Attached files

| file | filename |

|---|---|

| S-1/A - AMENDMENT NO. 1 TO FORM S-1 - FENDER MUSICAL INSTRUMENTS CORP | d293340ds1a.htm |

| EX-24.2 - POWER OF ATTORNEY (KENNETH L. GOODSON JR.) - FENDER MUSICAL INSTRUMENTS CORP | d293340dex242.htm |

| EX-23.1 - CONSENT OF KPMG LLP - FENDER MUSICAL INSTRUMENTS CORP | d293340dex231.htm |

| EX-10.37 - AMENDMENT TO LEASE, DATED DECEMBER 30, 2011 - FENDER MUSICAL INSTRUMENTS CORP | d293340dex1037.htm |

Exhibit 10.36

OFFICE LEASE AGREEMENT

WDP 17600 LLC, AS LANDLORD,

AND

FENDER MUSICAL INSTRUMENTS CORPORATION,

AS TENANT.

17600 N. Perimeter Drive

Scottsdale, Arizona

TABLE OF CONTENTS

| Page | ||||||||||||||

| DEFINITIONS |

|

1 | ||||||||||||

| BASIC TERMS |

|

1 | ||||||||||||

| ARTICLE 1 |

|

LEASE OF PREMISES AND LEASE TERM |

4 | |||||||||||

| 1.1 |

|

Premises |

4 | |||||||||||

| 1.2 |

|

Term; Commencement |

4 | |||||||||||

| 1.3 |

|

Extension of Term |

4 | |||||||||||

| 1.4 |

|

Selection of Fair Market Basic Rent |

5 | |||||||||||

| 1.5 |

|

Quiet Enjoyment |

5 | |||||||||||

| 1.6 |

|

Common Area |

6 | |||||||||||

| ARTICLE 2 |

|

RENTAL AND OTHER PAYMENTS |

6 | |||||||||||

| 2.1 |

|

Basic Rent |

6 | |||||||||||

| 2.2 |

|

Additional Rent |

6 | |||||||||||

| 2.3 |

|

Delinquent Rental Payments |

6 | |||||||||||

| 2.4 |

|

No Accord and Satisfaction |

6 | |||||||||||

| 2.5 |

|

Rent Tax |

7 | |||||||||||

| ARTICLE 3 |

|

PROPERTY EXPENSES |

7 | |||||||||||

| 3.1 |

|

Payment of Excess Property Expenses |

7 | |||||||||||

| 3.2 |

|

Estimation of Tenant’s Share of Excess Property Expenses |

7 | |||||||||||

| 3.3 |

|

Payment of Estimated Tenant’s Share of Excess Property Expenses |

7 | |||||||||||

| 3.4 |

|

Confirmation of Tenant’s Share of Excess Property Expenses |

7 | |||||||||||

| 3.5 |

|

Tenant’s Inspection and Audit Rights |

8 | |||||||||||

| 3.6 |

|

Adjustments to Property Expenses |

8 | |||||||||||

| 3.7 |

|

Personal Property Taxes |

8 | |||||||||||

| 3.8 |

|

Landlord’s Right to Contest Property Taxes |

8 | |||||||||||

| ARTICLE 4 |

|

TENANT’S USE |

9 | |||||||||||

| 4.1 |

|

Permitted Use |

9 | |||||||||||

| 4.2 |

|

Acceptance of Premises |

10 | |||||||||||

| 4.3 |

|

Change of Permitted Use |

10 | |||||||||||

| 4.4 |

|

Laws/Property Rules |

10 | |||||||||||

| 4.5 |

|

Claims Arising from Tenant’s Use |

10 | |||||||||||

| ARTICLE 5 |

|

HAZARDOUS MATERIALS |

10 | |||||||||||

| 5.1 |

|

Compliance with Hazardous Materials Laws |

10 | |||||||||||

| 5.2 |

|

Notice of Actions |

11 | |||||||||||

| 5.3 |

|

Hazardous Materials Indemnification |

11 | |||||||||||

| 5.3.1 | Tenant’s Indemnification |

11 | ||||||||||||

| 5.3.2 | Landlord’s Indemnification |

12 | ||||||||||||

| ARTICLE 6 |

|

SERVICES AND UTILITIES |

12 | |||||||||||

| 6.1 |

|

Landlord’s Obligations |

12 | |||||||||||

| 6.1.1 | Janitorial Service |

12 | ||||||||||||

| 6.1.2 | Electrical Energy |

12 | ||||||||||||

| 6.1.3 | Heating, Ventilation and Air Conditioning |

12 | ||||||||||||

| 6.1.4 | Water |

12 | ||||||||||||

| 6.1.5 | Elevator Service |

13 | ||||||||||||

i

| 6.2 | Tenant’s Obligations |

13 | ||||||||||

| 6.3 | Other Provisions Relating to Services |

13 | ||||||||||

| ARTICLE 7 |

|

MAINTENANCE AND REPAIR |

13 | |||||||||

| 7.1 | Landlord’s Obligations |

13 | ||||||||||

| 7.2 | Tenant’s Obligations |

14 | ||||||||||

| 7.2.1 | Maintenance of Premises |

14 | ||||||||||

| 7.2.2 | Notice to Landlord |

14 | ||||||||||

| 7.3 | Tenant’s Right to Self-Help |

14 | ||||||||||

| 7.4 | Supplemental Equipment |

15 | ||||||||||

| ARTICLE 8 |

|

ALTERATIONS |

15 | |||||||||

| 8.1 | Landlord Approval |

15 | ||||||||||

| 8.2 | Tenant Responsible for Cost and Insurance |

15 | ||||||||||

| 8.3 | Construction Obligations; Ownership of Alterations |

16 | ||||||||||

| 8.4 | Liens |

16 | ||||||||||

| 8.5 | Indemnification |

16 | ||||||||||

| 8.6 | Alterations Required by Laws |

16 | ||||||||||

| ARTICLE 9 |

|

RIGHTS RESERVED BY LANDLORD |

17 | |||||||||

| 9.1 | Landlord’s Entry |

17 | ||||||||||

| 9.2 | Control of Property |

17 | ||||||||||

| 9.3 | Common Area |

17 | ||||||||||

| 9.4 | Right to Cure |

18 | ||||||||||

| ARTICLE 10 |

|

INSURANCE |

18 | |||||||||

| 10.1 | Tenant’s Insurance |

18 | ||||||||||

| 10.1.1 | Liability Insurance |

18 | ||||||||||

| 10.1.2 | Property Insurance |

18 | ||||||||||

| 10.1.3 | Other Insurance |

18 | ||||||||||

| 10.2 | Landlord’s Insurance |

18 | ||||||||||

| 10.2.1 | Property Insurance |

18 | ||||||||||

| 10.2.2 | Liability Insurance |

19 | ||||||||||

| 10.2.3 | Other Insurance |

19 | ||||||||||

| 10.3 | Waivers and Releases of Claims and Subrogation |

19 | ||||||||||

| 10.3.1 | Tenant’s Waiver and Release |

19 | ||||||||||

| 10.3.2 | Landlord’s Waiver and Release |

19 | ||||||||||

| 10.3.3 | Limitation on Waivers of Claims |

19 | ||||||||||

| 10.4 | Tenant’s Failure to Insure |

20 | ||||||||||

| 10.5 | No Limitation |

20 | ||||||||||

| ARTICLE 11 |

|

DAMAGE OR DESTRUCTION |

20 | |||||||||

| 11.1 | Tenantable Within 270 Days |

20 | ||||||||||

| 11.2 | Not Tenantable Within 270 Days |

20 | ||||||||||

| 11.3 | Property Substantially Damaged |

20 | ||||||||||

| 11.4 | Insufficient Proceeds |

21 | ||||||||||

| 11.5 | Landlord’s Repair; Rent Abatement |

21 | ||||||||||

| 11.6 | Rent Abatement if Lease Terminates |

21 | ||||||||||

| 11.7 | Exclusive Casualty Remedy |

21 | ||||||||||

| 11.8 | Notice to Landlord |

21 | ||||||||||

| ARTICLE 12 |

|

EMINENT DOMAIN |

21 | |||||||||

| 12.1 | Termination of Lease |

21 | ||||||||||

| 12.2 | Landlord’s Repair Obligations |

22 | ||||||||||

| 12.3 | Tenant’s Participation |

22 | ||||||||||

| 12.4 | Exclusive Taking Remedy |

22 | ||||||||||

ii

| ARTICLE 13 |

|

TRANSFERS |

22 | |||||||||||||

| 13.1 |

|

Restriction on Transfers |

22 | |||||||||||||

| 13.2 |

|

Recapture Right |

23 | |||||||||||||

| 13.3 |

|

Costs |

23 | |||||||||||||

| 13.4 |

|

Landlord’s Consent Standards |

23 | |||||||||||||

| 13.5 |

|

Permitted Transfers |

23 | |||||||||||||

| ARTICLE 14 |

|

DEFAULTS; REMEDIES |

23 | |||||||||||||

| 14.1 |

|

Events of Default |

23 | |||||||||||||

| 14.1.1 | Failure to Pay Rent |

24 | ||||||||||||||

| 14.1.2 | Failure to Perform |

24 | ||||||||||||||

| 14.1.3 | Misrepresentation |

24 | ||||||||||||||

| 14.1.4 | Insolvency |

24 | ||||||||||||||

| 14.2 |

|

Remedies |

24 | |||||||||||||

| 14.2.1 | Termination of Tenant’s Possession/Re-entry and Reletting Right |

24 | ||||||||||||||

| 14.2.2 | Termination of Lease |

25 | ||||||||||||||

| 14.2.3 | Present Worth of Rent |

25 | ||||||||||||||

| 14.2.4 | Other Remedies |

25 | ||||||||||||||

| 14.3 | Costs | 25 | ||||||||||||||

| 14.4 |

|

Waiver of Re-entry Claims |

26 | |||||||||||||

| 14.5 |

|

Landlord’s Default |

26 | |||||||||||||

| 14.6 |

|

No Waiver |

26 | |||||||||||||

| ARTICLE 15 |

|

CREDITORS; ESTOPPEL CERTIFICATES |

26 | |||||||||||||

| 15.1 |

|

Subordination |

26 | |||||||||||||

| 15.2 |

|

Attornment |

26 | |||||||||||||

| 15.3 |

|

Mortgagee Protection Clause |

26 | |||||||||||||

| 15.4 |

|

Estoppel Certificates |

27 | |||||||||||||

| 15.4.1 | Contents |

27 | ||||||||||||||

| 15.4.2 | Failure to Deliver |

27 | ||||||||||||||

| ARTICLE 16 |

|

SURRENDER; HOLDING OVER |

27 | |||||||||||||

| 16.1 |

|

Surrender of Premises |

27 | |||||||||||||

| 16.2 |

|

Holding Over |

27 | |||||||||||||

| ARTICLE 17 |

|

TENANT IMPROVEMENTS |

28 | |||||||||||||

| 17.1 |

|

Base Building Improvements |

28 | |||||||||||||

| 17.2 |

|

Tenant Improvements |

28 | |||||||||||||

| 17.3 |

|

Tenant’s Project Manager |

28 | |||||||||||||

| 17.4 |

|

Improvement Allowance |

29 | |||||||||||||

| 17.5 |

|

Space Plan |

29 | |||||||||||||

| 17.6 |

|

Construction Drawings and Specifications |

29 | |||||||||||||

| 17.7 |

|

Changes to Construction Drawings and Specifications |

30 | |||||||||||||

| 17.8 |

|

Tenant’s Approval of Contractor; Tenant Improvement Costs |

30 | |||||||||||||

| 17.9 |

|

Test Fit Plan |

30 | |||||||||||||

| 17.10 |

|

Landlord’s Approval Rights |

30 | |||||||||||||

| 17.11 |

|

Tenant’s Representative |

30 | |||||||||||||

| 17.12 |

|

Substantial Completion |

30 | |||||||||||||

| 17.13 |

|

Access Prior to Substantial Completion |

31 | |||||||||||||

| 17.14 |

|

Punch List |

31 | |||||||||||||

| 17.15 |

|

Construction Warranty |

31 | |||||||||||||

| 17.16 |

|

Tenant Finish Work |

32 | |||||||||||||

| ARTICLE 18 |

|

ADDITIONAL PROVISIONS |

32 | |||||||||||||

| 18.1 |

|

Existing Furniture, Fixtures and Equipment |

32 | |||||||||||||

iii

| 18.2 | Parking |

32 | ||||||||

| 18.3 | Right of First Offer |

32 | ||||||||

| 18.4 | Early Termination Right |

33 | ||||||||

| 18.5 | Signs |

33 | ||||||||

| ARTICLE 19 |

|

MISCELLANEOUS PROVISIONS |

34 | |||||||

| 19.1 | Notices |

34 | ||||||||

| 19.2 | Transfer of Landlord’s Interest |

34 | ||||||||

| 19.3 | Successors |

34 | ||||||||

| 19.4 | Captions and Interpretation |

34 | ||||||||

| 19.5 | Relationship of Parties |

34 | ||||||||

| 19.6 | Entire Agreement; Amendment. |

34 | ||||||||

| 19.7 | Severability |

35 | ||||||||

| 19.8 | Landlord’s Limited Liability |

35 | ||||||||

| 19.9 | Survival |

35 | ||||||||

| 19.10 | Attorneys’ Fees |

35 | ||||||||

| 19.11 | Brokers |

35 | ||||||||

| 19.12 | Governing Law |

35 | ||||||||

| 19.13 | Time is of the Essence |

35 | ||||||||

| 19.14 | Independent Obligations |

35 | ||||||||

| 19.15 | Tenant’s Organization Documents; Authority |

35 | ||||||||

| 19.16 | Force Majeure |

36 | ||||||||

| 19.17 | Management |

36 | ||||||||

| 19.18 | Financial Statements |

36 | ||||||||

| 19.19 | No Recording |

36 | ||||||||

| 19.20 | Nondisclosure of Lease Terms |

36 | ||||||||

| 19.21 | Construction of Lease and Terms |

36 | ||||||||

| EXHIBITS | ||||

| EXHIBIT “A” |

Definitions | |||

| EXHIBIT “B” |

Legal Description of the Land | |||

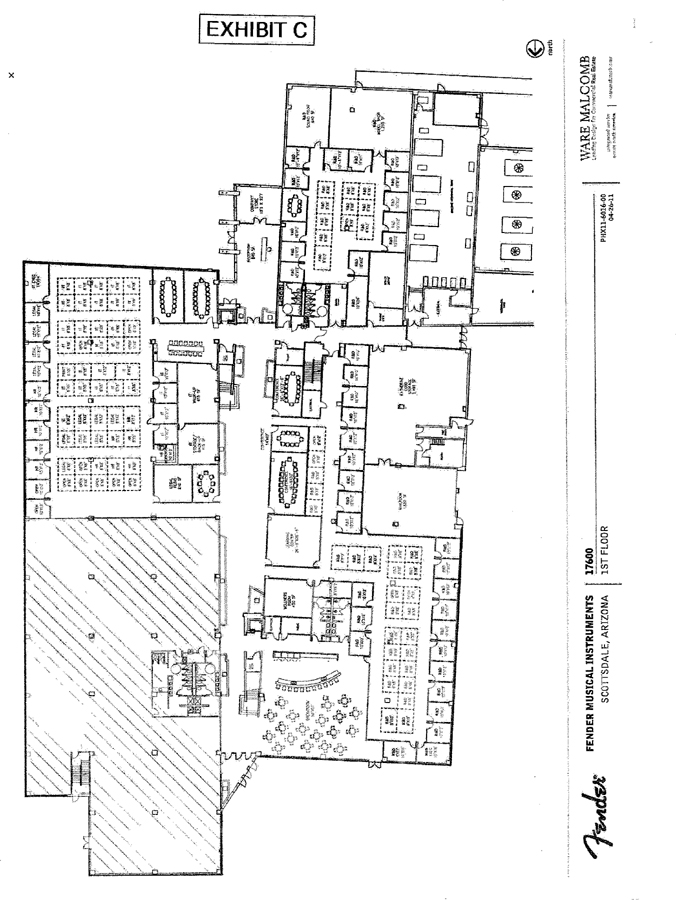

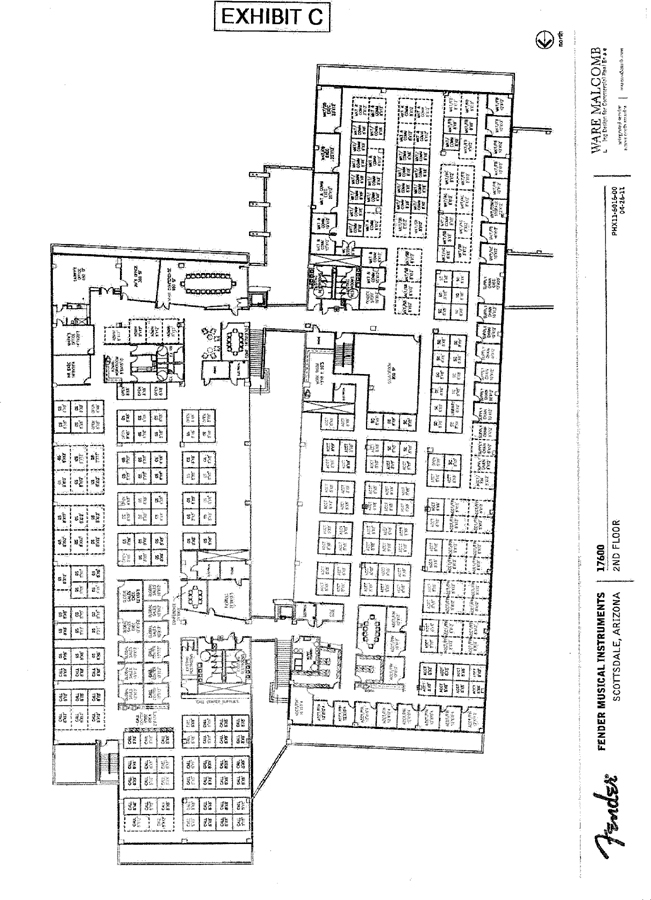

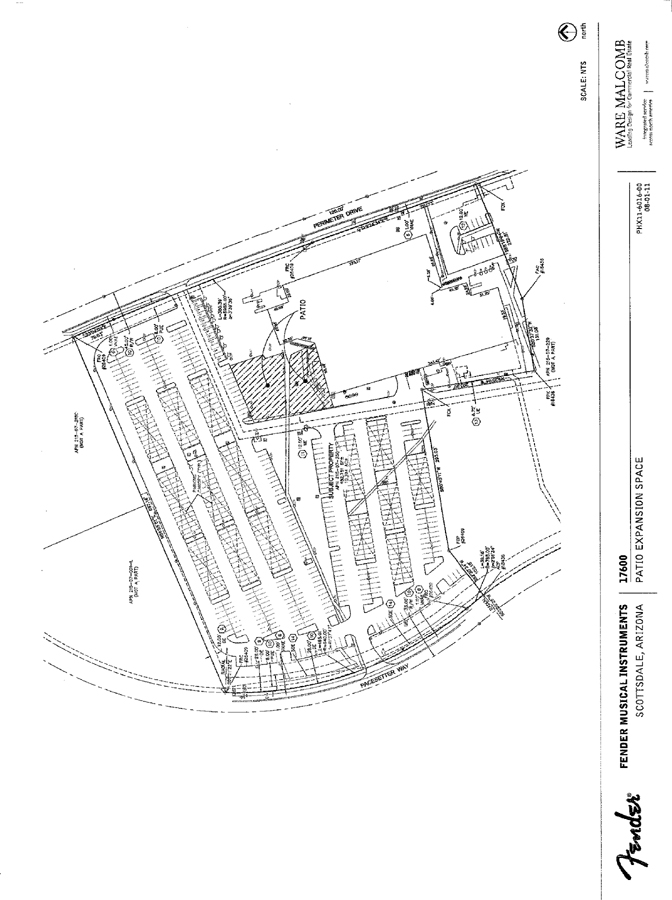

| EXHIBIT “C” |

Floor Plan | |||

| EXHIBIT “D” |

Commencement Date Memorandum | |||

| EXHIBIT “E” |

Property Rules | |||

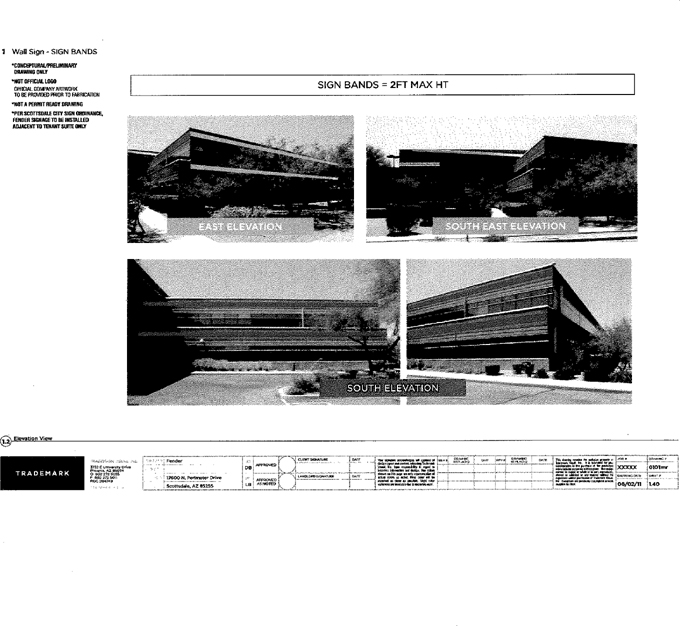

| EXHIBIT “F” |

Building Sign Location | |||

| EXHIBIT “G” |

Janitorial Services | |||

iv

OFFICE LEASE AGREEMENT

This Office Lease Agreement is made and entered into as of the Effective Date by and between WDP 17600 LLC, an Arizona limited liability company, as Landlord, and FENDER MUSICAL INSTRUMENTS CORPORATION, a Delaware corporation, as Tenant.

DEFINITIONS

Capitalized terms used in this Lease and not defined elsewhere have the meanings given them on the attached EXHIBIT “A”.

BASIC TERMS

The following Basic Terms are applied under and governed by the particular section(s) in this Lease pertaining to the following information:

| 1. | Premises: Approximately 110,875 rentable square feet located within the Building as depicted on EXHIBIT “C”. The Building is located at 17600 N. Perimeter Drive, Scottsdale, Arizona 85255. The Building contains approximately 127,690 rentable square feet. The final rentable and usable square footage of the Premises and rentable square footage of the Building will be determined as provided in Section 1.1. |

| 2. | Lease Term: Eleven (11) years and two (2) months (134 months) |

| Extension Periods: Two (2), five (5) year renewal options. |

| 3. | Delivery Date: February 15, 2012. |

| 4. | Basic Rent: |

| Months |

Annual Basic Rent per rentable square foot of the Premises |

|||

| 1-14 |

$ | 0.00 | ||

| 15-98 |

$ | 23.80 | ||

| 99-134 |

$ | 24.50 | ||

| 5. | Initial Tenant’s Share of Excess Property Expenses Percentage: 86.83% | |||

| 6. | Expense Stop: | Initially, $5.00 per rentable square foot; on January 1, 2013, the expense stop will be increased by the actual amount of Property Taxes assessed on the Property for tax year 2012, on a per rentable square foot basis, attributable to the Building but in any event such expense stop shall not be less than $7.00 per rentable square foot. No Excess Property Expenses shall be charged to Tenant for the first twenty-four (24) months of the Term. | ||

| 7. | Permitted Use: | Commercial general office purposes and related ancillary uses and amenities provided by Tenant to its employees (such as kitchen facilities, lunchroom, gymnasium,etc.), initially for the operation of a musical instrument business (including, but not limited to, sales, marketing, advertising, research and development, and sound room(s)) and for the operation of a non-publicized retail facility for Tenant’s products and accessories and non-publicized museum/display area of Tenant’s products and accessories, with such retail facility and museum/display area not to exceed five hundred (500) rentable square feet. | ||

| 8. | Improvement Allowance: | $42.00 per rentable square foot of the Premises; assuming the Premises contains 110,875 rentable square feet, the total amount of the Improvement Allowance will be $4,656,750.00. | ||

| 9. | Security Deposit: | None. | ||

| 10. | Initial Property Manager/ Rent Payment Address: | CB Richard Ellis 2415 E. Camelback Road Phoenix, Arizona 85016 Attn: Andi St. John Telephone: (602) 735-5622 | ||

| Facsimile: (602) 735-5244 | ||||

| 11. | Address of Landlord for Notices: |

WDP 17600 LLC c/o WDP Partners LLC 11411 N. Tatum Boulevard Phoenix, Arizona 85028 Attn: Brian Frakes Telephone: (602) 953-6277 Facsimile: (602) 494-6139 | ||

| With a copy to: | Gallagher & Kennedy, P.A. | |||

| 2575 E. Camelback Road | ||||

| Phoenix, Arizona 85016 | ||||

| Attn: Alexander L. Broadfoot | ||||

| Telephone: (602) 530-8326 | ||||

| Facsimile: (602) 530-8500 | ||||

| With a copy to: | Property Manager at the address set forth above. | |||

| 12. | Address of Tenant for Notices: |

Prior to the Commencement Date: | ||

| Fender Musical Instruments Corporation 8860 East Chaparral Road, Suite 100 Scottsdale, Arizona 85250-2618 Attn: Mark Van Vleet Telephone: (480) 596-7127 Facsimile: (480) 596-9948 | ||||

2

| After the Commencement Date: | ||||

| Fender Musical Instruments Corporation | ||||

| 17600 North Perimeter Drive, Suite | ||||

| Scottsdale, Arizona 85255 | ||||

| Attn: Mark Van Bleet | ||||

| Telephone: (480) 596-7127 | ||||

| Facsimile: (480) 596-9948 | ||||

| With a copy to: | Bryan Cave LLP | |||

| 2 North Central Avenue, Suite 2200 | ||||

| Phoenix, Arizona 85004 | ||||

| Attn: Mark P. Goss | ||||

| Telephone: (602) 364-7112 | ||||

| Facsimile: (602) 364-7070 | ||||

| 13. | Broker(s): | CB Richard Ellis, Inc. (Landlord) | ||

| CresaPartners (Tenant) | ||||

3

ARTICLE 1

LEASE OF PREMISES AND LEASE TERM

1.1 Premises. In consideration of the covenants and agreements set forth in this Lease and other good and valuable consideration, Landlord leases the Premises to Tenant and Tenant leases the Premises from Landlord, upon and subject to the terms and conditions set forth in this Lease. Landlord warrants and represents to Tenant that Landlord has the sole and exclusive right to lease the Premises. The approximate sizes of the Premises and Building are set forth in the Basic Terms. Pending measurement as provided below, those figures will be used for determining Rent. Upon Substantial Completion of the Tenant Improvements, Landlord’s architect will measure the Premises and the Building, which measurement shall be certified to Landlord and Tenant. The Premises and the Building will be measured substantially in accordance with ANSI/BOMA Z65.1-1996, as published by the Building Owners and Managers Association International (aka “BOMA”). Tenant shall have the right to verify such measurement in accordance with the terms provided herein and if the actual number of rentable square footage of the Premises is determined pursuant to the remaining provisions of this Section 1.1 to be more or less than 110,875 rentable square feet, then the Basic Rent, Tenant’s Share of Excess Property Expenses percentage and any other applicable provisions determined with reference to the rentable square footage of the Premises (excluding, however, any reduction in the amount of the rental abatement set forth in Paragraph 4 of the Basic Terms) shall be adjusted to conform to the actual rentable square feet contained in the Premises and Landlord and Tenant shall each promptly execute and deliver to the other an amendment memorializing any changes to the Basic Rent and any other applicable provisions of this Lease based upon the rentable square footage of the Premises. Within ten (10) days after receipt of Landlord’s architect’s certification as to the rentable square footage of the Premises, Tenant shall have the right to either approve or object to such certification. If Tenant fails to deliver notice of its approval or objection within said ten (10) day period, the rentable square footage of the Premises shall be as set forth in such architect’s certificate. If Tenant timely objects to such architect’s certification of the measurement of the Premises, then together with its objection, Tenant must specify the rentable square footage Tenant believes the Premises contains. The parties shall use reasonable efforts to resolve their differences. If within fifteen (15) days after Tenant’s objection the parties have not resolved their differences, each party shall name an architect within ten (10) days thereafter. Within ten (10) days after being named, said two architects shall name a third architect, who shall, within twenty (20) days, measure the rentable square footage of the Premises pursuant to the BOMA standards set forth herein and select either Landlord’s or Tenant’s architect’s measurement, whichever measurement is closest (whether above or below the measurement of the third architect) to the third architect’s measurement. The selected measurement shall be the rentable square footage of the Premises. The party whose measurement was not selected by the third architect shall pay the fees and expenses of the third architect, and each party shall pay the fees and expenses of its own architect. The square footages so determined will be specified in the Commencement Date Memorandum executed as provided in Section 1.2.

1.2 Term; Commencement. The Term of this Lease is the period stated in the Basic Terms. The Term commences on the Commencement Date and expires at 5:00 p.m. on the last day of the last calendar month of the Term. Landlord will tender possession of the Premises to Tenant upon Substantial Completion of the Tenant Improvements pursuant to Article 17. Promptly after the Commencement Date, Landlord and Tenant will execute a “Commencement Date Memorandum” in substantially the form of EXHIBIT “D” to this Lease.

1.3 Extension of Term. Provided that no Event of Default exists either at the time of exercise or at the time for commencement of each extension, Tenant may extend the Term of this Lease for up to two consecutive periods of five years each. Tenant must exercise each such right of extension by delivering written notice of Tenant’s exercise at least twelve (12) months prior to the expiration of the Term (as it may have been extended). Each extension of the Term will be on the same terms, covenants and conditions as in this Lease as are in effect at the time of the commencement of the applicable extension (provided that Tenant is not entitled to an Improvement Allowance with respect to any extension), other than Basic Rent. Basic Rent for each extension period will be 95% of the Fair Market Basic Rent for the extension period. In no event will the Fair Market Basic Rent for an extension of the Term be less than the Basic Rent (exclusive of temporary abatements) payable by Tenant for the Lease

4

Year immediately prior to commencement of the applicable extension period. Not earlier than sixteen (16) months, nor later than fourteen (14) months, before the date of expiration of the initial Term or of any extension of the Term, as the case may be, Tenant may request in writing that Landlord advise Tenant of Landlord’s estimated Fair Market Basic Rent for the Premises for the next extension of the Term. Within thirty (30) days after receipt of such request, Landlord shall respond with a written quotation of the applicable Fair Market Basic Rent (“Landlord’s Quote”) and if Landlord fails to do so, then the deadline for exercising any extension of the Term pursuant to this Section 1.3 shall be extended to the date that is thirty (30) days after Tenant’s receipt of Landlord’s Quote. Tenant’s failure to timely request that Landlord provide Landlord’s Quote is a waiver of Tenant’s right to extend the Term. After receipt of Landlord’s Quote, if Tenant timely gives notice of its exercise of the extension of the Term and does not in such notice contest Landlord’s Quote, then the applicable Fair Market Basic Rent during the applicable extension of the Term shall be as provided in Landlord’s Quote. After receipt of Landlord’s Quote, if Tenant timely gives notice of its exercise of the extension of the Term and in such notice contests Landlord’s Quote, then the applicable Basic Rent during the applicable extension of the Term shall be determined in accordance with Section 1.4 below. Tenant’s failure to timely give notice to Landlord of Tenant’s election to extend the Term is a waiver of Tenant’s right to extend the Term.

1.4 Selection of Fair Market Basic Rent. If Tenant disputes Landlord’s Quote of Fair Market Basic Rent for an extension of the Term, Tenant will deliver notice of such dispute, together with Tenant’s proposed Fair Market Basic Rent, to Landlord within thirty (30) days of Tenant’s receipt of Landlord’s Quote. The parties will then attempt in good faith to agree upon the Fair Market Basic Rent. If the parties fail to agree within fifteen (15) days, then either party shall be entitled to give notice to the other electing to have the Fair Market Basic Rent selected by an appraiser as provided in this Section 1.4. Upon delivery and receipt of such notice, the parties will within seven (7) days thereafter mutually appoint an appraiser who will select (in the manner set forth below) the Fair Market Basic Rent (the “Deciding Appraiser”). The Deciding Appraiser must have at least ten (10) years of full-time commercial appraisal experience with projects comparable to the Property and be a member of the American Institute of Real Estate Appraisers or a similar appraisal association. The Deciding Appraiser may not have any material financial or business interest in common with either of the parties. If Landlord and Tenant are not able to agree upon a Deciding Appraiser within such seven (7) days, each party will within five (5) days thereafter separately select an appraiser meeting the criteria set forth above, which two appraisers will, within seven (7) days of their selection, mutually appoint a third appraiser meeting the criteria set forth above (and who also does not have any material financial or business interest in common with either of the two selecting appraisers or with Landlord or Tenant) to be the Deciding Appraiser. Within seven (7) days of the appointment (by either method) of the Deciding Appraiser, Landlord and Tenant will submit to the Deciding Appraiser their respective determinations of Fair Market Basic Rent and any related information. Within twenty-one (21) days of such appointment of the Deciding Appraiser, the Deciding Appraiser will review each party’s submittal (and such other information as the Deciding Appraiser deems necessary) and will select, in total and without modification, the submittal presented by either Landlord or Tenant as the Fair Market Basic Rent, and the amount so selected shall be multiplied by 95% to yield the Basic Rent for the applicable extension of the Term; provided, however, that in no event will 95% of Fair Market Basic Rent for an extension of the Term be less than the Basic Rent (exclusive of temporary abatements) payable by Tenant immediately prior to commencement of the applicable extension period. Subject to the previous sentence, if the Deciding Appraiser timely receives one party’s submittal, but not both, the Deciding Appraiser must designate the submitted proposal as the Fair Market Basic Rent for the applicable extension of the Term. Any determination of Fair Market Basic Rent made by the Deciding Appraiser in violation of the provisions of this Section 1.4 shall be beyond the scope of authority of the Deciding Appraiser and shall be null and void. If the determination of Fair Market Basic Rent is made by a Deciding Appraiser, Landlord and Tenant will each pay, directly to the Deciding Appraiser, one-half ( 1/2) of all fees, costs and expenses of the Deciding Appraiser. Landlord and Tenant will each separately pay all costs, fees and expenses of their respective additional appraiser (if any) used to determine the Deciding Appraiser.

1.5 Quiet Enjoyment. So long as there is no Event of Default by Tenant under this Lease, Landlord covenants and agrees that, from and after the Commencement Date, Tenant may quietly hold, occupy, use and enjoy the Premises and Common Areas during the Term, subject to the terms and conditions of this Lease, free from molestation, hindrance or physical intrusion not authorized by this Lease by any person claiming by, through or under Landlord.

5

1.6 Common Area. Tenant will have the non-exclusive right, together with the other occupants and users of the Property, to use the Common Area during the Term in a proper and appropriate manner consistent with the purposes for which it is provided by Landlord. Such right to use the Common Area is subject to all of the terms and conditions of this Lease, including without limitation all Property Rules and other Laws.

ARTICLE 2

RENTAL AND OTHER PAYMENTS

2.1 Basic Rent. Tenant will pay Basic Rent in monthly installments to Landlord, in advance, beginning on the Commencement Date and thereafter on the first day of each and every calendar month during the Term. Tenant will make all Basic Rent payments to the Rent Payment Address specified in the Basic Terms or at such other place or in such other manner as Landlord may from time to time designate in writing. Tenant will make all Basic Rent payments without offset or deduction and without any previous demand or notice for payment. Landlord will prorate, on a per diem basis, Basic Rent for any partial month within the Term.

2.2 Additional Rent. Article 3 of this Lease requires Tenant to pay Tenant’s Share of Excess Property Expenses as Additional Rent pursuant to estimates Landlord delivers to Tenant. Tenant will make all such payments in accordance with Section 3.3 without offset or deduction and without any previous demand or notice for payment. Tenant will pay all other Additional Rent described in this Lease within thirty (30) days after receiving Landlord’s invoice for such Additional Rent. Tenant will make all Additional Rent payments to the same location and, except as described in the previous sentence, in the same manner as Basic Rent payments.

2.3 Delinquent Rental Payments. If Landlord does not receive any payment of Basic Rent or Additional Rent within five (5) days after the date the payment is due, Tenant will pay Landlord a late payment charge equal to One Thousand and No/100 Dollars ($1,000.00) for the first late payment in any calendar year and five percent (5%) of the amount of the delinquent payment for any subsequent late payment in such calendar year; provided, however, that Tenant is not obligated to pay such late payment charge on the first late payment in any calendar year unless Tenant fails to make the payment within five (5) days after receipt of written notice from Landlord that the payment is delinquent. Further, if Landlord does not receive any payment of Basic Rent or Additional Rent within thirty (30) days after the date the payment is due, Tenant will pay Landlord interest on the delinquent payment calculated at the Maximum Rate from the date the payment is due through the date the payment is received by Landlord. The parties agree that such amounts represent a fair and reasonable estimate of the damages Landlord will incur by reason of such late payment. Such charges and interest will be considered Additional Rent and Landlord’s right to such compensation for the delinquency is in addition to all of Landlord’s rights and remedies under this Lease, at law or in equity.

2.4 No Accord and Satisfaction. No statement or other notation on a payment from Tenant or in a letter accompanying a payment is binding on Landlord. Landlord may, with or without notice to Tenant, accept such payment without being bound to the conditions of any such statement or notation. No acceptance by Landlord of full or partial Rent during the continuance of any breach or default by Tenant constitutes a waiver of any such breach or default. If Tenant pays any amount other than the actual amount due Landlord, receipt or collection of such partial payment does not constitute an accord and satisfaction. Landlord may retain any such partial payment, whether restrictively endorsed or otherwise, without prejudice to Landlord’s right to collect the balance properly due. If all or any portion of any payment is dishonored for any reason, payment will not be deemed made until the entire amount due is actually collected by Landlord. The foregoing provisions apply in kind to the receipt or collection of any amount by any form or means of electronic payment or funds transfer, or by a lock box agent or other person or proxy on Landlord’s behalf.

6

2.5 Rent Tax. Tenant will pay to Landlord all Rent Tax (if any) due in connection with this Lease or the payment of Rent hereunder, which Rent Tax will be paid by Tenant to Landlord concurrently with each payment of Rent made by Tenant to Landlord under this Lease. Landlord shall notify Tenant in writing of the amount of the Rent Tax due for each payment of Rent hereunder, but Landlord’s failure to so notify Tenant of any such amount does not release Tenant of the obligation to pay same.

ARTICLE 3

PROPERTY EXPENSES

3.1 Payment of Excess Property Expenses. Commencing on the first day of the 24th month of the Term, Tenant will pay, as Additional Rent and in the manner this Article 3 describes, Tenant’s Share of Excess Property Expenses for each calendar year of the Term. If the Term includes any partial calendar years, or Tenant is otherwise required under this Lease to pay Tenant’s Share of Excess Property Expenses for only part of a full calendar year, Landlord will appropriately prorate Tenant’s Share of Excess Property Expenses for such partial calendar year on a per diem basis based on the number of days within such partial calendar year.

3.2 Estimation of Tenant’s Share of Excess Property Expenses. Prior to the date Tenant first becomes obligated for the payment of Excess Property Expenses, and thereafter from time to time during the Term, Landlord will deliver to Tenant a written estimate of the following for each calendar year of the Term: (a) Property Expenses, (b) Excess Property Expenses, (c) Tenant’s Share of Excess Property Expenses and (d) the annual and monthly Additional Rent attributable to Tenant’s Share of Excess Property Expenses. Landlord may re-estimate Property Expenses from time to time during the Term but not more often than twice in any calendar year. In such event, Landlord will revise the monthly Additional Rent attributable to Tenant’s Share of Excess Property Expenses to an amount sufficient for Tenant to pay the re-estimated amount over the balance of the calendar year. Landlord will notify Tenant at least thirty (30) days prior to the effective date of any such re-estimate.

3.3 Payment of Estimated Tenant’s Share of Excess Property Expenses. From and after the first day of the 24th month of the Term, Tenant will pay the amount Landlord estimates as Tenant’s Share of Excess Property Expenses under Section 3.2 in equal monthly installments, in advance, beginning on the first day of the 24th month of the Term (which may not be the first day of a calendar month) and thereafter on the first day of each and every calendar month during the Term. If Landlord has not delivered a new estimate to Tenant by the first day of January of the applicable calendar year, Tenant will continue paying Tenant’s Share of Excess Property Expenses based on Landlord’s estimates for the previous calendar year. When Tenant receives Landlord’s estimates for the current calendar year, Tenant will pay the estimated amount for such calendar year (less amounts Tenant paid to Landlord in accordance with the immediately preceding sentence) in equal monthly installments over the balance of such calendar year, with the number of installments being equal to the number of full calendar months remaining in such calendar year.

3.4 Confirmation of Tenant’s Share of Excess Property Expenses. After the end of each calendar year within the Term during which Tenant was obligated for the payment of Excess Property Expenses, Landlord will determine the actual amount of Tenant’s Share of Excess Property Expenses for the expired calendar year and deliver to Tenant a written statement of such amount. If Tenant paid less than the amount of Tenant’s Share of Excess Property Expenses specified in the statement, Tenant will pay the difference to Landlord as Additional Rent within thirty (30) days after written notice from Landlord. If Tenant paid more than the amount of Tenant’s Share of Excess Property Expenses specified in the statement, Landlord will, at Landlord’s option, either (a) refund the excess amount to Tenant, or (b) credit the excess amount against Tenant’s next due monthly installment or installments of Tenant’s Share of Excess Property Expenses. Landlord shall advise Tenant in writing of the option Landlord has selected under the preceding sentence, which notice may accompany the refund or credit. If Landlord is delayed in delivering such statement to Tenant, such delay does not constitute a waiver of either party’s rights under this Section.

7

3.5 Tenant’s Inspection and Audit Rights. If Tenant desires to audit Landlord’s determination of the actual amount of Tenant’s Share of Excess Property Expenses for any calendar year, Tenant must deliver to Landlord written notice of Tenant’s election to audit within one hundred eighty (180) days after Landlord’s delivery of the statement of such amount under Section 3.4. If such notice is timely delivered, and provided that no Event of Default then exists under this Lease, Tenant (but not any subtenant) may, at Tenant’s sole cost and expense, cause a certified public accountant to audit Landlord’s records relating to such amounts on a non-contingent basis. Such audit will take place during regular business hours at a time and place reasonably acceptable to Landlord (which may be the location where Landlord or Property Manager maintains the applicable records in Maricopa County, Arizona). Tenant’s election to audit Landlord’s determination of Tenant’s Share of Excess Property Expenses is deemed withdrawn unless Tenant completes and delivers the audit report to Landlord within ninety (90) days after the date Landlord has made available the time, date and place to perform the audit under this Section. If the audit report shows that the amount Landlord charged Tenant for Tenant’s Share of Excess Property Expenses was greater than the amount this Article 3 obligates Tenant to pay, unless Landlord reasonably contests the audit, Landlord will refund the excess amount to Tenant within thirty (30) days after Landlord receives a copy of the audit report. If the audit report shows that the amount Landlord charged Tenant for Tenant’s Share of Excess Property Expenses was less than the amount this Article 3 obligates Tenant to pay, Tenant will pay to Landlord, as Additional Rent, the difference between the amount Tenant paid and the amount determined in the audit. If Tenant elects to audit such costs and expenses as provided above and Landlord’s statement is found to be in error by more than 5%, then Landlord will also pay to Tenant, within thirty (30) days following written request from Tenant accompanied by reasonably supporting documentation, Tenant’s reasonable third party out-of-pocket costs for the audit, not to exceed $5,000 in connection with any audit. Pending resolution of any audit under this Section, Tenant will continue to pay to Landlord all estimated amounts of Tenant’s Share of Excess Property Expenses in accordance with Section 3.3. Tenant must keep all information it obtains in any audit strictly confidential and may only use such information for the limited purpose this Section describes and for Tenant’s own account.

3.6 Adjustments to Property Expenses. If any portions of the rentable area of the Building are not 100% occupied at any time during any calendar year pursuant to leases under which the terms and rents have commenced for such calendar year, Landlord will reasonably and equitably adjust its computation of Property Expenses for that calendar year to include all components of Property Expenses (if any) that vary based on occupancy in an amount equal to Landlord’s reasonable estimate of the amount such components of Property Expenses would have been if 100% of the rentable area of the Building had been so occupied at all times during such calendar year. If at any time or from time to time any components of Property Expenses relate to (a) services or benefits that are received by Tenant but not all other tenants in the Building; (b) costs that are incurred by Landlord on behalf of Tenant but not all other tenants in the Building; (c) costs that are incurred by Landlord solely, or in disproportionate amounts, as a result of Tenant’s particular use or occupancy of the Premises or Property as compared to other tenants in the Building; or (d) services, benefits or costs that are otherwise received or incurred in differing amounts by, for or as a result of Tenant’s particular use or occupancy of the Premises or Property as compared to other tenants of the Building, then Landlord may, in Landlord’s reasonable discretion, adjust Landlord’s computation of such components of Property Expenses to equitably allocate such components of Property Expenses among Tenant and the other tenants of the Building, as applicable, in amounts Landlord reasonably determines to be proportionate to the amounts of such services, benefits and costs received by or incurred for or as a result of Tenant and each such other tenant.

3.7 Personal Property Taxes. Tenant will pay, prior to delinquency, all taxes charged against Tenant’s Personal Property. Tenant will use all reasonable efforts to have Tenant’s Personal Property taxed separately from the Property. If any of Tenant’s Personal Property is taxed with the Property, Tenant will pay the taxes attributable to Tenant’s Personal Property to Landlord as Additional Rent.

3.8 Landlord’s Right to Contest Property Taxes. Landlord may, but is not obligated to, contest the amount or validity, in whole or in part, of any Property Taxes. If Property Taxes are reduced

8

(or if a proposed increase is avoided or reduced) because Property Taxes are contested, Landlord may include in its computation of Property Taxes the reasonable costs and expenses incurred in connection with such contest, including without limitation reasonable attorney’s fees, up to the amount of any Property Tax reduction obtained in connection with the contest or any Property Tax increase avoided or reduced in connection with the contest, as the case may be. Tenant may not contest Property Taxes.

ARTICLE 4

TENANT’S USE

4.1 Permitted Use. Tenant will use the Premises only for the permitted use specified in the Basic Terms and may not use the Premises for any other purposes. Tenant shall be under no obligation to occupy the Premises, or once occupied, Tenant shall have the right to cease occupancy of the Premises, so long as Tenant continues to pay all Rent and perform all other obligations under this Lease. Tenant will not conduct such permitted use, or allow such permitted use to be conducted, in violation of any Laws or in any manner that would (a) violate any certificate of occupancy affecting the Property; (b) violate, invalidate or cause a loss of coverage under any insurance now or after the Effective Date in force with respect to the Property; (c) cause injury or damage to the Property or to the person or property of any other tenant of the Property, or unreasonably interfere with the use and enjoyment of the Property by any other tenant of the Property; or (d) cause diminution in the value or usefulness of all or any part of the Property (reasonable wear and tear excepted). Notwithstanding the foregoing, Landlord and Tenant acknowledge that a portion of the Premises may be used by Tenant for research and development of sound-producing electronic amplification products, and that Tenant will construct a “sound room” within the Premises and a “boom room” outside of the Premises for such purposes. In no event may Tenant’s use of the sound room or the boom room result in unreasonable levels of noise being transmitted outside of the Building or to space occupied by other tenants in the Building. Tenant will not commit any nuisance or waste in, on or about the Premises or the Property. In addition, Tenant may, from time to time, but not during Business Hours, conduct non-public events within the patio area of the Premises identified on EXHIBIT “C” (the location of which may be changed to another location mutually acceptable to Landlord and Tenant), provided that Landlord and Tenant agree to arrange appropriate time(s) outside of Business Hours for Tenant to conduct such events when the conduct of such events is least likely to disturb other tenants within the Building. Notwithstanding anything to the contrary in the immediately preceding sentence, (i) so long as there are no other tenants in the Building, Tenant may conduct any such events during Business Hours, and (ii) if there are other tenants in the Building, Tenant may conduct such events during Business Hours provided that Tenant has received the prior consent of all other tenants in the Building. In the event that the noise from such events or activities disturbs other tenants within the Building, Tenant will promptly decrease the noise emanating from such event until it no longer disturbs the applicable tenants in the Building, and Landlord and Tenant will thereafter agree upon further reasonable measures for mitigating any adverse effects of such noise on other tenants. Tenant will not use the Common Area in any manner that is inconsistent with Tenant’s permitted use of the Premises nor in any manner that unreasonably interferes with the use of the Property by other occupants or users of the Property. Tenant will obtain and maintain, at Tenant’s sole cost and expense, all permits and approvals required under the Laws for Tenant’s use of the Property. If Tenant’s particular use or occupancy of the Premises or Property (even though within the scope of Tenant’s permitted use) causes or requires Landlord to incur any unusual or extraordinary costs or expenses (including, without limitation, costs for any (i) special governmental permits, (ii) special maintenance, monitoring, inspection or reporting requirements, (iii) additional insurance premiums, surcharges, policies or coverages, or (iv) other matters required solely as a result of Tenant’s particular use or occupancy of the Premises or Property), Landlord may bill Tenant directly therefor and Tenant will pay all such cost and expense so billed to Landlord as Additional Rent. So long as Tenant is using the Premises for the initial Tenant’s Permitted Use described in the Basic Terms, Landlord will not lease any space within the Property to any individual, corporation, partnership, unincorporated association, limited liability company, trust, governmental authority or other entity engaged in the business of manufacturing or selling, at wholesale or retail, fretted musical instruments, musical instrument amplification equipment, sound reinforcement equipment, or related products or accessories.

9

4.2 Acceptance of Premises. Except as may be expressly set forth in this Lease, (i) Tenant acknowledges that neither Landlord nor any agent, contractor or employee of Landlord has made any representation or warranty of any kind with respect to the Premises, the Building or the Property, specifically including, but not limited to, any representation or warranty of suitability or fitness of the Premises, Building or the Property for any particular purpose, and (ii) Tenant’s acceptance and occupancy of the Premises conclusively establishes Tenant’s acceptance of the Premises, the Building and the Property in an “AS IS—WHERE IS” condition. Nothing in this Section 4.2 releases Landlord from or otherwise diminishes or limits any obligation of Landlord expressly set forth in this Lease, including, without limitation, Landlord’s obligation to construct the Tenant Improvements as provided in Article 17 hereof and Landlord’s repair, maintenance and replacement obligations set forth in this Lease, including those maintenance and repair obligations identified in Section 7.1 hereof.

4.3 Change of Permitted Use. If Tenant desires to change the Permitted Use set forth in Paragraph 7 of the Basic Terms, Tenant shall first seek Landlord’s prior written consent, which consent shall not be unreasonably withheld, conditioned or delayed. Within thirty (30) days after receipt by Landlord of Tenant’s request for consent, Landlord shall provide Tenant written notice that Landlord has (i) consented to the proposed change in the Permitted Use, or (ii) declined to consent to the proposed change in Permitted Use. If Landlord fails to respond within said thirty (30) days, Tenant shall provide a second written notice seeking Landlord’s prior written consent to such change. If Landlord fails to respond to the second written notice from Tenant within ten (10) days after Landlord’s receipt thereof, Landlord shall be deemed to have consented to the proposed change in Permitted Use.

4.4 Laws/Properly Rules. This Lease is subject and subordinate to all Laws. A copy of the current Property Rules is attached to this Lease as EXHIBIT “E”. Landlord agrees that the Property Rules shall be uniformly applied and enforced, if at all, in a nondiscriminatory manner. Landlord may revise the Property Rules from time to time in Landlord’s reasonable discretion; provided, however, that the Property Rules shall be subject to the specific rights and uses granted to Tenant and the limitations on Landlord as set forth in this Lease, and to the extent the Property Rules conflict with or are inconsistent with any of the express terms and provisions set forth in this Lease, then the express terms and provisions of this Lease shall at all times govern and have controlling effect.

4.5 Claims Arising from Tenant’s Use. Except for any Claims expressly waived or limited by Landlord elsewhere in this Lease, to the fullest extent allowable under the Laws Tenant releases and will indemnify, protect, defend (with counsel reasonably acceptable to Landlord) and hold harmless the Landlord Parties from and against all Claims arising from (a) any use of the Premises or Property by Tenant that violates the terms of this Lease; (b) any breach or default by Tenant in the performance of any of Tenant’s covenants or agreements in this Lease; (c) any act, omission, negligence or misconduct of Tenant; (d) any accident, injury, occurrence or damage in or to the Premises; and (e) if caused in whole or in part by Tenant, any accident, injury, occurrence or damage in, on, about or to the Property.

ARTICLE 5

HAZARDOUS MATERIALS

5.1 Compliance with Hazardous Materials Laws. Tenant acknowledges that Landlord has delivered to Tenant a copy of the Phase I Environmental Site Assessment and Asbestos Survey (Job No. 2180JC273) previously prepared for the Property by Western Technologies Inc., dated August 11, 2010 (the “Phase I Report”). The Phase I Report identified the following three (3) de minimus issues: staining or leakage located at (i) the pit for Elevator #1, (ii) in the mechanical room, and (iii) around the cardboard compactor. Tenant has no obligation for the clean up or remediation of such issues. Landlord has received no written notice from any governmental authority of any uncured violation of any Hazardous Materials Law. If on or before the Commencement Date Landlord receives a notice from any governmental authority of any uncured violation of any Hazardous Materials Law, Landlord will use commercially reasonable efforts to cure such violation in accordance with applicable Hazardous Materials Law. In connection with the occupancy of and operation of the Property, each of Landlord and Tenant shall strictly comply with, and shall maintain the Premises and the Property, as applicable, in compliance with, all Hazardous Materials Laws. Tenant will not cause any Hazardous Materials to be brought upon,

10

kept or used on the Property in a manner or for any purpose that violates any Hazardous Materials Laws. Tenant, at its sole cost and expense, will comply with all Hazardous Materials Laws related to Tenant’s use of the Property. On or before the expiration or earlier termination of this Lease, Tenant will completely remove from the Property (regardless whether any Hazardous Materials Law requires removal, but Landlord’s standard for removal shall in all events be reasonable and Landlord shall not require a higher standard of removal than would typically be applicable to properties used for commercial purposes), in compliance with all Hazardous Materials Laws and at Tenant’s sole cost and expense, all Hazardous Materials Tenant causes to be present in, on, under or about the Property. Upon Landlord’s written request, Tenant will promptly deliver to Landlord documentation acceptable to Landlord disclosing the nature and quantity of any Hazardous Materials Tenant has located at the Property and evidencing the legal and proper handling, storage and disposal of all Hazardous Materials kept at or removed or to be removed from the Property by Tenant. All such documentation will list Tenant or its agent as the responsible party and will not attribute responsibility for any such Hazardous Materials to Landlord or Property Manager. Tenant will comply with and is solely responsible for all reporting and warning obligations required under Hazardous Materials Laws arising from Tenant’s use or occupancy of the Premises or Property. Notwithstanding any provision contained herein to the contrary, Tenant shall be allowed, without the consent of Landlord but in all events in accordance with applicable Hazardous Materials Laws, to store, use and dispense products, materials or substances which may in whole or in part constitute toxic or Hazardous Materials but which consist of cleaning materials or solvents used in the ordinary course of Tenant’s Permitted Use and in accordance with Hazardous Materials Laws in amounts or quantities for general use and sale to individual retail customers.

5.2 Notice of Actions. Landlord and Tenant shall each give written notice to each other as soon as reasonably possible, but in any event within five (5) days after receiving notice, of any of the following actions affecting Landlord, Tenant, or the Property: (a) actual knowledge (not imputed or constructive knowledge) of any enforcement, clean-up, removal or other governmental or regulatory action instituted, completed or threatened under any Hazardous Materials Law; (b) actual knowledge (not imputed or constructive knowledge) of any Claims made or threatened relating to any Hazardous Material; and (c) receipt of any reports, records, letters of inquiry and responses, manifests or other documents made by any person, including Tenant or Landlord, to or from any environmental agency relating to any Hazardous Material, including any complaints, notices, warnings or asserted violations. Except in the case where the applicable governmental authority has notified Tenant in writing that any delay would subject Tenant to additional or enhanced fines, damages, charges (criminal or otherwise) or additional costs and expenses of remediation (in which case Tenant will not take any remedial action until after Tenant has provided Landlord with a copy of the notice from the applicable governmental authority). Tenant will not take any remedial action in response to the presence of any Hazardous Materials in, on, under or about the Property, nor enter into any settlement agreement, consent decree or other compromise with respect to any Claims relating to or in any way connected with Hazardous Materials in, on, under or about the Property, without first notifying Landlord of Tenant’s intention to do so and affording Landlord reasonable opportunity to investigate, appear, intervene and otherwise assert and protect Landlord’s interest in the Property.

5.3 Hazardous Materials Indemnification.

5.3.1 Tenant’s Indemnification. To the fullest extent allowable under the Laws, Tenant releases and will indemnify, protect, defend (with counsel reasonably acceptable to Landlord) and hold harmless the Landlord Parties for, from and against any and all Claims whatsoever arising or resulting, in whole or in part, directly or indirectly, from the use, generation, presence, treatment, storage, transportation, disposal, release or management of Hazardous Materials in, on, under, about or from the Property (including water tables and atmosphere), but only to the extent arising from Tenant’s use or occupancy of the Premises or Property. Tenant’s obligations under this Section include, without limitation and whether foreseeable or unforeseeable, (a) the costs of any required or necessary repair, compliance, investigations, clean-up, monitoring, response, detoxification or decontamination of the Property; (b) the costs of implementing any closure, remediation or other required action in connection therewith; (c) the value of any loss of use and any diminution in value of the Property and adjacent and nearby properties, including groundwater; and (d) consultants’ fees, experts’ fees and response costs. The obligations of Tenant under this Article survive the expiration or earlier termination of this Lease.

11

5.3.2 Landlord’s Indemnification. To the fullest extent allowable under the Laws, Landlord releases and will indemnify, protect, defend (with counsel reasonably acceptable to Tenant) and hold harmless the Tenant Parties for, from and against any and all Claims whatsoever arising or resulting, in whole or in part, directly or indirectly, from the use, generation, presence, treatment, storage, transportation, disposal, release or management of Hazardous Materials in, on, under, about or from the Property (including water tables and atmosphere), but only to the extent caused by Landlord. Landlord’s obligations under this Section include, without limitation and whether foreseeable or unforeseeable, (a) the costs of any required or necessary repair, compliance, investigations, clean-up, monitoring response, detoxification or decontamination of the Property; (b) the costs of implementing any closure, remediation or other required action in connection therewith as stated above; and (c) consultants’ fees, experts’ fees and response costs. The obligations of Landlord under this Section survive the expiration or earlier termination of this Lease.

ARTICLE 6

SERVICES AND UTILITIES

6.1 Landlord’s Obligations. Landlord will provide the services listed in this Section 6.1, the costs of which will be included in Operating Expenses (but only to the extent provided under the definition thereof).

6.1.1 Janitorial Service. Landlord will provide janitorial service in the Premises and Common Area, at least five times per week, including cleaning, trash removal, vacuuming, and maintaining towels, tissue and other restroom supplies. A list of the janitorial services to be provided at the Premises is attached hereto as EXHIBIT “G”. Landlord will also provide periodic interior and exterior window washing and cleaning and waxing of uncarpeted floors in accordance with Landlord’s schedule for the Building.

6.1.2 Electrical Energy. Landlord will provide electrical energy to the Premises for lighting and for operating office machines for general office use. The electrical energy supplied will be sufficient for Tenant to operate personal computers and other equipment of similar low electrical consumption, but will not be sufficient for lighting in excess of three watts per square foot installed or for electrical convenience outlets in excess of four watts per square foot installed. Tenant will not use any equipment requiring electrical energy in excess of the above standards without receiving Landlord’s prior written consent, which consent Landlord will not unreasonably withhold, condition or delay. If Tenant’s use of electricity does exceed such standards and Landlord so consents to such excess use, Tenant will pay (a) all costs of installing any equipment and facilities necessary to furnish such excess energy, and (b) an amount equal to the average cost per unit of electricity for the Building applied to the excess use as reasonably determined either by an engineer selected by Landlord or by submeter installed at Tenant’s expense.

6.1.3 Heating, Ventilation and Air Conditioning. During Business Hours, Landlord will provide heating, ventilation and air conditioning to the Premises sufficient to maintain, in Landlord’s reasonable judgment, comfortable temperatures in the Premises. During other times, Landlord will provide heat and air conditioning upon Tenant’s reasonable advance notice (not less than 24 hours). Tenant will pay Landlord, as Additional Rent, for such extended service on an hourly basis at the prevailing rates Landlord reasonably establishes, which will be based on Landlord’s actual cost for providing such service. If extended service is not a continuation of the service Landlord furnished during Business Hours, Landlord may require Tenant to pay for a minimum of three hours of such service. Landlord will provide air conditioning to the Premises based on standard lighting and occupancy levels and general office use only.

6.1.4 Water. Landlord will provide hot and cold water from standard building outlets for lavatory, restroom and drinking purposes.

12

6.1.5 Elevator Service. Landlord will provide elevator service to be used by Tenant at the Premises and shall be responsible for maintenance, repair or replacement of same, and the costs of any such maintenance, repair or replacement shall be included in Operating Expenses to the extent such costs are permitted to be included in Operating Expenses.

6.2 Tenant’s Obligations. Tenant is solely responsible for paying directly to the applicable service or utility companies, prior to delinquency, all charges owed for any utilities or services supplied to the Premises other than those to be supplied by Landlord pursuant to Section 6.1. Except as provided in Section 6.1 and Article 17, Tenant will also obtain and pay for all other utilities and services Tenant requires with respect to the Premises (including, but not limited to, hook-up and connection charges).

6.3 Other Provisions Relating to Services. Tenant acknowledges that the expense stop specified in the Basic Terms contemplates use of utilities and services in the Premises consistent with typical and customary office use during Business Hours within the standard loads and densities for which the Building and Premises are designed. Landlord reserves the right to cause the Premises to be separately metered for electricity or any other service provided thereto, which separate metering will be at Tenant’s sole cost and expense, and/or to otherwise appropriately charge Tenant for use of any utilities or services in excess of such amounts. Tenant will also be responsible for all utility charges related to any Supplemental Equipment, either as separately metered (at Tenant’s expense) or as reasonably estimated by Landlord. Landlord is not required to provide any heat, air conditioning, electricity or other service in excess of that permitted by required governmental guidelines or any Laws. No interruption in, or temporary stoppage of, any of the services to be provided by Landlord under this Lease is to be deemed an eviction or disturbance of Tenant’s use and possession of the Premises, nor does any interruption or stoppage relieve Tenant from any obligation under this Lease, render Landlord liable for damages or entitle Tenant to any Rent abatement. In each instance where there is an interruption in service, Landlord shall exercise prompt and reasonably diligent efforts to eliminate the cause of the interruption of service and to conclude or resolve the interruption of service if the interruption is specific to the Building and/or Property and the correction or resolution thereof is within Landlord’s reasonable ability to address. Landlord shall give Tenant written notice, when practical, of the commencement and anticipated duration of any planned interruption in service. Landlord has the exclusive right and discretion to select the provider of any utility or service to the Property and to determine whether the Premises or any other portion of the Property may or will be separately metered or separately supplied. Landlord reserves the right, from time to time, to make reasonable and non-discriminatory modifications to the above standards for utilities and services.

ARTICLE 7

MAINTENANCE AND REPAIR

7.1 Landlord’s Obligations. Landlord will keep and maintain and replace (when required) the following portions of the Property in good, clean, and fully operative condition and repair, reasonable wear and tear excepted: (a) exterior surfaces of the exterior walls and roof of the Building; (b) structural integrity of the footings, foundation, slabs, floors, columns, exterior walls, roof, roof membrane, and other structural elements of the Building; (c) exterior doors, windows and plate glass of the Building; (d) building standard electrical, lighting, mechanical, plumbing, heating and air conditioning systems, facilities, fixtures and components serving the Premises and the Building (specifically excluding any Supplemental Equipment); (e) building standard light bulbs, tubes, ballasts and starters; (f) demising walls installed by Landlord inside the Building (excluding the interior surfaces of such walls); and (g) Common Area. Tenant will cooperate with Landlord to facilitate the performance of Landlord’s obligations under this Section 7.1, including any entry by Landlord into all or any portion of the Premises and the temporary relocation of items of Tenant’s Personal Property, all as Landlord may determine is reasonably necessary to properly perform such obligations. In exercising Landlord’s obligations under this Section 7.1, Landlord shall use commercially reasonable efforts, to the extent reasonably possible under the circumstances, not to unreasonably disrupt, impede or interfere with Tenant’s access, use or enjoyment of the Premises or Common Area or with the conduct by Tenant of its business at the Premises, which commercially reasonable efforts shall include, whenever possible and feasible, performing Landlord’s obligations after Tenant’s regular business hours, but Landlord is not obligated to pay overtime in order to perform

13

Landlord’s obligations after Tenant’s regular business hours. Landlord’s repair and maintenance obligations under this Section 7.1 are subject to the provisions of Articles 11 and 12 of this Lease regarding any Casualty or Taking. The costs and expenses incurred by Landlord in performing its obligations under this Section will be included in Operating Expenses (but only to the extent permitted under the definition thereof), provided that the items in subclause (b) above will not be included in Operating Expenses except to the extent that the costs of any such repair or replacement are permitted to be included in Operating Expenses as a capital improvement under subclause (m) of the definition of Operating Expenses.

7.2 Tenant’s Obligations.

7.2.1 Maintenance of Premises. Except for Landlord’s obligations described in Section 7.1 and any janitorial services provided by Landlord under Article 6, Tenant, at Tenant’s sole cost and expense, will keep and maintain the Premises in good, clean, sanitary, neat and operative condition and repair, reasonable wear and tear excepted, which obligations of Tenant will include, without limitation, the maintenance, repair and replacement of all: (a) interior surfaces of exterior walls and demising walls; (b) interior walls, moldings, partitions and ceilings; (c) carpeting; (d) non-structural interior components; (e) interior windows, plate glass and doors; (f) kitchen or break-room fixtures, appliances and equipment; and (g) Tenant’s Personal Property. Tenant will also pay or reimburse Landlord for (or, at Landlord’s option, perform) the repair or replacement of any waste or excessive or unreasonable wear and tear to the Premises or Property caused or permitted by Tenant. Any repairs or replacements performed by Tenant pursuant to this Section must be at least equal in quality and workmanship to the original work and be in accordance with all Laws. Tenant’s repair and maintenance obligations under this Section are subject to the provisions of Articles 11 and 12 of this Lease regarding any Casualty or Taking.

7.2.2 Notice to Landlord. If Tenant believes any maintenance or repair Landlord is obligated under Section 7.1 to perform is needed at the Property, Tenant will promptly provide written notice to Landlord specifying in detail the nature and extent of any condition requiring maintenance or repair. Landlord will not be deemed to have failed to perform its obligations under Section 7.1 with respect to any maintenance or repair unless Tenant has provided such written notice and Landlord has had a commercially reasonable time within which to respond to such notice and effect the needed maintenance or repair.

7.3 Tenant’s Right to Self-Help. If (i) Landlord fails to take any action which Landlord is obligated to take to provide utilities, services, repairs or maintenance to the Premises as set forth in Section 6.1 and/or 7.1 of this Lease, and (ii) such failure by Landlord unreasonably interferes with the conduct of Tenant’s business at the Premises, and (iii) such failure is within Landlord’s reasonable control to correct, Tenant may deliver written notice of the failure to Landlord (“Self-Help Notice”). The Self-Help Notice must specifically describe the action that is required of Landlord to satisfy the requirements of Section 6.1 and/or 7.1 with respect to the Premises. If within five (5) days of receiving Tenant’s Self-Help Notice, Landlord fails to cure (or, if such failure reasonably requires more than five (5) days to cure, Landlord fails within such five (5) day period to commence to cure, and thereafter diligently and continuously pursue the cure of) the items specified in the Self-Help Notice, Tenant may, subject to the terms of this Section 7.3, proceed to take the required action with respect to the Premises (but solely on its own behalf, and not as the agent of Landlord) and, in this regard, Tenant may enter upon any portion of the Building or Common Area to take such reasonable action and to incur such reasonable expenses as may be necessary, provided that Tenant will not enter the premises of any other tenant in the Building without such tenant’s permission. Tenant may not take any such self-help action which alters or modifies the Building systems or equipment, structural integrity of the Building or exterior appearance of the Building. Unless Landlord delivers a written objection to Tenant as set forth below, Landlord will reimburse Tenant for Tenant’s reasonable out-of-pocket costs and expenses in taking such action within thirty (30) days after receiving an invoice from Tenant setting forth a reasonably particularized breakdown of such costs and expenses. If Landlord does not so object and does not pay such invoice within said thirty (30) day period after Landlord receives the invoice, then Tenant may thereafter deduct from Basic Rent the amount set forth in such invoice, together with interest at twelve percent (12%) per annum accruing from the date Tenant first requested reimbursement, provided that in no event may Tenant

14

deduct more than 25% of the Basic Rent due during any single month as a result of the rights granted under this Section 7.3. If, however, Landlord delivers to Tenant, within 30 days after receiving Tenant’s invoice, a written objection to the payment of such invoice setting forth with reasonable particularity any defenses to payment Landlord believes it has (such as, for example, any claim that all or any portion of such action did not have to be taken by Landlord pursuant to the terms of this Lease, or that the charges are excessive (in which case Landlord will pay the amount it contends would not have been excessive), then Tenant will not be entitled to make any deduction from Basic Rent, and if the parties are unable to resolve Landlord’s objections then Tenant may institute an action at law to collect the unpaid amount. The provisions of this Section 7.3 will not operate to exclude from Operating Expenses any item properly includable therein.

7.4 Supplemental Equipment. Any Supplemental Equipment will be maintained, repaired and replaced as needed by Tenant at Tenant’s sole cost and expense. Landlord has no liability for the operation, repair, maintenance or replacement of any such Supplemental Equipment or for any other systems, fixtures or equipment placed within the Premises by Tenant that are not a part of the Building’s standard equipment and systems. If Landlord elects at any time to perform any repair or maintenance upon such Supplemental Equipment, Landlord will do so at Tenant’s sole cost and expense.

ARTICLE 8

ALTERATIONS

8.1 Landlord Approval. Tenant will not make any Major Alterations or other Alterations without Landlord’s prior written consent, which consent Landlord will not unreasonably withhold, condition or delay. Without Landlord’s prior consent, Tenant shall be entitled to make cosmetic, non-structural Alterations to the Premises which (i) do not constitute Major Alterations; (ii) do not reduce the overall quality of the leasehold improvements in the Premises; and (iii) do not exceed, either singularly or in the aggregate, more than One Hundred Thousand and No/100 Dollars ($100,000.00) in any twelve (12) month period (collectively, a “Permitted Change”). Along with any request for Landlord’s consent, Tenant will deliver to Landlord plans and specifications, to the extent applicable, for the Alterations and names and addresses of all prospective contractors for the Alterations. If Landlord approves the proposed Alterations, Tenant will, before commencing the Alterations or delivering (or accepting delivery of) any materials to be used in connection with the Alterations, deliver to Landlord certificates evidencing the insurance coverages and copies of any bonds required by Section 8.2, copies of all necessary permits and licenses, and such other information relating to the Alterations as Landlord reasonably requests. Tenant will not commence the Alterations before Landlord has, in Landlord’s reasonable discretion, provided Landlord’s written approval of the foregoing deliveries. In any event, Landlord shall deliver its written approval or disapproval of any requested Alterations not later than ten (10) days after Tenant has provided all necessary information required in accordance with the immediately preceding sentence, and if Landlord fails to approve or disapprove said requested Alterations within said ten (10) day period, Tenant may provide a second notice requesting approval, and if Landlord fails to approve or disapprove of the requested Alterations or Major Alterations within five (5) days following receipt of such second notice, Landlord shall be deemed to have granted its approval to the same. Except for any Permitted Change, Tenant, at its sole cost and expense, will remove any Alterations Tenant constructs without obtaining Landlord’s approval as provided in this Article 8 within thirty (30) days after Landlord’s written request and will thereafter fully and promptly repair and restore the Premises and Property to its previous condition. No approval or inspection of Alterations by Landlord constitutes any representation or agreement by Landlord that the Alterations comply with sound architectural or engineering practices or with all applicable Laws, and Tenant is solely responsible for ensuring such compliance.

8.2 Tenant Responsible for Cost and Insurance. Tenant will pay the entire cost and expense of all Alterations, including, without limitation, for any painting, restoring or repairing of the Premises or the Property necessitated by the Alterations and reasonable third party out-of-pocket charges incurred by Landlord for review, inspection and engineering time. Tenant will also obtain and/or require: (a) if the Alterations in question cost in the aggregate more than Three Hundred Thousand and No/100 Dollars ($300,000.00) payment and performance bonds in an amount not less than the full cost of the Alterations; (b) builder’s “all risk” insurance in an amount at least equal to the replacement value of

15

the Alterations; and (c) liability insurance insuring Tenant and each of Tenant’s contractors against construction related risks in at least the form, amounts and coverages required of Tenant under Article 10. The insurance policies described in clauses (b) and (c) of this Section must name Landlord, Landlord’s lender (if any) and Property Manager as additional insureds, specifically including completed operations.

8.3 Construction Obligations; Ownership of Alterations. Tenant will notify Landlord in writing thirty (30) days prior to commencing any Alterations in order to provide Landlord the opportunity to record and post notices of non-responsibility or such other protective notices available to Landlord under the Laws. Tenant will cause all Alterations to be constructed (a) promptly by contractors in a good and workmanlike manner, and if any Alterations constitute Major Alterations, by contractors approved by Landlord; (b) in compliance with all Laws; (c) in a manner that will minimize interference with other tenants’ use and enjoyment of the Property; and (d) in full compliance with all of Landlord’s reasonable rules and regulations applicable to third party contractors, subcontractors and suppliers performing work at the Property, provided Landlord has previously delivered such rules and regulations to Tenant. Landlord may inspect construction of the Alterations. All Alterations (including all telephone, computer, security and other wiring and cabling located within the walls of and outside the Premises, but excluding Tenant’s Personal Property) become the property of Landlord and a part of the Building immediately upon installation. Tenant will surrender the Alterations to Landlord upon the expiration or earlier termination of this Lease at no cost to Landlord, but Tenant is obligated to remove the “boom room” from the Property and to restore the area in which the boom room was located to shell condition.