Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PENSON WORLDWIDE INC | d316101d8k.htm |

| EX-99.1 - COPY OF PRESENTATION - PENSON WORLDWIDE INC | d316101dex991.htm |

Exhibit 99.2

Exhibit A – Disclosure Schedule

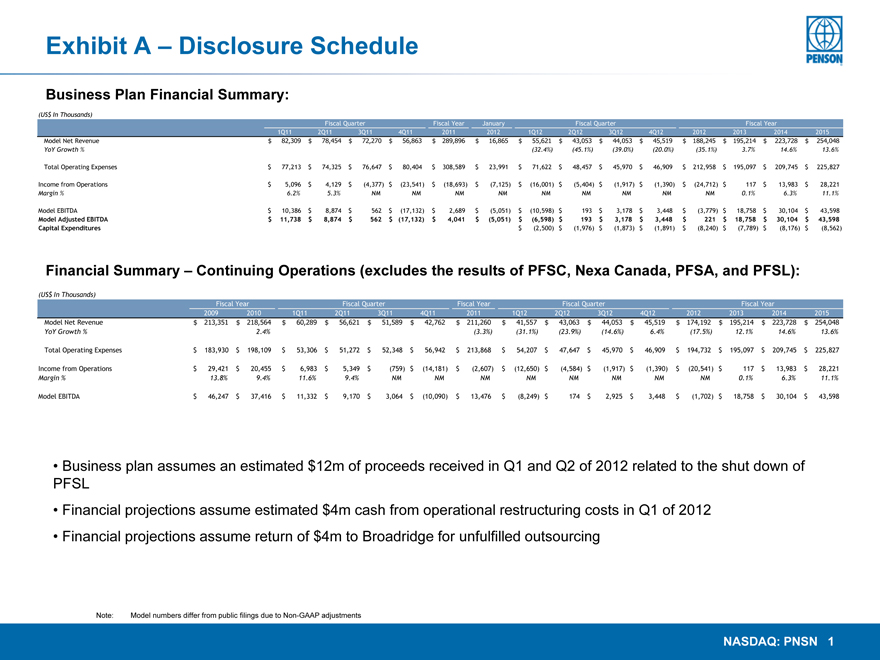

Business Plan Financial Summary:

(US$ In Thousands)

Fiscal Quarter Fiscal Year January Fiscal Quarter Fiscal Year

1Q11 2Q11 3Q11 4Q11 2011 2012 1Q12 2Q12 3Q12 4Q12 2012 2013 2014 2015

Model Net Revenue $ 82,309 $ 78,454 $ 72,270 $ 56,863 $ 289,896 $ 16,865 $ 55,621 $ 43,053 $ 44,053 $ 45,519 $ 188,245 $ 195,214 $ 223,728 $ 254,048

YoY Growth %(32.4%)(45.1%)(39.0%)(20.0%)(35.1%) 3.7% 14.6% 13.6%

Total Operating Expenses $ 77,213 $ 74,325 $ 76,647 $ 80,404 $ 308,589 $ 23,991 $ 71,622 $ 48,457 $ 45,970 $ 46,909 $ 212,958 $ 195,097 $ 209,745 $ 225,827

Income from Operations $ 5,096 $ 4,129 $(4,377) $(23,541) $(18,693) $(7,125) $(16,001) $(5,404) $(1,917) $(1,390) $(24,712) $ 117 $ 13,983 $ 28,221

Margin % 6.2% 5.3% NM NM NM NM NM NM NM NM NM 0.1% 6.3% 11.1%

Model EBITDA $ 10,386 $ 8,874 $ 562 $(17,132) $ 2,689 $(5,051) $(10,598) $ 193 $ 3,178 $ 3,448 $(3,779) $ 18,758 $ 30,104 $ 43,598

Model Adjusted EBITDA $ 11,738 $ 8,874 $ 562 $ (17,132) $ 4,041 $(5,051) $(6,598) $ 193 $ 3,178 $ 3,448 $ 221 $ 18,758 $ 30,104 $ 43,598

Capital Expenditures $(2,500) $(1,976) $(1,873) $(1,891) $(8,240) $(7,789) $(8,176) $(8,562)

Financial Summary – Continuing Operations (excludes the results of PFSC, Nexa Canada, PFSA, and PFSL):

(US$ In Thousands)

Fiscal Year Fiscal Quarter Fiscal Year Fiscal Quarter Fiscal Year

2009 2010 1Q11 2Q11 3Q11 4Q11 2011 1Q12 2Q12 3Q12 4Q12 2012 2013 2014 2015

Model Net Revenue $ 213,351 $ 218,564 $ 60,289 $ 56,621 $ 51,589 $ 42,762 $ 211,260 $ 41,557 $ 43,063 $ 44,053 $ 45,519 $ 174,192 $ 195,214 $ 223,728 $ 254,048

YoY Growth % 2.4%(3.3%)(31.1%)(23.9%)(14.6%) 6.4%(17.5%) 12.1% 14.6% 13.6%

Total Operating Expenses $ 183,930 $ 198,109 $ 53,306 $ 51,272 $ 52,348 $ 56,942 $ 213,868 $ 54,207 $ 47,647 $ 45,970 $ 46,909 $ 194,732 $ 195,097 $ 209,745 $ 225,827

Income from Operations $ 29,421 $ 20,455 $ 6,983 $ 5,349 $(759) $(14,181) $(2,607) $(12,650) $(4,584) $(1,917) $(1,390) $(20,541) $ 117 $ 13,983 $ 28,221

Margin % 13.8% 9.4% 11.6% 9.4% NM NM NM NM NM NM NM NM 0.1% 6.3% 11.1%

Model EBITDA $ 46,247 $ 37,416 $ 11,332 $ 9,170 $ 3,064 $(10,090) $ 13,476 $(8,249) $ 174 $ 2,925 $ 3,448 $(1,702) $ 18,758 $ 30,104 $ 43,598

• Business plan assumes an estimated $12m of proceeds received in Q1 and Q2 of 2012 related to the shut down of PFSL

• Financial projections assume estimated $4m cash from operational restructuring costs in Q1 of 2012

• Financial projections assume return of $4m to Broadridge for unfulfilled outsourcing

Note: Model numbers differ from public filings due to Non-GAAP adjustments

NASDAQ: PNSN 1

Exhibit A – Disclosure Schedule (cont’d)

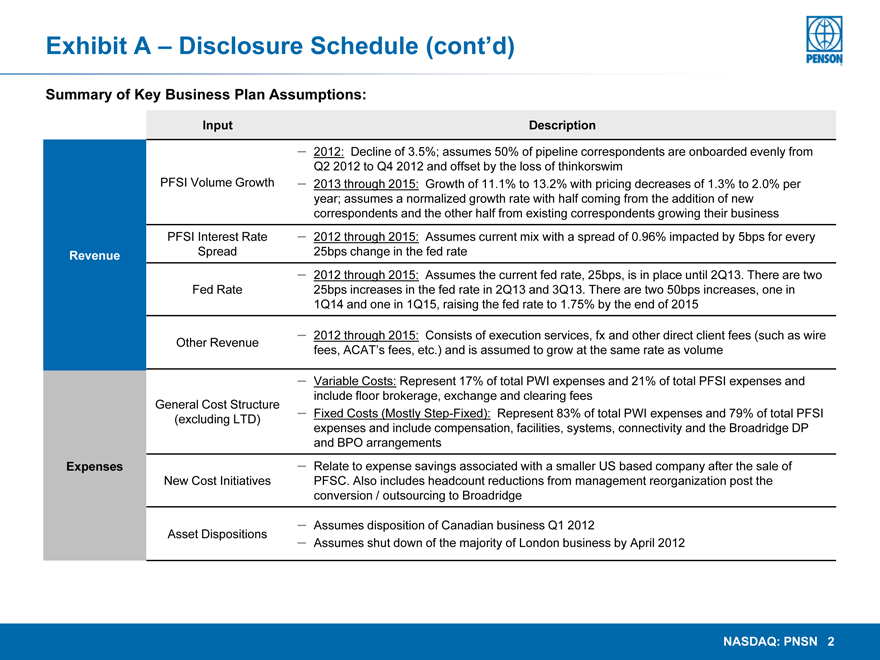

Summary of Key Business Plan Assumptions:

Input Description

– 2012: Decline of 3.5%; assumes 50% of pipeline correspondents are onboarded evenly from

Q2 2012 to Q4 2012 and offset by the loss of thinkorswim

PFSI Volume Growth – 2013 through 2015: Growth of 11.1% to 13.2% with pricing decreases of 1.3% to 2.0% per

year; assumes a normalized growth rate with half coming from the addition of new

correspondents and the other half from existing correspondents growing their business

PFSI Interest Rate – 2012 through 2015: Assumes current mix with a spread of 0.96% impacted by 5bps for every

Revenue Spread 25bps change in the fed rate

– 2012 through 2015: Assumes the current fed rate, 25bps, is in place until 2Q13. There are two

Fed Rate 25bps increases in the fed rate in 2Q13 and 3Q13. There are two 50bps increases, one in

1Q14 and one in 1Q15, raising the fed rate to 1.75% by the end of 2015

Other Revenue – 2012 through 2015: Consists of execution services, fx and other direct client fees (such as wire

fees, ACAT’s fees, etc.) and is assumed to grow at the same rate as volume

– Variable Costs: Represent 17% of total PWI expenses and 21% of total PFSI expenses and

include floor brokerage, exchange and clearing fees

General Cost Structure

(excluding LTD) – Fixed Costs (Mostly Step-Fixed): Represent 83% of total PWI expenses and 79% of total PFSI

expenses and include compensation, facilities, systems, connectivity and the Broadridge DP

and BPO arrangements

Expenses – Relate to expense savings associated with a smaller US based company after the sale of

New Cost Initiatives PFSC. Also includes headcount reductions from management reorganization post the

conversion / outsourcing to Broadridge

– Assumes disposition of Canadian business Q1 2012

Asset Dispositions – Assumes shut down of the majority of London business by April 2012

NASDAQ: PNSN 2