Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Freeze Tag, Inc. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - Freeze Tag, Inc. | frzt_ex311.htm |

| EX-32.2 - CERTIFICATION - Freeze Tag, Inc. | frzt_ex322.htm |

| EX-31.2 - CERTIFICATION - Freeze Tag, Inc. | frzt_ex312.htm |

| EX-10.20 - AMENDMENT NO. 1 TO SECURITIES PURCHASE AGREEMENT - Freeze Tag, Inc. | frzt_ex1020.htm |

| EX-10.19 - AMENDMENT NO. 1 TO SECURITIES PURCHASE AGREEMENT - Freeze Tag, Inc. | frzt_ex1019.htm |

| EX-10.21 - AMENDMENT NO. 1 TO PROMISSORY NOTE - Freeze Tag, Inc. | frzt_ex1021.htm |

| EX-10.18 - AMENDMENT NO. 1 TO SECURITIES PURCHASE AGREEMENT - Freeze Tag, Inc. | frzt_ex1018.htm |

| EX-32.1 - CERTIFICATION - Freeze Tag, Inc. | frzt_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

|

x

|

ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2011

OR

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from_____________ to _____________.

Commission file number 000-54267

FREEZE TAG, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

20-4532392

|

|

| (State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

|

228 W. Main Street, 2nd Floor

Tustin, California

|

92780

|

|

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (714) 210-3850

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

|

None

|

None

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

Aggregate market value of the voting stock held by non-affiliates: $643,390 as based on the last sales of our common stock to a third party. The voting stock held by non-affiliates on that date consisted of 18,382,549 shares of common stock.

Applicable Only to Registrants Involved in Bankruptcy Proceedings During the Preceding Five Years:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yeso No o

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 23, 2012, there were 44,082,949 shares of common stock, par value $0.001, issued and outstanding.

Documents Incorporated by Reference

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to rule 424(b) or (c) of the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980). None.

Freeze Tag, Inc.

TABLE OF CONTENTS

PART I

|

ITEM 1 – BUSINESS

|

2 | |||

|

ITEM 1A – RISK FACTORS

|

11 | |||

|

ITEM 1B – UNRESOLVED STAFF COMMENTS

|

18 | |||

|

ITEM 2 ‑ PROPERTIES

|

18 | |||

|

ITEM 3 ‑ LEGAL PROCEEDINGS

|

18 | |||

|

ITEM 4 – MINE SAFETY DISCLOSURES

|

18 | |||

|

PART II

|

||||

|

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

19 | |||

|

ITEM 6 – SELECTED FINANCIAL DATA

|

21 | |||

|

ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

|

22 | |||

|

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

|

33 | |||

|

ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

F-1 | |||

|

ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

34 | |||

|

ITEM 9A – CONTROLS AND PROCEDURES

|

34 | |||

|

ITEM 9B – OTHER INFORMATION

|

37 | |||

|

PART III

|

||||

|

ITEM 10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNACE

|

37 | |||

|

ITEM 11 – EXECUTIVE COMPENSATION

|

39 | |||

|

ITEM 12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

|

41 | |||

|

ITEM 13 ‑ CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

42 | |||

|

ITEM 14 – PRINCIPAL ACCOUNTING FEES AND SERVICES

|

42 | |||

|

PART IV

|

||||

|

ITEM 15 ‑ EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

43 | |||

PRINTER TO PAGINATE DOCUMENT, UPDATE THE INDEX ABOVE,

AND THEN REMOVE THIS NOTE BEFORE FILING

i

PART I

Explanatory Note

This Annual Report includes forward-looking statements within the meaning of the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on management’s beliefs and assumptions, and on information currently available to management. Forward-looking statements include the information concerning possible or assumed future results of operations of the Company set forth under the heading “Management's Discussion and Analysis of Financial Condition or Plan of Operation.” Forward-looking statements also include statements in which words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “consider” or similar expressions are used.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions. The Company's future results and shareholder values may differ materially from those expressed in these forward-looking statements. Readers are cautioned not to put undue reliance on any forward-looking statements.

1

ITEM 1 – BUSINESS

Corporate History

We were incorporated as Freeze Tag, Inc. in February 2006 in the State of Delaware. In March 2006, Freeze Tag, LLC, our predecessor which was formed in October 2005, was merged with and into Freeze Tag, Inc.

Business Overview

We are in the business of acquiring or developing and publishing casual games. We obtain games through three main sources: licenses, creation of original games, and the use of third-party developers. Most of the games with which we are involved are published in one or more of three platforms, or methods of distribution. These platforms are PC/Mac downloads, mobile, and other emerging platforms like social gaming sites.

Developing Casual Games

We acquire and develop games through licensing arrangements, the creation of our own original games, and through the use of third-party game developers.

Licensed Games

We may develop a game around a well known brand pursuant a license agreement from the owner of that brand. For example, we have a license agreement with the Ohio Art Company that allowed us to develop and distribute a game around their Etch A Sketch® brand. In exchange for the license, we pay a royalty to the Ohio Art Company based on our revenues from that product.

Our cost to develop a “licensed game” is the same as our cost to develop Freeze Tag original game plus royalty payments to the licensor, some of which may be paid in the form of non-refundable up-front royalty advances. The costs involved in developing original content games can range from $25,000 to $150,000 depending on the platform (iPhone vs. PC) and complexity of the game (simple puzzle vs. complex adventure genre). The average cost to develop an iPhone game is $100,000. The average cost to develop a PC/Mac game is $150,000. For a “licensed game” in addition to these development costs we usually have a royalty payment owed to the licensor of the intellectual property, which is usually 10% to 20% of the revenue collected from the game. At times we pay a portion of this royalty in the form of an up-front, non-refundable royalty advance, which typically is in the range of $5,000 to $20,000, but varies by game and is negotiated on a case-by-case basis with the owner of the intellectual property.

2

Our gross profit margins may be lower on a licensed game compared to an original game because of the royalty payment we pay to the licensor, which is usually 10% to 20% of the revenue from such game, but the sales can be much higher because of the recognition of the licensed title or brand by the casual game consumer. Brand names that are familiar to a casual game consumer create a sense of trust and familiarity that often increases sales.

In the past, our licensed games included Etch a Sketch®, Concentration, Nertz, Can You See What I See?, Can You See What I See? Dream Machine, Amelia Earhart. Going forward (2012), we have a current licensing agreement with Ohio Art Company (Etch A Sketch).

Freeze Tag Original Content

We have created, and will continue to create, original games to put in our portfolio. In the past we hired one or more contract engineers on a “work-for-hire” basis to create the game for us, and we pay that engineer or engineers a fixed fee for their work, known as a development fee. This development fee can range from $15,000 to as much as $75,000, depending on the amount and complexity of the work involved. While we still rely on contract engineers to develop some of our games, during 2011 we also hired in-house software engineers to develop games based on our own content. When we distribute the game, all of the revenues are ours to keep, unless we have negotiated a revenue share (or royalty) with the contract engineer(s). The costs involved in developing Freeze Tag original content games can range from $25,000 to $150,000, depending on the development platform (iPhone vs. PC) and complexity of the game (simple vs. complex). The average cost to develop an iPhone game is $100,000. The average cost to develop a PC/Mac game is $150,000. Generally, iPhone games are less expensive to develop than PC/Mac games because less programming and artwork are required.

Our gross profit margins are usually highest when we distribute our own original content, but we also assume all of the risk because we have paid to develop the game in advance, without knowing whether it will be a success or not. In addition, because there is no existing brand associated with an original game, we have to create the market for the game ourselves.

Our original content games are Victorian Mysteries ™: The Moonstone, Victorian Mysteries: Woman in White, Unsolved Mystery Club™: Amelia Earhart, The Conjurer (rights sold to Real Networks, and Real Detectives (rights sold to Real Networks). We are currently working on the next games in the Victorian Mysteries and Unsolved Mystery Club series. In 2011, we will be launching additional games we hope will become franchises or series in the future.

Publishing Third-Party Developer Titles

We often have a variety of independent developers working with us to build licensed and original titles for us. During the course of our working relationship, these developers sometimes bring a concept or a partially finished game to us for consideration. If we believe the title has merit and the potential to generate significant revenues, then we will contract with the developer to finish the game to our specifications. We will guide them through the development process and, most often, we will own certain intellectual property rights to the finished game. If we don’t own the game code, then we will at least own significant components of the intellectual property such as the name or character likeness.

Third party developers are attracted to working with us because we provide them creative guidance to ensure their game is market-ready, development funds to help them finish their game, and marketing expertise and distribution relationships to get their game to market and create an ongoing revenue stream. These developers often underestimate how much time and money is required in order to complete development of a game. They approach us to help them fund the completion of their game (usually an amount far less than the cost for Freeze Tag to develop an original title), in exchange for a percentage of the revenue generated by the game over a period of time and the transfer of certain intellectual property rights to us.

3

The risks are lower with third party games because the amount of upfront money required tends to be less than if we were developing the entire game. On occasion, there are games that are 90% finished when they come to us and they only require a small amount of development money to complete. In these circumstances, we can purchase rights in or ownership of a game or portion of the intellectual property (such as the name of the game) in exchange for very little out-of-pocket costs. However, the gross margin is lower than the margin generated by original titles because the developer not only shares in the risk (by having incurred a greater portion of the development costs themselves), but also generally receives a royalty on the back end, usually 20% to 50% of net sales.

Compared to the costs incurred by in-house development projects, our development costs involved in creating games by third party developers are generally low due to the fact that typically when developers bring products to us for publishing consideration, they have already completed or partially completed developing the game. Therefore, we only incur partial development costs in order to acquire distribution rights to publish the third party title. These costs are usually associated with “finishing” final stages of development, which range anywhere from $5,000 to $25,000 per title.

Our third-party developer titles include Xango Tango (we own the Intellectual Property (IP)), Paper Chase (we own the IP), and Letter Lab (we own the IP).

Distributing Casual Games

Once a game is developed, we distribute it through one of three methods. The majority of our games are downloaded onto a PC or Mac computer over the Internet. A smaller but growing percentage of our games are distributed over the iPhone. We do not yet distribute our games through a social networking platform, such as Facebook, however we are currently developing a game for that type of distribution.

Try-before-you-buy

All of our games are available for a limited period of time for free. This is the standard format in the industry, and applies to all three of our methods of distribution. Once required to purchase a game, the purchase price ranges from $2.99 to $19.99. On (industry) average, 1% of the users purchase a game after they try it. Our games are purchased by an average of 4% to 5% of the users who try it.

PC/Mac Downloadable Distribution

All of our games are available for PC or Mac download.

Most of the time, our customers find our games through a game website, such as www.bigfishgames.com or some other retail site such as www.amazon.com. Our distribution partners include, but are not limited, the following: Yahoo!, MSN Games, Amazon.com, Big Fish Games, Steam, Exent/Verizon, Apple, Game House, Shockwave, and Oberon.

Mobile Distribution – High Growth Opportunities.

At the current time, Apple is leading the way in mobile gaming devices with its iPhone (smartphone) and iPad (tablet) products. However, smartphones and tablets based on Google’s Android operating system are proliferating rapidly. Our Etch A Sketch® application was one of the first 500 applications introduced at the same time as the iPhone (2008), so we have been working with Apple since the launch of the iPhone. In 2011, we developed several new applications for mobile devices like iPhone, iPad, and Android devices, including the new “tablet” devices, which we plan to launch in 2012.

4

The most promising area of growth (for gaming companies) in mobile distribution is the new wave of “tablet” devices that appear to be very popular with consumers. The first tablet, Apple’s iPad, has been wildly successful, selling millions of units. Following Apple, many manufacturers, including Motorola (Xoom), Samsung (Galaxy), and RIM (Playbook) have launched tablet devices. With larger screen sizes, crisp colorful graphics capabilities and speedy processors, these tablets offer tremendous opportunities for games and other entertainment applications (such as electronic books and videos) that consumers enjoy.

In addition to the rapid growth that we believe will continue in the smartphone arena (iOS and Android), we believe that the growth in tablet devices will fuel a whole new wave of increased revenue opportunities in the casual gaming market. We intend to create games that will work on these new smartphone and tablet platforms now and in the future.

Other Emerging Methods of Distribution

We do not currently have a game that is distributed on a social networking site, such as Facebook. However, we are currently working on game designs, and have enabled our Etch A Sketch® iPhone App to be Facebook connected, as well as our Victorian Mysteries™: Moonstone iPhone App. We are also in the process of integrating social networking marketing techniques into our iPhone/iPad games in which players will be able to link to a page on a social networking site, such as Facebook, by clicking on a button within the game.

Business Strategy

Our strategy is to first develop and publish original casual game content on the high growth platforms and devices such as PC/Mac digital downloads and flash HD, smartphone (iPhone and Android), mobile internet devices (such as tablets) and social networking sites. According to a recent NPD report, in 2009, for the first times games sold via digital channels were close to equal the number of units sold through traditional retail outlets. Based on this trend, digital distribution appears to be the wave of the future for the games market. We have been riding that wave since our inception. New, powerful mobile internet devices such as smartphones (Apple iPhone and Android phones) and tablets (iPad) are new platforms that emerged as high growth, legitimate digital distribution channels for games and entertainment. As consumers continue to take up these mobile internet devices and consider them essential tools, the corresponding markets for digital entertainment created specifically for them are positioned to experience rapid adoption and growth.

In addition to attacking the high growth devices and digital distribution channels, we are creating original intellectual property. Wherever possible, we own registered trademark protection for properties we develop. As the digital markets evolve, there are and will continue to be many competitors who will imitate successful game properties. To date, we have received registered trademark approval from the United States Patent and Trademark Office for the following marks: Unsolved Mystery®, Unsolved Mystery Club®, Ancient Astronauts® and Victorian Mysteries® for all gaming platforms; and received preliminary approval on Rocket Weasel. These marks will enable us to defend against copycats who may try to incorporate these keywords into their game titles. We are continuously creating, researching and investigating new intellectual property (names and marks) that will not only provide us with unique and valuable marketing assets but also help us defend against unauthorized use or infringement.

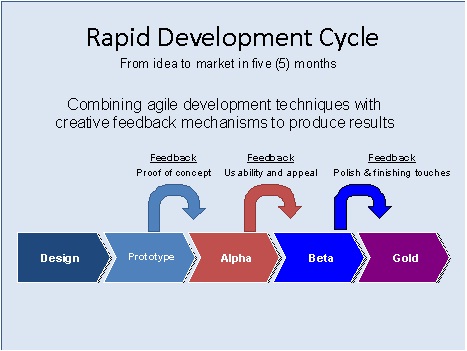

Our Production Process – How Do We Make a Game?

We have learned that establishing and following a rigid process is essential to producing commercially successful products, regardless of the platform. The process all begins with the creative development process. The chart below describes the approach we use to filter ideas and make final decisions on which games we will actually produce. After choosing the game that we will focus on, we write a detailed design document. A thorough design document insures that all of those involved in the creation of the game have a common reference source throughout the production process. Also critical to producing high quality games, a test plan accompanies every design document. Not only do we test for bugs, but also we test the game for usability. Since most casual gamers do not want to read instructions, it is critical that the finished game be easy to play by just pointing and clicking at objects on the screen. This is the way most casual gamers discover games.

5

As a publisher and developer of games, we have developed expertise in three core aspects of game production. These core competencies help to give us a competitive advantage in the industry. They are listed below, with the resulting benefit also identified.

|

1.

|

Create High Quality Products (including art and sound assets). Benefit: Provides high value to distribution partners and consumers, resulting in increased downloads and purchases.

|

|

2.

|

Maintain Flexible Engineering Tools and Processes. Benefit: Decreases time-to-market delivery of products.

|

|

3.

|

Minimize Risk by doing the following: 1) selecting proven genres, 2) keeping development costs low, and 3) modifying designs “on the fly” based on consumer feedback. Benefit: Increases the number of games released per year and decreases reliance on any one title’s success, ultimately improving return on investment for each game.

|

How Long Does it Take to Develop a Casual Game?

We use a team of development professionals located all over the world, including South America and Europe. We use a development methodology referred to as agile development, which focuses on short development and feedback cycles, leading to shortened development times. Because of this, our costs are reduced, and the availability of an almost unlimited number of engineers and programmers makes our development time approximately 5 months. This is a big competitive advantage.

6

The Casual Games Market

The Casual Games Association

The Casual Games Association is the international trade association for casual games professionals. The association has more than 4,000 paid members, including gaming executives, publishers, and developers. The association hosts conferences and publishes research reports on the industry. Craig Holland, our CEO, is currently serving as a Founding Advisor to the CGA. This has been extremely beneficial to the company. Mr. Holland’s close ties to the association provides access to information and partnerships, and opportunities that might not otherwise be available. Their website is (http://casualgamesassociation.org/).

The following statistics are published by the Casual Games Association:

|

·

|

the global market for casual games was $2.25 billion in 2007, and is expected to grow 20% per year in established markets;

|

|

·

|

an estimated 200 million people are playing casual games over the Internet each month in 2007;

|

|

·

|

in 2007, 49% of casual game players were men, and 51% were women. However, in that year, women accounted for 74% of paying casual game players.

|

|

·

|

in 2007, casual game players who paid for a subscription averaged 7 to 15 hours of playing per week. The heaviest times were right after dinner from 7pm – 9pm, and during lunch hours from 11am – 2pm.

|

|

·

|

in 2007, the average play time was short, from five minutes to 20 minutes – though it was common for people to play one game after another for many hours.

|

7

The Competition

Publishers

Casual game industry publishers typically provide funding, development guidance and distribution for casual games for online, retail and mobile platforms. Some of the largest casual game publishers are:

Rovio (creators of Angry Birds) Esbo, Finland

PopCap Games – acquired by Electronic Arts (creators of Bejeweled) Seattle, Washington

Big Fish Games (creators of Mystery Case Files) Seattle, Washington

Zynga (creators of Farmville), San Francisco, California

Playdom, Mountain View, CA (acquired by Disney)

GameHouse Partners (division of RealNetworks) Seattle, Washington

iWin San Francisco, California

Chillingo, United Kingdom (acquired by Electronic Arts)

Iplay (Oberon Media) Seattle, Washington & NYC

PlayFirst San Francisco, California

Sandlot Games – acquired by Digital Chocolate, Bothell, Washington

Distributors

Casual game industry online, retail and mobile distributors typically provide aggregation services for retail distributors. Some online distributors provide tools and services for online retailers to assist them in interfacing with consumers. According to the CGA's 2007 Market Report, some of the largest casual game distributors and retailers of casual games are:

Online Retailers (Portals)

Big Fish Games Seattle, Washington

RealGames Seattle, Washington

Oberon Media Seattle, Washington & NYC

Amazon.com Seattle, Washington

WildTangent Redmond, Washington

Exent (Verizon Games on Demand) Tel Aviv, Israel

Shockwave San Francisco, California

Yahoo! Games Santa Monica, California

8

Mobile Distribution

Apple Computer (iTunes), Cupertino, California

Google (Android Market Place), Mountain View, California

Amazon (Android App Store)

Verizon Wireless (Android App Store)

Barnes and Noble (Nook App Store)

Brick and Mortar Distributors

Activision Santa Monica, California

Encore USA Los Angeles, California

Focus Multimedia England, UK

Brick and Mortar Retailers

Gamestop Grapevine, Texas

Wal-Mart Bentonville, Arkansas

Best Buy Minneapolis, Minnesota

Target Minneapolis, Minnesota

Our Intellectual Property

Our intellectual property is an essential element of our business. We use a combination of trademark, patent, copyright, trade secret and other intellectual property laws, confidentiality agreements and license agreements to protect our intellectual property. We have also registered a number of domain names, which we believe will be important to the branding and success of our games. Our employees and independent contractors are required to sign agreements acknowledging that all inventions, trade secrets, works of authorship, developments and other processes generated by them on our behalf are our property, and assigning to us any ownership that they may claim in those works. Despite our precautions, it may be possible for third parties to obtain and use without consent intellectual property that we own or license. Unauthorized use of our intellectual property by third parties, and the expenses incurred in protecting our intellectual property rights, may adversely affect our business.

We intend to register ownership of software copyrights in the United States as well as seek registration of various trademarks associated with the Company’s name and casual games that we will develop.

In addition, many of our applications are based on or incorporate intellectual properties that we license from third parties. We have both exclusive and non-exclusive licenses to use these properties for terms of up to three years. Our licensed brands include, among others, Etch A Sketch®, Amelia Earhart, and Nertz. Our licensors include a number of well-established video game publishers and major media companies, including The Ohio Art Company and Nertz Company.

9

In addition to attacking the high growth devices and digital distribution channels, we are creating original intellectual property. Wherever possible, we own registered trademark protection for properties we develop. As the digital markets evolve, there are and will continue to be many competitors who will imitate successful game properties. We are investing in trademark protection to create game brands and protect them. For example, we have received approval from the United States Patent and Trademark office to register Unsolved Mystery®, Unsolved Mystery Club®, Ancient Astronauts® and Victorian Mysteries® for all gaming platforms and preliminary approval on Rocket Weasel. These marks will enable us to defend against copycats who may try to incorporate these terms into their game titles.

From time to time, we may encounter disputes over rights and obligations concerning intellectual property. While we believe that our product and service offerings do not infringe the intellectual property rights of any third party, we cannot assure you that we will prevail in any intellectual property dispute. If we do not prevail in such disputes, we may lose some or all of our intellectual property protection, be enjoined from further sales of the applications determined to infringe the rights of others, and/or be forced to pay substantial royalties to a third party.

Our Employees

We have 15 employees and/or contractors, 2 of which are our officers, 12 of which are engaged in art production, publishing and development, and 1 of which is engaged in administrative functions. We have a team of over 40 engineers, artists, and developers available to us on an independent contract basis around the world.

Description of Property

Our executive offices are located in Tustin, California, at 228 W. Main Street, 2nd Floor, Tustin, CA 92780. Our office space is approximately 2,000 square feet and the lease is month-to-month at a rate of $2,000 per month.

Available Information

We are a fully reporting issuer, subject to the Securities Exchange Act of 1934. Our Quarterly Reports, Annual Reports, and other filings can be obtained from the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549, on official business days during the hours of 10 a.m. to 3 p.m. You may also obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. The Commission maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the Commission at http://www.sec.gov.

Our Internet website address is http://www.freezetag.com.

10

ITEM 1A. – RISK FACTORS.

As a smaller reporting company we are not required to provide a statement of risk factors. However, we believe this information may be valuable to our shareholders for this filing. We reserve the right to not provide risk factors in our future filings. We face risks in developing our games and products and eventually bringing them to market. The following risks are material risks that we face. If any of these risks occur, our business, our ability to achieve revenues, our operating results and our financial condition could be seriously harmed. Our primary risk factors and other considerations include:

Risk Factors Related to the Business of the Company

We have a limited operating history and limited historical financial information upon which you may evaluate our performance.

You should consider, among other factors, our prospects for success in light of the risks and uncertainties encountered by companies that, like us, are in their early stages of development. We may not successfully address these risks and uncertainties or successfully implement our existing and new products and services. If we fail to do so, it could materially harm our business and impair the value of our common stock. Even if we accomplish these objectives, we may not generate the positive cash flows or profits we anticipate in the future. We were incorporated in Delaware in February 2006. In March 2006 we merged with Freeze Tag, LLC, our predecessor, which was formed in October 2005. Unanticipated problems, expenses and delays are frequently encountered in establishing a new business and developing new products and services. These include, but are not limited to, inadequate funding, lack of consumer acceptance, competition, product development, and inadequate sales and marketing. The failure by us to meet any of these conditions would have a materially adverse effect upon us and may force us to reduce or curtail operations. No assurance can be given that we can or will ever operate profitably.

If we are unable to meet our future capital needs, we may be required to reduce or curtail operations.

To date we have relied on cash flow from operations, funding from our founders, and debt financing to fund operations. We have extremely limited cash liquidity and capital resources. Our cash on hand as of December 31, 2011, was $26,587, and our monthly cash flow burn rate is approximately $85,000. For the year ended December 31, 2011, our revenue was $732,591.

Our future capital requirements will depend on many factors, including our ability to market our products successfully, cash flow from operations, and competing market developments. Based on our current financial situation we may have difficulty continuing our operations at their current level, or at all, if we do not receive additional financing in the near future. Consequently, although we currently have no specific plans or arrangements for financing, we intend to raise funds through private placements, public offerings or other financings. Any equity financings would result in dilution to our then-existing stockholders. Sources of debt financing may result in higher interest expense. Any financing, if available, may be on unfavorable terms. If adequate funds are not obtained, we may be required to reduce or curtail operations. We anticipate that our existing capital resources will not be adequate to satisfy our operating expenses and capital requirements for any length of time. However, this estimate of expenses and capital requirements may prove to be inaccurate.

Our independent registered public accounting firm has expressed doubts about our ability to continue as a going concern.

As a result of our financial condition, we have received a report from our independent registered public accounting firm for our financial statements for the year ended December 31, 2011 that includes an explanatory paragraph describing the uncertainty as to our ability to continue as a going concern. In order to continue as a going concern we must effectively balance many factors and increase our revenues to a point where we can fund our operations from our sales and revenues. If we are not able to do this we may not be able to continue as an operating company.

11

Because we face intense competition, we may not be able to operate profitably in our markets.

The market for casual games is highly competitive and is becoming more so, which could hinder our ability to successfully market our products. We may not have the resources, expertise or other competitive factors to compete successfully in the future. We expect to face additional competition from existing competitors and new market entrants in the future. Many of our competitors have greater name recognition and more established relationships in the industry than we do. As a result, these competitors may be able to:

|

·

|

develop and expand their product offerings more rapidly;

|

|

·

|

adapt to new or emerging changes in customer requirements more quickly;

|

|

·

|

take advantage of acquisition and other opportunities more readily; and

|

|

·

|

devote greater resources to the marketing and sale of their products and adopt more aggressive pricing policies than we can.

|

If we are unable to maintain brand image or product quality, our business may suffer.

Our success depends on our ability to maintain and build brand image for our existing products, new products and brand extensions. We have no assurance that our advertising, marketing and promotional programs will have the desired impact on our products’ brand image and on consumer preferences.

If we are unable to attract and retain key personnel, we may not be able to compete effectively in our market.

Our success will depend, in part, on our ability to attract and retain key management, including primarily Craig Holland and Mick Donahoo, technical experts, and sales and marketing personnel. We attempt to enhance our management and technical expertise by recruiting qualified individuals who possess desired skills and experience in certain targeted areas. Our inability to retain employees and attract and retain sufficient additional employees, and information technology, engineering and technical support resources, could have a material adverse effect on our business, financial condition, results of operations and cash flows. The loss of key personnel could limit our ability to develop and market our products.

Because our officers and directors control a large percentage of our common stock, they have the ability to influence matters affecting our shareholders.

Our officers and directors beneficially own over 58% of our outstanding common stock. As a result, they have the ability to influence matters affecting our shareholders, including the election of our directors, the acquisition or disposition of our assets, and the future issuance of our shares. Because they control such shares, investors may find it difficult to replace our management if they disagree with the way our business is being operated. Because the influence by these insiders could result in management making decisions that are in the best interest of those insiders and not in the best interest of the investors, you may lose some or all of the value of your investment in our common stock.

12

Our business may be negatively impacted by a slowing economy or by unfavorable economic conditions or developments in the United States and/or in other countries in which we operate.

A general slowdown in the economy in the United States or unfavorable economic conditions or other developments may result in decreased consumer demand, business disruption, supply constraints, foreign currency devaluation, inflation or deflation. A slowdown in the economy or unstable economic conditions in the United States or in the countries in which we operate could have an adverse impact on our business results or financial condition.

We may not be able to effectively manage our growth and operations, which could materially and adversely affect our business.

We may experience rapid growth and development in a relatively short period of time by aggressively marketing our casual games. The management of this growth will require, among other things, continued development of our financial and management controls and management information systems, stringent control of costs, increased marketing activities, the ability to attract and retain qualified management personnel and the training of new personnel. We intend to hire additional personnel in order to manage our expected growth and expansion. Failure to successfully manage our possible growth and development could have a material adverse effect on our business and the value of our common stock.

Failure to renew our existing licenses or to obtain additional licenses could harm our business.

Some of our game products are or will be based on or incorporate intellectual properties that we license from third parties. Our current licenses to use these properties do not extend beyond terms of two to three years. We may be unable to renew these licenses on terms favorable to us, or at all, and we may be unable to secure alternatives in a timely manner. We expect that licenses we obtain in the future may impose development, distribution and marketing obligations on us. If we breach our obligations, our licensors may have the right to terminate the license or change an exclusive license to a non-exclusive license.

Competition for licenses may also increase the advances, guarantees and royalties that we must pay to the licensor, which could significantly increase our costs. Failure to maintain our existing licenses or obtain additional licenses with significant commercial value could impair our ability to introduce new applications or continue our current game products and applications, which could materially harm our business.

If we fail to develop and introduce new casual games and other applications that achieve market acceptance, our sales could suffer.

Our business depends on providing casual games and applications that consumers want to buy. We must invest significant resources in research and development to enhance our offering of casual games and other applications and introduce new games and other applications. Our operating results would suffer if our games and other applications are not responsive to the preferences of our customers or are not effectively brought to market.

The planned timing or introduction of new casual games is subject to risks and uncertainties. Unexpected technical, operational, deployment, distribution or other problems could delay or prevent the introduction of new casual games, which could result in a loss of, or delay in, revenues or damage to our reputation and brand. If any of our applications is introduced with defects, errors or failures, we could experience decreased sales, loss of customers and damage to our reputation and brand. In addition, new applications may not achieve sufficient market acceptance to offset the costs of development. Our success depends, in part, on unpredictable and volatile factors beyond our control, including customer preferences, competing applications and the availability of other entertainment activities. A shift in Internet or mobile device usage or the entertainment preferences of our customers could cause a decline in our applications' popularity that could materially reduce our revenues and harm our business.

13

We intend to continuously develop and introduce new games and other applications for use on next-generation Internet and mobile devices. We must make product development decisions and commit significant resources well in advance of the anticipated introduction of new mobile devices. New mobile devices for which we will develop applications may be delayed, may not be commercially successful, may have a shorter life cycle than anticipated or may not be adequately promoted by wireless carriers or the manufacturer. If the mobile devices for which we are developing games and other applications are not released when expected or do not achieve broad market penetration, our potential revenues will be limited and our business will suffer.

If our independent, third-party developers cease development of new applications for us and we are unable to find comparable replacements, our competitive position may be adversely impacted.

We rely on independent third-party developers to develop some of our game products which subjects us to the following risks:

|

·

|

key developers who work for us may choose to work for or be acquired by our competitors;

|

|

·

|

developers currently under contract may try to renegotiate our agreements with them on terms less favorable to us; and

|

|

·

|

our developers may be unable or unwilling to allocate sufficient resources to complete our applications on a timely or satisfactory basis or at all.

|

If our developers terminate their relationships with us or negotiate agreements with terms less favorable to us, we may have to increase our internal development staff, which would be a time consuming and potentially costly process. If we are unable to increase our internal development staff in a cost-effective manner or if our current internal development staff fails to create successful applications, our earnings could be materially diminished.

In addition, although we require our third-party developers to sign agreements acknowledging that all inventions, trade secrets, works of authorship, development and other processes generated by them are our property and to assign to us any ownership they may have in those works, it may still be possible for third parties to obtain and use our intellectual properties without our consent.

Our industry is experiencing consolidation that may cause us to lose key relationships and intensify competition.

The Internet and media distribution industries are undergoing substantial change, which has resulted in increasing consolidation and formation of strategic relationships. We expect this consolidation and strategic partnering to continue. Acquisitions or other consolidating transactions could harm us in a number of ways, including:

|

|

·

|

we could lose strategic relationships if our strategic partners are acquired by or enter into relationships with a competitor (which could cause us to lose access to distribution, content, technology and other resources);

|

|

|

·

|

we could lose customers if competitors or users of competing technologies consolidate with our current or potential customers; and

|

|

|

·

|

our current competitors could become stronger, or new competitors could form, from consolidations.

|

Any of these events could put us at a competitive disadvantage, which could cause us to lose customers, revenue and market share. Consolidation could also force us to expend greater resources to meet new or additional competitive threats, which could also harm our operating results.

14

We rely on the continued reliable operation of third parties’ systems and networks and, if these systems and networks fail to operate or operate poorly, our business and operating results will be harmed.

Our operations are in part dependent upon the continued reliable operation of the information systems and networks of third parties. If these third parties do not provide reliable operation, our ability to service our customers will be impaired and our business, reputation and operating results could be harmed.

The Internet and our network are subject to security risks that could harm our business and reputation and expose us to litigation or liability.

Online commerce and communications depend on the ability to transmit confidential information and licensed intellectual property securely over private and public networks. Any compromise of our ability to transmit and store such information and data securely, and any costs associated with preventing or eliminating such problems, could damage our business, hurt our ability to distribute products and services and collect revenue, threaten the proprietary or confidential nature of our technology, harm our reputation, and expose us to litigation or liability. We also may be required to expend significant capital or other resources to protect against the threat of security breaches or hacker attacks or to alleviate problems caused by such breaches or attacks. Any successful attack or breach of our security could hurt consumer demand for our products and services, expose us to consumer class action lawsuits and harm our business.

We may be unable to adequately protect our proprietary rights.

Our ability to compete partly depends on the superiority, uniqueness and value of our intellectual property and technology, including both internally developed technology and technology licensed from third parties. To the extent we are able to do so, in order to protect our proprietary rights, we will rely on a combination of trademark, copyright and trade secret laws, confidentiality agreements with our employees and third parties, and protective contractual provisions and licensing agreement. Despite these efforts, any of the following occurrences may reduce the value of our intellectual property:

|

|

·

|

Our applications for trademarks and copyrights relating to our business may not be granted and, if granted, may be challenged or invalidated;

|

|

|

·

|

Issued trademarks and registered copyrights may not provide us with any competitive advantages;

|

|

|

·

|

Our efforts to protect our intellectual property rights may not be effective in preventing misappropriation of our technology;

|

|

|

·

|

Our efforts may not prevent the development and design by others of products or technologies similar to or competitive with, or superior to those we develop; or

|

|

|

·

|

Another party may obtain a blocking patent and we would need to either obtain a license or design around the patent in order to continue to offer the contested feature or service in our products.

|

We may be forced to litigate to defend our intellectual property rights, or to defend against claims by third parties against us relating to intellectual property rights.

We may be forced to litigate to enforce or defend our intellectual property rights, to protect our trade secrets or to determine the validity and scope of other parties’ proprietary rights. Any such litigation could be very costly and could distract our management from focusing on operating our business. The existence and/or outcome of any such litigation could harm our business.

Interpretation of existing laws that did not originally contemplate the Internet could harm our business and operating results.

The application of existing laws governing issues such as property ownership, copyright and other intellectual property issues to the Internet is not clear. Many of these laws were adopted before the advent of the Internet and do not address the unique issues associated with the Internet and related technologies. In many cases, the relationship of these laws to the Internet has not yet been interpreted. New interpretations of existing laws may increase our costs, require us to change business practices or otherwise harm our business.

15

It is not yet clear how laws designed to protect children that use the Internet may be interpreted, and such laws may apply to our business in ways that may harm our business.

The Child Online Protection Act and the Child Online Privacy Protection Act impose civil and criminal penalties on persons distributing material harmful to minors (e.g., obscene material) over the Internet to persons under the age of 17, or collecting personal information from children under the age of 13. We do not knowingly distribute harmful materials to minors or collect personal information from children under the age of 13. The manner in which these Acts may be interpreted and enforced cannot be fully determined, and future legislation similar to these Acts could subject us to potential liability if we were deemed to be non-compliant with such rules and regulations, which in turn could harm our business.

We may be subject to market risk and legal liability in connection with the data collection capabilities of our products and services.

Many of our products are interactive Internet applications that by their very nature require communication between a client and server to operate. To provide better consumer experiences and to operate effectively, our products send information to our servers. Many of the services we provide also require that a user provide certain information to us. We post an extensive privacy policy concerning the collection, use and disclosure of user data involved in interactions between our client and server products.

Risks Related To Our Common Stock

There is a limited public trading market for our common stock, which may impede our shareholders’ ability to sell our shares.

Currently, there is a limited trading market for our common stock, and there can be no assurance that a more robust market will be achieved in the future. There can be no assurance that an investor will be able to liquidate his or her investment without considerable delay, if at all. If the trading market for our common stock does increase, the price may be highly volatile. Factors discussed herein may have a significant impact on the market price of our shares. Moreover, due to the relatively low price of our securities, many brokerage firms may not effect transactions in our common stock if a market is established. Rules enacted by the SEC increase the likelihood that most brokerage firms will not participate in a potential future market for our common stock. Those rules require, as a condition to brokers effecting transactions in certain defined securities (unless such transaction is subject to one or more exemptions), that the broker obtain from its customer or client a written representation concerning the customer’s financial situation, investment experience and investment objectives. Compliance with these procedures tends to discourage most brokerage firms from participating in the market for certain low-priced securities.

If we are unable to pay the costs associated with being a public, reporting company, we may not be able to continue trading on the OTC Bulletin Board and/or we may be forced to discontinue operations.

We have significant costs associated with being a public, reporting company, which adds to the substantial doubt about our ability to continue trading on the OTC Bulletin Board and/or continue as a going concern. These costs include compliance with the Sarbanes-Oxley Act of 2002, which will be difficult given the limited size of our management, and we will have to rely on outside consultants. Accounting controls, in particular, are difficult and can be expensive to comply with.

Our ability to continue trading on the OTC Bulletin Board and/or continue as a going concern will depend on positive cash flow, if any, from future operations and on our ability to raise additional funds through equity or debt financing. If we are unable to achieve the necessary product sales or raise or obtain needed funding to cover the costs of operating as a public, reporting company, our common stock may be deleted from the OTC Bulletin Board and/or we may be forced to discontinue operations.

16

We do not intend to pay dividends in the foreseeable future.

We do not intend to pay any dividends in the foreseeable future. We do not plan on making any cash distributions in the manner of a dividend or otherwise. Our Board presently intends to follow a policy of retaining earnings, if any.

We have the right to issue additional common stock and preferred stock without consent of stockholders. This would have the effect of diluting investors’ ownership and could decrease the value of their investment.

We have additional authorized, but unissued shares of our common stock that may be issued by us for any purpose without the consent or vote of our stockholders that would dilute stockholders’ percentage ownership of our company.

In addition, our certificate of incorporation authorizes the issuance of shares of preferred stock, the rights, preferences, designations and limitations of which may be set by the Board of Directors. Our certificate of incorporation has authorized issuance of up to 10,000,000 shares of preferred stock in the discretion of our Board. The shares of authorized but undesignated preferred stock may be issued upon filing of an amended certificate of incorporation and the payment of required fees; no further stockholder action is required. If issued, the rights, preferences, designations and limitations of such preferred stock would be set by our Board and could operate to the disadvantage of the outstanding common stock. Such terms could include, among others, preferences as to dividends and distributions on liquidation.

As of the end of the period covered by this report, we have current outstanding non-affiliate debt obligations totaling approximately $160,725, which are convertible into our common stock. In the event the holder(s) of such instruments convert amounts owed to them into common stock and/or we default on the convertible instruments, significant dilution could occur to the other holders of our common stock and could significantly decrease the value of our common stock.

As of the end of the period covered by this report, we have outstanding non-affiliate debt obligations totaling approximately $160,725, which are convertible into our common stock. Under the terms of these convertible notes, the holders may convert the notes into our common stock at the greater of (i) the Variable Conversion Price and (ii) the Fixed Conversion Price. The “Variable Conversion Price” shall mean 55% multiplied by the Market Price (representing a discount rate of 45%). “Market Price” means the average of the lowest three (3) Trading Prices for the common stock during the ten (10) Trading Day period ending on the latest complete Trading Day prior to the Conversion Date. “Fixed Conversion Price” shall mean $0.00009. Although under the terms of the agreement, the number of shares of common stock issuable upon the conversion of any portion of the notes, cannot exceed an amount that would cause the beneficial ownership of the debt holder and its affiliates to own more than 4.99% of our outstanding shares of Common Stock, the issuance of almost 5% of our outstanding common stock in a short period time, possibly happening multiple times, would cause substantial dilution to our shareholders. In the event the holder(s) of such instruments convert amounts owed to them into common stock and/or we default on the convertible instruments, significant dilution could occur to the other holders of our common stock and could significantly decrease the value of our common stock. We evaluated the convertible notes and determined that the shares issuable pursuant to the conversion option were determinate due to the Fixed Conversion Price and, as such, do not constitute a derivative liability as we have obtained authorization from a majority of our shareholders such that should conversion occur at the Fixed Conversion Price the appropriate number of shares will be made available or issuable for settlement to occur.

17

Our common stock is governed under The Securities Enforcement and Penny Stock Reform Act of 1990.

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Such exceptions include any equity security listed on NASDAQ and any equity security issued by an issuer that has (i) net tangible assets of at least $2,000,000, if such issuer has been in continuous operation for three years, (ii) net tangible assets of at least $5,000,000, if such issuer has been in continuous operation for less than three years, or (iii) average annual revenue of at least $6,000,000, if such issuer has been in continuous operation for less than three years. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

ITEM 1B – UNRESOLVED STAFF COMMENTS

This Item is not applicable to us as we are not an accelerated filer, a large accelerated filer, or a well-seasoned issuer; however, we have not received written comments from the Commission staff regarding our periodic or current reports under the Securities Exchange Act of 1934 within the last 180 days before the end of our last fiscal year.

ITEM 2 – PROPERTIES

Our executive offices are located in Tustin, California, at 228 W. Main Street, 2nd Floor, Tustin, CA 92780. Our office space is approximately 2,000 square feet and the lease is month-to-month at a rate of $2,000 per month.

ITEM 3 - LEGAL PROCEEDINGS

We are not a party to or otherwise involved in any legal proceedings.

In the ordinary course of business, we are from time to time involved in various pending or threatened legal actions. The litigation process is inherently uncertain and it is possible that the resolution of such matters might have a material adverse effect upon our financial condition and/or results of operations. However, in the opinion of our management, other than as set forth herein, matters currently pending or threatened against us are not expected to have a material adverse effect on our financial position or results of operations.

ITEM 4 – MINE SAFETY DISCLOSURES

There is no information required to be disclosed by this Item.

18

PART II

ITEM 5 - MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock has been listed for trading on the OTC Bulletin Board since June 2011. Our current trading symbol is “FRZT.” Since our stock has been listed there have been a limited number of trades of our common stock.

The following table sets forth the high and low bid information for each quarter within the fiscal year ended December 31, 2011, as provided by the Nasdaq Stock Markets, Inc. The information reflects prices between dealers, and does not include retail markup, markdown, or commission, and may not represent actual transactions.

|

Bid Prices

|

||||||||||

|

Fiscal Year Ended December 31,

|

Period

|

High

|

Low

|

|||||||

|

2010

|

First Quarter

|

N/A | N/A | |||||||

|

Second Quarter

|

N/A | N/A | ||||||||

|

Third Quarter

|

N/A | N/A | ||||||||

|

Fourth Quarter

|

N/A | N/A | ||||||||

|

2011

|

First Quarter

|

$ | 0 | $ | 0 | |||||

|

Second Quarter

|

$ | 0.35 | $ | 0.35 | ||||||

|

Third Quarter

|

$ | 0.35 | $ | 0.14 | ||||||

|

Fourth Quarter

|

$ | 0.14 | $ | 0.03 | ||||||

The Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to a few exceptions which we do not meet. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

Holders

As of December 31, 2011, there were 39,275,720 shares of our common stock outstanding held by approximately 115 holders of record of our common stock. As of March 23, 2012, there were 44,082,949 shares of our common stock outstanding held by approximately 115 holders of record of our common stock. Of these 44,082,949 shares outstanding at March 23, 2012, 18,382,549 are held by non-affiliates. On the cover page of this filing we value these shares at $643,390. These shares were valued at $0.035 per share, based on recent trades of our common stock as listed on the OTC Bulletin Board.

19

Dividends

We have not declared or paid a cash dividend on our capital stock in our last two fiscal years and we do not expect to pay cash dividends on our common stock in the foreseeable future. We currently intend to retain our earnings, if any, for use in our business. Any dividends declared in the future will be at the discretion of our Board of Directors and subject to any restrictions that may be imposed by our lenders.

Securities Authorized for Issuance Under Equity Compensation Plans

There are no outstanding options or warrants to purchase, or securities convertible into, shares of our common stock.

Non-Qualified Stock Option Plan

On March 20, 2006, our Board of Directors and shareholders approved the Freeze Tag, Inc. 2006 Stock Plan. Pursuant to the Plan, we reserved 2,920,500 shares (post-split) of our common stock to be issued to employees and consultants for services rendered to the company. As of December 31, 2008, we had issued options to acquire a total of 1,247,850 shares (post-split) of our common stock to seven of our employees and/or consultants. Effective as of October 15, 2009, all seven of the option holders converted their options into a total of 1,123,065 shares of our common stock. Because of the 5.31-for-one forward stock split of our common stock on October 15, 2009, there are now 1,512,650 shares available for issuance as a part of this stock plan. As of the period ended December 31, 2011, there were 560,000 options outstanding to purchase shares of common stock, and no shares of common stock had been issued pursuant to stock purchase rights under the 2006 Plan.

Under the 2006 Plan, options may be granted to employees, directors, and consultants. Only employees may receive “incentive stock options,” which are intended to qualify for certain tax treatment, and consultants and directors may receive “non-statutory stock options,” which do not qualify for such treatment. A holder of more than 10% of the outstanding voting shares may only be granted options with an exercise price of at least 110% of the fair market value of the underlying stock on the date of the grant, and if such holder has incentive stock options, the term of the options must not exceed five years.

Options and stock purchase rights granted under the 2006 Plan generally vest ratably over a four year period (typically 1⁄4 or 25% of the shares vest after the 1st year and 1/48 of the remaining shares vest each month thereafter); however, alternative vesting schedules may be approved by our Board of Directors in its sole discretion. Any unvested portion of an option or stock purchase right will accelerate and become fully vested if a holder’s service with the company is terminated by us without cause within twelve months following a Change in Control (as defined in the 2006 Plan).

All options must be exercised within ten years after the date of grant. Upon a holder’s termination of service for any reason prior to a Change in Control, we may repurchase any shares issued to such holder upon the exercise of options or stock purchase rights. The Board of Directors may amend the 2006 Plan at any time. The 2006 Plan will terminate in 2016, unless terminated sooner by the Board of Directors.

20

As of December 31, 2011, we had the following options outstanding:

|

Plan Category

|

Number of Securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

|

(a)

|

(b)

|

(c)

|

|

|

Equity compensation plans approved by security holders

|

560,000

|

0.10

|

952,650

|

|

Equity compensation plans not approved by security holders

|

- 0 -

|

- 0 -

|

- 0 -

|

|

Total

|

560,000

|

0.10

|

952,650

|

Recent Issuance of Unregistered Securities

During the quarter ended December 31, 2011, we issued the following unregistered securities:

On November 29, 2011, we issued 125,000 shares of our common stock, restricted in accordance with Rule 144, to Michael Southworth for consulting services. The issuance was exempt from registration pursuant to Section 4(2) of the Securities Act of 1933, and the investor was accredited and sophisticated, familiar with our operations, and there was no solicitation.

If our stock is listed on an exchange we will be subject to the Securities Enforcement and Penny Stock Reform Act of 1990 requires additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The Commission has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to a few exceptions which we do not meet. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated therewith.

ITEM 6 – SELECTED FINANCIAL DATA

As a smaller reporting company we are not required to provide the information required by this Item.

21

ITEM 7 - MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

Forward-Looking Statements

This annual report on Form 10-K of Freeze Tag, Inc. for the year ended December 31, 2011 contains forward-looking statements, principally in this Section and “Business.” Generally, you can identify these statements because they use words like “anticipates,” “believes,” “expects,” “future,” “intends,” “plans,” and similar terms. These statements reflect only our current expectations. Although we do not make forward-looking statements unless we believe we have a reasonable basis for doing so, we cannot guarantee their accuracy and actual results may differ materially from those we anticipated due to a number of uncertainties, many of which are unforeseen, including, among others, the risks we face as described in this filing. You should not place undue reliance on these forward-looking statements which apply only as of the date of this annual report. These forward-looking statements are within the meaning of Section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbors created thereby. To the extent that such statements are not recitations of historical fact, such statements constitute forward-looking statements that, by definition, involve risks and uncertainties. In any forward-looking statement where we express an expectation or belief as to future results or events, such expectation or belief is expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement of expectation of belief will be accomplished.

We believe it is important to communicate our expectations to our investors. There may be events in the future; however, that we are unable to predict accurately or over which we have no control. The risk factors listed in this filing, as well as any cautionary language in this annual report, provide examples of risks, uncertainties and events that may cause our actual results to differ materially from the expectations we describe in our forward-looking statements. Factors that could cause actual results or events to differ materially from those anticipated, include, but are not limited to: distributors not accepting our games; price reductions; unforeseen delays in game production; changes in product strategies; general economic, financial and business conditions; changes in and compliance with governmental regulations; changes in various tax laws; and the availability of key management and other personnel.

Summary Overview

We are a casual online games publisher that develops and markets games across the major digital distribution platforms including PC/Mac downloadable (Web), mobile (including smartphones and tablets), and emerging platforms like social networking sites (including Facebook). We focus on casual games because of our belief that they appeal to a significant portion of the population.

During our most recent fiscal year ended December 31, 2011, we generated revenues of $732,591 from the sales our games compared to $643,518 for the year ended December 31, 2010. During the year ended December 31, 2011, we launched two games for various platforms, compared to four for the year ended December 31, 2010. During 2012, we anticipate we will publish up to eight to ten games for various platforms. In 2012 and going forward we plan to continue the trend we started in 2009 of developing games based on intellectual property we own or purchase from third parties, rather than license intellectual property that belongs to certain third parties, for which we then have to pay royalties to the owner of the intellectual property. We believe this will further enable us to decrease the costs associated with developing and publishing games and increase our gross margins over time.

Critical Accounting Estimates

Revenue Recognition

Our revenues are derived primarily by licensing software products in the form of online and downloadable games for PC, Mac and smartphone platforms. We distribute our products primarily through online games portals and smartphone device manufacturers (“distribution partners”), which market the games to end users. The nature of our business is such that we sell games basically through four distribution outlets – WEB portals, brick and mortar retail distributors, mobile distributors and publishers, and our own web portal, www.freezetag.com.

22

Product Sales (web and mobile revenues)

We recognize revenue from the sale of our products upon the transfer of title and risk of loss to our customers, and once any performance obligations have been completed. Revenue from product sales is recognized after deducting the estimated allowance for returns and price protection.

Licensing Revenues (retail revenues- royalties)

Third-party licensees distribute games under license agreements with us. We receive royalties from the licensees as a result. We recognize these royalties as revenues upon receipt of the monthly or quarterly (varies per distribution partner) revenue reports provided by the partner. Revenue from licensing/royalties is recognized after deducting the estimated allowance for returns and price protection.

Some license agreements require a royalty advance from the licensee/distributor in which case the original advance is recognized as a liability and royalty revenue is deducted from the advance as earned.

Other Revenues

Other revenues primarily include Ad game revenue and work-for-hire game related revenue. We derive our advertising game revenue from certain of our partners that offer our games free of charge to consumers in exchange for the consumers being exposed to advertising embedded in our games. In this way, we do not receive revenue for the sale of our games, but rather a percentage of the “advertising” revenue generated by these player views. This method of generating revenue is essentially the same as traditional radio or television advertising where consumers are allowed to enjoy content for “free” but are forced to watch (or listen) to advertising before, in between and at the end of the programming content.

Additionally, we derive some revenue from “work-for-hire” projects. Some of our partners occasionally ask us to render “work-for-hire” services for them such as preparing packaging materials. For example, a retail game and DVD publisher hired us to create several designs for printed packages that were used for games published by the publisher but not developed by us. For this work, we charge a one-time, fixed fee for each package design.

We recognize this revenue once all performance obligations have been completed. In addition, persuasive evidence of an arrangement must exist and collection of the related receivable must be probable.

We recognize revenue in accordance with current accounting standards when an arrangement exists, delivery has occurred, the price is fixed and determinable, and collectability is probable.

Cash and Cash Equivalents