Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PENSON WORLDWIDE INC | d316101d8k.htm |

| EX-99.2 - INVESTOR INFORMATION - PENSON WORLDWIDE INC | d316101dex992.htm |

Exhibit 99.1

4Q11 Review

Penson Worldwide, Inc. (NASDAQ: PNSN)

4Q11 Results & Strategic Initiatives Update Conference Call

March 13, 2012

Page 1 of 18

Forward Looking Statements, Non-GAAP Financial Measures & Other

Forward-Looking Statements

Statements contained in this document that are not based on current or historical fact are forward-looking in nature. Such forward-looking statements are based on current plans, goals, estimates and expectations. Forward-looking statements are based on known and unknown risks, assumptions, uncertainties and other factors. Actual results, performance, or achievements may differ materially from those currently anticipated and from any future results, performance, or achievements expressed or implied by such forward-looking statements. Penson undertakes no obligation to update or revise any forward-looking statement.

Non-GAAP Financial Measures

The Company uses certain non-GAAP measures of financial performance to supplement the unaudited financial statements presented in accordance with GAAP. The Company presents non-GAAP measures when we believe that the additional information is useful and meaningful to investors. Non-GAAP measures do not have any standardized meaning and are therefore unlikely to be comparable to similar measures presented by other companies. The presentation of non-GAAP measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP.

EBITDAS (earnings before interest, taxes, depreciation, amortization and stock-based compensation) is considered a non-GAAP financial measure as defined by SEC Regulation G. The Company considers EBITDAS an important measure of our financial performance and of our ability to generate cash flows to service debt, fund capital expenditures and fund other corporate investing and financing activities. EBITDAS eliminates the non-cash effect of tangible asset depreciation and amortization, intangible asset amortization and stock-based compensation.

The Company also considers “Adjusted EBITDA” (another non-GAAP financial measure as defined by SEC Regulation G) an important measure of our financial performance and of our ability to generate cash flows to service debt, fund capital expenditures and fund other corporate investing and financing activities. “Adjusted EBITDA” eliminates the effect in the fourth quarter ended December 31, 2011 of litigation, severance costs, restructuring costs, bad debt, goodwill and intangible asset impairment, and Ridge earnout adjustment and also eliminates the effect in the year ended December 31, 2011 of the CME shares mark to market, non-cash write down of nonaccrual receivables, Pension Asia closure, and other. EBITDAS and “Adjusted EBITDA” should be considered in addition to, rather than as a substitute for, pre-tax income, net income and cash flows from operating activities.

Note

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities. The New Senior Secured Notes, the Series A Senior Preferred Stock, the Series B Preferred Stock, the common stock and the exchange offer have not been registered under the Securities Act of 1933, or any applicable state securities laws and may not be offered, sold or exchanged in the United States, absent registration or an applicable exemption from such registration requirements.

Page 2 of 18

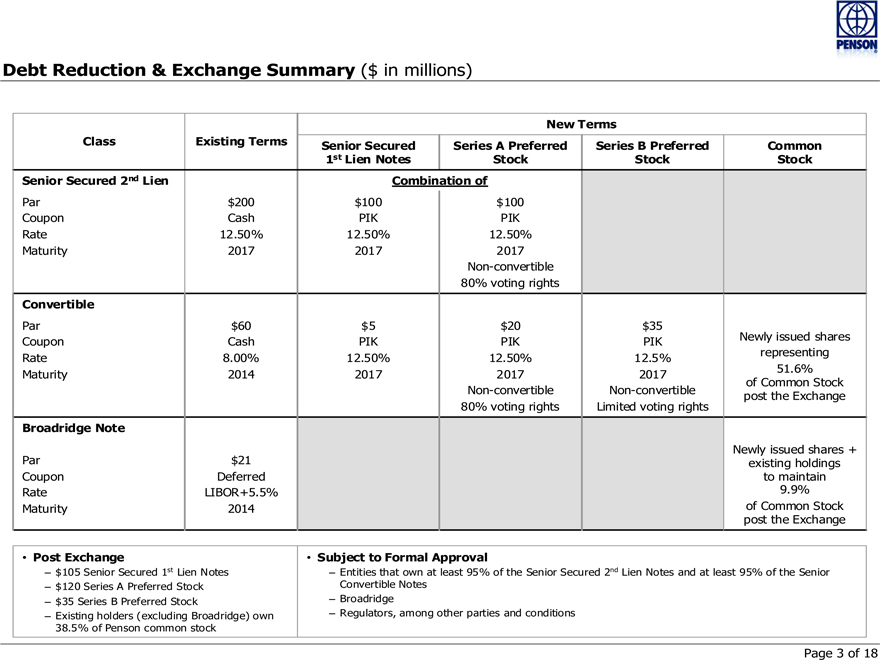

Debt Reduction & Exchange Summary ($ in millions)

New Terms

Class Existing Terms Senior Secured Series A Preferred Series B Preferred Common

1st Lien Notes Stock Stock Stock

Senior Secured 2nd Lien Combination of

Par $200 $100 $100

Coupon Cash PIK PIK

Rate 12.50% 12.50% 12.50%

Maturity 2017 2017 2017

Non-convertible

80% voting rights

Convertible

Par $60 $5 $20 $35

Coupon Cash PIK PIK PIK Newly issued shares

Rate 8.00% 12.50% 12.50% 12.5% representing

Maturity 2014 2017 2017 2017 51.6%

of Common Stock

Non-convertible Non-convertible post the Exchange

80% voting rights Limited voting rights

Broadridge Note

Newly issued shares +

Par $21 existing holdings

Coupon Deferred to maintain

Rate LIBOR+5.5% 9.9%

Maturity 2014 of Common Stock

post the Exchange

• Post Exchange • Subject to Formal Approval

– $105 Senior Secured 1st Lien Notes – Entities that own at least 95% of the Senior Secured 2nd Lien Notes and at least 95% of the Senior

– $120 Series A Preferred Stock Convertible Notes

– $35 Series B Preferred Stock – Broadridge

– Existing holders (excluding Broadridge) own – Regulators, among other parties and conditions

38.5% of Penson common stock

Page 3 of 18

Debt Reduction & Exchange Benefits ($ in millions)

Financial Benefits o Eliminate $176 of parent company debt o Eliminate $30 of annual cash interest payments o Increase parent company equity o Potential of significant one-time gain o Combined with cost savings, positions Penson for its objective of being as close as possible to break even on a cash basis in 2H12, even in current weak business environment o Note: Transaction related non-recurring expenses in the 1H12

Strategic Benefits o Significantly strengthens the Company’s financial position and core business o Company believes this to be the best way to speed the transition to our new model

Page 4 of 18

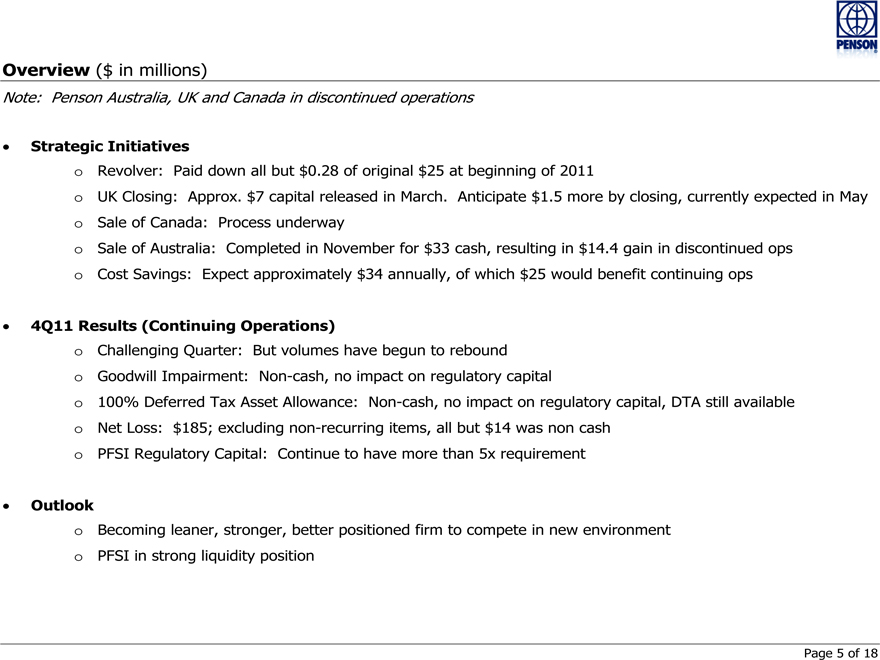

Overview ($ in millions)

Note: Penson Australia, UK and Canada in discontinued operations

Strategic Initiatives o Revolver: Paid down all but $0.28 of original $25 at beginning of 2011 o UK Closing: Approx. $7 capital released in March. Anticipate $1.5 more by closing, currently expected in May o Sale of Canada: Process underway o Sale of Australia: Completed in November for $33 cash, resulting in $14.4 gain in discontinued ops o Cost Savings: Expect approximately $34 annually, of which $25 would benefit continuing ops

4Q11 Results (Continuing Operations) o Challenging Quarter: But volumes have begun to rebound o Goodwill Impairment: Non-cash, no impact on regulatory capital o 100% Deferred Tax Asset Allowance: Non-cash, no impact on regulatory capital, DTA still available o Net Loss: $185; excluding non-recurring items, all but $14 was non cash o PFSI Regulatory Capital: Continue to have more than 5x requirement

Outlook o Becoming leaner, stronger, better positioned firm to compete in new environment o PFSI in strong liquidity position

Page 5 of 18

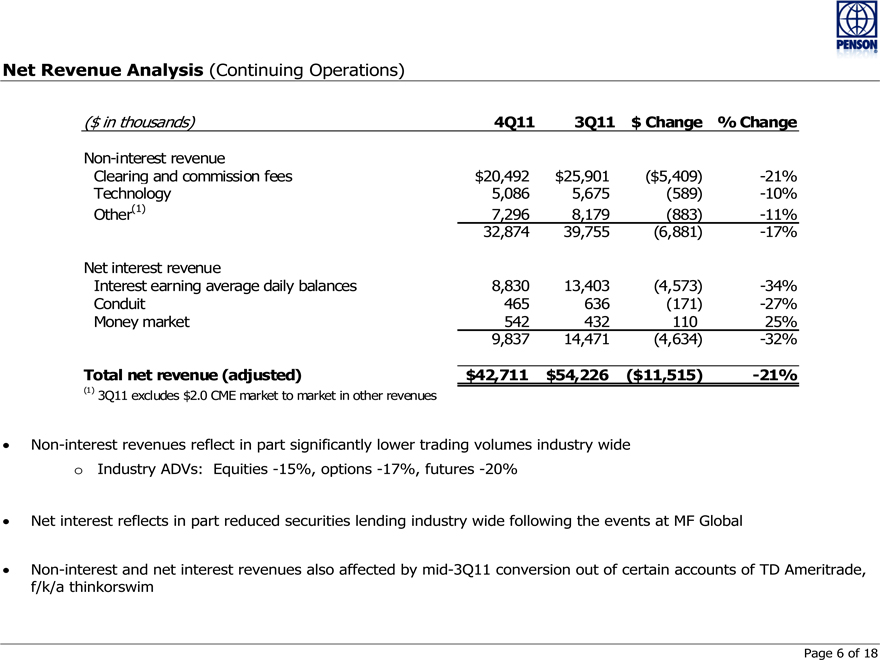

Net Revenue Analysis (Continuing Operations)

($ in thousands) 4Q11 3Q11 $ Change% Change

Non-interest revenue

Clearing and commission fees $20,492 $25,901($5,409) -21%

Technology 5,086 5,675(589) -10%

Other(1) 7,296 8,179(883) -11%

32,874 39,755(6,881) -17%

Net interest revenue

Interest earning average daily balances 8,830 13,403(4,573) -34%

Conduit 465 636(171) -27%

Money market 542 432 110 25%

9,837 14,471(4,634) -32%

Total net revenue (adjusted) $42,711 $54,226($11,515) -21%

(1) 3Q11 excludes $2.0 CME market to market in other revenues

Non-interest revenues reflect in part significantly lower trading volumes industry wide o Industry ADVs: Equities -15%, options -17%, futures -20%

Net interest reflects in part reduced securities lending industry wide following the events at MF Global

Non-interest and net interest revenues also affected by mid-3Q11 conversion out of certain accounts of TD Ameritrade, f/k/a thinkorswim

Page 6 of 18

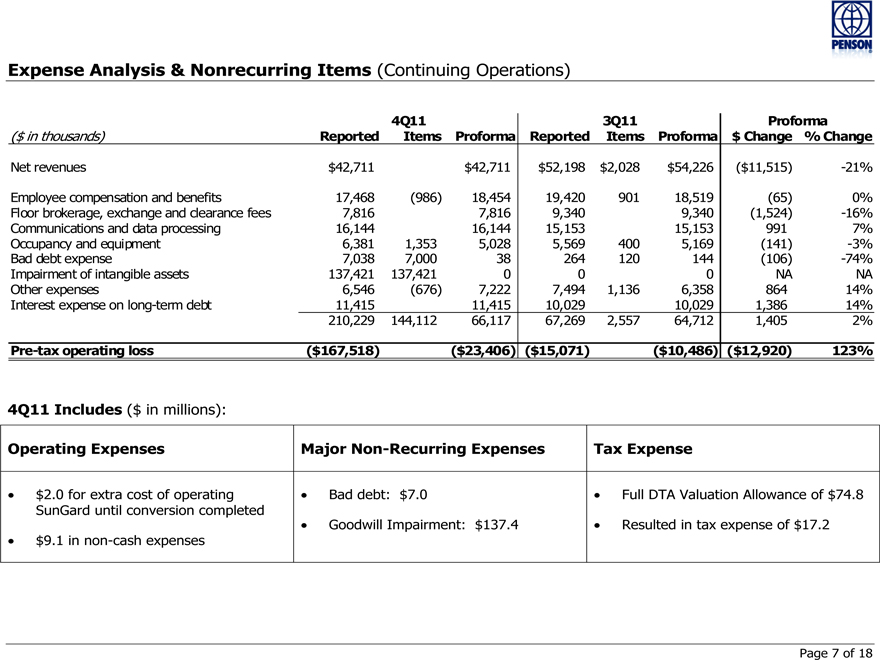

Expense Analysis & Nonrecurring Items (Continuing Operations)

4Q11 3Q11 Proforma

($ in thousands) Reported Items Proforma Reported Items Proforma $ Change% Change

Net revenues $42,711 $42,711 $52,198 $2,028 $54,226($11,515) -21%

Employee compensation and benefits 17,468(986) 18,454 19,420 901 18,519(65) 0%

Floor brokerage, exchange and clearance fees 7,816 7,816 9,340 9,340(1,524) -16%

Communications and data processing 16,144 16,144 15,153 15,153 991 7%

Occupancy and equipment 6,381 1,353 5,028 5,569 400 5,169(141) -3%

Bad debt expense 7,038 7,000 38 264 120 144(106) -74%

Impairment of intangible assets 137,421 137,421 0 0 0 NA NA

Other expenses 6,546(676) 7,222 7,494 1,136 6,358 864 14%

Interest expense on long-term debt 11,415 11,415 10,029 10,029 1,386 14%

210,229 144,112 66,117 67,269 2,557 64,712 1,405 2%

Pre-tax operating loss($167,518)($23,406)($15,071)($10,486)($12,920) 123%

4Q11 Includes ($ in millions):

Operating Expenses Major Non-Recurring Expenses Tax Expense

$2.0 for extra cost of operating Bad debt: $7.0 Full DTA Valuation Allowance of $74.8

SunGard until conversion completed

Goodwill Impairment: $137.4 Resulted in tax expense of $17.2

$9.1 in non-cash expenses

Page 7 of 18

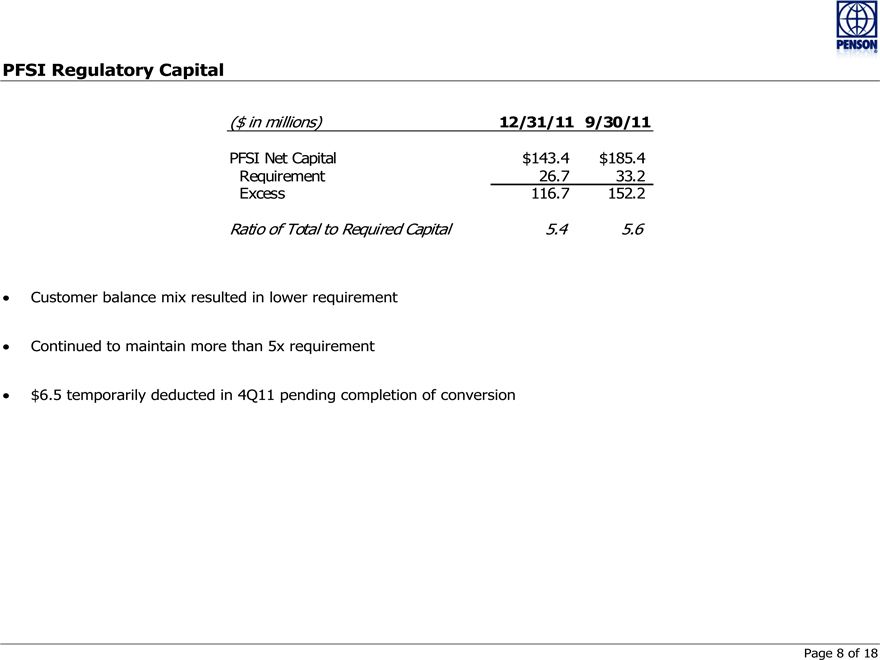

PFSI Regulatory Capital

($ in millions) 12/31/11 9/30/11

PFSI Net Capital $143.4 $185.4

Requirement 26.7 33.2

Excess 116.7 152.2

Ratio of Total to Required Capital 5.4 5.6

Customer balance mix resulted in lower requirement

Continued to maintain more than 5x requirement

$6.5 temporarily deducted in 4Q11 pending completion of conversion

Page 8 of 18

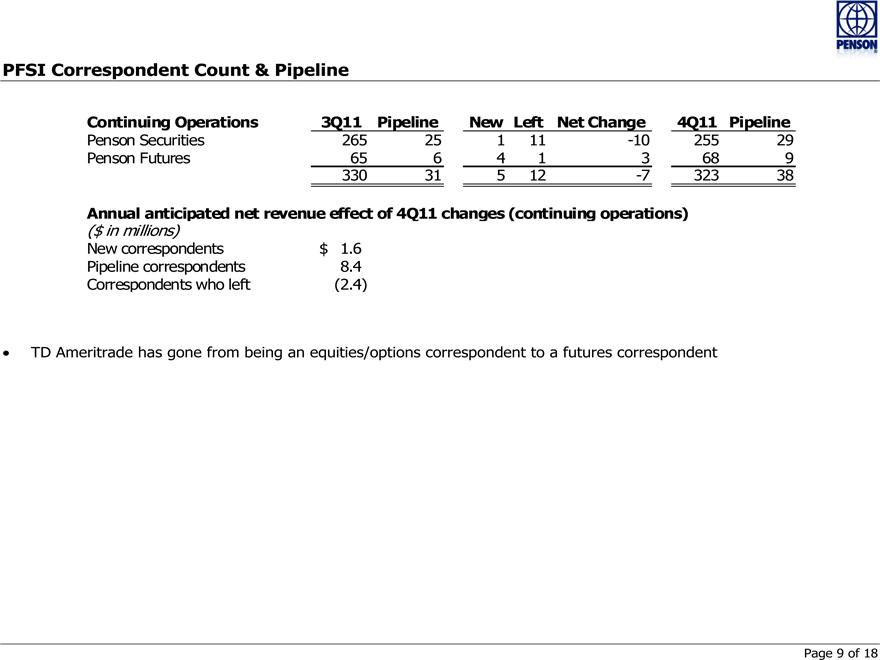

PFSI Correspondent Count & Pipeline

Continuing Operations 3Q11 Pipeline New Left Net Change 4Q11 Pipeline

Penson Securities 265 25 1 11 -10 255 29

Penson Futures 65 6 4 1 3 68 9

330 31 5 12 -7 323 38

Annual anticipated net revenue effect of 4Q11 changes (continuing operations)

($ in millions)

New correspondents $ 1.6

Pipeline correspondents 8.4

Correspondents who left(2.4)

TD Ameritrade has gone from being an equities/options correspondent to a futures correspondent

Page 9 of 18

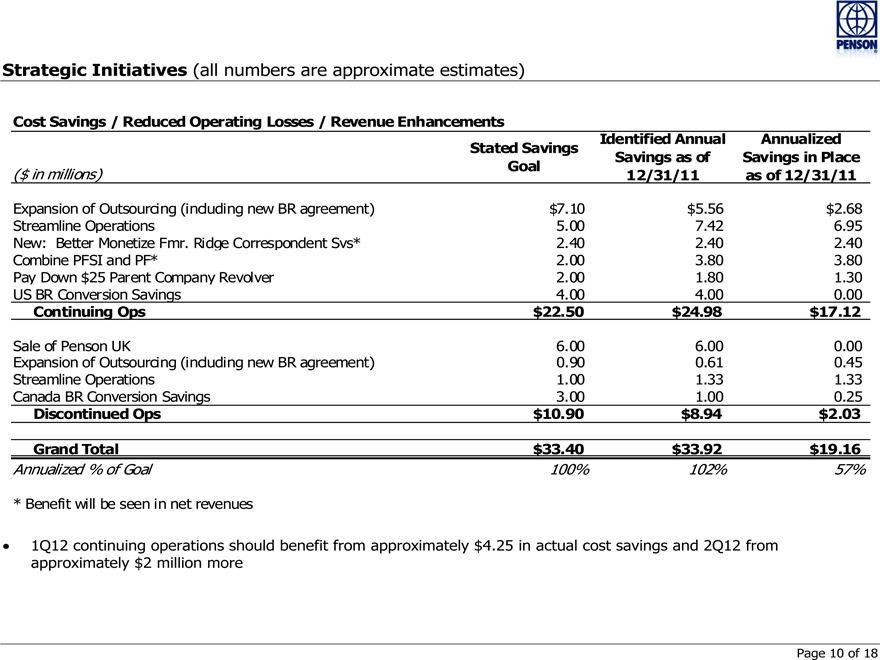

Strategic Initiatives (all numbers are approximate estimates)

Cost Savings / Reduced Operating Losses / Revenue Enhancements

Stated Savings Identified Annual Annualized

Goal Savings as of Savings in Place

($ in millions) 12/31/11 as of 12/31/11

Expansion of Outsourcing (including new BR agreement) $7.10 $5.56 $2.68

Streamline Operations 5.00 7.42 6.95

New: Better Monetize Fmr. Ridge Correspondent Svs* 2.40 2.40 2.40

Combine PFSI and PF* 2.00 3.80 3.80

Pay Down $25 Parent Company Revolver 2.00 1.80 1.30

US BR Conversion Savings 4.00 4.00 0.00

Continuing Ops $22.50 $24.98 $17.12

Sale of Penson UK 6.00 6.00 0.00

Expansion of Outsourcing (including new BR agreement) 0.90 0.61 0.45

Streamline Operations 1.00 1.33 1.33

Canada BR Conversion Savings 3.00 1.00 0.25

Discontinued Ops $10.90 $8.94 $2.03

Grand Total $33.40 $33.92 $19.16

Annualized % of Goal 100% 102% 57%

* Benefit will be seen in net revenues

1Q12 continuing operations should benefit from approximately $4.25 in actual cost savings and 2Q12 from approximately $2 million more

Page 10 of 18

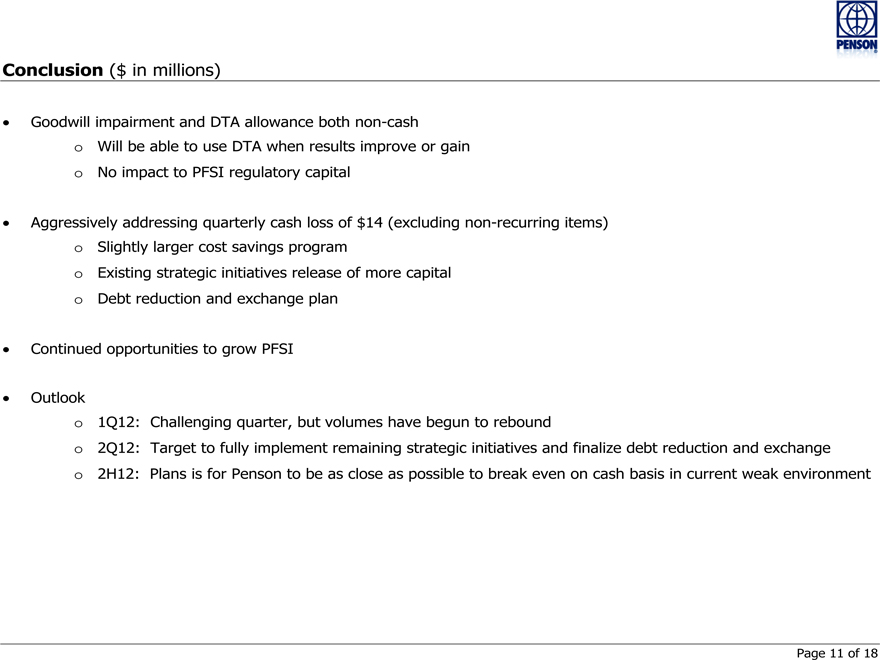

Conclusion ($ in millions)

Goodwill impairment and DTA allowance both non-cash o Will be able to use DTA when results improve or gain o No impact to PFSI regulatory capital

Aggressively addressing quarterly cash loss of $14 (excluding non-recurring items) o Slightly larger cost savings program o Existing strategic initiatives release of more capital o Debt reduction and exchange plan

Continued opportunities to grow PFSI

Outlook o 1Q12: Challenging quarter, but volumes have begun to rebound o 2Q12: Target to fully implement remaining strategic initiatives and finalize debt reduction and exchange o 2H12: Plans is for Penson to be as close as possible to break even on cash basis in current weak environment

Page 11 of 18

Appendix

Page 12 of 18

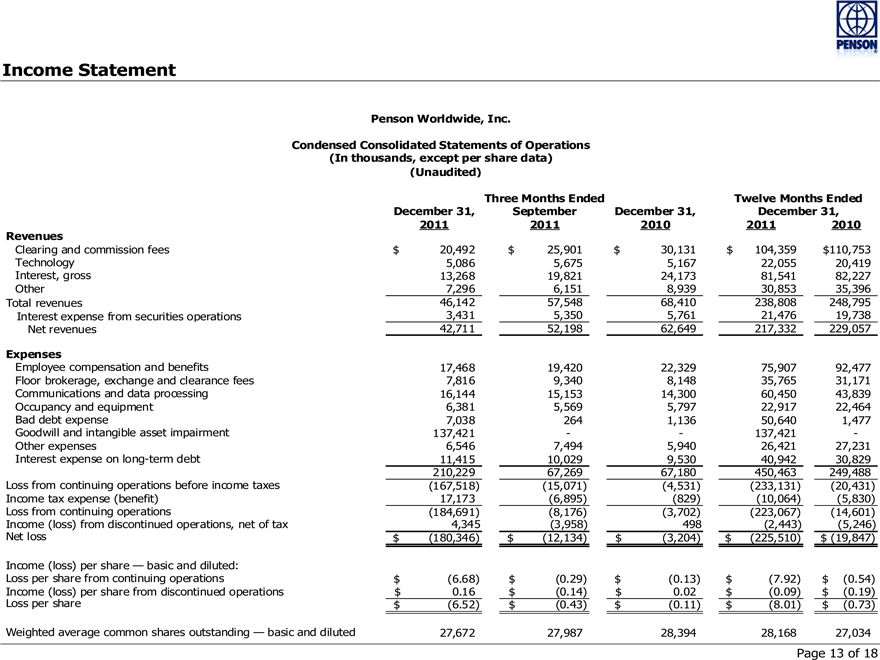

Income Statement

Penson Worldwide, Inc.

Condensed Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

Three Months Ended Twelve Months Ended

December 31, September December 31, December 31,

2011 2011 2010 2011 2010

Revenues

Clearing and commission fees $ 20,492 $ 25,901 $ 30,131 $ 104,359 110,753$

Technology 5,086 5,675 5,167 22,055 20,419

Interest, gross 13,268 19,821 24,173 81,541 82,227

Other 7,296 6,151 8,939 30,853 35,396

Total revenues 46,142 57,548 68,410 238,808 248,795

Interest expense from securities operations 3,431 5,350 5,761 21,476 19,738

Net revenues 42,711 52,198 62,649 217,332 229,057

Expenses

Employee compensation and benefits 17,468 19,420 22,329 75,907 92,477

Floor brokerage, exchange and clearance fees 7,816 9,340 8,148 35,765 31,171

Communications and data processing 16,144 15,153 14,300 60,450 43,839

Occupancy and equipment 6,381 5,569 5,797 22,917 22,464

Bad debt expense 7,038 264 1,136 50,640 1,477

Goodwill and intangible asset impairment 137,421—- 137,421 -

Other expenses 6,546 7,494 5,940 26,421 27,231

Interest expense on long-term debt 11,415 10,029 9,530 40,942 30,829

210,229 67,269 67,180 450,463 249,488

Loss from continuing operations before income taxes(167,518)(15,071)(4,531)(233,131)(20,431)

Income tax expense (benefit) 17,173(6,895)(829)(10,064)(5,830)

Loss from continuing operations(184,691)(8,176)(3,702)(223,067)(14,601)

Income (loss) from discontinued operations, net of tax 4,345(3,958) 498(2,443)(5,246)

Net loss $(180,346) $(12,134) $ (3,204) $ (225,510) $ (19,847)

Income (loss) per share — basic and diluted:

Loss per share from continuing operations $(6.68) $(0.29) $ (0.13) $ (7.92) $(0.54)

Income (loss) per share from discontinued operations $ 0.16 $(0.14) $ 0.02 $ (0.09) $(0.19)

Loss per share $(6.52) $(0.43) $ (0.11) $ (8.01) $(0.73)

Weighted average common shares outstanding — basic and diluted 27,672 27,987 28,394 28,168 27,034

Page 13 of 18

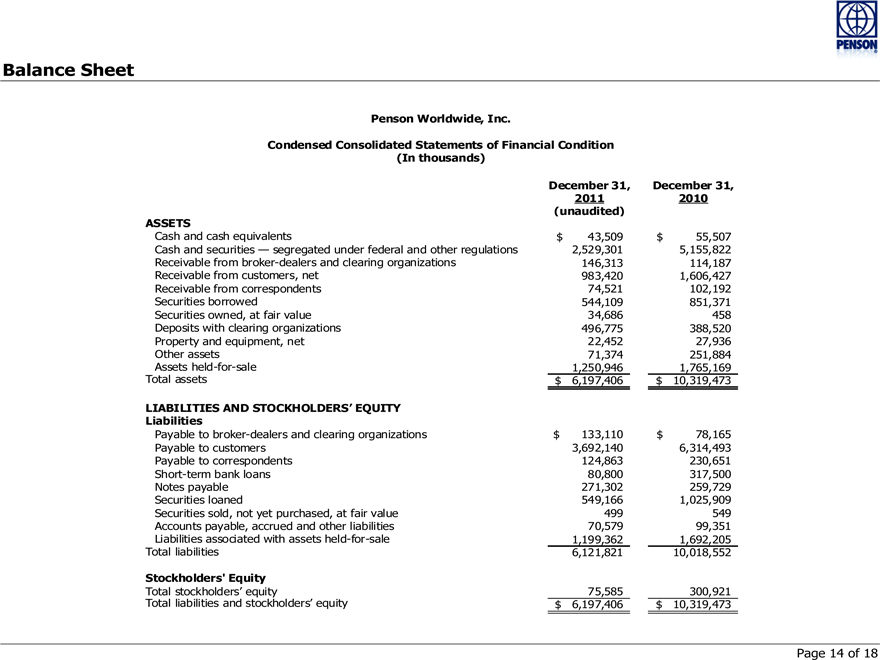

Balance Sheet

Penson Worldwide, Inc.

Condensed Consolidated Statements of Financial Condition

(In thousands)

December 31, December 31,

2011 2010

(unaudited)

ASSETS

Cash and cash equivalents $ 43,509 $ 55,507

Cash and securities — segregated under federal and other regulations 2,529,301 5,155,822

Receivable from broker-dealers and clearing organizations 146,313 114,187

Receivable from customers, net 983,420 1,606,427

Receivable from correspondents 74,521 102,192

Securities borrowed 544,109 851,371

Securities owned, at fair value 34,686 458

Deposits with clearing organizations 496,775 388,520

Property and equipment, net 22,452 27,936

Other assets 71,374 251,884

Assets held-for-sale 1,250,946 1,765,169

Total assets $ 6,197,406 $ 10,319,473

LIABILITIES AND STOCKHOLDERS’ EQUITY

Liabilities

Payable to broker-dealers and clearing organizations $ 133,110 $ 78,165

Payable to customers 3,692,140 6,314,493

Payable to correspondents 124,863 230,651

Short-term bank loans 80,800 317,500

Notes payable 271,302 259,729

Securities loaned 549,166 1,025,909

Securities sold, not yet purchased, at fair value 499 549

Accounts payable, accrued and other liabilities 70,579 99,351

Liabilities associated with assets held-for-sale 1,199,362 1,692,205

Total liabilities 6,121,821 10,018,552

Stockholders’ Equity

Total stockholders’ equity 75,585 300,921

Total liabilities and stockholders’ equity $ 6,197,406 $ 10,319,473

Page 14 of 18

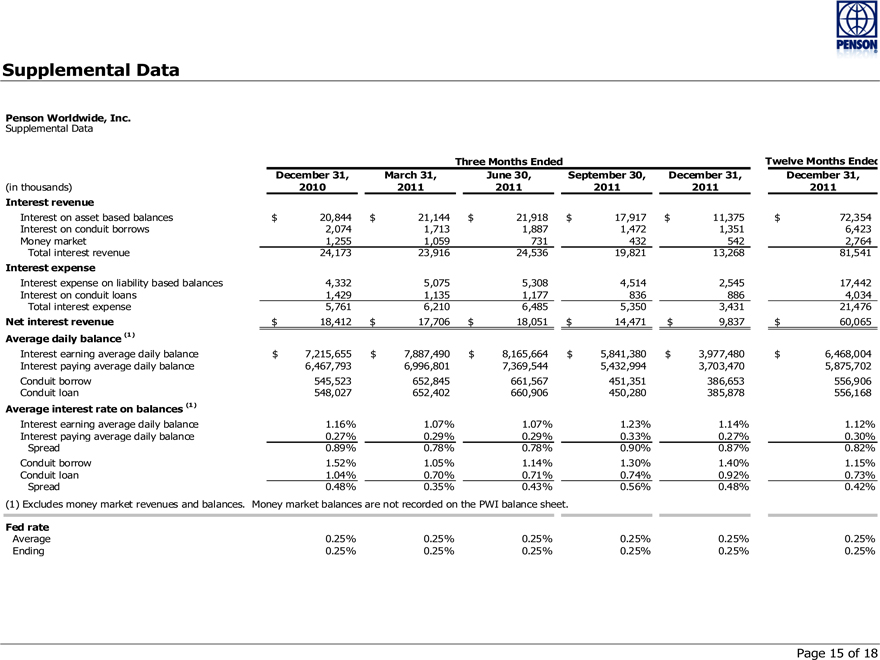

Supplemental Data

Penson Worldwide, Inc.

Supplemental Data

Three Months Ended Twelve Months Ended

December 31, March 31, June 30, September 30, December 31, December 31,

(in thousands) 2010 2011 2011 2011 2011 2011

Interest revenue

Interest on asset based balances $ 20,844 $ 21,144 $ 21,918 $ 17,917 $ 11,375 $ 72,354

Interest on conduit borrows 2,074 1,713 1,887 1,472 1,351 6,423

Money market 1,255 1,059 731 432 542 2,764

Total interest revenue 24,173 23,916 24,536 19,821 13,268 81,541

Interest expense

Interest expense on liability based balances 4,332 5,075 5,308 4,514 2,545 17,442

Interest on conduit loans 1,429 1,135 1,177 836 886 4,034

Total interest expense 5,761 6,210 6,485 5,350 3,431 21,476

Net interest revenue $ 18,412 $ 17,706 $ 18,051 $ 14,471 $ 9,837 $ 60,065

Average daily balance (1)

Interest earning average daily balance $ 7,215,655 $ 7,887,490 $ 8,165,664 $ 5,841,380 $ 3,977,480 $ 6,468,004

Interest paying average daily balance 6,467,793 6,996,801 7,369,544 5,432,994 3,703,470 5,875,702

Conduit borrow 545,523 652,845 661,567 451,351 386,653 556,906

Conduit loan 548,027 652,402 660,906 450,280 385,878 556,168

Average interest rate on balances (1)

Interest earning average daily balance 1.16% 1.07% 1.07% 1.23% 1.14% 1.12%

Interest paying average daily balance 0.27% 0.29% 0.29% 0.33% 0.27% 0.30%

Spread 0.89% 0.78% 0.78% 0.90% 0.87% 0.82%

Conduit borrow 1.52% 1.05% 1.14% 1.30% 1.40% 1.15%

Conduit loan 1.04% 0.70% 0.71% 0.74% 0.92% 0.73%

Spread 0.48% 0.35% 0.43% 0.56% 0.48% 0.42%

(1) Excludes money market revenues and balances. Money market balances are not recorded on the PWI balance sheet.

Fed rate

Average 0.25% 0.25% 0.25% 0.25% 0.25% 0.25%

Ending 0.25% 0.25% 0.25% 0.25% 0.25% 0.25%

Page 15 of 18

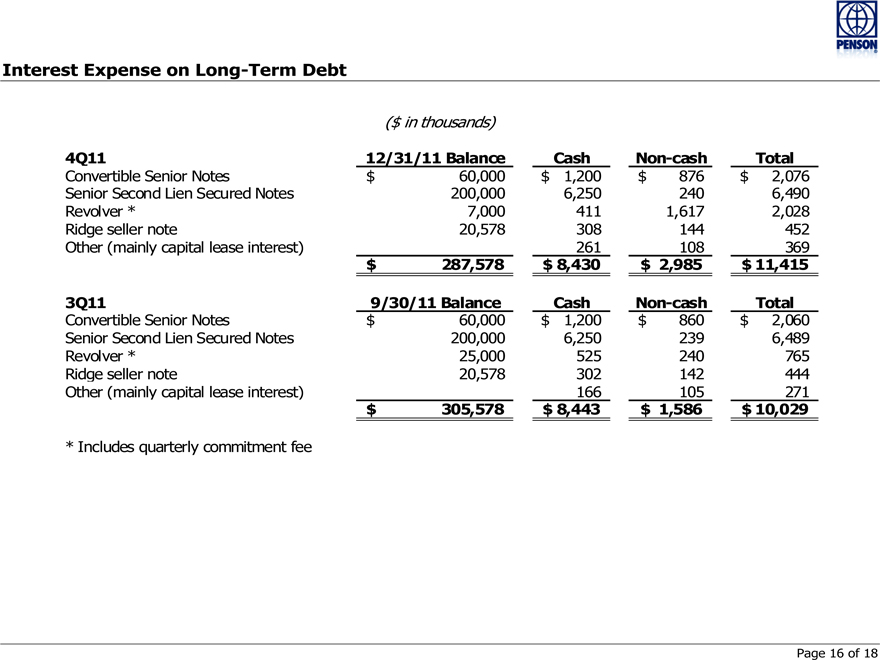

Interest Expense on Long-Term Debt

($ in thousands)

4Q11 12/31/11 Balance Cash Non-cash Total

Convertible Senior Notes $ 60,000 $ 1,200 $ 876 $ 2,076

Senior Second Lien Secured Notes 200,000 6,250 240 6,490

Revolver * 7,000 411 1,617 2,028

Ridge seller note 20,578 308 144 452

Other (mainly capital lease interest) 261 108 369

$ 287,578 $ 8,430 $ 2,985 $ 11,415

3Q11 9/30/11 Balance Cash Non-cash Total

Convertible Senior Notes $ 60,000 $ 1,200 $ 860 $ 2,060

Senior Second Lien Secured Notes 200,000 6,250 239 6,489

Revolver * 25,000 525 240 765

Ridge seller note 20,578 302 142 444

Other (mainly capital lease interest) 166 105 271

$ 305,578 $ 8,443 $ 1,586 $ 10,029

* Includes quarterly commitment fee

Page 16 of 18

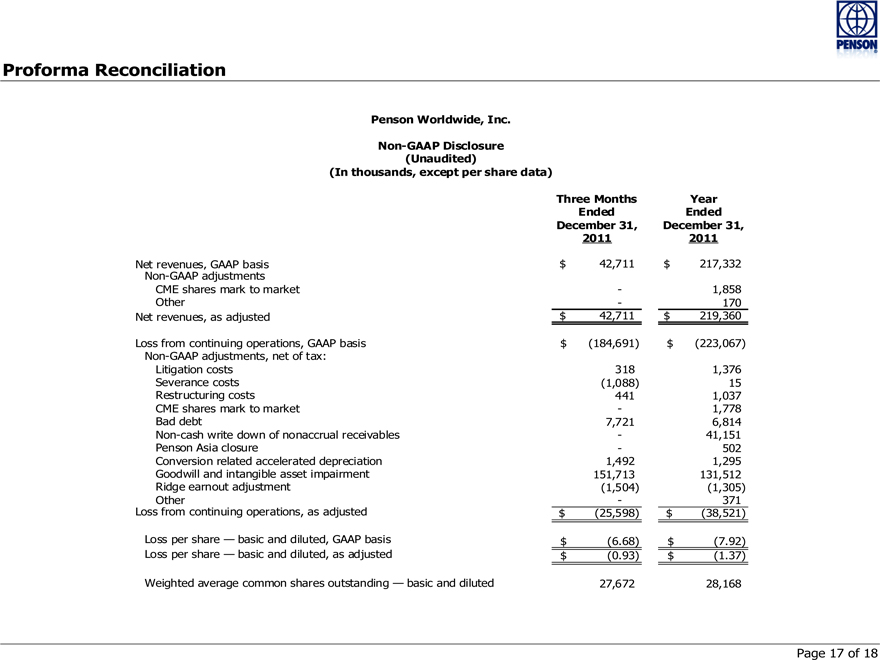

Proforma Reconciliation

Penson Worldwide, Inc.

Non-GAAP Disclosure

(Unaudited)

(In thousands, except per share data)

Three Months Year

Ended Ended

December 31, December 31,

2011 2011

Net revenues, GAAP basis $ 42,711 $ 217,332

Non-GAAP adjustments

CME shares mark to market—1,858

Other—170

Net revenues, as adjusted $ 42,711 $ 219,360

Loss from continuing operations, GAAP basis $(184,691) $(223,067)

Non-GAAP adjustments, net of tax:

Litigation costs 318 1,376

Severance costs(1,088) 15

Restructuring costs 441 1,037

CME shares mark to market—1,778

Bad debt 7,721 6,814

Non-cash write down of nonaccrual receivables—41,151

Penson Asia closure—502

Conversion related accelerated depreciation 1,492 1,295

Goodwill and intangible asset impairment 151,713 131,512

Ridge earnout adjustment(1,504)(1,305)

Other—371

Loss from continuing operations, as adjusted $(25,598) $(38,521)

Loss per share — basic and diluted, GAAP basis $(6.68) $(7.92)

Loss per share — basic and diluted, as adjusted $(0.93) $(1.37)

Weighted average common shares outstanding — basic and diluted 27,672 28,168

Page 17 of 18

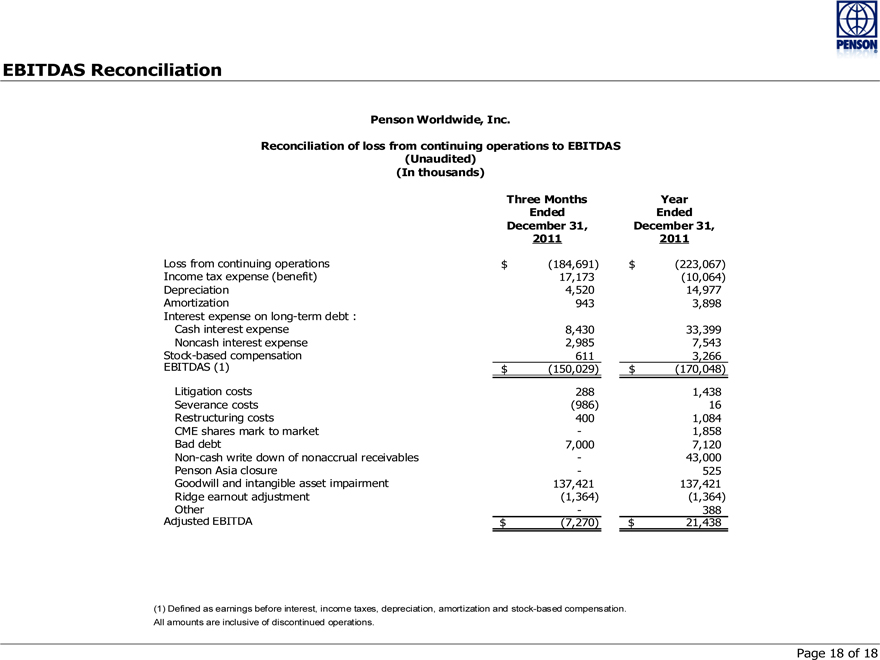

EBITDAS Reconciliation

Penson Worldwide, Inc.

Reconciliation of loss from continuing operations to EBITDAS

(Unaudited)

(In thousands)

Three Months Year

Ended Ended

December 31, December 31,

2011 2011

Loss from continuing operations $(184,691) $(223,067)

Income tax expense (benefit) 17,173(10,064)

Depreciation 4,520 14,977

Amortization 943 3,898

Interest expense on long-term debt :

Cash interest expense 8,430 33,399

Noncash interest expense 2,985 7,543

Stock-based compensation 611 3,266

EBITDAS (1) $(150,029) $(170,048)

Litigation costs 288 1,438

Severance costs(986) 16

Restructuring costs 400 1,084

CME shares mark to market—1,858

Bad debt 7,000 7,120

Non-cash write down of nonaccrual receivables—43,000

Penson Asia closure—525

Goodwill and intangible asset impairment 137,421 137,421

Ridge earnout adjustment(1,364)(1,364)

Other—388

Adjusted EBITDA $(7,270) $ 21,438

(1) Defined as earnings before interest, income taxes, depreciation, amortization and stock-based compensation. All amounts are inclusive of discontinued operations.

Page 18 of 18