Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Echo Automotive, Inc. | Financial_Report.xls |

| EX-32.1 - CERTIFICATION - Echo Automotive, Inc. | ex312.htm |

| EX-31.1 - CERTIFICATION - Echo Automotive, Inc. | ex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

|

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _____ to _____

COMMISSION FILE NUMBER 000-53681

CANTERBURY RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

98-0599680

|

|

|

State or other jurisdiction of incorporation or organization

|

(I.R.S. Employer Identification No.)

|

|

|

69 Stanley Point Road, Devonport,

Auckland, New Zealand

|

0624

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

|

Registrant's telephone number, including area code

|

(64) 9 445-6338

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

NONE.

|

|

|

Securities registered pursuant to Section 12(g) of the Act:

|

Common Stock, $0.001 Par Value Per Share.

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. [ ] Yes [X] No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. [ ] Yes [X] No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files. [X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ] (Do not check if a smaller reporting company)

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [X] Yes [ ] No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter: $50,000 as of June 30, 2011, based on the registered resale of securities on Form S-1/A effective June 3, 2009 at a price of $0.01 per share.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 27, 2012, the Registrant had 11,500,000 shares of common stock outstanding.

CANTERBURY RESOURCES, INC.

ANNUAL REPORT ON FORM 10-K

FOR THE YEAR ENDED DECEMBER 31, 2011

TABLE OF CONTENTS

| Page | ||

|

PART I

|

3

|

|

|

ITEM 1.

|

BUSINESS.

|

3

|

|

ITEM 1A.

|

RISK FACTORS.

|

4

|

|

ITEM 2.

|

PROPERTIES.

|

8

|

|

ITEM 3.

|

LEGAL PROCEEDINGS.

|

12

|

|

ITEM 4.

|

MINE SAFETY DISCLOSURES.

|

12

|

|

PART II

|

13

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

13

|

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

|

13

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

17

|

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

18

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES.

|

18

|

| ITEM 9B. | OTHER INFORMATION. | 19 |

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

20

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION.

|

21

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

22

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

23

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTING FEES AND SERVICES.

|

23

|

|

ITEM 15.

|

EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

|

24

|

|

SIGNATURES

|

25

|

2

PART I

The information in this discussion contains forward-looking statements. These forward-looking statements involve risks and uncertainties, including statements regarding the Company's capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "intend," "anticipate," "believe," "estimate,” "predict," "potential" or "continue," the negative of such terms or other comparable terminology. Actual events or results may differ materially. In evaluating these statements, you should consider various factors, including the risks described below, and, from time to time, in other reports the Company files with the United States Securities and Exchange Commission (the “SEC”). These factors may cause the Company's actual results to differ materially from any forward-looking statement. The Company disclaims any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements.

As used in this Annual Report, the terms “we,” “us,” “our,” “Canterbury,” and the “Company” mean Canterbury Resources, Inc., unless otherwise indicated. All dollar amounts in this Annual Report are expressed in U.S. dollars, unless otherwise indicated.

ITEM 1. BUSINESS.

OVERVIEW

We were incorporated on September 2, 2008 under the laws of the State of Nevada.

We are a pre-exploration stage company engaged in the acquisition and exploration of mineral properties. We own a 100% undivided interest in a mineral claim consisting of 93.1 hectares (approximately 230 acres) that we call the “Kaikoura Property.” The Kaikoura Property is located approximately 44 kilometers (27.5 miles) northwest of Kaikoura, New Zealand. Our plan is to conduct mineral exploration activities on the Kaikoura Property in order to assess whether it possesses commercially extractable deposits of gold.

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of the Kaikoura Property. We are presently in the pre-exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on the Kaikoura Property, or if such deposits are discovered, that we will enter into further substantial exploration programs. We currently do not have sufficient financial resources to meet the anticipated costs of completing the exploration program for the Kaikoura Property. Accordingly, we will need to obtain financing in order to complete our plan of operation and meet our current obligations as they come due.

COMPLIANCE WITH GOVERNMENT REGULATIONS

We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in New Zealand. The main agency that governs the exploration of minerals in New Zealand is the Department of Conservation. The Department of Conservation manages the development of public conservation lands and implements policies and programs respecting their development while protecting the environment.

The material legislation applicable to us is the Crown Minerals Act 1991 (the “Crown Minerals Act”) and the Resource Management Act 1991 (the “Resource Management Act”). The Crown Minerals Act and its regulations govern the procedures involved in locating, recording and maintaining permits in New Zealand.

All mineral exploration activities carried on public conservation land must be in compliance with the Crown Minerals Act. It outlines the powers of the Department of Conservation to monitor permits, the procedures for obtaining permits to commence work in, or on or about the property and other procedures to be observed on the property. In order to carry out our exploration program, we will be required to obtain the consent of the Department of Conservation for minimum impact activity. If we undertake activity other than minimum impact activity, we will be required to obtain an access agreement from the Department of Conservation.

3

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the exploration program. If the exploration activities require the falling of timber, then a permit or license to cut must be issued by the relevant ministry. We also may be required to obtain waste approvals. Waste approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

If our property merits additional exploration or extraction work, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on our mineral property.

COMPETITION

We are a pre-exploration stage company. We compete with other mineral resource exploration and development companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration and development companies with whom we compete have greater financial and technical resources than we do. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral properties of merit, on exploring their mineral properties and on developing their mineral properties. In addition, they may be able to afford greater geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact our ability to finance further exploration and to achieve the financing necessary for us to develop our mineral properties.

We will also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to make investments in junior mineral exploration companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We will also compete with other junior and senior mineral companies for available resources, including, but not limited to, professional geologists, camp staff, transportation, mineral exploration supplies and drill rigs.

EMPLOYEES

As of the date of this Annual Report, we have no employees other than our executive officers and sole director. We conduct our business largely through consultants.

RESEARCH AND DEVELOPMENT EXPENDITURES

We have not incurred any research expenditures since our incorporation.

PATENTS AND TRADEMARKS

We do not own, either legally or beneficially, any patent or trademark.

ITEM 1A. RISK FACTORS.

The following are some of the important factors that could affect our financial performance or could cause actual results to differ materially from estimates contained in our forward-looking statements. We may encounter risks in addition to those described below. Additional risks and uncertainties not currently known to us, or that we currently deem to be immaterial, may also impair or adversely affect our business, financial condition or results of operation.

4

If we do not obtain additional financing, our business will fail.

There is no assurance that we will be able to obtain additional financing. Our ability to obtain financing could be subject to a number of factors outside of our control, including the results from our exploration program, and any unanticipated problems relating to our mineral exploration activities, including environmental assessments and additional costs and expenses that may exceed our current estimates. If we are unable to obtain financing in the amounts and when needed, our business could fail.

We have no known mineral reserves.

We are in the initial phase of our exploration program for the Kaikoura Property. It is unknown whether this property contains viable mineral reserves. If we do not find a viable mineral reserve, or if we cannot exploit the mineral reserve, either because we have insufficient capital resources or because it is not economically feasible to do it, we may have to cease operations and our shareholders may lose their investment. Mineral exploration is a highly speculative endeavor. It involves many risks and is often non-productive. Even if mineral reserves are discovered on our property our production capabilities will be subject to further risks and uncertainties including:

|

(i)

|

Costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities, all of which we have not budgeted for;

|

|

(ii)

|

Availability and costs of financing;

|

|

(iii)

|

Ongoing costs of production; and

|

|

(iv)

|

Environmental compliance regulations and restraints.

|

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near the Kaikoura Property, and such other factors as government regulations, including regulations relating to allowable production, importing and exporting of minerals, and environmental protection.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of our mineral property. These include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Our mineral property does not contain a known body of commercial ore and, therefore, any program conducted on our mineral property would be an exploratory search of ore. There is no certainty that any expenditures made in the exploration of our mineral property will result in discoveries of commercial quantities of ore. Most exploration projects do not result in the discovery of commercially mineable deposits of ore. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims for new exploration. The acquisition of additional claims will be dependent upon our possessing sufficient capital resources to purchase such claims. If we do not have sufficient capital resources and are unable to obtain sufficient financing, we may be forced to abandon our operations.

We face significant competition.

We are a pre-exploration stage company. We compete with other mining and exploration companies possessing greater financial resources and technical facilities than we do. Accordingly, these competitors may be able to spend greater amounts on hiring and retaining qualified personnel to conduct our planned exploration activities, which could cause delays in our exploration program. In addition, there is significant competition for a limited number of mineral properties. Due to our weaker financial position, we may be unable to acquire rights to new mineral properties on a continuing basis.

5

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure against or which we may elect not to insure. At the present time we have no coverage to insure against these hazards. The payment of such liabilities may result in our inability to complete our planned exploration program and/or obtain additional financing to fund our exploration program.

As we undertake exploration of the Kaikoura Property, we will be subject to compliance with government regulations that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We will be required to comply with all regulations, rules and directives of governmental authorities and agencies applicable to the exploration of minerals in New Zealand. The main agency that governs the exploration of minerals on the Kaikoura Property is the Department of Conservation. All mineral exploration activities carried on a permit in New Zealand must be in compliance with the Crown Minerals Act 1991 (the “Crown Minerals Act”). The Crown Minerals Act applies to all mines during prospecting, exploration and mining. It outlines the powers of the Secretary of the Department of Conservation to monitor permits, the procedures for obtaining permits to commence work in, or on or about the property and other procedures to be observed on the property. In order to carry out our exploration program, we will be required to obtain the consent of the Department of Conservation for minimum impact activity. If we undertake activity other than minimum impact activity, we will be required to obtain an access agreement from the Department of Conservation.

If our property merits additional exploration or extraction work, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on our mineral property.

Because our executive officers and sole director do not have formal training specific to the technicalities of mineral exploration, there is a higher risk that our business will fail.

Our executive officers and sole director do not have any formal training as a geologist and do not have training in the technical aspects of managing a mineral exploration company. As such, we rely on independent geological consultants to make recommendations to us on work programs on our mineral property. With very limited direct training or experience in these areas, our management may not be fully aware of the specific requirements related to working within this industry. Our management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan and our business will fail.

Our success will largely depend on our ability to hire or contract highly qualified personnel with experience in geological exploration. These individuals may be in high demand and we may not be able to attract the staff we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Currently, we have not hired any key personnel. Our failure to hire key personnel when needed could have a significant negative effect on our business.

Because the prices of metals fluctuate, if the price of metals for which we are exploring decreases below a specified level, it may no longer be profitable to explore for those metals and we will cease operations.

6

Metal prices are determined by such factors as expectations for inflation, the strength of the United States dollar, global and regional supply and demand, and political and economic conditions and production costs in metals producing regions of the world. The aggregate effect of these factors on metal prices is impossible for us to predict. In addition, the price of metals such as gold is sometimes subject to rapid short-term and/or prolonged changes because of speculative activities. The current demand for and supply of these metals affect the metal prices, but not necessarily in the same manner as current supply and demand affect the prices of other commodities. The supply of these metals primarily consists of new production from mining. If the prices of the metals are, for a substantial period, below our foreseeable cost of production, it may not be economical for us to continue operations and our shareholders could lose their entire investment.

Because our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, Treasurer and sole Director, Bruce A. Wetherall, currently owns 56.5% of our issued and outstanding common stock, shareholders may find that corporate decisions controlled by Mr. Wetherall are inconsistent with the interests of other stockholders.

Bruce A. Wetherall, our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, Treasurer and sole director, currently owns 56.5% of our issued and outstanding shares. Accordingly, in accordance with our Articles of Incorporation and Bylaws, Mr. Wetherall is able to control who is elected as a director and thus could act, or could have the power to act, as our management. Since Mr. Wetherall is not simply a passive investor, but is also our sole executive officer and sole director, his interests as an executive officer and director may, at times, be adverse to those of passive investors. Where those conflicts exist, our shareholders will be dependent upon Mr. Wetherall exercising, in a manner fair to all of our shareholders, his fiduciary duties as an officer or as a director. Also, due to his stock ownership position, Mr. Wetherall will have: (i) the ability to control the outcome of most corporate actions requiring stockholder approval, including amendments to our Articles of Incorporation; (ii) the ability to control corporate combinations or similar transactions that might benefit minority stockholders which may be rejected by Mr. Wetherall to their detriment; and (iii) control over transactions between him and Canterbury.

We will likely conduct further offerings of our equity securities in the future, in which case your proportionate interest may become diluted.

We will likely be required to conduct additional equity offerings in the future to finance our exploration program or to finance subsequent projects that we decide to undertake. If common stock is issued in return for additional funds, the price per share could be lower than the price per share under our effective prospectus. We anticipate continuing to rely on equity sales of our common stock in order to fund our business operations. If we issue additional stock, our shareholders’ percentage interest in us could become diluted.

Even with being quoted on the OTC Bulletin Board, a market may not develop for our shock and our stockholders may be unable to sell their shares.

Even though we have recently commenced quotation on the OTC Bulletin Board (“OTCBB”) we can provide no assurance that a market will develop whereby our stockholders can sell their shares. In other words there may be no one wishing to purchase shares in our Company and our stockholders may not be able to re-sell the shares of our common stock that they have purchased and may lose all of their investment.

Because our stock is a penny stock, shareholders will be more limited in their ability to sell their stock.

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or quotation system. Because our securities constitute “penny stocks” within the meaning of the rules, the rules apply to us and to our securities. The rules may further affect the ability of owners of shares to sell our securities in any market that might develop for them. As long as the trading price of our common stock is less than $5.00 per share, the common stock will be subject to Rule 15g-9 under the Securities Exchange Act of 1934 (the “Exchange Act”). The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

7

|

1.

|

contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of securities laws;

|

|

2.

|

contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

3.

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

4.

|

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

|

|

5.

|

contains such other information and is in such form, including language, type, size and format, as the SEC shall require by rule or regulation.

|

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with: (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock.

ITEM 2. PROPERTIES.

Our office is located at 69 Stanley Point Road, Devonport, Auckland, New Zealand 0624, which is the personal residences of Bruce A. Wetherall, our sole executive officer and director.

We own a 100% interest in a mineral property called the Kaikoura Property.

KAIKOURA PROPERTY

On October 3, 2008, we acquired the Kaikoura Property from Plymouth Enterprises for $5,000. The Kaikoura Property consists of 93.1 hectares (approximately 230 acres), located 44 kilometers (27.5 miles) northwest of Kaikoura, New Zealand.

Description of Property

The Kaikoura Property is recorded with the Department of Conservation in New Zealand. In accordance with the regulations of the Crown Minerals Act, the Kaikoura Property is in good standing until March 16, 2013.

8

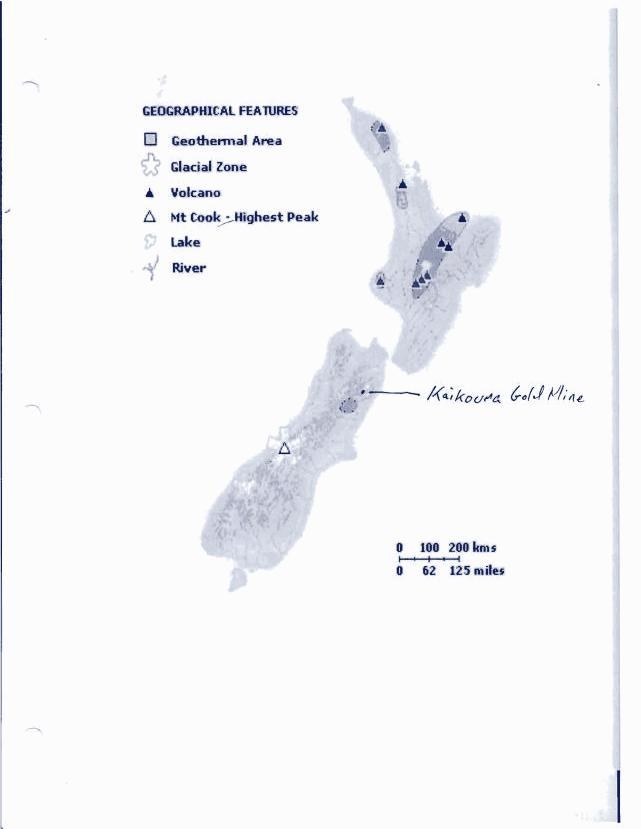

Figure 1

Location of the Kaikoura Property

9

Accessibility, Climate, Locale Resources, Infrastructure and Topography

The Kaikoura Property is accessible from Kaikoura by traveling either on State Highway one or the South Island main trunk railway. Kaikoura also has a small sealed airstrip. Even though the airstrip is mainly used for tourist flights, it can also be used by small private charter flights.

Kaikoura’s climate is strongly influenced by north-westerly winds that create a steep moisture gradient from the west along the main divide of the Southern Alps (average annual rainfall about 5,000 millimeters), to the dry eastern margins of the intermontane basins and coastal areas (average annual rainfall 500 to 800 millimeters).

Kaikoura has an experienced work force and can provide the services needed for an exploration and development program, including drilling companies and assay facilities. Kaikoura’s infrastructure also includes police, hospitals, groceries, fuel, helicopter services, hardware and other services.

History

Deposits of shell and eroded sand formed the basis for the limestone, which makes up most of New Zealand. This limestone was, over the ages, pushed upwards, making it possible to find sea fossils high in the country’s mountains. This pushing up continues today.

New Zealand is characterized by steep mountains without any substantial forest cover. High, steep mountains, short distances and lack of forest cover mean that rainwater runs fast to the sea, causing substantial erosion.

Numerous showings of mineralization have been discovered in the area and six prospects have achieved significant production. Currently, Greymouth Gold Mine produces approximately 120,000 ounces of gold annually. The Greymouth Gold Mine is located approximately 150 kilometers (approximately 94 miles) from the Kaikoura Property.

Records indicate that no detailed exploration program has been completed on the Kaikoura Property. Also, there is no indication that any drilling has occurred on the Kaikoura Property.

Regional Geology

The regions terrain consists of crystalline hard rocks with detached occurrences of crystalline limestone and iron ore veins and basic intrusives such as dolerites and anorthosites. Coastal zones contain sedimentary limestones, clay, laterites, heavy mineral sands and silica sands. The hill ranges are sporadically capped with laterites and bauxites of a residual nature. Gypsum and phosphatic nodules occur as sedimentary veins in rocks of the cretaceous age. Gypsum of secondary replacement occurs in some of the areas adjoining the foot hills of the Western Ghats. Lignite occurs as sedimentary beds of Tertiary age. The Black Granite and other hard rocks are amenable for high polish. These granites occur in most of the districts except the coastal area.

The principal mineral deposits for the area of Kaikoura Property (and for most of the New Zealand for that matter) are limestone in the Tertiary rocks.

In general the volcanoes culminate with effluents of hydrothermal solutions that carry precious metals in the form of naked elements, oxides or sulfides.

These hydrothermal solutions intrude into the older rocks as quartz veins. These rocks may be broken due to mechanical and chemical weathering into sand size particles and carried by streams and channels. Gold occurs also in these sands as placers.

10

Property Geology

The Kaikoura Property is underlain by sediments and volcanics. Intrusives consisting of rocks such as tonalite, monzonite, and gabbro are located east of the Kaikoura Property. The intrusives also consist of a large mass of granodiorite towards the western most point of the Kaikoura Property.

The area consists of interlayered chert, argillite and massive andesitic to basaltic volcanics. The volcanics are hornfelsed, commonly contain minor pyrite and pyrrhotite.

Mineralization

The thickness of deposits range from a few millimeters to over a meter. Individual veins display a variety of forms, including saddle-shaped, pod-shaped or lens-shaped, tabular or irregular bodies. The veining frequently forms anastomosing or stockwork patterns.

Mineralization is located within a large fractured block created where prominent northwest-striking shears intersect the north striking caldera fault zone. The major lodes cover an area of two kilometers and are mostly within 400 meters of the surface. Lodes occur in three main structural settings:

(i) steeply dipping northwest striking shears;

(ii) flatdipping (1040) fractures (flatmakes); and

(iii) shatter blocks between shears.

In this region, gold mineralization appears to occur in tellurides and pyrite.

Current Exploration Activities

Our consulting geologist concluded that the locale of the Kaikoura Property is underlain by the units of mineral deposits of limestone in the tertiary rocks that are found at those mineral occurrence sites. These rocks consisting of cherts and argillites (sediments) and andesitic to basaltic volcanic have been intruded by granodiorite. Structures and mineralization probably related to this intrusion are found throughout the region and occur on the Kaikoura Property. They are associated with all the major mineral occurrences and deposits in the area.

Our consulting geologist concluded that mineralization found on the Kaikoura Property is consistent with that found associated with zones of extensive mineralization. However, our consulting geologist noted that previous exploration work on the Kaikoura Property has been limited and sporadic and has not tested the potential of the property.

As a result of the above conclusions, our consulting geologist recommended a two phase exploration program to further delineate the mineralized system currently recognized on Kaikoura Property. The first phase of the exploration consists of air photo interpretation of the structures, geological mapping, both regionally and detailed on the area of the main showings, geophysical survey using both magnetic and electromagnetic instrumentation in detail over the area of the showings and in a regional reconnaissance survey. The second phase of the exploration will consist of geochemical soil sample surveying regionally to identify other areas on the claim that are mineralized and in detail on the known areas of mineralization. The effort of this exploration work is to define and enable interpretation of a follow-up diamond drill program, so that the known mineralization and the whole property can be thoroughly evaluated with the most up to date exploration techniques.

11

|

Phase

|

Recommended Exploration Program

|

Estimated Cost

|

Status

|

|

Phase I

|

Geological mapping and sampling on main showings and on Kaikoura Property.

|

$12,751

(Paid)

|

Commenced in November 2011.

|

|

Phase 2

|

Geochemical surveying and surface sampling in order to identify additional areas of mineralization on the Kaikoura Property.

|

$44,100 NZD (approximately $34,998)

|

To be determined based on the results of Phase I of our exploration program.

|

In October 2008, we conducted a soil sampling program on the Kaikoura Property. In connection with our sampling program, we drilled eight holes and collected samples from each hole. Holes 1 – 6 were drilled at 30 meter intervals on two lines approximately 5 meters apart. Holes 7 and 8 were drilling from the same collar 50 meters north of hole 6. The assay results we received from our sampling program is summarized as follows:

|

Hole No.

|

Total Depth in

(in Meters)

|

Mineralized Interval

(in Meters)

|

Au Results

(oz/t)

|

|

01

|

40.8

|

0.15

|

0.027

|

|

02

|

63.3

|

7.05

1.05

|

0.011

0.048

|

|

03

|

76.4

|

2.0

8.0

1.2

|

0.033

0.078

0.125

|

|

04

|

100.4

|

39.0

30.9

8.1

1.0

|

0.224

0.022

0.995

0.091

|

|

05

|

48.9

|

6.0

|

0.012

|

|

06

|

93.0

|

15.4

|

0.042

|

|

07

|

60.0

|

2.0

|

0.015

|

|

08

|

187.7

|

14.0

|

0.016

|

In November 2011, we commenced our geological mapping and sampling program on the Kaikoura Property and anticipate on receiving the results in the second quarter of 2012.

ITEM 3. LEGAL PROCEEDINGS.

We are not a party to any other legal proceedings and, to our knowledge; no other legal proceedings are pending, threatened or contemplated.

ITEM 4. MINE SAFETY DISCLOSURES.

Not Applicable.

12

PART II

|

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

|

MARKET INFORMATION

Our shares of common stock commenced quotation on OTCBB under the symbol (“CTBX”) on February 22, 2012. Prior to this date, no public market existed for our common stock.

HOLDERS OF OUR COMMON STOCK

As of March 27, 2012, there were 38 registered holders of record of our common stock.

DIVIDENDS

There are no restrictions in our Articles of Incorporation or Bylaws that would prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where, after giving effect to the distribution of the dividend:

|

1.

|

We would not be able to pay our debts as they become due in the usual course of business; or

|

|

2.

|

Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of stockholders who have preferential rights superior to those receiving the distribution.

|

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

RECENT SALES OF UNREGISTERED SECURITIES

None.

|

ITEM 7.

|

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITIONS AND RESULTS OF OPERATIONS.

|

PLAN OF OPERATION

During the next twelve months and subject to our ability to obtain financing, we intend to conduct mineral exploration activities on the Kaikoura Property in order to assess whether it possesses mineral reserves capable of commercial extraction. Our exploration program is designed to explore for commercially viable deposits of gold mineralization. We have not, nor has any predecessor, identified any commercially exploitable reserves of gold on the Kaikoura Property.

In late 2011, we commenced Phase I of our exploration program on the Kaikoura Property an anticipate on receiving the results in the second quarter of 2012.

We anticipate that we will incur the following expenses over the next twelve months:

13

|

Category

|

Planned Expenditures Over

The Next 12 Months (US$)

|

|||

|

Legal and Accounting Fees

|

10,500 | |||

|

Mineral Property Exploration Expenses

|

34,998 | |||

|

Other General and Administrative Expenses

|

10,000 | |||

|

TOTAL

|

$ | 55,498 | ||

To date, we have not earned any revenues and we do not anticipate earning revenues in the near future. As at December 31, 2011, we had cash on hand of $64,360. As such, we currently have sufficient financial resources to complete Phase Il of the Kaikoura Property and to meet the costs of our general and administrative expenses. Accordingly, we will not need to obtain financing at the present time. However we may need financing in the future. We currently do not have any arrangements for financing and we may not be able to obtain financing when required. Obtaining financing would be subject to a number of factors outside of our control, including the results from our exploration program, and any unanticipated problems relating to our mineral exploration activities, including environmental assessments and additional costs and expenses that may exceed our current estimates. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us in which case our business will fail.

RESULTS OF OPERATIONS

Summary of Year End Results

|

Year Ended

December 31, 2011

|

Year Ended

December 31, 2010

|

Percentage

Increase / (Decrease)

|

||||||||||

|

Revenue

|

$ | - | $ | - | n/a | |||||||

|

Expenses

|

(33,351 | ) | (24,219 | ) | 37.7 | % | ||||||

|

Net Loss

|

$ | (33,351 | ) | $ | (24,219 | ) | 37.7 | % | ||||

Revenue

We have not earned any revenues to date. We do not anticipate earning revenues until such time as we enter into commercial production of our mineral property. We are presently in the pre-exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our property, or if such deposits are discovered, that we will enter into further substantial exploration programs.

Expenses

The major components of our expenses for the years ended December 31, 2011 and 2010 are outlined in the table below:

|

Year Ended

December 31, 2011

|

Year Ended

December 31, 2010

|

Percentage

Increase / (Decrease)

|

||||||||||

|

Accounting and Audit

|

$ | 9,564 | $ | 4,162 | 129.8 | % | ||||||

|

Edgarizing

|

1,546 | 787 | 100.3 | % | ||||||||

|

Exploration expense

|

13,951 | - | 100.0 | % | ||||||||

|

Filing Fees

|

3,089 | 100 | 298.9 | % | ||||||||

|

Legal

|

5,000 | 5,000 | 0 | % | ||||||||

|

Management Fees

|

- | 9,000 | (100.0 | )% | ||||||||

|

Office

|

201 | 301 | (33.2 | )% | ||||||||

|

Rent

|

- | 2,700 | (100.0 | )% | ||||||||

|

Telephone

|

- | 1,350 | (100.0 | )% | ||||||||

|

Transfer agent fees

|

- | 819 | (100.0 | )% | ||||||||

|

Total Expenses

|

$ | 33,351 | $ | 24,219 | 37.7 | % | ||||||

Our expenses during our fiscal year ended December 31, 2011 primarily consisted of accounting and audit expenses, edgarizing expenses, legal expenses and exploration expenses.

14

Legal and accounting and audit expenses during our fiscal year ended December 31, 2011 primarily relate to the preparation and filing of our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q as well as complying with our ongoing reporting requirements under the Exchange Act.

In the previous year, we accrued a management fee expense of $1,000 per month, a rent expense $300 per month and a telephone expense of $150 per month with an offsetting entry to Capital in Excess of Par Value for each of these expenses up until September 30, 2010. We have ceased to accrue management fees, rent and telephone for the fourth quarter of fiscal 2010 and will not use this accounting practice in the future.

LIQUIDITY AND CAPITAL RESOURCES

Working Capital

|

As at

December 31, 2011

|

As at

December 31, 2010

|

Percentage

Increase / (Decrease)

|

||||||||||

|

Current Assets

|

$ | 64,360 | $ | - | n/a | |||||||

|

Current Liabilities

|

(143,602 | ) | (45,891 | ) | 212.9 | % | ||||||

|

Working Capital Deficit

|

$ | (79,242 | ) | $ | (45,891 | ) | 212.9 | % | ||||

Cash Flows

|

Year Ended

December 31, 2011

|

Year Ended

December 31, 2010

|

|||||||

|

Cash Flows used in Operating Activities

|

$ | (28,041 | ) | $ | (10,337 | ) | ||

|

Cash Flows used in Investing Activities

|

- | - | ||||||

|

Cash Flows from Financing Activities

|

92,401 | 10,337 | ||||||

|

Net Increase in Cash During Period

|

$ | 64,360 | $ | - | ||||

As of December 31, 2011, we had no cash on hand. We have incurred a cumulative net loss of $126,992 for the period from the date of our inception on September 2, 2008 to December 31, 2011 and have not attained profitable operations to date. Our working capital deficit increased from $45,891, as at December 31, 2010, to $79,242, as at December 31, 2011, primarily as a result of: (i) an increase in accounts payable due to our lack of capital to meet our ongoing expenditures; and (ii) the fact that we received advances from our sole executive officer of $92,401 during our fiscal year ended December 31, 2011.

Financing Requirements

We currently have sufficient financial resources to meet the anticipated costs of our future expenses and to complete our exploration program for the Kaikoura Property. In the event that we wish to conduct future exploration work on the Kaikoura Property, we will need to obtain additional financing.

There is no assurance that we will achieve any additional sales of our equity securities or arrange for debt or other financing to fund our planned business activities. We may also rely on advances from our sole executive officer and director; however, there are no assurances that our sole executive officer or director will provide us with any additional funds if and when needed.

Currently, we do not have any arrangements for financing. There is no assurance that we will be able to obtain financing if and when required. We anticipate that any financing may be in the form of sales of shares of our common stock which may result in dilution to our current shareholders.

15

OFF-BALANCE SHEET ARRANGEMENTS

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

CRITICAL ACCOUNTING POLICIES

The preparation of financial statements in conformity with generally accepted accounting principles requires our management to make estimates and assumptions that affect the reported amount of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our management routinely makes judgments and estimates about the effects of matters that are inherently uncertain.

We have identified certain accounting policies, described below, that are most important to the portrayal of our current financial condition and results of operations. Our significant accounting policies are disclosed in the notes to our audited financial statements included in this Annual Report on Form 10-K.

Estimates and Assumptions

Management uses estimates and assumptions in preparing financial statements in accordance with general accepted accounting principles. Those estimates and assumptions affect the reported amounts of the assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenues and expenses. Actual results could vary from the estimates that were assumed in preparing these financial statements.

Mineral Property Acquisition and Exploration Costs

Mineral property acquisition costs are initially capitalized when incurred. These costs are then assessed for impairment when factors are present to indicate the carry costs may not be recoverable. Mineral exploration costs are expensed when incurred.

16

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA.

|

1.

|

Report of Independent Registered Public Accounting Firm (Madsen & Associates CPA’s, Inc.);

|

|

2.

|

Balance Sheets as at December 31, 2011 and 2010;

|

|

3.

|

Statements of Operations for the years ended December 31, 2011 and 2010, and for the period from inception on September 2, 2008 to December 31, 2011;

|

|

4.

|

Statement of Stockholders’ Deficiency for the period from inception on September 2, 2008 to December 31,2011;

|

|

5.

|

Statements of Cash Flows for the years ended December 31, 2011 and 2010, and for the period from inception on September 2, 2008 to December 31, 2011

|

|

6.

|

Notes to Financial Statements.

|

17

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE.

|

We have had no changes in or disagreements with our principal independent accountant.

ITEM 9A. CONTROLS AND PROCEDURES.

Disclosure Controls and Procedures

Under the supervision and with the participation of our management, including the Principal Executive Officer and Principal Accounting Officer, we have evaluated the effectiveness of our disclosure controls and procedures as required by Exchange Act Rule 13a-15(b) as of December 31, 2011 (the “Evaluation Date”). Based on that evaluation, the Principal Executive Officer and Principal Accounting Officer have concluded that these disclosure controls and procedures were not effective as of the Evaluation Date as a result of the material weaknesses in internal control over financial reporting discussed below.

Disclosure controls and procedures are those controls and procedures that are designed to ensure that information required to be disclosed in our reports filed or submitted under the Exchange Act are recorded, processed, summarized and reported within the time periods specified in the SEC's rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to management, including our Principal Executive Officer and Principal Accounting Officer, to allow timely decisions regarding required disclosure.

Notwithstanding the assessment that our internal control over financial reporting was not effective and that there were material weaknesses as identified below, we believe that our financial statements contained in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 fairly present our financial condition, results of operations and cash flows in all material respects.

Management’s Report on Internal Control over Financial Reporting

Management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting. The Company's internal control over financial reporting is a process, under the supervision of the Chief Executive Officer and the Chief Financial Officer, designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of the Company's financial statements for external purposes in accordance with United States Generally Accepted Accounting Principles (GAAP). Internal control over financial reporting includes those policies and procedures that:

|

|

-

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the Company's assets;

|

|

|

-

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of the financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures are being made only in accordance with authorizations of management and the Board of Directors; and

|

|

|

-

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use, or disposition of the Company's assets that could have a material effect on the financial statements.

|

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions or that the degree of compliance with the policies or procedures may deteriorate.

The Company's management conducted an assessment of the effectiveness of the Company's internal control over financial reporting as of December 31, 2011, based on criteria established in Internal Control –Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission ("COSO"). As a result of this assessment, management identified a material weakness in internal control over financial reporting.

18

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the Company's annual or interim financial statements will not be prevented or detected on a timely basis.

The material weakness identified is described below.

|

1.

|

Certain entity level controls establishing a “tone at the top” were considered material weaknesses. As of December 31, 2011, the Company did not have a separate audit committee or a policy on fraud. A whistleblower policy is not necessary given the small size of the organization.

|

|

2.

|

Due to the significant number and magnitude of out-of-period adjustments identified during the year- end closing process, management has concluded that the controls over the period-end financial reporting process were not operating effectively. A material weakness in the period-end financial reporting process could result in us not being able to meet our regulatory filing deadlines and, if not remediated, has the potential to cause a material misstatement or to miss a filing deadline in the future. Management override of existing controls is possible given the small size of the organization and lack of personnel.

|

|

3.

|

There is no system in place to review and monitor internal control over financial reporting. The Company maintains an insufficient complement of personnel to carry out ongoing monitoring responsibilities and ensure effective internal control over financial reporting.

|

As a result of the material weakness in internal control over financial reporting described above, the Company's management has concluded that, as of December 31, 2011, the Company's internal control over financial reporting was not effective based on the criteria in Internal Control - Integrated Framework issued by COSO.

This Annual Report does not include an attestation report of our independent registered public accounting firm regarding internal control over financial reporting. We were not required to have, nor have we, engaged our independent registered public accounting firm to perform an audit of internal control over financial reporting pursuant to the rules of the Securities and Exchange Commission that permit us to provide only management's report in this Annual Report.

Our independent accountants have stated in their report dated March 19, 2012 that “the company is not required to have nor were we engaged to perform an audit of its internal control over financial reporting”.

Changes in Internal Controls

There were no changes in our internal control over financial reporting during the fiscal year ended December 31, 2011 that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION.

None.

19

PART III

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE.

|

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the name and positions of our executive officers and sole director as of the date hereof.

|

Name

|

Age

|

Positions

|

|

Bruce A. Wetherall

|

68

|

Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, Treasurer and Director

|

|

B. Gordon Brooke

|

68

|

Vice President, Finance

|

Bruce A. Wetherall has been our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, Treasurer and Director since our inception. In 1978, Mr. Wetherall founded Canterbury Systems Corporation, a software development company specializing in billing systems for law firms. Mr. Wetherall operated Canterbury Systems Corporation until 1991 when he sold it to CMS Data of Tallahassee, Florida. From 1993 to 2001, Mr. Wetherall worked as Vice-President of Software Development of CMS Data. In 2003, Mr. Wetherall founded a property development company called Pacific Bay Properties, which is he is currently a director and 50% owner.

B. Gordon Brooke has been our Vice-President, Finance since May 15, 2011. Mr. Brooke has an extensive accounting background, which has included being a Chartered Accountant at FF Sharles & Company, Chartered Accountants, and Deloitte, Haskens and Sells, Chartered Accountants, from the late 1960s to early 1970s. Since 2001, Mr. Brooke has been a financial consultant for Snack Crafters Inc. His responsibilities include preparing business plans, serving as an interim accountant providing accounting services, preparation of financial statements on a non-audit basis, corporate tax returns and assisting in its reorganization and restructuring. Mr. Brooke has also served as a director on various public companies, including Patterson Brooke Resources Inc. and Standard Capital Corporation.

Our executive officers and sole director do not have any formal training as geologists and do not have training on the technical and managerial aspects of managing a mineral exploration company. Mr. Wetherall has not had any prior managerial and consulting positions in the mineral exploration industry whereas Mr. Brooke was a director of Patterson Brooke Resources Inc. and Standard Capital Corporation, both companies involved in mineral exploration. Mr. Brooke’s function in both these companies was one of administration and was not involved in the exploration of their properties. Accordingly, we will have to rely on the technical services of others to advise us on the managerial aspects specifically associated with a mineral exploration company. We do not have any employees who have professional training or experience in the mining industry. We rely on independent geological consultants to make recommendations to us on work programs on our property, to hire appropriately skilled persons on a contract basis to complete work programs and to supervise, review, and report on such programs to us.

SIGNIFICANT EMPLOYEES

We have no significant employees other than our executive officers and sole director.

We conduct our business through agreements with consultants and arms-length third parties. Currently, we have no formal consulting agreements in place. We have a verbal arrangement with the consulting geologist currently conducting the exploratory work on the Kaikoura Property. We pay to this geologist the usual and customary rates received by geologists performing similar consulting services.

TERMS OF OFFICE

Members of our board of directors are appointed to hold office until the next annual meeting of our stockholders or until his successor is elected and qualified, or until they resign or are removed in accordance with the provisions of the Nevada Revised Statutes. Our officers are appointed by our board of directors and hold office until removed by the board.

20

COMMITTEES OF THE BOARD OF DIRECTORS

We do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee or any other committees of our board of directors.

AUDIT COMMITTEE

We do not maintain a separately-designated standing audit committee. As a result, our sole director, Mr. Wetherall, acts as our audit committee.

Mr. Wetherall does not meet the definition of an “audit committee financial expert.” We believe that the cost related to appointing a financial expert to our board of directors at this time is prohibitive.

CODE OF ETHICS

We adopted a Code of Ethics applicable to our officers and sole director which is a “code of ethics” as defined by applicable rules of the SEC. Our code of ethics is attached as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2009. If we make any amendments to our Code of Ethics other than technical, administrative, or other non-substantive amendments, or grant any waivers, including implicit waivers, from a provision of our Code of Ethics to our officers or directors, we will disclose the nature of the amendment or waiver, its effective date and to whom it applies in a current report on Form 8-K filed with the SEC.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than 10% of a registered class of our securities (“Reporting Persons”), to file reports of ownership and changes in ownership with the SEC. Reporting Persons are required by SEC regulations to furnish us with copies of all forms they file pursuant to Section 16(a). Based solely on our review of the copies of such forms received by us, we believe that, during the last fiscal year, the following persons have failed to file, on a timely basis, the identified reports required by Section 16(a) of the Exchange Act:

|

Name and Principal Position

|

Number of Late Insider Reports

|

Transactions Not Timely Reported

|

Known Failures to File a Required Form

|

|

Bruce Wetherall

CEO, CFO, President and Secretary

|

None

|

None

|

None

|

|

B. Gordon Brooke

Vice-President, Finance

|

One

|

One

|

None

|

ITEM 11. EXECUTIVE COMPENSATION.

SUMMARY COMPENSATION TABLE

We have not paid any compensation to our executive officers and sole director during the fiscal years ended December 31, 2011 and 2010. Previously, we accrued a management fee expense of $1,000 per month, but this accounting practice was discontinued during the fourth quarter of fiscal 2010.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR-END

We do not have any stock options outstanding. No stock options or stock appreciation rights under any stock incentive plans were granted to our officers or sole director since our inception.

21

EMPLOYMENT CONTRACTS

We do not have an employment contract with our executive officers and sole director. We also do not have any termination of employment or change-in-control arrangements with our sole executive officer and sole director.

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS.

|

EQUITY COMPENSATION PLANS

We have no equity compensation plans (including individual compensation arrangements) under which our equity securities are authorized for issuance.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the number of shares of our common stock owned beneficially as of March 27, 2012 by: (i) each person (including any group) known to us to own more than five percent (5%) of any class of our voting securities, (ii) each of our directors and each of our named executive officers (as defined under Item 402(m)(2) of Regulation S-K), and (iii) officers and directors as a group. Unless otherwise indicated, the shareholders listed possess sole voting and investment power with respect to the shares shown.

|

Title of Class

|

Name and Address of Beneficial Owner

|

Number of Shares of Common Stock(1)

|

Percentage of Common Stock(1)

|

|

DIRECTORS AND OFFICERS

|

|||

|

Common Stock

|

Bruce A. Wetherall

Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, Treasurer and Director

|

6,500,000

(Direct)

|

56.5%

|

|

Common Stock

|

B. Gordon Brooke

Vice President

|

Nil

|

0.0%

|

|

5% SHAREHOLDERS

|

|||

|

Common Stock

|

Bruce A. Wetherall

Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer, President, Secretary, Treasurer and Director

69 Stanley Point Road

Devonport, Auckland

New Zealand 0624

|

6,500,000

(Direct)

|

56.5%

|

|

(1)

|

Under Rule 13d-3, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise has or shares: (i) voting power, which includes the power to vote, or to direct the voting of shares; and (ii) investment power, which includes the power to dispose or direct the disposition of shares. Certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire the shares (for example, upon exercise of an option) within 60 days of the date as of which the information is provided. In computing the

|

22

|

(2)

|

percentage ownership of any person, the amount of shares outstanding is deemed to include the amount of shares beneficially owned by such person (and only such person) by reason of these acquisition rights. As a result, the percentage of outstanding shares of any person as shown in this table does not necessarily reflect the person’s actual ownership or voting power with respect to the number of shares of common stock actually outstanding on March 27, 2012. As of March 27, 2012, there were 11,500,000 shares of our common stock issued and outstanding.

|

CHANGES IN CONTROL

We are not aware of any arrangement which may result in a change in control in the future.

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

|

RELATED TRANSACTIONS

Except as otherwise described below, none of the following persons has any direct or indirect material interest in any transaction to which we were or are a party during the past two years, or in any proposed transaction to which we propose to be a party:

|

(a)

|

any director or officer;

|

|

(b)

|

any proposed nominee for election as a director;

|

|

(c)

|

any person who beneficially owns, directly or indirectly, shares carrying more than 5% of the voting rights attached to our common stock;

|

|

(d)

|

any promoters; or

|

|

(e)

|

any relative or spouse of any of the foregoing persons, or any relative of such spouse, who has the same house as such person or who is a director or officer of any parent or subsidiary.

|

As at December 31, 2011, we were indebted to our sole executive officer and director, Bruce A. Wetherall, in the principal amount of $128,086. The advances bear no interest and are due on demand.

DIRECTOR INDEPENDENCE

Our common stock is quoted on the OTC Bulletin Board inter-dealer quotation, which does not have director independence requirements. Under NASDAQ Rule 5605(a)(2), a director is not considered to be independent if he or she is also an executive officer or employee of the corporation. As Mr. Wetherall is our sole executive officer and director, we have determined that Mr. Wetherall is not an independent director as defined under NASDAQ Rule 5605(a)(2).

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES.

The aggregate fees billed for the two most recently completed fiscal years for professional services rendered by the principal accountant for the audit of our annual financial statements and review of the financial statements included in our Quarterly Reports on Form 10-Q and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal periods were as follows:

|

Year Ended December 31, 2011

|

Year Ended December 31, 2010

|

|||||||

|

Audit Fees

|

$ | 5,700 | $ | 5,100 | ||||

|

Audit-Related Fees

|

$Nil

|

$Nil

|

||||||

|

Tax Fees

|

$Nil

|

$Nil

|

||||||

|

All Other Fees

|

$Nil

|

$Nil

|

||||||

|

Total

|

$ | 5,700 | $ | 5,100 | ||||

23

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES.

The following exhibits are either provided with this Annual Report or are incorporated herein by reference:

|

Exhibit Number

|

Description of Exhibits

|

|

3.1

|

Articles of Incorporation.(1)

|

|

3.2

|

Bylaws, as amended.(1)

|

|

10.1

|

Assignment Agreement dated October 3, 2008 between Plymouth Enterprises and Canterbury Resources, Inc.(1)

|

|

14.1

|

Code of Ethics.(2)

|

|

31.1

|

Certification of Principal Executive Officer and Principal Accounting Officer as adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002.

|

|

32.1

|

Certification of Principal Executive Officer and Principal Accounting Officer as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

|

|

(1)

|

Previously filed as an exhibit to our Registration Statement on Form S-1 originally filed with the SEC on March 20, 2009, as amended May 12, 2009 and declared effective June 3, 2009.

|

|

(2)

|

Previously filed as an exhibit to our Annual Report on Form 10-K filed on March 31, 2010.

|

24

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

CANTERBURY RESOURCES, INC.

|

|||

|

Date:

|

March 28, 2012

|

By:

|

/s/ Bruce A. Wetherall

|

|

BRUCE A. WETHERALL

|

|||

|

President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer and Director

|

|||

|

(Principal Executive Officer and Principal Accounting Officer)

|

|||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

Date:

|

March 28, 2012

|

By:

|

/s/ Bruce A. Wetherall

|

|

BRUCE A. WETHERALL

|

|||

|

President, Secretary, Treasurer, Chief Executive Officer, Chief Financial Officer and Director

|

|||

|

(Principal Executive Officer and Principal Accounting Officer)

|

|||

25

|

MADSEN & ASSOCIATES CPA’s, INC.

|

684 East Vine Street, #3

|

|

Certified Public Accountants

|

Murray, Utah, 84107

|

|

Telephone: 801-268-2632

|

|

|

Fax: 801-262-3978

|

To the Board of Directors and

Stockholders of Canterbury Resources, Inc.

(A Pre-Exploration Stage Company)

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have audited the accompanying balance sheets of Canterbury Resources, Inc. (A Pre-exploration stage company) (The Company) as of December 31, 2011 and 2010, and the related statements of operations, stockholders' deficiency, and cash flows for each of the years in the two-year period ended December 31, 2011, and for the period from September 2, 2008 (date of inception) to December 31, 2011. The Company’s management is responsible for these financial statements. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The company is not required to have nor were we engaged to perform an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purposes of expressing an opinion on the effectiveness for the company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosure in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.