Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT ON FORM 8-K - EXAR CORP | d311940d8k.htm |

24

Annual Roth Conference

Institutional Investor Meetings

Presented by:

Louis DiNardo –

President & CEO

Kevin Bauer –

SVP & CFO

March 12, 2012

Exhibit 99.1

th |

2

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Safe Harbor

Forward-Looking Statements: This

presentation contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995.

These statements are based on management’s current expectations and beliefs and are subject to a

number of factors and uncertainties that could cause actual results to differ materially from

those described in the forward-looking statements. The forward-looking statements contained in this presentation include statements

about future financial and operating results; economic recession, industry and market

conditions, potential synergies and cost savings; the ability to drive growth and expand

customer and partner relationships, changes in gross margins, revenues and operating expenses, manufacturing yields or operations, product development

initiatives, design win conversion and other such statements. These statements are not guarantees of

future performance, involve risks, uncertainties and assumptions that are difficult to predict,

and are based upon assumptions as to future events that may not prove accurate. Therefore, actual outcomes and results

may differ materially from what is expressed herein. In any forward-looking statement in which the

Company expresses an expectation or belief as to future results, such expectation or belief is

expressed in good faith and believed to have a reasonable basis, but there can be no assurance that the statement or expectation or

belief will result or be achieved or accomplished. Information concerning risk factors are

detailed in the Company's SEC reports, including the Annual Report on Form 10-K for the

year ended March 27, 2011 and the Quarterly Report on Form 10-Q for the quarters ended July 3, 2011, October 2, 2011 and January 1, 2012.

Generally Accepted Accounting Principles: The

Company reports its financial results in accordance with GAAP. Additionally, the Company supplements reported GAAP financials with non-GAAP measures

which are included in related press releases and reports furnished to the SEC, copies of which are

available at the Company’s website: http://www.exar.com or the SEC’s website at:

http://www.sec.gov. In this presentation, we are disclosing non-GAAP gross profit, non-GAAP gross margin, non-GAAP research and development

expenses, non-GAAP selling, general and administrative expenses, non-GAAP operating income

(loss), non-GAAP net income (loss), and non-GAAP diluted earnings (loss) per share,

which are adjusted to exclude from our GAAP results all stock-based compensation expense, amortization of acquired intangible assets,

fair value adjustment of acquired inventories, acquisition-related costs, exit costs, separation

costs of executive officers, acceleration of depreciation on abandoned equipment, goodwill and

other intangible asset impairment, impairment charges on investments, and income tax effects. These non-GAAP measures are presented in

part to enhance the understanding of the Company’s historical financial performance and

comparability between reporting periods. The Company believes the non- GAAP presentation,

when shown in conjunction with the corresponding GAAP measures, provide relevant and useful information to analysts, investors, management

and other interested parties. For its internal purposes, the Company uses the foregoing non-GAAP

measures to evaluate performance across reporting periods, determine certain employee benefits

as well as plan for and forecast the Company’s future periods. These non-GAAP measures are not in accordance with, or an

alternative for measures prepared in accordance with GAAP, and may be different from non-GAAP

measures used by other companies. In addition, these non-GAAP measures are not based on any

comprehensive set of accounting rules or principles. The Company believes that non-GAAP measures have limitations in that they do

not reflect all of the amounts associated with the Company’s results of operations as determined

in accordance with GAAP. These measures should only be used to evaluate the Company’s

results of operations in conjunction with the corresponding GAAP measures. |

Management |

4

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Management Team

•

Louis DiNardo CEO

–

30 Years Experience in High Performance Analog Mixed-Signal; CEO, President

and COO, VP/GM •

Todd Smathers SVP Ops

–

30 Years Experience in High Performance Analog Mixed-Signal; SVP Ops,

VP/GM •

Carlos Laber SVP R&D

–

30 Years Experience in High Performance Analog Mixed-Signal; VP R&D, SVP

Technology •

Chris Dingley SVP Sales

•

Kevin Bauer CFO |

Strategic Vision |

6

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

•

Exar -

Top Tier High Performance Analog Mixed-Signal

Integrated Circuits and Sub-Systems Provider

–

Networking, Storage and Data Communications

–

Industrial and Embedded Systems

–

Consumer Electronics

–

Computing and Peripherals

•

Exar -

Long Term Differentiation

–

Provide Analog Mixed-Signal Solutions with Embedded Controller,

Computation and Advanced Connectivity

–

Provide Analog Mixed-Signal Solutions with Complete Software and

Firmware Drivers

Exar

-

Strategic

Vision |

7

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

•

Provide Consistent Profitable Growth

–

Revenue Growth

–

Gross Margin Expansion

–

Operating Expenses Reduction

–

Operating Profit Growth

•

Provide Appreciation in Shareholder Value

–

Alignment of Management Compensation

–

Exceed Peer Group Benchmarks

–

Maintain Stable Management

–

Maintain Consistent Strategy

Exar

-

Strategic

Vision |

Historical Perspective |

9

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Exar

-

Historical

Perspective

•

Timeline

–

Founded in 1972, reorganized in Delaware in 1991

–

IPO -1985

–

History of Analog Mixed-Signal and Communications Products

–

Conversion to fabless model -

1989-91

–

Exar / Sipex Merger –

2007

•

Assets

–

(+) Brand

–

(+) Customers

–

(+) Partners

–

(+) Expertise

–

(+) Balance Sheet |

10

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

*Note:

Non-GAAP

Gross

Profit

&

Non-GAAP

Gross

Margin

Revenue, Gross Profit*, Gross Margin*

Fiscal Quarters: FYE March

16

16

18

21

21

19

18

16

18

18

14

52%

52%

54%

54%

52%

51%

50%

46%

49%

49%

48%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

-

5

10

15

20

25

30

35

40

45

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

Gr Profit

Revenue

Gr Margin |

11

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Operating Expense*, Operating Income (Loss)*

*Note: Non-GAAP Operating Expense & Non-GAAP Operating Income

(Loss) Fiscal Quarters: FYE March

(5)

-

5

10

15

20

25

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

OpEx

OpInc |

12

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Restructuring

•

Workforce

–

Reduction

–

Alignment

–

Recruiting

•

Cost of Goods and Operating Expense Reductions

–

Headcount

–

Operating Excellence

–

Facilities Consolidation |

13

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Restructuring

•

Workforce Reduction

–

Phase 1 -

January 2012

•

15% of Headcount

•

3 Major Locations

•

5 Secondary Locations

•

$9.7mm Gross Savings

–

Phase 2 -

First Half Fiscal 2013

•

Significant Reduction in Remaining Expenses

•

Primarily S&M and G&A with some R&D

•

Target $10mm Annualized Savings |

14

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Restructuring

•

Workforce Alignment and Recruiting

–

Increase Analog Mixed-Signal Product Development

–

Increase Design, Product and Test Engineering Resources

–

Increase Field Applications Engineering Resources

–

Upgrade Key Sales and Marketing Resources |

15

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Restructuring

•

COGS and Operating Expense Reductions

–

Headcount: N. America, Malaysia, Shanghai, Hangzhou

–

Test Time Reduction: Existing Products, New Products

–

Supply Chain Management: Fab, Assembly and Test

–

Faculties Consolidation: Fremont

–

Inventory Control: Legacy and New Products

–

Backlog Management: Improve Business Processes |

16

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Success Model

•

Long Term Model

–

Growth 150% of Peer Group

–

Gross Margin 55%

–

Operating Expenses 32%

–

Operating Income 23%

•

Demonstrate Consistent Profitable Growth

–

Effective Market Selection

–

Product Differentiation

–

Business Discipline |

Markets and Products |

18

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Exar -

Markets and Products

•

Power Management

–

Programmable Power

–

Analog Power

•

Connectivity

–

Interface

–

UARTS

–

Bridges

•

Data Communications and

Storage

–

Acceleration

–

Encryption

–

Compression/Decompression

•

Communications

–

SONET

–

SDH

–

E1/T1

•

Standard Analog

–

Operational Amplifiers

–

Comparators

–

Voltage References

–

Digital Potentiometers

–

Analog-to-Digital Converters

–

Digital-to-Analog Converters

–

Real-time Clocks |

19

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Product

Line

Expansion

–

Power

Management

Required Additions

Design Engineering

Product Engineering

Test Engineering

Applications

Engineering

Process Development

Mask Cost

Wafer Cost

Power

Management

Programmable

Power

DC/DC

Converter

DC

Controller

Charge

Pump

LED

Controllers

TVS |

20

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Revenue –

Power Management

Fiscal Quarters: FYE March

-

1

2

3

4

5

6

7

8

9

10

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12 |

21

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

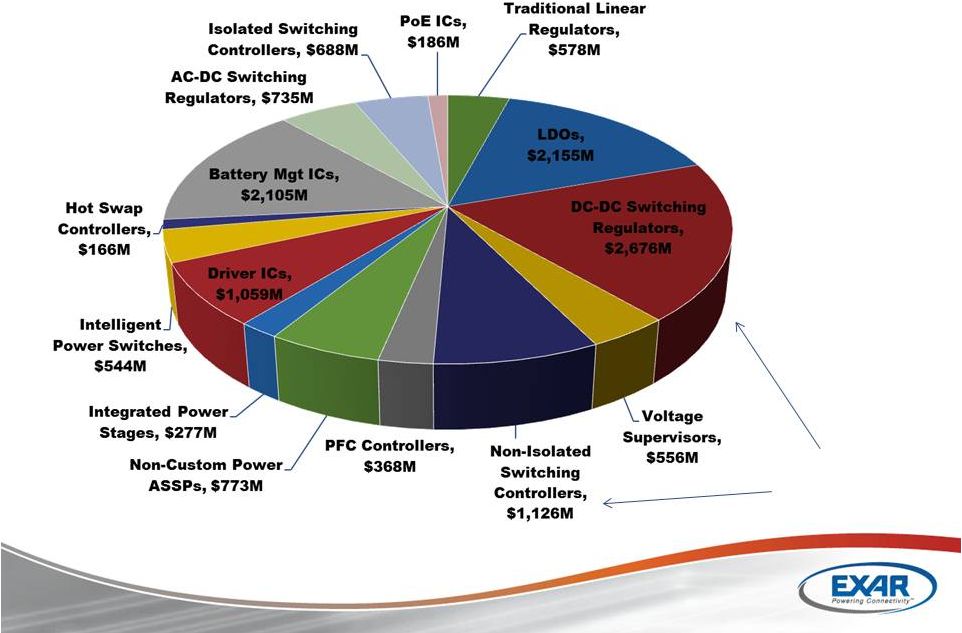

2011 $14B TAM

Market

TAM

&

Segment

SAM

–

Power

Management

IMS Research

(Does not include USB switches –

Analog products)

Digital Power

SAM |

22

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Application

Market Sets/yr

Exar

SAM/set

Exar

SAM

Top Customers

STB

150M

$2

$300M

Pace, Motorola, Technicolor

Switches/Routers

20M

$5

$100M

Cisco, HP, Alcatel, Huawei

MFP

10M

$5

$50M

HP, Canon, Konica Minolta

Server

10M

$5

$50M

HP, IBM, Dell

IP Camera

20M

$2

$40M

Siemens, Johnson, Pelco

Patient Monitor

10M

$3

$30M

GE, Honeywell, Mindray

BTS/BSC/RRH

4M

$8

$30M

NSN, Ericsson, ZTE

POS

15M

$2

$30M

Ingenico, Verifone, Hypercom

xPON

10M

$1

$10M

Huawei, ZTE, Fiberhome

Ultrasound

2M

$5

$10M

Seimens, GE, Mindray

Total

$650M

ABI Research, Gartner, Infonetic, IMS, Mobile Experts, Nilson

Focus

Application

SAMs

–

Power

Management |

23

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Products

-

Power

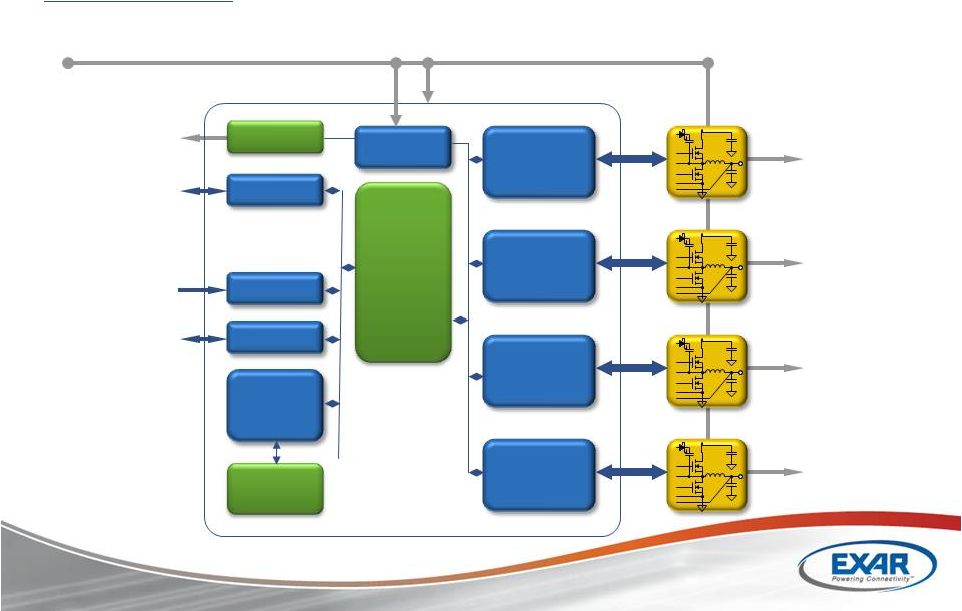

Management

•

Integration

•

Four independent programmable step-down DPWM controllers

•

Four Integrated FET drivers

•

Reconfigurable GPIO pins & I

C interface

•

Performance

•

Output currents up to 15A

•

High Efficiency ~95%

•

Single input 4.75V to 25V

•

9mA typical standby current

•

Management

•

Power monitoring

•

Full on-board protection: OTP, UVLO, OCP & OVP

•

Reusable design, PC design environment

2 |

Products

–

Power

Management

XRP 7724 Block Diagram

Vout 1

Vout 2

Vout 3

Vout 4

Vin (4.75 –

25V)

3.3V @ 50mA max

SDA / SCL to Host µC

2 GPIOs

General IC ENABLE

24

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

StandBy LDO

GPIO

Enable

I²C

Configuration

Register

set

Flash

Memory

Internal LDOs

4 Channel

Digital

PWM &

PFM

Control

Engine

Gate Drivers

Current Sensing

HS Charge Pump

Vout Feedback

Gate Drivers

Current Sensing

HS Charge Pump

Vout Feedback

Gate Drivers

Current Sensing

HS Charge Pump

Vout Feedback

Gate Drivers

Current Sensing

HS Charge Pump

Vout Feedback

th |

25

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Set-Top

Box

-

Point

of

Load

Requirements

Functional Block

Products

Exar Part Numbers

Power Supply Unit

(Sequencing, Monitoring)

Programmable Buck controllers

XRP7713, XRP7714

Power Supply Unit (DC/DC POLs)

Buck regulators, LDOs

SPX3819, SPX1117, SPX5205, SP6260, SP7662

XRP7664, XRP7665,

SDRAM Termination

Bus Termination regulators

XRP2997

LEDs

LED drivers

XRP7620, XRP712x

USB 2.0/3.0

USB Power switch

XRP2525, XRP2526, XRP2527

Conditional Access Module

Low voltage buck, LDOs

SP6669, SP6657, SP6260

Front USB

USB Power switch

XRP2525, SP619

RS232

RS232 serial transceiver

SP3232, SP232, SP202

GPIOs Expander

I2C & SPI GPIO expanders

XRA120x, XRA140x |

26

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Competition

–

Power

Management

Competitor

Competitor’s Strengths

Exar’s Advantage

•Leader in low current POL

•Captive low cost process

•Differentiated portfolio

•Brand in focus markets

•Strong Asian Presence

•Incumbents in large Asia ODMs

•Differentiated Portfolio

•US Brand

•Low Cost

•Closeness to Asian market

•Differentiated portfolio

•US Brand & Quality

•Analog brand

•Applications support

•Design expertise

•Lower cost solutions

•Lead on digital control

programmable power

•Broad Portfolio (+NSC)

•Brand Recognition

•Customer engagements

•Design expertise

•High volume foundry

•Lead on programmable power |

27

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Product

Line

Expansion

-

Communications

Discontinued Development Program Q4 FY’12

Comm

IC’s

SONET

E1/T1

Transport |

28

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Revenue

-

Communications

Fiscal Quarters: FYE March

-

1

2

3

4

5

6

7

8

9

10

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12 |

29

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Product

Line

Expansion

–

Data

&

Storage

Data

Storage

ASSP

SoC |

30

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Revenue

–

Data & Storage

Fiscal Quarters: FYE March

-

1

2

3

4

5

6

7

8

9

10

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12 |

31

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Application

SAM 2012

Industry Leaders

Enterprise Storage

$77.5M

EMC, Hitachi, IBM, NetApp

Big Data/

Data Warehousing

$79.3M

Teradata, Oracle, HP, IBM

Cloud Storage

$99.8M

Amazon, Microsoft, Rackspace

Cloud Computing

$63.3M

IBM, Google, Salesforce

Network Security

$137.2M

Cisco, Juniper, Huawei, F5

VOIP Security

$26.3M

Acme Packet, Cisco

Total

$483M

Source: IDC, Exar

Focus

Application

SAMs

-

Data

&

Storage |

32

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

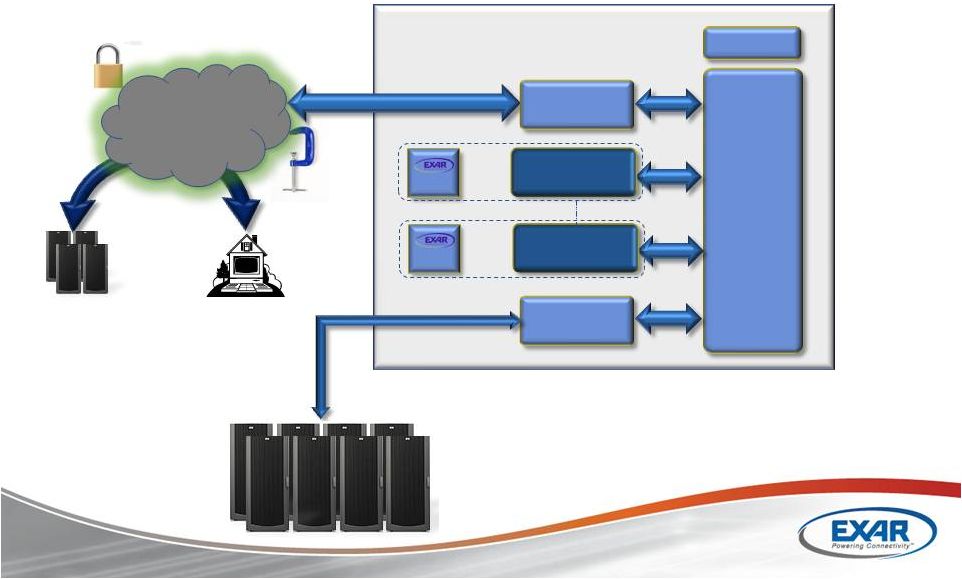

Backup Solution with DX17xx or 18xx Card

HBA

Processor /

Chipset

PCI-E

PCI-E

DX 18xx

DX 17xx

DX 18xx

DX 17xx

Application

Example

-

Data

&

Storage

Disk Interface

SERVER

STORAGE ARRAY |

33

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

SSL or IPsec VPN Gateway

CPU

Sub-

System

Memory

PCI-E

Secure

Secure

Cloud

Cloud

WAN I/F

1GbE/10GbE

NIC

PCI-E

WAN

Interface

PCI-E

PCI-E

Corporate Data Center

DX 18xx

DX 17xx

DX 18xx

DX 17xx

or

or

Remote

Data Center

Home Office

Application

Example

-

Data

&

Storage

820x

820x |

34

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Competition

-

Data

&

Storage

Competitor

Competitor’s Strengths

Exar’s Advantages

X86 Multi-core

Processors

•

Compute capabilities increasing as

number of CPU cores increases

•

Low cost: Riding Moore’s Law

•

Optimizes application

performance

•

Higher security/compression

performance

•

Lower power consumption

•

Reduced TCO

Intel I/O Hubs

•

Next Gen IOH integrates PK,

compression

•

Available on new platforms

•

Higher security/compression

performance

•

Better scalability

•

Lower power

Cavium

•

Compute capabilities increasing as

number of CPU cores increases

•

Next generation Nitrox family sampling

•

Integrated encryption, PK,

compression

•

Good performance

•

Simultaneous processing of

encryption, PK, and

compression without

performance penalty

•

Lower power consumption

Multi-core Network

Processors

(Netlogic, Freescale)

•

Compute capabilities increasing as

number of CPU cores increases

•

Integrated encryption, compression

•

Optimizes application

performance

•

Lower power consumption

•

Low latency |

35

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Product

Line

Expansion

-

Connectivity

Connectivity

UART

Interface

Bridges |

36

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Revenue

-

Connectivity

Fiscal Quarters: FYE March

-

2

4

6

8

10

12

14

16

18

20

22

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12 |

37

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Market

TAM

&

Segment

SAM

-

Connectivity

Other Analog

Other Analog

TAM: $1.7 Billon

TAM: $1.7 Billon

Other Digital

Other Digital

TAM: $1 Billon

TAM: $1 Billon

Worldwide Interface

TAM: $5.4 Billon

Source: Databeans

Connectivity/Bridges

Connectivity/Bridges

TAM: $2.1B

TAM: $2.1B

SAM: $500M

SAM: $500M

UARTs

UARTs

TAM/SAM: $130M

TAM/SAM: $130M

Serial Transceivers

Serial Transceivers

TAM/SAM: $500M

TAM/SAM: $500M |

38

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Application

Examples

-

Connectivity

Servers

Blade Servers

cPCI Servers

Consumer

Set Top

Box

HDTV

MFP

Tablets

Industrial/POS

Communications

Console Servers

KVM Switches

Wireless

Transceiver

GPS/Telematics

Network Routers

Embedded Systems

PC104/104+

ISA

PCI

MB |

39

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Competition

-

Connectivity

Competitor

Competitor’s Strengths

Exar Advantages

•Brand recognition

•Broad portfolio

•Customer engagements

•Broader UART portfolio

•Dual/Multi-protocol Serial Xcvrs

•Brand recognition

•Customer engagements

•Broader UART portfolio

•Product Synergy (UARTs & Serial Xcvrs)

•Analog brand recognition

•Broad portfolio

•Design expertise & technical support

•Single-chip Multi-protocol Serial Xcvrs

•UART portfolio

•Product Synergy (UARTs & Serial Xcvrs)

•Broad portfolio of Serial Xcvrs

•UART portfolio

•Product Synergy (UARTs & Serial Xcvrs)

•PCI/PCIe UARTs

•PCIe Switches/Bridges

•Much broader UART portfolio

•Product Synergy (UARTs & Serial Xcvrs)

•Broadest USB UART portfolio

•Worldwide presence in USB UARTs

•Much broader UART portfolio

•Smallest footprint USB UARTs

•Product Synergy (UARTs & Serial Xcvrs)

•Low cost development expertise

•Customer engagements in Asia

•Ethernet controller portfolio

•Much broader UART portfolio

•Customer engagements worldwide

•Product Synergy (UARTs & Serial Xcvrs) |

40

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Product

Line

Expansion

–

Standard

Analog

New

Development

Benchmarks

New Product Definition 120 DAYS

New Product Development 180 DAYS

New Product Design Wins 180 DAYS

Analog

Mixed-Signal

RTC

REF

AMP

ADC

DAC

DCP |

Growth Plans and Financial

Model |

42

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Product Line Expansion

Diversified Product Offering with Segments of High Growth and High Margin

Power

Management

Programmable

Power

DC/DC

Converter

DC

Controllers

Charge

Pump

LED

Controllers

TVS

Data

Storage

SoC

ASSP

Connectivity

UART

Interface

Bridges

Analog

Mixed-Signal

DCP

DAC

ADC

AMP

REF

Real Time

RTC

Comm IC’s

SONET

E1/T! |

43

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Exar Growth Initiatives

•

Top Tier High Performance Analog Mixed-Signal

Components and Advanced Networking Products

–

Phase I Growth through Market Share Growth

•

Existing Products with Existing Partners

–

Phase II Growth through Product Line Expansion

•

Additional Products through Licensing or Acquisition

–

Phase III Growth through New Product Introduction

•

Differentiation with Embedded Connectivity and Controller

|

44

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Revenue by Geography & Channel

Note: represents FY 2011 results

EMEA

16%

China

34%

Asia

(ex-China)

27%

Americas

23%

Direct

21%

POP (sell-in)

21%

POS

(sell through)

58% |

45

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

P&L

Quarterly

Targets

–

Non-GAAP

3Q FY12

Dec-2011

Current

Breakeven²

Target

Breakeven

Long Term

Operating

Model

Revenue

$29.7M

~$34-35M

~$28M

~$43M

Gross Margin¹

48.4%

47%

50%

55%

R&D¹

27.9%

SG&A¹

28.7%

Operating Expense¹

56.6%

47%

50%

32%

Operating Inc. / (Loss)¹

(8.2)%

Breakeven

Breakeven

23%

EBITDA¹

EBITDA Margin¹

$(0.2)M

-

$2M

6%

$2M

7%

$12M

28%+

1

Non-GAAP measures

2

After February 2012 product alignment (OTN) and reduction actions

|

Appendix

GAAP to Non-GAAP reconcilliations |

47

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Reconciliation of Unaudited GAAP to Non-GAAP Results (1/2)

(Thousands except per share amounts)

NINE

MONTHS

ENDED

JUN 27,

SEP 26,

DEC 26,

MAR 27,

JULY 3,

OCT 2,

JAN 1,

JAN 1,

MAR 27,

MAR 28,

2010

2010

2010

2011

2011

2011

2012

2012

2011

2010

Net Sales

39,636

$

37,233

$

35,365

$

33,771

$

36,978

$

36,120

$

29,679

$

102,777

$

146,005

$

134,878

$

GAAP gross profit

18,816

$

17,291

$

16,083

$

11,807

$

16,841

$

16,729

$

13,345

$

46,915

$

63,997

$

63,382

$

GAAP gross margin

47.5%

46.4%

45.5%

35.0%

45.5%

46.3%

45.0%

45.6%

43.8%

47.0%

Stock-based compensation

220

98

78

93

59

69

104

232

489

528

Amortization of acquired intangible assets

1,553

1,515

1,533

1,443

905

905

905

2,715

6,044

5,187

Fair value adjustment of acquired inventories

42

-

-

-

-

42

2,398

Acquisition-related costs

-

-

-

-

-

-

24

Exit costs

-

-

2,212

152

-

-

152

2,212

-

Non-GAAP gross profit

20,631

$

18,904

$

17,694

$

15,555

$

17,957

$

17,703

$

14,354

$

50,014

$

72,784

$

71,519

$

Non-GAAP gross margin

52.1%

50.8%

50.0%

46.1%

48.6%

49.0%

48.4%

48.7%

49.9%

53.0%

GAAP research and development expenses

14,443

$

11,840

$

12,071

$

12,744

$

9,395

$

8,838

$

8,871

$

27,104

$

51,098

$

48,511

$

Stock-based compensation

1,556

665

645

375

302

488

576

1,366

3,241

2,325

Amortization of acquired intangible assets

1,074

1,074

72

72

-

-

-

-

2,292

2,785

Acquisition-related costs

-

-

-

-

-

-

-

-

-

887

Exit costs

-

-

-

1,210

115

-

-

115

1,210

-

Non-GAAP research and development expenses

11,813

$

10,101

$

11,354

$

11,087

$

8,978

$

8,350

$

8,295

$

25,623

$

44,355

$

42,514

$

GAAP selling, general and administrative expenses

12,957

$

11,083

$

10,298

$

11,094

$

9,600

$

9,373

$

9,909

$

28,882

$

45,432

$

48,861

$

Stock-based compensation

1,546

751

585

769

523

620

653

1,796

3,651

3,112

Amortization of acquired intangible assets

298

297

294

254

174

174

174

522

1,143

697

Acquisition-related costs

328

-

-

-

-

-

-

-

328

5,385

Exit costs

-

-

-

165

58

-

-

58

165

-

Separation costs of executive officer

-

-

-

-

-

-

575

575

-

162

Accelaration of depreciation on abandoned equipment

-

-

-

-

-

-

-

-

-

50

Non-GAAP selling, general and administrative expenses

10,785

$

10,035

$

9,419

$

9,906

$

8,845

$

8,579

$

8,507

$

25,931

$

40,145

$

39,455

$

GAAP operating expenses

27,400

$

22,923

$

22,369

$

31,323

$

18,995

$

18,211

$

18,780

$

55,986

$

104,015

$

97,372

$

Stock-based compensation

3,102

1,416

1,230

1,144

825

1,108

1,229

3,162

6,892

5,437

Amortization of acquired intangible assets

1,372

1,371

366

326

174

174

174

522

3,435

3,482

Acquisition-related costs

328

-

-

-

-

-

-

-

328

6,272

Exit costs

-

-

-

1,375

173

-

-

173

1,375

-

Separation costs of executive officers

-

-

-

-

-

-

575

575

-

162

Accelaration of depreciation on abandoned equipment

-

-

-

-

-

-

-

-

-

50

Goodwill and intangible assets impairment

-

-

-

7,485

-

-

-

-

7,485

-

Non-GAAP operating expenses

22,598

$

20,136

$

20,773

$

20,993

$

17,823

$

16,929

$

16,802

$

51,554

$

84,500

$

81,969

$

GAAP operating loss

(8,584)

$

(5,632)

$

(6,286)

$

(19,516)

$

(2,154)

$

(1,482)

$

(5,435)

$

(9,071)

$

(40,018)

$

(33,990)

$

Stock-based compensation

3,322

1,514

1,308

1,237

884

1,177

1,333

3,394

7,381

5,965

Amortization of acquired intangible assets

2,925

2,886

1,899

1,769

1,079

1,079

1,079

3,237

9,479

8,669

Fair value adjustment of acquired inventories

42

-

-

-

-

-

-

-

42

2,398

Acquisition-related costs

328

-

-

-

-

-

-

-

328

6,296

Exit costs

-

-

-

3,587

325

-

-

325

3,587

-

Separation costs of executive officers

-

-

-

-

-

-

575

575

-

162

Accelaration of depreciation on abandoned equipment

-

-

-

-

-

-

-

-

-

50

Goodwill and intangible assets impairment

-

-

-

7,485

-

-

-

-

7,485

-

Non-GAAP operating income (loss)

(1,967)

$

(1,232)

$

(3,079)

$

(5,438)

$

134

$

774

$

(2,448)

$

(1,540)

$

(11,716)

$

(10,450)

$

TWELVE MONTHS ENDED

-

-

-

-

-

-

- |

48

March 12, 2012

24

Annual ROTH Conference

Institutional Investor Meetings

th

Reconciliation of Unaudited GAAP to Non-GAAP Results (2/2)

(Thousands except per share amounts)

NINE

MONTHS

ENDED

JUN 27,

SEP 26,

DEC 26,

MAR 27,

JULY 3,

OCT 2,

JAN 1,

JAN 1,

MAR 27,

MAR 28,

2010

2010

2010

2011

2011

2011

2012

2012

2011

2010

Net Sales

39,636

$

37,233

$

35,365

$

33,771

$

36,978

$

36,120

$

29,679

$

102,777

$

146,005

$

134,878

$

GAAP net loss

(7,414)

$

(4,459)

$

(4,959)

$

(18,836)

$

(1,426)

$

(1,077)

$

(4,733)

$

(7,236)

$

(35,668)

$

(28,110)

$

Stock-based compensation

3,322

1,514

1,308

1,237

884

1,177

1,333

3,394

7,381

5,965

Amortization of acquired intangible assets

2,925

2,886

1,899

1,769

1,079

1,079

1,079

3,237

9,479

8,669

Fair value adjustment of acquired inventories

42

-

-

-

-

-

-

-

42

2,398

Acquisition-related costs

328

-

-

-

-

-

-

-

328

6,296

Exit costs

-

-

-

3,587

325

-

-

325

3,587

-

Separation costs of executive officers

-

-

-

-

-

-

575

575

-

162

Accelaration of depreciation on abandoned equipment

-

-

-

-

-

-

-

-

-

50

Goodwill and intangible assets impairment

-

-

-

7,485

-

-

-

-

7,485

-

Impairment charges on investments

-

62

-

-

-

-

-

-

62

317

Income tax effects

33

32

(118)

129

(142)

221

(194)

(115)

76

(40)

Non-GAAP net income (loss)

(764)

$

35

$

(1,870)

$

(4,629)

$

720

$

1,400

$

(1,940)

$

180

$

(7,228)

$

(4,293)

$

GAAP loss per share

(0.17)

$

(0.10)

$

(0.11)

$

(0.42)

$

(0.03)

$

(0.02)

$

(0.11)

$

(0.16)

$

(0.81)

$

(0.64)

$

Stock-based compensation

0.08

0.03

0.03

0.03

0.02

0.03

0.03

0.08

0.17

0.14

Amortization of acquired intangible assets

0.07

0.07

0.04

0.04

0.02

0.02

0.02

0.07

0.21

0.20

Fair value adjustment of acquired inventories

0.00

-

-

-

-

-

-

-

0.00

0.06

Acquisition-related costs

0.01

-

-

-

-

-

-

-

0.01

0.14

Exit costs

-

-

-

0.08

0.01

-

-

0.01

0.08

-

Separation costs of executive officers

-

-

-

-

-

-

0.01

0.01

-

0.00

Accelaration of depreciation on abandoned equipment

-

-

-

-

-

-

-

-

-

0.00

Goodwill and intangible assets impairment

-

-

-

0.17

-

-

-

-

0.17

-

Impairment charges on investments

-

0.00

-

-

-

-

-

-

0.00

0.01

Income tax effects

0.00

0.00

(0.00)

0.00

(0.00)

0.00

(0)

(0.00)

0.00

(0.00)

Non-GAAP diluted earnings (loss) per share

(0.02)

$

0.00

$

(0.04)

$

(0.10)

$

0.02

$

0.03

$

(0.04)

$

0.00

$

(0.16)

$

(0.10)

$

43,897

44,173

44,300

44,503

44,599

44,759

44,830

44,726

44,218

43,584

The effect of dilutive potential common shares due to

reporting Non-GAAP net income

-

261

-

-

206

99

-

210

-

-

The effect of removing stock-based compensation expense

under SFAS 123R for Non-GAAP presentation purpose

-

(329)

-

-

(183)

(15)

-

(131)

-

-

Shares

used

in

diluted

earnings

per

share

---

Non-GAAP

43,897

44,105

44,300

44,503

44,622

44,843

44,830

44,805

44,218

43,584

Notes: Certain amounts may not total due to rounding.

Certain

amounts

previously

reported

above

have

been

reclassified

to conform to the current period presentation.

TWELVE MONTHS ENDED

Shares

used

in

earnings

(loss)

per

share

---

GAAP |