Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Delta Tucker Holdings, Inc. | d330949d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED BY THE COMPANIES ON APRIL 9, 2012 - Delta Tucker Holdings, Inc. | d330949dex991.htm |

April 9, 2012

Delta Tucker Holdings, Inc.

Parent of DynCorp International, Inc.

4th Quarter 2011 Final Earnings

Presentation

Exhibit 99.2 |

Page 2

April 9, 2012

Forward-Looking Statements and Non-GAAP Measures

This presentation includes forward-looking statements about Company’s future

business and financial performance, plans, goals, beliefs, or

expectations. All of these forward-looking statements are based on estimates and assumptions made by

the Company’s management that, although believed by the Company to be

reasonable, are inherently uncertain. Forward- looking statements involve

risks and uncertainties, including, but not limited to, our substantial level of indebtedness; the

outcome of any litigation, government investigation, audit or other regulatory

matters; award fee determination; termination or modification of key

contracts; changes in the demand for services; acts of war or terrorist activities; changes

in significant operating expenses; and other economic, competitive, governmental,

political and technological factors outside of the Company’s

control. These risks and uncertainties may cause the Company’s business, strategy or actual

results or events to differ materially from the statements made herein.

All

forward

looking

statements

included

in

this

presentation

are

based

upon

information

presently

available.

DynCorp

International undertakes no obligation to update or revise any forward-looking

statement it makes to reflect events or circumstances after the date of this

presentation or to reflect the occurrence of unanticipated events. The risks and

uncertainties relating to the forward-looking statements in this presentation

include those described under the caption “Risk

Factors”

and

“Forward-Looking

Statements”

detailed

from

time

to

time

in

our

reports

filed

with

the

SEC.

This presentation includes non-GAAP financial measures, including Adjusted

EBITDA, that are different from financial measures

calculated

in

accordance

with

GAAP

and

may

be

different

from

non-GAAP

calculations

made

by

other

companies. Management believes these non-GAAP financial measures are useful in

evaluating operating performance and are regularly used by investors, lenders

and other interested parties in reviewing the Company. For a reconciliation of these

non-GAAP financial measures to the most comparable GAAP financial measures, see

the earnings press release dated April 9,

2012 filed with the SEC on Current Report on Form 8-K and posted on our

website. |

Page 3

April 9, 2012

DI Year in Review

2011 Initiatives Made an Impact

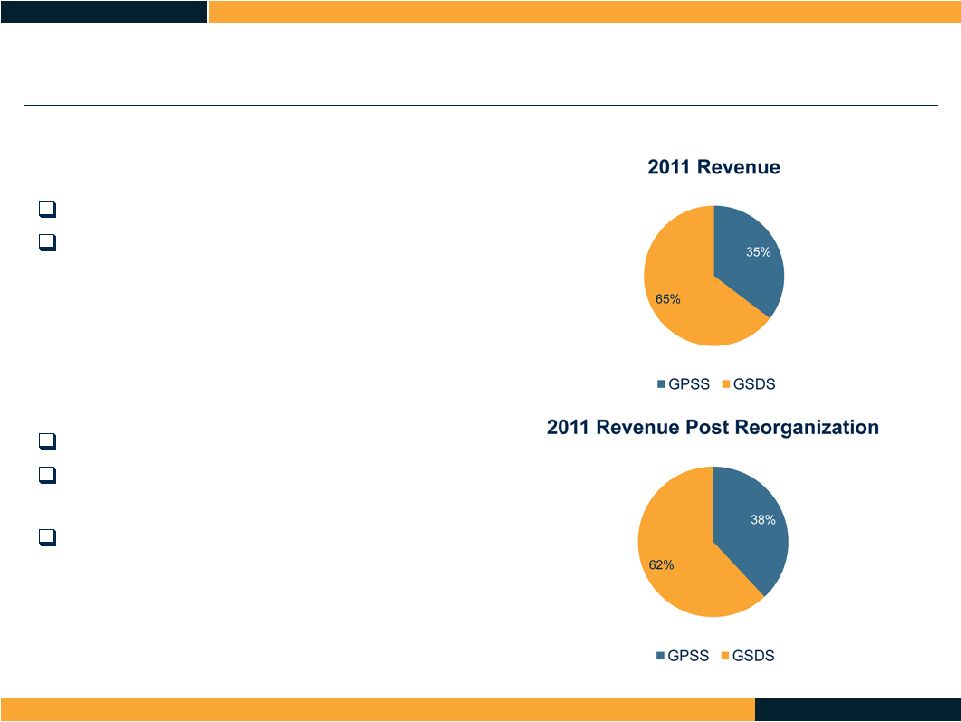

Reorganized Business & COEs

Win Rate Above 40% / Booked Over $5.1B of Orders

Stood Up a Supply Chain Organization

Leveraged $75M in Annual Savings

Implemented a Working Capital Improvement Plan

DSO Improves 13 Days from 2010 Levels

Focused on Leadership

Developed and Aligned the Team

Achieved Solid Financial Performance

Revenue of $3.7B –

Up 9.9% From 2010 Levels

Recorded $193.6M in Adjusted EBITDA –

Margins at 5.2%

Reduced Term Loan by $151M |

Page 4

April 9, 2012

Area of Concern

Priority Actions

Status

Comments

Business

Development

Redesign

•

Develop Marketing Department

•

Enhance Capture Process

•

Align Pricing Function

Redesigned Business Development Function

Created Marketing Function

Increased Funnel by $6.2 Billion (38% Increase)

Business System

Redesign

•

Leverage Company spend

•

Strategize Terms and Conditions (T/Cs)

•

Develop Strategic Discriminator

Prior Corrective Action Plans Scrubbed

Enhanced Focus on Business Systems

Launched 3-Phase Business System Remediation Plan

Cost Structure

•

Delayer

•

Develop Market Focus

•

Optimize Business Processes

De-layered: Introduced Business Area Teams (“BAT”) and

Centers of Excellence (“COE”)

Supply Chain

Redesign

•

Identify the Right Leaders

•

Develop Second and Third Tier

Leaders to Support Growth

Organization Redesign Completed

Spend Analysis Underway

Master Service Agreements Being Developed

Compliance

•

Identify and Develop Brand Identity

•

Educate External Audiences (Media,

Administration, Congress, Customers,

Partners, Oversight, decision Makers

and Opinion leaders)

Formalized Investigation and Adjudication Process

Code of Ethics and Business Conduct Rollout

Compliance Newsletter

Re-vamped Training

Leadership

Development

•

Who Are We Training?

•

When Do We Reach Them?

•

With What Information?

Talent Review Conducted

New Organization Formed

Training Framework Defined; Courses in Development

Brand and

Communications

•

Focus on Employees

•

Build a Foundation of Public

Understanding

•

Take a Strategic Approach to Proactive

Communications

Launched Advertising and Online Reputation

Management Campaigns

Launched Employee Spotlight for Internal/External Use

Increased Proactive Outreach Around BAT Teams

2011 Critical Action Plan -

Status |

Page 5

April 9, 2012

CEO View on 2012

Environment Remains Uncertain

The U.S. Afghan Strategy Under a Microscope

Middle East Remains Unstable

U.S. Presidential Election

2012 DoD Budget Still Robust

2012 O&M Budget at $197B

Continue to Make Progress on Strategic Initiatives

Large IDIQs

Diversify Offering

Focus on Program and Operational Excellence

LOGCAP Award Fee Scores

Reorganized into Strategic Groups to Fit the Changing Environment

|

Page 6

April 9, 2012

2012 New Business Construct –

Strategic Groups

GPSS:

Aviation Group –

Aviation BAT, Air Ops BAT

Global Logistics & Development Solutions

Group –

Development, O&M and

Contingency Operations BATs (excluding

LOGCAP IV)

GSDS:

Security Services Group –

Security BAT

Training & Intelligence Group –

T&M BAT,

Intelligence Training & Solutions BAT

LOGCAP IV program –

Standalone Group

to Optimize Management, Oversight and

Performance of the Program |

Page 7

April 9, 2012

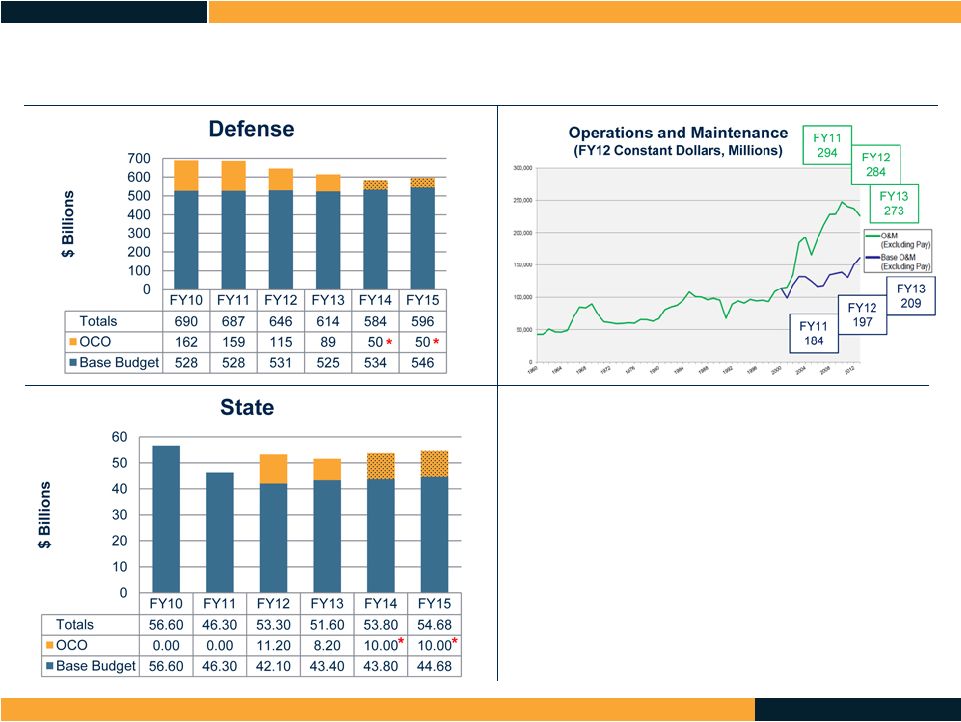

Big Drivers in U.S. Defense and Foreign Policy

Budget Season

Sequester would “Automatically

hollow out the force!”

Secretary Leon Panetta

FY12 DOD Enacted

•

$646B

FY13 DOD Request

•

$613.9B

FY13 DOD Budget

Winners/Losers

•

FY13 Modernization cut 53%

•

O&M Base --

$209B (+$11.7B)

FY12 State Enacted

•

$54B

FY13 State Request

•

$51.6B

FY13 State Winners/Losers

•

Topline down $2.4B

•

OCO --

up in Afghanistan,

down in Iraq

•

State funding is Obama

priority

Sequester

•

“Goofy!”

Secretary Panetta

Derailing the Strategy?

•

Green on Blue

•

Quran Burning

•

Civilian Shootings

Transition to Afghan Lead

•

Advisory teams embedded

Afghan Security Forces

Strategy

State Department Transition

•

“Early phases of military-to-

civilian transition”

•

Embassy branches in

Kandahar, Mazar-i-Sharif,

Herat, and Jalalabad

Long Term Presence

•

Strategic Partnership

•

De-scope vs. MILCON

•

Special Operations lead

Afghanistan: Transition

not Withdrawal

“Our forces will still be

fighting on the ground,

before, during and after

2014.”

Ambassador Neumann

War with Iran

“We will take every step available

to prevent Iran from obtaining a

nuclear weapon.”

President

Barack Obama

“Zone of Immunity”

•

Israeli strike?

•

“Iran will have nuclear

capability of a dozen

weapons within 60 months.”

General Barry McCaffrey

Iranian Military Capable

•

Submarines

•

Modern missile boats

•

Capable of significant damage

to Saudi and GCC oil shipping

and production

Worldwide Economic Impact

•

Iran

is

4

th

largest

oil

producer

•

Massive oil market disruptions

Policy Options

•

Acquiescence

•

Diplomacy.

•

Containment / Deterrence

/SPECOPS

•

Military Action

Interesting Times

“The United States should lead

an international effort to protect

key population centers in Syria.”

Senator John McCain

Syrian Crisis

•

Civil War

Pakistan

•

Secret cable warns about

havens

Iraq

•

Stabilizing or not?

African Contingency

•

Washington Post:

“Constellation of

secret bases”

Latin American Drug Wars

•

Mexico: Merida Initiative

•

Central America Security

Initiative

•

Caribbean Basin Security

Initiative

Pivot to Asia

•

Philippine Base Access

•

Australia hosts American

troops |

Page 8

April 9, 2012

2013 Budget Request Outlook

•

OCO Declines as Wars Wind Down

•

Base Requirement Continues

•

O&M Base Adjusting –

Big

Requirement Moving Forward

•

Fundamental Shift in how DoS Funds

Global Demands |

Page 9

April 9, 2012

Strategy to Market Alignment

Cut Procurement & RDT&E Funding

Reduce Force Structure

Increase O&M Funding

Enterprise IDIQs

MRAP Sustainment and Support $2B+

Aviation Field Maintenance (AFM) $2B+

CNTPO $3B+

Eagle (Follow on to First) IDIQ $30B

DI Strategies and Actions

Arab Awakening

GCC Customers Spending

Increased Opportunity in Africa

Spending + Central/South America

Established KSA Office

U.K. Opportunities

LOGCAP Africa

ARAVI Win

Egypt PSS Win

DI Strategies and Actions

Region Rife with Tension

U.S. Repositioning Forces

Maritime & Aviation Focus

Increased SOCOM Activity

Partnering for Australian Opportunities

Expand in the Philippines

Align with U.S. Asia/Pacific BOS Expansion

DI Strategies and Actions

Market Dynamics / Customer Actions

Market Dynamics / Geopolitics

Market Dynamics / Pivot to Asia |

Page 10

April 9, 2012

Financial Review |

Page 11

April 9, 2012

Full Year Highlights

Revenue

LOGCAP IV

INL Air Wing

CSTC-A, AMDP

CNTPO, CFT Aviation

CivPol Afghanistan and Iraq

Program Losses-APK Somalia,

LCCS

Adjusted EBITDA

LOGCAP IV Volume

INL Air Wing

CFT Margins

CNTPO

Aviation New Contracts

CivPol Volume & Mix

MRAP Lower Profitability

Program Losses

GLS (JV) Lower Troop Levels in Iraq

Dollars in millions

Q4 2011

CY 2011

2011 vs. 2010

Revenue

$983.0

$3,721.5

$334.4

9.9%*

Adjusted EBITDA

$41.4

$193.6

($26.2)

(11.9%)

Adjusted EBITDA Margin

4.2%

5.2%

(129 bps)

Total Backlog

$5,741

$959

20.1%

2011 Results

*excluding GLS revenue in 2010 |

Page 12

April 9, 2012

Global Stabilization and Development Solutions

Adjusted EBITDA

Training and Mentoring –

CSTC-A, AMDP, CivPol

Security Services

Contingency Operations –

LOGCAP IV AF Score

Total Backlog

LOGCAP IV, Security Services, ITS

CivPol, CSTC-A, Development, APK, MNSTC-I

Dollars in millions

Revenue

Contingency Operations –

LOGCAP IV, AFRICAP

Training and Mentoring –

AMDP, CSTC-A

Security Services –

WPS

CivPol

Q4 2011

CY 2011

2011 vs. 2010

Revenue

$638.8

$2,402.1

$315.3

15.1%

Adjusted EBITDA

$12.5

$77.2

($22.3)

(22.4%)

Adjusted EBITDA

Margin

2.0%

3.2%

(155 bps)

Total Backlog

$2,940

$184

6.7%

4Q-Highlights |

Page 13

April 9, 2012

Global Platform Support Solutions

Total Backlog

CFT, Andrews, C21, Pax River, International

INL Air Wing, Columbus, Sheppard

Dollars in millions

Revenue

Air Operations –

INL Air Wing

Aviation –

CFT, VIPSAM, CNTPO,

Ft. Campbell, Pax River

O&M-MRAP Programs

Aviation –

LCCS Loss

Adjusted EBITDA

Air Operations –

INL Air Wing

Aviation –

CNTPO Volume, CFT Margins,

VIPSAM, Pax River

O&M –

MRAP –

Lower Profit on New Contract

Aviation –

LCCS Loss

4Q-Highlights

Q4 2011

CY 2011

2011 vs. 2010

Revenue

$349.4

$1,313.6

$17.5

1.3%

Adjusted EBITDA

$30.0

$104.8

$5.7

5.8%

Adjusted EBITDA

Margin

8.6%

8.0%

(33 bps)

Total Backlog

$2,801

$775

38.3% |

Page 14

April 9, 2012

EBITDA Down on Lower Troop Levels in Iraq

Represents DI’s 51% Share of Joint Venture

Investment in GLS Written Down in 3Q

Dollars in millions

Global Linguist Solutions Joint Venture (GLS)

Q4 2011

CY 2011

2011 vs. 2010

Adjusted EBITDA

$0.0

$11.8

($8.4)

(41.5%) |

Page 15

April 9, 2012

2011 Free Cash Flow of $163.1M

Cash From Operating Activities –

$168M

Purchase of Property, Equipment and Software –

($4.9M)

Working Capital of $376M –

10.1%

Improved Substantially from Q3 levels of 11.5%

DSO at 69 –

Improved 7 Days from Q3 & 13 Days from 2010

Current Net Debt Position of $802.7M

Improved $83.4M from Q3 2011

Improved $169.0M from December 2010

Net Cash Position of $70.2M at December 2011

$151.3M of Total Debt Reduction in 2011

Financial Review –

CY11 |

Page 16

April 9, 2012

Internal Plan Forecasts Growth

Revenue Growth Expected in Mid-Single Digit Range

Adjusted EBITDA to Grow as Well

Margins to Remain Flat

Profitability & Margins to Expand in Aviation Group

Final Year of Headwind from CivPol / AMDP Transition

Loss of GLS Profitability in Iraq also a Headwind

Cash Flows to Remain Strong

Continued Liquidation of Investment in Working Capital

2012 Guidance |

Page 17

April 9, 2012

CEO Summary

Proud of the Team’s Accomplishments In 2011

Foreign Policy Environment Remains Uncertain

Reorganized the Business to Align with New Realities

Strong Backlog Provides Momentum for 2012

Must Focus On Program and Operational Excellence

Increase LOGCAP Award fee Scores

Continue to Execute our Strategies

Enterprise IDIQs

Diversify Our Offering

Continue the Momentum

Make Our Commitments in 2012 |

Page 18

April 9, 2012

Q&A |

Page 19

April 9, 2012

Appendix |

Page 20

April 9, 2012

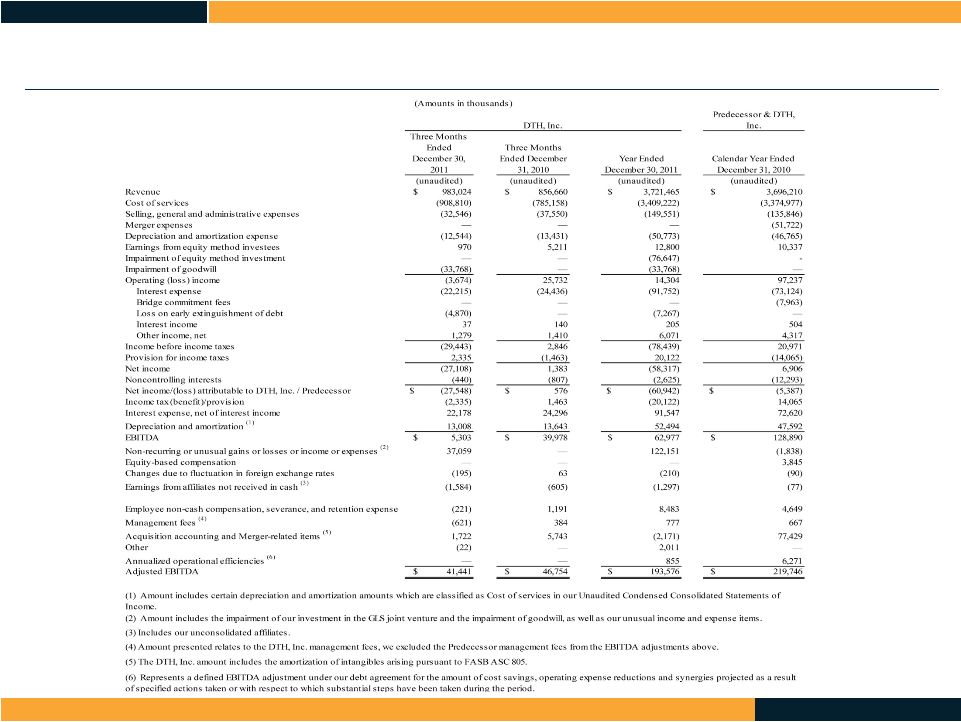

Condensed Consolidated Statement of Operations |

Page 21

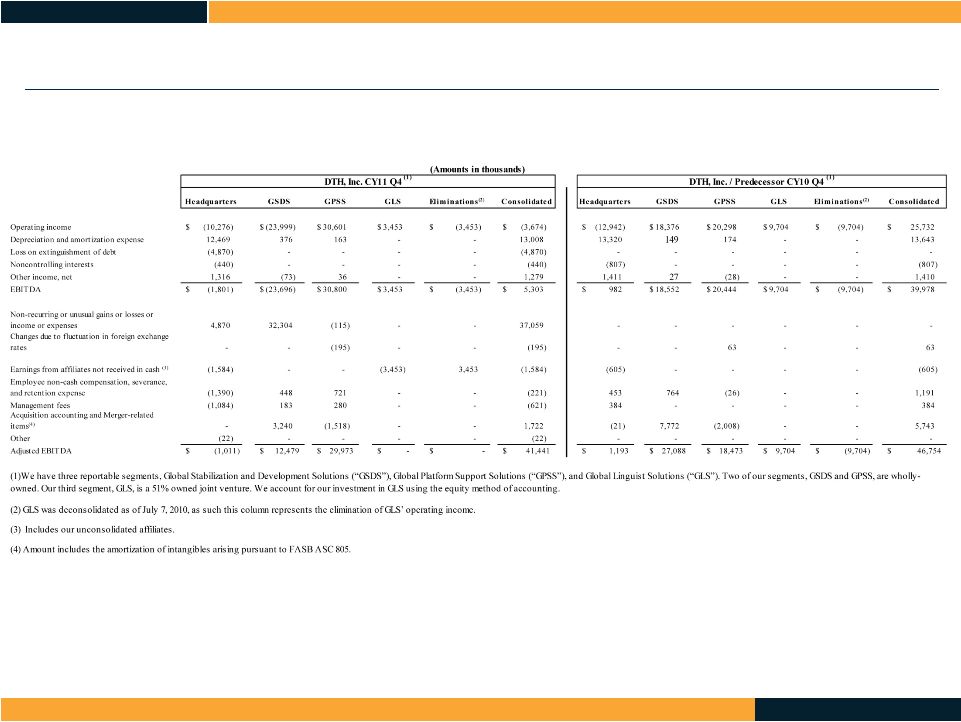

April 9, 2012

Adjusted EBITDA by Segment |

Page 22

April 9, 2012

Condensed Consolidated Balance Sheets

December 30, 2011

December 31, 2010

(unaudited)

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

70,205

$

52,537

$

Restricted cash

10,773

9,342

Accounts receivable, net of allowances of $1,947 and $558,

respectively 752,756

782,095

Other current assets

88,877

150,613

Total current assets

922,611

994,587

Non-current assets

1,091,810

1,268,768

Total assets

2,014,421

$

2,263,355

$

LIABILITIES AND EQUITY

Current portion of long-term debt

-

$

5,700

$

Other current liabilities

633,259

639,172

Total current liabilities

633,259

644,872

Long-term debt, less current portion

872,909

1,018,512

Other long-term liabilities

50,768

82,645

Total equity attributable to Delta Tucker Holdings, Inc.

452,299

512,975

Noncontrolling interest

5,186

4,351

Total equity

457,485

517,326

Total liabilities and equity

2,014,421

$

2,263,355

$

(Amounts in thousands)

|