Attached files

| file | filename |

|---|---|

| EX-21.1 - LIST OF SUBSIDIARIES - Jive Software, Inc. | d315406dex211.htm |

| EX-32.2 - SECTION 906 CFO CERTIFICATION - Jive Software, Inc. | d315406dex322.htm |

| EX-32.1 - SECTION 906 CEO CERTIFICATION - Jive Software, Inc. | d315406dex321.htm |

| EX-23.1 - CONSENT OF KMPG LLP, INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - Jive Software, Inc. | d315406dex231.htm |

| EX-31.2 - SECTION 302 CFO CERTIFICATION - Jive Software, Inc. | d315406dex312.htm |

| EX-31.1 - SECTION 302 CEO CERTIFICATION - Jive Software, Inc. | d315406dex311.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended: December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 001-35367

JIVE SOFTWARE, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 42-1515522 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 325 Lytton Avenue, Suite 200, Palo Alto, California | 94301 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: 650-319-1920

Securities Registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.0001 par value per share | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities

Act: Yes ¨ No x

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the

Act: Yes ¨ No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

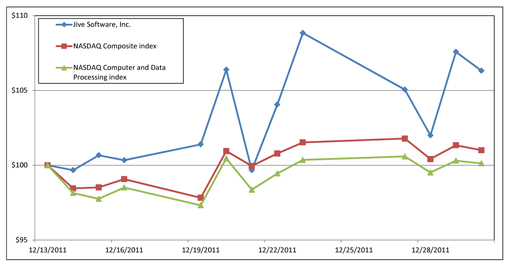

The registrant’s common stock began trading on The NASDAQ Global Market on December 13, 2011. As of December 31, 2011, the aggregate market value of shares of common stock held by non-affiliates of the registrant was $381 million based on the number of shares held by non-affiliates as of December 31, 2011 and based on the last reported sale price of the registrant’s common stock on December 31, 2011.

The number of shares outstanding of the Registrant’s Common Stock as of March 12, 2012 was 61,464,783 shares.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement for the 2012 Annual Stockholders’ Meeting are incorporated by reference into Part III.

Table of Contents

JIVE SOFTWARE, INC.

2011 FORM 10-K ANNUAL REPORT

1

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Forward-Looking Statements

This Annual Report on Form 10-K, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” (“MD&A”) in Item 7, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements may be identified by the use of forward-looking words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “would,” “project,” “plan,” “expect” or the negative or plural of these words or similar expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

| • | our ability to timely and effectively scale and adapt our existing technology and network infrastructure; |

| • | our ability to increase adoption of our platform by our customers’ internal and external users; |

| • | our ability to protect our users’ information and adequately address security and privacy concerns; |

| • | our ability to maintain an adequate rate of growth; |

| • | our future expenses; |

| • | the effects of increased competition in our market; |

| • | our ability to effectively manage our growth; |

| • | our ability to successfully enter new markets and manage our international expansion; |

| • | our ability to maintain, protect and enhance our brand and intellectual property; |

| • | the attraction and retention of qualified employees and key personnel; and |

| • | other risk factors included under “Risk Factors” in this Annual Report on Form 10-K. |

These forward-looking statements are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements. Please refer to Item 1A. Risk Factors in this Annual Report on Form 10-K for a discussion of reasons why our actual results may differ materially from our forward-looking statements. While we may elect to update forward-looking statements at some point in the future, we specifically disclaim any obligation to do so, even if our expectations change.

Overview

We were incorporated in Delaware in February 2001, with a mission to change the way that work gets done. We believe that our social business software unleashes creativity, drives innovation and improves productivity by increasing engagement within the enterprise, as well as with customers and partners. We believe that, just as consumer social technologies are changing the way we live, social business software is transforming the way we work.

We provide a social business software platform that we believe improves business results by enabling a more productive and effective workforce through enhanced communications and collaboration both inside and outside the enterprise. We believe our platform is intuitive, easy to use, flexible and scalable, and can be provided as a public cloud service or as a private cloud solution. We are focused on unlocking the power of the enterprise social graph—the extended social network of an enterprise, encompassing relationships among its employees, customers and partners, as well as their interactions with people and content. Organizations deploy our platform to improve strategic decision making and employee productivity, enhance revenue opportunities, lower operational costs and increase customer retention.

Our comprehensive Jive Engage Platform enables collaboration across two principal communities: employees within the enterprise and customers and partners outside the enterprise. Internally, the Jive Engage Platform is used as a communications tool and collaborative workspace that supports and enhances knowledge sharing, facilitates communication within and across organizational boundaries, and

2

Table of Contents

enables individuals to work together to achieve common business goals. Externally, customers and partners of the enterprise use our platform to connect socially with one another, as well as with the enterprise, in a structured online community that allows users to ask questions, post answers and communicate about a product or particular issue. Our solution also taps into the social web by integrating relevant content and connections across the social networking landscape, enabling enterprises to improve their interactions with customers, leverage feedback to deliver improved products and services, and respond more quickly to market opportunities.

Our social business software has been recognized as a leading platform by industry analysts. Gartner has recognized us as a market leader in three distinct reports: the “Magic Quadrant for Social Software for the Workspace,” the “Magic Quadrant for Externally Facing Social Software” and the “Magic Quadrant for Social Customer Relationship Management.” Forrester lists us as a leader in two reports: “The Forrester Wave™: Enterprise Social Platforms, Q3 2011” and “The Forrester Wave™: Community Platforms, Q4 2010.”

We sell our platform primarily through a direct sales force both domestically and internationally. As of December 31, 2011, we had 667 enterprise Jive Engage Platform customers with over 20 million users within these customers and their communities. Some of our top 10 customers by annual contract value for the year ended December 31, 2011 include ACE Group, Hewlett-Packard Company, SAP AG, T-Mobile and UBS AG.

Recent Developments

During the fourth quarter of 2011, we received $131.4 million of net proceeds from our initial public offering. We used approximately $19 million of those proceeds for the repayment of outstanding debt. We currently intend to use the remaining proceeds for general corporate purposes as described in the prospectus for the offering.

Our Industry

Impact of Social Networking in the Workplace

We believe the rise of social networking applications, such as Facebook, LinkedIn and Twitter, is creating demand for enhanced communication and collaboration capabilities in the workplace. Since its founding in 2004, Facebook has disclosed more than 845 million active users. LinkedIn, the largest professional network, has disclosed over 150 million members. These social networking websites and related tools not only enable individuals to easily communicate and share their opinions and recommendations, but also amplify the voices of marketplace participants and thus have profound implications for how consumers purchase goods and services. Individuals are becoming accustomed to connecting with others via an activity stream, through “friend” and “follow” relationships, and through links and “likes.” Further, social networking applications are increasingly mobile. For example, Facebook reports that over 425 million users access its services via mobile devices. As a result, individuals are more connected in their personal lives today than ever before, and information and digital content is created and shared rapidly and often virally via social networking websites, blogs and forums.

The Need for a New Way to Business

Despite the consumer social technology revolution, we believe little has changed in the enterprise. Over the past several decades, enterprises have invested heavily in legacy software applications to facilitate and manage internal and external communications, share documents, and collaborate within and among teams. However, we believe many of the applications deployed within enterprises today are based on business processes and software architectures that were originally designed in the 1980s and 1990s and thus are limited in their ability to leverage modern, Internet-based technologies and standards. Further, we believe, unlike consumer social networking applications, which are organized around people, most enterprise applications are architected around data to automate business processes, increase transactional efficiency, keep records, comply with regulations and process information. Many existing software applications within an enterprise are deployed in a dedicated functional area or to automate a single business process, with myriad point solutions for individual business functions and departments. Further, we believe many legacy enterprise applications designed to manage relationships external to an

3

Table of Contents

enterprise simply present static information and pre-defined content, rather than enable the real-time, interactive engagement demanded by customers. As a result of these data-centric architectures and legacy deployment models, we believe enterprises and their employees, customers and partners struggle to effectively discover information and share knowledge both within the enterprise and across enterprise boundaries.

Adoption of Social Business Software

Social business software has the potential to significantly improve how enterprises collaborate and share information with employees, customers and partners through unlocking the power of the enterprise social graph. We believe the deployment of social business software is increasingly becoming a mission critical initiative for business and IT executives. McKinsey Global Institute analyzed the business benefits of social business software in a study on enterprise social software and described the findings in a recent article entitled The rise of the networked enterprise: Web 2.0 finds its payday:

“A new class of company is emerging—one that uses collaborative Web 2.0 technologies intensively to connect the internal efforts of employees and to extend the organization’s reach to customers, partners, and suppliers. Results from our analysis of proprietary survey data show that the Web 2.0 use of these companies is significantly improving their reported performance. In fact, our data show that fully networked enterprises are not only more likely to be market leaders or to be gaining market share but also use management practices that lead to margins higher than those of companies using the Web in more limited ways.”

We believe these findings underscore the velocity at which social business is increasingly becoming a mission critical initiative for enterprises and is fundamentally changing the way people work.

We believe that the addressable market for social business software encompasses the overall market for collaborative applications, which IDC1 estimates will be $10.3 billion by 2013. Additionally, we believe social business software has begun to displace the functionality of, and derive budget historically set aside for, adjacent application areas, including content management, customer relationship management, marketing automation and enterprise portals.

Requirements for Social Business Platforms

We believe that social business platforms need to incorporate the following key elements:

| • | Uniform platform for the enterprise. Address the entire business, not one specific function or department. |

| • | Internal and external communication. Enhance communication both inside and outside the enterprise and connect employees with customers and partners; engage customers in public communities and the social web. |

| • | Right content, right place. Improve relevance of information delivered to each user and make content and people easily discoverable and accessible. |

| • | Scalable and secure. Scale to meet the needs of the largest enterprises, while meeting increasingly complex security, compliance and regulatory requirements. |

| • | Seamless integration. Leverage information from legacy enterprise applications such as email and other content management and collaboration applications. |

| • | Standards-based application framework. Enable the development of applications by enterprises and third-party developers to extend and integrate with the functionality of the social business software platform. |

| • | Configurable and versatile. Simplify custom configuration for each individual business and offer a variety of features and functions via a unified platform. |

| • | Deployable in public or private cloud. Leverage the functional and cost advantages of being delivered as a hosted service or in a private cloud deployment model. |

| 1 | IDC. Worldwide Collaborative Applications, 2011-2015 Forecast by Erin Traudt. Doc #228926. June 2011. |

4

Table of Contents

Our Solution

We deliver a social business software platform that features the innovation, creativity and ease of use found in consumer applications combined with the security, flexibility and scalability necessary for enterprise deployment.

Key Elements

| • | Unified social software platform for the enterprise. We offer an enterprise-class social software platform, purpose-built to enable our customers to manage workplace communication and collaboration. Our solution can be deployed across all employees, functional departments and business units. |

| • | Communities for employees, customers and partners. Our solution enables our customers to operate both internal and external communities by offering a platform that allows communication and collaboration between and among employees, customers and partners. |

| • | Discovery of relevant information and experts. Our platform includes a proprietary recommendation engine that helps users connect to and easily locate relevant information and experts on an enterprise-wide basis across departmental and geographic boundaries, as well as across externally-facing customer and partner communities. |

| • | Scalable and secure. Our platform is capable of supporting large deployments, including those with complex environments with tens of thousands of employees internally and millions of users externally. We provide tools to help our customers manage the critical elements of application security, including authentication, authorization and regulatory compliance. |

| • | Integration with existing enterprise applications. Our platform integrates with legacy IT infrastructure and a broad range of existing enterprise applications—including email, content management, customer relationship management, marketing automation, product development, eCommerce and instant messaging—and enables access from mobile devices, browsers, desktop applications, collaboration applications and consumer social platforms. |

| • | Enterprise applications market built on open standards. We enable customers and third parties to develop applications that leverage our platform through our Jive Apps Market, built on the industry standard OpenSocial specifications, which allow social graph data to be shared between browser-based applications. Users can easily find, purchase and install applications tailored to meet specific business needs in a variety of industries and business functions, enabling further innovation and functionality on our platform. Developers can leverage the enterprise social graph to make applications more social and broaden their reach. |

| • | Readily deployable and configurable solution. Our platform has been developed to facilitate easy deployment with familiar interfaces. We offer our customers the ability to configure our solutions to deliver the specific functionality and user experience they want for their end-users, and the ability to modify the look and feel of our solutions to conform to their branding or other requirements. |

| • | Public cloud and private cloud delivery. Our customers can use our platform on demand through the public cloud, or via a private cloud. This flexible delivery model allows us to meet a variety of security and cost requirements and better address the needs of each customer, and enables us to target a wider range of potential customers. |

Business Benefits

| • | Improve strategic decision making. Our platform helps our customers to improve and accelerate decision making by increasing the flow of ideas, streamlining and recommending the most relevant content, and delivering a comprehensive set of analytics that provide insight into employee and customer communications. |

| • | Improve employee productivity. Our centralized collaboration platform and proprietary recommendation engine leverages relationships, expertise and areas of interest to efficiently connect employees with one another, simplify the process of finding people and information and substantially reduce duplicate tasks. Employees can also collaborate more effectively through sharing and commenting using our platform and leveraging our integrations with legacy business applications. |

5

Table of Contents

| • | Enhance revenue opportunities. Our platform helps our customers to create and manage external communities, which can increase brand awareness, attract new customers, inspire new product ideas and deliver referrals to sales teams. Internal communities can also make our customers’ sales representatives more efficient by quickly connecting them with relevant information and expertise within the enterprise. |

| • | Lower operational costs. Our platform helps our customers reduce operating costs via communication efficiencies and improved knowledge management. Externally, our solution enables our customers to provide more effective and efficient support communities while significantly reducing customer support infrastructure expenses, including call centers. Internally, our solution can reduce information discovery time for end-users, reducing ramp time for new hires and increasing employee efficiency. |

| • | Increase customer retention. We enable enterprises to strengthen connections to their customers. Our platform enables enterprises to increase customer satisfaction and retention by establishing communities to support their end-users and enable their end-users to interact with each other. This support and interaction allows our customers to more quickly and effectively process end-user queries and feedback. |

Our Strategy

Our goal is to extend our industry leadership in social business software. The principal elements of our strategy include:

| • | Grow our customer base. In order to grow our customer base, we are investing heavily in our direct sales efforts. In particular, we intend to significantly invest in our sales organization in the United States, Europe, South America and Asia. Additionally, we plan to grow our indirect distribution efforts by increasing our network of channel partners. We are also in the process of developing a new cloud-based offering initially targeted at making it easier for departments within a larger organization to get started using Jive and ultimately drive viral adoption within the larger organization. |

| • | Expand business with existing customers. We have successfully migrated, and intend to continue migrating, customers from a single external community or departmental deployment to broader implementations over time, including the upsell of additional users, page views, modules and additional communities. We will continue to focus on generating positive user experiences and tangible business results that we believe will drive incremental demand for our solutions. |

| • | Innovate and extend our technology and product leadership. We intend to expand our current platform and extend our product leadership by developing and acquiring innovative technologies and products, and leveraging the innovation of our partners in the Jive Apps Market. For example, in the second quarter of 2011 we introduced an update to our platform with the release of Jive 5.0, which includes new features such as Jive What Matters, a recommendations engine, and enhanced integration with Microsoft Office and Microsoft Outlook, enabling a more comprehensive social experience. |

| • | Develop the Jive ecosystem. We intend to continue to develop the Jive ecosystem by enabling customers and other third parties to create applications that integrate with our platform. We further intend to increase the number of our Jive Alliance Partners that provide strategic advisory, business transformation and customization services for our solutions. |

Our Platform

Our flagship product, the Jive Engage Platform, offers industry-leading social business capabilities that enable employee, customer and partner engagement on a unified platform. The core platform can be expanded by adding optional modules, including Analytics, Ideation, Mobile, Video, and Jive Connects, which connect the Jive Engage Platform to existing enterprise systems. Our platform can also be extended to include cloud and customer-built applications through the Jive Apps Market and connections to the social Web through Jive Fathom. All of this activity and content is aggregated and presented to users via the Jive What Matters layer.

6

Table of Contents

The Jive Engage Platform

The Jive Engage Platform serves two types of communities:

| • | Employees. Our platform connects users across the enterprise and its functional departments, leveraging social intelligence, such as business relationships, expertise and areas of interest, to proactively provide relevant documents, discussions and other content to users. |

| • | Customers and partners. Our platform enables our customers to build and manage external communities to build their brand, increase interaction and feedback, and reduce their support costs through enhanced online communication with their own customers and business partners. |

Core Platform Capabilities and Features

Our social business software platform includes the following capabilities and features:

| • | Social networking capability. The Jive Engage Platform enables rich social profiles, visual enterprise directories, connections and expertise identification. Users can easily find, follow and access both people and data through structured spaces, including public and private social groups and projects. This provides users with up to the minute access to relevant and critical information. |

| • | Comprehensive communication environment. Our platform enables blogging, microblogging, discussions, Q&A and direct messaging and aggregates these familiar methods of social communications into the Jive What Matters interface to allow users to find relevant information quickly and easily. |

| • | Engaging social features. Our platform provides a streamlined and intuitive user interface and enables commenting, sharing Web bookmarks, “liking,” reviews and rating capabilities designed to capture the attention of a user and drive interaction and adoption. |

| • | Reputation and recognition. Our platform provides a variety of mechanisms for users to be recognized for their contributions to the community and to proactively build their reputations, including community status leaderboards, user achievement badges, and trending people and content. |

| • | Content and collaboration. Our platform includes wikis, document sharing, an easy-to-use rich text editor, and full-fidelity rendering of Microsoft Office documents and PDFs with inline commenting, allowing users to collaborate real-time. Our platform enhances collaboration by allowing users to control access to content at the individual, group or document level. |

| • | Search. Our platform includes advanced search capabilities to locate relevant people, content and groups using information captured in the enterprise social graph, such as users’ unique skills or profile information. |

| • | Community bridging. Our innovative bridging capability enables an enterprise to expand its operating ecosystem, bringing discussions and questions in external communities back into the enterprise. With one click, an internal user can post a response back to an external discussion. |

| • | Security. Our platform allows customers to control access to specific content and groups. In addition, it is designed to take advantage of and integrate with existing security and authentication systems. |

| • | Connections to legacy systems. Our platform can integrate with legacy systems such as customer relationship management, enterprise resource planning, software configuration management, or product lifecycle management systems, via our application programming interfaces, or APIs. |

Jive What Matters

Jive What Matters is an innovative user interface that makes it easy to track, consume, manage and filter critical business information, communications and actions. A key component of Jive What Matters is a highly tuned enterprise activity stream that enables users to rapidly access, discover and interact with conversations, content and decisions. Our noise filtering capability addresses the challenges of information overload, helping users focus on mission critical, timely information. Additionally, Jive What Matters draws on real-time intelligence derived from the enterprise social graph to predict and recommend content, people and groups to users, based upon employee roles, positions and previous communications.

7

Table of Contents

Jive Apps Market

The Jive Apps Market provides a secure market of business applications that are integrated to and accessed from within the Jive Engage Platform. Built on the industry standards established by the OpenSocial Foundation, the Jive Apps Market enables customers and third parties to develop applications that provide access to existing enterprise applications and provides a secure way of deploying popular cloud-based applications. Developers can leverage the enterprise social graph to make applications more social and to broaden their reach. These applications can be easily found, purchased and installed by end-users, and allow our platform to be further extended and tailored to meet specific business needs in a variety of industries and business functions.

Platform Modules

Jive offers additional functionality in modules built to integrate with the Jive Engage Platform.

Jive Connects. Jive Connects provides prebuilt integration with common content management applications, communication systems and systems of record, including the following:

| • | Microsoft Outlook. Enables users to interact with our platform from the familiar interface of Microsoft Outlook. Users can see activity streams and social profiles, comment on documents and blog posts, and create status updates and discussions, from within Microsoft Outlook. Users can also turn email threads into discussions and post email attachments directly to our platform. Users can use the search feature to include people, emails, appointments, and attachments from Microsoft Outlook, as well as documents and discussions from the Jive Engage Platform. |

| • | Microsoft Office. Users can collaborate on Microsoft Office documents, including co-authoring across different Microsoft Office versions, publishing content directly to our platform and participating in document discussions from directly within Microsoft Word, PowerPoint or Excel. |

| • | Content management systems. Content management systems, such as Microsoft SharePoint, can be integrated into our platform so that content can be shared across our platform and these systems. Users can search our platform and content management systems simultaneously and can access our social capabilities from within these systems. |

| • | Enterprise IM. Enterprise instant messaging systems, such as IBM Sametime, can be integrated into our platform. |

Jive Fathom. Our Social Media Engagement module, Jive Fathom, allows employees, including marketers, product designers, and sales and customer service representatives, to listen to, engage in and analyze conversations on the social web relevant to their company, such as conversations relating to product lines, industry, sales accounts or competition. Our platform captures and analyzes real-time content from Twitter, Facebook and thousands of blog and news sources to provide a comprehensive view of real-time discussions. As information is captured, our platform assesses the influence of the author as well as the sentiment of the information. With Jive Fathom users can engage on Facebook and Twitter from within the Jive Engage Platform to manage their brand, increase awareness, provide support, build relationships with influencers and identify sales opportunities.

Analytics. In addition to the standard reporting included in the Jive Engage Platform, the Analytics module provides detailed reporting on the rich information captured by our platform, including key indicators covering adoption, participation and usage trends.

Ideation. Our Ideation module involves employees, customers and partners in the process of capturing, refining and prioritizing innovative ideas. Once an idea is submitted, users can vote it up or down, and discuss ways to improve the idea. Those managing the ideation process can categorize ideas to keep participants up-to-date of progress.

Mobile. Our Mobile module enables users in both internal and external communities to access our platform from mobile devices. Users can search for people and content, participate in discussions and post status updates remotely. Because Jive Mobile is built on mobile standards such as HTML5, it is accessible on any Internet connected mobile device, including on mobile platforms such as Apple iOS, Google Android and Blackberry OS. The mobile interface can also be themed to reflect a company’s brand, ensuring a consistent brand experience.

8

Table of Contents

Video. The Jive Engage Platform includes the ability to embed videos in different content types and to create a secure video storage, management and streaming service as part of an internal or external community.

Professional Services and Customer Support

Our professional services team provides a range of offerings including strategy consulting, project management, technical expertise, and education and training. Our team leads the design, implementation and launch of a Jive community and seeks to ensure that our solution meets the design and implementation parameters established by our customers. We also provide post-launch support and on-going assistance to encourage and facilitate adoption within the enterprise.

We offer training services to our customers and partners. We offer both traditional classroom-style, instructor-led training either in-person or over the web and online educational classes. We also provide a variety of training videos and quick start guides that are available online. Our education offerings are targeted at training partners, users, community mangers and system administrators.

Our global customer support organization provides both proactive and customer-initiated support. Assistance is available by email, telephone and self-service through our online Jive Community built on our social business platform. Customers can track the status and relevant information relating to their queries in real-time and have access to a wide range of information sharing utilities that facilitate access to both internal and external community feedback.

Our support team is staffed with experienced software support specialists and engineers and has experience with the software systems with which our products integrate. We engage in regular training and certification processes as new products and technologies are introduced.

Our basic deployment includes standard support. Our customers may contract for increased levels of support, which provides for higher required service levels for response and resolution time as well as additional support services.

Technology and Operations

The Jive Engage Platform was built to deliver an intuitive end-user experience to encourage high levels of end-user adoption and engagement in a secure enterprise environment. Our solutions combine proprietary technology we have created with technology developed in the open source community. Our use of open source technology allows us to both increase the speed at which we develop and enhance our solutions as well as reduce the overall cost of providing our social business software platform.

The core application of the Jive Engage Platform is written in Java and is optimized for usability, performance and overall user experience. It is designed to be deployed in the production environments of our customers, runs on top of the Linux operating system and supports multiple databases, including Microsoft SQL Server, MySQL, Oracle and PostgreSQL. The core application is augmented by externally hosted web-based services such as a recommendation service and an analytics service. We have made investments towards consolidating these services on a Hadoop-based platform. The Jive Engage Platform integrates with existing enterprise systems and can be extended with new functionality through the utilization of a broad set of APIs. These APIs enable Jive Connects and the Jive Apps Market, and facilitate the building of custom integrations to our platform.

Our social business software platform is provided through the public cloud or on-premise in a private cloud and leverages the same code base regardless of how it is deployed. In both our public cloud and private cloud deployments, our customers can customize our platform to meet their enterprise requirements for branding and security, through customer-specific domain names, SSL encryption and other mechanisms.

9

Table of Contents

We host our public cloud platform for hundreds of our customers and millions of end-users. We work with SunGard to deliver our social business software platform on an enterprise class hardware platform that provides performance, flexibility and a high level of security. We currently utilize three SunGard facilities located in Aurora, Colorado, Mississauga, Ontario and London, U.K. Each facility offers multiple network providers, as well as services to help ensure reliability, redundancy and performance. In addition to our SunGard relationship, we maintain and operate an additional facility in Chicago, Illinois for offsite backup storage.

We recently began to transition our operating environment to a co-located facility, located in Phoenix, Arizona, managed by our internal network operations team. We believe this transition will enable us to continue to increase the quality of services as well as improve our cost of delivery. In connection with this migration, we have also developed technology that enables us to automate the process of deploying and upgrading customer environments. We continue to make significant investments in our hosting infrastructure to improve efficiency, performance, security and to increase our ability to scale our hosting environment. Our architecture and security team is based in our Palo Alto, California headquarters, and our network operations center and deployment team is based in Portland, Oregon.

Sales and Marketing

We sell our platform primarily through our global direct sales organization. Our direct sales team is comprised of inside sales and field sales personnel who are organized by geographic regions, including the United States, South America and Europe. We intend to expand into Asia in 2012. We also work with channel partners, including resellers, leading global outsourcing vendors and system integrators. As of December 31, 2011, we had 127 employees in sales and marketing and we had over 100 Jive Alliance Partners distributing our platform worldwide.

We generate customer leads, accelerate sales opportunities and build brand awareness through our marketing programs. Our marketing programs target company executives, technology professionals and senior business leaders. Our principal marketing programs include:

| • | use of our website to provide product and company information, as well as learning opportunities for potential customers; |

| • | field marketing events for customers and prospects; |

| • | inside sales professionals who respond to incoming leads to convert them into new sales opportunities; |

| • | participation in, and sponsorship of, user conferences, trade shows and industry events; |

| • | customer programs, including user meetings and our online customer community; |

| • | online marketing activities, including direct email, online web advertising, blogs and webinars; |

| • | public relations and social networking initiatives; |

| • | cooperative marketing efforts with partners, including joint press announcements, joint trade show activities, channel marketing campaigns and joint seminars; and |

| • | sponsorships and participation in marketing programs in the broader Jive ecosystem including Jive Apps Market partners. |

In addition, we host our annual JiveWorld global user conference, where current and potential customers participate in a variety of programs designed to help drive business results through the use of our platform. This conference features a variety of prominent keynote and customer speakers, panelists and presentations focused on businesses of all sizes, across a wide range of industries. Attendees also gain insight into our recent product releases and enhancements and participate in interactive sessions that give them the opportunity to express opinions on new features and functionality.

Customers

We generally sell our platform and related services through our global sales organization directly to businesses, government agencies and other enterprises. As of December 31, 2011, we had 667 Jive Engage Platform customers in diverse industries, including consulting services, education, financial services, healthcare, life sciences, manufacturing, retail, telecommunications and technology. No individual customer represented more than 10% of our total revenues in 2011, 2010 or 2009.

10

Table of Contents

The following table sets forth a representative list of our largest customers by industry category:

| Financial Services |

Healthcare |

Retail | ||

| E*TRADE Financial Corporation Fidelity Liberty Mutual Scotiabank UBS AG |

Allscripts Cerner Kaiser Permanente Mayo Clinic United Health Group |

Avon Enterprise Holdings, Inc. Nike Starbucks Yum! Brands | ||

| Technology |

Telecommunications |

|||

| Hewlett-Packard Hitachi Data Systems McAfee NetApp SAP AG |

Alcatel-Lucent Motorola Solutions Sprint T-Mobile Verizon |

|||

Research and Development

Our engineering efforts support product development across all major operating systems, browsers, databases and mobile devices. We work closely with our customers and our user community to continually improve and enhance our platform and develop new products and features. We emphasize collaboration with customers throughout all areas of our organization in the development process. Our Jive Community allows customers to suggest, collaborate on and vote on new features and functionality. This input is utilized in many of our development plans and provides valuable customer insight that we use to establish the priorities of our engineering team. We also incorporate feedback from our employees, all of whom test our platform before each major release. Leveraging the platform architecture of Jive 5.0, we can quickly introduce new features across our entire customer base without the need for customers to install or implement any software.

As of December 31, 2011, we had 136 employees in research and development.

Competition

The overall market for social business software solutions is rapidly evolving and highly competitive, and subject to changing technology, shifting customer needs and frequent introductions of new products and services. We currently compete with large, well-established multi-solution enterprise software vendors, such as Microsoft and IBM, enterprise software application providers which are adding social features to their existing applications, such as salesforce.com, inc., and smaller specialized software vendors. Our primary competition currently comes from established enterprise software companies that have greater name recognition, larger customer bases, much longer operating histories and significantly greater financial, technical, sales, marketing and other resources than we have and are able to provide comprehensive business solutions that are broader in scope than the solution we offer. Additionally, we compete with smaller companies who may adapt better to changing conditions in the market.

We expect that the competitive landscape will change as the market for social business software consolidates and matures.

We believe the principal competitive factors in our market include the following:

| • | total cost of ownership; |

| • | breadth and depth of product functionality; |

| • | brand awareness and reputation; |

| • | ease of deployment and use of solutions; |

11

Table of Contents

| • | level of customization, configurability, security, scalability and reliability of solutions; |

| • | ability to innovate and respond to customer needs rapidly; |

| • | size of customer base and level of user adoption; and |

| • | ability to integrate with legacy enterprise infrastructures and third-party applications. |

We believe that we compete favorably on the basis of these factors. Notwithstanding the fact that some of our competitors offer the basic versions of their products for free or as low-cost additions to other software suites, we have demonstrated that customers are willing to pay for the value that our platform delivers. Our ability to remain competitive will depend, to a great extent, upon our ongoing performance in the areas of product development and customer support.

Intellectual Property

We protect our intellectual property rights by relying on federal, state and common law rights, as well as contractual restrictions. We control access to our proprietary technology by entering into confidentiality and invention assignment agreements with our employees, contractors and consultants, and confidentiality agreements with third parties. We also rely on a combination of trade secret, copyright, trademark, trade dress and domain name to protect our intellectual property. We have only recently begun to implement a strategy to seek patent protections for our technology and processes. We pursue the registration of our domain names and trademarks and service marks in the United States and in certain locations outside the United States. As of February 29, 2012 we had four pending U.S. patent applications.

Circumstances outside our control could pose a threat to our intellectual property rights. For example, effective intellectual property protection may not be available in the United States or other countries in which our products and solutions are distributed. Also, protecting our intellectual property rights is costly and time-consuming and the efforts we have taken to protect our proprietary rights may not be sufficient or effective. Any impairment of our intellectual property rights could harm our business or our ability to compete and harm our operating results.

Employees

As of December 31, 2011, we had 430 regular full-time employees, including 31 in hosting, 32 in support, 60 in professional services, 136 in research and development, 127 in sales and marketing and 44 in general and administrative roles. None of our employees is represented by a labor union or covered by a collective bargaining agreement. We have not experienced any work stoppages and we consider our relations with our employees to be good.

Segments

We sell a single platform, have one business activity and there are no segment managers who are held accountable for operations, operating results or plans for levels or components below the consolidated unit level. Accordingly, we have determined that we operate in a single reporting segment, software sales and services. For a discussion of revenues, operating profit or loss and total assets, please see Part II, Item 8 of this Form 10-K.

Geographic Information

See Note 15 of Notes to Consolidated Financial Statements included in Part II, Item 8 of this Form 10-K.

Seasonality

Our fourth quarter has historically been our strongest quarter for new billings and renewals. This pattern may be amplified over time if the number of customers with renewal dates occurring in the fourth quarter continues to increase. Furthermore, our quarterly sales cycles are frequently weighted toward the end of the quarter, with an increased volume of sales in the last few weeks of each quarter. The year-over-year compounding effect of this seasonality in billing patterns and overall new business and renewal activity causes the value of invoices that we generate in the fourth quarter to continually increase in proportion to our billings in the other three quarters of our fiscal year.

12

Table of Contents

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Key Metrics” for information regarding our backlog.

Available Information

We file annual, quarterly and other reports, proxy statements and other information with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as amended (“Exchange Act”). We also make available, free of charge on our website at www.jivesoftware.com, our Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after they are filed electronically with the SEC. You can inspect and copy our reports, proxy statements and other information filed with the SEC at the offices of the SEC’s Public Reference Room located at 100 F Street, NE, Washington D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of Public Reference Rooms. The SEC also maintains an Internet website at http://www.sec.gov/ where you can obtain most of our SEC filings. You can also obtain paper copies of these reports, without charge, by contacting Investor Relations at (646) 277-1217.

| ITEM 1A. | RISK FACTORS |

Our operations and financial results are subject to various risks and uncertainties, including those described below, which could adversely affect our business, results of operations, cash flows, financial condition, and the trading price of our common stock.

Risks Related to our Business and Industry

We have a history of cumulative losses and we do not expect to be profitable for the foreseeable future.

We have incurred losses in each of the last five years, including a net loss of $50.8 million in 2011. At December 31, 2011, we had an accumulated deficit of $104.7 million. As we continue to invest in infrastructure, development of our solutions and sales and marketing, our operating expenses will continue to increase. Additionally, to accommodate future growth, we are in the process of transitioning our customer data centers from a third-party service provider to a co-located facility managed by our internal network operations team. This transition has required and will continue to require significant up front capital expenditures and these costs and expenses will be incurred before we realize any associated incremental billings or revenues. As a result, our losses in future periods may be significantly greater than the losses we would incur if we developed our business more slowly. In addition, we may find that these efforts are more expensive than we currently anticipate or that they may not result in increases in our revenues or billings or provide the gross margin improvements we anticipated. Although we have experienced revenue growth in recent periods, you should not consider our recent revenue growth or growth rates as indicative of our future performance. We do not expect to be profitable on a GAAP basis in the foreseeable future and we cannot assure you that we will achieve profitability in the future or that, if we do become profitable, we will sustain profitability.

We have a limited operating history, which makes it difficult to predict our future operating results.

Although we were incorporated in 2001, our current platform, the Jive Engage Platform, was not introduced until 2007 and, at that time, we began offering our platform on a subscription basis for internal and external communities. As a result of our limited operating history, our ability to forecast our future operating results is limited and subject to a number of uncertainties, including our ability to plan for and model future growth.

We have encountered and will encounter risks and uncertainties frequently experienced by growing

13

Table of Contents

companies in rapidly changing industries, such as the risks and uncertainties described in this report. If our assumptions regarding these uncertainties, which we use to plan our business, are incorrect or change in reaction to changes in our markets, or if we do not address these risks successfully, our operating and financial results could differ materially from our expectations and our business could suffer.

Our future growth is, in large part, dependent upon the widespread adoption of social business software by enterprises and it is difficult to forecast the rate at which this will happen.

Social business software for enterprises is at an early stage of technological and market development and the extent to which social business software will become widely adopted remains uncertain. It is difficult to predict customer adoption rates, customer demand for our platform, the future growth rate and size of this market or the entry of competitive solutions. Any expansion of the social business software market depends on a number of factors, including the cost, performance and perceived value associated with social business software. If social business software does not achieve widespread adoption, or there is a reduction in demand for social business software caused by a lack of customer acceptance, technological challenges, weakening economic conditions, competing technologies and products, decreases in corporate spending or otherwise, it could result in lower billings, reduced renewal rates and decreased revenue and our business could be adversely affected. Additionally, mergers or consolidations among our customers could reduce the number of our customers and could adversely affect our revenues and billings. In particular, if our customers are acquired by entities that are not our customers, or that use fewer of our solutions, or that have more favorable contract terms and choose to discontinue, reduce or change the terms of their use of our platform, our business and operating results could be materially and adversely affected.

The market for social business software is in its early stages of development and intensely competitive, and if we do not compete effectively, our business would be harmed.

The market for social business software is relatively new, highly competitive and rapidly evolving with new competitors entering the market. We expect the competitive landscape to intensify in the future as a result of regularly evolving customer needs and frequent introductions of new products and services. We currently compete with large well-established multi-solution enterprise software vendors, stand-alone enterprise software application providers, and smaller software application vendors. Our primary competition currently comes from large well-established enterprise software vendors such as Microsoft Corporation and IBM Corporation, both of which are significantly larger than we are, have greater name recognition, larger customer bases, much longer operating histories, significantly greater financial, technical, sales, marketing and other resources, and are able to provide comprehensive business solutions that are broader in scope than the solution we offer. These well established vendors may have preexisting relationships with our existing and potential customers and to the extent our solutions are not viewed as being superior in features, function and integration or priced competitively to existing solutions, we might have difficulty displacing them. We also compete with stand-alone enterprise software applications that have begun adding social features to their existing offerings, including salesforce.com, inc. Some of these companies have large installed bases of active customers that may prefer to implement social business software solutions that are provided by an existing provider of customer management software, and these companies may be able to offer discounts and other pricing incentives that make their solutions more attractive. In addition, large social and professional networking providers with greater name recognition, financial resources and other resources may add social business applications to their existing applications, resulting in increased competition.

Several early stage private social business software companies have obtained significant financing, which could enable these competitors to offer lower pricing, execute deeper and broader marketing programs, expand their product offerings and functionality and significantly increase the size of their sales force; all of which could adversely affect our billings, revenues, and margins.

Some potential customers, particularly large enterprises, may elect to develop their own internal solutions. In addition, some of our competitors offer their solutions at a lower price or at no cost, which has resulted in pricing pressures and increased competition. If we are unable to price our solutions appropriately, our operating results could be negatively impacted. In addition, lower margins, pricing pressures and increased competition generally could result in reduced sales and billings, losses or the failure of our platform to achieve or maintain more widespread market acceptance, any of which could harm our business. Our current and potential competitors may also establish cooperative relationships among themselves or with third parties that may further enhance their product offerings or resources. Current or potential competitors may be acquired by third parties with greater available resources and as a result of such acquisitions, might be able to adapt more quickly to new technologies and customer needs, devote greater resources to the promotion or sale of their solutions, initiate or withstand substantial price competition, take advantage of other opportunities more readily or develop and expand their offerings more quickly than we do. If we are unable to compete effectively for a share of our market, our business, operating results and financial condition could be materially and adversely affected.

14

Table of Contents

We cannot accurately predict new subscription, subscription renewal or upsell rates and the impact these rates may have on our future revenues and operating results.

In order for us to improve our operating results and continue to grow our business, it is important that we continually attract new customers and that existing customers renew their subscriptions with us when their existing contract term expires. Our existing customers have no contractual obligation to renew their subscriptions after the initial subscription period and we cannot accurately predict renewal rates. Our customers’ renewal rates may decline or fluctuate as a result of a number of factors, including, but not limited to, their satisfaction with our platform and our customer support, the level of usage of our platform within their enterprise, the frequency and severity of outages, our product uptime or latency, the pricing of our, or competing, software or professional services, the effects of global economic conditions, and reductions in spending levels or changes in our customers’ strategies regarding social collaboration tools. If our customers renew their subscriptions, they may renew for fewer users or page views, for shorter contract lengths, or on other terms that are less economically beneficial to us. If customers enter into shorter initial subscription periods, the risk of customers not renewing their subscriptions with us would increase and our billings may be adversely impacted. We have limited historical data with respect to rates of customer renewals, so we may not accurately predict future renewal trends. We cannot assure you that our customers will renew their subscriptions, and if our customers do not renew their agreements or renew on less favorable terms, our revenues may grow more slowly than expected or decline and our billings may be adversely impacted.

To the extent we are successful in increasing our customer base, we could incur increased losses because costs associated with generating customer agreements and performing services are generally incurred up front, while revenue is recognized ratably over the term of the agreement. This risk is particularly applicable for those customers who choose to implement our platform in the public cloud. If new customers sign agreements with short initial subscription periods and do not renew their subscriptions, our operating results could be negatively impacted due to the up-front expenses associated with our sales and implementation efforts.

In order for us to improve our operating results, it is important that our customers make additional significant purchases of our functionality and offerings, including additional modules, users or page views, communities or professional services. If our customers do not purchase additional functionality or offerings, our revenues may grow more slowly than expected. Additionally, increasing incremental sales to our current customer base requires increasingly sophisticated and costly sales efforts that are targeted at senior management. We also invest various resources targeted at expanding the utilization rates of our platform. There can be no assurance that our efforts would result in increased sales to existing customers, or upsells, and additional revenue. If our efforts to upsell to our customers are not successful, our business would suffer.

15

Table of Contents

Our quarterly results are likely to fluctuate due to a number of factors, and the value of our stock could decline substantially.

Our quarterly operating results are likely to fluctuate as a result of a variety of factors, many of which are outside our control. If our quarterly financial results fall below the expectations of investors or any securities analysts who follow our stock, the price of our common stock could decline substantially. Fluctuations in our quarterly financial results may be caused by a number of factors, including, but not limited to, the following:

| • | the renewal rates for our platform; |

| • | upsell rates for our solutions and services; |

| • | changes in deferred revenue balances due to changes in the average duration of subscriptions, rate of renewals and the rate of new business growth; |

| • | changes in the mix of the average term length and payment terms; |

| • | order sizes in any given quarter; |

| • | the amount and timing of operating costs and capital expenditures related to the operations and expansion of our business; |

| • | changes in our pricing policies, whether initiated by us or as a response to competitive or other factors; |

| • | the cost and timing associated with, and management effort for, the introduction of new features to our platform; |

| • | the rate of expansion and productivity of our sales force; |

| • | the length of the sales cycle for our platform; |

| • | changes in our go-to-market strategy; |

| • | the success of our international expansion strategy; |

| • | new solution introductions by our competitors; |

| • | our success in selling our platform to large enterprises; |

| • | general economic conditions that may adversely affect either our customers’ ability or willingness to purchase additional subscriptions or a larger deployment, or hinder or delay a prospective customer’s purchasing decision, or reduce the value of new subscriptions, or affect renewal rates; |

| • | timing of additional investments in the development of our platform or deployment of our services; |

| • | disruptions in our hosting services or our inability to meet service level agreements and any resulting refunds to customers; |

| • | security breaches and potential financial penalties to customers and government entities; |

| • | purchases of new equipment and bandwidth in connection with planned data center expansion; |

| • | regulatory compliance costs; |

| • | the timing of customer payments and payment defaults by customers; |

| • | the impact on services margins as a result of the use of third party contractors to fulfill demand; |

| • | costs associated with acquisitions of companies and technologies; |

| • | potential goodwill impairment charges related to prior acquisitions; |

| • | extraordinary expenses such as litigation or other dispute-related settlement payments; |

| • | the impact of new accounting pronouncements; and |

| • | the timing of stock awards to employees. |

Additionally, our fourth quarter has historically been our strongest quarter for new billings and renewals. This pattern may be amplified over time if the number of customers with renewal dates occurring in the fourth quarter continues to increase. Furthermore, our quarterly sales cycles are frequently weighted toward the end of the quarter, with an increased volume of sales in the last few weeks of each quarter, which may impact our revenue and billings significantly.

We may fail to meet or exceed the expectations of securities analysts and investors, and the market price for our common stock could decline. If one or more of the securities analysts who cover us change their recommendation regarding our stock adversely, the market price for our common stock could decline. Additionally, our stock price may be based on expectations, estimates or forecasts of our future performance that may be unrealistic or may not be achieved. Further, our stock price may be affected by financial media, including press reports and blogs.

Due to our evolving business model, the rapid pace of technological change, the unpredictability of the emerging market in which we participate and potential fluctuations in future general economic and financial market conditions, we may not be able to accurately forecast our rate of growth. We plan our expense levels and investments on estimates of future revenue and future anticipated rate of growth. We may not be able to adjust our spending quickly enough if the addition of new customers, the upsell rate for existing customers or the price for which we are able to sell our platform falls short of our expectations. As a result, we expect that our billings, revenues, operating results and cash flows may fluctuate significantly and comparisons of our billings, revenues, operating results and cash flows may not be meaningful and should not be relied upon as an indication of future performance.

16

Table of Contents

We believe that our quarterly operating results, including the levels of our revenues and billings, may vary significantly in the future and that period-to-period comparisons of our operating results may not be meaningful. You should not rely on the results of any one quarter as an indication of future performance.

Our sales cycle can be long and unpredictable, particularly with respect to large enterprises, and we may have to delay revenue recognition for some of the more complex transactions, which could harm our business and operating results.

The timing of our sales is difficult to predict. Our sales efforts involve educating our customers about the use, technical capabilities, security and benefits of our platform. Customers often undertake a prolonged product-evaluation process which frequently involves not only our solutions but also those of our competitors. As we continue to target our sales efforts at large enterprise customers, we will face greater costs, long sales cycles and less predictability in completing some of our sales. In this market segment, the customer’s decision to subscribe to our platform may be an enterprise-wide decision and, if so, may require us to provide even greater levels of education regarding the use and benefits of our platform. In addition, prospective enterprise customers may require customized features and functions unique to their business process and may require acceptance testing related to those unique features. As a result of these factors, these sales opportunities may require us to devote greater sales support and professional services resources to individual customers, increasing costs and time required to complete sales and diverting our own sales and professional services resources to a smaller number of larger transactions, while potentially requiring us to delay revenue recognition on some of these transactions until the acceptance requirements have been met.

We rely on a third-party service provider to host some of our solutions and any interruptions or delays in services from this third party could impair the delivery of our products and harm our business.

We currently outsource our hosting services to SunGard Availability Services LP, or SunGard. These services are provided by three of SunGard’s data centers worldwide. We do not control the operation of SunGard’s facilities and therefore must rely on SunGard to ensure that our technology and customer data is adequately protected. SunGard’s facilities are vulnerable to damage or interruption from natural disasters, fires, power loss, telecommunications failures and similar events. They are also subject to employee negligence, break-ins, computer viruses, sabotage, intentional acts of vandalism and other misconduct. The occurrence of any of these disasters, a decision by SunGard to close the facilities without adequate notice or other unanticipated problems could result in lengthy interruptions in our service which would materially impact our customers’ use of our offerings and may result in financial penalties.

Additionally, we are in the process of transitioning a portion of our hosting services to a Jive managed hosting facility. This facility is subject to the risks as those existing in our SunGard facilities as well as other risks inherent in the fact that we are now managing the infrastructure that hosts our customer communities. These risks include our failure to properly plan for our infrastructure capacity requirements and our inability obtain and maintain the technologies and personnel necessary to cause the hosting services to operate efficiently and in accordance with our contractual commitments including those pertaining to uptime and security.

Furthermore, the availability of our platform could be interrupted by a number of additional factors outside of our hosting facilities, including our customers’ inability to access the Internet, the failure of our network or software systems due to human or other error, security breaches or ability of the infrastructure to handle spikes in customer usage. We may be required to issue credits or refunds or indemnify or otherwise be liable to customers or third parties for damages that may occur resulting from certain of these events. For example, in January 2011, we experienced a hosting outage, which impacted some of our customers for up to 14 hours. As a result of this outage, we provided service credits to certain customers. If we experience similar outages in the future, we may experience customer dissatisfaction and potential loss of confidence, which could harm our reputation and impact future revenues from these customers.

17

Table of Contents

A rapid expansion of our business could cause our network or systems to fail.

In the future, we may need to expand our hosting operations at a more rapid pace than we have in the past, spend substantial amounts to purchase or lease data centers and equipment, upgrade our technology and infrastructure to handle increased customer demand and introduce new solutions. For example, if we secure a large customer or a group of customers which require significant amounts of bandwidth or storage to enable their community, we may need to increase bandwidth, storage, power or other elements of our hosting operations and our existing systems may not be able to scale in a manner satisfactory to our existing or prospective customers. In addition, our sales expansion strategies in Asia and Latin America may require us to set up or partner with hosting providers in those regions and we may have to spend substantial amounts to purchase or lease new data centers and equipment. Any such expansion could be expensive and complex and result in inefficiencies or operational failures and could reduce our margins.

Our planned transition from third-party hosted data centers for our public cloud customers to our own managed facilities is expensive and complex, and could result in inefficiencies or operational failure and increased risk.

Our planned transition from data centers managed by a third-party service provider to a co-located facility managed by our internal network operations team is complex, could result in operational inefficiencies or operational failures and will require significant up front capital expenditures for equipment and infrastructure as well as increased personnel expense. We expect these investments will have a negative impact on margins in the near term. In this regard, we anticipate making capital expenditures of approximately $10.0 million during 2012 for purchases of network equipment, as well as for additional hosting services. If it takes longer than we expect to complete this transition, the negative impact on our operating results would likely exceed our initial expectations, particularly if the scope of the project grows and we deploy additional resources and hire additional personnel to complete the project. Additionally, to the extent that we are required to add data center capacity to accommodate customer demands for additional bandwidth or storage to enable their communities, we may need to significantly increase the bandwidth, storage, power or other elements of our hosting operations, and the costs associated with adjustments to our data center architecture could also negatively affect our margins and operating results.

There is an increased risk that service interruptions may occur as a result of our data center transition or other unforeseen issues. Even after we transition our data centers, we will remain subject to the continued risks associated with data center operations, including security and privacy compliance, the maintenance of appropriate data security certifications, risks of disruptions or delays in services and other factors. Our failure to effectively manage these risks could damage our reputation and result in a financial liability or a loss of customers, which would harm our business and operating results.

If our security measures are breached or unauthorized access to customer data is otherwise obtained, our solutions may be perceived as not being secure, customers may reduce the use of or stop using our solutions and we may incur significant liabilities.

Our hosting operations involve the storage and transmission of data and security breaches could result in the loss of this information, litigation, indemnity obligations and other liability. While we have security measures in place our systems and networks are subject to ongoing threats and therefore these security measures may be breached as a result of third-party action, including cyberattacks or other intentional misconduct by computer hackers, employee error, malfeasance or otherwise. This could result in one or more third parties obtaining unauthorized access to our customers’ data or our data, including intellectual property and other confidential business information. Third parties may also attempt to fraudulently induce employees or customers into disclosing sensitive information such as user names, passwords or other information in order to gain access to our customers' data or our data, including intellectual property and other confidential business information.

18

Table of Contents

Our hosting, support and professional services personnel sometimes must access customer communities to fulfill our contractual obligations to provide these services to our customers. This access may result in exposure to confidential customer data that is stored within our platform. If our personnel or our software systems were to permit unauthorized loss or access to this customer data, our reputation could be damaged and we could incur significant liability.

Additionally, while our platform is not intended for the transmission or storage of sensitive health, personal and financial information and we contractually prohibit our customers from doing so, we do not monitor or review the content that our customers upload and store within their communities. Therefore, we have no direct control over the substance of the content within our hosted communities. If customers use our platform for the transmission or storage of sensitive health, personal or financial information and our security measures are breached our reputation could be damaged, our business may suffer and we could incur significant liability as many domestic and international laws place a higher burden of care on organizations that transmit and process this type of information.