Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CRAILAR TECHNOLOGIES INC | Financial_Report.xls |

| EX-23.1 - AUDITOR CONSENT LETTER - CRAILAR TECHNOLOGIES INC | exhibit23-1.htm |

| EX-31.1 - CERTIFICATION OF CHIEF EXECUTIVE OFFICER - CRAILAR TECHNOLOGIES INC | exhibit31-1.htm |

| EX-31.2 - CERTIFICATION OF CHIEF FINANCIAL OFFICER - CRAILAR TECHNOLOGIES INC | exhibit31-2.htm |

| EX-32.1 - SECTION 906 CERTIFICATIONS - CRAILAR TECHNOLOGIES INC | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

Mark One

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File No.:000-50367

NATURALLY ADVANCED TECHNOLOGIES

INC.

(Exact name of registrant in its charter)

| British Columbia | 98-0359306 |

| (State or other jurisdiction of incorporation | (I.R.S. Employer Identification No.) |

| or organization) |

Suite 305, 4420 Chatterton Way, Victoria, British

Columbia, Canada V8X 5J2

(Address of principal executive

offices)

(250) 658-8582

(Registrant’s telephone

number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: |

| None | N/A |

Securities registered pursuant to Section 12(g) of the

Act:

Common Stock, without par value

(Title of Class)

Indicate by checkmark if registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act.

[ ]

Yes [X] No

Indicate by check mark if the registrant is not required to file

reports pursuant to Section 13 or 15(d) of the Exchange Act.

[ ]

Yes [X] No

Indicate by check mark whether the registrant (i) has filed all

reports required to be filed by Section 13 or 15(d) of the Exchange Act during

the past 12 months (or for such shorter period that the registrant was required to file such reports), and (ii) has been subject to

such filing requirements for the past 90 days.

[X]

Yes [ ] No

1

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such files).

[X] Yes [ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

| Large accelerated filer [ ] | Accelerated filer [X] |

| Non-accelerated filer [ ] | Smaller reporting company [ ] |

| (Do not check if smaller reporting company) |

Indicate by checkmark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes [

] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, was $99,259,000

The registrant had 42,422,804common stock outstanding as of March 15, 2012.

2

TABLE OF CONTENTS

3

Forward-Looking Statements

Statements made in this Form 10-K that are not historical or current facts are “forward-looking statements” made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements often can be identified by the use of terms such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “approximate,” “potential” or “continue,” or the negative of such terms or other comparable terminology. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management’s best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Available Information

We file annual, quarterly, current reports, proxy statements, and other information with the Securities and Exchange Commission (the “SEC”). You may read and copy documents referred to in this Annual Report on Form 10-K that have been filed with the SEC at the SEC’s Public Reference Room, 100 F Street, N.E., Washington, D.C., 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You can also obtain copies of our SEC filings by going to the SEC’s website at http://www.sec.gov.

References

As used in this annual report: (i) the terms “we,” “us,” “our,” or the “Company” refer to Naturally Advanced Technologies Inc. and our subsidiaries, unless the context otherwise requires; (ii) “SEC” refers to the Securities and Exchange Commission; (iii) “Securities Act” refers to the United States Securities Act of 1933, as amended; (iv) “Exchange Act” refers to the United States Securities Exchange Act of 1934, as amended; and (v) all dollar amounts refer to United States dollars unless otherwise indicated.

PART I

ITEM 1. BUSINESS

Corporate Structure and Subsidiaries

We were incorporated under the laws of British Columbia, Canada, on October 6, 1998, under the name “Hemptown Clothing Inc.” The current corporate structure is a single public company, incorporated under the Business Corporations Act (British Columbia). On February 22, 2006, our Board of Directors authorized and approved the change in our corporate name to “Naturally Advanced Technologies Inc.” and the subsequent filing of the Amendment with the Registrar of Companies for the Province of British Columbia. This name change to Naturally Advanced Technologies Inc. became effective March 21, 2006, and our trading symbol for our shares of common stock trading on the OTC Bulletin Board was changed to “NADVF:OB”. Our shares of common stock commenced trading under the symbol “NAT.V” on the TSX Venture Exchange (the “TSX-V”) at the opening of market on July 8, 2008.

We were founded in response to the growing demand for environmentally friendly, socially responsible clothing, and we adhere to a “triple bottom line” philosophy, respecting the human rights of employees, the environmental impact of our operations and fiscal responsibility to our shareholders.

4

Our wholly-owned subsidiaries are as follows:

CRAiLAR®Fiber Technologies Inc.

Our wholly owned subsidiary CRAiLAR®Fiber Technologies Inc. (“CRAiLAR®”) was incorporated on April 5, 2005. It was incorporated for the purpose of developing BastFiber Technology for uses in textiles, cellulose pulp, paper, and composites.

HTnaturals Apparel Corp.

HTnaturals Apparel Corp. (“HTnaturals”) was incorporated under the laws of the Province of British Columbia on December 7, 2007, for the purpose of carrying out the natural and sustainable apparel portion of our business. We, through our wholly owned subsidiary HTnaturals, were also a provider of environmentally sustainable hemp, bamboo, organic cotton and soy blended apparel.

During our fiscal year ended December 31, 2009, we discontinued our apparel division in order to focus our resources on our CRAiLAR® technology.

0697872 B.C. Ltd.

Our wholly-owned subsidiary, 0697872 B.C. Ltd., was incorporated under the laws of the Province of British Columbia on June 18, 2004, and held the title to real property located in Craik, Saskatchewan. We decided against proceeding with the intended use of the property and returned all rights to the town of Craik.

Hemptown USA, Inc.

Our wholly-owned subsidiary, Hemptown USA, Inc., was incorporated under the laws of the State of Nevada on November 22, 2004, for factoring purposes so that business dealings could be accomplished daily without currency valuations and fluctuations, as well as to provide an American base inventory control to customers.

Naturally Advanced Technologies US Inc.

Naturally Advanced Technologies US Inc. was incorporated under the laws of the State of Nevada on August 24, 2010, to manage our U.S. business operations. This company was also issued a Certificate of Authorization by the State of South Carolina to transact business on October 21, 2010.

Our principal offices are located at Suite 305, 4420 Chatterton Way, Victoria, British Columbia V8X 5J2, our telephone number is (250) 658-8582, and our web site address is www.naturallyadvanced.com.

5

Business Operations

Naturally Advanced Technologies (NAT) is bringing sustainable bast fiber-based products to market, providing environmentally friendly natural fiber alternatives for a broad range of existing and emerging product applications, with equivalent or superior performance characteristics to cotton, wood or fossil-fuel based competitors. As of the date of this report, our business operations consists primarily of the deployment and execution of our proprietary and natural CRAiLAR® Flax Fibers, as well as our CRAiLEXTM high grade dissolving pulp technology, which are bast fiber processing technologies targeted at the textile, pulping, composite and plastics industries.

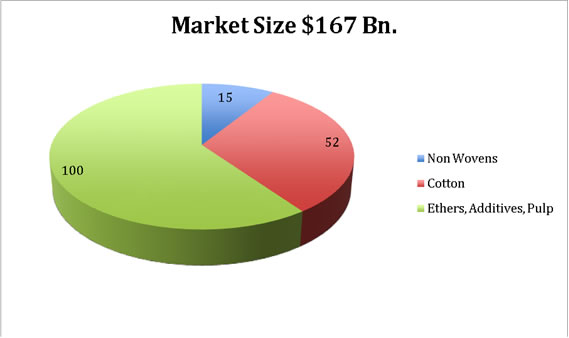

Industry Opportunity for CRAiLAR® and CRAiLEXTM

With a projected increase of global population and continued development of market economies, we expect to see a rise in the need for fibers worldwide. Management estimates that global demand for fiber will increase by almost 30million tons in the next ten years. We do not believe that this increased demand can be met by the existing natural fibers market. While some demand is likely to be filled by synthetic fibers, management expects that the desires for consumers to live both sustainably and naturally will outweigh their desire for un-naturally derived products. We believe that the Company has a unique opportunity to fill this shortfall through the production of CRAiLAR® fiber.

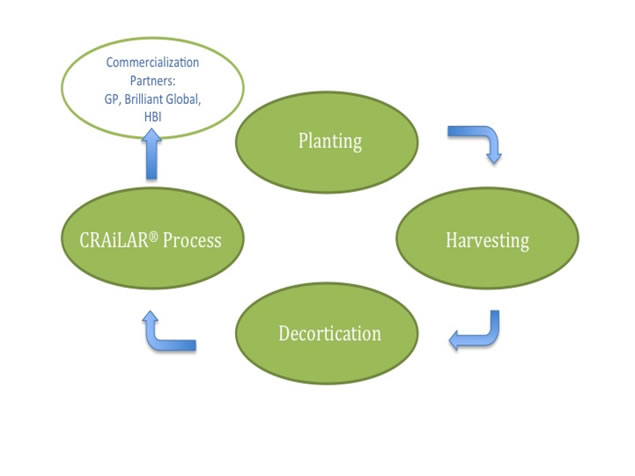

CRAiLAR® Fiber processing involves the enzymatic processing of bast fibers, by removing the lignin which binds the fibers together, to produce individual, separated fibers into the equivalent of ginned cotton. The CRAiLAR® Fiber technology has been developed by Dr. Wing Sung and his team at the National Research Council of Canada. Under development since 2004, this technology has undergone successful final demonstration scale testing. The technology involves the use of enzymes to effectively clean and polish the raw bast fiber such as flax and hemp.

6

The CRAiLAR® Fiber enzymatic process is significantly faster than existing methods of bast fiber processing, produces highly consistent results, and is environmentally benign, as compared to the toxic chemical baths employed elsewhere for the processing of bast fibers. The resulting CRAiLAR® Fibers are vastly superior to traditionally processed bast fibers for textile applications, and integrate seamlessly with cotton fibers. Because the CRAiLAR® Fiber enzymatic processing is so effective at cleaning bast fiber, it can be spun on traditional cotton equipment at commercially viable speeds.

The capital costs involved in building a commercial CRAiLAR® Fibers processing facility have been determined to be relatively modest. All of our final products can be processed utilizing existing industry equipment.

CRAiLEX Advanced Materials technology was developed with Alberta Innovates — Technology Futures. The unique pulping process does not require the numerous harsh chemicals or expensive pressurized equipment used in the traditional kraft pulping industry. The result is a superior dissolving pulp from the flax and hemp plants to be used in performance yarns, industrial additives and absorbent pulp and paper products.

Naturally Advanced Technologies holds the exclusive worldwide license to these patented technologies.

CRAiLAR® is a versatile technology which performs well on all bast fiber crops. At the end of April of 2010, we announced that we had successfully spun flax-cotton and help-cotton yarns. We found the CRAiLAR® flax to be of very high quality and ideally suited for fine knit items such as T-shirts. The environmental sustainability of flax is virtually identical to hemp. Differences are that hemp produces more biomass per acre while flax generates a higher percentage of bast fiber. We feel for a wide range of applications and a superior hand-feel that flax is the right crop with which to launch our CRAiLAR® brand.

Flax has the potential to be a zero waste crop. We are already in the process of investigating by-product opportunities that are beneficial to both the consumer and economy (those by-products being seed and shive).

Flax has been used for textile applications for thousands of years and is known as linen when it is processed using traditional mechanical techniques. It is labor intensive, costly to process and has a rougher hand feel than cotton and polyester. In addition, it is prone to wrinkling and high shrinkage if washed in hot water and tumble dried. Traditionally processed flax must also be spun on specialty linen machinery making it unviable for mass production.

Flax is a cost-effective raw material for fiber production. Flax is easy to grow with minimal use of herbicides, and requires only regular rainfall for irrigation, which significantly reduces costs as compared to other natural fibers.

We also enjoy the ability to use the straw of the oilseed flax crop, which is cultivated for food and industrial applications. This straw would normally be discarded and burned following the seed harvest. Making use of this waste byproduct will only further enhance the CRAiLAR® Flax Fiber sustainability rating.

With mill delivered cotton priced between $0.95 to $1.05 per pound, flax is a cost-effective raw material for fiber production. Flax is easy to grow with minimal use of herbicides, pesticides and engineered irrigation that significantly reduces costs as compared to other natural fibers.

The CRAiLAR® Fiber process is a clean, sustainable, environmentally responsible process, which works with bast fiber feed stocks. Bast fiber plants grow abundantly, without excessive water, herbicide, fertilizer and pesticide use. Initially, CRAiLAR® Flax Fibers will be used in union with cotton, which when blended together, results in a much better performing fabric than cotton alone. The resulting fabric (if simply an 80/20 blend) takes on the characteristics of CRAiLAR® Flax Fibers, which are enhanced moisture management and comfort (wicking), durability, superior dye uptake characteristics (a potential minimal dye reduction of 10%), and garment shrinkage reduction (a potential minimum of 50%).

7

Recent Developments

On September 20, 2010, we announced that we have created a sustainable, commercially viable complement to cotton using flax as a raw material. After successfully transforming hemp fibers into yarns and fabrics with the desirable qualities of cotton, we are now engaged in a strategic shift to use flax fibers as the foundation for the next phase of our proprietary CRAiLAR® Fiber technology.

We believe that compared to current cotton prices, flax is a cost-effective raw material for fiber production. The CRAiLAR® process can also be used with the stalk portion of the oilseed flax plant – traditionally cultivated for food and industrial applications – which would normally be discarded during processing. We believe that making use of this byproduct, in addition to processing fiber-variety flax, enhances CRAiLAR®’s sustainability factor.

The all-natural CRAiLAR® process removes the binding agents from flax that contribute to its stiff texture. The process bathes bast fibers in a proprietary enzyme wash that transforms them into soft, yet strong and durable textile fibers, which can be used in both fashion and industrial applications. We believe that fibers made through the CRAiLAR® process have the comfort and breathability of cotton, with the strength, moisture-wicking properties and shrink-resistance of sturdy bast fibers. Our recent trials have shown that flax can be spun on existing machinery to produce a yarn that can be used alone or blended with other fibers.

On January 18, 2011, we announced that we have joined forces with Hanesbrands Inc. and the U.S. Department of Agriculture’s Agricultural Research Service (USDA-ARS) in a cooperative research project designed to cultivate and evaluate the viability of various flax strains for use in CRAiLAR® technology. The project takes place in South Carolina and has an initial term of one year with a renewal option for two additional years.

On March 17, 2011, we announced that we signed a ten-year CRAiLAR® fiber supply agreement with Hanesbrands Inc. to commercialize the Company’s proprietary fibers.

On April 14, 2011, we announced that we had entered into a short term CRAiLAR® Flax fiber development agreement with Levi Strauss & Co. beginning in April 2011 to support evaluation of processing CRAiLAR® flax fiber in woven casual apparel products, specifically denim and non-denim, bottom and top weight fabrics.

In June 2011 the Company entered into a short-term CRAiLAR® Flax fiber development agreement with Cintas Corporation beginning June 2011 to support evaluation of processing CRAiLAR® flax fiber in corporate identity uniform programs.

In June 2011 the Company entered into a joint development agreement with Hercules Incorporated, a subsidiary of Ashland Inc., beginning June 2011 to support evaluation of CRAiLEXTM cellulosic products for multiple products.

On July 14, 2011 the Company entered into an agreement with Carolina Eastern Precision Ag, of Pamplico, S.C., to provide agronomic consultation to the Company and its contractors in the region. Under the terms of the agreement, Carolina Eastern will assist NAT in the recruitment of growers and contractors, and advise on all cultivation related to flax that will be turned into its branded CRAiLAR® fiber including seeding rates, fertilization, and weed control.

8

On July 8, 2011 the Company completed the public offering of 3,800,000 units (the “Units”) of the Company at a price of C$3.45 per Unit for aggregate gross proceeds of C$13,110,000 (the “Offering”). Each Unit is comprised of one common share and one half of one common share purchase warrant of the Company (each whole common share purchase warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one common share of the Company at an exercise price of C$4.50 per common share at any time prior to July 8, 2013.

On July 20, 2011 the Underwriter’s over-allotment option was partially exercised and the Underwriters purchased an additional 212,500 units (each a “Over-Allotment Unit”), at C$3.45 per Over-Allotment Unit, and 100,445 warrants (each a “Over-Allotment Warrant”) of the Company, at C$0.32 per Over-Allotment Warrant, for aggregate gross proceeds to the Company of approximately C$765,267. Each Over-Allotment Unit is comprised of one common share and one half of one common share purchase warrant of the Company. Each whole warrant entitles the holder thereof to acquire one common share of the Company at an exercise price of C$4.50 per common share at any time prior to July 8, 2013.

The Company plans to use the net proceeds from the Offering (including the net proceeds from the over-allotment option exercise) for capacity expansion, debt repayment, working capital and other general corporate purposes.

In August 2011, the Company named Jay Nalbach to the role of Chief Marketing Officer. Mr. Nalbach was previously Brand Director at adidas Group Japan KK, and Global Head of Men’s Lifestyle Footwear for Reebok International.

In September, 2011, the Company entered into a three year CRAiLAR® Fiber supply agreement with Georgia Pacific Consumer Products LLC, for the use of CRAiLAR® fiber in formed substrates for the industrial and personal care markets. The agreement is automatically extendable to ten years upon notification by GP of the intention to do so.

In September, 2011, the Company announced the appointment of Tom Robinson to the role of Chief Operating Officer, and the transition of Jason Finnis, the Company’s co-founder, to the role of Chief Innovation Officer. Mr. Robinson joins the company after twenty-seven years of experience in the textile industry. He joins the Company from International Textile Group, where he was most recently Vice President of Cotton Operations Planning and Technical Support in the company’s apparel division. Mr. Finnis’ newly created role will focus on ways to improve NAT’s processing techniques, throughput efficiencies, and yield.

In September, 2011, the Company entered into an agreement with Westex Inc, for the evaluation and development of CRAiLAR® Fibers in flame and arc resistant fabrics for the industrial, military and service sector industries. Westex Inc. is the market leader in this category.

In September, 2011, the Company entered into a purchasing agreement for a minimum of one and a half million pounds of CRAiLAR® Flax fiber with Brilliant Global LTD, the Hong Kong-based private label knitwear manufacturer which produces a broad spectrum of sweater and accessory items in natural fibers for globally recognized brands and retailers. The first retail introduction of CRAiLAR® fibers in this market is expected to be at the beginning of the second quarter 2012.

9

In October 2011, the Company entered into an agreement with Carhartt Inc., for the evaluation and development of CRAiLAR® Fiber in work wear apparel. Carhartt are the industry leader in work wear apparel, with a broad distribution of product in both retail and corporate markets. CRAiLAR® Fibers are expected to add performance improvements to Carhartt garments in durability, moisture management and dye chemical savings.

In December 2011, the Company entered into an agreement with Target to evaluate the use of its CRAiLAR® Flax fiber in Target’s domestic textiles category beginning December 1, 2011. The agreement includes two years of exclusivity in the category and calls for target’s evaluation of CRAiLAR® Flax in a number of products including sheets, top or bed, shower curtains, window treatments, table linens, decorative pillows, towels, and more.

In January 2012, the Company entered into a non-exclusive and non-transferable license with Tuscarora Yarns, one of the world’s premier yarn innovators, to explore a host of new blended yarns and related products using CRAiLAR® Flax, which Tuscarora is expected to design and manufacture for sale and distribution to third party licensees of CRAiLAR®.

In February 2012, the Company appointed Mr. Scott Staff as a director of the Company. Mr. Staff serves as the Director of Business Development for Perkins Coie LLP, an international law firm where he leads the firm's business development strategy, and oversees its client service interview, client service and industry teams programs. Mr. Staff joined Perkins Coie in 2004 and currently works out of the Seattle office. Mr. Staff is on the boards of advisors of DNA Response Inc. and Rouxbe Video Technologies.

In February 2012, the Company appointed Mr. Gregg Wright as Vice President of Strategic Fiber Markets, with an initial focus on the distribution of secondary fiber and byproducts from the CRAiLAR® decortication platform.

In March 2012, the Company appointed Mr. Steve Sandroni as Vice President of Agriculture. Mr. Sandroni brings more than 34 years of experience working in various aspects of agribusiness to the Company.

Strategic Alliances

National Research Counsel of Canada

Collaboration Agreement

In October 2007, we entered into a joint collaboration agreement with the National Research Counsel of Canada (the “NRC”) to continue to develop a patentable enzyme technology for the processing of hemp fibers. The agreement was for three years and was set to expire on May 9, 2010. On February 19, 2010, we signed an amendment to the agreement which will now expire on May 9, 2012. We will continue our joint collaboration of enzyme technology with the NRC, however the research will refocus on cellulose technology for the production of lignocellulosic ethanol. The NRC is to be paid as it conducts work on the joint collaboration. There are no further costs or other off-balance sheet liabilities associated with the NRC agreement.

Over the term of the amended agreement, we will pay the NRC a total of $280,536 divided into nine payments up to May 9, 2012. As of the date of these statements all payments due in 2011($130,044) have been paid.

10

Technology License Agreement

On November 1, 2006, the Company entered into a technology license agreement with the NRC. The license agreement provides the Company a worldwide license to use and sublicense the NRC technology called CRAiLAR®. The Company paid an initial $20,525 (CDN $25,000) fee and will pay an ongoing royalty of 3% on sales of products derived from the CRAiLAR® process to the NRC with a minimum annual payment set at $14,750 (CDN$15,000) per year. During the year ended December 31, 2011 the Company paid $7,375 (CDN$7,500) and accrued $7,375 (CDN$7,500) of the minimum annual royalty.

Alberta Innovates – Technology Futures

In June 2007, the Company's subsidiary, Crailar Fiber Technologies Inc. (“CFT”), entered into a Master Agreement for Technology Development with Alberta Innovates – Technology Futures (“AITF”, formerly Alberta Research Council) (the “Technology Agreement”) to further develop and commercialize bast fiber technology. The Technology Agreement is intended to act as an umbrella agreement for further bast fiber development planned to be performed by the AITF under separate Project Agreements. Under the terms of the Technology Agreement, commencing July 1, 2007, we will pay $20,525 (CDN $25,000) per quarter to the AITF and can terminate the agreement with 90 days notice, unless there are Project Agreements in effect, in which case this Technology Agreement shall expire when there are no longer any Project Agreements in effect. In addition to the above payments, CFT will be responsible for providing work-in-kind with a value of $20,525 (CDN $25,000) per calendar quarter commencing with the first Project Agreement. During 2011, we paid AITF for specific tasks to further the development of AITF's Technology, the amount paid was $135,890 (2010-$7,991). Under the terms of the Project Agreements signed with AITF the Company will be entitled to an exclusive, worldwide, royalty-bearing license to use any new intellectual property developed pursuant to the Project Agreements. The royalty based on this option will be 3% of gross sales for the first $50,000,000 and 1.5% of gross sales on excess of $50,000,000. The Technology Agreement is in effect as long as there is an active Project Agreement.

Research and Development

During fiscal year 2007, CRAiLAR® completed proof of concept testing on three separate bast fiber processing techniques with the NRC in Ottawa and the AITF in Edmonton. Proof of concept testing at the NRC included the completion of the first CRAiLAR® Fiber processing equipment which was constructed in Montreal and installed at the NRC facility in Ottawa. Ongoing tests with this equipment continue to establish the efficacy of CRAiLAR® enzymatic processes, with early test fibers meeting the requirements of the textile producing industry.

During the fourth quarter of 2007, and first three quarters of 2008, we began scaling CRAiLAR® Fiber processing equipment at a pilot plant facility in Montreal. The equipment became operational during the second quarter of 2008. During the third and fourth quarters of 2008, the pilot plant facility processed 1000kgs of fiber, a portion of which was sent to North Carolina State’s Textile College, where it was spun and then knitted into a fabric suitable for T-shirt or other knit garments.

In May 2007, AITF filed two provisional patent applications related to decortication and degumming technologies for which we have secured exclusive worldwide licensing rights from the AITF. We completed the installation of proprietary decortication equipment at the AITF. We completed proof of concept testing on the proprietary degumming technology at the NRC’s Industrial Materials Institute in Montreal. Test results were in line with expectations and suitable for industrial use.

11

During 2009, our research and development efforts for CRAiLAR® Fibers were concentrated on producing fiber for spinning trials. Different variations of our enzymatic process, drying, carding and equipment was tested to optimize the fiber for spinning using traditional cotton spinning equipment. These research and development efforts led to the successful initial spinning trials of CRAiLAR® fibers. The spinning trials were sponsored by Hanesbrands Inc. at North Carolina State University. We carded and spun a blended CRAiLAR® yarn on a cotton ring spinning system with no modifications using CRAiLAR® Fiber Technology. The resulting 20/1 Ne* ring spun yarn was knitted into a 5-ounces per square yard jersey fabric. Management believes that this was the first time hemp was processed on conventional cotton spinning equipment.

Through CRAiLEXTM Advanced Materials we concentrated our research and development to refining our decortication technology and producing enough decorticated fiber for tests using our proprietary pulp. We engaged an independent testing company to verify the quality of our dissolving pulp and their test results confirmed our AITF lab results and showed the CRAiLEXTM dissolving pulp has qualities far in excess of standard soft or hardwood pulps on the market. We also began commercial trials at a leading North American consumer paper products company where paper products made from our pulp were successfully made and further market applications for CRAiLEXTM pulp were determined.

We have invested a considerable amount of time and effort into product research and development. Our research and development costs for our fiscal year ended December 31, 2011 totaled $757,443 (2010 - $596,212), all of which was attributable to the CRAiLAR® and CRAiLEXTM technology development.

Trademark and Domain Name Rights

In September 2005, we trademarked the term CRAiLAR® to identify our proprietary technology platform relating to the engineering, processing and production of bast fibers including technology co-developed with and licensed from the NRC. Under the CRAiLAR® Technology platform, we have secured the exclusive worldwide licensing rights to intellectual property arising from our collaborative research agreements. In May 2007, the NRC filed a patent application for intellectual property related to the extraction of hemp fibers, under the Patent Cooperation Treaty simultaneously seeking protection in up to 117 countries worldwide. We have secured the exclusive worldwide licensing rights from AITF related to the CRAiLEXTM Technology for use in textile, composite and pulp applications.

We are currently evaluating partnering opportunities for multiple product development and commercialization of our proprietary CRAiLAR® and CRAiLEXTM Technologies for environmentally sustainable bast fiber processing and production. Exclusive international licensing rights to these patent applications allow us to protect our investment to date in the development of CRAiLAR® and CRAiLEXTM Technologies and confidently move forward in seeking an appropriate development and commercialization partner.

We also own the web sites www.naturallyadvanced.com, www.crailar.com and www.crailex.com.

Marketing Strategy

Our primary target markets are the natural yarn, the cellulose pulp and composites markets. We believe that our technologies have the potential to redefine the platform of sustainable yarns, delivering a complete solution from a consumer’s perspective. This implies market relevant performance attributes that are also cost benefit relevant, in a delivery that is sustainable and transparent. The current areas of focus, from a comparison and proof of concept perspective, are the cotton, high performance yarn and pulping industries. Each have entrenched market plays that are either toxic, resource limited, or potentially offensive to informed consumers. Our technologies provide enhanced performance solutions to these industries, whilst delivering a triple bottom line philosophy, respecting the human rights of employees, the environmental impact of our operations and fiscal responsibility to our shareholders. We believe that we offer two key opportunities for development:

12

-

CRAiLAR® Fiber for textiles, which fiber will be flax, hemp (or other sustainable bast fiber) available in a variety of blends, textures, colors and applications; and

-

CRAiLEXTM Advanced Materials, which develops technologies for the processing of these cellulose-based fibers in pulp and paper, high grade dissolving pulp and performance apparel industries.

Marketing Initiatives

Because CRAiLAR® Fibers can be an ingredient in countless products, management believes that partnering with the largest, most successful brands, all of which are top of mind to the North American consumer, is the path to successful commercialization. The Company has signed development and supply agreements with some of the world’s largest fiber consuming companies such as Hanesbrands Inc, Levis Strauss & Co., Georgia-Pacific, and Target. Sustainability, risk mitigation, consumer satisfaction and product enhancement are all offered within the CRAiLAR® experience.

We believe that our marketing model will drive a pull-through marketing strategy, which draws from detailed brand building and delivers that promise directly to consumers. Brand building strategies imply a strong direct to consumer platform, which will allow us to build equity in a consumer focused model ultimately allowing transfer of that equity to establishing branding partnerships with some of the worlds leading consumer brands. We further believe that the CRAiLAR® and CRAiLEXTM processes will entice those in North America to ramp up flax and hemp farming and/or processing as it is expected to create significant margins. Another target market will be partners. We believe that the creation of partnerships is an important strategy for a small company, and our public partnerships with NRC and AITF have been very important to us. We believe additional partnerships with consumer brands will also be important for the branding opportunities that these global brands will provide.

Further down the road, the Company will be working in tandem with our partners to communicate the benefits of CRAiLAR® through co-branding, ingredient call-outs, co-op marketing efforts, in-store signage, point of purchase and with links to the relevant social media networks and websites. The Company believes that our own presence and prosperity will grow in concert with the growth of our growers and business partners, allowing CRAiLAR® to be top of mind, similar to ingredient brand successes such as Gore-Tex® and Intel®.

Pricing Strategy

It is expected that fibers and yarns produced with the CRAiLAR® process will be competitively priced vis-a-vis current natural and synthetic fibers and allow us to realize significant margins. Add to that, a transparent and certifiable sustainability platform, and we believe that CRAiLAR® has the potential to establish a new industry standard.

Global Strategies

Global Industry Partners

We recognize that our patented technologies have global, multi industry applications, and as such represents a significant opportunity for companies currently in those industries. Additionally, speed to market and being first to establish new industry standards is a crucial and strategic marketing advantage. With that understanding in mind, we are evaluating potential strategic partnerships with global leaders in the pulp and paper, yarn, fabric, carpeting, upholstery and composites industries.

13

In addition, we believe that the opportunity exists to partner with global brands, which we believe will allow us to leverage the considerable branding and marketing talent of global brands to increase the brand power of CRAiLAR® and CRAiLEXTM. More than just an enzyme or pulping technology, we believe that CRAiLAR® and CRAiLEXTM can be consumer recognized performance brands that are valued and demanded by an informed public.

We have negotiated and signed agreements with some of the largest fiber consuming companies in the world. We have done this by following through on enquiries from CEOs, COOs, CMOs as well as Innovation Officers to confirm the attributes and benefits of CRAiLAR® fibers. We have been able to showcase an extraordinary opportunity that has been worked into the fabric of corporate responsibility & sustainability platforms. We understand that in order for new initiatives to be pulled through the corporate system to market reality, you need to start at the top. By linking our sales and marketing goals to our production and operations plans, we decided very early that if we are here for good, and are willing to assist the consumer on the path to sustainability, we need to positively affect the national footprint of “dirtier” fibers and processes as quickly as we can.

As we move forward to commercialization, our partners are not only successfully integrating our CRAiLAR® flax fiber within their biggest product categories, but as well, discovering benefits and enhancements which are exclusive to their developments, allowing the CRAiLAR® brand to evolve and grow, while servicing both the consumer and business needs.

Government Regulation

Trade Regulation

Our operations are subject to the effects of international treaties and regulations such as the North American Free Trade Agreement (NAFTA). We are also subject to the effects of international trade agreements and embargoes by entities such as the World Trade Organization. Generally, these international trade agreements benefit our business rather than burden it because they tend to reduce trade quotas, duties, taxes and similar impositions. However, these trade agreements may also impose restrictions that could have an adverse impact on our business, by limiting the countries from whom we can purchase our fabric or other component materials, or limiting the countries where we may market and sell our products.

Environmental Regulation

Our operations are subject to various environmental and occupational health and safety laws and regulations. We believe that we are in compliance with the regulatory requirements of British Columbia. We will continue to make expenditures to comply with these requirements, and we do not believe that compliance will have a material adverse effect on our business. As is the case with manufacturers in general, if a release of hazardous substances occurs on or from our properties or any associated offsite disposal locations, or if contamination from prior activities is discovered at any of our properties, we may be held liable. While the amount of such liability could be material, we endeavor to conduct our operations in a manner that reduces such risks.

Employees

We currently employ eighteen full time employees.

14

Transfer Agent

Our transfer agent is Computershare Investor Services Inc., 510 Burrard Street, 2nd Floor, Vancouver, B.C. V6C 3B9.

ITEM 1A. RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We Have a History of Operating Losses and There Can Be No Assurance We Will Be Profitable in the Future.

We have a history of operating losses, expect to continue to incur losses, may never be profitable, and must be considered to be in the development stage. Further, we have been dependent on sales of our equity securities and debt financing to meet our cash requirements. We have incurred losses totaling approximately $6,907,844 and $3,293,439, respectively, for fiscal years ended December 31, 2011 and 2010. As of December 31, 2011, we had accumulated deficits of $22,846,476. As at December 31, 2011 we had cash and cash equivalents of $6,340,505 and working capital of $5,932,991. Further, we do not expect positive cash flow from operations until Q4 2012. There is no assurance that actual cash requirements will not exceed our estimates.

We May Need to Raise Capital To Continue Our Operations.

Based upon our historical losses from operations, we may require additional funding in the future. If we cannot obtain capital through financings or otherwise, our ability to execute our development plans and achieve profitable operational levels will be greatly limited. Historically, we have funded our operations through the issuance of equity and short-term debt financing arrangements. We may not be able to obtain additional financing on favorable terms, if at all. Our future cash flows and the availability of financing will be subject to a number of variables, including demand for CRAiLAR® and CRAiLEXTM technologies. Further, debt financing could lead to a diversion of cash flow to satisfy debt-servicing obligations and create restrictions on business operations. If we are unable to raise additional funds, it would have a material adverse effect upon our operations.

Our Success is Dependent Upon the Acceptance of CRAiLAR®and CRAiLEXTMTechnologies.

Our success depends upon our achieving significant market acceptance of our CRAiLAR®and CRAiLEXTM Technology and demand for alternative bio-based products. Acceptance of our CRAiLAR®and CRAiLEXTM Technology will depend on the success of our and our partners’ promotional and marketing efforts and ability to attract customers. To date, we have not spent significant funds on marketing and promotional efforts, although in order to increase awareness of our products we expect our partners to spend a significant amount on promotion, marketing and advertising in the future. If these expenses fail to develop an awareness of our CRAiLAR®and CRAiLEXTM Technologies and products, these expenses may never be recovered and we may never be able to generate any significant future revenues. In addition, even if awareness of our CRAiLAR®and CRAiLEXTM Technology increases, we may not be able to produce enough product to meet demand.

15

We May Be Unable to Retain Key Employees or Management Personnel.

The loss of Messrs. Kenneth Barker, Jason Finnis, Guy Prevost, Tom Robinson, Jay Nalbach, Ms. Larisa Harrison or any of our key management personnel would have an adverse impact on our future development and could impair our ability to succeed. Our performance is substantially dependent upon the expertise of our Chief Executive Officer, Mr. Kenneth Barker and our Chief Innovation Officer, Mr. Jason Finnis, and other key management personnel and our ability to continue to hire and retain such personnel. Messrs. Barker, Finnis, Prevost, Robinson and Nalbach spend substantially all, or most, of their working time with us and our subsidiaries. It may be difficult to find sufficiently qualified individuals to replace Mr. Barker, Mr. Finnis, Mr. Prevost, Mr. Robinson, Mr. Nalbach, Ms. Harrison or other key management personnel if we were to lose any one or more of them. The loss of Mr. Barker, Mr. Finnis, Mr. Robinson, Mr. Nalbach or Mr. Prevost, or any of our other key management personnel could have a material adverse effect on our business, development, financial condition, and operating results. We maintain “key person” life insurance on our senior executive officers.

Our Officers and Directors May Be Subject to Conflicts of Interest.

Certain of our officers and directors may be subject to conflicts of interest. Certain of our directors devote part of their working time to other business endeavors, including consulting relationships with other entities, and have responsibilities to other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, certain of our directors may be subject to conflicts of interest. Currently, we have no policy in place to address such conflicts of interest. However, such directors have acknowledged their fiduciary duty to perform their duties in our best interest and those of our shareholders.

Government Regulation and Trade Restrictions Could Have a Negative Impact on Our Business.

Governments or special interest groups may attempt to protect existing industries through the use of duties, tariffs or public relations campaigns. These efforts may adversely affect interest in and demand for our CRAiLAR® and CRAiLEXTM Technology.

Moreover, any negative changes to international treaties and regulations such as NAFTA and to the effects of international trade agreements and embargoes imposed by such entities such as the World Trade Organization which could result in a rise in trade quotas, duties, taxes and similar impositions or which could limit the countries from whom we can purchase component materials, or which could limit the countries where we or our customers might market and sell products created using CRAiLAR® Technology, which could have an adverse effect on our business.

The laws, regulations, policies or current administrative practices of any government body, organization or regulatory agency in the United States or any other jurisdiction, may be changed, applied or interpreted in a manner which will fundamentally alter our ability to carry on business. The actions, policies or regulations, or changes thereto, of any government body or regulatory agency, or other special interest groups, may have a detrimental effect on us. Any or all of these situations may have a negative impact on our ability to operate and/or our profitability.

16

If Our Competitors Misappropriate Unpatented Proprietary Know-How and Our Trade Secrets, It May Have a Material Adverse Affect on Our Business.

The loss of or inability to enforce our trademark CRAiLAR® and other proprietary know-how, including our CRAiLAR® and CRAiLEXTM process, and trade secrets could adversely affect our business. We depend heavily on trade secrets and the design expertise of our employees. If any of our competitors copies or otherwise gains access to our trade secrets or develops similar technologies or processes independently, we would not be able to compete as effectively. The measures we take to protect our trade secrets and design expertise may not be adequate to prevent their unauthorized use. Further, the laws of foreign countries may provide inadequate protection of such intellectual property rights. We may need to bring legal claims to enforce or protect such intellectual property rights. Any litigation, whether successful or unsuccessful, could result in substantial costs and diversions of resources. In addition, notwithstanding the rights we have secured in our intellectual property, other persons may bring claims against us that we have infringed on their intellectual property rights or claims that our intellectual property right interests are not valid. Any claims against us, with or without merit, could be time consuming and costly to defend or litigate and therefore could have an adverse affect on our business.

Currency Fluctuations May Cause Translation Gains and Losses.

A significant portion of our expenses are incurred in Canadian dollars. As a result, appreciation in the value of these currencies relative to the United States dollar could adversely affect our operating results. Foreign currency translation gains and losses arising from normal business operations are credited to or charged against other income for the period incurred. Fluctuations in the value of Canadian dollars relative to United States dollars may cause currency translation gains and losses.

Risks Related to Our Common Stock

Sales of a Substantial Number of Shares of Our Common Stock May Result in Significant Downward Pressure on the Price of Our Common Stock and Could Affect Your Ability to Realize the Current Trading Price of Our Common Stock.

As of December 31, 2011, there were 41,701,604 shares of our common stock issued and outstanding. (As of March 15, 2012, there were 42,422,804 shares of our common stock issued and outstanding). Further, as of December 31, 2011 there were an aggregate of 5,290,970 Stock Options and 3,294,219 share purchase warrants outstanding that are exercisable into 5,290,970 shares of common stock (at a weighted average exercise price of $1.48) and 3,294,219 shares of common stock (at a weighted average exercise price of $3.57), respectively.

Any significant downward pressure on the price of our common stock as certain stockholders sell their shares of our common stock may encourage short sales. Any such short sales could place further downward pressure on the price of our common stock.

The Trading Price of Our Common Stock on the OTC Bulletin Board Has Been and May Continue to Fluctuate Significantly and Stockholders May Have Difficulty Reselling Their Shares.

During our fiscal year ended December 31, 2011, our common stock has traded as low as $1.03 and as high as $4.50. In addition to volatility associated with Bulletin Board securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock:

- changes in the demand for flax and other eco-friendly products;

17

-

disappointing results from our or our partners’ marketing and sales efforts;

-

failure to meet our revenue or profit goals or operating budget;

-

decline in demand for our common stock;

-

downward revisions in securities analysts’ estimates or changes in general market conditions;

-

lack of funding generated for operations;

-

investor perception of our industry or our business prospects; and

-

general economic trends.

In addition, stock markets have experienced extreme price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, investors may be unable to sell their shares at a fair price and you may lose all or part of your investment.

Additional Issuances of Equity Securities May Result in Dilution to Our Existing Stockholders.

Our Articles of Incorporation authorize the issuance of 100,000,000 shares of common stock. The Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. As a result of such dilution, if you acquire shares of our common stock, your proportionate ownership interest and voting power could be decreased. Further, any such issuances could result in a change of control.

We are not authorized to issue shares of preferred stock. However, there are provisions of British Columbia law that permit a company’s board of directors, without shareholder approval, to issue shares of preferred stock with rights superior to the rights of the holders of shares of common stock. As a result, shares of preferred stock could be issued quickly and easily, adversely affecting the rights of holders of shares of common stock and could be issued with terms calculated to delay or prevent a change in control or make removal of management more difficult. Although we have no present plans to issue any shares of preferred stock, the issuance of preferred stock in the future could adversely affect the rights of the holders of common stock and reduce the value of the common stock.

Our Common Stock is Classified as a “Penny Stock” Under SEC Rules Which Limits the Market For Our Common Stock.

Because our stock is not traded on the NASDAQ National Market or the NASDAQ Small Cap Market, and because the market price of the common stock is less than $5 per share, the common stock is classified as a “penny stock.” Our stock has not traded above $5 per share. SEC Rule 15g-9 under the Exchange Act imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an “established customer” or an “accredited investor.” This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customers concerning the risk of penny stocks. Many broker-dealers decline to participate in penny stock transactions because of the extra requirements imposed on penny stock transactions. Application of the penny stock rules to our common stock reduces the market liquidity of our shares, which in turn affects the ability of holders of our common stock to resell the shares they purchase, and they may not be able to resell at prices at or above the prices they paid.

18

We Are a Canadian Company and a Majority of Our Directors and Officers Are Canadian Citizens and/or Residents, Which Could Make It Difficult for Investors to Enforce Judgments Against Us in the United States.

We are a company incorporated under the laws of the Province of British Columbia, Canada and a majority of our directors and officers reside in Canada. Therefore, it may be difficult for investors to enforce within the United States any judgments obtained against us or any of our directors or officers. All or a substantial portion of such persons’ assets may be located outside the United States. As a result, it may be difficult for investors to effect service of process on our directors or officers, or enforce within the United States or Canada any judgments obtained against us or our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof. Consequently, you may be effectively prevented from pursuing remedies under U.S. federal securities laws against them. In addition, investors may not be able to commence an action in a Canadian court predicated upon the civil liability provisions of the securities laws of the United States. We have been advised by our Canadian counsel that there is doubt as to the enforceability, in original actions in Canadian courts, of liability based upon the U.S. federal securities laws and as to the enforceability in Canadian courts of judgments of U.S. courts obtained in actions based upon the civil liability provisions of the U.S. federal securities laws. Therefore, it may not be possible to enforce those actions against us or any of our directors or officers.

A Decline in the Price of Our Common Stock Could Affect Our Ability to Raise Further Working Capital and Adversely Impact Our Operations.

A decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise additional capital for our operations. Because our operations to date have been principally financed through the sale of equity securities, a decline in the price of our common stock could have an adverse effect upon our liquidity and our continued operations. A reduction in our ability to raise equity capital in the future would have a material adverse effect upon our business plan and operations, including our ability to continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

ITEM 1B. UNRESOLVED STAFF COMMENTS

As of the date of this Annual Report, there are no unresolved comments pending from either the SEC or the British Columbia Securities Commission.

ITEM 2. PROPERTIES

Our Vancouver office space lease expired on November 30, 2011 where we paid a monthly rent of CDN$6,000 plus applicable taxes. On June 30, 2011 we entered into a lease for approximately 1,571 square feet of office space in Victoria, British Columbia for a monthly basic net rent of CDN$2,749.25 (US$2,703.29 based on the exchange rate on December 31, 2011 of US$1.00 = CDN$1.0170) . The new lease is for a term of three (3) years commencing on August 1, 2011 and expiring on July 31, 2014 with one renewal term of three (3) years.

Effective August 9, 2010, we signed a ten-month sublease of a facility at 164 County Camp Road, Kingstree, SC, 29556, at a rental cost of $4,400 per month. We attained the space for use as an initial scale-up flax fiber facility to conduct the decortication process of CRAiLAR® Fibers. The property is housed near 300 acres of flax crops that we intend to use to conduct our flax fiber growing trials. On July 1, 2011, we signed a one year lease for this same property and facility in Kingstree, South Carolina, for a monthly rent of $3,300 expiring on June 30, 2012.

19

Effective August 15, 2011, we entered into a lease for approximately 1468 square feet of office space in Lake Oswego, Oregon for a monthly rent of $3,000 during the first year, $3,500 during the second year and $4,000 during the third year. This lease is for a term of three (3) years expiring on August 14, 2014.

ITEM 3. LEGAL PROCEEDINGS

Management is not aware of any legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Annual Report, no director, officer or affiliate is a party adverse to us in any legal proceeding, or has an adverse interest to us in any legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market for Common Stock

Shares of our common stock have been quoted on the OTC Bulletin Board under the symbol “NADVF.OB” since March 21, 2006. The market for our common stock is limited, and can be volatile. The following table sets forth the high and low bid prices relating to our common stock on a quarterly basis for the periods indicated as quoted by the OTC Bulletin Board. These quotations reflect inter-dealer prices without retail mark-up, mark-down, or commissions, and may not reflect actual transactions.

| Quarter Ended | High Bid | Low Bid |

| December 31, 2011 | $2.55 | $1.57 |

| September 30, 2011 | $3.45 | $1.95 |

| June 30, 2011 | $4.50 | $1.87 |

| March 31, 2011 | $1.98 | $1.03 |

| December 31, 2010 | $1.26 | $0.63 |

| September 30, 2010 | $1.04 | $0.80 |

| June 30, 2010 | $1.35 | $0.90 |

| March 31, 2010 | $1.29 | $0.80 |

In addition, shares of our common stock have been listed on the TSX-V under the symbol “NAT.V”) since July 8, 2008. The following table sets forth the high and low sales prices of our common stock on a quarterly basis for the periods indicated as quoted by the TSX-V.

20

| Quarter Ended | High | Low |

| December 31, 2011 | CDN$2.66 | CDN$1.50 |

| September 30, 2011 | CDN$3.30 | CDN$2.05 |

| June 30, 2011 | CDN$4.49 | CDN$1.73 |

| March 31, 2011 | CDN$1.87 | CDN$0.98 |

| December 31, 2010 | CDN$1.40 | CDN$0.66 |

| September 30, 2010 | CDN$1.06 | CDN$0.82 |

| June 30, 2010 | CDN$1.53 | CDN$0.92 |

| March 31, 2010 | CDN$1.30 | CDN$0.87 |

As of March 1, 2011, there were approximately 63 shareholders of record of our common shares as reported by our transfer agent, Computershare Investor Services Inc., which does not include shareholders who shares are held in street or nominee names. We believe that there are approximately 300 beneficial owners of our common stock. There are no other classes of shares issued or outstanding.

Dividend Policy

No dividends have ever been declared by the Board of Directors on our common stock. Our losses do not currently indicate the ability to pay any cash dividends, and we do not indicate the intention of paying cash dividends either on our common stock in the foreseeable future.

Securities Authorized for Issuance under Compensation Plans

We have one equity compensation plan: our 2011 Fixed Share Option Plan. As described below, the 2011 Plan adopted all options outstanding under our previous stock option plans, including our 2006 Stock Option Plan (the “2006 Plan”), our 2008 Fixed Share Option Plan (the “2008 Plan”) and our 2010 Fixed Share Option Plan (the “2010 Plan”). The table set forth below presents information relating to our equity compensation plans as of December 31, 2011.

| Number of Securities | ||||||

| Remaining Available for | ||||||

| Number of Securities to | Weighted-Average | Future Issuance Under | ||||

| be Issued Upon Exercise | Exercise Price of | Equity Compensation | ||||

| of Outstanding Options, | Outstanding Options, | Plans (excluding column | ||||

| Plan Category | Warrants and Rights | Warrants and Rights | (a)) | |||

| (a) | (b) | (c) | ||||

| Equity Compensation Plans | ||||||

| Approved by Security | ||||||

| Holders (2011 Plan Stock | ||||||

| Options, Including Stock | ||||||

| Options Originally Granted | ||||||

| Under 2006 Plan, 2008 | ||||||

| Plan and 2010 Plan) | 5,290,970 | $1.48 | 2,364,395 | |||

| Equity Compensation Plans | ||||||

| Not Approved by Security | ||||||

| Holders | N/A | N/A | N/A | |||

| Total | 5,290,970 | $1.48 | 2,364,395 |

21

2011 Fixed Share Option Plan

Effective August 9, 2011, our Board of Directors authorized and approved the adoption of our 2011 Fixed Share Option Plan (the “2011 Plan”) as of such date, under which an aggregate of 8,224,240 of our shares, representing 20% of the issued and outstanding common share capital of the Company as of August 9, 2011, may be issued. Our shareholders approved the 2011 Plan at our annual general meeting held on September 15, 2011. As described below, all options issued under our Previous Option Plan (as defined below) are covered by our 2011 Plan.

Prior to the adoption of the 2011 Plan, we had a stock option plan outstanding, the 2010 Fixed Share Option Plan (the “Previous Option Plan”). Under the Previous Option Plan, a maximum of 7,057,640 options were reserved for issuance. As of August 9, 2011, 4,499,421 options were issued and outstanding under the Previous Option Plan. All outstanding options under the Previous Option Plan were rolled into the 2011 Plan and are counted against the number of common shares available for option under the 2011 Plan.

The purpose of the 2011 Plan is to enhance our long-term stockholder value by offering opportunities to our directors, officers, employees and eligible consultants to acquire and maintain stock ownership in order to give these persons the opportunity to participate in our growth and success, and to encourage them to remain in our service.

The 2011 Plan is to be administered by our Board of Directors or a committee appointed by the Board of Directors, which shall determine, among other things:

-

the persons to be granted options under the 2011 Plan;

-

the number of options to be granted; and

-

the terms and conditions of the options granted.

An option may not be exercised after the termination date of the option and may be exercised following the termination of an eligible participant’s continuous service only to the extent provided by the terms of the 2011 Plan.

Based on the terms of the individual option grants, options granted under the 2011 Plan generally expire three to ten years after the grant date (with a maximum exercise period of 10 years from grant) and become exercisable over a period of one year based on continued employment, either with monthly vesting or upon achievement of pre-determined deliverable.

Form S-8 Registration Statement

On February 15, 2012, we filed a registration statement on Form S-8 relating to a maximum of 8,124,240 shares of common stock, without par value, issuable directly by us under our 2011 Plan or pursuant to the exercise of options that have been or may be granted under the 2011 Plan (including options granted under our Previous Stock Option Plan as described above).

Common Stock Purchase Warrants

As of the date of this annual report, there are an aggregate of 3,019,219 common stock purchase warrants issued and outstanding.

22

Recent Sales of Unregistered Securities

On May 19, 2010, we issued 1,424,739 units pursuant to a private placement to 16 subscribers at $1.00 per unit, for proceeds of $1,424,739. Each unit consists of one common share and one-half of one non-transferable common stock purchase warrant, with each whole warrant exercisable to purchase one additional share at $1.25 per share, expiring on May 19, 2013. The units issued to eight of the subscribers under an exemption from the registration requirements of the U.S. Securities Act pursuant to Regulation S and to the remaining eight subscribers under an exemption from the registration requirements of the U.S. Securities Act pursuant to Rule 506 for accredited investors, in each case based on representations and warranties made by the subscribers in their respective subscription agreements with the Company. One of the subscribers is an officer and director of the Company, and another subscriber is a director of the Company. We paid a total $62,152 for agent commissions and other expenses which have been recorded as share issue costs.

On April 7, 2011, we issued 2,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share. The shares were issued outside the United States to one non-U.S. Person (as such terms are defined in Regulation S) in reliance on Regulation S.

On April 19, 2011, we issued 5,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On April 25, 2011, we issued 25,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of U.S.$1.25 per share. The shares were issued to an accredited investor in reliance on Regulation D. Also on April 25, 2011, we issued a further 7,137 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On April 28, 2011, we issued 100,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On May 2, 2011, we issued 32,556 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to four non-U.S. Persons in reliance on Regulation S.

On May 4, 2011, we issued 18,708 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. These shares were issued outside the United States to three non- U.S. Persons in reliance on Regulation S. Also on May 4, 2011, we issued a further 53,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of US$1.25 per share. The shares were issued outside the United States to two non-U.S. Persons in reliance on Regulation S.

On May 5, 2011, we issued 8,334 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to two non-U.S. Persons in reliance on Regulation S.

On May 9, 2011, we issued 11,364 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share and a further 17,500 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of U.S.$1.25 per share. The shares were issued to an accredited investor in reliance on Regulation D.

23

On May 10, 2011, we issued 5,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On May 12, 2011, we issued 70,593 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. These shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S. Also on May 12, 2011, we issued a further 2,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On May 17, 2011, we issued 5,556 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On May 19, 2011, we issued 1,852 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On May 24, 2011, we issued 20,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

On May 26, 2011, we issued 34,960 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.20 per share and a further 17,480 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share. The shares were issued outside the United States to two non-U.S. Persons in reliance on Regulation S.

On June 1, 2011, we issued 114,654 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to three non-U.S. Persons in reliance on Regulation S.

On June 10, 2011, we issued 40,741 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to two non-U.S. Persons in reliance on Regulation S.

On June 13, 2011, we issued 30,558 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. The shares were issued outside the United States to five non-U.S. Persons in reliance on Regulation S.

On June 16, 2011, we issued 26,760 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. These shares were issued outside the United States to five non-U.S. Persons in reliance on Regulation S. Also on June 16, 2011, we issued a further 5,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share. The shares were issued outside the United States to one non-U.S. Person in reliance on Regulation S.

24

On June 23, 2011, we issued 16,852 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. These shares were issued outside the United States to two non-U.S. Persons in reliance on Regulation S. Also on June 23, 2011, we issued a further 5,834 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.50 per share. The shares were issued outside the United States to two non-U.S. Persons in reliance on Regulation S.

On June 28, 2011, we issued 173,384 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. 99,680 of these shares were issued to two accredited investor in reliance on Regulation D, and the remaining 73,704 shares were issued outside the United States to six non-U.S. Persons in reliance on Regulation S.

On July 4, 2011, we issued 58,175 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of CDN$1.95 per share. These shares were issued outside the United States to seven non- U.S. Persons in reliance on Regulation S.

On July 5, 2011, we issued 6,500 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of $1.12 per share. These shares were issued outside the United States to one non- U.S. Person in reliance on Regulation S.

On July 7, 2011, we issued 10,000 shares of our common stock upon exercise of previously issued share purchase warrants at an exercise price of $1.02 per share. These shares were issued outside the United States to one non- U.S. Person in reliance on Regulation S.

On July 8, 2011, we completed the public offering of 3,800,000 units (the “Units”) of the Company at a price of CDN$3.45 per Unit for aggregate gross proceeds of CDN$13,110,000 (the “Offering”). Each Unit is comprised of one common share and one half of one common share purchase warrant of the Company (each whole common share purchase warrant, a “Warrant”). Each Warrant entitles the holder thereof to acquire one common share of the Company at an exercise price of CDN$4.50 per common share at any time prior to July 8, 2013. The Units were issued outside the United States to non-U.S. Persons in reliance on Regulation S and within the United States in reliance on Rule 144A and Regulation D.

The Company has paid to the underwriters 6% of the gross proceeds of the Offering (including with respect to the Over-Allotment Units as described below) and granted the underwriters options (the “Compensation Options”) to purchase that number of units (each, a “Compensation Unit”) equal to 6% of the number of Units sold in the Offering (including with respect to Over-Allotment Units as described below) at an exercise price of CDN$3.45 per Compensation Unit for 24 months after closing of the Offering. Each Compensation Unit includes one common share (each, a “Compensation Share”) and one half of one warrant (each, a “Compensation Warrant”). Each whole Compensation Warrant is exercisable for 24 months after closing at CDN$4.50 per common share.

The Company also granted the underwriters an option (the “Over-Allotment Option”), exercisable in whole or in part at any time up to 30 days following the closing of the Offering, to purchase up to an additional 570,000 units (each, an “Over-Allotment Unit”) at CDN$3.45 per Over-Allotment Unit and up to 285,000 warrants (each, an “Over-Allotment Warrant”) at CDN$0.32 per Over-Allotment Warrant.

Effective July 20, 2011, the underwriters’ Over-Allotment Option was partially exercised and the underwriters have purchased an additional 212,500 Over-Allotment Units at CDN$3.45 per unit, and 100,445 Over-Allotment Warrants at CDN$0.32 per warrant, for aggregate gross proceeds to the Company of approximately CDN$765,267. Each Over-Allotment Unit is comprised of one common share and one half of one common share purchase warrant of the Company. Each whole warrant entitles the holder thereof to acquire one common share of the Company at an exercise price of CDN$4.50 per common share at any time prior to July 8, 2013. The Over-Allotment Units and Over-Allotment Warrants were issued outside the United States to non-U.S. Persons in reliance on Regulation S and within the United States in reliance on Regulation D.

25