Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - COVER ALL TECHNOLOGIES INC | Financial_Report.xls |

| EX-31.1 - EX-31.1 - COVER ALL TECHNOLOGIES INC | d29041_ex31-1.htm |

| EX-31.2 - EX-31.2 - COVER ALL TECHNOLOGIES INC | d29041_ex31-2.htm |

| EX-23.1 - EX-23.1 - COVER ALL TECHNOLOGIES INC | d29041_ex23-1.htm |

| EX-32.1 - EX-32.1 - COVER ALL TECHNOLOGIES INC | d29041_ex32-1.htm |

| EX-32.2 - EX-32.2 - COVER ALL TECHNOLOGIES INC | d29041_ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] |

Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended

December 31, 2011.

[ ] |

Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from

______ to ______.

Commission file number 1-09228

COVER-ALL TECHNOLOGIES INC.

(Exact name of Registrant as specified in its

charter)

Delaware (State or other jurisdiction of incorporation or organization) |

13-2698053 (I.R.S. Employer Identification No.) |

|||||

55 Lane

Road, Fairfield, New Jersey (Address of principal executive office) |

07004 (Zip Code) |

|||||

(973) 461-5200

(Registrant’s telephone number, including area code)

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the

Act:

None

None

Securities registered pursuant to Section 12(g) of the

Act:

Common Stock, par value $.01 per share

Common Stock, par value $.01 per share

Indicate by check mark if the

registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes [ ] No [X]

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the

past 90 days. Yes [X] No [ ]

Indicate by check mark whether

the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and

posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if

disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be

contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form

10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of

“larger accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check

one):

Large accelerated

filer [ ] |

Accelerated filer

[ ] |

|||||

Non-accelerated

filer (Do not check if a smaller reporting company) [ ] |

Smaller reporting

company [X] |

|||||

Indicate by check mark whether

the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

Yes [ ] No [X]

The aggregate market value of the voting and non-voting

common equity held by non-affiliates of the registrant as of June 30, 2011, the last business day of the registrant’s most recently completed

second fiscal quarter, was approximately $39,494,000.

As of March 19, 2012, there were 25,782,730 shares

outstanding of our common stock.

Documents Incorporated by Reference:

Portions of the Registrant’s Proxy Statement for the

2012 Annual Meeting of Stockholders (“Proxy Statement”), to be filed with the Securities and Exchange Commission (the “SEC”) not

later than 120 days after the close of the Registrant’s fiscal year, are incorporated by reference as described in Part III.

FORWARD-LOOKING STATEMENTS

Certain of the matters discussed

in this annual report on Form 10-K, including, without limitation, matters discussed under Item 1 — “Business”, Item 1A —

“Risk Factors” and Item 7 — “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” may

constitute forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). These forward-looking statements are necessarily subjective and involve known and unknown risks, uncertainties and other important factors

that could cause our actual results, performance or achievements, or industry results, to differ materially from any future results, performance or

achievement described or implied by such statements. Certain of these forward-looking statements can be identified by the use of forward-looking

terminology such as “believes,” “expects,” “may,” “will,” “should,” “seeks,”

“approximately,” “intends,” “plans,” “estimates,” or “anticipates” or the negative of these terms or

other comparable terminology, or by discussions of strategy, objectives, expectations, plans or intentions. Statements contained in this annual report

on Form 10-K that are not historical facts are forward-looking statements. Without limiting the generality of the preceding statement, all statements

in this annual report on Form 10-K concerning or relating to estimated and projected earnings, margins, costs, expenditures, cash flows, growth rates

and financial results are forward-looking statements. In addition, through our senior management, from time to time we make forward-looking statements

concerning our expected future operations and performance and other developments. Such forward-looking statements are necessarily estimates reflecting

our best judgment based upon current information and involve a number of risks and uncertainties. Other factors may affect the accuracy of these

forward-looking statements and our actual results may differ materially from the results anticipated in these forward-looking statements. While it is

impossible to identify all such factors, factors that could cause actual results to differ materially from those estimated by us include, but are not

limited to, those factors or conditions described under Item 1A — “Risk Factors” and Item 7 — “Management’s Discussion

and Analysis of Financial Condition and Results of Operations — Critical Accounting Policies and Estimates” and general conditions in the

economy and capital markets. Except to the extent required by applicable laws and regulations, we undertake no obligations to update any

forward-looking statements to reflect events or circumstances after the date of this annual report on Form 10-K or to reflect the occurrence of

unanticipated events.

PART I |

|||||||||||

ITEM

1. |

BUSINESS |

1 | |||||||||

ITEM

1A. |

RISK

FACTORS |

8 | |||||||||

ITEM

1B. |

UNRESOLVED STAFF COMMENTS |

12 | |||||||||

ITEM

2. |

PROPERTIES |

12 | |||||||||

ITEM

3. |

LEGAL

PROCEEDINGS |

12 | |||||||||

ITEM

4. |

MINE

SAFETY DISCLOSURES |

12 | |||||||||

PART II |

|||||||||||

ITEM

5. |

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

13 | |||||||||

ITEM

6. |

SELECTED FINANCIAL DATA |

16 | |||||||||

ITEM

7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

17 | |||||||||

ITEM

7A. |

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

28 | |||||||||

ITEM

8. |

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA |

28 | |||||||||

ITEM

9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

28 | |||||||||

ITEM

9A. |

CONTROLS AND PROCEDURES |

28 | |||||||||

ITEM

9B. |

OTHER

INFORMATION |

29 | |||||||||

PART III |

|||||||||||

ITEM

10. |

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

30 | |||||||||

ITEM

11. |

EXECUTIVE COMPENSATION |

31 | |||||||||

ITEM

12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

31 | |||||||||

ITEM

13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

31 | |||||||||

ITEM

14. |

PRINCIPAL ACCOUNTING FEES AND SERVICES |

31 | |||||||||

PART IV |

|||||||||||

ITEM

15. |

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES |

32 | |||||||||

i

PART I

ITEM

1. |

BUSINESS |

In this annual report on Form

10-K, “Cover-All,” “the Registrant,” “the Company,” “our Company,” “we,” “us” and

“our” refer to Cover-All Technologies Inc. and its wholly-owned subsidiary, Cover-All Systems, Inc. Cover-All®, My Insurance CenterTM (MIC) NexGen and Insurance Policy DatabaseTM (IPD) are trademarks of Cover-All Technologies Inc.

GENERAL

We provide advanced,

cost-effective business-focused solutions to the property and casualty insurance industry. Our customers include insurance companies, agents, brokers

and managing general agents (MGAs). Our proprietary technology solutions and services are designed to enable our customers to introduce new products

quickly, expand their distribution channels, reduce costs and improve service to their customers. In addition, we also offer an innovative Business

Intelligence suite of products to enable our customers to leverage their information assets for real time business insights and for better risk

selection, pricing and financial reporting.

In December 2011, we expanded our

portfolio of insurance solutions by acquiring the assets of a leading claims solution provider, BlueWave Technology. The acquisition of claims software

marked another milestone in our goal of becoming a leading full solution provider to the property and casualty insurance industry.

Our software products and

services focus on the functions required to underwrite, rate, quote, issue, print, bill and support the entire lifecycle of insurance policies and with

the BlueWave acquisition, the important claims functions. Our products and services combine an in-depth knowledge of property and casualty insurance

with an innovative and proprietary state-of-the-art technology platform. Our products provide advanced insurance functionality available on an

“off-the-shelf” basis yet also provide additional flexibility for accommodating a high degree of customization for our customers to compete

in the marketplace through differentiation. Our software is licensed for use in the customer’s data centers or can be provided through our

application services provider, referred to as “ASP,” using third party technology platforms and support.

We generate revenue from software

contract licenses, professional services fees from ongoing software customization and continuing maintenance fees for technical and regulatory software

updates on a monthly basis. We provide a wide range of professional services that support product customizations, conversion from existing systems,

data integration with other software or reporting agencies and other technical services. We also offer ongoing support services including incorporating

recent insurance rates, rules and forms changes. These support services provide turnkey solutions to our customers as we perform analysis, development,

quality assurance, documentation and distribution for delivering changes in a timely fashion.

Our ongoing maintenance and

support services, usually through five-year minimum customer contracts, typically generate significant recurring revenue of approximately 25 to 30

cents for every dollar spent on licensing fees.

We were incorporated in Delaware

in April 1985 as Warner Computer Systems, Inc. and changed our name to Warner Insurance Services, Inc. in March 1992. In June 1996, we changed our name

to Cover-All Technologies Inc. Our products and services are offered through our wholly-owned subsidiary, Cover-All Systems, Inc., also a Delaware

corporation.

PRODUCTS

My Insurance

Center

Our My Insurance Center, referred

to as “MIC,” is a customizable and configurable web-based, data-centric “hub and spoke” software platform built around a shared

“information hub” and suite of product components. MIC is designed for insurance agents, brokers and carriers with integrated workflows and

access to real-time information. By centralizing the data in the MIC platform and using customized components to enable processes, we can quickly build

a unique solution for each customer.

1

My Insurance Center is designed

to efficiently and rapidly adapt to changes in our customer’s business needs as well as to address the complexity and rate of change of the

insurance business, state regulation and technology innovation. The MIC architecture concept was originally introduced in 2001 and it has been

significantly enhanced and expanded every year since. The early implementations of My Insurance Center utilized our then-existing rating and issuance

products. In 2009, we announced MIC NexGen, a set of capabilities designed and built to support the entire policy issuance process to add significant

functionality, enhance performance and position Cover-All to introduce new service offerings.

Our My Insurance Center NexGen

component is a powerful set of tools and capabilities providing full policy support (data capture, rate, quote, issue, statistical reporting, print,

audits and complete policy lifecycle management) for customized products that we believe is unparalleled in the insurance industry. We have also

developed a set of processes and tools that enable us to work together with our customers in an interactive development process that, when combined

with our off-shore development resources, deliver these products in short time frames.

In addition to our ability to

create and support custom products, we offer off-the-shelf products including full support for such complex products as ISO’s (Insurance Services

Office) Commercial Automobile and Commercial Package products for all states as well as full support for Workers Compensation. Some of these new

products have been developed and released in 2010. With the delivery of the NexGen products, we have completely replaced all our older platforms,

collectively known as Classic, with new, fully integrated state-of-the-art technologies.

These NexGen products have been

redesigned by us to enable us to provide services to our customers that can be measured in terms of quality, speed and value. In addition, we are able

to provide a significant number of capabilities to our customers to enable them to customize, personalize and control their My Insurance Center

platform in real time.

MIC is designed to be the

platform to serve players throughout the entire insurance value chain, including the insured, agents, brokers, insurance companies and reinsurers.

Because it is scalable, MIC is able to serve both large and small organizations. MIC can be accessed securely over the Internet. MIC is designed to be

deployed globally in the future to adapt to different languages and currencies and to support different insurance products in other

countries.

MIC provides an integrated

platform with baseline common insurance functions that can be customized by us for customers’ business needs. MIC also provides many configuration

capabilities that are used by customers for further tailoring the application. Finally, MIC allows end users to personalize screens and content for

meeting their roles and responsibilities.

MIC is designed to fully support

STP (Straight-Through-Processing). MIC enables our customers to utilize our rating, policy issuance, billing and other software components into a

fully-integrated platform that, among other things, eliminates redundant data entry. Information is stored in a client-centric database and becomes

immediately available to other users or functions. MIC may be customized to generate user alerts when a user-specified condition occurs. Additionally,

MIC has been designed to allow the customer to configure features according to their own look and feel preferences and workflow processes. For

instance, the browser-based user interface allows employees, agents and other end users to personalize their desktops so they see only the information

they need or desire. We believe that MIC allows our customers to reduce costs, leverage the latest technologies, better manage risk, provide better

service to their customers, enter new markets, introduce new products and grow premiums.

We are investing in research and

development for evolving the MIC platform to meet customers’ business needs in a rapidly changing marketplace. We have added new and advanced

capabilities to MIC, such as our NexGen policy administration platform, workflow management, rules-based underwriting, financial modules for

determining profitability by policy, account-centric and policy-centric views, integration with partners’ accounting, claims processing systems

and certain other new components. With these new capabilities, MIC enables us to develop complex and custom products in shorter timeframes for

introducing new insurance products into the marketplace.

My Insurance Center utilizes a

data-centric architecture which enables us to provide our customers with an integrated solution of shared information. When combined with the

straight-through processing and information access tools, My Insurance Center provides outstanding access to information for business leaders. In

addition, this data centric approach enables us to interface with external data sources and other internal systems very effectively.

Access to accurate and timely

information can be a significant competitive advantage for better pricing, risk selection and service. With this access to information, our customers

can develop insights and tools to create competitive

2

advantage. The nimbleness of My Insurance Center can then be leveraged to open new markets, develop new products, or implement new predictive modeling tools to improve underwriting.

In order to exploit these information-driven opportunities, in April 2010 we

purchased certain assets of Moore Stephens Business Solutions LLC (“MSBS”), a provider of custom business intelligence solutions for the property and

casualty insurance industry. While creating custom business intelligence solutions for a number of insurance clients, MSBS had developed a template for

new customers that created a starting point for new implementations. Utilizing our experience in creating customizable, out-of-the-box products, we

developed a new product that, while utilizing some of the design concepts of MSBS, is both fully integrated with MIC and a stand-alone product with interfaces

to other policy administration, claims and reinsurance systems. We expect that this new product will be sold as an additional component to MIC customers

and will “plug in” to their existing MIC, as well as to other customers to interface with their existing infrastructure of systems.

MIC is being made available to

users either for in-house implementation or through our ASP. We also support “Software as a Service” (SaaS) to meet emerging customer

requirements.

MIC offers the following benefits

to our customers:

• |

Straight-Through-Processing — Business acquisition and the processing side of commercial property and casualty insurance is not only complex but it is highly regulated and spans across multiple constituents in the value chain. Straight-Through-Processing helps customers to reduce expenses, provide faster service times and obtain a higher degree of compliance. MIC provides Straight-Through-Processing through browser-based accessibility, roles-based security, rules-based underwriting, advanced workflow referrals and comprehensive insurance processing functions such as rating, issuance, printing and statistical coding. |

• |

Speed To Market — In a highly competitive insurance marketplace, insurers seek to maintain competitive advantage and high profit margins through innovation and introduction of new insurance products. The information-hub architecture of MIC enables development of complex and custom products in rapid timeframes. |

• |

Regulatory Compliance — In highly state regulated insurance industry, compliance requires frequent software updates and audit capabilities. MIC provides regulatory updates, which are delivered on a monthly basis through our support services. |

• |

Security — MIC provides roles-based security with fine-grained access control, and encryption with data auditing helps enterprise data centers meet their security requirements. |

• |

Configurability — MIC provides a wide scope of customization to allow MIC to meet customers’ business and operational needs while taking advantage of its baseline common capabilities for achieving cost-effective and rapid implementation. |

• |

Integration — MIC provides real-time integration with audit logs for seamlessly integrating MIC with other systems in our customers’ technical ecosystem. |

• |

Openness and Scalability — MIC is based on open technologies such as J2EE, XML, Oracle and Web 2.0 (AJAX, GWT) through which we can deliver technological changes. MIC is designed to scale “horizontally” without adding significant cost to meet customers’ growing business needs. |

MIC NexGen — The Policy

Administration Component of MIC

The MIC NexGen software uses a

unique design that separates the “insurance product definition” from the actual technology “engines.” The sophistication of this

design is intended to enable us to stay current with technology innovations while preserving our “insurance knowledge” investment. In

addition, by centralizing many of the complexities of insurance in the core (similar to a video game console), we are able to create metadata-driven

“cartridges” that define the actual insurance product (rates, rules, forms, etc.) very quickly. In addition, MIC NexGen is designed for

change and flexibility.

The MIC NexGen software and

products support the following policy functions:

• |

Data capture and editing |

• |

Rating |

• |

Policy issuance including multiple recipient print |

• |

All policy transactions including quotes, new lines, endorsements, renewals, audits and cancellations |

• |

Statistical coding |

• |

Full Policy Print (with variable data) |

3

• |

Audits |

• |

Out of Sequence Processing |

• |

Full Policy Life Cycle support |

• |

Installments |

MIC NexGen is designed to

accommodate all lines of property and casualty insurance. We believe that it is especially effective in coping with the complexity and variability of

commercial lines of insurance.

We believe that this flexibility

of MIC NexGen is a competitive advantage, and we have utilized its capabilities to develop many custom products as well as all state support for

Workers Compensation, ISO Commercial Automobile (delivered in the first quarter of 2011) and ISO Commercial Package (delivered in the second quarter of

2011). The NexGen products have now replaced our earlier MIC Rating & Issuance products that have been in use by our customers for many years.

Today, we offer off-the-shelf support for more than 40 lines of commercial business in all 50 states, the District of Columbia and Puerto

Rico.

Both the older Rating &

Issuance and the new NexGen platform leverage the Engine/Metadata design and are fully integrated with the MIC platform. The innovative design of the

product isolates insurance product knowledge from the application itself in data files, referred to as “Metadata.” We have built an extensive

knowledge base, estimated at more than 100 person-years of effort, in this Metadata that defines the details of virtually hundreds of insurance policy

types and coverages.

The MIC Rating & Insurance

product is in use in over 30 companies.

The new NexGen policy

administration platform of MIC provides the following advanced capabilities:

• |

Dynamic data capture for reducing data entry and different views for brokers and underwriters |

• |

Improved user interface and features for boosting user productivity |

• |

Custom and complex rating algorithm |

• |

Custom or branded document generation capability |

• |

Rapid development of new products and changes in existing products |

• |

Better audit support for compliance checks |

• |

Out of Sequence endorsement processing |

My Insurance Center —

Functional Capabilities

We have, through MIC, a deep

inventory of insurance software components combined with a sophisticated implementation platform. MIC includes the following critical

components:

• |

My Insurance Center Portal |

• |

Enterprise, Customer-centric Oracle database |

• |

Underwriting Tools |

• |

End User access to information in real time — Straight-Through-Processing |

• |

Rating and Issuance |

• |

Full policy lifecycle support |

• |

Clear and comprehensive data collection with extensive real time edits |

• |

Policy history — easy policy changes and useful for activities such as coverage inquiries |

• |

On-line system, screen and field level look-ups |

• |

On-line Commercial Lines Manual Tables and Footnotes |

• |

Easy and direct system navigation |

• |

Standard ISO (Insurance Service Office)/NCCI coverages and rates support |

• |

Company customized coverages and rates support |

• |

Fully automated recipient-driven issuance of insurance policies, worksheets, ID cards, etc., including print preview |

• |

Policy database |

• |

Multiple company/program/state/coverage support |

• |

Templates to reduce data entry time |

4

• |

Advanced Billing Capabilities — integrating with NetSuite |

• |

Claims Repository |

• |

Customer Relationship Management |

• |

Agency and Program Management |

• |

Advanced Administration Tools |

• |

Access to Web Services and Information Providers |

• |

Policy Dashboard — premium and loss information |

• |

Advanced Workflows, Diaries |

• |

Electronic Underwriting files |

• |

Compliance Assist, Help Desk |

• |

Interfaces to “back end” accounting and reporting systems |

• |

Policy-level Premium and Loss Information for profitability tracking/accounting |

• |

Quote, Binder, Policy Lifecycle support |

We continue to utilize and expand

these capabilities to expand and leverage our ability to respond to broadening marketplace and new customer opportunities with solutions that address

the special needs of carriers, managing general agents, agents, brokers and third party providers with both off-the-shelf and custom

solutions.

We are also increasing and

enhancing our services portfolio. We have expanded our professional services with conversion and interface offerings. We developed new rules-based

capabilities to enable us to implement data exchange services that will save our customers time and effort converting to our products or linking our

products to existing systems. We also have developed a “custom” service offering for customers who desire specially-tailored services,

service level agreements and other services that enable them to achieve their business objectives.

We believe that our

business-focused approach allows customers to accelerate their time to market, solve ongoing business challenges and achieve sustainable competitive

advantages during periods of economic uncertainty.

COMPETITION

The computer software and

services industry is highly competitive and rapidly changing, as current competitors expand their product offerings and new companies enter the

marketplace. Because of our extensive base of knowledge in the insurance industry, however, we believe that our products offer customers certain

advantages not available from our competitors. Our customers have access to our extensive experience and software inventory in the area of rating and

policy issuance of commercial lines policies, among the most complex of insurance transactions.

There are a number of larger

companies, including computer software, services and outsourcing companies, consulting firms, computer manufacturers and insurance companies that have

greater financial resources than we have and possess the technological ability to develop software products similar to those we offer. These companies

represent a significant competitive challenge to our business. Very large insurers that internally develop systems similar to ours may or may not

become our major customers for software or services. We compete on the basis of our insurance knowledge, products, service, price, system functionality

and performance and technological advances.

MARKETING

We maintain an in-house sales and

marketing staff. We also utilize outside consultants and other complimentary service providers to market our products. We redesigned our Internet site

and established linkages to portals and other websites. We will continue to expand in 2012 as we focus on the Internet as a valuable source of

information for current and potential customers interested in our products and services. We participate in, display and demonstrate our software

products at industry trade shows. Our consulting staff, business partners and other third parties also generate sales leads. We also communicate with

our existing customers in a variety of ways including an annual Customer Conference.

RESEARCH AND DEVELOPMENT

Our business is characterized by

rapid business and technological change. We believe our success will depend, in part, on our ability to meet the new needs of our customers and the

marketplace as well as continuing to enhance our products

5

based on new technologies. Accordingly, we must maintain ongoing research and development programs to add value to our suite of products, as well as any possible expansion of our product lines.

Our goal with all of our products

and services is to enhance the ease of implementation, functionality, long-term flexibility and the ability to provide improved customer

service.

Research and development expenses

were $617,000, $847,000 and $891,000 for the years ended December 31, 2011, 2010 and 2009, respectively.

INTELLECTUAL PROPERTY

We currently have no patents or

patent applications pending. We rely on a combination of trade secret, copyright and trademark laws, nondisclosure and other contractual agreements and

technical measures to protect our proprietary rights.

BACKLOG

We had no licenses, support

services or professional services backlog of unbilled work of as of December 31, 2011.

MAJOR CUSTOMERS

Our product line is in use in

over 30 companies. For the years ended December 31, 2011, 2010 and 2009, we had three, four and three customers who contributed revenues in excess of

10% of our total revenues for the respective years.

As our business has grown, we

have become less reliant on any one major customer, including three units of Chartis Inc., formerly units of American International Group, Inc.

(“CHARTIS”). For the year ended December 31, 2011, two customers, none of which are units of CHARTIS, generated approximately 19% and 13% of

our revenues, respectively.

A third customer, a unit of

CHARTIS, generated approximately 10%, 11% and 15% of our revenues for the years ended December 31, 2011, 2010 and 2009, respectively. Another customer,

a second unit of CHARTIS, generated approximately 5%, 5% and 12% of our revenue for the years ended December 31, 2011, 2010 and 2009, respectively, and

one other customer, a third unit of CHARTIS, generated approximately 4%, 4% and 6% of our revenue for the years ended December 31, 2011, 2010 and 2009,

respectively. The aggregate percentage of our total revenue generated by the three CHARTIS customers for the years ended December 31, 2011, 2010 and

2009, respectively, is 19%, 20% and 33%.

On March 29, 2012, we received notice from the third, and on March 30, 2012,

we received notice from the second of the CHARTIS units referred to above that each will not renew its respective contractual arrangements, pursuant to which

they were primarily receiving support services, with us when those arrangements expire on September 30, 2012. We have not received any notice of

non-renewal of our contractual arrangements from the first of the CHARTIS units referred to above, and we expect that our contractual arrangements with such

unit will continue upon the same terms and conditions as had been in effect in 2011. For the year ended December 31, 2011, the revenues we generated from

support services for the three units of CHARTIS represented approximately 8%, 4% and 4%, respectively, of our total revenues, and the total revenues we

generated from the three units of CHARTIS represented approximately 10%, 5% and 4%, respectively, of our total revenues.

6

EMPLOYEES

We had 71 employees, all of whom

were full-time employees, as of December 31, 2011. None of our employees is represented by a labor union, and we have not experienced any work

stoppages. We believe that relations with our employees are good.

AVAILABLE INFORMATION

We are subject to the reporting

requirements of the Exchange Act, and the rules and regulations promulgated thereunder, and accordingly file reports, information statements or other

information with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, reports of current events on Form 8-K and proxy or

information statements. The public may read and copy any materials we file with the SEC at its Public Reference Room at 100 F Street, NE, Washington,

D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an

Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the

SEC.

Our website address is

www.cover-all.com. We make available, free of charge, through our website our annual reports on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically

file such material with, or furnish it to, the SEC. The information on our website is not incorporated by reference into this annual report on Form

10-K.

7

ITEM

1A. |

RISK FACTORS |

RISK FACTORS

In addition to the other

information described elsewhere in this annual report on Form 10-K, you should carefully consider the following risk factors, which could materially

adversely affect our business, financial condition and results of operations. The risks described below are not the only risks facing our Company.

Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may materially adversely affect our business,

financial condition and results of operations.

RISKS RELATED TO OUR BUSINESS AND OUR

INDUSTRY

If we do not continue to innovate

and provide products and services that are useful to insurance companies in a cost-effective way, we may not remain competitive, and our revenues and

operating results could suffer.

Our future success depends on our

ability to provide innovative and quality products and services for the insurance marketplace. Because our products and services represent the core

functionality that powers the businesses of our customers, our competitors are constantly developing innovations in similar products and services. As a

result, we must continue to invest significant resources in research and development in order to enhance our existing products and services and

introduce new products and services that insurance companies can easily and effectively use. If we are unsuccessful in these endeavors, we may not

remain competitive, and our revenues and operating results could suffer. Additionally, we rely on our references from existing customers for new sales.

If we are unable to provide quality products and services, then our customers may become dissatisfied and may not provide these references. We also

rely on an offshore software development vendor for developing and servicing our products, and our operating results would suffer if we cannot maintain

our current cost structure through offshore development resources in the future.

We depend on product

introductions in order to remain competitive in our industry.

We are currently investing

resources in product development and expect to continue to do so in the future. Our future success will depend on our ability to continue to enhance

our current product line and to continue to develop and introduce new products that keep pace with competitive product introductions and technological

developments, satisfy diverse and evolving insurance industry requirements and otherwise achieve market acceptance. We may not be successful in

continuing to introduce and market, on a timely and cost-effective basis, product enhancements or new products that respond to technological advances

by others. Any failure by us to anticipate or respond adequately to changes in technology and insurance industry preferences, or any significant delays

in product development or introduction, would significantly and adversely affect our business, operating results and financial

condition.

Our products may not achieve

market acceptance, which may make it difficult for us to compete.

Our future success will depend

upon our ability to increase the number of insurance companies that license our software products. As a result of the intense competition in our

industry and the rapid technological changes which characterize it, our products may not achieve significant market acceptance. Further, insurance

companies are typically characterized by slow decision-making and numerous bureaucratic and institutional obstacles which will make our efforts to

significantly expand our customer base difficult.

We depend on key

personnel.

Our success depends to a

significant extent upon a limited number of members of senior management and other key employees, including John W. Roblin, our Chief Executive

Officer, Manish D. Shah, our President and Chief Technology Officer, and Maryanne Gallagher, our Executive Vice President and Chief Operating Officer.

We maintain “key-man” life insurance on Mr. Roblin, Mr. Shah and Ms. Gallagher in the amount of $1,000,000 per individual. The loss of the

service of one or more key managers or other key employees could have a significant and adverse effect upon our business, operating results or

financial condition. In addition, we believe that our future success will depend in large part upon our ability to attract and retain additional highly

skilled technical, management, sales and marketing personnel. Competition for such personnel in the computer software industry is intense. We may not

be successful in attracting and retaining such personnel, and the failure to do so could have a material adverse effect on our business, operating

results or financial condition.

8

We may be subject to information

technology system failures and network disruptions.

Information technology system

failures, network disruptions and breaches of data security caused by such factors, including, but not limited to, earthquakes, fire, flood, theft,

fraud, malicious attack, acts of terrorism or other causes could disrupt our operations. While we have taken steps to address these concerns by

implementing internal control measures, there can be no assurance that such a system failure, disruption or breach will not materially adversely affect

our financial condition and operating results, including loss of revenue due to adverse customer reaction or required corrective action. In addition,

our property and business interruption insurance coverage may not be adequate to fully compensate us for losses that may occur.

Our market is highly

competitive.

Both the computer software and

the insurance software systems industries are highly competitive. There are a number of larger companies, including computer manufacturers, computer

service and software companies and insurance companies, that have greater financial resources than we have. These companies currently offer and have

the technological ability to develop software products that are core to the business of insurance companies and similar to those offered by us. These

companies present a significant competitive challenge to our business. Because we do not have the same financial resources as these competitors, we may

have a difficult time in the future in competing with these companies. In addition, very large insurers internally develop systems similar to our

systems and as a result, they may not become customers of our software. We compete on the basis of our insurance knowledge, products, service, price,

system functionality and performance and technological advances. Although we believe we can continue to compete on the basis of these factors, some of

our current competitors have longer operating histories, larger customer bases, greater brand recognition and significantly greater financial,

marketing and other resources than we do. Our current competitors may be able to:

• |

undertake more extensive marketing campaigns for their brands and services; |

• |

devote more resources to product development; |

• |

adopt more aggressive pricing policies; and |

• |

make more attractive offers to potential employees and third-party service providers. |

We may need additional financing

in order to continue to develop our business.

We may need additional financing

to continue to fund acquisitions and business development and to expand and grow our business generally. If equity securities are issued in connection

with a financing or business acquisition, dilution to our stockholders may result, and if additional funds are raised through the incurrence of debt,

we may be subject to further restrictions on our operations and finances both in and outside the ordinary course of business. As of December 31, 2011,

we had net stockholders’ equity of approximately $16,921,000 and net working capital of approximately $3,251,000.

We depend upon proprietary

technology and we are subject to the risk of third party claims of infringement.

Our success and ability to

compete depends in part upon our proprietary software technology. We also rely on certain software that we license from others. We rely on a

combination of trade secret, copyright and trademark laws, nondisclosure and other contractual agreements and technical measures to protect our

proprietary rights. We currently have no patents or patent applications pending. Despite our efforts to protect our proprietary rights, unauthorized

parties may attempt to copy aspects of our products or to obtain and use information that we regard as proprietary. The steps we take to protect our

proprietary technology may not prevent misappropriation of our technology, and this protection may not stop competitors from developing products which

function or have features similar to our products.

While we believe that our

products and trademarks do not infringe upon the proprietary rights of third parties, third parties may claim that our products infringe, or may

infringe, upon their proprietary rights. Any infringement claims, with or without merit, could be time-consuming, result in costly litigation and

diversion of technical and management personnel, cause product shipment delays or require us to develop non-infringing technology or enter into royalty

or licensing agreements. Royalty or licensing agreements, if required, may not be available on terms acceptable to us or at all. If a claim of product

infringement against us is successful and we fail or are unable to develop non-infringing technology or license the infringed or similar technology,

our business, operating results and financial condition could be significantly and adversely affected.

9

We depend on existing major

customers, the loss of one or more of which could have a material adverse effect on our results of operations and financial

condition.

We anticipate that our operations will continue to depend upon the continuing

business of our existing customers, particularly our major customers, and the ability to attract new customers. The loss of one or more of our existing

major customers or our inability to continue to attract new customers could significantly and adversely affect our business, operating results and financial

condition.

In 2011, 2010 and 2009, our software products operations depended primarily on

certain existing major customers. Two customers generated approximately 19% and 13% of our revenues in 2011. One additional customer, a unit of

CHARTIS, accounted for approximately 10%, 11% and 15% of our total revenues in 2011, 2010 and 2009, respectively. One other customer, a second unit of

CHARTIS, accounted for approximately 5%, 5% and 12% of our total revenues in 2011, 2010 and 2009, respectively. Another customer, a third unit of CHARTIS,

generated approximately 4%, 4% and 6% of our total revenues for the years ended December 31, 2011, 2010, and 2009, respectively.

NYSE Amex’s listing standards, we may be delisted. In the event of delisting, trading of our common stock would most likely be conducted in the over the counter market on an electronic bulletin board established for unlisted securities, which could have a material adverse effect on the market liquidity and value of our common stock.

significant increase in its accounts receivable in 2009 due to the license sales to new customers offset by non-cash expenses and payment of liabilities.

On March 29, 2012, we received notice from the third, and on March 30, 2012,

we received notice from the second of the CHARTIS units referred to above that each will not renew its respective contractual arrangements, pursuant to which

they were primarily receiving support services, with us when those arrangements expire on September 30, 2012. We have not received any notice of

non-renewal of our contractual arrangements from the first of the CHARTIS units referred to above, and we expect that our contractual arrangements with such

unit will continue upon the same terms and conditions as had been in effect in 2011. For the year ended December 31, 2011, the revenues we generated from

support services for the three units of CHARTIS represented approximately 8%, 4% and 4%, respectively, of our total revenues, and the total revenues we

generated from the three units of CHARTIS represented approximately 10%, 5% and 4%, respectively, of our total revenues. See “Business – Major

Customers”. The impact of the non-renewal by the second and third CHARTIS units of their contractual arrangements would not be realized until the

fourth quarter of 2012, and for that quarter the maximum potential impact to our revenue resulting from any such non-renewal would be approximately $360,000.

A decline in computer software

spending may result in a decrease in our revenues or lower our growth rate.

A decline in the demand for

computer software among our current and prospective customers may result in decreased revenues or a lower growth rate for us because our sales depend,

in part, on our customers’ level of funding for new or additional computer software systems and services. Moreover, demand for our solutions may

be reduced by a decline in overall demand for computer software and services. The current decline in overall technology spending may cause our

customers to reduce or eliminate software and services spending and cause price erosion for our solutions, which would substantially affect our sales

of new software licenses and the average sales price for these licenses. Because of these market and economic conditions, we believe there will

continue to be uncertainty in the level of demand for our products and services. Accordingly, we cannot assure you that we will be able to increase or

maintain our revenues.

We may not get the full benefit

of our tax loss carry forwards.

Under the United States Internal

Revenue Code, companies that have not been operating profitably are allowed to apply certain of their past losses to offset future taxable income

liabilities they may incur once they reach profitability. These amounts are known as net operating tax loss carryforwards. At December 31, 2011, we had

approximately $9 million of federal net operating tax loss carryforwards expiring at various dates through 2026. Because of certain provisions of the

Tax Reform Act of 1986 related to change of control, however, we may not get the full benefit of these loss carryforwards. If we are limited from using

net operating tax loss carryforwards to offset any of our income, this would increase our taxes owed and reduce our cash for

operations.

RISKS RELATED TO OUR COMMON STOCK

If we are unable to maintain the

listing standards of the NYSE Amex, our common stock may be delisted, which may have a material adverse effect on the liquidity and value of our common

stock.

Our common stock is traded on the

NYSE Amex. To maintain our listing on the NYSE Amex, we must meet certain financial and liquidity criteria. The market price of our common stock has

been and may continue to be subject to significant fluctuation as a result of periodic variations in our revenues and results of operations. If we fail

to meet any of the

10

NYSE Amex’s listing standards, we may be delisted. In the event of delisting, trading of our common stock would most likely be conducted in the over the counter market on an electronic bulletin board established for unlisted securities, which could have a material adverse effect on the market liquidity and value of our common stock.

Holders of our common stock may

have difficulty in selling those shares.

While our common shares trade on

the NYSE Amex, our stock is thinly traded and investors may have difficulty in selling their shares. The low trading volume of our common stock is

outside of our control, and may not increase in the near future or, even if it does increase in the future, may not be maintained. In addition, because

our common stock trades at a price less than $5.00 per share, brokers effecting transactions in our common stock may be subject to additional customer

disclosure and record keeping obligations, including disclosure of the risks associated with low price stocks, stock quote information and broker

compensation. Brokers effecting transactions in our common stock may also be subject to additional sales practice requirements under certain Exchange

Act rules, including making inquiries into the suitability of investments for each customer or obtaining a prior written agreement for the specific

stock purchase. Because of these additional obligations, some brokers will not effect transactions in our common stock.

Our stock price has been

volatile.

Quarterly operating results have

fluctuated and are likely to continue to fluctuate. The market price of our common stock has been and may continue to be volatile. Factors that are

difficult to predict, such as quarterly revenues and operating results, limited trading volumes and overall market performance, may have a significant

effect on the price of our common stock. Revenues and operating results have varied considerably in the past from period to period and are likely to

vary considerably in the future. We plan product development and other expenses based on anticipated future revenue. If revenue falls below

expectations, financial performance is likely to be adversely affected because only small portions of expenses vary with revenue. As a result,

quarterly period-to-period comparisons of operating results are not necessarily meaningful and should not be relied upon to predict future

performance.

Provisions of our certificate of

incorporation, as amended, and by-laws and Delaware law might discourage, delay or prevent a change of control of or changes in our management and, as

a result, depress the trading price of our common stock.

Our certificate of incorporation,

as amended (the “Certificate of Incorporation”), and by-laws contain provisions that could discourage, delay or prevent a change in control

or changes in our management that our stockholders may deem advantageous. These provisions:

• |

require super-majority voting to amend some provisions in our Certificate of Incorporation and by-laws; |

• |

establish a staggered board of directors; |

• |

limit the ability of our stockholders to call special meetings of stockholders; |

• |

prohibit stockholder action by written consent, which requires all stockholder actions to be taken at a meeting of our stockholders; |

• |

provide that the board of directors is expressly authorized to make, alter or repeal our by-laws; and |

• |

establish advance notice requirements for nominations for election to our board of directors or for proposing matters that can be acted upon by stockholders at stockholder meetings. |

In addition, we are subject to

Section 203 of the Delaware General Corporation Law, which, subject to some exceptions, prohibits “business combinations” between a Delaware

corporation and an “interested stockholder,” which is generally defined as a stockholder who becomes a beneficial owner of 15% or more of a

Delaware corporation’s voting stock for a three-year period following the date that the stockholder became an interested stockholder. Section 203

could have the effect of delaying, deferring or preventing a change in control that our stockholders might consider to be in their best

interests.

These anti-takeover defenses

could discourage, delay or prevent a transaction involving a change in control. These provisions could also discourage proxy contests and make it more

difficult for you and other stockholders to elect directors of your choosing and cause us to take corporate actions other than those you

desire.

11

We may not pay any cash dividends

on our common stock in the future.

Declaration and payment of any

dividend on our common stock is subject to the discretion of our board of directors. The timing and amount of dividend payments will be dependent upon

factors such as our earnings, financial condition, cash requirements and availability, and restrictions in our credit facilities. While we paid a

special cash dividend in April 2009, the payment of future dividends is not guaranteed or assured. Accordingly, it is likely that investors may have to

rely on sales of their common stock after price appreciation, which may never occur, as the only way to realize any future gains on their

investment.

RISKS RELATED TO ACQUISITIONS

We may fail to realize the

anticipated benefits of the acquisitions of the PipelineClaims assets of Ho’ike Services, Inc. dba BlueWave Technology, and the assets of Moore

Stephens Business Solutions, LLC.

On December 30, 2011, we acquired

substantially all of the PipelineClaims assets (excluding working capital) of Ho’ike Services, Inc. dba BlueWave Technology (“BlueWave”), and on April 12, 2010, we

acquired substantially all of the assets (excluding working capital) of MSBS, in each instance through our wholly-owned subsidiary, Cover-All Systems,

Inc. The success of these acquisitions will depend on, among other things, our ability to realize anticipated benefits, growth opportunities and cost

savings and to integrate the operations of BlueWave and MSBS in a manner that does not materially disrupt our own operations. If we are not able to

successfully achieve these objectives, the anticipated benefits of the acquisition may not be realized fully, or at all, or may take longer to realize

than expected. Further, it is possible that the integration process could result in the disruption of the ongoing business or inconsistencies in

standards, controls, procedures and policies that would adversely affect our business, financial condition or results of operations.

ITEM

1B. |

UNRESOLVED STAFF COMMENTS |

Not applicable.

ITEM

2. |

PROPERTIES |

Our headquarters is located in

Fairfield, New Jersey, where we occupy approximately 20,000 square feet under a lease that expires on October 31, 2012. Currently, we fully utilize

this facility. We believe that our headquarters is well maintained and adequate to meet our needs for the foreseeable future. Based upon the upcoming

expiration of this lease, however, we are currently assessing our operational needs and evaluating our options for remaining at our present location

under a new lease or entering into a new lease at a different location following the end of our current lease. We believe that if we do not remain at

our current location, we could find alternative space and relocate our operations to such new location without any material disruption to our

business.

As a consequence of our

acquisition of MSBS, we also have office space of approximately 6,000 square feet located in mid-town Manhattan under a separate lease which is due to

expire on January 31, 2014. We believe that this office space is also well maintained and will be adequate to meet our needs for the foreseeable

future. In connection with our BlueWave acquisition, we are continuing to use a portion of the premises used by the business prior to the acquisition

located in Honolulu, Hawaii, pursuant to a short-term transitional arrangement between us and Ho’ike Services, Inc. We are currently in the

process of seeking new office space in Honolulu from which we will continue to operate the BlueWave business.

ITEM

3. |

LEGAL PROCEEDINGS |

None.

ITEM

4. |

MINE SAFETY DISCLOSURES |

Not applicable.

12

PART II

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

MARKET PRICE OF AND DIVIDENDS ON COMMON

STOCK

Our common stock has been quoted

on the NYSE Amex under the symbol “COVR” since May 25, 2011. Prior to May 25, 2011, our common stock was quoted on the OTCQB market under the

symbol “COVR.PK” and prior to February 23, 2011, our common stock was quoted on the OTC Bulletin Board under the symbol “COVR.OB”.

The table below sets forth (x) for the periods indicated commencing from and after May 25, 2011, the high and low sales prices for our common stock on

the NYSE Amex and (y) for periods preceding May 25, 2011, the high and low bid prices for our common stock as reported on the OTCQB or OTC Bulletin

Board, as applicable. The quotations below for OTCQB or OTC Bulletin Board, as applicable, bid prices reflect inter-dealer prices, without retail

mark-up, mark-down or commission and may not necessarily represent actual transactions.

| 2011: |

High |

Low |

||||||||

|---|---|---|---|---|---|---|---|---|---|---|

4th

Quarter |

$ | 1.95 | $ | 1.29 | ||||||

3rd

Quarter |

2.69 | 1.75 | ||||||||

2nd

Quarter |

3.37 | 1.90 | ||||||||

1st

Quarter |

2.30 | 1.51 | ||||||||

2010: |

High | Low | ||||||||

4th Quarter |

$ | 1.62 | $ | 1.20 | ||||||

3rd Quarter |

1.45 | 1.17 | ||||||||

2nd Quarter |

1.75 | 1.12 | ||||||||

1st Quarter |

1.49 | 0.94 | ||||||||

As of March 19, 2012, there were

445 holders of record of our common stock. This number does not include beneficial owners who may hold their shares in street name.

No dividends were declared in

2011 or 2010.

The closing sales price for our

common stock on March 19, 2012 was $2.31, as reported by the NYSE Amex.

13

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth,

as of December 31, 2011, information related to our equity compensation plans. All options to acquire our equity securities are exercisable for or

represent the right to purchase our common stock.

| Plan Category |

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) |

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights (b) |

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding Securities Referenced in Column (a)) (c) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Equity

Compensation Plans Approved by Security Holders(1) |

1,777,463 | 1.24 | 2,195,179 | |||||||||||

Equity

Compensation Plans Not Approved by Security Holders |

— | — | — | |||||||||||

Total |

1,777,463 | 1.24 | 2,195,179 | |||||||||||

(1) |

Reflects grants under our Amended and Restated 2005 Stock Incentive Plan. The numbers in the table include the restricted stock granted under our 2005 Stock Incentive Plan. |

14

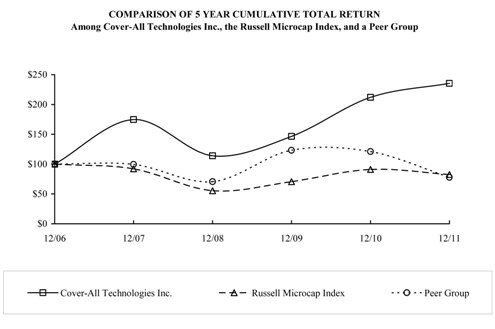

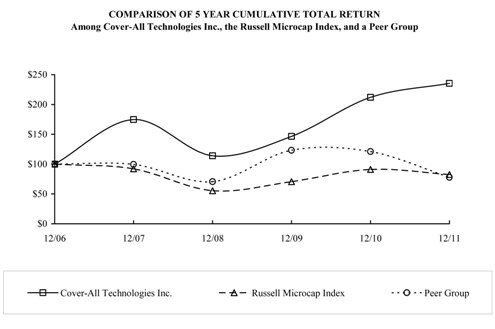

PERFORMANCE GRAPH

The graph below compares the

cumulative total stockholder returns (including reinvestment of dividends) from the period from December 31, 2006 through December 31, 2011 on an

investment of $100 in (i) our common stock, (ii) the Russell Microcap Index (an index of microcap companies), and (iii) an index of peer companies

selected by us (the “Peer Group”), as described below. You should be aware that historical results are not necessarily indicative of future

performance.

We have selected the Russell

Microcap Index for comparative purposes. We believe that, given our current size of operations and market capitalization, the Russell Microcap Index,

which measures the performance of stocks in the microcap segment of the U.S. equity securities market, provides an appropriate benchmark against which

to measure our stock performance.

Our Peer Group consists of

Computer Sciences Corporation, Ebix Inc., Pegasystems Inc. and Sapient Corp.

| December 31, |

|||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

||||||||||||||||||||||

Cover-All

Technologies Inc. |

$ | 100.00 | $ | 174.68 | $ | 113.92 | $ | 146.50 | $ | 211.90 | $ | 235.44 | |||||||||||||||

Russell

Microcap Index |

$ | 100.00 | $ | 92.00 | $ | 55.40 | $ | 70.63 | $ | 91.03 | $ | 82.59 | |||||||||||||||

Peer

Group |

$ | 100.00 | $ | 99.50 | $ | 70.51 | $ | 123.18 | $ | 121.05 | $ | 77.82 | |||||||||||||||

15

ITEM

6. |

SELECTED FINANCIAL DATA |

The following selected historical

consolidated financial information as of December 31, 2011 and 2010, and for each of the years ended December 31, 2011, 2010 and 2009, have been

derived from and should be read in conjunction with our audited consolidated financial statements and related notes thereto and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this annual report on Form 10-K. The selected

historical consolidated financial information as of December 31, 2009, 2008 and 2007 and for the years ended December 31, 2008 and 2007 have been

derived from our audited consolidated financial statements which are not included in this annual report on Form 10-K.

Selected Five-Year Consolidated Financial

Data

The following is a summary of

selected five-year consolidated financial data as of and for the years ended December 31, 2011, 2010, 2009, 2008 and 2007:

| Year ended December 31, |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2011 |

2010 |

2009 |

2008 |

2007 |

|||||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||||||

Statement

of Operations Data: |

|||||||||||||||||||||||

Revenues |

$ | 17,596 | $ | 17,457 | $ | 14,515 | $ | 13,467 | $ | 9,777 | |||||||||||||

Income

before income tax |

1,185 | 2,215 | 3,335 | 2,904 | 1,245 | ||||||||||||||||||

Net income

|

1,185 | 2,952 | (1) | 3,917 | (1) | 4,556 | (2) | 1,231 | |||||||||||||||

Net income

per share — basic |

0.05 | 0.12 | 0.16 | 0.19 | 0.06 | ||||||||||||||||||

Net income

per share — diluted |

0.05 | 0.12 | 0.16 | 0.19 | 0.05 | ||||||||||||||||||

Cash

dividends per share |

$ | — | $ | — | $ | 0.03 | $ | — | $ | — | |||||||||||||

| As of December 31, |

|||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2011 |

2010 |

2009 |

2008 |

2007 |

|||||||||||||||||||

| (in thousands) |

|||||||||||||||||||||||

Balance

Sheet Data: |

|||||||||||||||||||||||

Cash and cash

equivalents |

$ | 3,282 | $ | 5,893 | $ | 4,324 | $ | 4,686 | $ | 11 | |||||||||||||

Working

capital |

3,251 | 5,013 | 7,232 | 4,806 | 545 | ||||||||||||||||||

Total

assets |

20,458 | 19,513 | 14,999 | 11,039 | 5,864 | ||||||||||||||||||

Short-term

debt |

— | 400 | — | — | 262 | ||||||||||||||||||

Long-term

debt |

— | — | — | — | — | ||||||||||||||||||

Stockholders’ equity |

$ | 16,921 | $ | 15,204 | $ | 11,502 | $ | 7,804 | $ | 2,285 | |||||||||||||

(1) |

Net income for such year included a deferred income tax benefit of $0.8 million as a result of the Company’s reversal of a portion of its Deferred Tax Asset valuation allowance. |

(2) |

Net income for such year included a deferred income tax benefit of $1.7 million as a result of the Company’s reversal of a portion of its Deferred Tax Asset valuation allowance. |

16

Selected Quarterly Financial Data

(Unaudited)

The following is a summary of

selected quarterly financial data for the years ended December 31, 2011 and 2010:

| 2011 |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q1 |

Q2 |

Q3 |

Q4 |

||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||

Total

revenues |

$ | 5,197 | $ | 5,996 | $ | 3,384 | $ | 4,019 | |||||||||||

Operating

income (loss) |

$ | 1,237 | $ | 674 | $ | (701 | ) | $ | (31 | ) | |||||||||

Net income

(loss) |

$ | 1,205 | $ | 681 | $ | (710 | ) | $ | 9 | ||||||||||

Net income

(loss) per common share |

|||||||||||||||||||

Basic |

$ | 0.05 | $ | 0.03 | $ | (0.03 | ) | $ | 0.00 | ||||||||||

Diluted |

$ | 0.05 | $ | 0.03 | $ | (0.03 | ) | $ | 0.00 | ||||||||||

| 2010 |

|||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q1 |

Q2 |

Q3 |

Q4 |

||||||||||||||||

| (in thousands, except per share amounts) | |||||||||||||||||||

Total

revenues |

$ | 3,754 | $ | 4,695 | $ | 4,669 | $ | 4,339 | |||||||||||

Operating

income |

$ | 792 | $ | 673 | $ | 522 | $ | 194 | |||||||||||

Net

income |

$ | 721 | $ | 566 | $ | 448 | $ | 1,217 | |||||||||||

Net income

per common share |

|||||||||||||||||||

Basic |

$ | 0.03 | $ | 0.02 | $ | 0.02 | $ | 0.05 | |||||||||||

Diluted |

$ | 0.03 | $ | 0.02 | $ | 0.02 | $ | 0.05 | |||||||||||

ITEM

7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

OVERVIEW

We are a supplier of software

products for the property and casualty insurance industry, supplying a wide range of professional services that support product customization,

conversion from existing systems and data integration with other software or reporting agencies. We also offer on-going support services including

incorporating recent insurance rate and rule changes in our solutions. These support services also include analyzing the changes, developments, quality

assurance, documentation and distribution of insurance rate and rule changes.

We earn revenue from software

contract licenses, fees for servicing the product, which we call support services, and professional services. Total revenue in 2011 increased to

$17,596,000 from $17,457,000 in 2010, due to an increase in license and support services offset by a decrease in professional

services.

The following is an overview of

the key components of our revenue and other important financial data in 2011:

Software Licenses. License

revenue was $4,770,000 in 2011 compared to $2,288,000 in 2010 as a result of new customer sales and sales to existing customers in 2011. Our new

software license revenue is affected by the strength of general economic and business conditions and the competitive position of our software products.

New software license sales are characterized by long sales cycles and intense competition. Timing of new software license sales can substantially

affect our quarterly results.

Support Services. Support

services revenue was $8,346,000 in 2011 compared to $8,099,000 in 2010. The increase in maintenance revenue in 2011 was mainly due to the annual

renewal of existing customers’ maintenance and maintenance from new customer contracts. Support services revenue is influenced primarily by the

following factors: the renewal rate from our existing customer base, the amount of new support services associated with new license sales and annual

price increases.

17

Professional Services. The

decrease in professional services revenue to $4,480,000 in 2011 from $7,070,000 in 2010 was a result of decreased demand for new software capabilities

and customizations from our current customer base and the shift of MSBS revenue from professional services to license sales.

Income before Provision for

Income Taxes. Income before provision for income taxes was $1,185,000 in 2011 compared to $2,125,000 in 2010, primarily due to a decrease in

professional services revenue.

Income Tax Benefit. We

recorded income taxes, which are comprised of New Jersey state tax and Federal alternative minimum tax, of $0 and $63,000 in 2011 and 2010,

respectively. We also recorded income tax benefit of $0 and $800,000 in 2011 and 2010, respectively.

Net Income. Net income for

2011 was $1,185,000 compared to $2,952,000 in 2010, mainly as a result of a decrease in professional services revenue.

EBITDA. Earnings before

interest, taxes, depreciation and amortization (“EBITDA”), a non-GAAP metric, was $3.0 million for 2011 compared to $3.1 million for

2010.

Cash Flow. We generated

$3,317,000 in positive cash flow from operations in 2011 and ended the year with $3,282,000 in cash and cash equivalents and $1,818,000 in accounts

receivable.

We continue to face competition

for growth in 2012 mainly in the marketing and selling of our products and services to new customers caused by a number of factors, including long

sales cycles and general economic and business conditions. In addition, there are risks related to customers’ acceptance and implementation delays

which could affect the timing and amount of license revenue we are able to recognize. However, given the positive response to our new software from

existing customers, the significant expansion of our relationship with a very large customer and the introduction of additional software capabilities,

we are expanding our sales and marketing efforts to both new and existing customers. Consequently, we continue to incur additional sales and marketing

expense in advance of generating the corresponding revenue.

As we shift over time from

software development to deployment, from a financial perspective, the non-cash charges for amortization of developed software will increasingly impact

our bottom line. Therefore, in order to provide more visibility to investors, we have decided to also report EBITDA to show what we believe is the

Company’s earnings power without the impact of, among other items, amortization. In 2011, the non-cash charge for amortization of capitalized

software increased more than 150% from 2010 to $1.5 million, and we expect this amount could exceed $3 million, or $0.12 per share, in 2012, depending

on our sales success. Therefore, we believe that EBITDA will be a useful measure of the true earnings power of the Company while we complete the

development and deployment cycle. As such, we expect to increasingly focus on EBITDA to evaluate our progress.

USE OF NON-GAAP FINANCIAL MEASURES

In evaluating our business, we

consider and use EBITDA as a supplemental measure of our operating performance. The Company defines EBITDA as earnings before interest, taxes,

depreciation and amortization. The Company presents EBITDA because it believes it is frequently used by securities analysts, investors and other

interested parties as a measure of financial performance.

The term EBITDA is not defined

under U.S. generally accepted accounting principles, or U.S. GAAP, and is not a measure of operating income, operating performance or liquidity

presented in accordance with U.S. GAAP. EBITDA has limitations as an analytical tool, and when assessing the Company’s operating performance,

investors should not consider EBITDA in isolation, or as a substitute for net income (loss) or other consolidated income statement data prepared in

accordance with U.S. GAAP. Among other things, EBITDA does not reflect the Company’s actual cash expenditures. Other companies may calculate

similar measures differently than Cover-All limiting their usefulness as comparative tools. We compensate for these limitations by relying on our U.S.

GAAP results and using EBITDA only supplementally.

18

The following is an unaudited

reconciliation of U.S. GAAP net income to EBITDA for the years ended December 31, 2011 and 2010:

| 2011 |

2010 |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Net

Income |

$ | 1,184,766 | $ | 2,951,786 | ||||||

Interest

income, net |

13,498 | 10,053 | ||||||||

Income tax

(benefit) expense |

— | (736,933 | ) | |||||||

Depreciation |

146,397 | 159,835 | ||||||||

Amortization |

1,686,647 | 717,148 | ||||||||

EBITDA |

$ | 3,031,308 | $ | 3,101,889 | ||||||

EBITDA per

common share: |

||||||||||

Basic |

$ | 0.12 | $ | 0.12 | ||||||

Diluted |

$ | 0.12 | $ | 0.12 | ||||||

CRITICAL ACCOUNTING POLICIES AND

ESTIMATES