Attached files

| file | filename |

|---|---|

| EX-21 - HERMAN MILLER INC | hmi10k052910ex21.htm |

| EX-32.B - HERMAN MILLER INC | hmi10k052910ex32b.htm |

| EX-32.A - HERMAN MILLER INC | hmi10k052910ex32a.htm |

| EX-31.A - HERMAN MILLER INC | hmi10k052910ex31a.htm |

| EX-23.A - HERMAN MILLER INC | hmi10k052910ex23a.htm |

| EX-10.1 - HERMAN MILLER INC | hmi10k052910ex101.htm |

| EX-31.B - HERMAN MILLER INC | hmi10k052910ex31b.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

[ X ] | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

[__] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For Fiscal Year Ended May 29, 2010 | Commission File No. 001-15141 |

Herman Miller, Inc.

(Exact name of registrant as specified in its charter)

Michigan | 38-0837640 | |||

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||

855 East Main Avenue | ||||

PO Box 302 | ||||

Zeeland, Michigan | 49464-0302 | |||

(Address of principal executive offices) | (Zip Code) |

Registrant's telephone number, including area code: (616) 654 3000 | |

Securities registered pursuant to Section 12(b) of the Act: None | |

Securities registered pursuant to Section 12(g) of the Act: | Common Stock, $.20 Par Value (Title of Class) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | |

Yes [ X ] No [__] | |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | |

Yes [__] No [ X ] | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | |

Yes [ X ] No [__] | |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | |

Yes [__] No [__] | |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “accelerated filer,” “large accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ X ] Accelerated filer [__] Non-accelerated filer [__] Smaller reporting company [__]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | |

Yes [__] No [ X ] | |

The aggregate market value of the voting stock held by “nonaffiliates” of the registrant (for this purpose only, the affiliates of the registrant have been assumed to be the executive officers and directors of the registrant and their associates) as of November 28, 2009, was $835,337,496 (based on $15.17 per share which was the closing sale price as reported by NASDAQ).

The number of shares outstanding of the registrant's common stock, as of July 23, 2010: Common stock, $.20 par value - 57,060,055 shares outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Certain portions of the Registrant's Proxy Statement for the Annual Meeting of Shareholders to be held on October 11, 2010, are incorporated into Part III of this report.

TABLE OF CONTENTS

Page No. | |

Part I | |

Item 1 Business | |

Item 1A Risk Factors | |

Item 1B Unresolved Staff Comments | |

Item 2 Properties | |

Item 3 Legal Proceedings | |

Additional Item: Executive Officers of the Registrant | |

Part II | |

Item 5 Market for the Registrant's Common Equity, Related Shareholder Matters, and | |

issuer Purchases of Equity Securities | |

Item 6 Selected Financial Data | |

Item 7 Management's Discussion and Analysis of Financial Condition and Results of | |

Operations | |

Item 7A Quantitative and Qualitative Disclosures about Market Risk | |

Item 8 Financial Statements and Supplementary Data | |

Item 9 Changes in and Disagreements with Accountants on Accounting and Financial | |

Disclosures | |

Item 9A Controls and Procedures | |

Item 9B Other Information | |

Part III | |

Item 10 Directors, Executive Officers, and Corporate Governance | |

Item 11 Executive Compensation | |

Item 12 Security Ownership of Certain Beneficial Owners and Management and Related | |

Stockholder Matters | |

Item 13 Certain Relationships and Related Transactions, and Director Independence | |

Item 14 Principal Accountant Fees and Services | |

Part IV | |

Item 15 Exhibits and Financial Statement Schedule | |

Signatures | |

Report of Independent Registered Public Accounting Firm on Financial Statement Schedule | |

Schedule II Valuation and Qualifying Accounts | |

Exhibits |

PART I

Item 1 BUSINESS

General Development of Business

The company researches, designs, manufactures, and distributes interior furnishings, for use in various environments including office, healthcare, educational, and residential settings, and provides related services that support organizations and individuals all over the world. The company's products are sold primarily to or through independent contract office furniture dealers. Through research, the company seeks to define and clarify customer needs and problems existing in its markets and to design, through innovation where appropriate and feasible, products, systems, and services as solutions to such problems. Ultimately, the company seeks to enhance the performance of human habitats worldwide, making its customers' lives more productive, rewarding, delightful, and meaningful.

Herman Miller, Inc. was incorporated in Michigan in 1905. One of the company's major plants and its corporate offices are located at 855 East Main Avenue, PO Box 302, Zeeland, Michigan, 49464-0302, and its telephone number is (616) 654-3000. Unless otherwise noted or indicated by the context, the term “company” includes Herman Miller, Inc., its predecessors, and majority-owned subsidiaries. Further information relating to principles of consolidation is provided in Note 1 to the Consolidated Financial Statements included in Item 8 of this report.

Financial Information about Segments

Information relating to segments is provided in Note 20 to the Consolidated Financial Statements included in Item 8 of this report.

Narrative Description of Business

The company's principal business consists of the research, design, manufacture, and distribution of office furniture systems, products, and related services. Most of these systems and products are designed to be used together.

The company works for a better world around our customers by designing furnishings and related services that improve the human experience wherever people work, heal, learn and live. The company's ingenuity and design excellence creates award-winning products and services, that makes us a leader in design and development of furniture and furniture systems. This leadership is exemplified by the innovative concepts introduced by the company in its modular systems (including Action Office®, Ethospace®, Resolve®, My Studio Environments™ and Vivo Interiors™). The company also offers a broad array of seating (including Embody®, Aeron®, Mirra®, Setu™, Celle™, Equa®, and Ergon® office chairs), storage (including Meridian®, Tu™ and Teneo® products), wooden casegoods (including Geiger® products), and freestanding furniture products (including , Abak™, Intent™, Sense™ and Envelop®). These, along with innovative business practices and a commitment to responsible leadership, has resulted in the company being recognized as the most admired company in the industry.

The company's products are marketed worldwide by its own sales staff, its owned dealer network, independent dealers and retailers, and via the Internet. Salespersons work with dealers, the design and architectural community, and directly with end-users. Independent dealerships concentrate on the sale of Herman Miller products and some complementary product lines of other manufacturers. It is estimated that approximately 70 percent of the company's sales in the fiscal year ended May 29, 2010, were made to or through independent dealers. The remaining sales were made directly to end-users, including federal, state, and local governments, and several major corporations, by the company's own sales staff, its owned dealer network, or independent retailers.

-3-

The company is also a recognized leader within its industry for the use, development, and integration of customer-centered technologies that enhance the reliability, speed, and efficiency of our customers' operations. This includes proprietary sales tools, interior design and product specification software; order entry and manufacturing scheduling and production systems; and direct connectivity to the company's suppliers.

The company's furniture systems, seating, freestanding furniture, storage and casegood products, and related services are used in (1) office/institution environments including offices and related conference, lobby, and lounge areas, and general public areas including transportation terminals; (2) health/science environments including hospitals, clinics, and other healthcare facilities; (3) industrial and educational settings; and (4) residential and other environments.

Raw Materials

The company's manufacturing materials are available from a significant number of sources within the United States, Canada, Europe, and Asia. To date, the company has not experienced any difficulties in obtaining its raw materials. The costs of certain direct materials used in the company's manufacturing and assembly operations are sensitive to shifts in commodity market prices. In particular, the costs of steel components, plastics, and particleboard are sensitive to the market prices of commodities such as raw steel, aluminum, crude oil, lumber, and resins. Increases in the market prices for these commodities can have an adverse impact on the company's profitability. Further information regarding the impact of direct material costs on the company's financial results is provided in Management's Discussion and Analysis in Item 7 of this report.

Patents, Trademarks, Licenses, Etc.

The company has 176 active United States utility patents on various components used in its products and 52 active United States design patents. Many of the inventions covered by the United States patents also have been patented in a number of foreign countries. Various trademarks, including the name and stylized “Herman Miller” and the “Herman Miller Circled Symbolic M” trademark are registered in the United States and many foreign countries. The company does not believe that any material part of its business depends on the continued availability of any one or all of its patents or trademarks, or that its business would be materially adversely affected by the loss of any thereof, except for Herman Miller®, Herman Miller Circled Symbolic M®, Geiger®, Nemschoff®, Action Office®, Ethospace®, Aeron®, Mirra®, Eames®, PostureFit®, and Vivo Interiors™. It is estimated that the average remaining life of such patents and trademarks is approximately 6 years and 9 years, respectively.

Working Capital Practices

Information concerning the company's inventory levels relative to its sales volume can be found under the Executive Overview section in Item 7 of this report. Beyond this discussion, the company does not believe that it or the industry in general, has any special practices or special conditions affecting working capital items that are significant for understanding the company's business.

Customer Base

It is estimated that no single dealer accounted for more than 5 percent of the company's net sales in the fiscal year ended May 29, 2010. It is also estimated that the largest single end-user customer, the U.S. federal government, accounted for $180.3 million or approximately 14 percent of the company's fiscal 2010 net sales. The 10 largest customers accounted for approximately 27 percent of net sales. The company does not believe that its business depends on any single or small number of customers, the loss of which would have a materially adverse effect upon the company.

Backlog of Unfilled Orders

As of May 29, 2010, the company's backlog of unfilled orders was $243.6 million. At May 30, 2009, the company's backlog totaled $207.8 million. It is expected that substantially all the orders forming the backlog at May 29, 2010, will be filled during the next fiscal year. Many orders received by the company are reflected in the backlog for only a short period while other orders specify delayed shipments and are carried in the backlog for up to one year. Accordingly, the amount of the backlog at any particular time does not necessarily

-4-

indicate the level of net sales for a particular succeeding period.

Government Contracts

Other than standard provisions contained in contracts with the United States Government, the company does not believe that any significant portion of its business is subject to material renegotiation of profits or termination of contracts or subcontracts at the election of various government entities. The company sells to the U.S. Government both through a GSA Multiple Award Schedule Contract and through competitive bids. The GSA Multiple Award Schedule Contract pricing is principally based upon the company's commercial price list in effect when the contract is initiated, rather than being determined on a cost-plus-basis. The company is required to receive GSA approval to increase its list prices during the term of the Multiple Award Schedule Contract period.

Competition

All aspects of the company's business are highly competitive. The company competes largely on design, product and service quality, speed of delivery, and product pricing. Although the company is one of the largest office furniture manufacturers in the world, it competes with several manufacturers that have greater resources and sales as well as many smaller companies. In the United States, the company's most significant competitors are Haworth, HNI Corporation, Kimball International, Knoll, and Steelcase.

Research, Design and Development

The company draws great competitive strength from its research, design and development programs. Accordingly, the company believes that its research and design activities are of significant importance. Through research, the company seeks to define and clarify customer needs and problems and to design, through innovation where feasible and appropriate, innovative products and services as solutions to customer needs and problems. The company uses both internal and independent research and design resources. Exclusive of royalty payments, the company spent approximately $33.2 million, $36.2 million, and $38.8 million, on research and development activities in fiscal 2010, 2009, and 2008, respectively. Generally, royalties are paid to designers of the company's products as the products are sold and are not included in research and development costs since they are variable based on product sales.

Environmental Matters

Living with integrity and respecting the environment stands as one of the company's core values. This is based in part, on the belief that environmental sustainability and commercial success are not exclusive ends, but instead exist side by side in a mutually beneficial relationship. The company continues to rigorously reduce, recycle, and reuse solid waste generated by its manufacturing processes and the company's efforts and accomplishments have been widely recognized. Additionally, the company is pursuing the use of green energy in its manufacturing processes. During the NeoCon show we announced our achievement of fueling 100% of our facilities with renewable energy. This past year we made significant progress toward our goal of having zero impact on the environment by the year 2020. Based on current facts known to management, the company does not believe that existing environmental laws and regulations have had or will have any material effect upon the capital expenditures, earnings, or competitive position of the company. However, there can be no assurance new environmental legislation and technology in this area will not result in or require material capital expenditures or additional costs to our manufacturing process.

Human Resources

The company considers its employees to be another of its major competitive strengths. The company stresses individual employee participation and incentives, believing that this emphasis has helped attract and retain a competent and motivated workforce. The company's human resources group provides employee recruitment, education and development, and compensation planning and counseling. There have been no work stoppages or labor disputes in the company's history, and its relations with its employees are considered good. Approximately 6 percent of the company's employees are covered by collective bargaining agreements, most of whom are employees of its Nemschoff and Herman Miller Limited (U.K.) subsidiaries.

As of May 29, 2010, the company employed 5,460 full-time and 175 part-time employees, representing a

-5-

7.5 percent increase and a 15.1 percent increase, respectively, compared with May 30, 2009. In addition to its employee work force, the company uses temporary purchased labor to meet uneven demand in its manufacturing operations.

Information about International Operations

The company's sales in international markets are made primarily to office/institutional customers. Foreign sales consist mostly of office furniture products such as Ethospace®, Abak®, Aeron®, Mirra®, and other seating and storage products. The company conducts business in the following major international markets: Europe, Canada, the Middle East, Latin America, and the Asia/Pacific region. In certain foreign markets, the company's products are offered through licensing of foreign manufacturers on a royalty basis.

The company's products currently sold in international markets are manufactured by wholly owned subsidiaries in the United States, the United Kingdom, and China. Sales are made through wholly owned subsidiaries or branches in Canada, France, Germany, Italy, Japan, Mexico, Australia, Singapore, China, India, and the Netherlands. The company's products are offered in the Middle East, South America, and Asia through dealers.

In several other countries, the company licenses manufacturing and selling rights. Historically, these licensing arrangements have not required a significant investment of funds or personnel by the company, and in the aggregate, have not produced material net earnings for the company.

Additional information with respect to operations by geographic area appears in Note 20 of the Consolidated Financial Statements included in Item 8 of this report. Fluctuating exchange rates and factors beyond the control of the company, such as tariff and foreign economic policies, may affect future results of international operations. Refer to Item 7A, Quantitative and Qualitative Disclosures about Market Risk, for further discussion regarding the company's foreign exchange risk.

Available Information

The company's annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available free of charge through the “Investors” section of the company's internet website at www.hermanmiller.com, as soon as practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (SEC). The company's filings with the SEC are also available for the public to read and copy in person at the SEC's Public Reference Room at 100 F Street NE, Washington, DC 20549, by phone at 1-800-SEC-0330, or via their internet website at www.sec.gov.

-6-

Item 1A RISK FACTORS

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones we face; others, either unforeseen or currently deemed less significant, may also have a negative impact on our company. If any of the following actually occurs, our business, operating results, cash flows, and financial condition could be materially adversely affected.

Our pension expenses are affected by factors outside our control, including the performance of plan assets, interest rates, actuarial data and experience and changes in laws and regulations.

Our future funding obligations for our U.S. defined benefit pension plans depend upon changes in the level of benefits provided for by the plans, the future performance of assets set aside in trusts for these plans, the level of interest rates used to determine funding levels, actuarial data and experience and any changes in government laws and regulations. In addition, our employee benefit plans hold a significant amount of equity securities. If the market values of these securities decline significantly, our future pension expenses and funding obligations could increase significantly. Decreases in interest rates that are not offset by contributions and asset returns could also increase our obligations under such plans. We may be legally required to make contributions to our U.S. pension plans in the future, and those contributions could be material. In addition, if local legal authorities increase the minimum funding requirements for our pension plan outside the United States, we could be required to contribute more funds, which would negatively affect our cash flow.

Sustained downturn in the economy could adversely impact our access to capital.

The global economic and financial market disruption of the past 24 months impacted the broader financial and credit markets, at times reducing the availability of debt and equity capital for the market as a whole. Conditions such as these could re-emerge in the future. Accordingly, our ability to access the capital markets could be restricted at a time when we would like, or need, to access those markets, which could have an impact on our flexibility to react to changing economic and business conditions. The resulting lack of available credit, increased volatility in the financial markets and reduced business activity could materially and adversely affect our business, financial condition, results of operations, our ability to take advantage of market opportunities and our ability to obtain and manage our liquidity. In addition, the cost of debt financing and the proceeds of equity financing may be materially and adversely impacted by these market conditions. The extent of any impact would depend on several factors, including our operating cash flows, the duration of tight credit conditions and volatile equity markets, our credit capacity, the cost of financing, and other general economic and business conditions. Our credit agreements contain performance covenants, such as a limit on the ratio of debt to earnings before interest, taxes, depreciation and amortization, and limits on subsidiary debt and incurrence of liens. Although we believe none of these covenants are presently restrictive to our operations, our ability to meet the financial covenants can be affected by events beyond our control.

We may not be successful in implementing and managing our growth strategy.

We have established a set of key strategic goals for our business. Included among these are specific targets for growth in net sales and operating profit as a percentage of net sales. Our strategic plan assumes growth targets will be achieved by pursuing and winning new business in the following areas:

•

Primary Markets — Capturing additional market share within our primary markets by offering superior solutions to customers who value space as a strategic tool.

•

Adjacent Markets — Further applying our core skills in space environments such as healthcare, higher education, and residential.

•

Developing Economies — Expanding our geographic reach in areas of the world with significant growth potential.

•

New Markets — Developing new products and technologies that serve wholly new markets.

While we have confidence that our strategic plan targets opportunities that are appropriate and achievable and that anticipates and manages the associated risks, there is the possibility that the strategy may not

-7-

deliver the projected results due to inadequate execution, incorrect assumptions, sub-optimal resource allocation, or changing customer requirements.

There is no assurance that our current product and service offering will allow us to meet these goals. Accordingly, we believe we will be required to continually invest in the research, design, and development of new products and services. There is no assurance that such investments will have commercially successful results.

Certain growth opportunities may require us to invest in acquisitions, alliances, and the startup of new business ventures. These investments may not perform according to plan.

Future efforts to expand our business within developing economies, particularly within China and India, may expose us to the effects of political and economic instability. Such instability may cause us difficulty in competing for business. It may also put at risk the availability and/or value of our capital investments within these regions. These expansion efforts expose us to operating environments with complex, changing, and in some cases, inconsistently applied legal and regulatory requirements. Developing knowledge and understanding of these requirements poses a significant challenge, and failure to remain compliant with them could limit our ability to continue doing business in these locations.

Pursuing our growth plan in new and adjacent markets, as well as within developing economies, will require us to find effective new channels of distribution. There is no assurance that we can develop or otherwise identify these channels of distribution.

The markets in which we operate are highly competitive, and we may not be successful in winning new business.

We are one of several companies competing for new business within the furniture industry. Many of our competitors offer similar categories of products, including office seating, systems and freestanding office furniture, casegoods, storage, and residential and healthcare furniture solutions. We believe that our innovative product design, functionality, quality, depth of knowledge, and strong network of distribution partners differentiates us in the marketplace. However, increased market pricing pressure could make it difficult for us to win new business with certain customers and within certain market segments at acceptable profit margins.

Adverse economic and industry conditions could have a negative impact on our business, results of operations, and financial condition.

Customer demand within the contract office furniture industry is affected by various macro-economic factors; general corporate profitability, white-collar employment levels, new office construction rates, and existing office vacancy rates are among the most influential factors. History has shown that declines in these measures can have an adverse effect on overall office furniture demand. Additionally, factors and changes specific to our industry, such as developments in technology, governmental standards and regulations, and health and safety issues can influence demand. There is no assurance that current or future economic or industry conditions will not adversely affect our business, operating results, or financial condition.

Our business presence outside the United States exposes us to certain risks that could negatively affect our results of operations and financial condition.

We have significant manufacturing and sales operations in the United Kingdom, which represents our largest marketplace outside the United States. We also have manufacturing operations in China. Additionally, our products are sold internationally through wholly-owned subsidiaries or branches in various countries including Canada, Mexico, Brazil, France, Germany, Italy, Netherlands, Japan, Australia, Singapore, China, and India. In certain other regions of the world, our products are offered primarily through independent dealerships.

Doing business internationally exposes us to certain risks, many of which are beyond our control and could

-8-

potentially impact our ability to design, develop, manufacture, or sell products in certain countries. These factors could include, but would not necessarily be limited to:

•

Political, social, and economic conditions

•

Legal and regulatory requirements

•

Labor and employment practices

•

Cultural practices and norms

•

Natural disasters

•

Security and health concerns

•

Protection of intellectual property

In some countries, the currencies in which we import and export products can differ. Fluctuations in the rate of exchange between these currencies could negatively impact our business. Additionally, tariff and import regulations, international tax policies and rates, and changes in U.S. and international monetary policies may have an adverse impact on results of operations and financial condition.

Disruptions in the supply of raw and component materials could adversely affect our manufacturing and assembly operations.

We rely on outside suppliers to provide on-time shipments of the various raw materials and component parts used in our manufacturing and assembly processes. The timeliness of these deliveries is critical to our ability to meet customer demand. Any disruptions in this flow of delivery could have a negative impact on our business, results of operations, and financial condition.

Increases in the market prices of manufacturing materials may negatively affect our profitability.

The costs of certain manufacturing materials used in our operations are sensitive to shifts in commodity market prices. In particular, the costs of steel, plastic and aluminum components and particleboard are sensitive to the market prices of commodities such as raw steel, aluminum, crude oil, lumber, and resins. Increases in the market prices of these commodities may have an adverse impact on our profitability if we are unable to offset them with strategic sourcing, continuous improvement initiatives or increased prices to our customers.

Disruptions within our dealer network could adversely affect our business.

Our ability to manage existing relationships within our network of independent dealers is crucial to our ongoing success. Although the loss of any single dealer would not have a material adverse effect on the overall business, our business within a given market could be negatively affected by disruptions in our dealer network caused by the termination of commercial working relationships, ownership transitions, or dealer financial difficulties.

If dealers go out of business or restructure, we may suffer losses because they may not be able to pay for products already delivered to them. Also, dealers may experience financial difficulties, creating the need for outside financial support, which may not be easily obtained. In the past, we have, on occasion, agreed to provide direct financial assistance through term loans, lines of credit, and/or loan guarantees to certain dealers. There is no assurance that these dealers will be able to repay amounts owed to us or to banks with which we have offered guarantees.

Increasing competition for highly skilled and talented workers could adversely affect our business.

The successful implementation of our business strategy depends, in part, on our ability to attract and retain a skilled workforce. The increasing competition for highly skilled and talented employees could result in higher compensation costs, difficulties in maintaining a capable workforce, and leadership succession planning challenges.

Costs related to product defects could adversely affect our profitability.

We incur various expenses related to product defects, including product warranty costs, product recall and retrofit costs, and product liability costs. These expenses relative to product sales vary and could increase.

-9-

We maintain reserves for product defect-related costs based on estimates and our knowledge of circumstances that indicate the need for such reserves. We cannot, however, be certain that these reserves will be adequate to cover actual product defect-related claims in the future. Any significant increase in the rate of our product defect expenses could have a material adverse effect on operations.

Government and other regulations could adversely affect our business.

Government and other regulations apply to many of our products. Failure to comply with these regulations or failure to obtain approval of products from certifying agencies could adversely affect the sales of these products and have a material negative impact on operating results.

-10-

Item 1B UNRESOLVED STAFF COMMENTS — none

Item 2 PROPERTIES

The company owns or leases facilities located throughout the United States and several foreign countries. The location, square footage, and use of the most significant facilities at May 29, 2010 were as follows:

Owned Locations | Square Footage | Use | ||

Holland, Michigan | 917,400 | Manufacturing, Distribution, Warehouse, Design, Office | ||

Spring Lake, Michigan | 582,800 | Manufacturing, Warehouse, Office | ||

Spring Lake, Michigan(1) | 235,500 | Idle Manufacturing facility | ||

Zeeland, Michigan | 750,800 | Manufacturing, Warehouse, Office | ||

Sheboygan, Wisconsin | 257,700 | Manufacturing, Warehouse, Office | ||

England, U.K. | 85,000 | Manufacturing, Office | ||

Leased Locations | ||||

Zeeland, Michigan(2) | 98,100 | Office currently vacant | ||

Atlanta, Georgia | 176,700 | Manufacturing, Warehouse, Office | ||

England, U.K. | 93,500 | Manufacturing, Warehouse | ||

Ningbo, China | 94,700 | Manufacturing, Warehouse, Office | ||

(1) The Spring Lake, Michigan, IMT facility, manufacturing, warehouse, and office facility was exited as part of the manufacturing consolidation restructuring action in fiscal 2010.

(2) The Zeeland, Michigan office facility was exited as part of the restructuring action in fiscal year 2009. The lease on this facility expires in December 2010.

The company also maintains showrooms or sales offices near many major metropolitan areas throughout North America, Europe, Asia/Pacific, and Latin America. The company considers its existing facilities to be in excellent condition, efficiently utilized, well suited, and adequate for its design, production, distribution, and selling requirements.

Item 3 LEGAL PROCEEDINGS

The company is involved in legal proceedings and litigation arising in the ordinary course of business. In the opinion of management, the outcome of such proceedings and litigation currently pending will not materially affect the company’s operations, cash flows and financial condition.

-11-

ADDITIONAL ITEM: EXECUTIVE OFFICERS OF THE REGISTRANT

Certain information relating to Executive Officers of the company is as follows.

Name | Age | Year Elected an Executive Officer | Position with the Company | |

Gregory J. Bylsma | 45 | 2009 | Executive Vice President, Chief Financial Officer | |

James E. Christenson | 63 | 1989 | Senior Vice President, Legal Services, and Secretary | |

Steven C. Gane | 55 | 2009 | Senior Vice President, President, Geiger International | |

Donald D. Goeman | 53 | 2005 | Executive Vice President, Research, Design & Development | |

Kenneth L. Goodson, Jr. | 58 | 2003 | Executive Vice President, Operations | |

Kathleen D. Koch | 52 | 2009 | Senior Vice President of Marketing | |

Andrew J. Lock | 56 | 2003 | Executive Vice President, President, International | |

Elizabeth A. Nickels | 48 | 2000 | Executive Vice President, President, Herman Miller Healthcare | |

Curtis S. Pullen | 50 | 2007 | Executive Vice President, President, North American Office and Learning Environments | |

Jeffrey M. Stutz | 39 | 2009 | Treasurer and Vice President, Investor Relations | |

Brian C. Walker | 48 | 1996 | President and Chief Executive Officer | |

B. Ben Watson | 45 | 2010 | Executive Creative Director |

Except as discussed below, each of the named officers has served the company in an executive capacity for more than five years.

Mr. Bylsma joined Herman Miller, Inc. in 2000 as Director of Reporting & Planning for North America prior to being appointed Corporate Controller in 2005.

Mr. Gane joined Herman Miller in 2007 as President of Geiger International. Prior to this he worked for Furniture Brands International for 16 years serving mostly as President of HBF.

Mr. Goeman joined Herman Miller’s New Product Development group in 1980, and during his 30 years with the company he has held a variety of new product design and development leadership positions.

Mrs. Koch joined Herman Miller, Inc. in 2007 as Senior Vice President of Marketing, and prior to this she served as Chief Marketing Officer for Kodak Health Imaging and Kodak Entertainment Imaging for 10 years.

Mr. Pullen joined Herman Miller in 1991 and served as Chief Financial Officer from 2007 to 2009, Senior Vice President of Dealer Distribution from 2003 to 2007, Senior Vice President of Finance for North America from 2000 to 2003, and Vice President of Finance, Herman Miller International from 1994 to 2000.

Mr. Stutz joined Herman Miller in 2009 as Treasurer and Vice President, Investor Relations. Previously he served as Chief Financial Officer for Izzy Designs Inc., subsequent to holding various positions within Herman Miller finance.

Mr. Watson joined Herman Miller in 2010 as Executive Creative Director, and prior to this he served as Managing Director and CEO of Moroso USA. Prior to this Mr. Watson served in creative roles as Global Creative Director of Apparel at Nike, and Global Marketing Director at Vitra.

There are no family relationships between or among the above-named executive officers. There are no arrangements or understandings between any of the above-named officers pursuant to which any of them was named an officer.

-12-

PART II

Item 5 MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

Share Price, Earnings, and Dividends Summary

Herman Miller, Inc., common stock is traded on the NASDAQ-Global Select Market System (Symbol: MLHR). As of July 23, 2010, there were approximately 18,200 record holders, including individual participants in security position listings, of the company's common stock.

Per Share and Unaudited | Market Price High (at close) | Market Price Low (at close) | Market Price Close | Earnings Per Share- Diluted (1) | Dividends Declared Per Share | ||||||||||||||

Year ended May 29, 2010: | |||||||||||||||||||

First quarter | $ | 17.20 | $ | 13.43 | $ | 16.13 | $ | 0.14 | $ | 0.02200 | |||||||||

Second quarter | 19.15 | 15.17 | 15.17 | 0.17 | 0.02200 | ||||||||||||||

Third quarter | 18.23 | 15.19 | 18.20 | 0.12 | 0.02200 | ||||||||||||||

Fourth quarter | 22.37 | 18.06 | 19.23 | — | 0.02200 | ||||||||||||||

Year | $ | 22.37 | $ | 13.43 | $ | 19.23 | $ | 0.43 | $ | 0.08800 | |||||||||

Year ended May 30, 2009: | |||||||||||||||||||

First quarter | $ | 28.54 | $ | 23.70 | $ | 28.14 | $ | 0.60 | $ | 0.08800 | |||||||||

Second quarter | 30.39 | 11.38 | 14.71 | 0.60 | 0.08800 | ||||||||||||||

Third quarter | 15.13 | 10.08 | 10.08 | (0.10 | ) | 0.08800 | |||||||||||||

Fourth quarter | 15.02 | 8.05 | 14.23 | 0.14 | 0.02200 | ||||||||||||||

Year | $ | 30.39 | $ | 8.05 | $ | 14.23 | $ | 1.25 | $ | 0.28600 | |||||||||

(1) The sum of the quarters may not equal the annual balance due to rounding associated with the calculation of earnings per share on an individual quarter basis

Dividends were declared and paid quarterly during fiscal 2010 and 2009 as approved by the Board of Directors. While it is anticipated that the company will continue to pay quarterly cash dividends, the amount and timing of such dividends is subject to the discretion of the Board depending on the company's future results of operations, financial condition, capital requirements, and other relevant factors.

Issuer Purchases of Equity Securities

The following is a summary of share repurchase activity during the fourth quarter ended May 29, 2010.

Period | (a) Total Number of Shares (or Units) Purchased | (b) Average Price Paid per Share or Unit | (c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs | (d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet be Purchased Under the Plans or Programs (1) | ||||||||

2/28/10-3/27/10 | 30 | 17.87 | 30 | $ | 170,375,922 | |||||||

3/28/10-4/24/10 | 377 | 22.00 | 377 | $ | 170,367,628 | |||||||

4/25/10-5/29/10 | 1,327 | 19.70 | 1,327 | $ | 170,341,476 | |||||||

Total | 1,734 | 20.17 | 1,734 | |||||||||

(1) Amounts are as of the end of the period indicated

-13-

The company repurchases shares under a previously announced plan authorized by the Board of Directors on September 28, 2007, which provided share repurchase authorization of $300,000,000 with no specified expiration date.

No repurchase plans expired or were terminated during the fourth quarter of fiscal 2010, nor do any plans exist under which the company does not intend to make further purchases.

During the period covered by this report the company did not sell any of its equity shares that were not issued under the Securities Act of 1933.

Shareholder Return Performance Graph

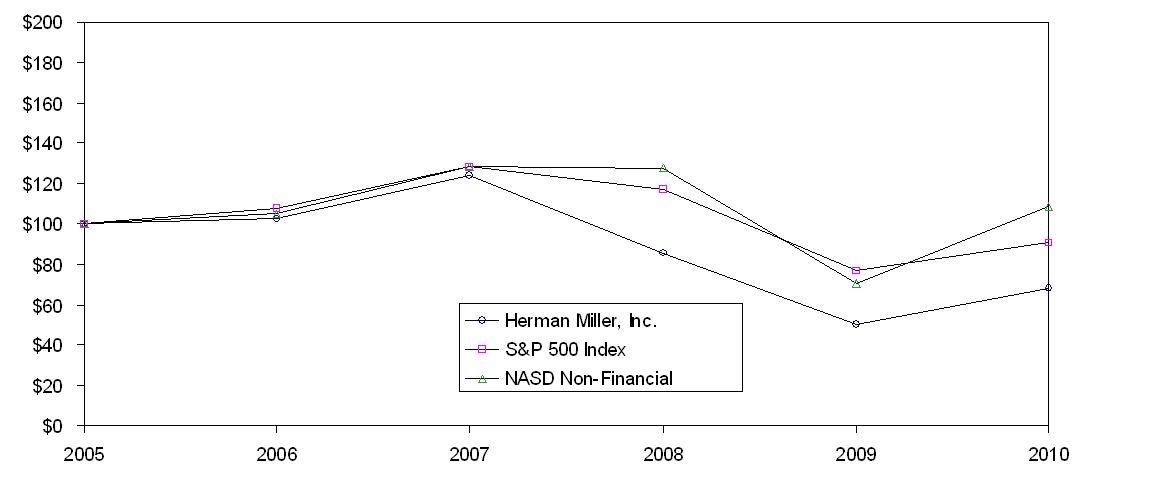

Set forth below is a line graph comparing the yearly percentage change in the cumulative total shareholder return on the Company's common stock with that of the cumulative total return of the Standard & Poor's 500 Stock Index and the NASD Non-Financial Index for the five-year period ended May 29, 2010. The graph assumes an investment of $100 on May 28, 2005 in the company's common stock, the Standard & Poor's 500 Stock Index and the NASD Non-Financial Index, with dividends reinvested.

2005 | 2006 | 2007 | 2008 | 2009 | 2010 | ||||||||||||||||||

Herman Miller, Inc. | $ | 100 | $ | 102 | $ | 124 | $ | 85 | $ | 50 | $ | 68 | |||||||||||

S&P 500 Index | $ | 100 | $ | 107 | $ | 128 | $ | 117 | $ | 77 | $ | 91 | |||||||||||

NASD Non-Financial | $ | 100 | $ | 105 | $ | 128 | $ | 127 | $ | 71 | $ | 109 | |||||||||||

Information required by this item is also contained in Item 12 of this report.

-14-

Item 6 SELECTED FINANCIAL DATA

Review of Operations | |||||||||||||||||||

(In millions, except key ratios and per share data) | 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||

Operating Results | |||||||||||||||||||

Net sales | $ | 1,318.8 | $ | 1,630.0 | $ | 2,012.1 | $ | 1,918.9 | $ | 1,737.2 | |||||||||

Gross margin | 428.5 | 527.7 | 698.7 | 645.9 | 574.8 | ||||||||||||||

Selling, general, and administrative(8) | 334.4 | 359.2 | 400.9 | 395.8 | 371.7 | ||||||||||||||

Design and research | 40.5 | 45.7 | 51.2 | 52.0 | 45.4 | ||||||||||||||

Operating earnings | 53.6 | 122.8 | 246.6 | 198.1 | 157.7 | ||||||||||||||

Earnings before income taxes | 34.8 | 98.9 | 230.4 | 187.0 | 147.6 | ||||||||||||||

Net earnings attributable to controlling interest | 28.3 | 68.0 | 152.3 | 129.1 | 99.2 | ||||||||||||||

Cash flow from operating activities | 99.1 | 91.7 | 213.6 | 137.7 | 150.4 | ||||||||||||||

Depreciation and amortization | 42.6 | 41.7 | 43.2 | 41.2 | 41.6 | ||||||||||||||

Capital expenditures | 22.3 | 25.3 | 40.5 | 41.3 | 50.8 | ||||||||||||||

Common stock repurchased plus cash dividends paid | 5.7 | 19.5 | 287.9 | 185.6 | 175.4 | ||||||||||||||

Key Ratios | |||||||||||||||||||

Sales growth (decline) | (19.1 | )% | (19.0 | )% | 4.9 | % | 10.5 | % | 14.6 | % | |||||||||

Gross margin (1) | 32.5 | 32.4 | 34.7 | 33.7 | 33.1 | ||||||||||||||

Selling, general, and administrative (1) (8) | 25.4 | 22.0 | 19.9 | 20.6 | 21.4 | ||||||||||||||

Design and research expense (1) | 3.1 | 2.8 | 2.5 | 2.7 | 2.6 | ||||||||||||||

Operating earnings (1) | 4.1 | 7.5 | 12.3 | 10.3 | 9.1 | ||||||||||||||

Net earnings attributable to controlling interest growth (decline) | (58.4 | ) | (55.4 | ) | 18.0 | 30.1 | 45.9 | ||||||||||||

After-tax return on net sales (4) | 2.1 | 4.2 | 7.6 | 6.7 | 5.7 | ||||||||||||||

After-tax return on average assets (5) | 3.7 | 8.8 | 21.0 | 19.4 | 14.4 | ||||||||||||||

After-tax return on average equity (6) | 64.2 | % | 433.1 | % | 170.5 | % | 87.9 | % | 64.2 | % | |||||||||

Share and Per Share Data | |||||||||||||||||||

Earnings per share-diluted | $ | 0.43 | $ | 1.25 | $ | 2.56 | $ | 1.98 | $ | 1.45 | |||||||||

Cash dividends declared per share | 0.09 | 0.29 | 0.35 | 0.33 | 0.31 | ||||||||||||||

Book value per share at year end | 1.41 | 0.15 | 0.42 | 2.47 | 2.10 | ||||||||||||||

Market price per share at year end | 19.23 | 14.23 | 24.80 | 36.53 | 30.34 | ||||||||||||||

Weighted average shares outstanding-diluted | 57.5 | 54.5 | 59.6 | 65.1 | 68.5 | ||||||||||||||

Financial Condition | |||||||||||||||||||

Total assets | $ | 770.6 | $ | 767.3 | $ | 783.2 | $ | 666.2 | $ | 668.0 | |||||||||

Working capital (3) | 181.7 | 243.7 | 182.7 | 103.2 | 93.8 | ||||||||||||||

Current ratio (2) | 1.3 | 1.6 | 1.6 | 1.4 | 1.3 | ||||||||||||||

Interest-bearing debt and related swap agreements | 301.2 | 377.4 | 375.5 | 176.2 | 178.8 | ||||||||||||||

Shareholders' equity | 80.1 | 8.0 | 23.4 | 155.3 | 138.4 | ||||||||||||||

Total capital (7) | 381.3 | 385.4 | 398.9 | 331.5 | 317.2 | ||||||||||||||

(1) Shown as a percent of net sales.

-15-

(2) Calculated using current assets divided by current liabilities.

(3) Calculated using current assets less non-interest bearing current liabilities.

(4) Calculated as net earnings attributable to controlling interest divided by net sales.

(5) Calculated as net earnings attributable to controlling interest divided by average assets.

(6) Calculated as net earnings attributable to controlling interest divided by average equity.

(7) Calculated as interest-bearing debt plus shareholders' equity.

(8) Selling, general, and administrative expenses include restructuring expenses in years that are applicable.

2005 | 2004 | 2003 | 2002 | 2001 | 2000 | |||||||||||||||||

$ | 1,515.6 | $ | 1,338.3 | $ | 1,336.5 | $ | 1,468.7 | $ | 2,236.2 | $ | 2,010.2 | |||||||||||

489.8 | 415.6 | 423.6 | 440.3 | 755.7 | 680.4 | |||||||||||||||||

327.7 | 304.1 | 319.8 | 399.7 | 475.4 | 404.4 | |||||||||||||||||

40.2 | 40.0 | 39.1 | 38.9 | 44.3 | 41.3 | |||||||||||||||||

121.9 | 61.2 | 48.3 | (79.9 | ) | 236.0 | 234.7 | ||||||||||||||||

112.8 | 51.6 | 35.8 | (91.0 | ) | 225.1 | 221.8 | ||||||||||||||||

68.0 | 42.3 | 23.3 | (56.0 | ) | 140.6 | 139.7 | ||||||||||||||||

109.3 | 82.7 | 144.7 | 54.6 | 211.8 | 202.1 | |||||||||||||||||

46.9 | 59.3 | 69.4 | 112.9 | 92.6 | 77.1 | |||||||||||||||||

34.9 | 26.7 | 29.0 | 52.4 | 105.0 | 135.7 | |||||||||||||||||

152.0 | 72.6 | 72.7 | 30.3 | 105.3 | 101.6 | |||||||||||||||||

13.2 | % | 0.1 | % | (9.0 | )% | (34.3 | )% | 11.2 | % | 9.9 | % | |||||||||||

32.3 | 31.1 | 31.7 | 30.0 | 33.8 | 33.8 | |||||||||||||||||

21.6 | 22.7 | 23.9 | 27.3 | 21.3 | 20.1 | |||||||||||||||||

2.7 | 3.0 | 2.9 | 2.6 | 2.0 | 2.1 | |||||||||||||||||

8.0 | 4.6 | 3.6 | (5.4 | ) | 10.6 | 11.7 | ||||||||||||||||

60.8 | 81.5 | 141.6 | (139.8 | ) | 0.6 | (1.5 | ) | |||||||||||||||

4.5 | 3.2 | 1.7 | (3.8 | ) | 6.3 | 6.9 | ||||||||||||||||

9.6 | 5.7 | 3.0 | (6.3 | ) | 14.5 | 16.5 | ||||||||||||||||

37.3 | % | 21.9 | % | 10.3 | % | (18.2 | )% | 43.5 | % | 55.5 | % | |||||||||||

$ | 0.96 | $ | 0.58 | $ | 0.31 | $ | (0.74 | ) | $ | 1.81 | $ | 1.74 | ||||||||||

0.29 | 0.18 | 0.15 | 0.15 | 0.15 | 0.15 | |||||||||||||||||

2.45 | 2.71 | 2.62 | 3.45 | 4.63 | 3.76 | |||||||||||||||||

29.80 | 24.08 | 19.34 | 23.46 | 26.90 | 29.75 | |||||||||||||||||

70.8 | 73.1 | 74.5 | 75.9 | 77.6 | 80.5 | |||||||||||||||||

$ | 707.8 | $ | 714.7 | $ | 757.3 | $ | 788.0 | $ | 996.5 | $ | 941.2 | |||||||||||

162.3 | 207.8 | 189.9 | 188.7 | 191.6 | 99.1 | |||||||||||||||||

1.5 | 1.8 | 1.7 | 1.8 | 1.5 | 0.9 | |||||||||||||||||

194.0 | 207.2 | 223.0 | 235.1 | 259.3 | 225.6 | |||||||||||||||||

170.5 | 194.6 | 191.0 | 263.0 | 351.5 | 294.5 | |||||||||||||||||

364.5 | 401.8 | 414.0 | 498.1 | 610.8 | 520.1 | |||||||||||||||||

-16-

Item 7 MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Management's Discussion and Analysis

You should read the issues discussed in Management's Discussion and Analysis in conjunction with the company's Consolidated Financial Statements and the Notes to the Consolidated Financial Statements included in this Form 10-K.

Executive Overview

At Herman Miller, we work for a better world around you. We do this by designing and developing award-winning furniture and related services and technologies that improve your environment, whether it's an office, hospital, school, home, an entire building, or the world at large. At present, most of our customers come to us for work environments in both corporate office and healthcare settings. We also have a growing presence in educational and residential markets, including home office. Our primary products include furniture systems, seating, storage and material handling solutions, freestanding furniture, and casegoods. Our other services extend from workplace solutions to furniture asset management.

More than 100 years of innovative business practices and a commitment to social responsibility have established Herman Miller as a recognized global company. In 2009, we were again cited by FORTUNE as both the “Most Admired” in our industry and among the “100 Best Companies to Work For” in America, while Fast Company named Herman Miller among the innovative “Companies to Watch.”

Our products are sold internationally through wholly-owned subsidiaries or branches in various countries including the United Kingdom, Canada, France, Germany, Italy, Japan, Mexico, Australia, Singapore, China, India, and the Netherlands. Our products are offered elsewhere in the world primarily through independent dealerships. We have customers in over 100 countries.

We are globally positioned in terms of manufacturing operations. In the United States, our manufacturing operations are located in Michigan, Georgia, Iowa and Wisconsin. In Europe, we have a manufacturing presence in the United Kingdom, our largest marketplace outside of the United States. In Asia, we have manufacturing operations in Ningbo, China. We manufacture our products using a system of lean manufacturing techniques collectively referred to as the Herman Miller Performance System (HMPS). We strive to maintain efficiencies and cost savings by minimizing the amount of inventory on hand. Accordingly, production is order-driven with direct materials and components purchased as needed to meet demand. The standard lead time for the majority of our products is 10 to 20 days. These factors result in a high rate of inventory turns and typically cause our inventory levels to appear relatively low compared to our sales volume.

A key element of our manufacturing strategy is to limit fixed production costs by sourcing component parts from strategic suppliers. This strategy has allowed us to increase the variable nature of our cost structure while retaining proprietary control over those production processes that we believe provide us a competitive advantage. As a result of this strategy, our manufacturing operations are largely assembly-based.

Our business consists of various operating segments as defined by generally accepted accounting principles. These operating segments are determined on the basis of how we internally report and evaluate financial information used to make operating decisions and are organized by the various markets we serve. For external reporting purposes, we aggregate these operating segments as follows.

•

North American Furniture Solutions - Includes the business associated with the design, manufacture, and sale of furniture products for office, learning and healthcare environments throughout the United States, Canada, and Mexico.

-17-

•

Non-North American Furniture Solutions - Includes the business associated with the design, manufacture, and sale of furniture products primarily for work-related settings outside North America.

•

Other - Includes our North American residential furniture business as well as other business activities such as Convia, unallocated corporate expenses, and restructuring costs.

Core Strengths

We rely on the following core strengths in delivering workplace solutions to our customers.

•

Brand - Our brand is recognized by customers as a pioneer in design and sustainability, and as an advocate that supports their needs and interests. Within our industry, Herman Miller is acknowledged as one of the leading brands that inspire architects and designers to create their best commercial design solutions. Leveraging our brand equity across our lines of business to extend our reach to customers and consumers is an important element of our business strategy.

•

Problem - Solving Design and Innovation - We are committed to developing research-based functionality and aesthetically innovative new products and have a history of doing so. We believe our skills and experience in matching problem-solving design with the workplace needs of our customers provide us with a competitive advantage in the marketplace. An important component of our business strategy is to actively pursue a program of new product research, design, and development. We accomplish this through the use of an internal research, engineering, and design staff as well as third party design resources generally compensated on a royalty basis.

•

Operational Excellence - We were among the first in our industry to embrace the concepts of lean manufacturing. HMPS provides the foundation for all of our manufacturing operations. We are committed to continuously improving both product quality and production and operational efficiency. We have extended this lean process work to our non-manufacturing processes as well as externally to our manufacturing supply chain and distribution channel. We believe this work holds great promise for further gains in reliability, quality and efficiency.

•

Building and Leading Networks - We value relationships in all areas of our business. We consider our networks of innovative designers, owned and independent dealers, and suppliers to be among our most important competitive factors and vital to the long-term success of our business.

Channels of Distribution

Our products and services are offered to most of our customers under standard trade credit terms between 30 and 45 days and are sold through the following distribution channels.

•

Independent Contract Furniture Dealers and Licensees - Most of our product sales are made to a network of independently owned and operated contract furniture dealerships doing business in many countries around the world. These dealers purchase our products and distribute them to end customers. We recognize revenue on product sales through this channel once our products are shipped and title passes to the dealer. Many of these dealers also offer furniture-related services, including product installation.

•

Owned Contract Furniture Dealers - At May 29, 2010, we owned 9 contract furniture dealerships, some of which have operations in multiple locations. The financial results of these owned dealers are included in our Consolidated Financial Statements. Product sales to these dealerships are eliminated as inter-company transactions from our consolidated financial results. We recognize revenue on these sales once products are shipped to the end customer and installation is substantially complete. We believe independent ownership of contract furniture dealers is generally the best model for a financially strong distribution network. With this in mind, our strategy is to continue to pursue opportunities to transition our owned dealerships to independent owners. Where possible, our goal

-18-

is to involve local managers in these ownership transitions.

•

Direct Customer Sales - We sometimes sell products and services directly to end customers without an intermediary (e.g. sales to the U.S. federal government). In most of these instances, we contract separately with a dealership or third-party installation company to provide sales-related services. We recognize revenue on these sales once products are shipped and installation is substantially complete.

•

Independent Retailers - Certain products are sold to end customers through independent retail operations. Revenue is recognized on these sales once products are shipped and title passes to the independent retailer.

Challenges Ahead

Like all businesses, we are faced with a host of challenges and risks. We believe our core strengths and values, which provide the foundation for our strategic direction, have us well prepared to respond to the inevitable challenges we will face in the future. While we are confident in our direction, we acknowledge the risks specific to our business and industry. Refer to Item 1A of our Annual Report on Form 10-K for discussion of certain of these risk factors.

Future Avenues of Growth

We believe we are well positioned to successfully pursue our mission in spite of the risks and challenges we face. That is, we will design and develop furniture and related services and technologies that reflect sustainable business practices that improve your environment and help create a better world around you. In pursuing our mission, we have identified the following as key avenues for our future growth.

•

Primary Markets - Capture additional market share within our primary markets by offering superior solutions to customers who value space as a strategic tool.

•

Adjacent Markets - Further apply our core skills in space environments such as healthcare, higher education, and residential.

•

Developing Economies - Expand our geographic reach in areas of the world with significant growth potential.

•

New Markets - Develop or acquire new products and technologies that serve new markets.

Industry Analysis

The Business and Institutional Furniture Manufacturer's Association (BIFMA) is the trade association for the U.S. domestic office furniture industry. We monitor the trade statistics reported by BIFMA and consider them an indicator of industry-wide sales and order performance. BIFMA publishes statistical data for the contract segment and the office supply segment within the U.S. furniture market. The U.S. contract segment is primarily with large to mid-size corporations installed via a network of dealers. The office supply segment is primarily to smaller customers via wholesalers and retailers. We primarily participate, and are a leader in, the contract segment. It is important to note that our diversification strategy lessens our dependence on the U.S. office furniture market.

We also analyze BIFMA statistical information as a benchmark comparison against the performance of our domestic U.S. business and also to that of our competitors. The timing of large project-based business may affect comparisons to this data in any one period. Finally, BIFMA regularly provides its members with industry forecast information, which we use internally as one of several considerations in our short and long-range planning process.

-19-

Discussion of Business Conditions

Our fiscal years ended May 29, 2010 and May 30, 2009 each included 52 weeks of operations.

Fiscal 2010 was a year marked by economic challenge and strategic achievement. For the second year in a row sales decreased by 19 percent and we were called upon to make tough choices to balance current profitability against future investments. From an economic perspective, the macro drivers of demand in the contract office furniture industry have remained relatively soft with lagging office construction rates and reduced employment levels. However, after finishing the year with two consecutive quarters of year-over-year order growth, it appears that our business is benefiting from some momentum in the broader economy.

Apart from the overall economic challenges, we have made great progress this year toward our strategic goals. Despite lower sales relative to last year, we have remained solidly profitable, achieving an operating earnings of 4.1 percent of sales for the full year. We took action to de-leverage our balance sheet in the first quarter through the early retirement of $75 million of long-term debt and then in the third quarter by partially funding our pension obligations. As part of our continuing efforts to reduce fixed operating expenses, our operations team worked diligently toward the implementation of two factory consolidation projects, both of which were successfully concluded during the fourth quarter. Even in this challenging environment we have continued our focus on operational excellence with our manufacturing operations maintaining a reliability score above 99 percent throughout the year. At this year's NeoCon, the contract furniture industry's largest tradeshow, our new healthcare showroom was named the large showroom winner, and, for the fourth time in five years, we received the Office Furniture Dealers Alliance (OFDA) Gold award as the Manufacturer of the Year.

During the year, we worked hard to deliver superior products and services to our dealer network. Despite the economic downturn, the development of new products has remained a critical element of our business strategy. At this year's NeoCon we introduced 18 new products. Among the most significant achievements at this year's show was a new healthcare product called CompassTM, which won a Gold award in the healthcare furniture category and the launch of the ThriveTM portfolio of ergonomic products, which includes the technology support category's Silver award winning FloTM monitor arm. In launching ThriveTM we demonstrated that we can and will move quickly to find new areas to serve our traditional customers and dealers. We also hosted an invitation-only event to preview a new chair family we believe will set a new reference point for comfort, beauty and value.

During the NeoCon show we announced another milestone for our company: being the first in our industry (and one of the first in the world) to fuel 100% of our facilities with renewable energy. This past year we made significant progress toward our goal of having zero impact on the environment by the year 2020. While we still have progress to make, we believe the finish line is in sight.

As in our own business, the severity of the downturn over the past two years has forced our independent dealer network to reduce costs and increase operating efficiencies. As a rule, the financial health of the network remained remarkably strong all year. During the fourth quarter one exception to this rule prompted action on our part. We assumed ownership control of an independent dealer, the Living Edge Group, with locations throughout Australia, in order to protect the continuity of distribution in that region. We have moved aggressively to restructure operations and are pursuing a strategy aimed at returning the dealership to profitability and independent ownership.

During our first fiscal quarter of 2010, we completed the acquisition of Nemschoff, a healthcare furniture manufacturer in Sheboygan, Wisconsin. We immediately began the process of integrating its products and processes into our existing healthcare business. This acquisition, along with the fiscal 2008 acquisition of Brandrud, greatly expands our healthcare lineup and our ability to bring complete solutions to the marketplace.

During the fourth quarter we acquired U.K.-based Colebrook Bosson Saunders (CBS) a leading designer

-20-

and distributor of ergonomic work accessories. This acquisition enhances the scale of our existing accessories business and provides a compelling lineup of solutions to our dealers. The products offered by CBS are now included under the ThriveTM portfolio of ergonomic products and services.

As we look forward, with business conditions seemingly improving, there's a growing sense of optimism within the company. Our continued investments in product and business development throughout the downturn have enhanced both the depth and diversity of our market offering, leaving us well equipped to grow in each of our markets. And it's all backed by the innovative spirit of our people and a brand that we believe is second-to-none in our industry.

Looking forward, the general economic outlook for our industry in the U.S. is expected to improve in fiscal 2011. For calendar 2011, BIFMA expects positive 9.9 percent and 11.1 percent growth for orders and sales, respectively. This projected improvement is based on a forecasted improvement in the U.S. economy, and assumptions that higher employment will prevail in sectors most likely to consume office furniture and that vacancy rates will decline as unemployment rates fall.

Financial Results

The following is a comparison of our annual results of operations and year-over-year percentage changes for the periods indicated.

(Dollars In millions) | Fiscal 2010 | % Chg from 2009 | Fiscal 2009 | % Chg from 2008 | Fiscal 2008 | ||||||||||||

Net sales | $ | 1,318.8 | (19.1 | )% | $ | 1,630.0 | (19.0 | )% | $ | 2,012.1 | |||||||

Cost of sales | 890.3 | (19.2 | )% | 1,102.3 | (16.1 | )% | 1,313.4 | ||||||||||

Gross margin | 428.5 | (18.8 | )% | 527.7 | (24.5 | )% | 698.7 | ||||||||||

Operating expenses | 374.9 | (7.4 | )% | 404.9 | (10.4 | )% | 452.1 | ||||||||||

Operating earnings | 53.6 | (56.4 | )% | 122.8 | (50.2 | )% | 246.6 | ||||||||||

Net other expenses | 18.8 | (21.3 | )% | 23.9 | 47.5 | % | 16.2 | ||||||||||

Earnings before income taxes | 34.8 | (64.8 | )% | 98.9 | (57.1 | )% | 230.4 | ||||||||||

Income tax expense | 6.5 | (79.0 | )% | 31.0 | (60.4 | )% | 78.2 | ||||||||||

Net loss attributable to noncontrolling interest | — | (100.0 | )% | (0.1 | ) | — | (0.1 | ) | |||||||||

Net earnings attributable to controlling interest | $ | 28.3 | (58.4 | )% | $ | 68.0 | (55.4 | )% | $ | 152.3 | |||||||

-21-

The following table presents, for the periods indicated, the components of the company's Consolidated Statements of Operations as a percentage of net sales.

Fiscal Year Ended | May 29, 2010 | May 30, 2009 | May 31, 2008 | |||||

Net sales | 100.0 | % | 100.0 | % | 100.0 | % | ||

Cost of sales | 67.5 | 67.6 | 65.3 | |||||

Gross margin | 32.5 | 32.4 | 34.7 | |||||

Selling, general, and administrative expenses | 24.1 | 20.3 | 19.7 | |||||

Restructuring | 1.3 | 1.7 | 0.3 | |||||

Design and research expenses | 3.1 | 2.8 | 2.5 | |||||

Total operating expenses | 28.4 | 24.8 | 22.5 | |||||

Operating earnings | 4.1 | 7.5 | 12.3 | |||||

Net other expenses | 1.4 | 1.5 | 0.8 | |||||

Earnings before income taxes | 2.6 | 6.1 | 11.5 | |||||

Income tax expense | 0.5 | 1.9 | 3.9 | |||||

Net earnings attributable to controlling interest | 2.1 | 4.2 | 7.6 | |||||

Net Sales, Orders, and Backlog - Fiscal 2010 Compared to Fiscal 2009

For the fiscal year ended May 29, 2010, consolidated net sales declined 19.1 percent to $1,318.8 million from $1,630.0 million for the fiscal year ended May 30, 2009. This year-over-year decline was driven by the global economic environment and was experienced across nearly all operating and geographic units. While the U.S. dollar strengthened against many major currencies during fiscal 2010, it weakened against others, notably the Canadian dollar. The overall impact of foreign currency changes for the fiscal year was to increase net sales by approximately $5 million.

Consolidated net trade orders for fiscal 2010 totaled $1,322.4 million compared to $1,564.7 million in fiscal 2009, a decrease of 15.5 percent. Order rates began the year at a steady pace with orders averaging between approximately $25 million and $27 million per week through the first two quarters. These order rates, and other economic inputs, gave a solid signal that the business had hit bottom and was stabilized. Moving into the second half of the year, the third quarter, which historically has the weakest order rate of the year, orders dipped down to an average weekly rate of approximately $22 million per week. Although low, this order rate represented a slight increase in order rates from the prior year. The fourth quarter order rates averaged approximately $28 million per week, which represented our highest order rate in 18 months. The overall impact of foreign currency changes for the fiscal year was to increase net orders by approximately $4 million to $5 million.

Our backlog of unfilled orders at the end of fiscal 2010 totaled $243.6 million, a 17.2 percent increase from the $207.8 million backlog at the end of fiscal 2009.

BIFMA reported an estimated year-over-year decline in U.S. office furniture shipments of approximately 22.3 percent for the twelve-month period ended May 2010. By comparison, the net sales decline for our domestic U.S. business was approximately 18.8 percent. We believe that while comparisons to BIFMA are important, we continue to pursue a strategy of revenue diversification that makes us less reliant on the drivers that impact BIFMA.

Net Sales, Orders, and Backlog - Fiscal 2009 Compared to Fiscal 2008

For the fiscal year ended May 30, 2009, consolidated net sales declined 19.0 percent to $1,630.0 million from $2,012.1 million in fiscal 2008. This year-over-year decline was driven by the global economic environment and was experienced across nearly all operating and geographic units. The strengthening of the U.S. dollar during fiscal 2009 against most major foreign currencies reduced our top line by approximately

-22-

$30 million.

Consolidated net trade orders for fiscal 2009 totaled $1,564.7 million. This is comparable to net trade orders of $2,008.5 million in fiscal 2008, and represents a decrease of 22.1 percent. Starting with the financial market volatility in early fiscal 2009, in part related to the instability in the banking industry, we experienced a sudden and dramatic fall in order rates through most of the third quarter of fiscal 2009. Order rates stabilized through the fourth quarter of fiscal 2009, albeit at much lower level than fiscal 2008. The strong dollar reduced orders by approximately $38 million compared with fiscal 2008.

Our backlog of unfilled orders at the end of fiscal 2009 totaled $207.8 million, a 27.4 percent decline from $286.2 million at the end of fiscal 2008.

BIFMA reported an estimated year-over-year decline in U.S. office furniture shipments of approximately 13.8 percent for the twelve-month period ended May 2009. By comparison, the net sales decline for our domestic U.S. business was approximately 14.6 percent. We believe that while comparisons to BIFMA are important, we continue to pursue a strategy of revenue diversification that makes us less reliant on the drivers that impact BIFMA.

Discussion of Operating Segments - Fiscal 2010 Compared to Fiscal 2009

Net sales within the North American Furniture Solutions (North America) segment were $1,074.5 million in fiscal 2010, a $274.9 million or 20.4 percent decrease from fiscal 2009 net sales of $1,349.4 million. We again experienced a decline throughout our North American business operations in fiscal 2010, except for healthcare which benefited from the acquisition of Nemschoff in the first quarter. Nemschoff sales were $67.6 million during fiscal 2010 or 6.3 percent of net sales. Within this segment, we again experienced better than average sales from education, government and healthcare customers. Operating earnings for the segment in fiscal 2010 were $72.3 million, or 6.7 percent of net sales. This compares to segment earnings of $133.0 million or 9.9 percent in fiscal 2009. With net sales in the segment down 20.4 percent, having operating earnings of 6.7 percent of sales shows the ability to generate strong operating performance despite a significant decline in volume. This performance is largely due to the variable cost business model, which has allowed costs to be shed as net sales declined.

Net sales from the non-North American Furniture Solutions (non-North America) segment were $196.3 million in fiscal 2010, a $42.1 million, or 17.7 percent, decrease from fiscal 2009 net sales of $238.4 million. There were regions that experienced year-over-year sales growth, including India, China and Brazil. The areas hardest hit during the year were the Middle East and North Latin America which were down 41 and 37 percent from prior year, respectively. Operating losses within the non-North American segment totaled $1.0 million for the year or negative 0.5 percent of net sales. This compares to operating earnings of $15.1 million or 6.3 percent of net sales in fiscal 2009, a decrease of 680 basis points. The operating loss in fiscal 2010 was significantly affected by an independent dealer in Australia that went into receivership and resulted in bad debt expense of approximately $5 million.

Net sales within the “Other” segment category were $48.0 million in fiscal 2010 an increase of $5.8 million, or 13.7 percent, compared to fiscal 2009 net sales of $42.2 million. The increase in net sales is the result of strong sales by our North American Home business. It should be noted that while the majority of corporate costs are allocated to the operating segments, certain costs that are generally considered the result of isolated business decisions are not subject to allocation. Restructuring and asset impairment expenses are some of these costs, and have been allocated entirely to the "Other" category in fiscal 2010. Restructuring and asset impairment expenses totaled $16.7 million in fiscal 2010 and $28.4 million in fiscal 2009 and are discussed further in Note 21 of the Consolidated Financial Statements.

Operating losses within the “Other” segment category totaled $17.7 million for the year or negative 36.9 percent of net sales. This compares to a loss of $25.3 million or negative 60.0 percent of net sales in the prior year, an improvement of 2,310 basis points. The significant driver of operating losses in both years

-23-

were restructuring expenses, though it should be noted that in the current year there were also $2.5 million of asset impairment charges related to the Convia business that contributed to the operating loss.

The U.S. dollar was up and down against the British pound and the euro during fiscal 2010, and weakened throughout the year against the Canadian dollar. The changes in currency exchange rates from the prior year affected the U.S. dollar value of net sales only in the North American operating segment. The non-North American segment ended the year with essentially no impact from currency on year-over-year net sales. We estimate these changes effectively increased our fiscal 2010 net sales within the North American Furniture Solutions segment by approximately $5 million, driven entirely by the U.S. dollar / Canadian dollar impact, with the Mexican peso having a slight negative impact. It is important to note that period-to-period changes in currency exchange rates have a directionally similar impact on our international cost structures. Operating earnings within our non-North American segment increased an estimated $1.0 million in fiscal 2010. The estimated impact on operating earnings of our North American business segment due to currency changes, was an increase of approximately $3.5 million.

Discussion of Operating Segments - Fiscal 2009 Compared to Fiscal 2008