Attached files

| file | filename |

|---|---|

| EX-99.1 - HERMAN MILLER INC | hmi8k3-21x2012ex991.htm |

| 8-K - HERMAN MILLER INC | hmi032120128-k.htm |

Pension Funding and Transition Strategy March 22, 2012

Situation Overview 2 We have 3 defined benefit (DB) pension plans These plans are under-funded (1) May 2011 = $42MM Today ≈ $50MM Plan expenses are currently ≈$10MM (FY2012) and will likely rise in the future Funding commitments have been significant Avg. $23MM per year (past 10 years) Potential future interest rate increases will not significantly lower the termination liability (1) On an accounting basis as measured against Projected Benefit Obligation (PBO)

3 (1) On an accounting basis as measured against Projected Benefit Obligation (PBO) Volatility in Funded Status We have experienced significant volatility in the funded status (assets less liabilities) of our DB plans. (1)

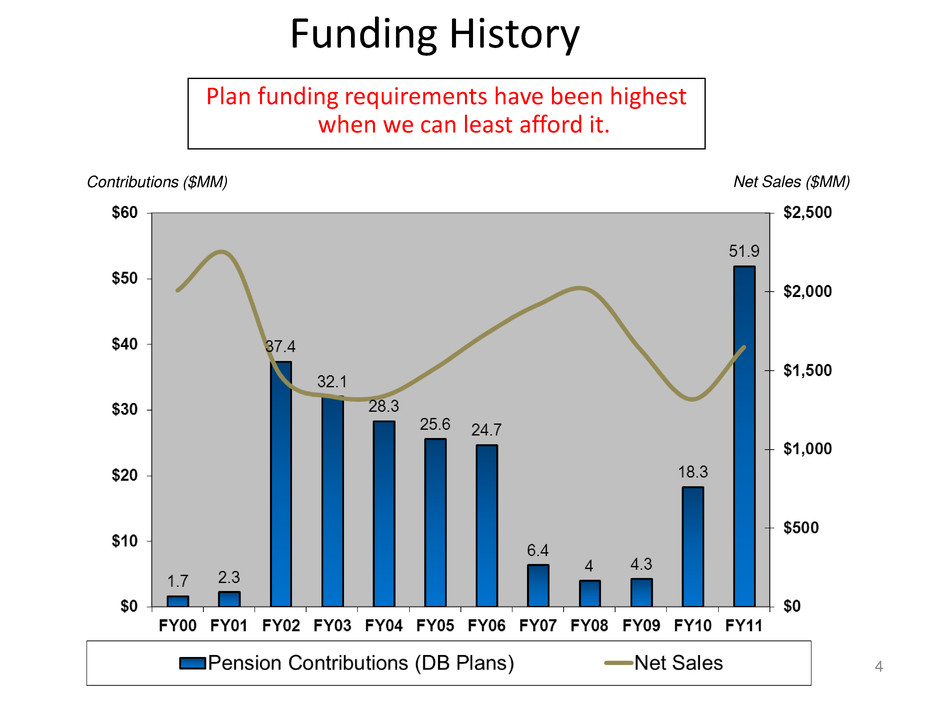

Funding History 4 Contributions ($MM) Net Sales ($MM) Plan funding requirements have been highest when we can least afford it.

Our Strategy Going Forward 5 1. Improve the funded position of our plans Estimated initial cash outlay: $40MM to $45MM (net of tax benefits) Estimated Timing: Majority Q4 FY2012 / Balance Q1 FY2013 2. Reduce the risk profile of plan investments 3. Cease future service accruals on all DB plans “Hard Freeze” the plans in early FY2013 Replace ongoing benefits with a new DC-based model 4. Begin the formal termination process of US-based plans Process to begin during Q2 FY2013 Takes approximately 12 to 24 months to complete Estimated additional cash outlay at completion: ≈$10MM to $15MM (net of tax benefits) We intend to transition away from our defined benefit structure by implementing the following action plan.

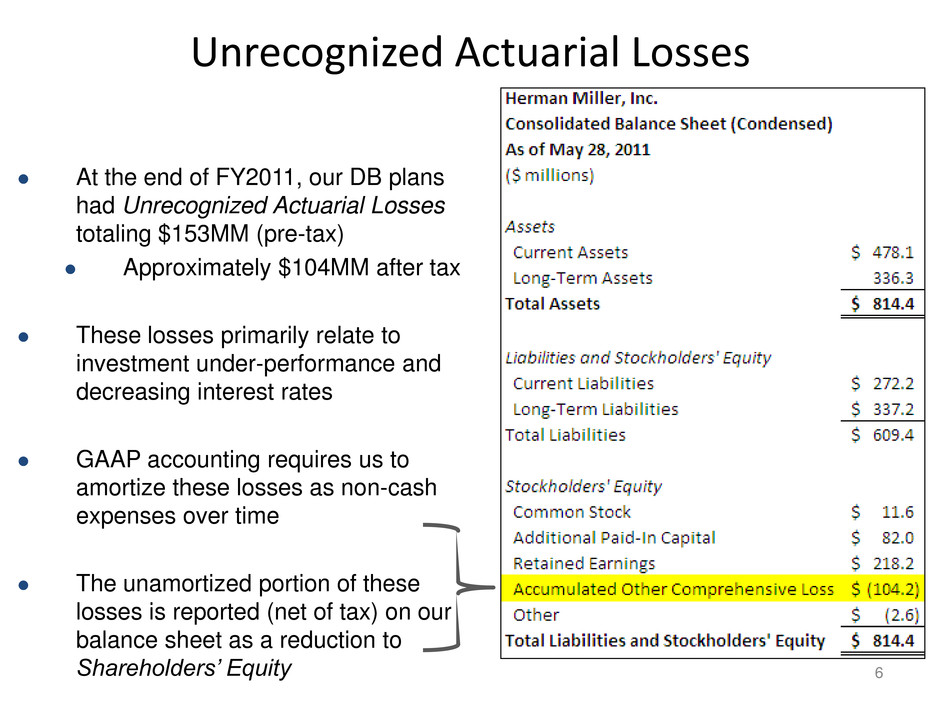

Unrecognized Actuarial Losses 6 At the end of FY2011, our DB plans had Unrecognized Actuarial Losses totaling $153MM (pre-tax) Approximately $104MM after tax These losses primarily relate to investment under-performance and decreasing interest rates GAAP accounting requires us to amortize these losses as non-cash expenses over time The unamortized portion of these losses is reported (net of tax) on our balance sheet as a reduction to Shareholders’ Equity

7 Income Statement Impact The Unrecognized Actuarial Losses associated with our DB plans will drive an increase in non-cash pension expenses for a period of time. The amortization of these losses will continue throughout the 12 to 24 month transition period Currently running approximately $9MM per year As plan liabilities are settled during this period, we will also recognize large portions of the Unrecognized Actuarial Losses as pension settlement charges We expect ≈$25MM in FY2013; ≈$125MM in FY2014; all non-cash / pre-tax These amortization and settlement expenses will be non- cash in nature and have no impact on total stockholders’ equity or our financial debt covenants

Benefits of this Strategy 8 Eliminates Company exposure to investment risk associated with employee retirement plans in the U.S. Better aligns cash flow and expenses with business cycles Eliminates a volatile liability and increases future debt capacity Free up future cash flow for strategic investment and/or return to shareholders Maintains market competitive retirement benefits for employee-owners