Attached files

| file | filename |

|---|---|

| 8-K - 8-K - IT TECH PACKAGING, INC. | v305539_8-k.htm |

March 2012

2 Safe Harbor Statement CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING STATEMENTS This presentation includes or incorporates by reference statements that constitute forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These statements relate to future events or to our future financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance, or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements . These statements include, but are not limited to, increasing market demand for paper products, acceptance of new products by the market, our ability to complete capacity expansion project on time, government regulations, and cost of raw materials . In some cases, you can identify forward - looking statements by the use of words such as “may,” “could,” “expect,” “intend,” “plan,” “seek,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “continue,” or the negative of these terms or other comparable terminology . You should not place undue reliance on forward - looking statements since they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond our control and which could materially affect actual results, levels of activity, performance or achievements .

3 Investment Highlights Rapidly growing & profitable diversified paper products manufacturer and distributor in northern China Government - mandated industry consolidation eliminates smaller competitors Strategically located in Beijing/Tianjin, China’s printing/publishing hub Strategic location creates cost advantage and strong supplier relationships Compelling growth strategy to expand future production capacity with internal cash flow and debt financing

4 Equity Snapshot Ticker: AMEX: ONP Price (3/5/2012): $4.05 Market Cap (3/1/2012): $74.3 mil Revenues (FY 2011):* $150.7 mil Net Income (FY 2011):* $21.5 mil Shares Outstanding (11/4/11): 18.35 mil Diluted EPS (FY 2011):* $1.17 P/E Ratio (FY 2011):* 3.5x Fiscal Year End: December 31 * The full year 2011 numbers are based on the unaudited preliminary results released in February 2012.

5 Corporate Overview ▪ Founded in 1996 ▪ Located in Hebei Province, about 60 miles south of Beijing and Tianjin ▪ Paper products: » Corrugating medium paper (CMP) » Offset printing paper » Digital photo paper ▪ Environmental - friendly producer – utilizing domestic recycled paper as primary raw material Hebei Shanghai Beijing

6 Rapid Growth of China’s Paper Industry ▪ In 2010, there were approximately 3,700 paper and paper board manufacturers in the PRC, with a total output of 92.7 million tons, up 7.29% from 86.4 million tons in 2009 (China Paper Association) ▪ Paper consumption in China is estimated to reach 140 million tons by 2015 and 200 million tons by 2020 Source: 2010 Annual Report of the Paper Making Industry, China Paper Association - 10.00 20.00 30.00 40.00 50.00 60.00 70.00 80.00 90.00 100.00 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Million Tons Domestic Production Volume Domestic Consumption Volume

7 Rising Per Capita Paper Consumption ▪ Strong growth in GDP per capita and manufacturing in China drives demand for paper product consumption ▪ China's per capita consumption of paper and paper board increased to 64 kgs in 2009 from 45 kgs in 2005, compared to 2009 per capita consumption of 227 kgs in the United States 7 Rising Per Capita Paper Consumption ▪ Strong growth in GDP per capita and manufacturing in China drives demand for paper product consumption ▪ China's per capita consumption of paper and paper board increased to 64 kgs in 2009 from 45 kgs in 2005, compared to 2009 per capita consumption of 227 kgs in the United States - 50 100 150 200 250 227 165 46 215 64 151 7 141 44 8 Year 2009 Per Capita Paper Consumption 2009 (by country) Source: www.paperonweb.com

8 Industry Consolidation Benefits “Survivors” Source: China Paper Association, www.earthtrends.org and www.prlog.org ▪ The PRC government has mandated the closure of small paper mills due to environmental protection (many of them using straw pulp) and operating efficiency concerns ▪ In 2011, 8.2 million tons of outdated paper milling capacities forced to close down across China ▪ 82 companies with total capacities of approximately 1.1 million tons (or 13% of total closure) are based in Hebei Province ▪ Government - mandated closures of regional paper mills + growing market demand = rising sales quantity - 500 1,000 1,500 2,000 1,839 1,070 990 510 508 350 334 260 257 Inefficient and Polluting Paper Production Capacities Eliminated † by the PRC Government in Year 2011, By Province* Source: Ministry of Industry and Information Technology of the PRC, August 5, 2010 Capacities Eliminated, in '000 tons † : Total capacity elimination announced by the PRC government = 8.19 million tons *: Showing the provinces with capacity elimination more than 250K tons in 2011

9 Well Positioned To Be A Regional Leader ▪ One of the largest regional paper companies in Northern China ▪ Majority of paper production in China is concentrated in eastern and southern China ▪ Very few large paper producers in Beijing and Tianjin area ▪ Close proximity (60 miles) to Beijing and Tianjin provides access to ~40% of China’s Tianjin printing and publishing industry and large consumer markets ▪ Easy access to a variety of long - term suppliers of locally recycled raw material ▪ Regional economic development in Beijing, Tianjin and vicinity creates more paper demand for industrial use

10 Advantage vs. Out - of - Province Competitors ▪ Lower logistic costs compared to out - of - province competitors ▪ Lower production costs because of lower transportation costs for procuring raw materials and coal ▪ Domestic recycled paper costs less than imported recycled paper

11 Diversified Product Portfolio

12 Corrugating Medium Paper ▪ Used in the manufacturing of corrugated paperboard, boxes, etc. ▪ Products sold to packaging companies in Northern China ▪ Use domestic recycled paperboard (or Old Corrugated Cardboard, “OCC”) as the only major raw material ▪ 28% gross profit margin in the third quarter of 2011

13 Corrugating Medium Paper Expansion ▪ Built a new 360,000 tons corrugating medium paper production line which began operations in Dec 2011 ▪ Total cost for 360,000 tons new production line and facilities is approximately $70M. Proceeds of April 2010 public offering (approximately $27M) and internal cash reserve of $41M are financing the cost ▪ New capacity will more than double existing CMP capacity; production ramp - up to start in the first quarter of 2012; projected production of up to 150,000 tons in 2012

14 Offset Printing Paper ▪ Used for offset printing, typically coated and brightened ▪ Major customers are printing/publishing companies in Beijing/Baoding ▪ Use recycled scrap paper from local printing stores and publisher warehouses as raw material ▪ Also sell printing paper purchased from 3 rd parties for roughly 6% of gross profit margin ▪ 18% overall gross profit margin in the third quarter of 2011

15 Digital Photo Paper ▪ Acquired 2 digital photo paper coating lines in Dec 2009 for RMB 93MM ($13.7MM); paid for with financing proceeds ($4.5MM) and cash from operations ($9.2MM); accretive to gross profits and net earnings ▪ Officially launched production in March 2010 ▪ Final product is semi - matte photo paper and glossy photo paper, sold to advertising companies and printing companies ▪ Currently operating at 85% of the originally estimated 2,500 tons/yr. capacity ▪ 32% gross profit margin in the third quarter of 2011

16 Compelling Growth Strategy Increase and diversify product offerings and customer base ( developing new security paper ) Increase production efficiency for improved utilization and profitability Capacity Expansion: Ramp up new 360K tons CMP line Focus on introducing middle and high - end products with higher margins Expand rapidly growing paper business in Northern China by internal cash flow and debt financing

17 Experienced Management Team Zhenyong Liu – Chairman of the Board and CEO Chairman of the Board and CEO of Orient Paper Inc since 1996. Mr. Liu first became an entrepreneur in 1990 and previously ran several successful businesses. In 2005, Mr. Liu was elected as a Representative from Hebei Province in the National People's Congress. Mr. Liu graduated from the Department of Economics and Management of Hebei University of Economics and Trade and the EMBA program of Guanghua Management School in Beijing University. Winston Yen – Chief Financial Officer Joined Orient Paper Inc. as Chief Financial Officer in May 2009. Before joining the Company, he has worked in the public accounting industry in Los Angeles area since 1994 and became partner of local accounting firms since 2001. Prior to 2001, he was a manager and supervising senior in several national firms, including CBIZ and Moss Adams, LLP. Mr. Yen is a licensed California CPA and received his Master's degree in Accounting Science from the University of Illinois at Urbana - Champaign in 1994. Zhongmin Ma – General Engineer Joined Orient Paper Inc. as General Engineer in May 2010. He is a seasoned senior engineer with over 20 years of experience in the paper industry. Prior to joining Orient Paper, Mr. Ma severed as senior production manager with several paper manufacturers in China. Mr. Ma received a Bachelor’s degree in pulping and paper engineering from Tianjin Light Industry Institute in 1985. Fulai Huang – Vice President of Environmental Protection Has been Orient Paper’s Vice President of Environmental Protection since 1999. Previously, Mr. Huang worked as a technician with a number of paper companies based in Shandong and specialized in environmental protection. He graduated from Tianjin Technological University with a Bachelor’s degree in 1987, majoring in paper manufacturing. Gengqi Yang – Vice President of Sales Serves as Vice President of Sales at Orient Paper, Inc. and is in charge of overall sales for the Company. He served as Quality Control Director, Sales Representative and Sales Director respectively after joining Orient Paper, Inc. in 1998. Previously, Mr. Yang worked with several paper distribution companies in Beijing. He received a Bachelor’s degree in Economics from Baoding Financial College.

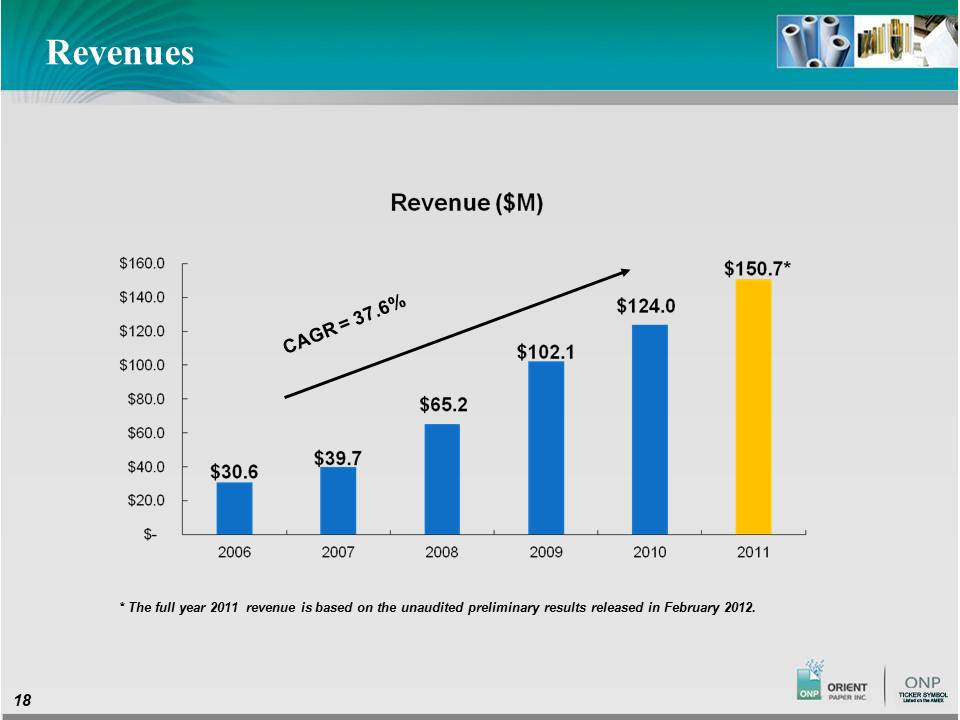

18 Revenues * The full year 2011 revenue is based on the unaudited preliminary results released in February 2012.

19 Gross Profit * The full year 2011 gross profit is based on the unaudited preliminary results released in February 2012.

20 Net Income * The full year 2011 net income is based on the unaudited preliminary results released in February 2012.

21 Balance Sheet As of September 30, 2011 As of December 31, 2010 Current Assets: Cash and cash equivalents $4,945,142 $11,348,108 Accounts receivable 2,509,577 1,839,235 Inventories 3,699,579 7,422,518 Total current assets 11,456,583 21,103,123 Total Assets 135,576,324 115,506,341 Total Liabilities 14,241,163 13,964,265 Total Liabilities and Stockholders’ Equity 135,576,324 115,506,341

22 Investment Highlights Rapidly growing & profitable diversified paper products manufacturer and distributor in northern China Government - mandated industry consolidation eliminates smaller competitors Strategically located in Beijing/Tianjin, China’s printing/publishing hub Strategic location creates cost advantage and strong supplier relationships Compelling growth strategy to expand future production capacity with internal cash flow and debt financing

23 Contact Information CCG Investor Relations Crocker Coulson, President Phone: 646.213.1915 E - mail: crocker.coulson@ccgir.com www.ccgirasia.com Orient Paper, Inc. Winston Yen, Chief Financial Officer Phone: +1 - 562 - 818 - 3817 (Los Angeles) wyen@orientpaperinc.com www.orientpaperinc.com Legal Counsel : Sichenzia Ross Friedman Ference LLP Auditor: BDO China Shu Lun Pan CPAs LLP This Presentation of ONP was developed by the Company and is intended solely for informational purposes and is not to be cons tru ed as an offer to sell or the solicitation of an offer to buy the Company’s stock. This presentation is based upon information a vai lable to the public, as well as other information from sources which management believes to be reliable, but is not represented by ONP as bei ng fully accurate nor does it purport to be complete. Opinions expressed herein are those of management as of the date of public ati on and are subject to change without notice.

Thank You