Attached files

| file | filename |

|---|---|

| EX-31.1 - SECTION 302 CEO CERTIFICATION - HASTINGS ENTERTAINMENT INC | d327759dex311.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - HASTINGS ENTERTAINMENT INC | d327759dex312.htm |

| EX-32.1 - SECTION 906 CEO AND CFO CERTIFICATION - HASTINGS ENTERTAINMENT INC | d327759dex321.htm |

| EXCEL - IDEA: XBRL DOCUMENT - HASTINGS ENTERTAINMENT INC | Financial_Report.xls |

| EX-23.1 - CONSENT OF ERNST & YOUNG LLP - HASTINGS ENTERTAINMENT INC | d327759dex231.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 31, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 000-24381

HASTINGS ENTERTAINMENT, INC.

(Exact name of registrant as specified in its charter)

| Texas | 75-1386375 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 3601 Plains Boulevard, Amarillo, Texas | 79102 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (806) 351-2300

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.01 par value per share | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of July 31, 2011, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $21.7 million based on the closing sale price as reported on the NASDAQ Stock Market, LLC.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

| Class |

Outstanding at March 31, 2012 | |

| Common Stock, $0.01 par value per share | 8,241,747 shares |

DOCUMENTS INCORPORATED BY REFERENCE

| Document |

Parts Into Which Incorporated | |

| Proxy Statement for the Annual Meeting of Shareholders of the registrant to be held May 30, 2012 (Proxy Statement) | Part III |

Table of Contents

HASTINGS ENTERTAINMENT, INC.

Form 10-K Annual Report

For the Fiscal Year Ended January 31, 2012

| PAGE | ||||||

| PART I |

||||||

| Item 1. |

1 | |||||

| Item 1A. |

9 | |||||

| Item 1B. |

13 | |||||

| Item 2. |

14 | |||||

| Item 3. |

15 | |||||

| Item 4. |

15 | |||||

| PART II |

||||||

| Item 5. |

16 | |||||

| Item 6. |

19 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operation |

21 | ||||

| Item 7A. |

33 | |||||

| Item 8. |

34 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

61 | ||||

| Item 9A. |

61 | |||||

| Item 9B. |

62 | |||||

| PART III |

||||||

| Item 10. |

62 | |||||

| Item 11. |

62 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

62 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

62 | ||||

| Item 14. |

62 | |||||

| PART IV |

||||||

| Item 15. |

63 | |||||

| 68 | ||||||

Table of Contents

PART I

Forward-looking Statements

Certain written and oral statements set forth below or made by Hastings with the approval of an authorized executive officer constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “intend,” “anticipate,” “project,” “will” and similar expressions identify forward-looking statements, which generally are not historical in nature. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future including statements relating to the business, expansion, merchandising and marketing strategies of Hastings, industry projections or forecasts, inflation, effect of critical accounting policies including lower of cost or market for inventory adjustments, the returns process, rental asset depreciation, store closing reserves, impairment or disposal of long-lived assets, revenue recognition, and vendor allowances, sufficiency of cash flow from operations and borrowings under our revolving credit facility and statements expressing general optimism about future operating results are forward-looking statements. Such statements are based upon our management’s current estimates, assumptions and expectations, which are based on information available at the time of the disclosure, and are subject to a number of factors and uncertainties, including, but not limited to, consumer appeal of our existing and planned product offerings, and the related impact of competitor pricing and product offerings; overall industry performance and the accuracy of our estimates and judgments regarding trends; our ability to obtain favorable terms from suppliers; the reduction or elimination of the in-store window for rental video; our ability to respond to changing consumer preferences, including with respect to new technologies and alternative methods of content delivery, and to effectively adjust our offerings if and as necessary; the application and impact of future accounting policies or interpretations of existing accounting policies; whether our assumptions turn out to be correct; our inability to attain such estimates and expectations; a downturn in market conditions in any industry relating to the products we inventory, sell or rent; the degree to which we enter into and maintain vendor relationships; the challenging times that the U.S. and global economies are currently experiencing, the effects of which have had and will continue to have an adverse impact on spending by Hastings’ current retail customer base and potential new customers, and the possibility that general economic conditions could deteriorate further; volatility of fuel and utility costs; acts of war or terrorism inside the United States or abroad; unanticipated adverse litigation results or effects; the effect of inclement weather on the ability of consumers to reach our stores and other factors which may be outside of our control; any of which could cause actual results to differ materially from those described herein. We undertake no obligation to affirm, publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

| ITEM 1. | BUSINESS. |

General

Incorporated in 1972, Hastings Entertainment, Inc. (the “Company,” “Hastings,” or “Hastings Entertainment”) is a leading multimedia entertainment retailer. We operate entertainment superstores that buy, sell, trade and rent various home entertainment products, including books, music, software, periodicals, movies on DVD and Blu-Ray, video games, video game consoles and consumer electronics. We also offer consumables and trends products such as apparel, t-shirts, action figures, posters, greeting cards and seasonal merchandise. As of March 31, 2012, we operated 138 superstores principally in medium-sized markets located in 19 states, primarily in the Western and Midwestern United States. We also operate three concept stores, Sun Adventure Sports, located in Amarillo, Texas and Lubbock, Texas and TRADESMART, located in Littleton, Colorado. Sun Adventure Sports sells a wide range of bicycles and related accessories, skateboards, and various other athletic equipment, apparel, and shoes, and offers bicycle repair services and cycling classes. TRADESMART, born from the culture of recycling, features over 400,000 predominantly used and new books, CDs, DVDs, Blu-rays, video games and video game systems, as well as consumer electronics, trends, skateboards and paintball merchandise, and much more available for purchase. TRADESMART also buys back for cash or store credit entertainment products that customers have previously enjoyed.

We also operate a multimedia entertainment e-commerce web site offering a broad selection of books, software, video games, movies on DVD and Blu-Ray, music, trends, and electronics. We fill orders for new and used product placed at the website and also through Amazon Marketplace using our proprietary goShip program, which allows us to ship directly from stores. We have one wholly-owned subsidiary, Hastings Internet, Inc. References herein to fiscal years are to the twelve-month periods that end in January of each following calendar year. For example, the twelve-month period ended January 31, 2012 is referred to as fiscal 2011.

1

Table of Contents

Business Strategy

Our goal is to continue to enhance our position as a leading multimedia entertainment retailer primarily in medium-sized communities by expanding and remodeling existing stores and opening new stores in selected markets, along with adapting our product lines to meet the changing needs of our customers and offering our products through the Internet. Each element of our business strategy is designed to build consumer awareness of the Hastings concept and achieve high levels of customer loyalty and repeat business. We believe the key elements of this strategy are the following:

Superior Multimedia Concept. Our stores present a wide variety of product categories with individual products tailored to local preferences in a dynamic and comfortable atmosphere with exceptional service. Our diverse product categories allow us to more effectively merchandise for our customers’ constant desire for entertainment, regardless of which formats are most popular at any given time. Our stores average approximately 21,000 square feet of sales space, with our new stores generally ranging in size from 20,000 to 30,000 square feet of sales space. Our stores offer customers an extensive product assortment customized for a specific site. Below is a listing of the approximate minimum and maximum title selections for our stores:

| Product Category |

Minimum Title Count |

Maximum Title Count |

||||||

| Books |

6,000 | 46,000 | ||||||

| Rental Video and Video Games |

15,000 | 26,000 | ||||||

| Used Video, Video Games, Music |

8,000 | 32,000 | ||||||

| Music |

7,000 | 14,000 | ||||||

| Video and Video Games |

6,000 | 13,000 | ||||||

| Trends and Consumables |

6,000 | 19,000 | ||||||

| Used Books |

5,000 | 51,000 | ||||||

| Periodicals |

— | 3,000 | ||||||

| Consumer Electronics |

1,000 | 2,000 | ||||||

The following table shows our revenue mix as a percentage of total revenues (excluding gift card breakage), for both used and new products, for the last three fiscal years:

| Fiscal Year | ||||||||||||

| Product Category |

2011 | 2010 | 2009 | |||||||||

| Books |

22 | % | 22 | % | 23 | % | ||||||

| Video |

22 | % | 22 | % | 21 | % | ||||||

| Rental |

14 | % | 16 | % | 16 | % | ||||||

| Music |

12 | % | 12 | % | 13 | % | ||||||

| Video Games |

12 | % | 12 | % | 12 | % | ||||||

| Trends |

8 | % | 7 | % | 6 | % | ||||||

| Consumables and Hardback Café |

5 | % | 4 | % | 4 | % | ||||||

| Electronics |

3 | % | 3 | % | 3 | % | ||||||

| Other |

2 | % | 2 | % | 2 | % | ||||||

All stores carry a core product assortment for each product category. This assortment is supplemented with tailored components to accommodate the particular demographic profile and demand of the local market in which the store operates through the utilization of our proprietary purchasing and inventory management systems. We believe that our multimedia format reduces our reliance on and exposure to any particular entertainment segment and enables us to efficiently add exciting new entertainment categories to our existing product lines.

Medium-Sized Market Focus. We target medium-sized markets with populations generally less than 250,000 where our extensive new and used product selection, low pricing strategy, ability to trade-in, efficient operations and superior customer service enable us to become the market’s destination entertainment store. We believe that the medium-sized markets where we operate the majority of our stores present an opportunity to profitably operate and expand our unique entertainment store format. We base our merchandising strategy on an in-depth understanding of our customers and our individual markets. We strive to optimize each store’s merchandise selection by using our proprietary information systems to analyze the sales history, anticipated demand and demographics of each store’s market. In addition, we utilize flexible layouts that enable each store to present our products according to local interests and to customize the layout in response to new customer preferences and product lines.

2

Table of Contents

Customer-Oriented Format. We design our stores to provide an easy-to-shop, open store atmosphere by offering major product categories in a “store-within-a-store” format. Most of our stores position product with customer affinities together in three departments (e.g., books, music/video games/trends and video/rental) that are designed to allow customers to view the entire store. Currently, 105 stores utilize some form of the three across department format, and the Company plans to expand this model in fiscal 2012 to an additional eleven existing stores. This store configuration produces significant cross-marketing opportunities among the various departments, which we believe results in higher average transaction volumes and impulse purchases. We position product with customer affinities together around a wide racetrack aisle in stores not using the three department format. We also plan to redesign the product flow in a total of fifty-five stores during fiscal 2012 in order to reduce the footprint of Rental Movies and increase the footprint of new and expanded product lines in categories such as Trends and Consumer Electronics. To encourage browsing and the perception of Hastings as a community gathering place, we have continued to invest in our Hardback Coffee Cafés. At March 31, 2012, we had seventy-six Hardback Coffee Cafés serving gourmet coffee and pastries, thirty-eight of which allow the customer to place drive-thru orders. We have plans to open a Hardback Coffee Café in one existing store in fiscal 2012, which will facilitate drive-thru orders. All Hardback Coffee Cafés currently offer Wi-Fi accessibility to customers. Stores without Hardback Coffee Cafés have incorporated other amenities, such as comfortable chairs for reading, soft drinks and snacks, video game auditioning stations, interactive information kiosks, children’s reading areas and in-store promotional events.

Low Pricing. Our pricing strategy is to offer value to our customers by maintaining low prices that are competitive with or lower than the prices charged by other retailers in the market. We determine our prices on a market-by-market basis, depending on the level of competition and other market-specific considerations. We believe that our low pricing structure results in part from (i) our ability to purchase a majority of our products directly from publishers, studios and manufacturers as opposed to purchasing from distributors, (ii) our proprietary information systems, to which we continually make improvements that enable management to make more precise and targeted purchases and pricing decisions for each store and (iii) our consistent focus on maintaining low occupancy and operating costs.

Used and Budget-Priced Products. Since 1992, we have bought or traded for customers’ CDs to sell as used product in order to leverage the value of our CD offering. During 2001, we added DVDs and video games and in 2004 we added books to our used product offerings. Additionally, we purchase used product directly from outside vendors, although the majority of our purchases come straight from customers selling back product. In addition to used products, we offer budget-priced products in all of our major product categories in order to promote value to a broad base of budget conscious consumers. By offering used and budget products, we allow the customer to choose between a new or a less expensive used copy of the same title. During fiscal 2011, 2010, and 2009, we generated approximately 15.7%, 14.5% and 14.2%, respectively, of our total revenues (excluding breakage revenue) from used and budget-priced products. We believe customer loyalty and additional visits are created by customers trading in unwanted entertainment media for cash or credit.

Internet. During July 2009, we introduced our new and improved Internet e-commerce web site, www.goHastings.com, which includes updated branding, expanded product availability, improved searching and browsing capabilities and increased interactivity for users. The site enables customers to access over 800,000 unique new and used entertainment products and unique contemporary gifts and offers customers exceptional merchandise pricing. The new site also offers third-party product reviews, recommendations based on the items a customer has viewed, the option to set up a wish-list that a customer can share with family and friends for better gift giving and the ability to check gift card balances. Customers can watch trailers for movies and video games, sample music titles, digitally download music selections and even reserve a copy of an upcoming release online to be picked up in the store or shipped to them upon release. The new site integrates more seamlessly with stores, allowing customers to look up specific store information, store hours, unique store events, and to check online to see if an item is in stock at their local store. The site also features an Investor Relations section with links to press releases and filings with the Securities and Exchange Commission (the “SEC”), including officer certifications of financial information listed as exhibits to such filings and our board committee charters, code of conduct and biographies for board members and executive officers.

3

Table of Contents

During 2011, we launched a new homepage and mobile version for www.goHastings.com, and added electronic books (“eBooks”) to our product selection. Features of the new homepage included updated headers and footers which improve overall usability, added department menus for eBooks and MP3s, and a more prominent placement of the search box, email sign-up link, store locater and link to view the weekly newspaper ads. These updates not only improve the customer experience, but they also provide us with better promotional opportunities and the customers with a better overall picture of what Hastings has to offer. The mobile version of our website makes it easy for customers to quickly find an item or browse major categories and promotional offers for all departments from their mobile device. The mobile site includes a prominent search box, store locator and overall department menu, along with an accordion style menu outlining each department’s best categories and promotional offers.

To accompany the addition of eBooks to our product lineup, we also introduced our free Readmor application, which allows customers access to hundreds of thousands of best-selling books in a digital format. Designed to meet the changing demands of customers for digital entertainment, the Readmor application can be downloaded to customers’ favorite Apple or Android devices. It also comes preloaded on each Nextbook Premium 7 we sell. Introduced in November 2011, the Nextbook Premium 7 tablet is a total entertainment Wi-Fi Android OS system that is Flash 10.1 ready and equipped with a 7” color capacitive touch screen 1 GHz processor, G-sensor, SD memory card slot, and integrated speakers. The Nextbook Premium 7 tablet enables our customers to read electronic books, surf the web, view email, listen to MP3s and watch movies, all on one simple device. Additionally, we are the first chain to allow customers to trade in their physical books at our stores for credit they can use to purchase the Nextbook Premium 7 in our stores or to purchase digital content at www.goHastings.com.

We prominently display the website in our weekly advertisements and in-store to drive direct visits to www.goHastings.com. In order to widen our reach to customers that may not live near a Hastings store, we use various channels to market our website. Affiliate marketing, which includes using partner websites to advertise our promotions, is a strong channel. When a customer clicks on our link from an affiliate website they are sent to www.goHastings.com where they can purchase our product. For fiscal 2011, we had approximately 759,000 customers click on an affiliate link and 6.4% of those visits resulted in a sale. Total sales through affiliate marketing were approximately $1.3 million for fiscal 2011. Through another channel, we send semiweekly emails notifying customers of promotions and special offers. We have also begun user segmentation by sending emails to customers about the departments they are interested in. We also take part in Social Media, a growing marketing channel. Social Media is the new “word of mouth” marketing that influences the buying decisions of customers. Facebook and Twitter are two primary Social Media channels that we utilize. Our Facebook page, which currently has over 200,000 fans, allows us to let fans know about current events at their local stores and current sales or promotions. It also gives us a forum to communicate with fans who post questions or comments about their Hastings experiences. Through Twitter, we “tweet” our latest sales, promotions, and events. Other marketing channels we employ include comparison shopping engines, display advertisement (on various online websites), pay-per-click, referrals, and search engine optimization. Through each marketing channel, we work to convert “clicks” into sales and reach customers nationwide.

Expansion Strategy

We do not plan to open, relocate or remodel any stores during fiscal 2012. We plan to close three stores during fiscal 2012, two of which have been closed before the filing of this Annual Report on Form 10-K. Beyond fiscal 2012, we have identified potential locations for future stores in under-served, medium-sized markets that meet our new-market criteria. Management intends to continue its practice of reviewing the profitability trends and prospects of existing stores and closing or relocating under-performing stores. We believe that with our current information systems and distribution capabilities, our infrastructure can support our anticipated rate of expansion and growth for at least the next several years.

Merchandising Strategy

Our combination of books, periodicals, movies, video games, trends, music, electronics and consumables is unique in the marketplace. These core categories, supplemented by our video and video game rental business and the ability of our customers to buy, sell, and trade used products, create a store environment that appeals to a broad customer base, and positions our stores as destination entertainment stores in our targeted medium-sized markets.

The specific merchandise mix within our core product categories is continually refined to reflect changing trends and new technologies. Product assortments are tailored to match the local demographic profiles and customers’ needs. This store level profiling is accomplished through our proprietary purchasing, inventory management, selection, and database management systems.

4

Table of Contents

Information Technologies

Our information system is based on technology that allows for communication and exchange of current information among all locations, corporate and retail, via a wide-area network. The primary components of the information system are as follows:

New Release Allocation. Our buyers use our proprietary new release allocation system to purchase new release products for our stores and have the ability within the system to utilize multiple methods of forecasting demand. By using store-specific sales history, factoring in specific market traits, applying sales curves for similar titles or groups of products and minimizing subjectivity and human emotion in a transaction, the system customizes purchases for each individual store to satisfy customer demand. The process provides the flexibility to allow us to anticipate customer needs, including tracking missed sales and factoring in regional influences. We believe that our new release allocation system enables us to increase revenues by having the optimum levels and selection of products available in each store at the appropriate time to satisfy customers’ entertainment needs.

Rental Asset Purchasing System. Our proprietary rental asset purchasing system uses store-specific performance on individual rental titles to anticipate customer demand for new release rental titles. The system analyzes the performance of a similar title and factors in the effect of such influences as seasonal trends, box office draw and prominence of the movie’s cast to customize an optimal inventory level for each individual store. The system also allows for the customized purchasing of other catalog rental assets on an individual store basis, additional copy depth requirements under revenue-sharing agreements and timely sell-off of previously viewed rentals. We believe that our rental asset purchasing system allows us to efficiently plan and stock each store’s rental asset inventory, thereby improving performance and reducing exposure from excess inventory.

Store Replenishment. Store replenishment covers four main areas for controlling a store’s inventory.

Selection Management. Selection Management constantly analyzes store-specific sales, traits and seasonal trends to determine title selection and inventory levels for each individual store. By forecasting annual sales of products, the system enables us to promptly identify overstocked or under-stocked items, prompt required store actions and maintain optimal inventory levels. The system tailors each individual store’s inventory to the market. There are over 700,000 stock keeping units in our inventory.

Model Stock Calculation/Ordering. Model stock calculation uses store-specific sales, seasonal trends and sophisticated-sales curve fitting to forecast orders. It also accounts for lead times from a vendor or our distribution center and tracks historical missed sales to adjust orders to adequately fulfill sales potential. Orders are currently calculated on a weekly basis and transmitted by all stores to the corporate office to establish a source vendor for the product.

Inventory Management. Inventory management systems interface with other store systems and accommodate electronic receiving and returns to maintain perpetual inventory information. Cycle counting procedures allow us to perform all physical inventory functions, including the counting of a portion of each store’s inventory on a weekly basis, resulting in the equivalent of full wall-to-wall inventory counts over the course of the year. The system provides reports to assist in researching any variances. We utilize Advanced Ship Notifications from our vendors to efficiently and accurately receive inventory.

Used Inventory Management. Our proprietary used inventory management system allows stores to buy back selected products from our customers as well as from wholesale vendors. It utilizes many parameters to determine the product’s demand, selling price and cash or in-store credit amounts. The cash offer or in-store credit amount is determined at the Store Support Center, and the system’s many parameters tell an associate whether or not to buy back specific titles. The system checks the titles and units needed at the local store as well as other stores to decide if a title should be repurchased. The system also shifts inventory from overstocked stores to understocked stores via our returns center.

Store Systems. Each store has a dedicated server within the store for processing information, which is connected through a wide area network. This connectivity provides consolidation of individual transactions and allows store management and Store Support associates easy access to the information needed to make informed decisions. Transactions at the store are summarized and used to assist in staff scheduling, loss prevention and inventory control. Our proprietary Point Of Sale system allows the scanning of merchandise and rental products as well as customer membership cards, allowing for maximum customer efficiency at checkout. Our proprietary data transfer system copies data between the stores and the Store Support Center, including, among other things, sales and inventory transactions.

5

Table of Contents

Warehouse Management. Our warehouse management system provides for increased product picking and shipping efficiencies, faster product introduction and movement from dock to store shipment. The increased level of detail reporting in our system allows us to refine product movement within the warehouse, effectively manage the cost per unit of transactions, and increase on-hand accuracy. It has simplified data sharing across the enterprise, and includes event management, analysis and reporting capabilities.

Data Center. Our data facility includes redundant power, climate control and communications as well as a backup generator. The physical building has been reinforced and is anticipated to withstand most natural disasters.

goShip. We fill Internet orders for new and used product placed at www.goHastings.com, Amazon Marketplace and eBay through our proprietary goShip program, which allows us to ship product to customers directly from store inventories. The goShip system allows us to list the selected stores’ inventory on www.goHastings.com, Amazon Marketplace and eBay. When orders are placed, they are sourced to the stores and generally shipped to the customer within 72 hours. This has allowed us to leverage our store inventory to a wider group of customers, which increases store revenue and enhances the performance of the product inventory. As of March 31, 2012, we had 130 stores participating in goShip.

Distribution and Vendors

Our distribution center is located in a 198,000 square foot facility adjacent to our corporate headquarters in Amarillo, Texas. This central location and the local labor pool enable us to realize relatively low transportation and labor costs. The distribution center is utilized primarily for receiving, storing and distributing approximately 39,000 products offered in substantially every store. The primary purpose of the distribution center is to warehouse large deal purchases, including forward buys, closeouts and other bulk purchases. In addition, the distribution facility is used to carry high velocity products purchased from vendors that have long lead times to ensure adequate in-stock positions. The distribution facility is also used to receive, process and ship items that are to be returned to manufacturers and distributors, and to rebalance merchandise inventories among our stores. This facility currently provides inventory to all Hastings stores and is designed to support our anticipated rate of expansion and growth for the next two years. We ship products weekly to each Hastings store, facilitating quick and responsive inventory replenishment. We send additional shipments to various stores one to two times per week for new release or hot selling products that need replenishment in between weekly shipments. Approximately 35% of our total product, based on store receipts, is distributed through the distribution center. Approximately 65% of our total product is shipped directly from vendors to the stores.

Our information systems and corporate infrastructure facilitate our ability to purchase products directly from manufacturers, which contributes to our low-pricing structure. In fiscal 2011, we purchased the majority of our products directly from manufacturers, rather than through distributors. Our top three vendors accounted for approximately 19% of total products purchased during fiscal 2011. While selections from a particular artist or author generally are produced by a single studio or publisher, we strive to maintain vendor relationships that can provide alternate sources of supply. Products we purchase are generally returnable to the supplying vendor. Typically, vendors charge a fee for the return of product. In addition to this fee, we incur freight and handling costs to return product to vendors.

Store Operations

Most of our stores employ one store manager, and approximately half of our stores employ one manager in training. Store managers and managers in training are responsible for the execution of all operational, merchandising, human resources and marketing strategies for the store in which they work. Stores also generally have department managers, who are individually responsible for their respective departments: books, lifestyles, video, customer service, café, and inventory control. Hastings stores are generally open Sunday through Thursday from 9:00 a.m. to 10:00 p.m. and Friday and Saturday from 9:00 a.m. to 11:00 p.m. The only day our stores are closed is Christmas.

6

Table of Contents

Competition

Hastings competes, within our trading areas, with all specialty music, book, video, and video game retailers and with mass retailers. Additionally, Hastings competes with video and video game rental stores and both Internet retail and rental businesses operating in our core product categories.

Seasonality

Our business is highly seasonal, with significantly higher revenues and operating income realized during the fourth quarter, which includes the holiday selling season.

Trademarks and Servicemarks

We believe our trademarks and service marks, including the marks HASTINGS, HASTINGS BOOK MUSIC VIDEOS, HASTINGS YOUR ENTERTAINMENT SUPERSTORE, SUN ADVENTURE SPORTS, SUN ADVENTURE SPORTS (Design), GOHASTINGS, GOHASTINGS.COM, GOHASTINGS.COM (Design), HARD BACK COFFEE CAFÉ, HARDBACK CAFÉ, HARDBACK CAFÉ (Design), HASTINGS DISCOVER YOUR ENTERTAINMENT (Design), TRADESMART, TRADESMART (Design), READMOR, and READMOR (DESIGN) have significant value and are important to our marketing efforts. We have registered each of the above as service marks with the United States Patent and Trademark Office. We are currently claiming common law rights in the marks BUY SELL TRADE RENT, HASTINGS HARD BACK CAFÉ, HASTINGS HARD BACK COFFEE CAFÉ, and HASTINGS YOUR ENTERTAINMENT SUPERSTORE HARD BACK CAFÉ. We maintain a policy of pursuing registration of our principal marks and vigorously opposing any infringement of our marks.

Associates

We refer to our employees as associates because of the critical role they play in the success of each Hastings store and the Company as a whole. As of March 31, 2012, we employed 5,153 associates, of which 1,740 are full-time and 3,413 are part-time associates. Of this number, 4,710 were employed at retail stores, 190 were employed at our distribution center and 253 were employed at our corporate offices. None of our associates are represented by a labor union or subject to a collective bargaining agreement. We believe that our relations with our associates are good.

Executive Officers of the Company

Below is certain information about the executive officers of Hastings.

| Name |

Age |

Position | ||

| John H. Marmaduke | 64 | Chairman of the Board, President and Chief Executive Officer | ||

| Alan Van Ongevalle | 44 | Executive Vice President of Merchandising | ||

| Dan Crow | 65 | Vice President of Finance and Chief Financial Officer | ||

| Scott Voth | 50 | Vice President of Stores | ||

| Kevin Ball | 55 | Vice President of Marketing | ||

| Phil McConnell | 49 | Vice President, Divisional Merchandise Manager | ||

| John Hintz | 47 | Vice President of Information Technology | ||

| Victor Fuentes | 45 | Vice President, Divisional Merchandise Manager |

All executive officers are chosen by the Board of Directors and serve at the Board’s discretion. Information concerning the business experience of our executive officers is as follows:

John H. Marmaduke, age 64, has served as President and Chief Executive Officer of the Company since July 1976 and as Chairman of the Board since October 1993. Mr. Marmaduke served as President of the Company’s former parent company, Western Merchandisers, Inc. (“Western”), from 1982 through June 1994, including the years 1991 through 1994 when Western was a division of Wal-Mart Stores, Inc. Mr. Marmaduke also serves on the board of directors of the Entertainment Merchants Association. Mr. Marmaduke has been active in the entertainment retailing industry with the Company and its predecessor company for over 40 years.

7

Table of Contents

Alan Van Ongevalle, age 44, has served as Executive Vice President of Merchandising of the Company since August 2009. From February 2007 to August 2009, Mr. Van Ongevalle served as Senior Vice President of Merchandising. From February 2003 until February 2007, Mr. Van Ongevalle served as Vice President of Information Technology and Distribution. From August 2002 to February 2003, Mr. Van Ongevalle served as Vice President of Marketing and Distribution. From May 2000 to August 2002, Mr. Van Ongevalle served as Vice President of Marketing. From August 1999 to May 2000, Mr. Van Ongevalle served as the Senior Director of Marketing and from September 1998 to August 1999 as Director of Advertising. Mr. Van Ongevalle joined Hastings in November 1992 and held various store operation management positions including Store Manager and Director of New Stores for the Southern Kansas area through September 1998.

Dan Crow, age 65, has served as Vice President of Finance and Chief Financial Officer of the Company since October 2000. From July 2000 to October 2000, Mr. Crow served as Vice President of Finance. Mr. Crow is a member of the American Institute of Certified Public Accountants and Financial Executives International.

Scott Voth, age 50, has served as Vice President of Store Operations since January 2011. Mr. Voth has served as Senior Director of Field Operations since November 2010. Mr. Voth joined the Company in May 2009 and previously served as a Regional Manager and Director of Field Operations. Prior to joining the Company, Mr. Voth worked as a Market Manager for Wal-Mart Stores, Inc. (Sam’s Club Division), an international retailer not affiliated with the Company, from 1998 through 2008. He holds over 25 years of retailing experience.

Kevin Ball, age 55, has served as Vice President of Marketing of the Company since May 2004. From 2001 to 2004, Mr. Ball served as Vice President of Marketing at Organized Living, a specialty retailer of home organization products, headquartered in Kansas City. From 2000 to 2001, Mr. Ball held the position of Vice President of Marketing at Crown Books in Washington, D.C., and from 1995 to 2000 was the Director of Marketing at Trans World Entertainment in Albany, N.Y.

Phil McConnell, age 49, has served as Vice President and Divisional Merchandise Manager, responsible for Music, Trends, Consumables, Consumer Electronics, Distribution and Inventory Management of the Company, since June 2006. Prior to that, Mr. McConnell most recently served for nine years as Vice President of Merchandising for VMI Services for Alliance Entertainment Corporation (AEC), the largest wholesale distributor of prerecorded music and movies in the nation. Previously, Mr. McConnell served in senior merchandising positions with Best Buy and Circuit City.

John Hintz, age 47, has served as Vice President of Information Technology of the Company since February 2007. Mr. Hintz previously served as Senior Director of Application Development since August 2006. From February 2006 to August 2006, he served as the Director of Application Development. From August 2003 to August 2006, he served as Director of Retail Technologies. He was promoted to Director of Store Systems in August of 2001. Mr. Hintz joined Hastings in 1987 as a store associate.

Victor Fuentes, age 45, has served as Vice President and Divisional Merchandise Manager, responsible for Books, Movies, Video Games, and all Used Product Initiatives, since October 2007. Mr. Fuentes has served as Divisional Merchandise Manager of Movies, Video Games, and Consumer Electronics of the Company, since June 2006. From June 2000 to June 2006, he served as Senior Product Director of Movies and Video Games. Mr. Fuentes joined Hastings in 1987 as a store associate. In September 1989, he was promoted to the corporate office and subsequently held various positions in the Company prior to serving as Senior Buyer from September 1994 to May 2000.

Available Information

We file annual, quarterly and current reports, proxy statements and other information with the SEC. The public may read and copy any materials we file with the SEC at the SEC’s public Reference Room at 100 F Street, N.E., Washington, D.C. 20549 on official business days during the hours of 10:00 a.m. to 3:00 p.m. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

The address of our Internet web site is www.gohastings.com and through the links on the Investor Relations portion of our web site, we make available free of charge our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other items filed with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such material is made available through our web site as soon as reasonably practicable after we electronically file with or furnish the material to the SEC. In addition, links to press releases, the committee charters of the Audit and Compensation Committees of our board and our code of ethics for financial and other executive officers are posted in the Investor Relations section of our web site.

8

Table of Contents

| ITEM 1A. | RISK FACTORS. |

CAUTIONARY STATEMENTS

An investment in the Company involves significant risks and uncertainties. The cautionary statements and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations. If any of the following risks occur, our business, financial condition, operating results and cash flows could be materially adversely affected.

Our business is highly seasonal.

As is the case with many retailers, a significant portion of our revenues, and an even greater portion of our operating income, is generated in the fourth fiscal quarter, which includes the holiday selling season. As a result, a substantial portion of our annual earnings has been, and will continue to be, dependent on the results of this quarter. Less than satisfactory net sales for such period could have a material adverse effect on the Company’s financial condition or results of operations for the year and may not be sufficient to cover any losses that may have been incurred in the first three quarters of the year. We experience reduced rental activity in the spring because customers spend more time outdoors. Major world or sporting events, such as the Super Bowl, the Olympic Games or the World Series, also have a temporary adverse effect on revenues. Future operating results may be affected by many factors, including variations in the number and timing of store openings, the number and popularity of new book, music video and video game titles, as well as the popularity of electronics and trends merchandise, the cost of new release or “best renter” titles, changes in comparable-store revenues, competition, marketing programs, increases in the minimum wage, weather, special or unusual events and other factors that may affect our operations.

Our business is dependent on consumer spending patterns.

Revenues generated from the sale and rental of books, music, videos and other products we carry have historically been dependent upon discretionary consumer spending, which may be affected by general economic conditions, energy prices, interest rates, consumer confidence and other factors beyond our control. During fiscal 2008, the economy entered a recession that affected and continues to affect consumer spending. A continued deterioration of U.S. markets could have a material adverse effect on our financial condition and results of operation. A decline in consumer spending on the products we offer could have a material adverse effect on our financial condition and results of operations and our ability to fund our expansion strategy.

Intense competition from traditional retail sources and the Internet may adversely affect our business.

We operate in a highly competitive industry. For all of our product categories, we compete directly with national store operators, regional chains, specialty retailers and independent single store operators, discount stores, warehouse and mail order clubs and mass merchandisers. In addition, the Internet is a significant channel for retailing for most of the product categories that we offer. In particular, the retailing of books, music and video over the Internet is highly competitive, and increased competition may come as it becomes easier for smaller, individual sellers to list products for sale on the Internet. In addition, we face competition from companies engaged in the business of selling books, music and movies and the renting of movies via electronic means, including the downloading of music content, in-home video delivery and the delivery of books to electronic book readers. An increase in competition in the physical or electronic markets in which we operate has had and may continue to have a material adverse effect on our operations.

Our business could be negatively impacted if the in-store video retailer distribution window is reduced or eliminated.

A competitive advantage that in-store video retailers currently enjoy over most other movie distribution channels, except theatrical release, is the early timing of the in-store video retailer “distribution window.” After the initial theatrical release of a movie, studios generally make their movies available to in-store video retailers (for rental and retail, including mass merchant retailers) for specified periods of time. This distribution window is typically exclusive against most other forms of non-theatrical movie distribution, such as premium television, basic cable and network and syndicated television. The length of this exclusive distribution window for in-store video retailers varies, but has traditionally ranged from 45 to 60 days for domestic video stores. According to industry statistics, more movies are now being released to pay-per-view, video-on-demand or digital downloads at the shorter end of the in-store video retailer distribution window rather than at the longer end. In addition, many of the major movie studios have entered into various ventures to provide video-on-demand or similar services of their own. Recently, certain studios have also instituted a distribution window by which titles are available on pay-per-view and for sale only for an initial twenty-eight days before being available to an in-store video retailer. Increased studio participation in or support of these types of services could impact their decisions with respect to the timing and exclusivity of the in-store video retailer distribution window.

9

Table of Contents

Our business could be negatively affected if (i) in-store video retailer distribution windows were no longer the first distribution channel following the theatrical release, (ii) the length of the in-store video retailer distribution windows were shortened or (iii) the in-store video retailer distribution windows were no longer as exclusive as they are now because newly released movies would be made available earlier on these other forms of non-theatrical movie distribution. As a result, consumers would no longer need to wait until after the in-store video retailer distribution window to view a newly released movie on these other distribution channels.

We believe that most studios have a significant interest in maintaining a viable in-store video retail industry. However, the order, length and exclusivity of each window for each distribution channel is determined solely by the studio releasing the movie, and we cannot predict future decisions by the studios or the impact, if any, of those decisions. In addition, any consolidation or vertical integration of media companies to include both content providers and digital distributors could pose a risk to the continuation of the distribution window.

Our business is subject to changes in current rental video studio pricing policies.

Recent changes to studio pricing for movies released to in-store video retailers has impacted our video business. Historically, studio pricing was based on whether or not a studio desired to promote a movie for both rental and sale to the consumer, or primarily for rental, from the beginning of the in-store video distribution window. In order to promote a movie title for rental, the title would be released to in-store video retailers at a price that was too high to allow for an affordable sales price by the retailer to the consumer at the beginning of the retail in-store video distribution window. As rental demand subsided, the studio would reduce pricing in order to then allow for reasonably priced sales to consumers. Currently, substantially all DVD titles are released at a price to the in-store video retailer that is low enough to allow for an affordable sales price by the retailer to the consumer from the beginning of the retail in-store video distribution window. This low sell-through pricing policy has led to increasing competition from other retailers, including mass merchants and online retailers, who are able to purchase DVDs for sale to consumers at the same time as traditional in-store video retailers, like Hastings, which purchase DVDs for rental. In addition, some retailers sell movies at lower prices in order to increase overall traffic to their stores or businesses, and mass merchants may be more willing to sell at lower prices, and in some instances, below wholesale. These factors have increased consumer interest in purchasing DVDs, which has reduced the significance of the DVD rental window.

We believe that the increased consumer purchases are due in part to consumer interest in building DVD libraries of classic movies and personal favorites and that the studios will remain dependent on the traditional in-store video retailer to generate revenues for the studios from titles that are not classics or current box office hits. Approximately 60% of most studios’ revenues are derived from their home entertainment divisions. We therefore believe the importance of the video rental industry to the studios will continue to be a factor in studio pricing decisions. However, we cannot control or predict studio pricing policies with certainty, and we cannot assure that consumers will not increasingly desire to purchase rather than rent movies as a result of further decreases in studio sell-through pricing and/or sustained or further depressed pricing by competitors. Additionally, studios entering into exclusive alliances with our competitors could negatively affect our ability to purchase rental titles at competitive prices. Personal DVD libraries could also cause consumers to rent or purchase fewer movies in the future. Our profitability could therefore be negatively affected if, in light of any such consumer behavior, we were unable to (i) grow our rental business, (ii) replace gross profits from generally higher-margin rentals with gross profits from increased sales of generally lower-margin sell-through product or (iii) otherwise positively affect gross profits, such as through price increases or cost reductions. Our ability to achieve one or more of these objectives is subject to risks, including the risk that we may not be able to compete effectively with other DVD retailers, some of whom may have competitive advantages such as the pricing flexibility described above or favorable consumer perceptions regarding value.

Regardless of the wholesale pricing environment, the extent of our profitability is dependent on our ability to enter into and maintain arrangements with the studios that effectively balance copy depth and cost considerations. Each type of arrangement provides different advantages and challenges for us. The ability to negotiate preferred terms under revenue sharing agreements for the procurement of DVD or video game titles is crucial to our operations. Our profitability could be negatively affected if studios were to make other changes in their wholesale pricing policies and revenue-sharing agreements.

10

Table of Contents

Our business has been and will continue to be negatively impacted by new technology that provides alternate methods of video, music and book delivery.

Advances in technologies such as video-on-demand, rental video kiosks and electronic book readers, or certain changes in consumer behavior driven by these or other technologies and methods of delivery have had and could continue to have a negative effect on our business. In particular, our business could be impacted if (i) newly released movies were to be made widely available by the studios to these technologies at the same time or before they are made available to in-store video retailers for rental and (ii) these technologies were to be more widely accepted by consumers. In addition, advances in direct broadcast satellite and cable technologies may adversely affect public demand for video store rentals. If direct broadcast satellite and digital cable were to become more widely available and accepted, this could cause a smaller number of movies to be rented if viewers were to favor the expanded number of conventional channels and expanded content, including movies, specialty programming and sporting events, offered through these services. If this were to occur, it could have a negative effect on our video rental business. Direct broadcast satellite providers transmit numerous channels of programs by satellite transmission into subscribers’ homes. Also, cable providers are taking advantage of digital technology to transmit many additional channels of television programs over cable lines to subscribers’ homes.

The continuing popularity of technological advances that allow consumers to download music directly from the Internet could continue to have a negative impact on our music business. Additionally, the emergence of rental video kiosks could continue to have an adverse affect on our movie rental business. Electronic book readers that allow consumers to download books directly to a portable device have had, and could continue to have, a negative impact on our book business.

We rely on certain key personnel.

Management believes that the Company’s continued success will depend, to a significant extent, upon the efforts and abilities of Mr. John H. Marmaduke, Chairman, President and Chief Executive Officer. The loss of Mr. Marmaduke’s services could have a material adverse effect on our operations. We maintain a “key man” term life insurance policy on Mr. Marmaduke for $10 million. In addition, our success depends, in part, on our ability to retain key management and attract other personnel to satisfy our current and future needs. The inability to retain key management personnel or attract additional qualified personnel could have a material adverse effect on our operations.

Our growth is dependent on our ability to execute our expansion strategy.

Our growth strategy is dependent principally on our ability to open new stores and remodel, expand or relocate certain of our existing stores and operate them profitably. In general, the rate of our expansion depends, among other things, on general economic and business conditions affecting consumer confidence and spending, the availability of qualified management personnel and our ability to manage the operational aspects of our growth. It also depends upon the availability of adequate capital, which in turn depends in a large part upon the cash flow generated from operations.

Our future results will depend, among other things, on the success in implementing our expansion strategy. If stores are opened more slowly than expected, sales at new stores reach targeted levels more slowly than expected (or fail to reach targeted levels) or related overhead costs increase in excess of expected levels, our ability to successfully implement our expansion strategy would be adversely affected.

Changes to information technology systems may disrupt the supply chain.

We use a number of computerized information systems to manage our new release allocations, selection management, merchandise planning, pricing, markdowns and inventory replenishment at each store and at our distribution facility. These major systems collectively support our supply chain. Through continuing processes of review and evaluation, the Company is implementing modifications, enhancements and upgrades to its information technology systems. In some cases these changes include replacing legacy systems with successor systems. There are inherent risks associated with modifying or replacing these core systems, including timely, accurate movement and processing of data, which could possibly result in supply chain disruptions. We believe that the appropriate processes, procedures and controls are in place through our software development life cycle, design, testing and staging implementation, and as a result of obtaining appropriate commercial contracts and application documentation with third-party vendors supplying such replacement technologies. There are no assurances that we will successfully modify, integrate or launch these new systems or changes as planned or that they will occur without supply chain or other disruptions or without impacts on inventory valuation. These disruptions or impacts, if not anticipated and appropriately mitigated, could have a negative effect on our financial condition and results of operations.

11

Table of Contents

Our business is dependent upon renewing or entering into new leases on favorable terms.

All of the Company’s stores are located in leased premises. If the cost of leasing existing stores increases, the Company cannot assure that it will be able to maintain its existing store locations as leases expire. In addition, the Company may not be able to enter into new leases on favorable terms or at all, or it may not be able to locate suitable alternative sites or additional sites for new store expansion in a timely manner. The Company’s revenues and earnings may decline if the Company fails to maintain existing store locations, enter into new leases, locate alternative sites or find additional sites for new expansion.

We cannot predict the impact of the current volatility in the financial markets and the resulting costs or constraints in obtaining financing on our business and financial results.

Historically, our principal sources of cash are our operating activities and borrowings under our revolving credit facility. The crisis in the financial markets beginning in fiscal 2008 has had a significant adverse impact on a number of financial institutions. The inability of the financial institution providing our credit facility to fund its commitment could adversely affect our ability to generate cash. We cannot predict with any certainty the impact of any continued deterioration in the financial markets or any resulting material impact on our lender’s liquidity, future financing costs or results of operations.

Global economic conditions, including recessions or slow economic growth, and continuing credit market disruptions in the United States, could continue to adversely affect our business and financial results.

The continued uncertainty in the economy could have a significant negative impact on consumer spending, particularly discretionary spending for the products we sell. Consumer confidence, recessionary and inflationary trends, consumer credit availability, interest rates, consumers’ disposable income and spending levels, fuel prices, unemployment rates and income tax rates may directly affect our financial results. Specifically, these economic conditions could negatively impact:

| • | consumer demand for our products, including shifting consumer purchasing patterns to lower-cost options, |

| • | the mix of our products’ sales, and |

| • | the ability of certain suppliers to fill our orders for various products or other goods and services. |

Ongoing volatility in global commodity, currency and financial markets resulted in uncertainty in the business environment beginning in 2009, which is expected to continue into 2012. We rely on access to the credit markets, specifically our revolving credit facility, to provide supplemental funding for our operations. Although we have not experienced a disruption in our ability to borrow under this facility, it is possible that we may have difficulty accessing the credit markets in the future, which may disrupt our businesses or further increase our cost of funding its operations.

We may see increased costs or lower revenue arising from health care reform.

In March 2010, Congress passed, and the President signed, the Patient Protection and Affordable Care Act. This act may have a significant impact on health care providers, insurers and others associated with the health care industry. We are currently evaluating the impact of this comprehensive act on our business. In March 2012, the U.S. Supreme Court heard oral arguments on the constitutionality of this legislation, and the Court may strike down all or portions of the statute, making its application even more uncertain. Federal and state governments may propose other health care initiatives and revisions to the health care and health insurance systems. It is uncertain what legislative programs, if any will be adopted in the future, or what action the Supreme Court, Congress or state legislatures may take regarding health care reform proposals or legislation.

12

Table of Contents

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. |

None.

13

Table of Contents

| ITEM 2. | PROPERTIES. |

As of March 31, 2012, we operated 138 superstores in 19 states located as indicated in the following table:

| Name of State |

Number of Stores | |||

| Alabama |

1 | |||

| Arkansas |

11 | |||

| Arizona |

7 | |||

| Colorado |

3 | |||

| Idaho |

10 | |||

| Indiana |

1 | |||

| Kansas |

7 | |||

| Kentucky |

1 | |||

| Louisiana |

1 | |||

| Missouri |

6 | |||

| Montana |

6 | |||

| Nebraska |

4 | |||

| New Mexico |

14 | |||

| Oklahoma |

12 | |||

| Tennessee |

6 | |||

| Texas |

36 | |||

| Utah |

2 | |||

| Washington |

7 | |||

| Wyoming |

3 | |||

|

|

|

|||

| Total |

138 | |||

Additionally, we operated two Sun Adventure Sports stores, located in Amarillo, Texas and Lubbock, Texas, and one TRADESMART store, located in Littleton, Colorado.

Currently, we lease sites for all our stores. These sites typically are located in pre-existing, stand-alone buildings or strip shopping centers. Our primary market areas are medium-sized communities with populations generally less than 250,000. We have developed a systematic approach using our site selection criteria to evaluate and identify potential sites for new stores. Key demographic criteria for stores include community population, community and regional retail sales, personal and household disposable income levels, education levels, median age and proximity of colleges or universities. Other site selection factors include current competition in the community, visibility, available parking, ease of access and anchor tenants.

We actively manage our existing stores and from time to time close under-performing stores. We closed six stores during fiscal 2011 and three stores during fiscal 2010. Additionally, we plan to close three stores during fiscal 2012, when the leases for these stores expire.

The terms of our store leases vary considerably. We strive to maintain maximum location flexibility by entering into leases with long initial terms and multiple short-term extension options. We have been able to enter into leases with these terms in part because we generally bear a substantial portion of the cost of preparing the space for a store.

The following table sets forth, as of March 31, 2012, the number of superstores that have current lease terms that will expire during each of the following fiscal years and the associated number of stores for which we have options to extend the lease term:

| Number of Stores | Options | |||||||

| Fiscal Year 2012 |

13 | 12 | ||||||

| Fiscal Year 2013 |

20 | 12 | ||||||

| Fiscal Year 2014 |

26 | 21 | ||||||

| Fiscal Year 2015 |

21 | 16 | ||||||

| Fiscal Year 2016 |

11 | 8 | ||||||

| Thereafter |

47 | 46 | ||||||

|

|

|

|

|

|||||

| Total |

138 | 115 | ||||||

14

Table of Contents

In addition to the table set forth above, the Sun Adventure Sports located in Amarillo, Texas has a lease that will expire during fiscal 2020, with options available to extend the lease term. The Sun Adventure Sports located in Lubbock has a lease that will expire during fiscal 2022 with an option available to extend the lease term. TRADESMART, located in Littleton, Colorado, has a lease that will expire during fiscal 2021 with an option available to extend the lease term.

Historically, we have not experienced any significant difficulty renewing or extending leases on a satisfactory basis.

Our headquarters and distribution center are located in Amarillo, Texas in a leased facility consisting of approximately 45,000 square feet for office space and 198,000 square feet for the distribution center. The leases for this property terminate in September 2014, and we have the option to renew these leases through March 2026.

| ITEM 3. | LEGAL PROCEEDINGS. |

Information regarding our legal proceedings is set forth in Note 15 to the consolidated financial statements, which information is incorporated herein by reference.

| ITEM 4. | MINE SAFETY DISCLOSURES. |

Not applicable.

15

Table of Contents

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. |

The shares of Hastings’ common stock are listed and traded on The NASDAQ National Market (“NASDAQ”) under the symbol “HAST.” Our common stock began trading on June 12, 1998, following our initial public offering. The following table contains, for the fiscal periods indicated, the high and low sales prices per share of our common stock as reported on NASDAQ:

| High | Low | |||||||

| 2011: |

||||||||

| First Quarter |

$ | 6.60 | $ | 4.64 | ||||

| Second Quarter |

$ | 5.29 | $ | 3.85 | ||||

| Third Quarter |

$ | 4.82 | $ | 1.85 | ||||

| Fourth Quarter |

$ | 2.32 | $ | 1.25 | ||||

| 2010: |

||||||||

| First Quarter |

$ | 9.38 | $ | 3.82 | ||||

| Second Quarter |

$ | 8.02 | $ | 5.10 | ||||

| Third Quarter |

$ | 7.55 | $ | 6.35 | ||||

| Fourth Quarter |

$ | 6.87 | $ | 5.21 | ||||

As of March 31, 2012, there were 290 holders of record of our common stock.

The payment of dividends is within the discretion of the Board of Directors and will depend on our earnings, capital requirements and our operating and financial condition, among other factors. We have not declared or paid any dividend during fiscal 2011 or 2010, nor do we intend to pay dividends in the foreseeable future.

A summary of our purchases of shares of our common stock for the three months ended January 31, 2012 is as follows:

ISSUER PURCHASES OF EQUITY SECURITIES

| Period |

Total number of shares purchased (1) |

Average price paid per share |

Total number of shares purchased as part of publicly announced plans or programs |

Approximate dollar value of shares that may yet be purchased under the plans or programs (2) |

||||||||||||

| November 1 to November 30, 2011 |

— | $ | — | — | N/A | |||||||||||

| December 1 to December 31, 2011 |

65,000 | 1.48 | 65,000 | N/A | ||||||||||||

| January 1 to January 31, 2012 |

167,100 | 1.60 | 167,100 | N/A | ||||||||||||

|

|

|

|

|

|

|

|||||||||||

| Total |

232,100 | $ | 1.57 | 232,100 | $ | 6,286,630 | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| (1) | All share purchases were open-market purchases made under a repurchase plan publicly announced in a press release dated September 28, 2001. Our Board of Directors initially authorized the repurchase of up to $5.0 million worth of our common stock. To date, the Board of Directors has approved the repurchase of up to an additional $32.5 million of our common stock. Each such authorization to increase amounts was publicly announced in a press release. The repurchases satisfied the conditions of the safe harbor of Rule 10b-18 under the Exchange Act. |

| (2) | A total of 5,343,749 shares have been purchased under the repurchase plan at a total cost of approximately $31.2 million, or approximately $5.84 per share. |

16

Table of Contents

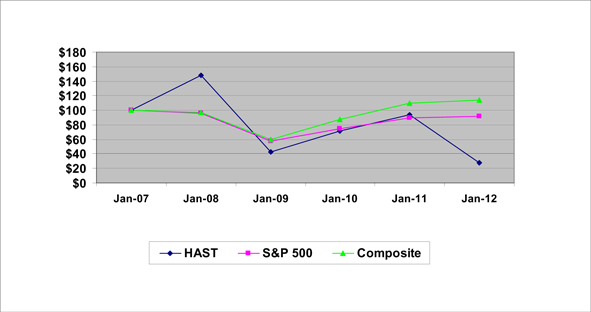

Comparison of Cumulative Five Year Total Return

| Fiscal Years Ended | ||||||||||||||||||||||||

| January 31, 2007 |

January 31, 2008 |

January 31, 2009 |

January 31, 2010 |

January 31, 2011 |

January 31, 2012 |

|||||||||||||||||||

| Hastings |

$ | 100.00 | $ | 148.14 | $ | 42.71 | $ | 71.86 | $ | 93.90 | $ | 27.46 | ||||||||||||

| S&P 500 Index |

100.00 | 95.85 | 57.42 | 74.67 | 89.42 | 91.25 | ||||||||||||||||||

| NASDAQ Composite Index |

100.00 | 96.99 | 59.92 | 87.15 | 109.58 | 114.20 | ||||||||||||||||||

The graph above compares the cumulative total shareholder return on our common stock for the last five years with the cumulative total return on the S&P 500 Index and the NASDAQ Composite Index over the same period. The graph assumes the investment of $100 in Hastings common stock, the S&P 500 Index and the NASDAQ Composite Index on January 31, 2007 and the reinvestment of all dividends.

17

Table of Contents

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information concerning stock options outstanding, the weighted average exercise price of those options and options remaining to be granted under existing option plans, whether approved or not approved by security holders, as of January 31, 2012. The purpose of this table is to illustrate the potential dilution that could occur from past and future equity grants. Hastings does not have any outstanding warrants or stock appreciation rights.

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of

securities remaining available for future issuance under equity compensation plans |

|||||||||

| Equity compensation plans approved by security holders |

655,083 | (1) | $ | 4.68 | 454,798 | |||||||

| Equity compensation plans not approved by security holders |

— | — | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total |

655,083 | $ | 4.68 | 454,798 | ||||||||

|

|

|

|

|

|

|

|||||||

| (1) | Not included in the above table are 78,750 restricted stock units that will result in the issuance of Hastings common stock upon the vesting of such restricted stock units. The restricted stock units were granted under equity compensation plans that have been approved by security holders. |

18

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA. |

The data set forth below should be read in conjunction with Item 7 - “Management’s Discussion and Analysis of Financial Condition and Results of Operation” and the Company’s Financial Statements and notes thereto.

| Fiscal Year | ||||||||||||||||||||

| (In thousands, except per share and square foot data) | 2011 | 2010 | 2009 | 2008 | 2007 | |||||||||||||||

| Income Statement Data: |

||||||||||||||||||||

| Merchandise revenue |

$ | 425,142 | $ | 440,038 | $ | 441,462 | $ | 451,492 | $ | 458,076 | ||||||||||

| Rental revenue |

70,426 | 80,216 | 81,374 | 87,256 | 89,609 | |||||||||||||||

| Gift card breakage revenue (1) |

819 | 801 | 8,510 | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenues |

496,387 | 521,055 | 531,346 | 538,748 | 547,685 | |||||||||||||||

| Merchandise cost of revenue |

295,506 | 303,714 | 307,074 | 315,780 | 321,438 | |||||||||||||||

| Rental asset cost of revenue |

27,166 | 29,950 | 29,424 | 30,948 | 31,107 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total cost of revenues |

322,672 | 333,664 | 336,498 | 346,728 | 352,545 | |||||||||||||||

| Gross profit |

173,715 | 187,391 | 194,848 | 192,020 | 195,140 | |||||||||||||||

| Selling, general and administrative expenses (2) |

185,107 | 184,142 | 183,413 | 182,511 | 177,028 | |||||||||||||||

| Pre-opening expenses |

244 | — | 3 | 233 | 120 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating income (loss) |

(11,636 | ) | 3,249 | 11,432 | 9,276 | 17,992 | ||||||||||||||

| Interest expense |

(1,334 | ) | (1,014 | ) | (1,014 | ) | (1,961 | ) | (2,919 | ) | ||||||||||

| Other, net (3) |

275 | 156 | 1,902 | 193 | 123 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

(12,695 | ) | 2,391 | 12,320 | 7,508 | 15,196 | ||||||||||||||

| Income tax expense (4) |

4,884 | 686 | 5,387 | 3,449 | 4,951 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (17,579 | ) | $ | 1,705 | $ | 6,933 | $ | 4,059 | $ | 10,245 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Basic income (loss) per share |

$ | (2.05 | ) | $ | 0.19 | $ | 0.72 | $ | 0.40 | $ | 0.95 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted income (loss) per share |

$ | (2.05 | ) | $ | 0.18 | $ | 0.71 | $ | 0.39 | $ | 0.93 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Weighted-average common shares outstanding – basic |