Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Manitex International, Inc. | d320714d8k.htm |

| EX-99.1 - PRESS RELEASE - Manitex International, Inc. | d320714dex991.htm |

“Focused

manufacturer of

engineered lifting

equipment”

Manitex International, Inc.

Conference Call

Fourth Quarter & Full Year 2011

March 22nd, 2012

Exhibit 99.2 |

2

Forward Looking Statements &

Non GAAP Measures

“Focused

manufacturer of

engineered lifting

equipment”

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: This presentation contains statements that are forward-looking in

nature which express the beliefs and expectations of management including

statements regarding the Company’s expected results of operations or liquidity;

statements concerning projections, predictions, expectations, estimates or forecasts

as to our business, financial and operational results and future economic

performance; and statements of management’s goals and objectives and

other similar expressions concerning matters that are not historical facts. In some

cases, you can identify forward-looking statements by terminology such as

“anticipate,” “estimate,”

“plan,”

“project,”

“continuing,”

“ongoing,”

“expect,”

“we believe,”

“we intend,”

“may,”

“will,”

“should,”

“could,”

and similar expressions. Such statements are based on current plans, estimates and

expectations and involve a number of known and unknown risks, uncertainties

and other factors that could cause the Company's future results, performance

or achievements to differ significantly from the results, performance or

achievements expressed or implied by such forward-looking statements. These factors and additional

information are discussed in the Company's filings with the Securities and Exchange

Commission and statements in this presentation should be evaluated in light of

these important factors. Although we believe that these statements are based

upon reasonable assumptions, we cannot guarantee future results.

Forward-looking statements speak only as of the date on which they are made, and

the Company undertakes no obligation to update publicly or revise any

forward-looking statement, whether as a result of new information, future

developments or otherwise. Non-GAAP

Measures:

Manitex

International

from

time

to

time

refers

to

various

non-GAAP

(generally

accepted accounting principles) financial measures in this presentation.

Manitex believes that this information is useful to understanding its

operating results without the impact of special items. See Manitex’s

Fourth Quarter and Full Year 2011 Earnings Release on the Investor Relations section of our

website www.manitexinternational.com

for a description and/or reconciliation of these measures.

|

3

“Focused

manufacturer of

engineered lifting

equipment”

Overview

•

2011 Performance set several Company records

–

Sales of $142 million (48% increase)

–

Adjusted net income* $3.6 million (69% increase)

–

Adjusted EPS $0.31 (63% increase)

–

EBITDA $11.1 million (28% increase)

•

Markets steadily improved through 2011 and this trend looks to be

continuing. Very dynamic energy sector driving demand for boom trucks

–

Backlog increased sequentially. YOY increase 110% to $83.7 million

•

Prepared for further growth

–

Renewed and increased working capital facilities

–

Repaid $3 million of long term debt in 2011. Targeting more in

2012

•

2012 pace of growth predicated on continuing to expand output internally and

from suppliers

* Adjusted net income is GAAP net income adjusted for tax effected unusual legal

settlement. See slide 7 reconciliation |

4

“Focused

manufacturer of

engineered lifting

equipment”

Commercial Update

•Market sentiment appears more optimistic

•Energy sector experiencing high levels of growth particularly N

America •General construction activity still relatively slow, but

increased activity •European markets slow, impacted by customer

credit availability •S. America / other non-European

international enquiries increasing •OEM price increases implemented

for orders being received for 2012 and 2013 •Product

demand

still

focused

on

more

specialized,

higher

tonnage

units

or

industry

specific

product (e.g. energy).

•

Strongest demand for our Manitex boom trucks

•

Boom truck market estimated 2011 growth of 130% in our categories

•

Commercial material handling and specialized trailer demand strengthened in

second half of 2011 and continues firm

•12/31/11 Backlog 83.7 million

•Broad based order book, with boom trucks in particular out to

Q3-2012 •Stronger military / governmental component for second

half 2012 •Looking for further ramp up of production in 2012

•Orders still currently being received at a faster rate than output

|

5

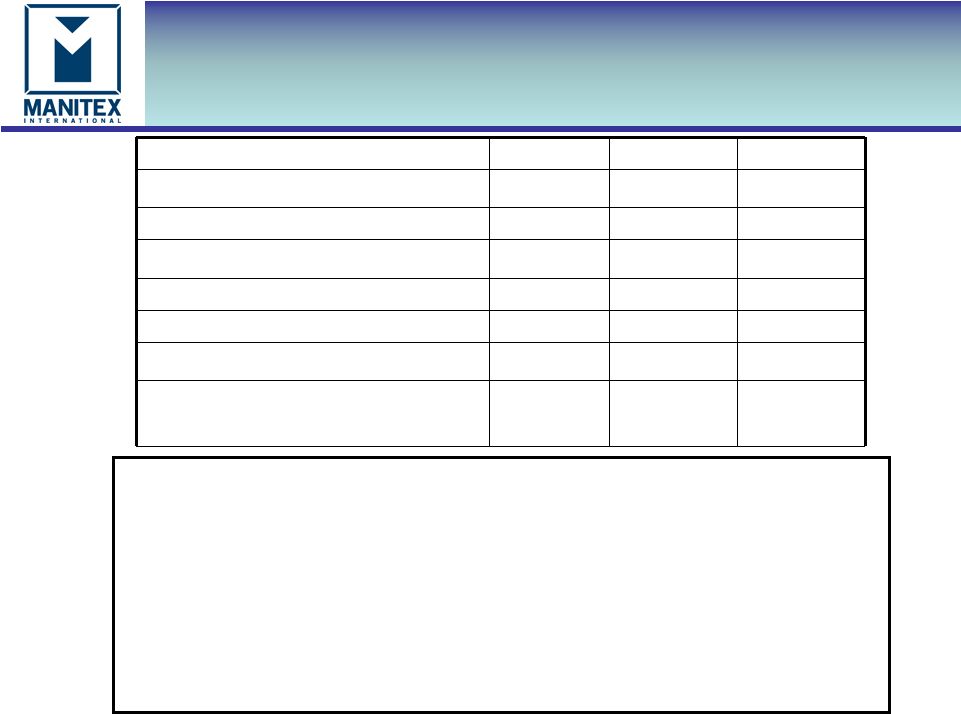

Key Figures -

Annual

“Focused

manufacturer of

engineered lifting

equipment”

USD thousands

2011

2010

2009

Net sales

$142,291

$95,875

$55,887

% change in 2011 to prior period

48.4%

154.6%

Gross profit

29,250

23,334

11,157

Gross margin %

20.6%

24.3%

20.0%

Operating expenses*

21,466

17,797

7,813

Adjusted Net Income*

3,561

2,109

3,639

Ebitda

11,120

8,676

1,982

Ebitda % of Sales

7.8%

9.0%

3.5%

Working capital

41,032

31,692

25,578

Current ratio

2.4

2.4

2.8

Backlog

83,700

39,905

22,122

% change in 2011 to prior period

109.7%

278.4%

•

2011 adjusted to exclude unusual $1,183k legal settlement. See

reconciliation on slide 7 •

2009 includes $3,815k bargain purchase gain on acquisitions in year

|

6

Key Figures -

Quarterly

“Focused

manufacturer of

engineered lifting

equipment”

USD thousands

Q4-2011

Q4-2010

Q3-2011

Net sales

$36,561

$29,544

$36,942

% change in Q4-2011 to prior period

23.8%

(1.0%)

Gross profit

7,489

7,660

7,824

Gross margin %

20.5%

25.9%

21.2%

Operating expenses *

5,431

5,605

5,591

Adjusted Net Income *

1,070

932

1,020

Ebitda

2,876

2,850

3,147

Ebitda % of Sales

7.9%

9.6%

8.5%

•

Q4-2011 adjusted to exclude unusual $1,183k legal settlement. See

reconciliation in Appendix |

7

“Focused

manufacturer of

engineered lifting

equipment”

Adjusted Net Income

Three Months ending

Twelve Months Ending

December 31,

2011

December 31,

2010

December 31,

2011

December 31,

2010

Net income as reported

289

932

2,780

2,109

Add: Legal settlement

1,183

-

1,183

-

Less: Tax at effective

rate of 34%

(402)

-

(402)

-

Net income as adjusted

1,070

932

3,561

2,109

Diluted Earnings per

share, as reported

$0.03

$0.08

$0.24

$0.19

Add: EPS impact of legal

settlement (net of tax)

$0.07

-

$0.07

-

Diluted Earnings per

share as adjusted

$0.09

$0.08

$0.31

$0.19

Weighted average diluted

shares outstanding

11,555,764

11,395,814

11,548,158

11,380,966

Legal settlement charge is present value of twenty annual payments of $95k

|

8

“Focused

manufacturer of

engineered lifting

equipment”

2011 Operating Performance

$m

$m

2010 Net income

2.1

Gross profit impact of increased sales of $46.4 million (2011

sales

less

2010

sales

at

2010

gross

profit

%

).

Includes

approx.

$23

million

for

additional 6 months of operations in 2011 v 2010 for CVS and NAEE

11.3

Impact

from

reduced

margin

(2011

gross

profit

%

-

2010

gross

profit %

multiplied by 2011 sales)

(5.3)

Increase in gross profit

6.0

Increase in operating expenses (including R&D increase of

$0.4m)

CVS & NAEE 2011 12 month expenses v 2010 six months

(1.6)

(2.1)

Interest & Other income / (expense)

-

Increase in tax

(0.8)

2011 Adjusted Net income

$ 3.6 |

9

Working Capital

“Focused

manufacturer of

engineered lifting

equipment”

$000

2011

2010

2009

Working Capital

$41,032

$31,692

$25,578

Days sales outstanding (DSO)

61

60

67

Days payable outstanding (DPO)

59

62

73

Inventory turns

2.7

2.9

1.7

Current ratio

2.4

2.4

2.8

Operating working capital

50,007

36,763

29,112

Operating working capital % of annualized

LQS

34.2%

31.1%

48.7%

•Major movements in working capital increase 2011 v 2010 of $9.3m

•Receivables ($5.6m), inventory ($11.6m), offset by increased short term

notes ($2.7m), trade accounts payable ($4.0m) and accrued expenses

($0.6m) and reduced prepayments ($0.4m)

•Inventory increase v 2010 in raw materials and WIP to support growth,

and increased cost from material cost inflation

•Current ratio, DSO & DPO remain strong through growth phase,

and operating working capital % increased to support future revenue

growth |

10

“Focused

manufacturer of

engineered lifting

equipment”

$000

2011

2010

2009

Total Cash

71

662

287

Total Debt

42,227

34,019

33,511

Total Equity

46,794

43,274

40,428

Net capitalization

88,950

76,631

73,652

Net debt / capitalization

47.4%

43.5%

45.1%

YTD EBITDA

11,120

8,676

1,982

YTD EBITDA % of sales

7.8%

9.0%

3.5%

•Increase in debt at 12/31/2011 from 12/31/2010 of $8.2m

•

Increase in lines of credit and Italian working capital finance $7.5m

•

Long

term

debt:

CVS

acquisition

funding

$3.8m;

Payments

on

other

debt ($3.0m)

•N. American revolver facilities, based on available collateral at December

31, 2011 was $30m. •Cash and N. American revolver availability at

December 31, 2011 $4.5m Debt & Liquidity

•

Net capitalization is the sum of debt plus equity minus cash

•

Net debt is total debt less cash |

11

2012 Outlook

“Focused

manufacturer of

engineered lifting

equipment”

•

Expect market demand to continue, particularly energy, with

general economic pick up in addition

•

Anticipate sequential quarterly increase in sales

•

Key challenge is continuing to increase internal output and that

of suppliers

•

Net income to benefit from impact of higher volume and lower %

of SG&A |