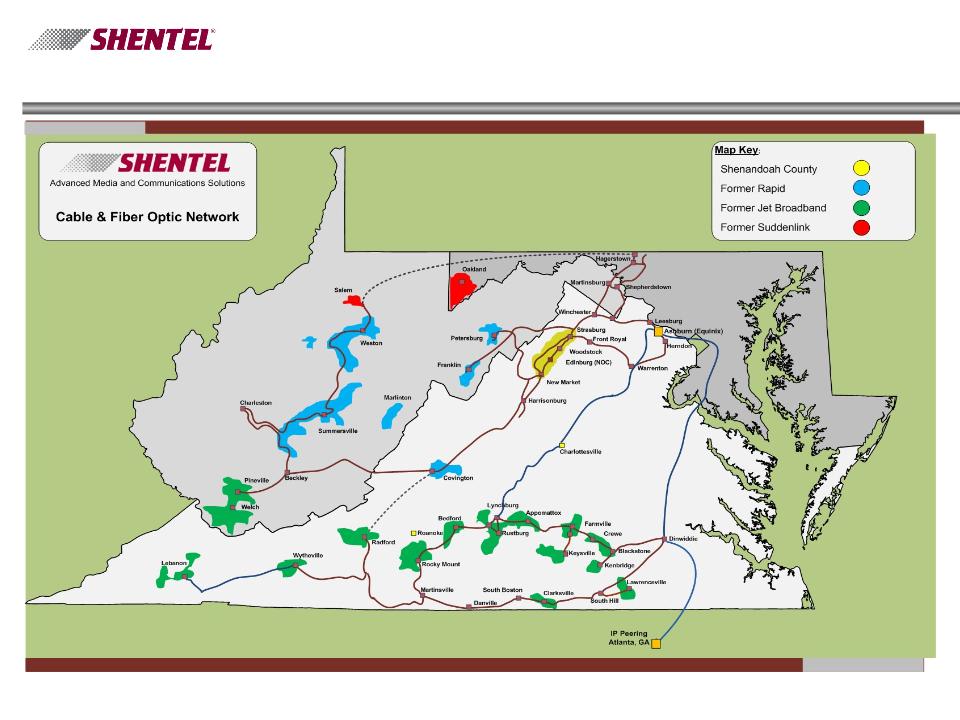

Cable Service Areas

18

Cable Revenue Generating Units (in thousands)

19

How Does Shentel Cable Compare?

* Industry Averages are from SNL Kagan's estimate of U.S. totals.

20

Why Cable has a Competitive Advantage

q Issues with the Local Telephone Company

Ø Limits of DSL - Is it the new dial up?

Ø Requires significant capital investment to offer comparable

Ø Loss of cash flow from shrinking voice service

Ø Long-term pricing advantages as access revenues decrease

Ø Bundling of satellite video with their voice and DSL

q Issues with Satellite - Dish/DirecTV

Ø Bundling of telco DSL and voice with their video

Ø Satellite internet is fast but has limited capacity

Ø No local presence

21

Shentel’s Cable Advantage

q We know Telephone - Our primary competitor

Ø Needs to spend lots of capital to match our service

Ø Unfavorable changes in economics

q Own/control our backbone fiber network

q Own our telephone switch

q Regional focus on small markets

22

Investing in the Future - CapEx Spending (in millions)

23

Adele Skolits

CFO and VP of Finance

24

2011 Financial Highlights

Net Income (in millions)

Net Income from Continuing

Operating (in millions)

Operating (in millions)

25

Revenues (in millions)

Note: Effective 2007, Shentel amended its agreement with Sprint Nextel. The net

effect of this amendment was a reduction in both revenues and expenses.

26

Mix of Revenues by Quarter (in millions)

27

Wireline

Wireless

Cable

28

Expenses by Quarter (in millions)

29

Debt to Operating Cash Flow

30

Cash Dividends Per Share

Annual Shareholder Meeting

April 17, 2012